Key Takeaways

- The full cycle accounts payable process ensures invoices are received, verified, approved, paid, and recorded accurately.

- Automating accounts payable reduces manual errors, speeds up approvals, and improves compliance.

- Invoice matching helps prevent overpayments, fraud, and discrepancies.

- Optimizing payment schedules improves cash flow and strengthens vendor relationships.

- Using AP automation software streamlines invoice processing, approval workflows, and reconciliation.

What is Full Cycle Accounts Payable Process?

The full cycle accounts payable process is how you handle every step of paying your vendors, from receiving invoices to making payments and reconciling accounts. It ensures that your financial obligations are accurately recorded, authorized, and processed on time.

Managing this process well helps you maintain cash flow, prevent duplicate payments, and strengthen vendor relationships. Since it’s part of the procure-to-pay cycle, you need a structured workflow to track expenses, reduce errors, and stay compliant.

By automating invoice processing and approvals, you can improve efficiency, minimize fraud risks, and maintain accurate financial records for audits and financial planning.

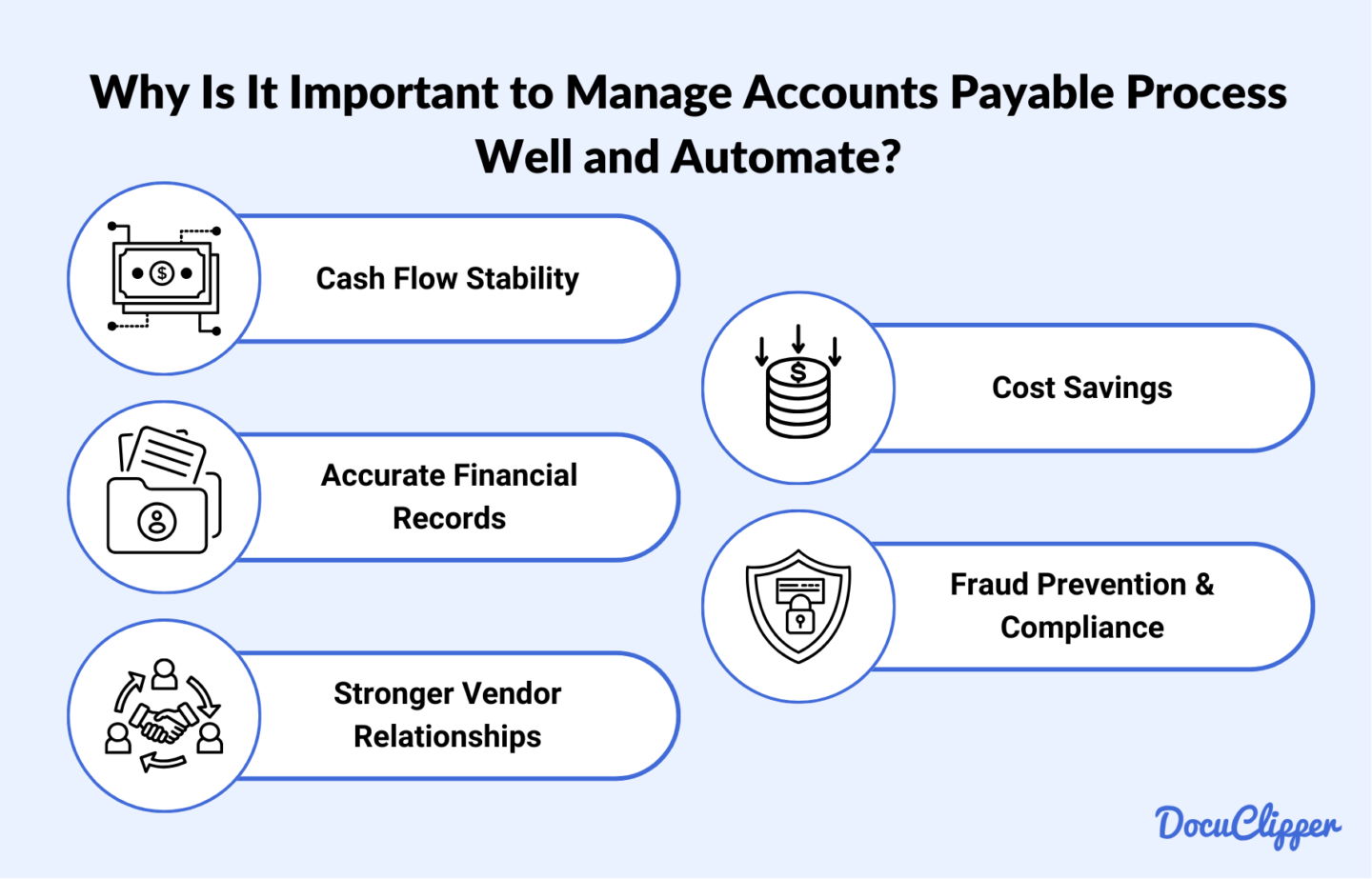

Why Is It Important to Manage Accounts Payable Process Well and Automate?

Here are the reasons why businesses need to manage AP processes well:

- Cash Flow Stability: When you manage accounts payable efficiently, you ensure vendors are paid on time, preventing cash shortages that could disrupt your operations. If you don’t stay on top of payments, your business risks financial instability—82% of small businesses fail due to cash flow problems. (Score)

- Accurate Financial Records: Automating accounts payable helps you reduce manual errors, ensuring that your financial records are always accurate. This accuracy is essential for making informed business decisions and staying compliant with financial regulations.

- Stronger Vendor Relationships: When you pay suppliers on time and with accuracy, you build trust, leading to better pricing, priority service, and stronger business partnerships. Late or inconsistent payments can damage these relationships, making it harder to negotiate favorable terms.

- Cost Savings: Automating your accounts payable process can significantly cut down processing costs. If you rely on manual AP handling, you’re spending more time and resources than necessary—companies using full AP automation save an average of $14.93 per invoice. (NextProcess)

- Fraud Prevention & Compliance: Automated AP controls help you detect fraudulent invoices, unauthorized payments, and compliance risks before they become costly problems. With automation, you safeguard your company’s finances while ensuring all transactions meet regulatory requirements.

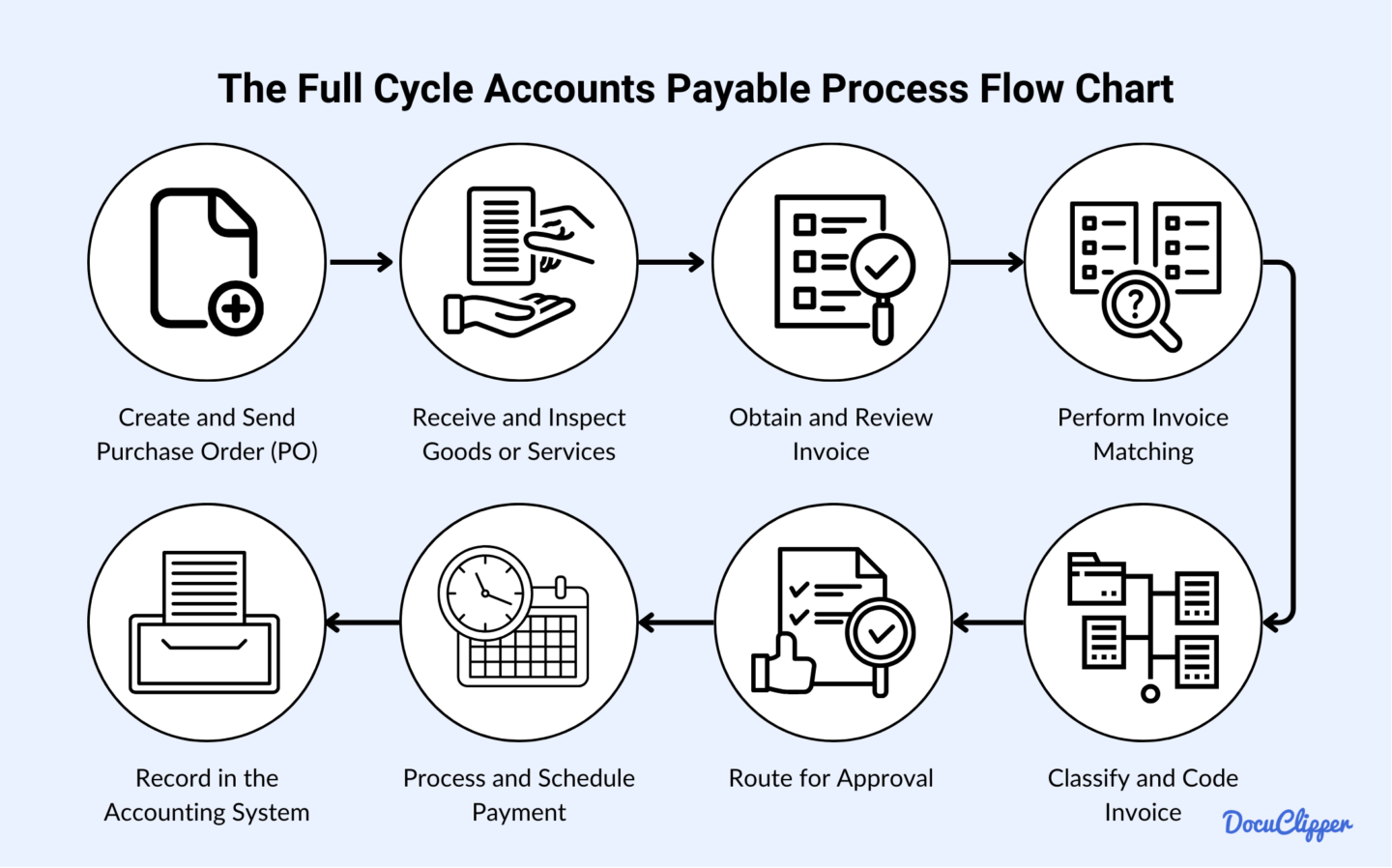

The Full Cycle Accounts Payable Process Flow Chart

Managing accounts payable involves multiple steps to ensure accuracy, compliance, and efficiency. Here’s how the process flows from purchase to payment:

- Create and Send Purchase Order (PO): You submit a purchase order to the supplier, specifying the items, quantities, pricing, and terms.

- Receive and Inspect Goods or Services: When the supplier delivers, you verify that everything matches the PO in terms of quality and quantity.

- Obtain and Review Invoice: The supplier sends an invoice, and you confirm that it aligns with the agreed terms before processing.

- Perform Invoice Matching (2-Way or 3-Way Match): You cross-check the invoice against the PO and receiving report to ensure accuracy and prevent overpayments.

- Classify and Code Invoice: You assign general ledger (GL) codes to track expenses correctly in your financial records.

- Route for Approval: The invoice goes through your internal approval workflow based on company policies before payment is initiated.

- Process and Schedule Payment: Once approved, you schedule the payment using ACH, wire transfer, check, or another preferred method.

- Record in the Accounting System: Finally, you log the transaction in your general ledger to maintain accurate financial records, facilitate reconciliation, and ensure compliance.

Upstream vs Downstream

In accounts payable, your upstream process includes everything before a payment is made—setting up vendor accounts, negotiating terms, and implementing invoice approval workflows.

You focus on accuracy and compliance to prevent duplicate invoices, overpayments, and fraud. Strong upstream controls make your downstream process smoother, reducing delays and financial risks.

Your downstream process starts once an invoice is approved. You execute payments, reconcile transactions, and generate financial reports to ensure everything aligns with your records. Managing this stage well helps you pay vendors on time, maintain accurate books, and strengthen business relationships while optimizing cash flow.

Accounts Payable Process Cycle Challenges

Here are some challenges of the accounts payable process cycle when done manually:

- Slow and Frustrating Approvals: You waste time chasing signatures and waiting on approvals, leading to payment delays and strained vendor relationships.

- High Risk of Costly Errors: Manual data entry increases the chances of mistakes, duplicate invoices, and lost documents, putting your financial accuracy at risk.

- Lack of Real-Time Visibility: Outdated records and incomplete data make it difficult to track expenses, forecast cash flow, and prevent financial surprises.

- Disorganized Tracking: Without automation, you struggle to monitor due dates, reconcile payments, and avoid costly late fees or missed discounts.

- Inefficient and Labor-Intensive: Sorting through paper invoices and emails drains your time and resources, slowing down operations and increasing costs.

How To Manage & Improve Accounts Payable Processes

Streamline the Full Cycle Accounts Payable Process

To streamline accounts payable, you need to eliminate bottlenecks, standardize approvals, and automate repetitive tasks. AP automation software speeds up processing, improves accuracy, and ensures compliance. A centralized system helps you track invoices efficiently, reducing lost documents and payment delays.

Automate Invoice Processing and Data Entry

Manual data entry slows you down and increases errors, leading to duplicate payments and inefficiencies. AP automation tools with OCR and AI extract PDF invoice details automatically, match them to purchase orders, and flag discrepancies. Automating invoice processing speeds up approvals, reduces errors, and ensures accurate financial reporting.

Implement Invoice Matching to Prevent Errors

Invoice matching helps you catch discrepancies and prevent fraud. Using 2-way matching (invoice vs. purchase order) or 3-way matching (adding goods receipt verification) ensures payments align with approved purchases. Automation flags mismatches, duplicate invoices, and unauthorized charges, reducing overpayments, disputes, and financial errors.

Establish Clear Approval Workflows

A structured approval workflow keeps payments on track and ensures compliance. By defining approval hierarchies, assigning user roles, and automating invoice routing, you eliminate bottlenecks. Modern AP systems let you set approval thresholds, requiring multiple authorizations for high-value invoices. Automation speeds up approvals, reduces manual work, and improves audit readiness.

Optimize Payment Scheduling for Better Cash Flow

Strategic payment scheduling helps you balance cash flow while maintaining vendor relationships. Taking advantage of early payment discounts, negotiating better terms, and timing payments correctly optimizes working capital. Paying too early strains cash reserves, while delays can hurt supplier trust. A well-planned AP strategy keeps your finances stable and vendors satisfied.

Track and Monitor Key AP Metrics

Tracking AP metrics helps you spot inefficiencies and improve processes. Key KPIs include invoice processing time (how long it takes from receipt to payment), error rates (percentage of discrepancies or manual mistakes), and cost per invoice (total processing expenses). Monitoring these ensures better efficiency, lower costs, and optimized operations.

Conduct Regular Audits and Reconciliation

Regular audits and reconciliations keep your financial records accurate and compliant. Audits help you detect fraud, duplicate payments, and vendor inconsistencies, while reconciliation ensures bank statements match AP records. Routine checks improve transparency, prevent errors, and strengthen financial reliability.

Best Practices for Accounts Payable Management

To improve efficiency and accuracy in accounts payable, you should follow these best practices:

- Standardize AP Policies and Procedures: Ensure consistency in invoice processing, approvals, and compliance.

- Manage Vendor Master Data: Keep vendor records accurate to prevent duplicate payments and fraud.

- Leverage Early Payment Discounts: Optimize cash flow by negotiating better payment terms.

- Implement Exception Handling Protocols: Quickly resolve discrepancies to avoid payment delays.

- Adopt Continuous Improvement Methodologies: Regularly refine AP processes to increase efficiency.

- Enhance Fraud Prevention and Control: Use automated controls to detect and prevent fraudulent transactions.

- Optimize Payment Strategies: Schedule payments strategically to maintain liquidity and vendor trust.

Technologies Transforming Accounts Payable

Automation is reshaping how you handle accounts payable, reducing manual effort and improving accuracy. Key technologies include:

- OCR and AI-powered Data Extraction: Capture invoice details automatically, eliminating manual entry errors.

- AP Automation Software: Streamline invoice approvals, matching, and payments with minimal human intervention.

- Cloud-Based AP Systems: Access and manage invoices from anywhere, improving collaboration and efficiency.

- Electronic Payments and Virtual Cards: Replace paper checks with faster, more secure digital transactions.

- Blockchain for AP Security: Enhance transparency and fraud prevention with tamper-proof transaction records.

How DocuClipper Can Make Your Accounts Payable Process Easier

DocuClipper streamlines your accounts payable process by automating data extraction from invoices, bank statements, and other financial documents. Utilizing Optical Character Recognition (OCR) technology, it accurately captures essential information, reducing manual data entry and associated errors.

By integrating seamlessly with accounting software like QuickBooks, Xero, and Sage, DocuClipper ensures efficient data transfer, enhancing workflow efficiency. This automation accelerates invoice processing times, allowing your team to focus on strategic tasks rather than repetitive manual entries.

Frequently Asked Questions About Accounts Payable Process:

Here are some frequently asked questions in automating the accounts payable process:

What is the workflow of accounts payable?

The accounts payable workflow includes invoice receipt, verification, approval, payment processing, and recordkeeping. You match invoices to purchase orders, route them for approval, schedule payments, and log transactions in your accounting system. Automating this process reduces errors, speeds up approvals, and ensures compliance, improving cash flow and vendor relationships.

What is the AP cycle process?

The accounts payable cycle covers invoice receipt, validation, approval, payment processing, and reconciliation. You verify invoices, match them with purchase orders, get approvals, process payments, and record transactions in your accounting system. Automating the AP cycle improves accuracy, reduces delays, and ensures compliance while optimizing cash flow and vendor relationships.

What is the P2P process in AP?

The procure-to-pay (P2P) process in accounts payable covers procurement, invoice processing, approval, payment, and reconciliation. You issue purchase orders, receive goods or services, verify invoices, approve payments, and record transactions. Automating P2P improves efficiency, prevents errors, and ensures compliance while strengthening vendor relationships and optimizing cash flow.

What is the three-way process of accounts payable?

The three-way process in accounts payable involves matching an invoice with a purchase order and a receiving report to verify accuracy before payment. This prevents overpayments, duplicate invoices, and fraud. Automating three-way matching improves efficiency, ensures compliance, and reduces financial risks by flagging discrepancies before processing payments.

What software to use with the accounts payable process?

Accounts payable software includes DocuClipper, QuickBooks, Xero, SAP, Oracle NetSuite, and Stampli. These tools automate invoice processing, approval workflows, and payment tracking. Features like OCR, AI-powered data extraction, and real-time reporting help reduce errors, speed up approvals, and improve cash flow management. Choosing the right software depends on your business size and needs.