Looking for an alternative to Affinda for invoice data extraction? While Affinda offers solid AI-powered document automation, it might not address every unique need in customization, scalability, or integration.

If you’re experiencing limitations with your current solution, exploring other options could enhance accuracy, streamline workflows, and offer more cost-effective pricing.

In this guide, you’ll discover the nine best Affinda alternatives and competitors for invoice data extraction, tools designed to optimize invoice processing, reduce manual effort, and improve overall financial efficiency.

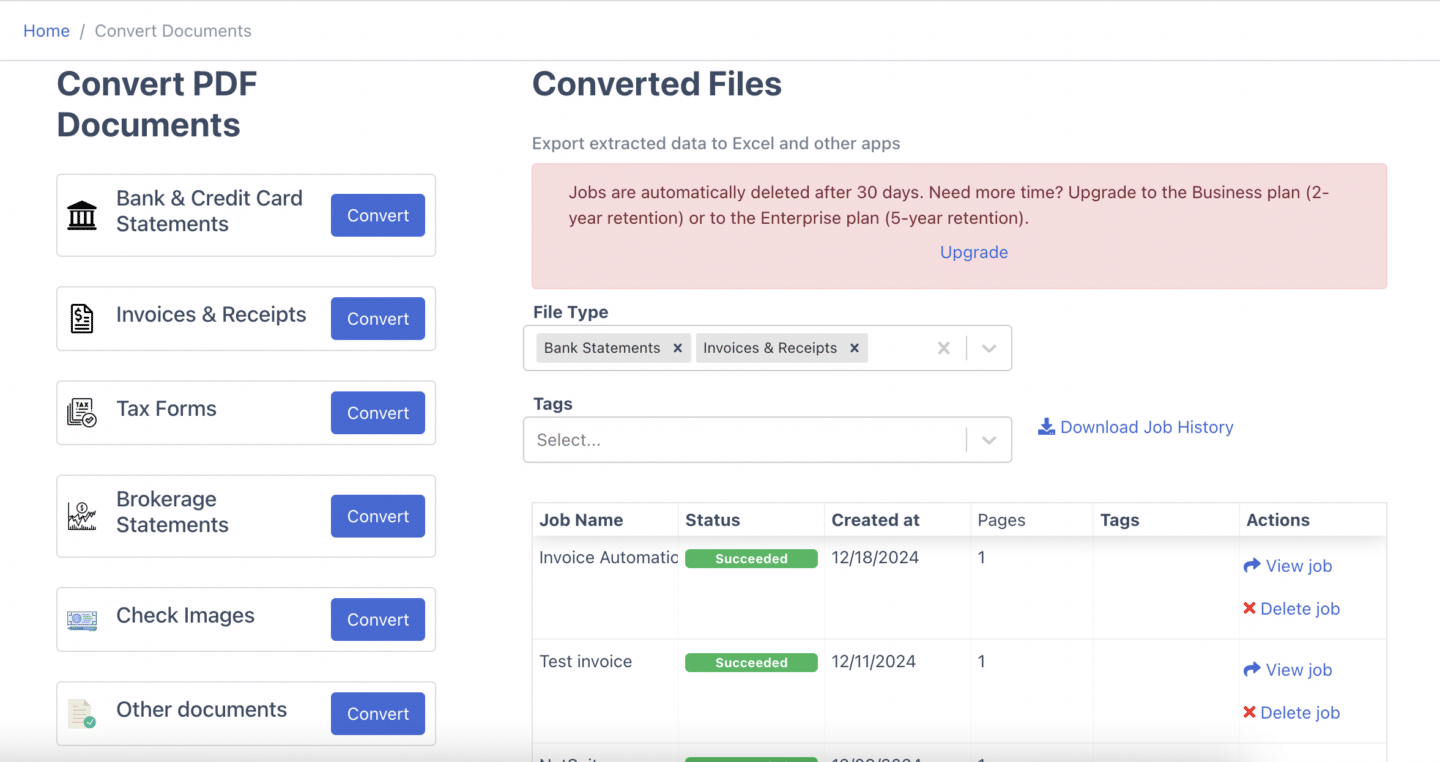

1. DocuClipper

DocuClipper is a robust invoice data extraction tool that simplifies the conversion of invoices, receipts, and financial statements into Excel, CSV, and QBO formats. By automating data capture and organization, it reduces manual input and minimizes errors.

With advanced OCR technology and specialized financial document processing algorithms, DocuClipper ensures high accuracy and fast processing. Whether handling a small number of invoices daily or managing large volumes of financial statements, it enhances efficiency, improves workflow accuracy, and streamlines invoice management.

Pros

- User-Friendly Interface: DocuClipper’s web-based platform is built for ease of use, making invoice data extraction simple and intuitive.

- Affordable Pricing Model: With a page-based pricing structure, it offers a budget-friendly option for small businesses compared to competitors that charge per line item.

- High OCR Accuracy: Advanced OCR technology precisely extracts invoice data, seamlessly converting PDFs into Excel, CSV, or QBO with minimal errors.

- Rapid Processing: The platform can process hundreds of invoices within minutes, significantly reducing the time spent on manual data entry.

- Secure Data Storage: All financial information is encrypted and stored securely in the cloud, ensuring compliance with data protection standards.

Cons

- No Mobile App Support: DocuClipper lacks a mobile application with built-in camera scanning, requiring invoices to be converted into PDFs before processing.

- Limited Native Integrations: While it integrates smoothly with Sage, Xero, and QuickBooks, connecting with other accounting software necessitates API configuration.

Pricing

- Starter: $39/month for 200 pages.

- Professional: $74/month for 500 pages.

- Business: $159/month for 2000 pages.

- Enterprise: Custom pricing based on page volume. Contact DocuClipper for details.

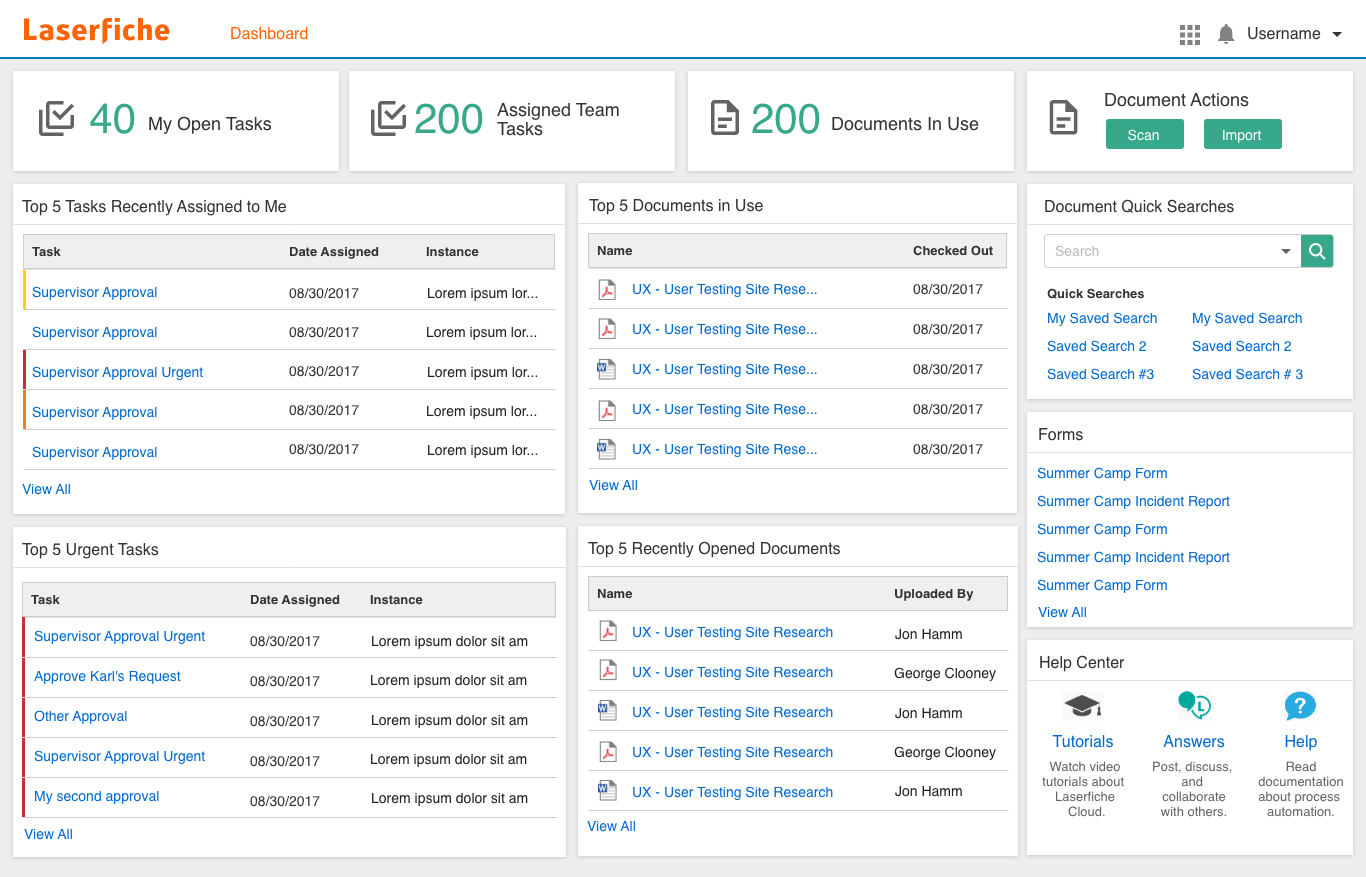

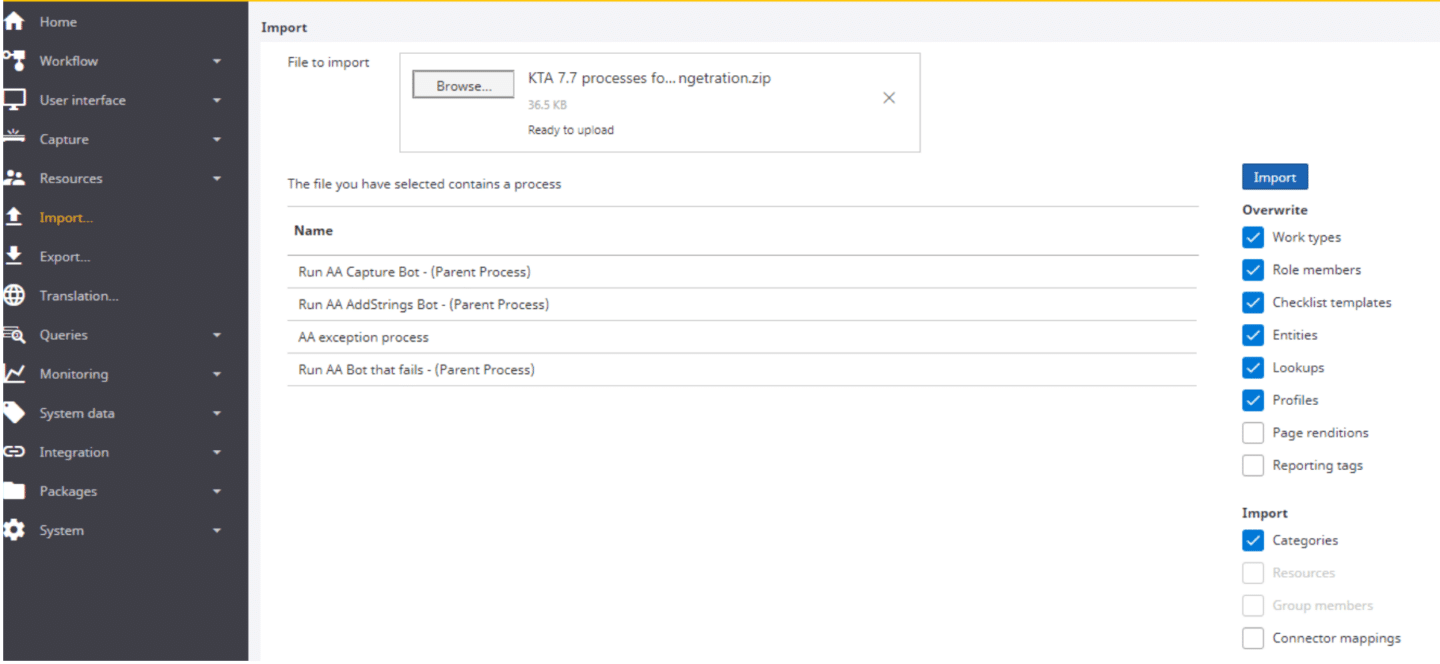

2. Laserfiche

Laserfiche transformed document management by pioneering paperless office solutions through enterprise content management. With a cloud-centric approach, it utilizes AI and machine learning to help organizations optimize workflows, enhance efficiency, and transition to fully digital operations on a global scale.

Pros

- Centralized Document Management: Laserfiche offers a unified system that eliminates the complexity of handling documents across different cloud storage platforms and network drives.

- Advanced Automation Capabilities: The platform enhances workflow efficiency by automating document storage, records management, and form processing, minimizing manual tasks and increasing productivity.

Cons

- Difficult Setup and Customization: Initial configuration can be complex and requires technical expertise, though community support and training materials are available to assist.

- Potential Workflow Interruptions: Software updates may occasionally disrupt workflows, necessitating adjustments, while new users might experience a steep learning curve despite available resources.

- Limited Business Process Integration: The platform does not fully support seamless connectivity between different business processes, which may restrict workflow automation.

- Inconsistent Customer Support: Some users have reported delays in email responses and a lack of follow-up, making issue resolution slower than expected.

- Differences Between Cloud and On-Premise Versions: Businesses transitioning to the cloud may experience discrepancies in functionality compared to the on-premise version, which could impact workflow consistency.

Pricing

Contact sales representatives for more information.

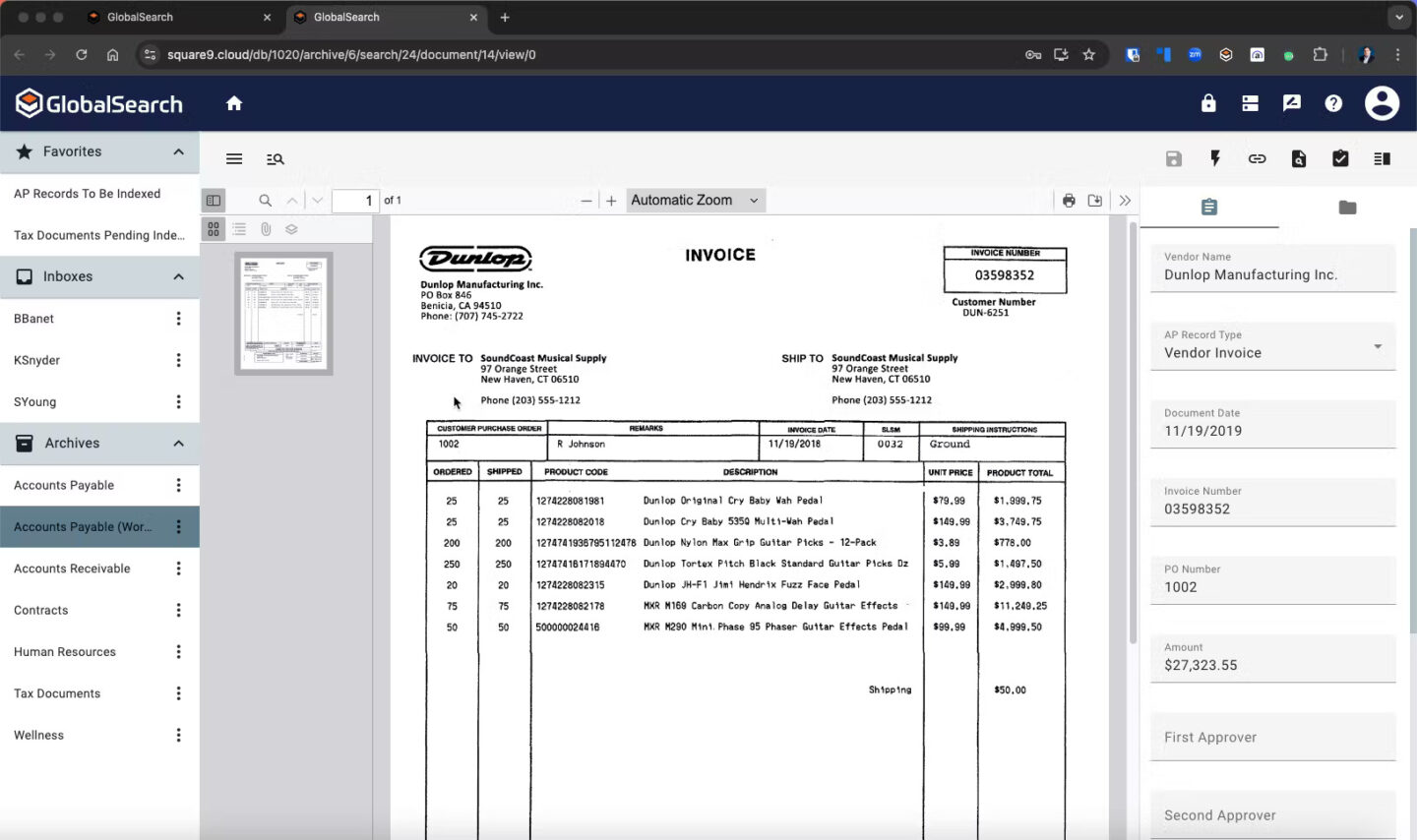

3. Square 9 Softworks

Square 9 is an AI-powered document management platform designed to automate invoice data extraction and enhance financial workflows. It eliminates the inefficiencies of paper-based processes by converting scanned invoices and PDFs into structured, searchable data.

With intelligent automation and streamlined workflows, Square 9 helps businesses improve efficiency, reduce manual data entry, and ensure greater accuracy in invoice processing.

Pros

- Centralized Document Management: Easily access, search, and export invoices and financial documents from a single secure location.

- Strong Security Measures: User access controls can be customized to safeguard sensitive financial information.

- Enhanced Digital Workflow: Minimizes dependence on paper-based document storage, streamlining financial record management.

- Reliable Customer Support: Users appreciate the responsive support team, which assists with setup and troubleshooting.

- Optimized Accounts Payable Processes: Maintains accurate, well-organized invoice records, ensuring compliance and improving financial workflow efficiency.

Cons

- File Access Challenges: Downloaded documents may open as “Enabled” files, requiring extra steps to access them.

- Difficult Scanner Integration: Setting up new scanners can be complex, though customer support is available for assistance.

- High Upfront Costs: While beneficial in the long run, the initial setup and deployment expenses can be significant.

- Software Glitches: Users report occasional login issues and disappearing features that sometimes require an application reset.

- Complicated Data Extraction: Retrieving information from large databases can be cumbersome, and reporting tools could be more user-friendly.

Pricing

Square 9 provides three subscription plans tailored to different business needs:

- Process Automation Essentials – $50 per user/month (minimum 5 users). Includes features for accounts payable, accounts receivable, human resources, and contract management.

- Digital Transformation Essentials – $68 per user/month. Offers OCR extraction, table data extraction, and support for multiple companies.

- Enterprise Essentials – $75 per user/month. Includes integrations with major platforms like Sage, Microsoft Dynamics, SAP, and Microsoft 365.

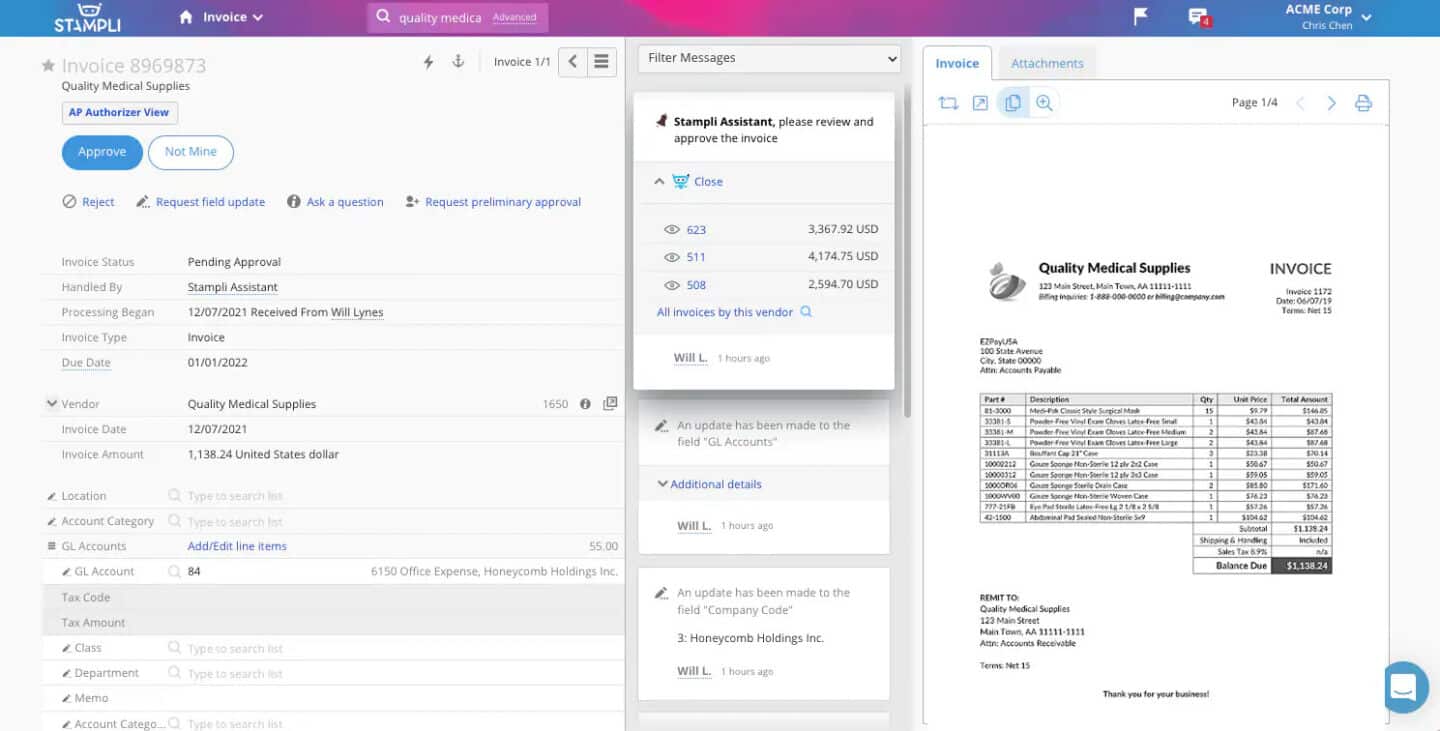

4. Stampli

Stampli is a procure-to-pay solution designed to simplify procurement and accounts payable by centralizing approvals, transactions, and communication. Its AI-powered assistant, Billy the Bot™, automates invoice processing, managing over $90 billion in transactions annually.

With built-in integrations for ERPs such as Sage, Microsoft, Oracle, SAP, QuickBooks, and Acumatica, Stampli seamlessly adapts to various financial workflows. Its fast implementation allows businesses to deploy the platform within weeks, ensuring accessibility for all stakeholders involved in invoice management.

Pros

- Intuitive Interface: Stampli’s user-friendly design allows for effortless navigation, making it easy to manage multiple locations and streamline invoice approvals.

- Proactive Customer Support: The support team responds promptly, offers regular follow-ups, and conducts monthly check-ins to enhance user experience.

- Advanced Search Capability: The powerful search tool simplifies audits by allowing keyword-based searches, reducing the time spent reviewing invoices.

- Seamless NetSuite Integration: Stampli integrates smoothly with NetSuite, eliminating the need for lengthy implementations and enabling faster adoption.

Cons

- Limited Support Availability: Stampli does not provide 24/7 support and is unavailable on holidays, which can be inconvenient for users needing assistance outside of standard business hours.

- QuickBooks Sync Issues: Vendor or customer name changes in QuickBooks result in duplicate entries in Stampli, requiring manual corrections due to the lack of a batch update feature.

- Delayed Invoice Processing: Invoices submitted late in a period may not be reviewed in time for QuickBooks export, requiring manual date adjustments for accurate reporting.

- Prepayments Complexity: The prepayment feature is not as seamless as expected, making integration into existing workflows more challenging.

- No AP Aging Report: Stampli lacks a built-in accounts payable aging report, which would be useful for monitoring outstanding payables.

- Slow Issue Resolution via Chat: While chat support is available, resolving issues can take a long time, and the absence of phone support makes troubleshooting less efficient.

Pricing

Stampli follows a usage-based pricing structure, with exact costs varying based on business needs. Pricing details are not publicly listed, so interested users must contact Stampli directly through their website to receive a customized quote.

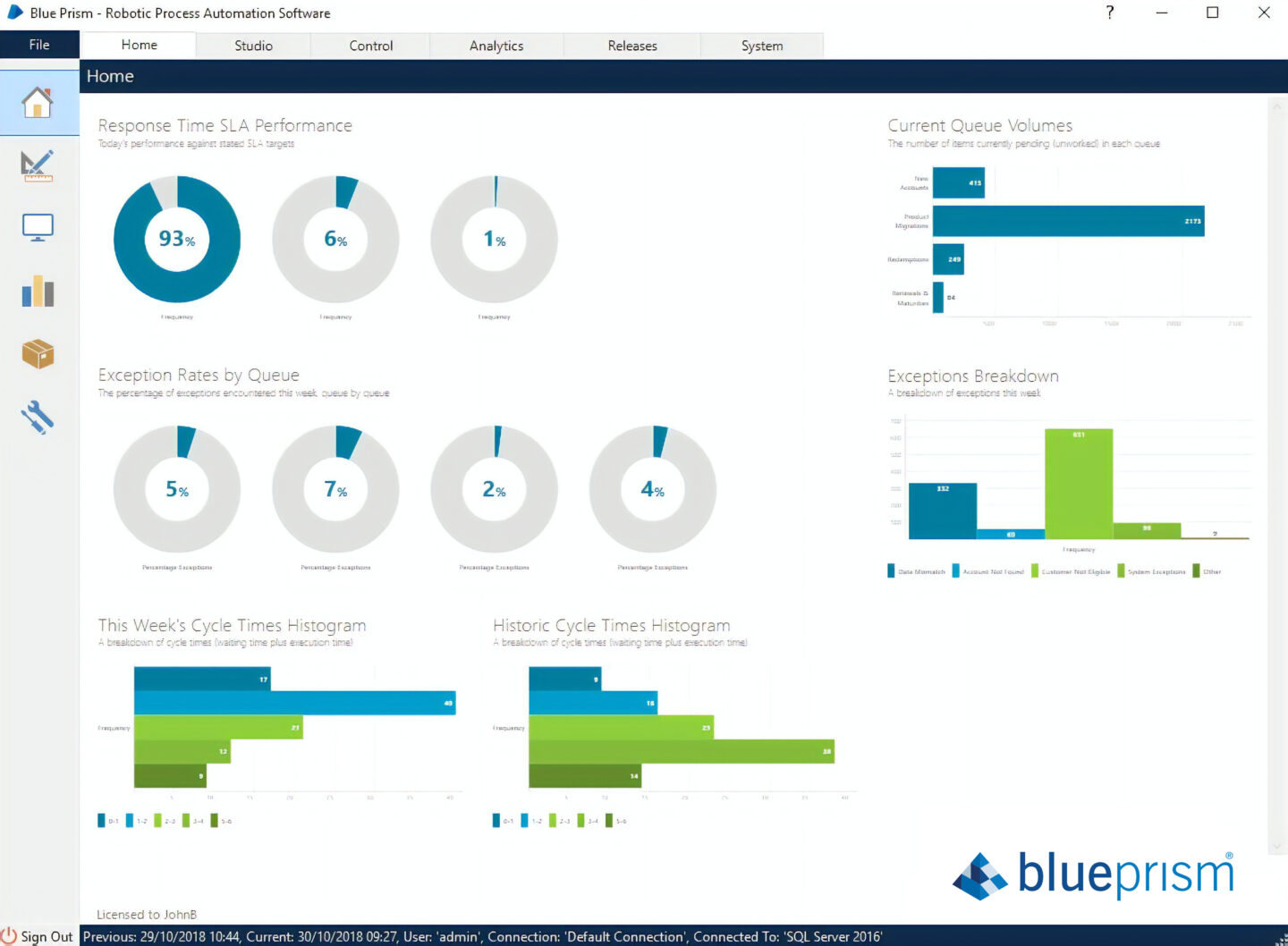

5. SS&C Blue Prism

SS&C Blue Prism’s intelligent automation platform (IAP) merges human and digital operations by integrating systems, cognitive tools, and applications with a range of pre-built automations.

By leveraging business process management, robotic process automation, and AI, it enhances workflows and supports better decision-making across organizations.

Its digital workforce helps businesses improve efficiency, cut operational costs, and reduce manual tasks, allowing employees to focus on more strategic work. By automating repetitive processes, it increases productivity while fostering job satisfaction and career growth.

Pros

- Easy to Use: Blue Prism is built for accessibility, making it user-friendly for those without technical expertise. Unlike competitors that require extensive manual setup, its intuitive interface simplifies automation.

- Drag-and-Drop Functionality: The visual workflow builder allows users to create automated processes quickly with minimal coding effort.

- Affordable Compared to Competitors: It provides strong automation capabilities at a lower cost than many other RPA platforms.

- On-Premise Deployment Available: While many automation solutions are cloud-only, Blue Prism offers on-premise options, making it suitable for organizations with strict security and compliance requirements.

- Supports Advanced Technologies: The platform integrates with OCR and large language models (LLMs), expanding its automation capabilities for document processing and AI-driven workflows.

Cons

- Cumbersome Scheduling System: Setting up task automation can be tedious, with limited feedback on scheduled processes, leading to more manual monitoring than expected.

- Slow Bug Fixes and Updates: Issue resolution can take multiple software versions, delaying improvements and feature enhancements.

- Steep Learning Curve: Initial setup requires technical knowledge, and new users may take time to become proficient with all features.

- Compatibility Challenges: Running Blue Prism on older systems without recent technology updates may require additional configurations.

- Expensive for Small Businesses: While packed with features, the pricing structure may not be suitable for smaller companies with budget constraints.

- Limited AI Capabilities: Some automation workflows lack advanced cognitive functions, making them less adaptable to dynamic processes.

Pricing

Contact sales rep for a quote.

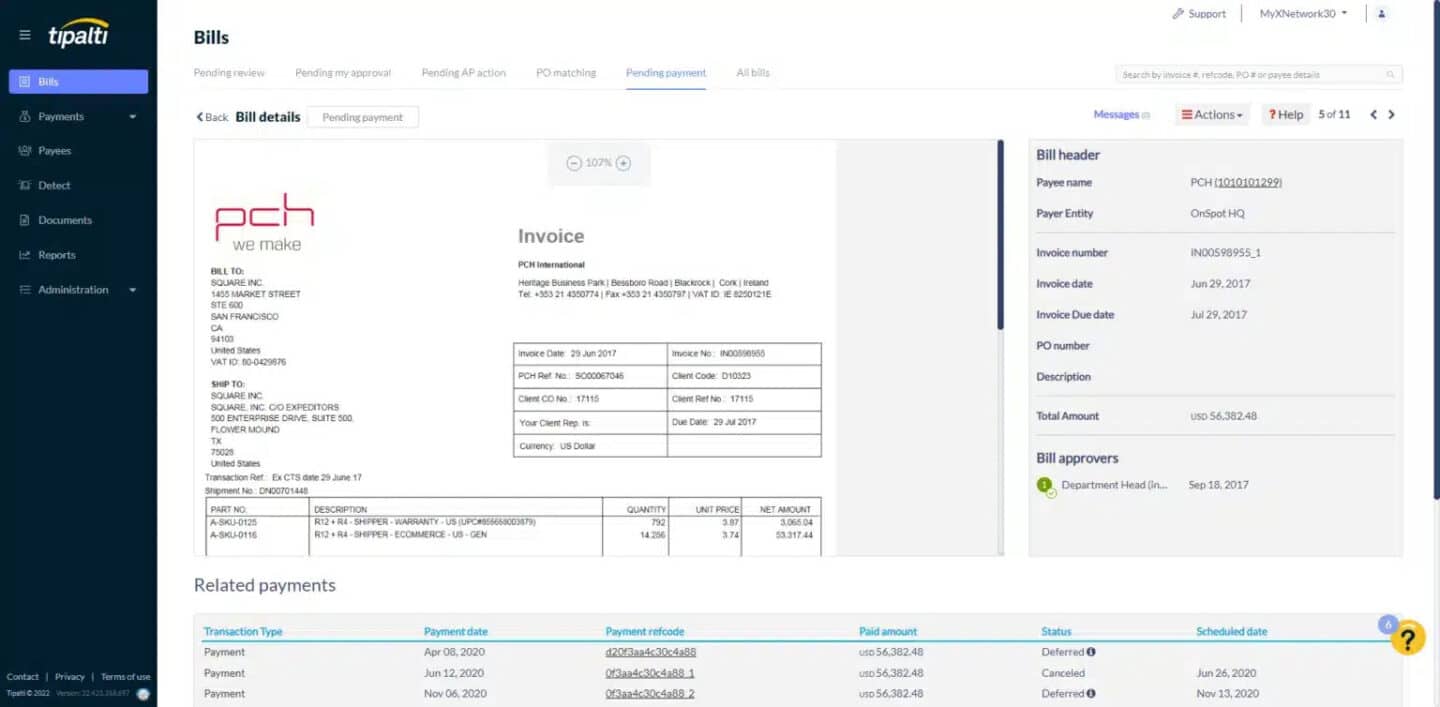

6. Tipalti

Tipalti is an all-in-one platform that automates the entire payables workflow. It provides a suite of tools for managing accounts payable, global payments, procurement, and employee expenses, cutting manual tasks by up to 80% and accelerating financial close by 25%.

With Tipalti, you can quickly onboard suppliers, partners, and freelancers, simplify purchase order creation, speed up approval workflows, eliminate manual invoice entry, and process global payments in local currencies across 196 countries.

The platform also supports global tax compliance, 2-way and 3-way purchase order matching, multi-entity management, OCR-based invoice scanning, and both virtual and physical employee expense cards.

Pros

- Highly Responsive Customer Support: Tipalti’s support team quickly resolves basic inquiries and provides hands-on assistance through dedicated account managers, even escalating issues to leadership when necessary.

- Strong Customer Commitment: Unlike some providers that feel distant, Tipalti actively works to resolve concerns efficiently, ensuring a dependable and supportive experience.

- Becomes Intuitive Over Time: Although there is an initial learning curve, users find that once familiar with the system, managing payments and accounts becomes seamless.

- Reliable Performance: Users report consistent and dependable functionality, making Tipalti a trusted platform for handling financial operations.

Cons

- Limited Procurement Customization: Certain procurement features lack flexibility, making them less effective for users with specific workflow needs.

- Sluggish System Performance: The platform can experience lag, particularly when syncing data, which may slow down operational efficiency.

- Slow Bill Corrections: Making adjustments to bills requires a sync process that takes about 15 minutes, creating unnecessary delays.

- Lack of Self-Service for Sync Errors: Some synchronization issues require Tipalti support intervention, even when users could potentially resolve them independently.

- Cumbersome Payment Batch Processing: Managing payment batches that include bill credits can be time-consuming and difficult for users.

- Multiple Supplier Portals: Payees must maintain separate login credentials for each instance of Tipalti, which can be inconvenient.

- Extended Payee Onboarding: Registering payees is a lengthy process, with some organizations taking up to eight months to onboard 75% of their payees.

- Limited Payout Rule Flexibility: Users have expressed a need for more customization in payout rules, and the inability to manage both pay-ins and payouts may require an additional payment solution.

Pricing

Starting plan begins at 99 GBP and contact sales representatives for upgrades and custom pricing.

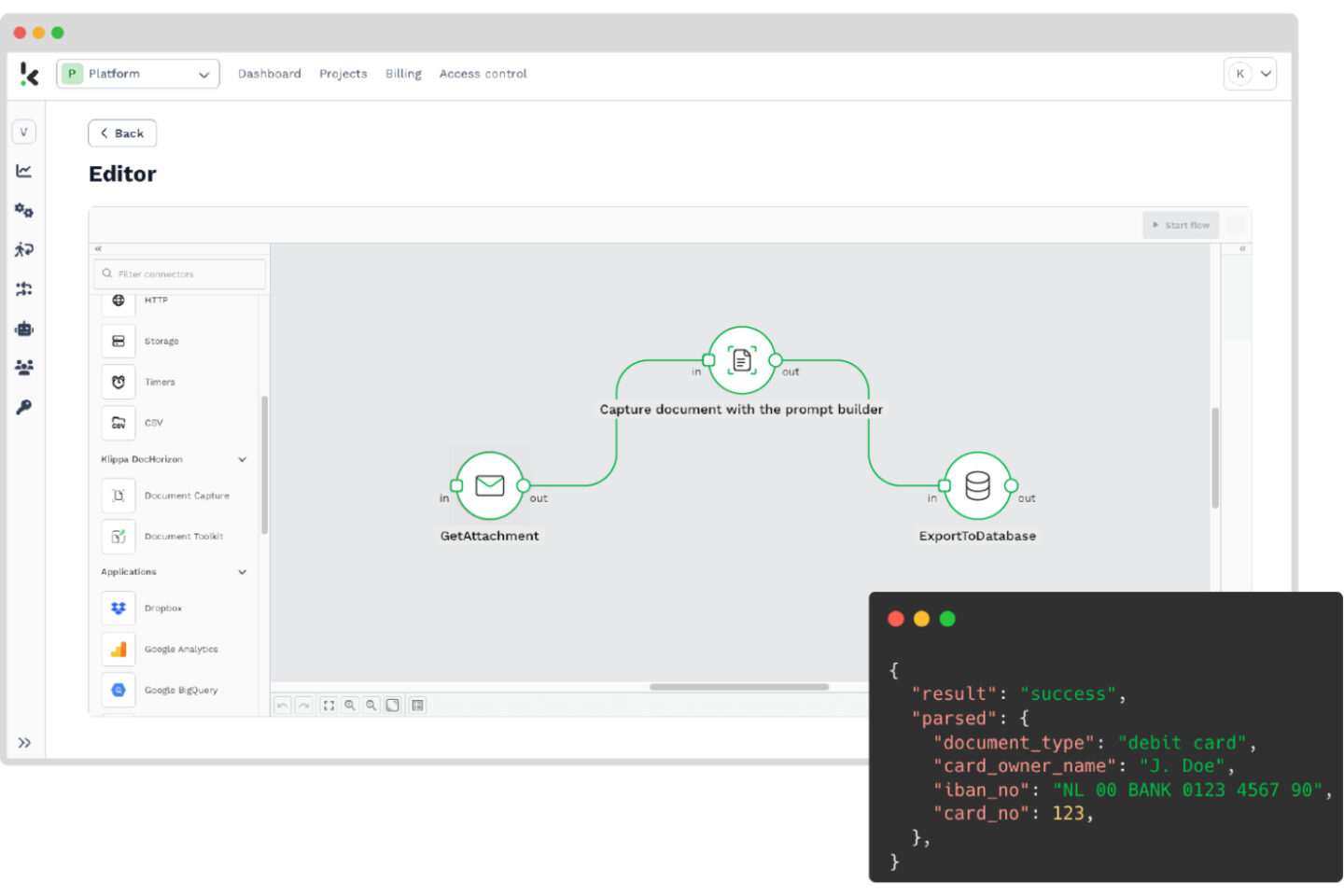

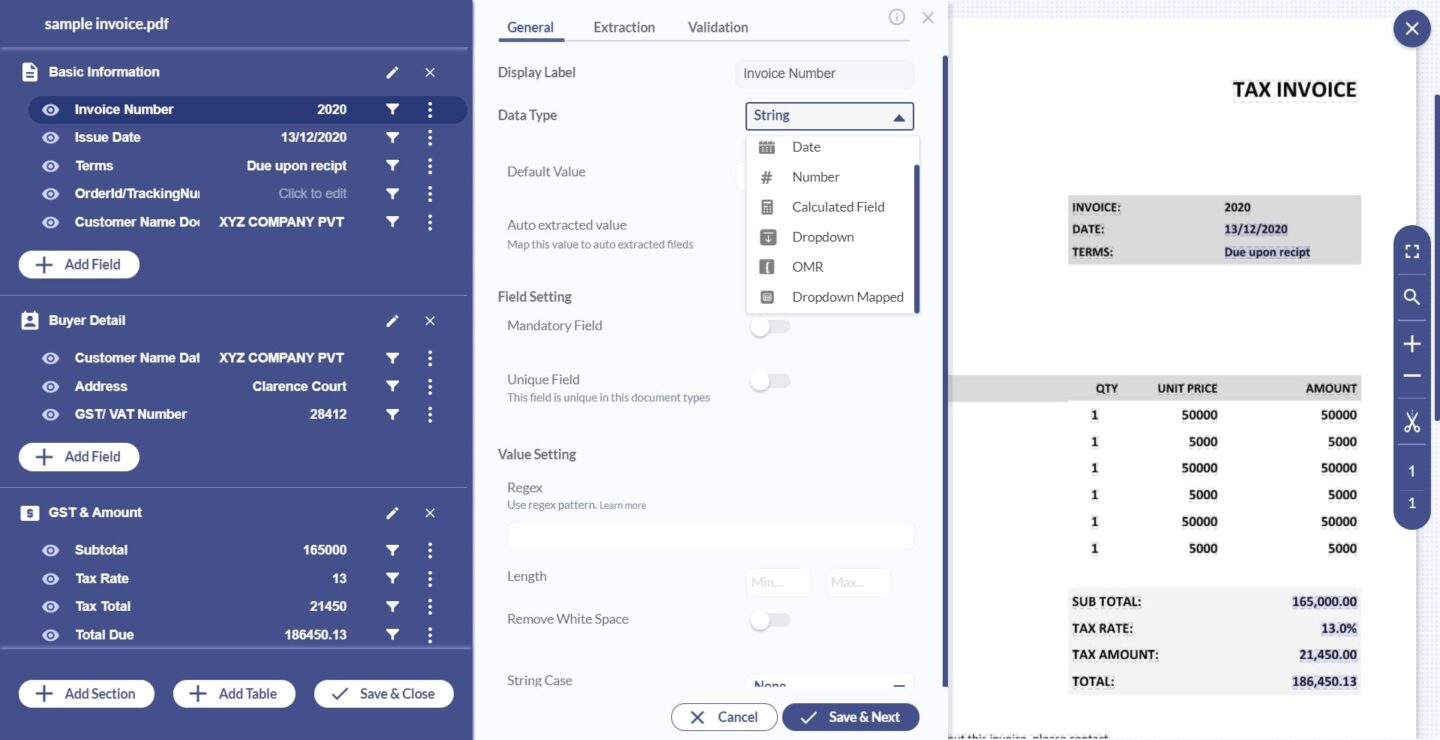

7. Klippa DocHorizon

Klippa DocHorizon is an invoice data extraction platform designed to optimize document workflows using OCR technology, automated data capture, classification, and format conversion. By reducing reliance on manual data entry, it enhances efficiency and accuracy in invoice processing.

With features like mobile scanning and document verification, Klippa DocHorizon simplifies invoice management across various industries, making it a valuable tool for businesses seeking to automate financial document processing.

Pros

- Intuitive Interface – Klippa DocHorizon is designed with ease of use in mind, allowing both new users and implementation teams to navigate the platform effortlessly.

- Reliable OCR Accuracy – The system utilizes advanced OCR technology for precise invoice data extraction, ensuring high accuracy and well-documented functionality.

- Supportive Customer Service – Users benefit from a responsive support team that assists with setup, troubleshooting, and workflow optimization.

- Continuous Improvements – Regular updates enhance platform performance by introducing new features, further streamlining document processing efficiency.

Cons

- Restricted Customization – The platform offers limited flexibility, which may make it difficult for users with specific workflow needs to tailor the system accordingly.

- Integration Challenges – While functional, Klippa DocHorizon may not integrate smoothly with all business processes, requiring additional configuration.

- Overwhelming Feature Set – The wide range of features can be excessive for some users, making it challenging to determine the most suitable settings for their requirements.

Pricing

Klippa DocHorizon follows a credit-based pricing model, where users receive €25 in free trial credits. After the trial, additional credits can be purchased as needed. The billing structure is based on document usage, allowing businesses to scale their expenses according to processing needs.

8. Tungsten Automation

Tungsten Network is a cloud-based e-invoicing platform designed to optimize procure-to-pay operations. It enables businesses to process invoices with greater efficiency, lower operational costs, improve cash flow management, and reduce fraud risks.

Additionally, the platform offers invoice data extraction capabilities, helping organizations automate financial workflows and enhance overall accuracy.

Pros

- Automated Invoice Creation: Tungsten Network enables users to generate and send invoices in multiple formats, streamlining the invoice management process.

- Cloud Accessibility: As a cloud-based solution, the platform allows businesses

Cons

- Internet Dependency: Tungsten Network requires a stable internet connection for optimal performance, which may be a limitation for users in areas with unreliable connectivity, or users already having issues like exclamation mark on their WiFi icon.

- Challenging User Experience: The platform is reported to be maintenance-intensive and difficult to use, with a coding-heavy interface that may not be user-friendly.

- Limited Automation Features: While effective for basic file transfers, Tungsten lacks advanced automation capabilities for more complex tasks.

Pricing

- Power PDF Standard for Windows and Mac: $129

- Power PDF Advanced for Windows: $179

9. Docsumo

Docsumo is an Intelligent Document Processing (IDP) solution built for SMB lenders, insurers, commercial real estate (CRE) lenders, and investors. Initially focused on invoice automation, it has expanded into a comprehensive data extraction platform, serving a wide range of financial services across the U.S.

Pros

- Strong Backend Infrastructure: Docsumo’s advanced system supports diverse use cases, helping businesses streamline document processing.

- Excellent Customer Support: The support team offers in-depth guidance during setup and optimization, ensuring a smooth experience.

- User-Friendly Design: Built for accessibility, Docsumo simplifies document processing for users of all technical skill levels.

- Flexible API Integration: The platform provides adaptable API connectivity, making it easy to integrate with existing business workflows.

- Reliable Performance: Users experience a stable, glitch-free platform that enhances operational efficiency and reduces downtime.

Cons

- Requires Technical Knowledge: Some customization options may be challenging for users without a technical background.

- Lengthy Setup Process: Configuring models can take time, especially for businesses dealing with diverse document formats.

- Limited Navigation Shortcuts: Users find the platform lacks efficient keyboard shortcuts to speed up data review.

- Retraining for Small Changes: Even minor modifications require AI model retraining, which can slow down workflow improvements.

Pricing

- Free: 100 pages per month for individual users.

- Starter: 1,000 pages per month for $299, for up to 3 users.

- Growth: 3,000 pages per month for $799, for up to 5 users.

- Business: 10,000 pages per month for $2,499, for up to 10 users.

- Enterprise: Custom pricing with flexible document volumes and unlimited users.

All plans come with a 14-day free trial.

For more information on pricing, visit the Docsumo website.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about affinda alternatives:

What factors should I consider when choosing an Affinda Invoice Extractor alternative?

When selecting an alternative to Affinda Invoice Extractor, consider factors like OCR accuracy, integration capabilities, pricing structure, and ease of use. Look for platforms that support multiple file formats, offer automation features, and ensure data security. Additionally, assess customer support quality and scalability to match your business’s growing document processing needs.

Are these alternatives suitable for small businesses?

Yes, many of these alternatives are suitable for small businesses. They offer flexible pricing plans, user-friendly interfaces, and automation features that reduce manual data entry. Some platforms provide pay-as-you-go options, making them cost-effective for businesses with lower invoice volumes. It’s important to choose a solution that aligns with your budget and integration needs.

Do these tools support multiple languages?

Yes, many of these tools support multiple languages for invoice data extraction and document processing. Some platforms offer built-in multilingual OCR capabilities, allowing businesses to process invoices and financial documents in various languages. However, the level of language support may vary, so it’s best to check with the provider for specific language compatibility.

Can these platforms integrate with existing enterprise systems?

Yes, most of these platforms offer integration with existing enterprise systems, including ERP and accounting software like SAP, Oracle, QuickBooks, and Xero. Many provide API access, allowing seamless data synchronization with your existing workflows. However, the integration process may vary by platform, so it’s best to check compatibility with your specific system.

Is training required to use these invoice processing tools?

Training requirements vary depending on the platform. Some invoice processing tools feature intuitive, user-friendly interfaces that require minimal training, making them easy to adopt. Others, especially those with advanced automation and customization options, may need onboarding sessions or technical guidance. Many providers offer tutorials, documentation, or customer support to help users get started efficiently.