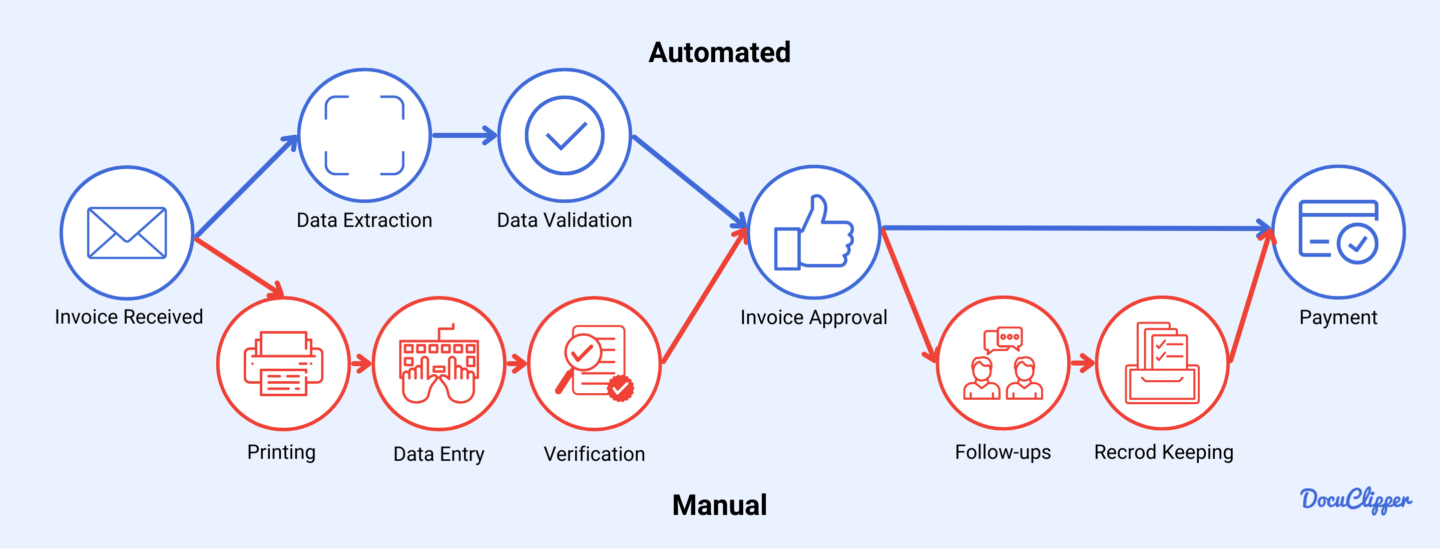

Processing invoices manually is slow and frustrating. You have to enter data, check for errors, match invoices with purchase orders, and route approvals—all by hand. This takes time, increases the risk of mistakes, and makes it harder to manage large volumes of invoices.

A single typo or missed duplicate payment can cause financial discrepancies, late fees, or compliance issues. AI invoice processing solves these problems by automating the entire workflow.

Using OCR, machine learning, and natural language processing, AI extracts invoice details, verifies accuracy, and routes approvals instantly. This eliminates manual invoice data entry, reduces errors, and speeds up invoice processing.

In this article, you will learn how AI-powered invoice processing works, what technologies it uses, and how you can implement it to streamline your accounts payable workflow.

What is AI Invoice Processing?

AI invoice processing is the use of artificial intelligence to automate invoice data extraction, validation, approval, and payment. It eliminates the need for manual data entry by using optical character recognition (OCR) to capture text and machine learning (ML) to extract key details like invoice numbers, vendor names, dates, and amounts.

Once extracted, the data is validated and mapped into financial systems for seamless processing. AI also automates approval workflows by either auto-approving invoices based on predefined policies or notifying approvers when manual review is required.

Additionally, AI detects errors and anomalies, ensuring invoices are accurate and legitimate. By streamlining the entire invoice workflow, AI invoice processing reduces costs, improves efficiency, and minimizes the risk of duplicate or fraudulent payments

What technologies are used in AI invoice processing

AI invoice processing uses OCR, machine learning, and natural language processing to extract and process invoice data with minimal manual effort.

OCR scans invoices and converts text into machine-readable data. It captures vendor names, invoice numbers, dates, amounts, and line items, making them usable for automation.

Machine learning improves accuracy by learning from past invoices. It adapts to different formats, automates data validation, and reduces manual corrections.

Natural language processing helps AI understand extracted text. It ensures numbers, dates, and vendor details are correctly identified, even when invoice formats vary.

These technologies work together to automate invoice processing, flag errors, and improve efficiency over time.

Why is AI invoice processing important?

AI invoice processing helps you work faster, reduce errors, and strengthen financial controls. By automating key tasks, you can process invoices more efficiently, cut costs, and stay compliant. Here’s how AI makes a difference:

- Faster invoice processing: AI reduces invoice processing time by 50% for smaller companies, ensuring payments are made on time and avoiding late fees.

- Lower error rates: AI eliminates 1.2% of manual data entry mistakes, preventing duplicate payments and financial discrepancies.

- Cost savings: Businesses reduce processing costs by $5.00 per invoice through automation, cutting the need for extra staff and manual reviews.

- Fraud prevention: AI detects suspicious transactions by identifying duplicate invoices and payment inconsistencies.

- Stronger compliance: Automated validation ensures invoices meet financial regulations, reducing audit risks and penalties.

- Real-time financial insights: AI provides instant visibility into cash flow and spending, helping businesses optimize financial decisions.

AI Invoice Processing vs Traditional Invoice Automation

You may already be using invoice automation, but without AI, it still requires rules, templates, and manual validation. Traditional automation speeds up processing, but it struggles with variations in invoice formats and unexpected errors. You still have to step in when something doesn’t match.

AI invoice processing takes automation further. It adapts to different invoice layouts, learns from past data, and improves accuracy over time. Instead of relying on rigid templates, AI-powered tools use machine learning and OCR to extract and verify invoice details with minimal manual input.

Rule-based automation vs AI-driven decision-making

If you use traditional invoice automation, you depend on fixed rules that work well for predictable tasks but fail when something unexpected happens. For example, if an invoice exceeds a set amount, it gets routed for approval, but any slight deviation often requires you to step in and make manual adjustments.

AI invoice processing removes this rigidity. It learns from past data, adapts to different invoice formats, and detects errors or anomalies automatically. Instead of requiring constant updates, AI refines its accuracy over time, reducing manual intervention and making your workflows more efficient.

Template-based OCR vs AI-powered dynamic data extraction

If you rely on traditional OCR, it works only when invoices follow a fixed format. Any change in layout, font, or structure can cause errors, forcing you to manually update templates to keep the system accurate. This makes processing inconsistent and time-consuming.

AI-powered OCR removes this limitation by using machine learning and natural language processing to extract data without relying on predefined templates. It adapts to different invoice formats, learns from new data, and improves accuracy over time. This means you can process invoices reliably, no matter their structure, without constant manual adjustments.

Manual validation vs Machine learning-based data validation

If you use traditional invoice automation, you still have to manually check and correct OCR errors to ensure accuracy. This slows down processing and increases the risk of human mistakes, especially when dealing with large volumes of invoices.

AI eliminates the need for manual validation by comparing extracted data against historical records. It automatically detects inconsistencies like duplicate invoices or unusual amounts, flagging potential errors before they cause issues. This reduces your workload, improves accuracy, and strengthens fraud detection without requiring constant manual oversight.

Fixed workflow automation vs Adaptive AI-driven workflows

If you use traditional invoice automation, your workflows follow fixed steps that require IT support whenever changes are needed. If business rules shift, you have to manually update the system, slowing down processes and creating inefficiencies.

AI-driven workflows adapt in real time. Instead of relying on static rules, AI analyzes trends, optimizes approval processes, and detects bottlenecks automatically. It can fast-track low-risk invoices while flagging exceptions for review, reducing delays and keeping your workflow efficient without constant reconfiguration.

How AI Invoice Processing Works

Here is how you can integrate AI system with your invoice process:

1. Invoice Capture

AI invoice processing begins by capturing data from invoices, whether they are in paper form, PDFs, scanned images, or email attachments. Using OCR and Intelligent Character Recognition (ICR), AI reads both printed and handwritten text, converting it into machine-readable data. This step ensures accurate data extraction, even when dealing with different invoice formats and layouts.

2. Invoice Data Extraction with AI

Once the invoice is captured, AI applies natural language processing and machine learning to extract essential details, including invoice numbers, vendor names, dates, line items, total amounts, and taxes. Unlike template-based extraction, which requires manual configuration, AI dynamically identifies patterns across different invoice layouts. This improves accuracy and minimizes errors, regardless of format variations.

3. Invoice Data Validation

AI verifies extracted invoice data by comparing it against predefined rules, vendor databases, and financial records. It checks that vendor details align with company records, ensures line items add up to the correct total, and detects duplicate invoices, incorrect dates, or missing information. Machine learning continuously refines validation accuracy by learning from past data and corrections.

4. Invoice Matching

AI streamlines 2-way and 3-way matching by verifying invoices against purchase orders and receipts. It ensures that quantities, prices, and totals are accurate across all documents. When discrepancies such as overcharges or missing purchase orders are detected, AI flags them for review. This minimizes manual reconciliation and helps prevent duplicate payments and fraudulent transactions.

5. Invoice Categorization and Sorting

AI classifies invoices based on department, project code, expense type, or vendor without requiring manual input. By analyzing invoice details, it assigns them to the correct categories, ensuring organized record-keeping and easy retrieval during audits. This automation improves financial reporting, reduces misfiling, and lowers administrative workload.

6. Invoice Approval Workflow Automation

AI automates invoice approvals by directing invoices to the right stakeholders based on set policies. It determines approval requirements based on factors like invoice amount, department, or vendor type. Approvers receive instant notifications and can approve invoices digitally, speeding up the process. AI also auto-approves invoices that meet validation rules while flagging exceptions for manual review, ensuring a faster and more efficient workflow.

7. Payment Processing

After approval, AI handles payment processing by integrating with accounting and ERP systems. It schedules payments based on due dates, vendor terms, and cash flow availability, helping you avoid late fees and improve cash management. AI automation ensures payments are accurate, on time, and free from manual entry errors.

8. Analytics and Reporting

AI gives you real-time insights into invoice trends, processing speed, and overall financial performance. It generates reports on spending patterns, cash flow forecasts, and vendor payment cycles. By identifying bottlenecks in your workflow, AI helps you optimize accounts payable processes.

Predictive analytics also improve expense forecasting, making financial planning and budgeting more accurate.

9. Continuous Learning

AI invoice processing gets smarter over time by learning from past mistakes, user feedback, and new invoice formats. The more invoices it processes, the better it becomes at extracting data, detecting fraud, and optimizing workflows.

This continuous learning allows AI to adapt to changing invoice structures and business needs, making the system more accurate and efficient with each cycle.

How to implement AI for Invoice Processing

AI-driven invoice processing helps you eliminate manual data entry, increase accuracy, and optimize workflows. Here’s how you can integrate AI into your invoice management process:

1. Define Your Requirements

Assess the challenges in your current invoice processing workflow. Evaluate the number of invoices you handle, the need for integration with accounting software, and the level of automation required to improve efficiency.

2. Choose the Right AI-Powered Invoice Processing Software

Selecting the right AI invoice processing software is essential for efficiency and accuracy. Look for a solution that includes

OCR invoice technology to extract text from invoices, ensuring that data is accurately captured from various formats. Machine learning capabilities help improve accuracy over time by recognizing patterns and reducing errors. Seamless integration with accounting platforms like QuickBooks, Xero, or SAP ensures that invoice data flows directly into your financial system without manual entry.

Additionally, choose software that supports automated validation and approval workflows, allowing invoices to be processed, verified, and approved with minimal human intervention. A well-rounded AI-powered solution will save time, reduce mistakes, and streamline your entire accounts payable process.

3. Integrate with Your Existing System

To maximize efficiency, your AI invoice processing software should integrate smoothly with your existing ERP or accounting system. This allows invoices to be automatically imported, eliminating the need for manual data entry and reducing the risk of errors.

A seamless connection ensures that extracted invoice data is accurately mapped to the correct accounts, vendors, and expense categories. Integration also streamlines reconciliation by matching invoices with purchase orders and payment records in real time.

Choosing software that supports direct integration with platforms like QuickBooks, Xero, or SAP will help maintain consistency across financial records and improve overall workflow efficiency.

4. Train AI Models for Enhanced Accuracy

Some AI invoice processing solutions let you train models using historical invoice data, allowing the system to improve accuracy over time.

By analyzing past invoices, AI learns to recognize patterns in vendor formats, line items, and invoice structures, reducing errors in data extraction. The more data it processes, the better it becomes at handling variations in layouts, fonts, and terminology.

Training AI models also helps refine validation rules, making it easier to detect inconsistencies, duplicate invoices, or fraudulent transactions. Regularly updating AI with new invoice samples ensures it adapts to changes in supplier formats and continues to deliver precise results with minimal manual intervention.

5. Set Up Automated Workflows

Customize automation rules to streamline invoice processing and minimize manual effort. Set up invoice matching to compare invoices with purchase orders using two-way or three-way matching, ensuring accuracy before approval.

Configure the system to detect discrepancies such as pricing errors, duplicate charges, or missing details, automatically flagging them for review.

Establish approval workflows that route invoices to the appropriate stakeholders based on factors like amount, department, or vendor type, ensuring timely processing while maintaining compliance with financial policies.

6. Monitor and Optimize Performance

Continuously evaluate AI-generated results to improve accuracy and efficiency. Regularly check extracted data for inconsistencies and refine automation settings to minimize errors. Adjust workflows as needed to enhance performance and ensure seamless invoice processing.

Use Case of AI for Invoice Processing

AI helps you process invoices faster, reduce errors, and prevent fraud. Here’s how you can use it:

- Fraud detection: AI spots duplicate invoices, mismatched details, and unusual transactions, helping you prevent unauthorized payments.

- Automated data extraction: AI captures key invoice details like vendor names, invoice numbers, dates, and line items, so you don’t have to enter them manually.

- Two-way and three-way matching: AI checks invoices against purchase orders and receipts to ensure accuracy before approval.

- Automated approvals: AI routes invoices to the right people based on set rules, speeding up the approval process and reducing delays.

- Expense tracking and reporting: AI organizes invoice data into real-time reports, giving you better insights into spending and cash flow.

- Seamless bookkeeping integration: AI syncs invoices with QuickBooks, Xero, and other accounting software, eliminating manual reconciliation.

AI Invoice Processing: Best Practices

To get the most out of AI invoice processing, follow these best practices:

- Choose the right AI invoice processing software: Select a solution with OCR, machine learning, and seamless integration with your accounting system.

- Ensure data accuracy with preprocessing: Clean and standardize invoice formats before processing to improve AI extraction accuracy.

- Automate invoice matching: Set up AI-driven two-way and three-way matching to verify invoices against purchase orders and receipts.

- Establish validation and exception handling workflows: Configure AI to flag discrepancies and route them for manual review when needed.

- Integrate AI with accounting and ERP systems: Sync invoice data with platforms like QuickBooks, Xero, or SAP to eliminate manual data entry.

- Continuously train AI models: Use historical invoice data to improve AI’s ability to recognize patterns and reduce errors.

- Maintain compliance and security standards: Ensure AI follows financial regulations and protects sensitive invoice data.

Best AI invoice processing tools

Here are the best AI invoice processing tools available in the market:

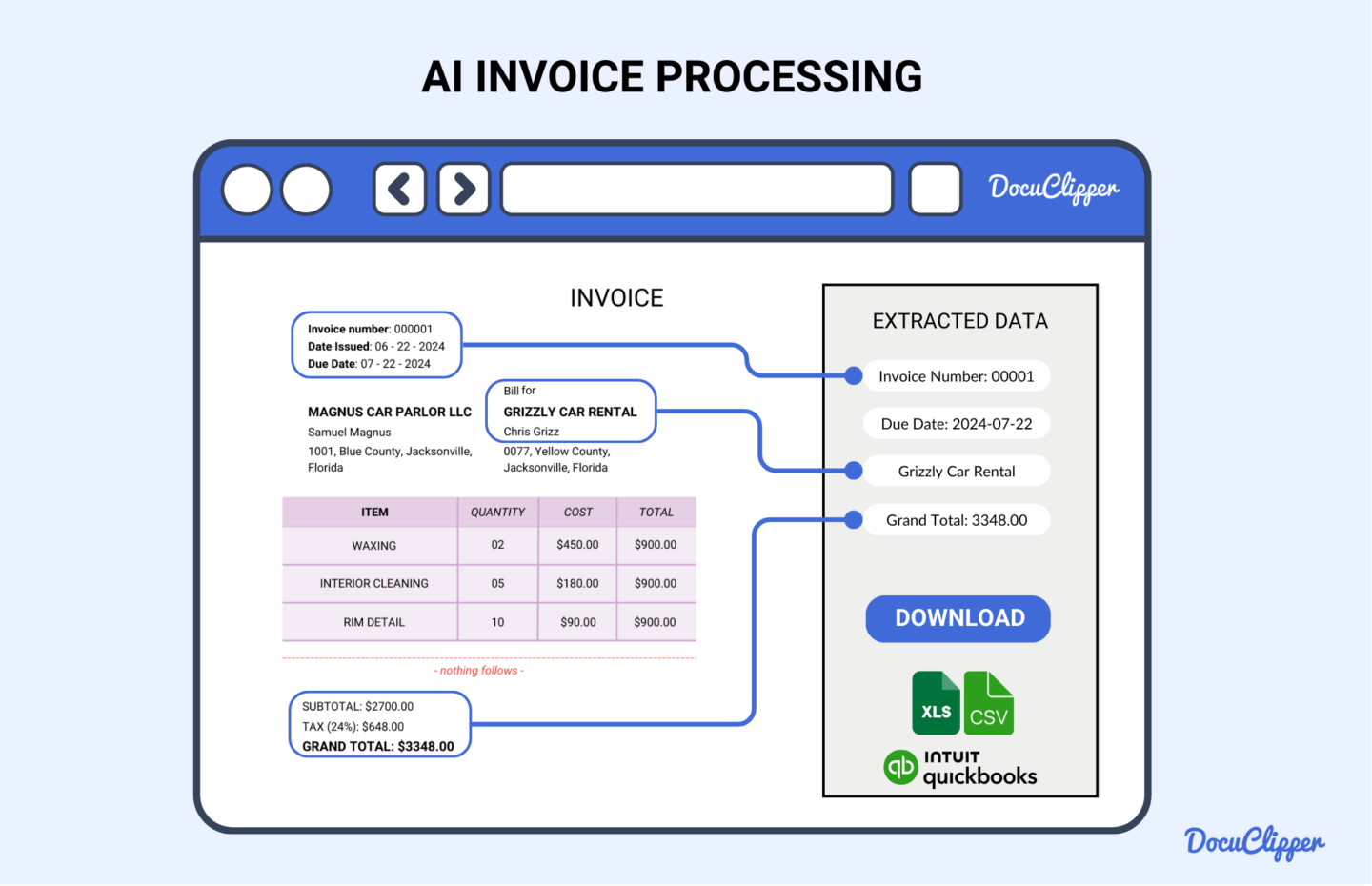

- DocuClipper: Specializes in financial document conversion, offering automated data extraction from invoices, receipts, and bank statements. Integrates with QuickBooks and provides an intuitive interface for accounting professionals.

- Stampli: Focuses on accounts payable automation with collaborative invoice management, real-time communication between teams, and AI-powered data capture. Seamlessly integrates with ERP systems like Oracle NetSuite and QuickBooks.

- Tipalti: A comprehensive payables automation platform with global payment support, tax compliance features, and supplier management tools. Ideal for businesses handling international payments and regulatory compliance.

- Rossum: A cloud-based document processing solution with AI-driven data extraction that adapts to various invoice formats. Features real-time anomaly detection and flexible integration with existing workflows.

- DocuWare: Provides secure document storage, automated invoice workflows, and seamless integration with multiple business applications. Known for improving accessibility and efficiency in document management

How DocuClipper’s AI Helps Invoice Processing

DocuClipper enhances invoice processing by automating data extraction through advanced Optical Character Recognition (OCR) technology.

It swiftly converts information from various invoice formats into structured data, such as Excel or CSV files, facilitating seamless integration with your existing accounting and Enterprise Resource Planning (ERP) systems.

This automation not only reduces manual data entry but also minimizes errors, streamlining your financial workflows and improving overall efficiency.

FAQs about AI Invoice Processing

Here are some frequently asked questions about AI invoice processing:

How much does AP Automation cost per invoice?

AP automation can significantly reduce the cost per invoice processed. While manual processing can cost between $15 to $40 per invoice, automated solutions typically lower this to approximately $1 to $2 per invoice. The exact cost depends on factors such as invoice volume, the complexity of the AP process, and the specific features of the automation solution

What role does machine learning play in AI invoice processing?

Machine learning improves AI invoice processing by recognizing patterns, adapting to different invoice formats, and increasing data extraction accuracy over time. It reduces manual corrections by validating entries, detecting duplicates, and flagging anomalies. As the system processes more invoices, it continuously learns, optimizing workflows and making invoice approval and reconciliation faster and more reliable.

How does AI-powered OCR improve invoice data extraction?

AI-powered OCR improves invoice data entry by accurately reading printed and handwritten text, even from complex or varying invoice formats. It recognizes key details like invoice numbers, dates, vendor names, and amounts while reducing errors caused by manual entry. Machine learning enhances accuracy over time, ensuring better data extraction and seamless integration with accounting systems.

Can AI detect errors or fraud in invoices?

Yes, AI can detect errors and fraud in invoices by identifying duplicate payments, mismatched amounts, and suspicious transactions. It cross-checks invoice details against historical data, purchase orders, and financial records to flag inconsistencies. Machine learning improves fraud detection over time, helping businesses prevent unauthorized payments and maintain accurate financial records with minimal manual oversight.

What is the typical implementation time for AI invoice processing?

The implementation time for AI invoice processing varies based on system complexity and integration needs. Cloud-based solutions can be set up within a few days, while enterprise-level implementations may take weeks. Factors like data migration, workflow customization, and ERP integration impact the timeline. With proper setup, businesses can start seeing efficiency gains quickly.