Invoice processing often faces issues like errors, duplicate payments, and fraud and 3-way matching addresses these problems by verifying details between purchase orders, goods receipts, and invoices.

In this blog, you’ll learn how 3-way matching works and why it’s essential for accurate and efficient invoice management.

What is 3-Way Matching?

3-way matching is an accounts payable control process that helps businesses ensure payment accuracy and prevent fraud.

It compares three essential documents:

- Purchase Order (PO)

- Goods Receipt Notes

- Vendor Invoice

By comparing these three documents, you can securely verify that ordered items match what was received, quantities are consistent, prices align with agreements, and invoice calculations are correct.

This process helps you prevent various issues such as paying for undelivered goods, incorrect payments, double billing, unauthorized purchases, and potential fraud with many modern accounting systems now automating this verification process for you.

Benefits of Three-Way Matching

With the three-way matching process, you can ensure that every payment you make is accurate, helping you avoid costly errors and overpayment, additionally, other key benefits your business can gain may include:

- Error Prevention: With 3-way matching, you ensure that the Purchase Order, Goods Receipt, and Invoice all match. This helps prevent costly mistakes, ensuring your business only pays for goods you’ve ordered and received.

- Cost Savings: By cross-checking every detail, you avoid overpayments, duplicate charges or billing mistakes. Over time, this process can help save your business a substantial amount of capital.

- Faster Approval Process: Due to your upfront verification, Invoices move quickly through the approval process, reducing delays and improving cash flow management.

- Enhanced Fraud Prevention: 3-way matching helps you identify discrepancies and fraudulent Invoices, protecting your business from potential scams and errors before they become bigger problems.

- Improved Vendor Relationships: By ensuring timely and accurate payments, you can maintain positive relationships with vendors, avoiding disputes over incorrect billing or delayed payments.

- Maintain Financial Accuracy: This process ensures that your accounts payable records are accurate and audit-ready. It’s an effective way to keep your financial reporting reliable and avoid potential complications during audits.

- Increased Transparency: The matching process provides clear visibility into all transactions, which helps in better decision-making and improved tracking of purchases and payments.

Overall, 3-way matching is a very popular method to ensure you

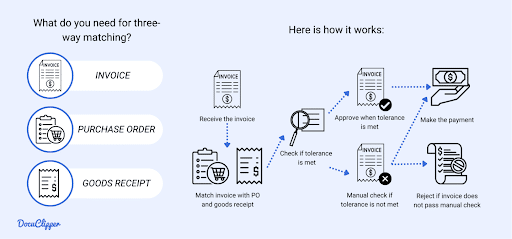

How Three-Way Matching Works

In the three-way matching process, you compare the Purchase Order, Goods Receipt, and Invoice to ensure they all align before approving any payment.

It is easy to understand, let’s understand how it works:

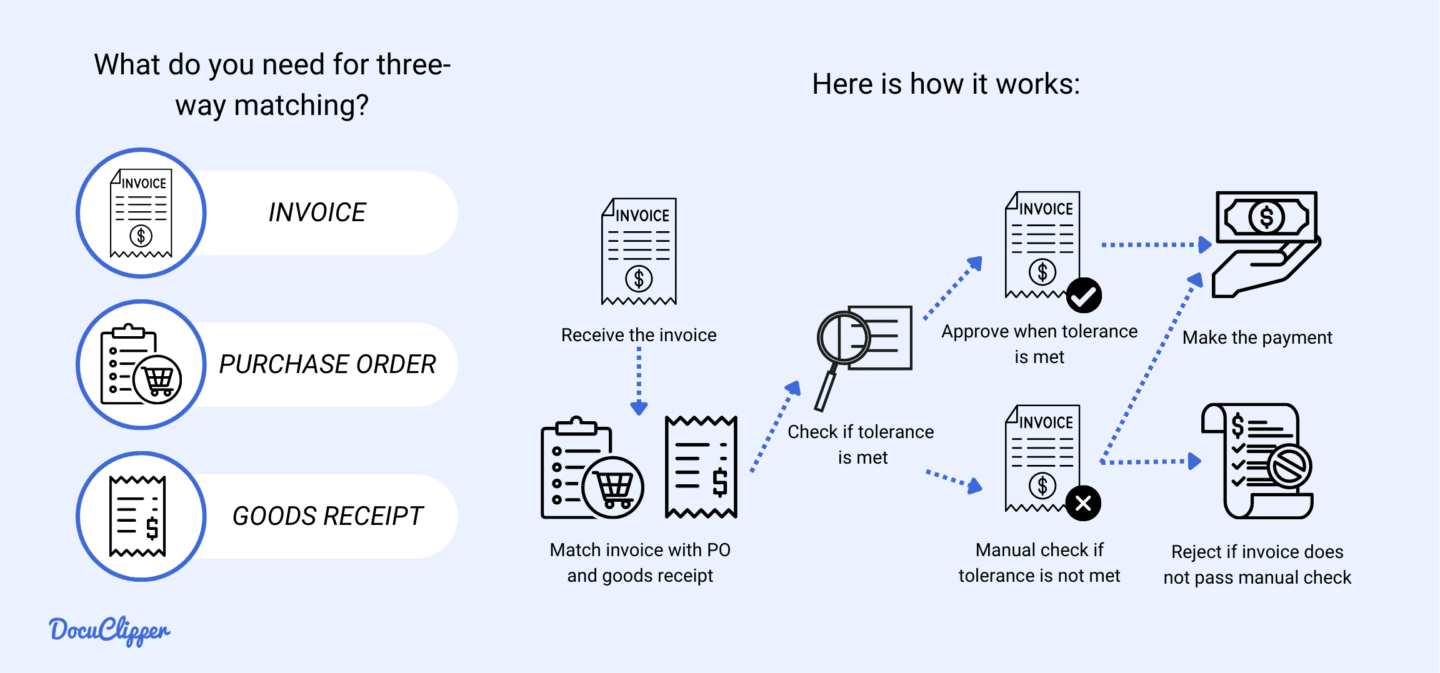

What You Need for Three-Way Matching:

For 3-way matching, you need three key documents:

- Purchase order (PO): This document contains the details of what was ordered, including item descriptions, quantities, and agreed-upon prices.

- Goods Receipt (GR): This document confirms that the goods or services have been delivered and received.

- Invoice: The invoice outlines what the supplier is charging for the goods or services provided.

Three-Way Matching Process

3-way matching is a three-step process which initiates when you order or receive goods in your business:

- Review the Purchase Order: The first step is to confirm the items and quantities listed in the Purchase Order. This ensures that the purchase was approved, and the terms are agreed upon.

- Verify the Goods receipt: Once the goods are delivered, the Goods Receipt document is checked to confirm that the right items and quantities were received. If there are discrepancies, they should be addressed immediately.

- Check the Invoice: Lastly, the Invoice is compared to both the Purchase Order and Goods Receipt. The amounts on the invoice should match what was ordered and received, confirming there are no overcharges or billing errors.

2 Examples of a 3-Way Match

To better understand how the three-way matching process works in real-world scenarios, let’s look at two clear examples. These examples will provide practical insights, helping you see how this method ensures accuracy and efficiency in invoice processing.

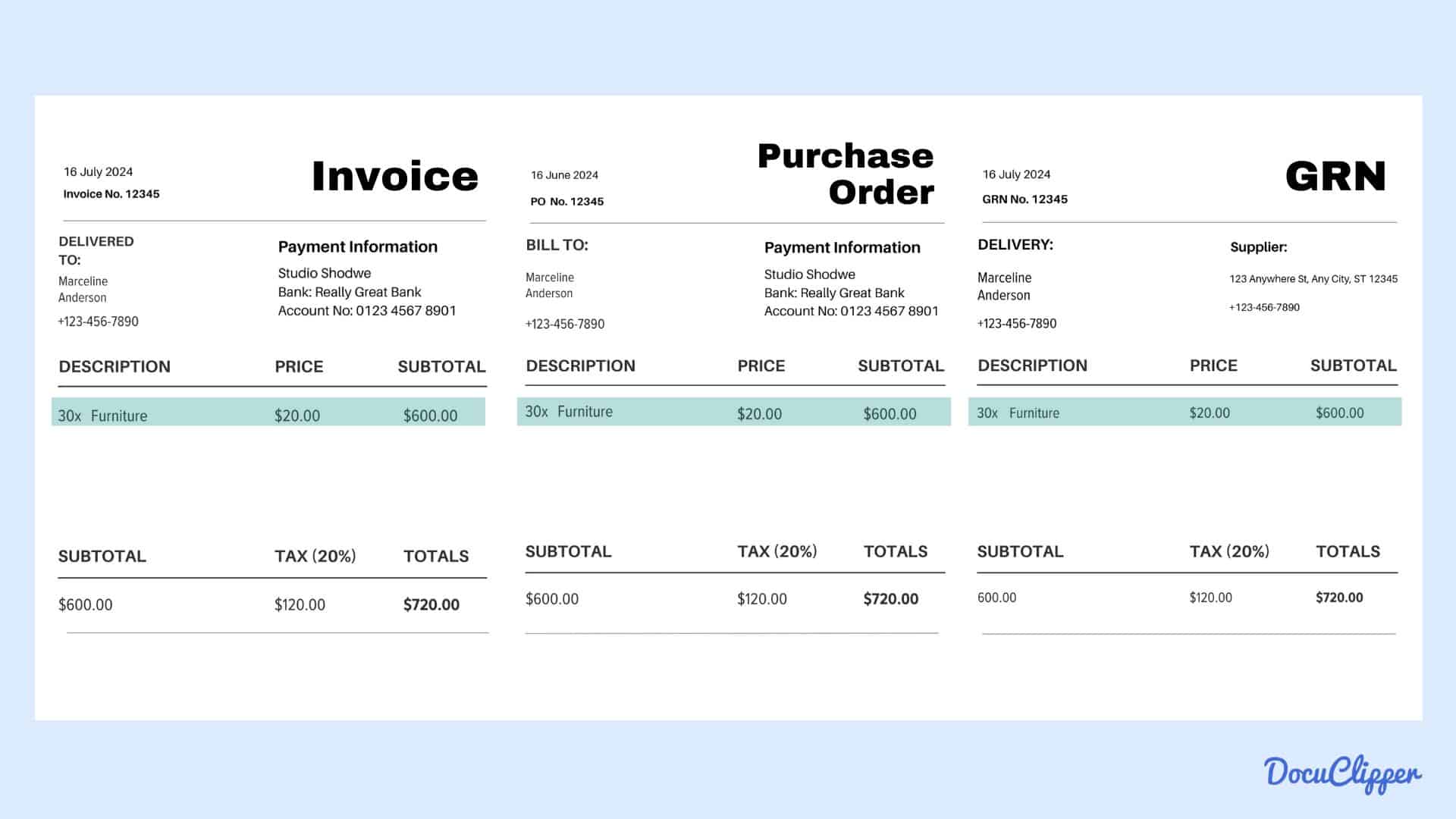

Example 1: Furniture industry

You must have once in your lifetime ordered furniture, let us see how your order initiated 3-way processing in the furniture store:

- Purchase Order: A Purchase Order was issued for 30 pieces of furniture at $20 each. The total amount, including a 20% tax, came to $720.

- Goods Receipt Note: Upon delivery, 30 pieces of Furniture were received. The total amount matches the Purchase Order: $720.

- Invoice: The invoice shows 30 pieces of Furniture at $20 each. The total, including tax, is $720, matching the Purchase Order and the Goods Receipt Note.

Since all three documents align perfectly, the transaction is cleared for payment.

In case any error or discrepancy is found, the invoice is held and not approved for payment. An invoice management personnel must manually address and resolve the issue with the vendor before the process can continue.

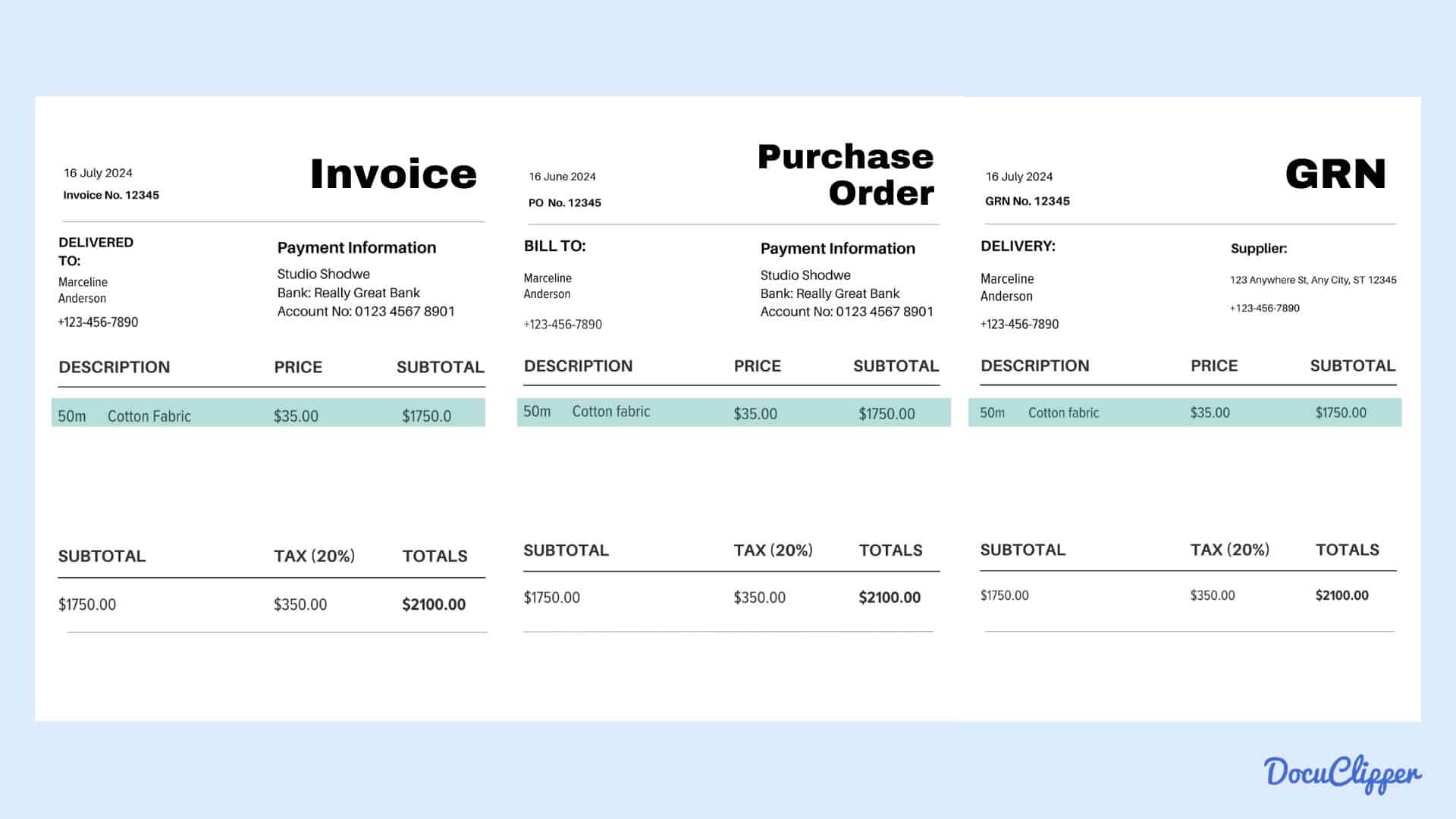

Example 2: Textile Industry

Similarly in the Textile Industry 3-way processing can be understood with the following illustration:

- Purchase Order: A Purchase Order was issued for 50 metres of Cotton Fabric at $35/ metre. The total amount, including a 20% tax, totalled $2100.

- Goods Receipt Note: Upon delivery, 50 metres pieces of Cotton Fabric were received. The total amount matches the Purchase Order: $2100.

- Invoice: The Invoice shows 50 Metres of Cotton Fabric at $35 each. The total, including tax, is $2100, matching the Purchase Order and the Goods Receipt Note.

Since all three documents align perfectly, the transaction is cleared for payment.

In case any error or discrepancy is found, the invoice is held and not approved for payment. An invoice management personnel must manually address and resolve the issue with the vendor before the process can continue.

How to Extract Data from the Invoices

Invoice data extraction can be done using two methods: Manual and Automated. While Manual data extraction involves entering details by hand, automated tools streamline the process, saving time and reducing errors.

Manual data extraction methods

In manual data extraction, key fields such as the Purchase Order, Invoice number, quantity, and price are identified and recorded. While this method ensures control over data accuracy, it can be slow, inconsistent, and prone to human error, especially with high volumes of invoices.

Maintaining accuracy and consistency requires diligent checks, which increases processing time.

Automated data extraction tools

Invoice automation uses tools like OCR which scan Invoice details such as vendor names and amounts.

By automating this process businesses can eliminate manual errors, reduce processing time, and handle large volumes of invoices. This makes automation an essential step towards efficient and reliable accounting.

Advantages of Automation in Data Extraction:

- Facilitate faster processing speeds, enabling quicker turnaround times.

- Enable seamless integration with automated data entry

- Provide secure data handling with advanced encryption and security protocols.

- Creates an intercontrol for efficient Invoice management

How to Implement 3-Way Matching for Your Business

When you decide that you can start a 3-way matching process for your business, here are some necessary steps:

- Review Your Current AP Workflow: Analyze your current accounts payable process to identify gaps and areas for improvement and document how key documents are handled to prepare for 3-way matching.

- Establish and Communicate New Processes: Define a clear process for incorporating 3-way matching and train your AP team to manage Purchase Orders, Goods Receipts, and Invoices accurately and efficiently.

- Leverage Automation Tools: You can utilize software that automates the matching of Purchase Orders, Goods Receipts, and Invoices. Ensure the tools integrate with your existing systems for seamless operations.

- Evaluate and Refine the Process: Continuously monitor the 3-way matching system for effectiveness. Make necessary adjustments and update training to optimize the process over time.

Types of Invoice Matching

There are several ways to match your invoices, here are the most common types:

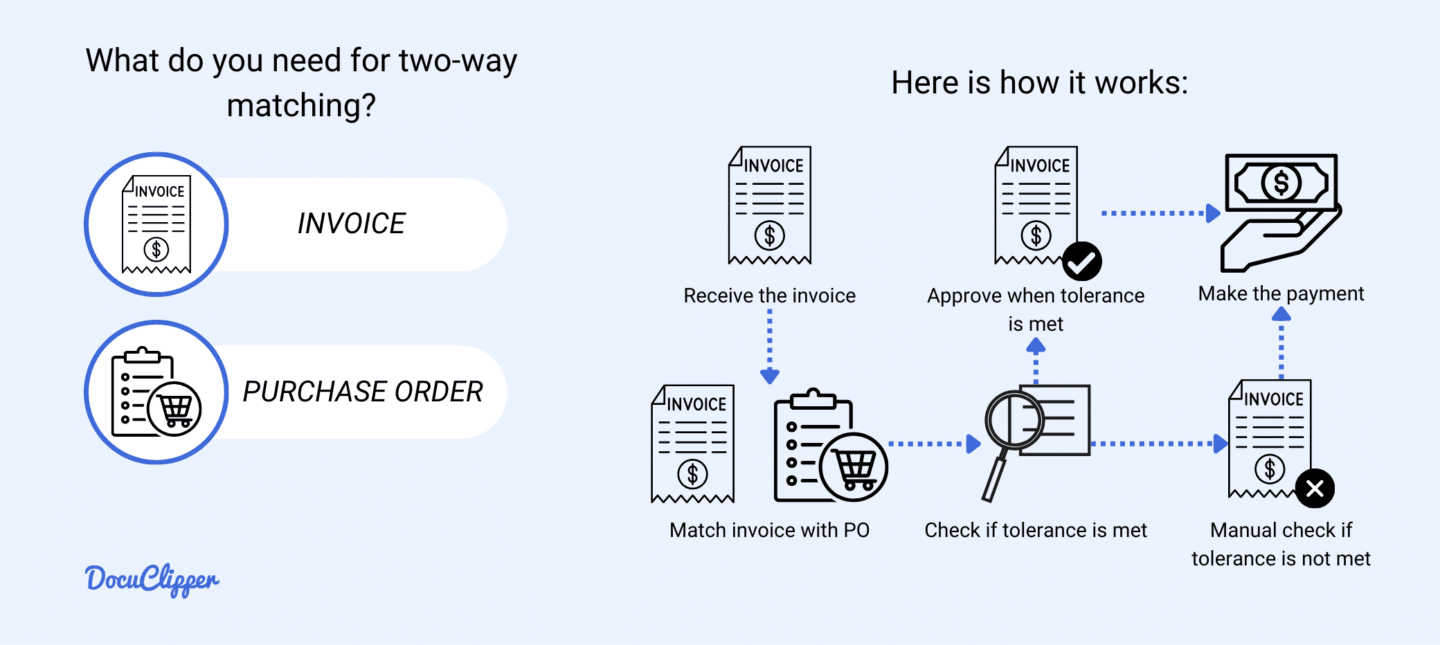

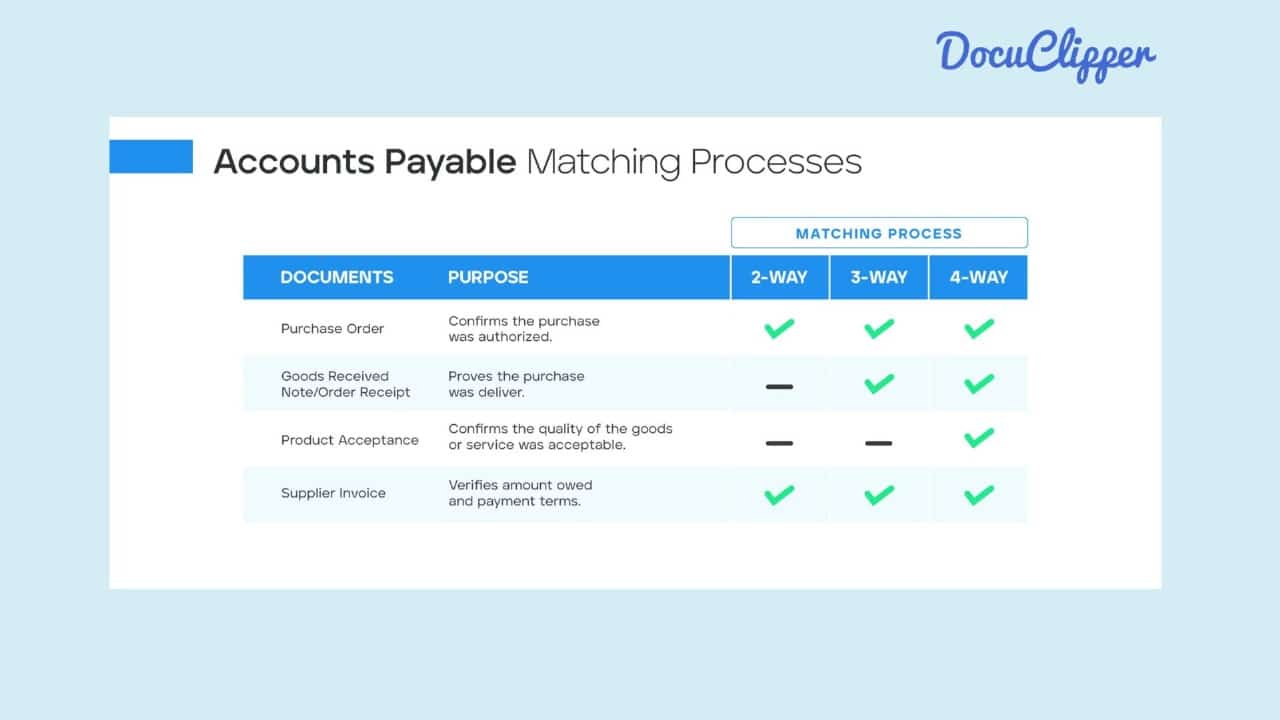

2-Way Matching

Two-way matching, also known as purchase order matching, is a process that checks for discrepancies between the invoice and the purchase order (PO). This method ensures that the details on the invoice, such as item descriptions, quantities, and prices, match the PO.

If the discrepancies fall within predefined acceptable limits, the invoice is approved for payment; otherwise, it is flagged for review. This process reduces the risk of human error and speeds up the invoice verification process.

3-Way Matching

Three-way matching is an advanced process that compares the invoice and purchase order to the goods receipt note (GRN). It involves verifying that the goods or services billed in the invoice match both the PO and the GRN, confirming that the items were received as ordered.

This method provides greater assurance that the invoice reflects actual goods or services received, reducing the risk of overpayment and fraud. However, it is more time-consuming and requires accurate and timely recording of goods receipts.

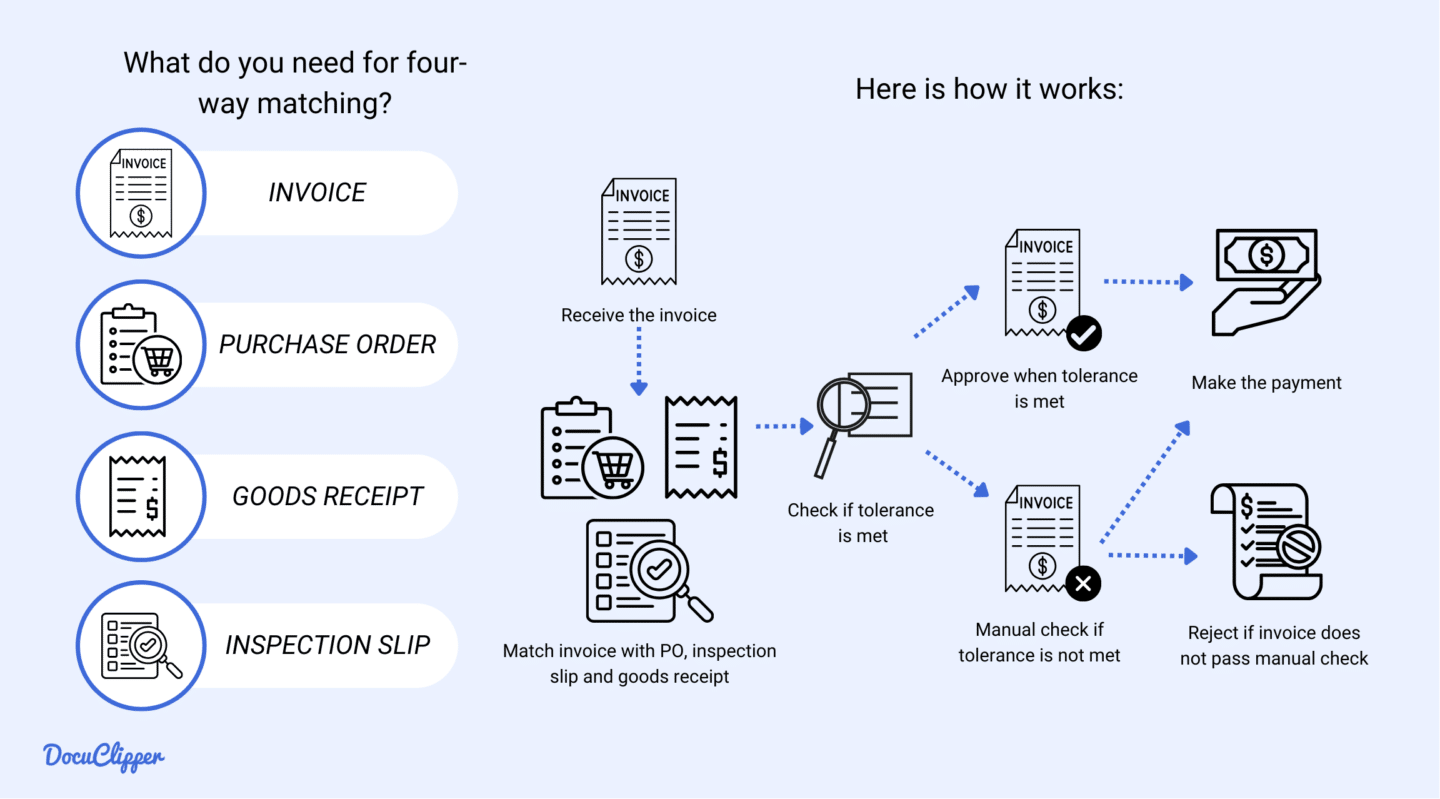

4-Way Matching

Four-way matching is the most comprehensive invoice matching process, adding an inspection step to the verification. This method involves comparing the invoice, purchase order, goods receipt note, and inspection slip that verifies the quality and quantity of the received items.

The invoice is approved for payment only if all documents match within acceptable limits. This method ensures the highest accuracy and fraud prevention level but is the most time-consuming and requires coordination across multiple departments.

2-Way vs 3-Way vs 4-Way Matching

2-way matching is the simplest and quickest method, suitable for repetitive transactions from clients with good relationships and a lower risk of discrepancies. It compares the invoice to the purchase order, ensuring basic accuracy and reducing human error.

In contrast, 3-way matching adds another layer of verification by including the goods receipt note, making it ideal for transactions where confirming receipt of goods is crucial. This method significantly reduces the risk of overpayment and fraud but it takes more steps.

4-way matching takes it a step further by incorporating an inspection slip to verify both the quantity and quality of received goods, providing the highest level of accuracy and security. However, it is the most complex and time-consuming method, requiring thorough coordination and documentation.

Conclusion

In conclusion, 3-way matching is an effective way to ensure accurate and justified payments in accounts payable. It reduces the risk of errors by matching details from Purchase Orders, Goods Receipts, and Invoices.

Tools like Docuclipper, which use OCR and machine learning, make data extraction faster and simplify the process even further.

Whether dealing with high volumes of invoices or seeking to improve vendor relationships, implementing two-way matching can significantly enhance your financial processes and contribute to better overall business performance.

FAQs about 3-Way Matching

In this section, we’re going to answer common questions about 3-way matching:

What is the 3-way match issue?

The 3-way match issue occurs when discrepancies arise between the Purchase Order, Goods Receipt, and Invoice during the matching process. Differences in quantities, pricing, or delivery details can delay payment approval and lead to errors or disputes. Addressing these issues through automated tools like Invoice scanning software helps improve accuracy and efficiency.

Who is responsible for a 3 way match?

The Accounts Payable (AP) team of Buyer is primarily responsible for performing the 3-way match. They ensure that the Purchase Order, Goods Receipt, and Invoice are aligned before processing payments.

What is the main goal of a three-way match?

The main goal of a 3-way match is to ensure payment accuracy by verifying that the details on the Purchase Order, Goods Receipt, and Invoice align. This process helps prevent overpayments, reduce errors, and ensure that businesses only pay for goods or services that were ordered and received, improving financial control and efficiency.

Why is the 3-way match considered an internal control?

The 3-way match is considered an internal control because it helps prevent errors, fraud, and unauthorized payments. By verifying that the Purchase Order, Goods Receipt, and Invoice match, it ensures that only legitimate and accurate transactions are processed. This control enhances transparency and accountability in the accounts payable process.

Which document typically triggers the three-way match?

The Purchase Order (PO) typically triggers the 3-way match. It outlines the terms of the purchase, including quantities and prices. The Goods Receipt and Invoice are then compared against the PO to ensure that the correct items and amounts are delivered and billed before making a payment.

Related Articles

Here are more related articles that talk about processing invoices: