Paying invoices that contain high-value goods at high frequencies is one of the biggest challenges for AP personnel. Many problems can occur like mispricing, questionable quality, and lacking quantities.

Fortunately, there is a solution that you can apply for your automated invoice processing workflow that can help you point out these discrepancies. It’s called 4-way matching.

In this article, we’ll talk about what 4-way matching is and how you can implement it for your business.

What is 4-Way Matching?

4-way matching is the process where you verify against four documents—purchase order, goods received note (GRN), inspection report, and invoice—align before approving payment.

This ensures that the invoice matches the purchase order, confirms the goods were received as ordered, and meets the expected quality.

By implementing 4-way matching, you enforce compliance, reduce the risk of unauthorized payments, and strengthen your internal controls, ensuring accurate payments to the correct vendors and minimizing the chance of invoice fraud.

Benefits of Four-Way Matching

Here are some reasons why businesses are using 4-way matching:

- Fraud Prevention: Billing fraud frequently occurs in 20% of the covered cases. Four-way matching is a great defense against invoice fraud by verifying all documents eliminating fraud in your company.

- Error Reduction: The detailed cross-referencing involved in four-way matching significantly reduces the chances of discrepancies and errors in the accounts payable process.

- Accurate Payments: 61% of invoice inaccuracies can lead to late payments. By matching the invoice with the purchase order and goods received note, four-way matching guarantees that payments are accurate. This greatly reduces late payments.

- Improved Vendor Relationships: Four-way matching plays a significant role in building better vendor relationships. By holding vendors accountable to the quality and terms agreed upon, this process enables you to address any issues related to quality or discrepancies proactively, plus it significantly improve timely payments.

- Compliance Assurance: This process helps your organization comply with internal controls and external regulatory requirements. It provides a clear audit trail that can be essential for compliance with financial reporting standards and industry regulations.

- Quality Assurance: The inclusion of a quality inspection report is a key differentiator in four-way matching. It ensures that the received goods not only match the order but also meet the required quality standards. This prevents vendors from being paid for defective or substandard products, which could otherwise compromise your operations or customer satisfaction.

- Enhanced Inventory Management: By confirming that goods received match what was ordered and billed, four-way matching supports accurate inventory records improving your inventory management.

- Better Financial Accuracy: The process ensures that your financial records are accurate and reflect your obligations and expenses. This contributes to more reliable financial reporting and better decision-making.

How Four-Way Matching Works

4 way matching is more complicated compared to other matching methods and you’ll need more documents for it. Here’s how it works:

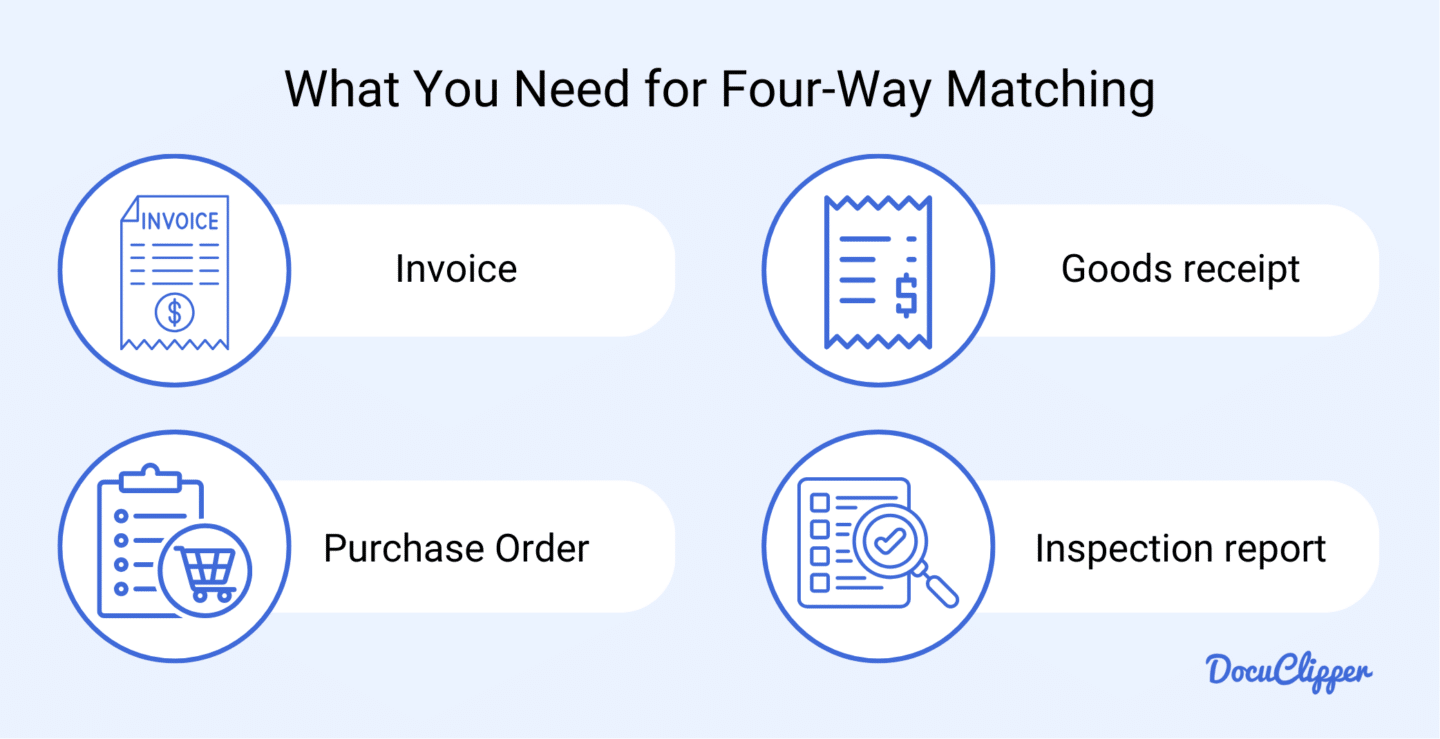

What You Need for Four-Way Matching

As it sounds, you will need four documents for this to work:

- Purchase Order: This document outlines the details of the order, including quantities, prices, and terms agreed upon with the vendor.

- Goods Received Note (GRN): The GRN confirms the receipt of goods or services, documenting the quantities and condition of the items received.

- Quality Inspection Slip or Report: This report verifies that the received goods meet the required quality standards and specifications.

- Invoice: The invoice is the vendor’s bill, detailing the items provided, including their costs, quantities, and any additional charges.

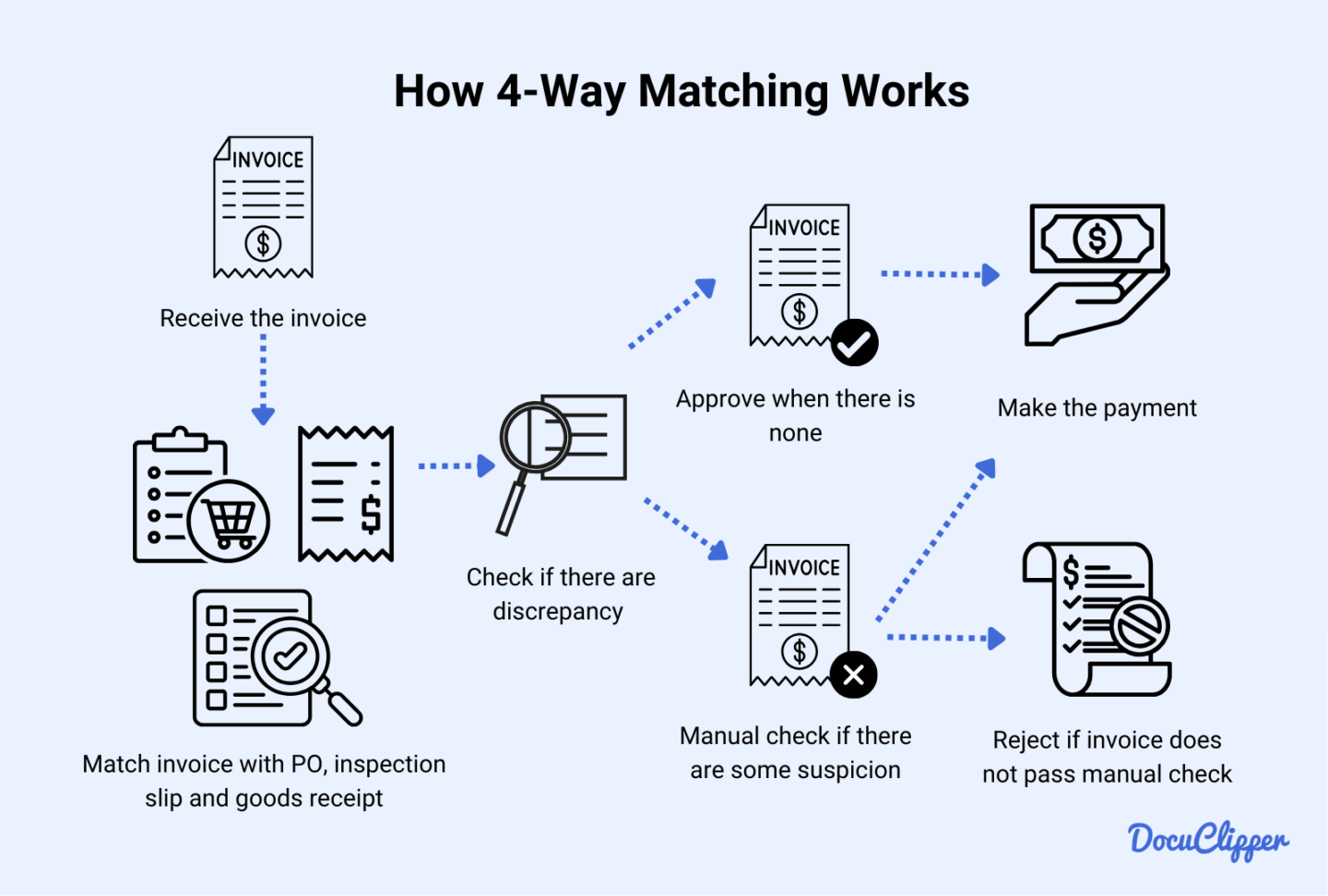

Four-Way Matching Process

Once all your documents are complete, you can start doing the marching process using these steps:

- Receive the Invoice: Begin by receiving the vendor’s invoice, which details the items or services provided, including quantities, prices, and any additional charges. This invoice is essential for the matching process.

- Match with the Purchase Order: Compare the invoice against the original purchase order (PO). Ensure that the quantities, prices, and terms on the invoice match the PO exactly. This step confirms that the invoice aligns with the agreed-upon purchase.

- Match with the Goods Receipt: Next, verify the goods receipt or delivery note against both the purchase order and the invoice. This document should confirm that the correct items or services were received, in the right quantities and condition, as ordered.

- Match with the Inspection or Quality Check Report: Finally, match the invoice, purchase order, and goods receipt with the inspection or quality check report. Ensure that the received goods or services meet the quality and specifications agreed upon. Any discrepancies should be noted and addressed.

- Contact the vendor if there are any inconsistencies: If any inconsistencies are found during the matching process, communicate with the vendor or relevant internal departments. Adjust the invoice as necessary to correct the discrepancies.

- Approve Payment: Once all documents are verified and discrepancies resolved, approve the invoice for payment. This approval indicates that the invoice has passed all checks and is ready for processing.

2 Examples of a 4-Way Match

For you to visualize these steps, here are some examples so you’ll have an easy time applying them for your business:

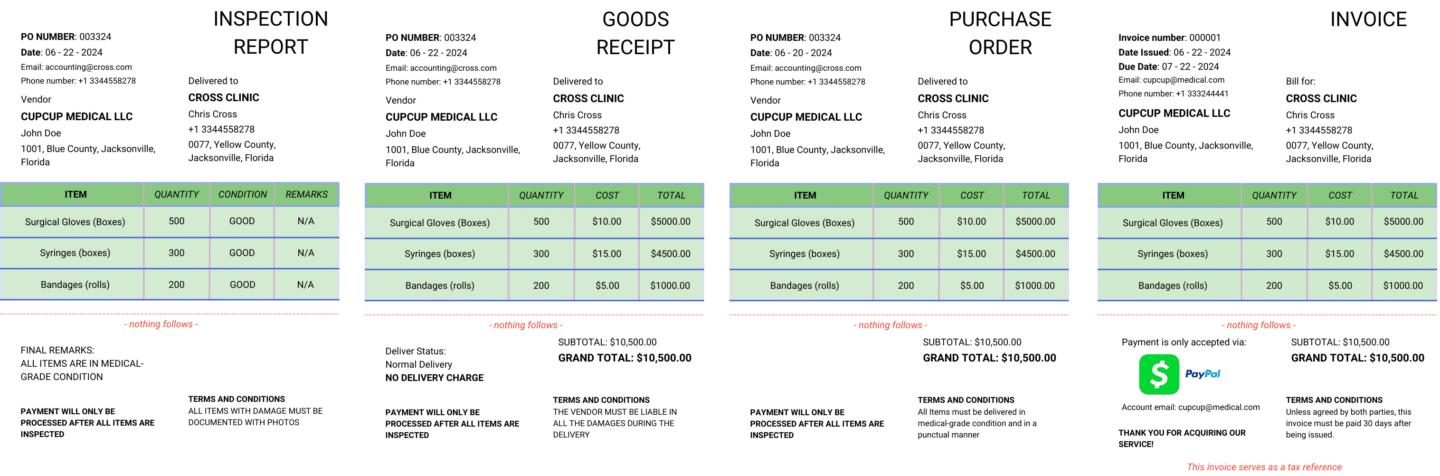

Example 1: Hospital 4-Way Matching

This example is a hospital ordering medical supplier for their daily operations:

- Receive the Invoice: A hospital receives an invoice from a medical supply vendor for an order of 500 boxes of surgical gloves, 300 boxes of syringes, and 200 rolls of bandages. The invoice details that each box of surgical gloves is priced at $10, each box of syringes at $15, and each roll of bandages at $5. The total invoice amount is $10,500.

- Match with the Purchase Order: The hospital’s procurement department compares the invoice to the original purchase order. The purchase order confirms that the hospital requested exactly 500 boxes of surgical gloves, 300 boxes of syringes, and 200 rolls of bandages, with the agreed-upon prices matching those on the invoice: $10 per box of gloves, $15 per box of syringes, and $5 per roll of bandages.

- Match with the Goods Receipt: The hospital’s receiving department checks the goods receipt provided by the warehouse. The receipt confirms that all 500 boxes of surgical gloves, 300 boxes of syringes, and 200 rolls of bandages were delivered. The team verifies that the quantities received align perfectly with those listed on both the invoice and the purchase order.

- Match with the Inspection or Quality Check Report: The hospital’s quality control team inspects the medical supplies. They confirm that the surgical gloves are properly sealed, the syringes are sterile and undamaged, and the bandages are in good condition. The inspection report shows that all items meet the required medical standards, with no defects or issues. This report matches the details on the invoice, purchase order, and goods receipt.

- Resolve Any Discrepancies: Since there are no discrepancies in quantity, price, or quality, the hospital does not need to contact the vendor for any corrections or adjustments.

- Approve Payment: The financial or invoice management personnel approves the invoice for payment, confirming that the hospital is billed correctly for the exact products ordered and received in the expected condition. The payment of $10,500 is processed to the vendor.

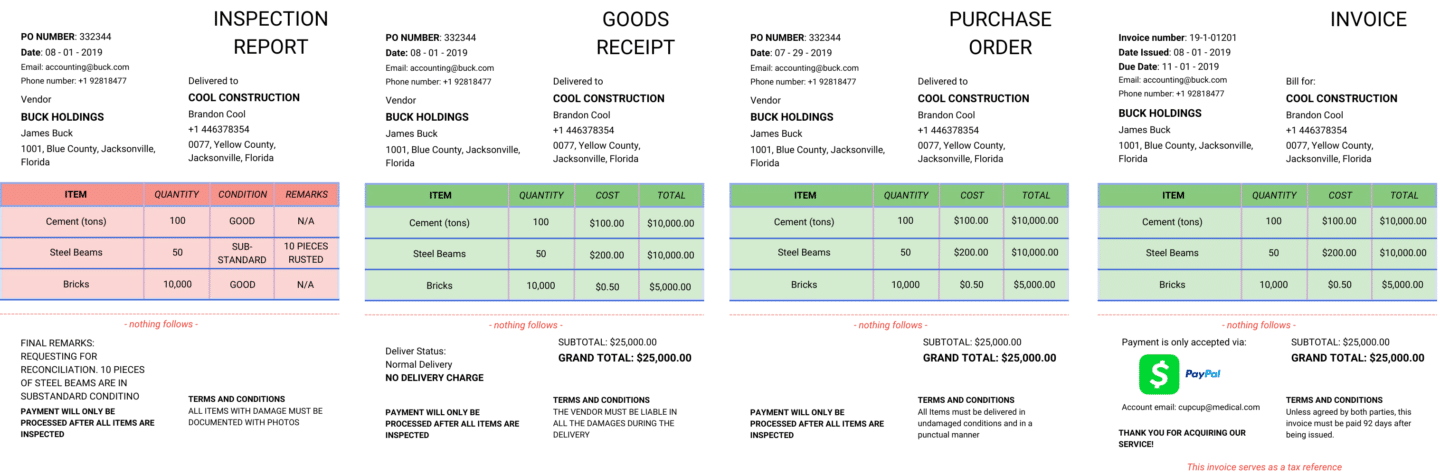

Example 2: Construction 4-Way Matching

This second example is for a construction company that has noticed some discrepancies that highlight the importance of 4-way matching:

- Receive the Invoice: A construction company receives an invoice from a supplier for an order consisting of 100 tons of cement, 50 steel beams, and 10,000 bricks. The invoice specifies that each ton of cement is priced at $100, each steel beam at $200, and each brick at $0.50. The total invoice amount is $25,000.

- Match with the Purchase Order: The procurement team compares the invoice with the original purchase order. The purchase order confirms that the construction company requested exactly 100 tons of cement, 50 steel beams, and 10,000 bricks, with the agreed-upon prices matching those on the invoice: $100 per ton of cement, $200 per steel beam, and $0.50 per brick.

- Match with the Goods Receipt: The site manager checks the goods receipt provided by the delivery team. The receipt confirms that the delivery included 100 tons of cement, 50 steel beams, and 10,000 bricks. The quantities received are consistent with the purchase order and invoice.

- Match with the Inspection or Quality Check Report: The quality control team inspects the materials. They find that the cement is of the correct grade and the bricks are in good condition. However, upon inspecting the steel beams, they discover that 10 of the 50 beams have visible rust and do not meet the required quality standards for the project. The inspection report documents this issue and flags it as a significant concern.

- Resolve Any Discrepancies: The construction company contacts the supplier to report the issue with the rusted steel beams. They negotiate either a replacement for the defective beams or a credit adjustment on the invoice. The supplier agrees to replace the 10 rusted beams at no additional cost. The invoice is then adjusted accordingly to reflect only 40 acceptable beams, reducing the steel beam charge to $8,000.

- Approve Payment: After the issue with the steel beams is resolved, and the replacement beams are delivered and inspected, the finance department approves the payment for the adjusted invoice amount of $23,000. This payment reflects the correct quantity and quality of materials received.

- Record and Archive: The construction company’s accounting system records and archives all related documents, including the purchase order, invoice, goods receipt, inspection report, and any correspondence or adjustments related to the discrepancy. This documentation is essential for future reference and audits.

How to Extract Data from the Invoices

You need to extract data from invoices to make invoice matching more efficient. When a business starts to scale, many invoices and purchases will arrive and an extraction process must be in place to make invoice matching easier:

Manual data extraction methods

Manual data extraction methods are the most basic approach, suitable only for low volumes of invoices. This method involves manually inputting key fields such as PO number, invoice number, quantity, and price into the spreadsheet by a data entry clerk or AP person.

However, it is time-consuming, costly, and highly prone to errors, making it inefficient for larger operations.

In fact, About 39% of invoices contain errors.

Ensuring invoice accuracy and consistency in manual data extraction can be challenging, as human error is a significant risk compared to automated systems.

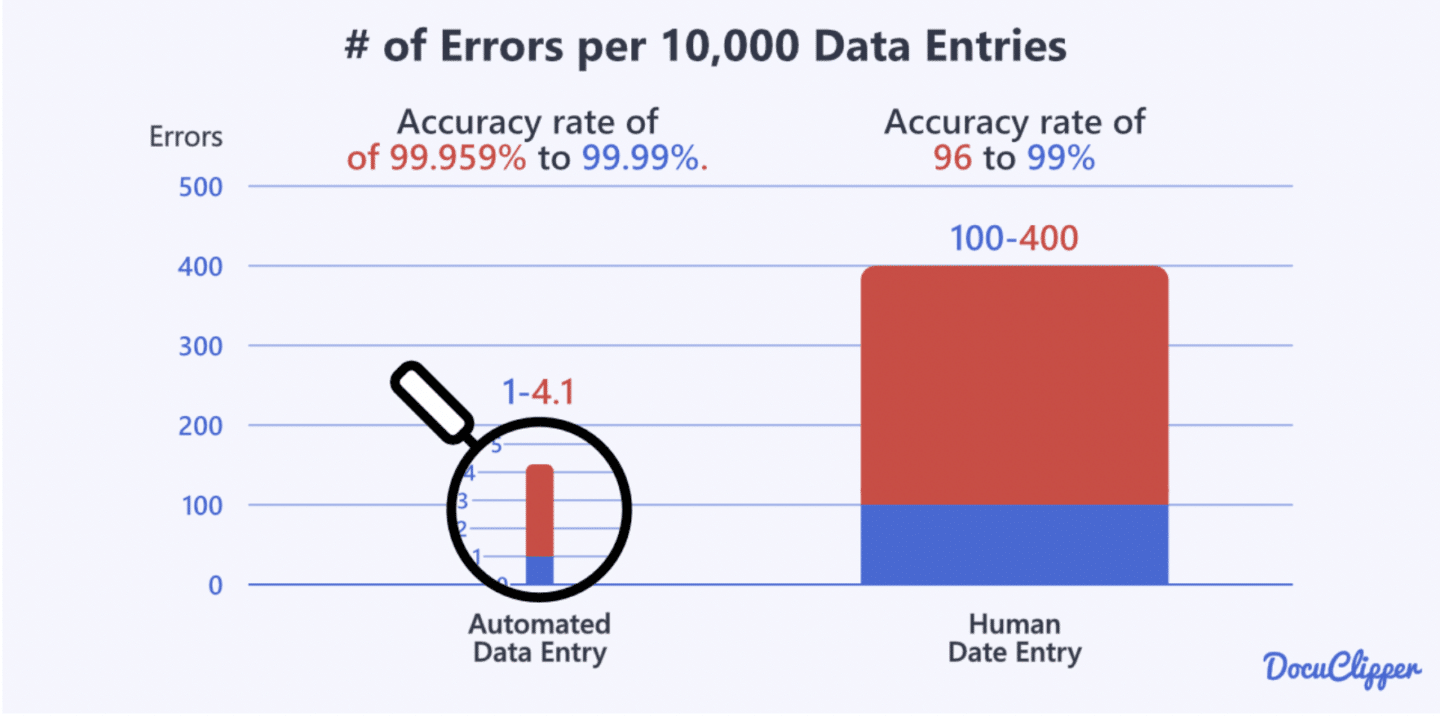

Typically, automated data entry boasts an accuracy rate of 99.959% to 99.99%. In contrast, the accuracy rate for human data entry ranges from 96% to 99%.

While it may work for small-scale operations, the drawbacks make it less ideal as your business scales, requiring the need for more automated solutions.

Automated data extraction tools

Automated document data extraction tools are preferred by business operations because they improve the invoice processing workflow, making it faster and easier for your accounts payable team.

In fact, companies with automated invoice processing spend less than 1 hour weekly on invoices.

Using invoice data extraction tools like Optical Character Recognition (OCR) and specialized software solutions, you can achieve high accuracy, reduce costs, and speed up data entry.

These tools automatically extract key information from invoices, such as PO numbers and quantities, with minimal errors.

An example of an OCR software is DocuClipper. It is capable of invoice data extraction, eliminating the need for manual data entry. It can convert PDF invoices to XLS, CSV, and QBO

The benefits of automated invoice data extraction include improved efficiency, enhanced accuracy, and significant time savings, allowing your team to focus on more strategic tasks rather than manual data entry.

How to Implement 4-Way Matching for Your Business

When you think that a 4-way matching process is the right one for your business, here are the steps to start implementing it:

- Assess and Document Current Processes: Start by evaluating your existing procurement, receiving, and payment processes. Document these processes to identify gaps and areas where 4-way matching can be integrated effectively.

- Set Up a Standardized 4-Way Matching Procedure: Develop a clear and standardized procedure that outlines how purchase orders, goods receipts, inspection reports, and invoices should be handled and matched. Extracted invoice data using spreadsheets makes it easier to match. Ensure that all relevant departments understand and follow these procedures.

- Invest in the Right Tools: Implement or upgrade to an ERP system or accounting software that supports 4-way matching. This technology should automate the matching process and provide real-time tracking of all related documents to reduce manual errors.

- Train Your Team: Conduct comprehensive training sessions for all staff involved in procurement, receiving, quality control, and finance. Ensure they understand the importance of each step in the 4-way matching process and how to execute their roles effectively.

- Monitor and Adjust: Continuously monitor the effectiveness of the 4-way matching process. Track discrepancies and the time taken to resolve them, using this data to refine your procedures and make necessary adjustments.

- Communicate and Collaborate with Vendors: Keep open communication with your vendors about your quality standards and the 4-way matching process. Collaborating with vendors can help reduce discrepancies and streamline the entire matching process.

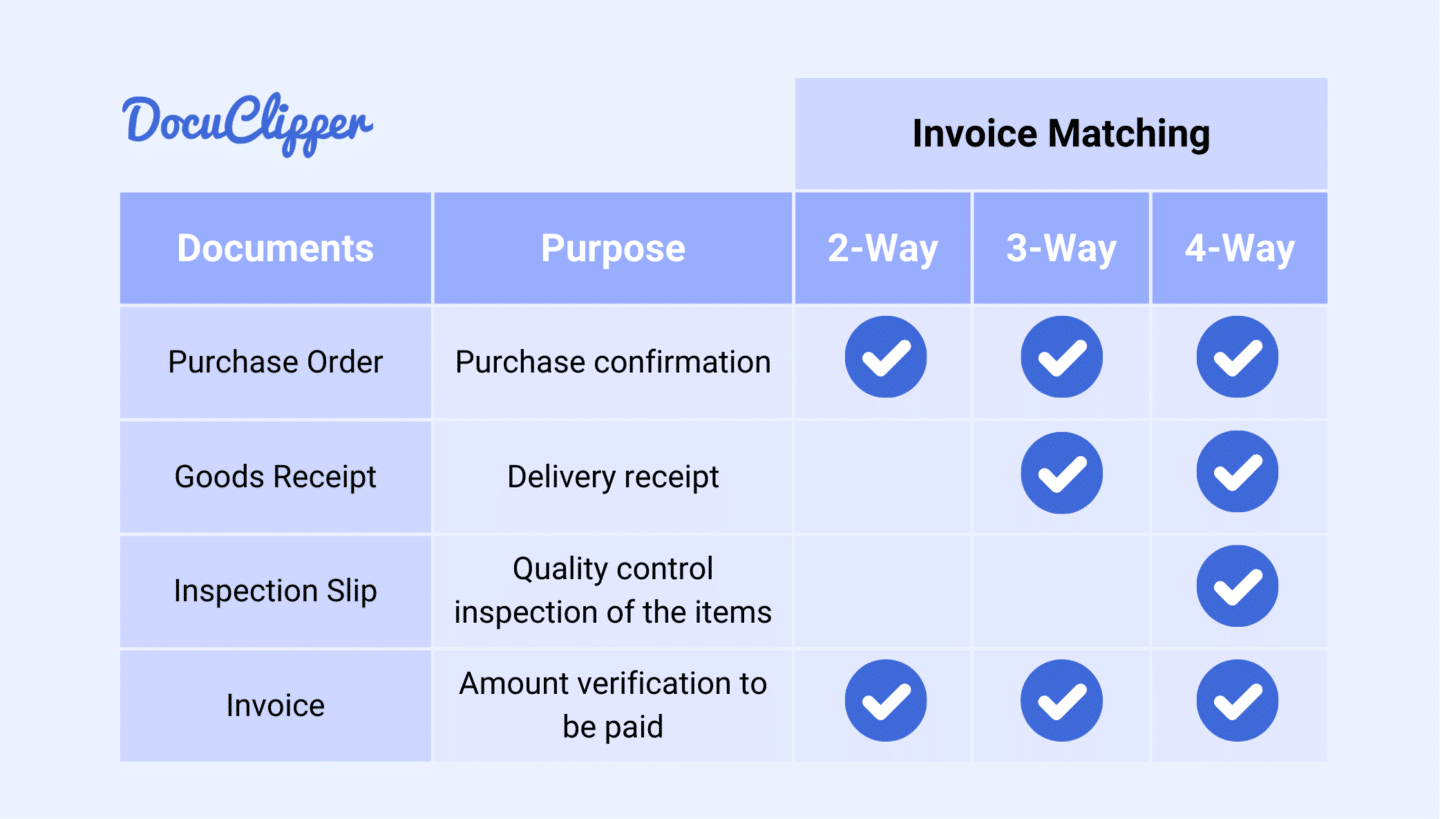

Types of Invoice Matching

There are many types of invoice matching aside from the 4-way. Each with it strengths and weaknesses;

2-Way Matching

In 2-way matching, the invoice is compared directly with the purchase order (PO). This involves checking that the quantities, prices, and terms on the invoice match what was originally agreed upon in the PO.

Strengths:

- Simplicity: It’s the simplest and quickest form of matching, making it ideal for straightforward purchases with minimal risk.

- Efficiency: Reduces the time and effort required for matching, as only two documents are compared.

Weaknesses:

- Limited Accuracy: Does not account for whether the goods or services were actually received or if they were of the expected quality.

- Higher Risk: May result in payment for goods that were not received or that are defective.

3-Way Matching

In 3-way matching, the invoice is matched against both the purchase order and the goods receipt. This process ensures that the items billed for were not only ordered but also received.

Strengths:

- Increased Accuracy: Provides a higher level of verification by ensuring that the goods or services were received before payment is made.

- Fraud Prevention: Helps prevent overpayment or payment for goods that were not delivered.

Weaknesses:

- More Time-Consuming: Involves an additional step compared to 2-way matching, which can slow down the payment process.

- More Complex: Requires more detailed record-keeping and coordination between departments.

4-Way Matching

4-way matching extends 3-way matching by adding an inspection or quality check report to the process. This ensures that the goods received meet the required quality standards before payment is approved.

Strengths:

- Maximum Accuracy: Ensures that the business pays only for goods that meet both the ordered specifications and quality standards.

- Quality Assurance: Helps prevent payment for defective or substandard goods, safeguarding the business’s interests.

Weaknesses:

- Most Time-Consuming: The inclusion of a quality check adds another layer of complexity and time to the matching process.

- Resource-Intensive: Requires more resources and coordination among procurement, receiving, quality control, and finance departments.

2-Way vs 3-Way vs 4-Way Matching

When comparing 2-way, 3-way, and 4-way matching, each method offers a different balance of simplicity, accuracy, and control.

2-way matching is the simplest and fastest, making it suitable for low-risk, high-volume transactions, but it provides the least protection against errors and fraud.

On the other hand, 3-way matching offers a balanced approach, adding an additional layer of verification by ensuring that goods or services have been received before payment is made. This method is widely used because it provides a good level of accuracy without being overly complex.

For transactions where quality and specification adherence are critical, 4-way matching is the most comprehensive, adding an extra step to verify that the goods received meet the required standards before approving payment.

While this method offers the highest level of control, it is also the most time-consuming and resource-intensive, making it ideal for high-value or critical purchases.

The choice of the matching method depends on the specific needs and risk tolerance of the business.

Conclusion

Implementing 4-way matching in your accounts payable process is a powerful way to ensure accuracy, prevent fraud, and maintain strong vendor relationships.

By carefully verifying purchase orders, goods received notes, quality inspection reports, and invoices, you can confidently approve payments that align with your company’s standards.

While more complex, this method provides greater control and peace of mind, safeguarding your financial operations and improving overall efficiency. As your business grows, adopting 4-way matching will prove invaluable in maintaining financial integrity.

FAQs about 4-Way Matching

Here are some frequently asked question about 4-way invoice matching:

What is the 4-way match issue?

The 4-way match issue occurs when discrepancies arise between the four key documents—purchase order, goods received note, quality inspection report, and invoice. These mismatches can prevent the approval of payment, requiring further investigation to resolve discrepancies and ensure that the payment aligns with the actual transaction details.

Who is responsible for a 4 way match?

The buyer is primarily responsible for ensuring that the 4-way matching process is completed accurately. This involves coordinating between procurement, receiving, quality control, and accounts payable departments to verify that all documents align before payment is approved, ensuring compliance with internal controls and vendor agreements.

What is the main goal for a four-way match?

The main goal of a four-way match is to verify that the goods or services received match the purchase order in terms of quantity, price, and quality before approving payment. This process minimizes errors, prevents fraud, and ensures that the company only pays for what was actually ordered and received.

Why is the 4-way match considered an internal control?

The 4-way match is considered an internal control because it enforces compliance and accuracy within the accounts payable process. By requiring verification of four key documents before payment is approved, it reduces the risk of unauthorized or incorrect payments, helping to safeguard the company’s financial integrity.

Which document typically triggers the four-way match?

The purchase order typically triggers the 4-way matching process. It is the initial document that outlines the agreed-upon terms with the vendor, including quantities and prices. The subsequent documents—the goods received note, quality inspection report, and invoice—are matched against the purchase order to ensure consistency before payment.