An accounting practice or small business has challenges in keeping track of finances to the smallest dime. More problems add up when mistakes occur during the data entry process.

Well, this process can’t easily be ditched and fortunately, solutions are being developed over time. One of the solutions is automating data entry with OCR software and AI technology.

In this blog, we’ll talk about how automating the data entry process makes your business or practice more efficient in handling data and what software is easily available and produces the best results.

What is Automated Data Entry?

Automated data entry is the process of using automation processes in data entry procedures to capture data and information.

Automating data entry is about using technology to input data quickly and accurately, instead of doing it by hand which is slow and often prone to errors. This change makes the work faster and more efficient.

Keir Thomas-Bryant, an expert in accounting and small business finance, says that 63% of accountants and bookkeepers spend too much time on manual data entry, a big problem in their work.

Fortunately, using automation combined with cloud-based accounting solutions can solve this problem. This approach isn’t just an idea—it’s already helping practices worldwide work smarter. Adopting these technologies can make your practice more efficient and make fewer mistakes.

Benefits of Automated Data Entry

As accounting professionals adapt to this method and businesses slowly transition into automation, here are some notable benefits that they have observed.

Reduce Data Entry Error Rate

Error rates in manual data entry are ridiculously high. It may vary depending on the industry and the proficiency of the data entry clerk.

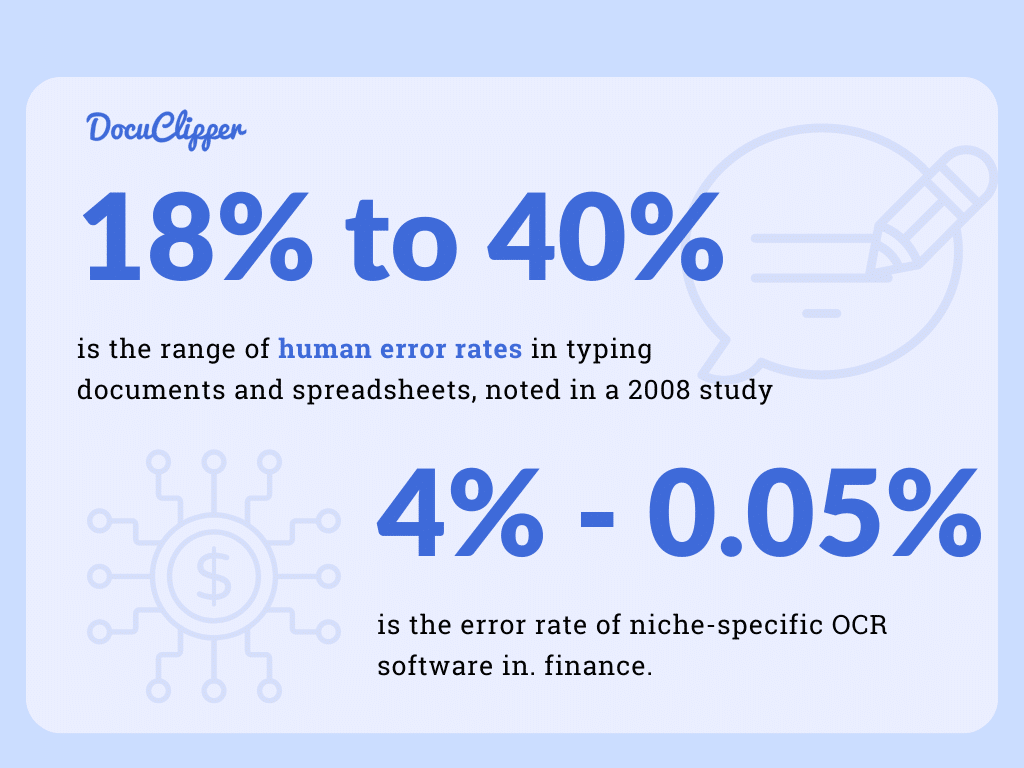

In a study in 2008, in the years when manual data entry was at its highest, the human error rate in typing in documents and spreadsheets can range from 18% to 40%.

At this ridiculous rate, no decent accounting can be done. Luckily, niche-specific OCR software in finance can reduce mistakes to 4%-0.05%. With these accuracy rates, your accounting process will be in its best form.

Increase Data Entry Speed

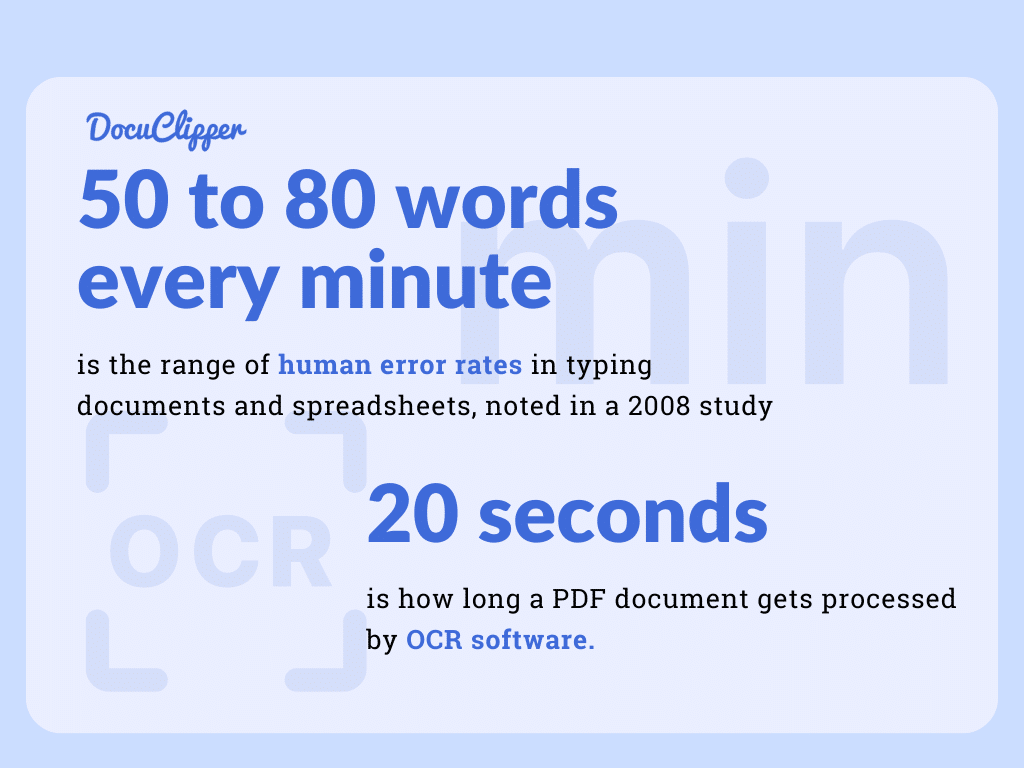

The average rate that a professional typist can type is around 50 to 80 words per minute. This rate is still in the more generalized field and not in the accounting or financial sector. It’ll be significantly slower when things are only typed.

By using automated bookkeeping, tasks that involve organizing and understanding information can be done in about 20 seconds. This makes work much quicker compared to typing everything by hand.

Scalability of Business Processes

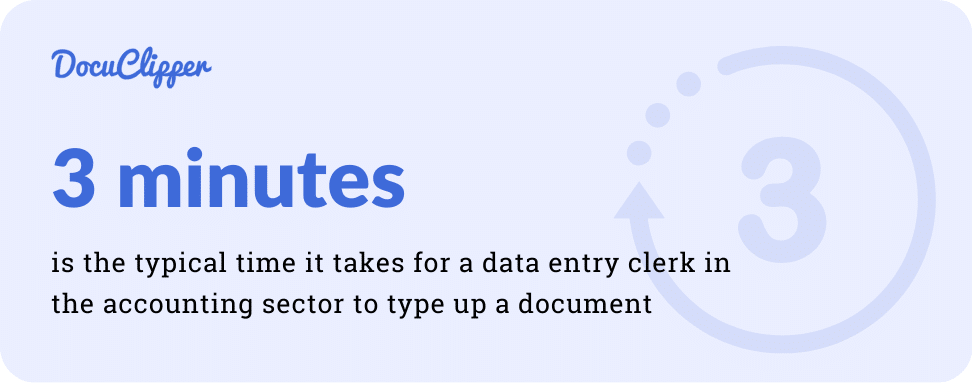

In the accounting sector, a data entry clerk can usually finish typing up a document in about 3 minutes. This time can change based on what they’re working on.

For example, if they have to work on 100 bank statements in a day, they might start slowing down from 3 minutes per document to 10 minutes. This slowdown happens because the more they work, the more tired they get, and their work speed and quality can drop.

However, using the newest OCR (Optical Character Recognition) technology to convert bank statements changes the game. This tech can process the bulk of bank statements in less than a minute, making the work much faster than typing everything by hand.

Allowing businesses to take more clients and bigger clients without the worrying of scaling the manual data entry processes from pre-accounting tasks to post-accounting workflows.”

Standardized Output

What makes automated data processing shine is how reliable and error-free its results are. Since it’s set up or programmed in advance, it always works the same way, giving you consistent results every time.

This is a big deal compared to manual data entry, where the quality can go up and down because people might get tired or lose interest.

Having results that you can count on makes it much easier to check the quality of the information.

It allows you to standardize your processes and further improve your scalability, profitability, and productivity, and you will deliver predictable results at a much higher rate.

Easy to Train New Employees

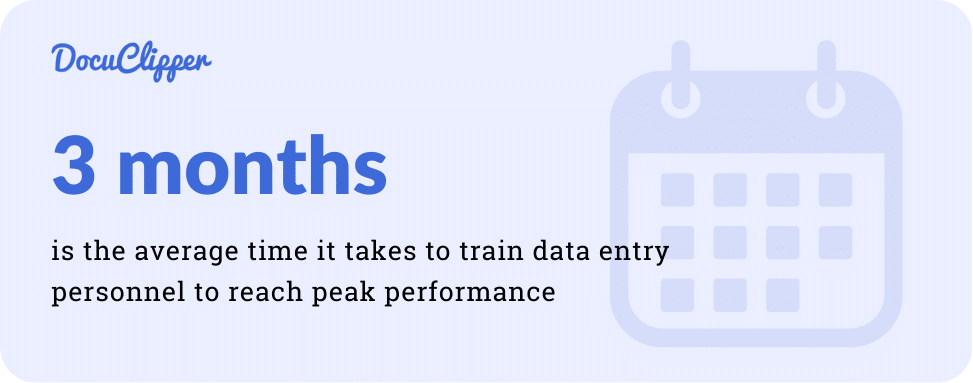

Training employees in data entry can take a lot of time. On average, it takes about 3 months to train data entry personnel to be in top shape.

While using an automated system, it will only take a few minutes or an hour to preprogram and set up the algorithm. And within a few tests, it’ll be ready to handle large amounts of data.

Additionally, most of the data entry automation tools require a minimum amount of training and within a day or two, the user is proficient enough to work with them.

Unless it’s more complicated software such as ERP systems which takes substantial amounts of training for employees, but they also automate large amounts of data and work.

As you can see, automating your data entry has significant advantages and it’s often a preferred choice from outsourcing data entry.

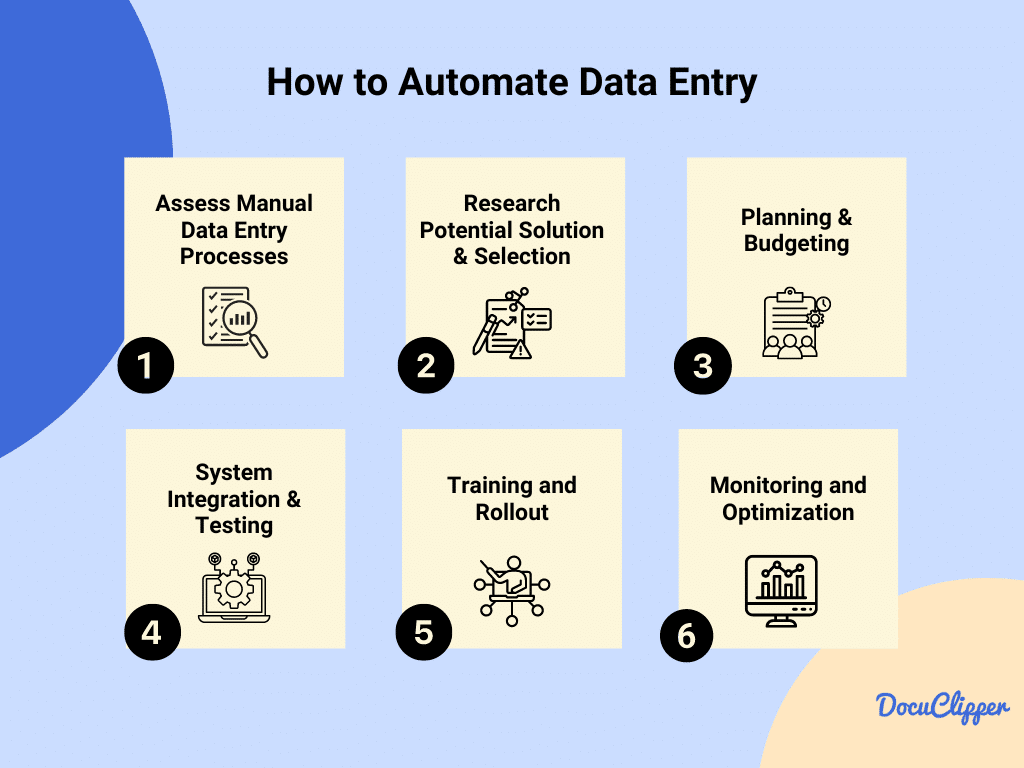

How to Automate Data Entry

Preparing a business or accounting practice to transition from a manual-centered data entry process to an automated model takes a few steps to produce the best results. Here are some things to put into practice:

Step 1: Assess Manual Data Entry Processes

Firstly, taking a close look at your existing manual processes is necessary. For example for bank statement conversion, this means examining how your team manually inputs data from bank statements and identifying inefficiencies within the system.

Similarly, for automating lead capturing, assess how leads from various platforms are manually entered into your CRM, noting areas where time is lost or errors occur.

Your goal is to find where your employees spend unnecessarily large amounts of time on repetitive manual data entry tasks.

Of course, there will always be manual data entry tasks, but if it’s only once a while or it takes a few minutes a week, then you don’t need to automate it.

However, if manual data entry starts taking hours a week, it keeps your employees away from more important tasks, then investing in automating this would be highly beneficial to your company and employee productivity.

So this is when you need to decide which of the manual data entry tasks are worth spending time and resources to automate and which ones can still be manually done.

Step 2: Research Potential Solution & Selection

Next, exploring the market for the right tools is key.

There are countless tools for almost every problem leading us to the dilemma of “Which software is right for me”?

You have to determine the problem that you are having within your business. You can try searching for your problem and some solver, calculator, or whatever tool and do their free trials.

If you are looking for something that converts bank statements to CSV, you can try searching “OCR bank statement converter”. Try as many free trials as you can, you’ll find the right fit for you with their diverse feature and different user interface.

In the case of bank statement conversion, this involves searching for OCR software that can accurately process bank statements with high accuracy.

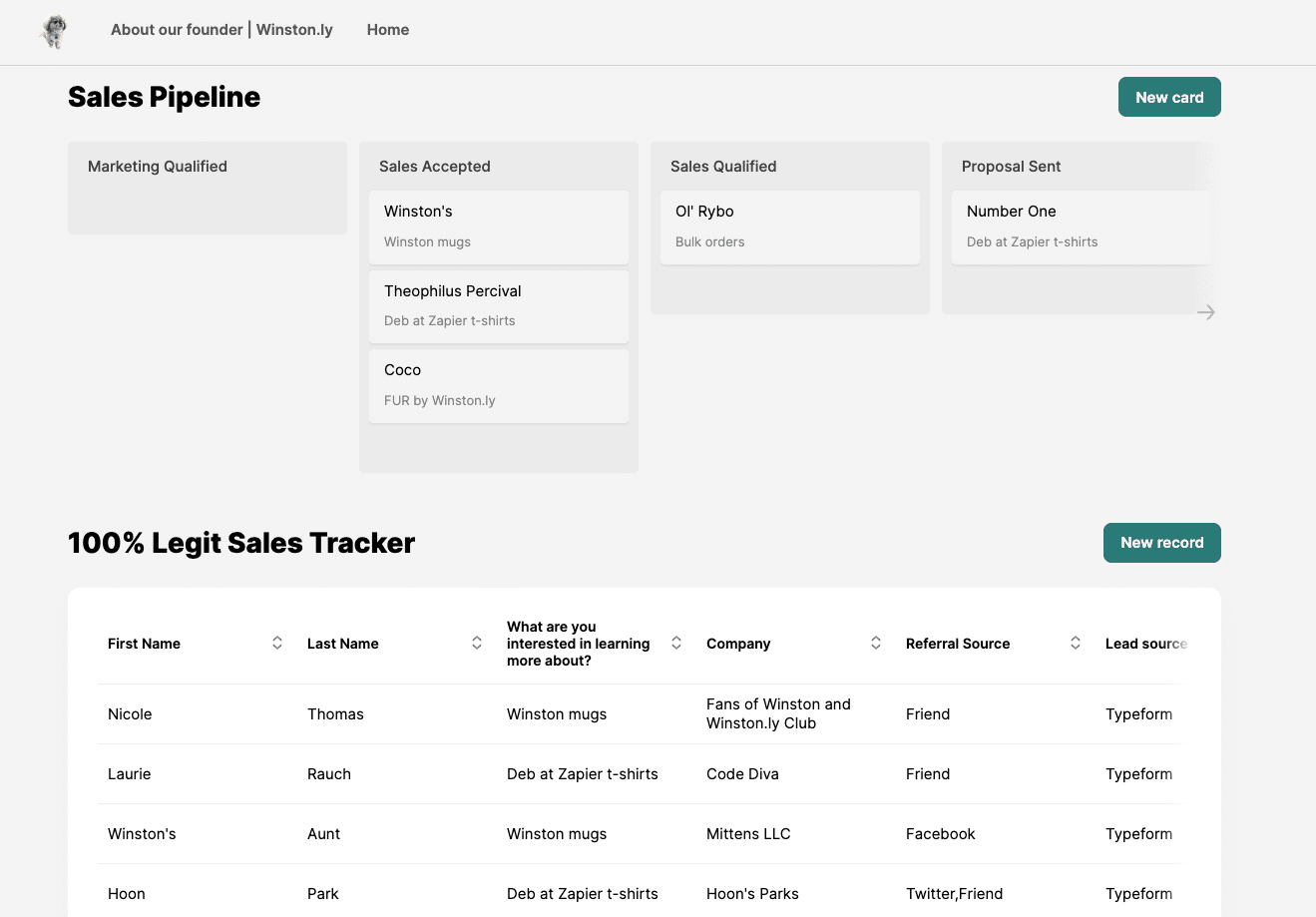

For automating lead capturing, the focus would be on finding tools that can seamlessly gather leads from various sources and integrate them into your CRM system.

AI SDR tools help automate sales outreach and follow-ups, reducing the manual effort in lead generation and qualification.

Step 3: Planning & Budgeting

With the right solutions identified, planning their implementation and budgeting for the necessary expenses is the next step.

This is the time when you get a free trial or demo to see how the software works and whether it does what you need it to do.

Often times marketing can be “too promising” and you should test the solutions in order to see whether it can do what you need to do.

For bank statement conversion, this includes the cost of the OCR software. There are also costs associated with maintaining the software and the scale of documents you process.

For lead-capturing automation, consider the cost of the lead management system and any associated training expenses. If it costs more than with relatively smaller increases in speed and quality, it is better not to transition.

Step 4: System Integration & Testing

Integrating and testing the new systems ensures they work well within your existing setup.

This means looking at the output and how easily it will be to import the data into your software, whether there are integrations with your current software, or how easy it is to use their API with your own software

The goal of automating your data entry is to ensure that automates as much of the work as possible.

Of course, in most cases, you will still need to do some manual tasks to complete the process, but the workload can be reduced by up to 90% which is a huge time saver, not talking about the potential error-reduction benefits.

To convert bank statements, you’ll link the OCR tool with your accounting software. The key is to see if transferring these converted statements is straightforward or if the OCR’s system integrates easily with your software.

Make sure to test this process a few times using actual bank statements, aiming to cover all your needs. If you encounter any errors or difficulties, such as inaccuracies in the data or issues with the software link, jot them down. This information is crucial for refining the process and ensuring a smooth operation.

In automating lead capturing, integrate the chosen tool with your CRM and test the capturing process from multiple sources. Test the leads to determine whether they are active or not. Also check the classifications that it tried to conclude if it is hot, warm, cold, or nurture a lead.

Step 5: Training & Rollout

Ensuring your team is well-equipped to use the new systems is important, though no intensive training is required, it is more on familiarizing and orienting the employees with the setup.

Ensure that everybody is comfortable with the new system and the new procedures introduced with them.

Talk to employees about any concerns they may have about the new system and how it can be addressed.

For example in bank statement conversion, training would cover how to operate the OCR software and handle any discrepancies.

For lead-capturing automation, training focuses on managing the newly integrated leads within the CRM system.

Always take note that the training should only require less time compared to training a new employee when they do a manual data entry job.

Step 6: Monitoring and Optimization

Finally, ongoing monitoring and optimization are essential for maintaining efficiency. Like all newly implemented systems, there are still many hiccups and possible mistakes down the road.

This will ensure that it works as it is supposed to, and your employees are not slipping back to manual data entry because they’re resisting the change or simply don’t understand the new system or for other reasons.

For bank statement conversion, this involves regularly checking the OCR system’s accuracy and making adjustments as needed.

For automated lead capturing, continuously analyze lead quality and conversion rates, making improvements to capture forms or source integrations to optimize results.

Use Cases of Data Entry

Automated data entry has already been used in many fields and industry.

Convert Financial Documents

In accounting and financial services, clerks often spend considerable time on document data extraction from financial documents such as bank statements, receipts, and invoices.

Invoice data entry, bank statement processing, receipt data extraction, and other process can be slow and prone to errors, especially with a high volume of documents.

However, OCR technology automates bank statement, invoice data entry, receipt data entry, and similar ones allowing for the rapid conversion of these documents into digital format. This technology drastically reduces the time needed for data entry and minimizes errors.

As most bank statements and invoices are given in PDF formats, converting them to Excel files or CSV formats allows accounting professionals to integrate them across different accounting software.

Automated Document Processing

This is particularly useful for lenders and accountants who frequently deal with customer-submitted documents in their bookkeeping and data entry.

Instead of manually processing each document, automated systems convert and import them as needed, streamlining operations and saving significant amounts of time.

Businesses can use OCR for invoice data extraction, receipt data capture, or extracting data from bank statements.

The software can detect income brackets, credit scores, assets, and many factors that can determine the eligibility of the lender.

Streamlined Lead Management

For marketing departments, manually tracking leads from various sources can be inefficient.

Automated systems simplify this by automatically importing leads into CRM systems. Sales personnel are notified about new leads, and automated responses can be sent to potential customers, making the process more efficient.

Quoting Sam Altman, “95% of Marketing will be automated with AI,” suggests a significant shift towards marketing and lead management automation, highlighting its potential to streamline operations.

Legal Document Analysis

Law offices and legal teams are now using computers to quickly pull out important details from documents like contracts and bank statements. This allows them to have a centralized database that can easily be searched when needed as they have multiple clients throughout their legal practice.

This makes researching laws and looking at documents much faster and more correct and helps manage risks better. It also prevents tampering and being dependent on physical documents that can easily be damaged.

Loan Application Processing

Banks and loan companies are turning to automated systems to help process loan applications faster and more accurately. They put all information like income statements and ID proofs in automated systems to ensure they have a standardized output and can be stored in an organized database.

This allows loan companies and banks to cut the assessment time for every client and helps them immediately determine the allowable loaning amount they can have.

Credit Risk Assessment

Automated tools help check if someone can be trusted with a loan by quickly looking at information from credit agencies, bank details, and job histories.

This cuts the backlog for leading companies and determines immediately the metrics of a client It also leads to smarter lending choices, fewer loans going bad, and a better understanding of how risky a loan might be.

Best Automated Data Entry Software

Here are some data entry software When you are already considering having an automated data entry system for your business or accounting practice.

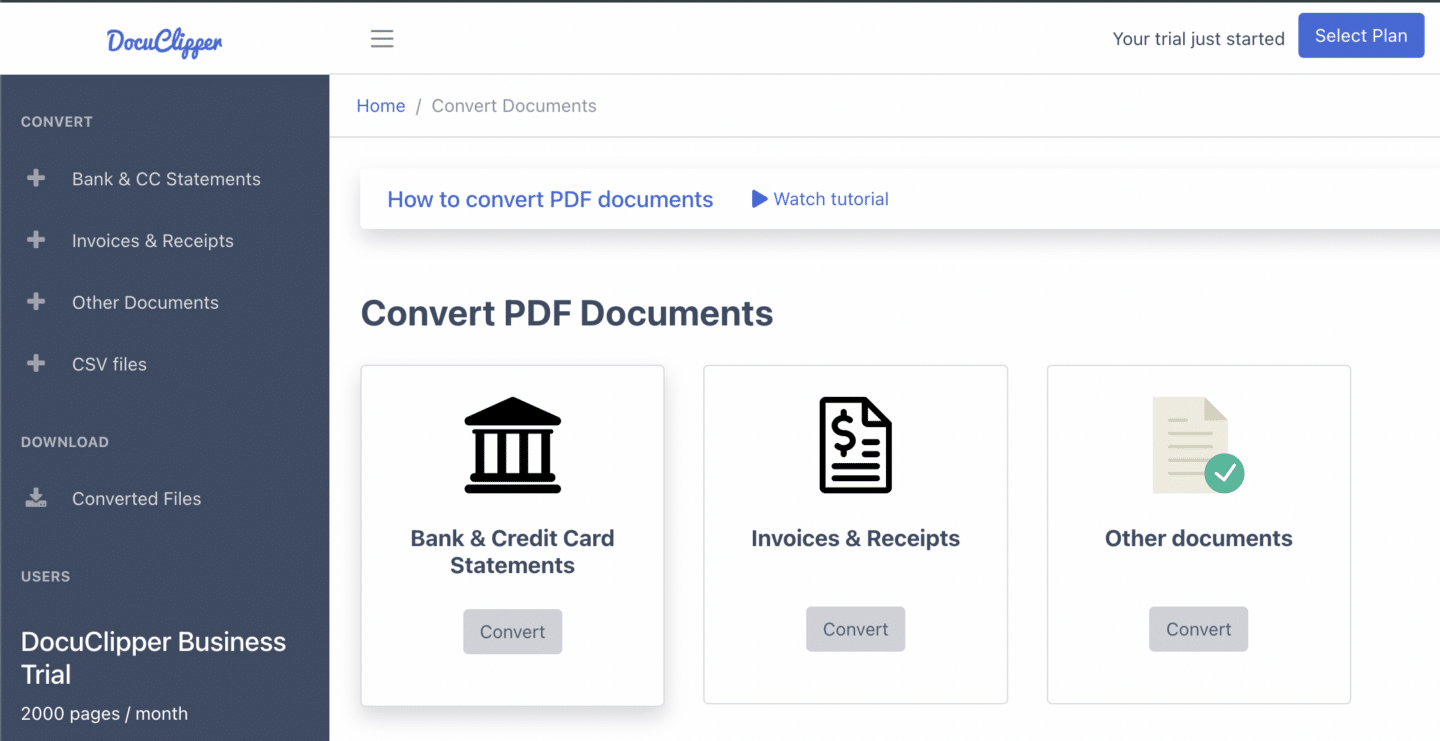

DocuClipper

DocuClipper is a financial data extraction software and powerful bank statement converter designed for converting and analyzing bank statements. It takes PDF bank statements and turns them into formats like Excel, CSV, or QBO, making it easier for users to handle their banking information. It is one of the best data entry accounting software available.

What sets DocuClipper apart is its focus on bank statements, boasting a unique OCR (Optical Character Recognition) algorithm that offers an impressive 99.5% accuracy rate. It’s trained on over 2 million bank formats globally, ensuring fast conversion in about 20 seconds and ranking as the top choice on G2 for bank statement software.

Benefits:

- High Accuracy: A specialized OCR algorithm ensures nearly perfect accuracy.

- Specialization: Focuses specifically on bank statements, unlike general OCR tools.

- Wide Support: Works with any bank format from around the world.

- Speed: Converts statements quickly, saving valuable time.

- Affordability: Offers various pricing plans to suit different needs, making it accessible for all sizes of businesses.

Pros and Cons:

- Pros: High accuracy, fast processing, and specialized in bank statements, supporting a vast array of formats, making it highly versatile.

- Cons: Primarily focused on bank statements, which might limit its use for those needing broader document processing capabilities.

Costs:

- Starter Plan: $39/mo for freelancers and small businesses, including 200 pages per month and basic features.

- Professional Plan: $74/mo for growing businesses, with 500 pages per month and additional features like transaction categorization.

- Business Plan: $159/mo for established firms, offering 2,000 pages per month and advanced features like premium support and API access.

- Enterprise Plan: Custom pricing for large firms with high-volume needs, including custom page counts and extended data retention.

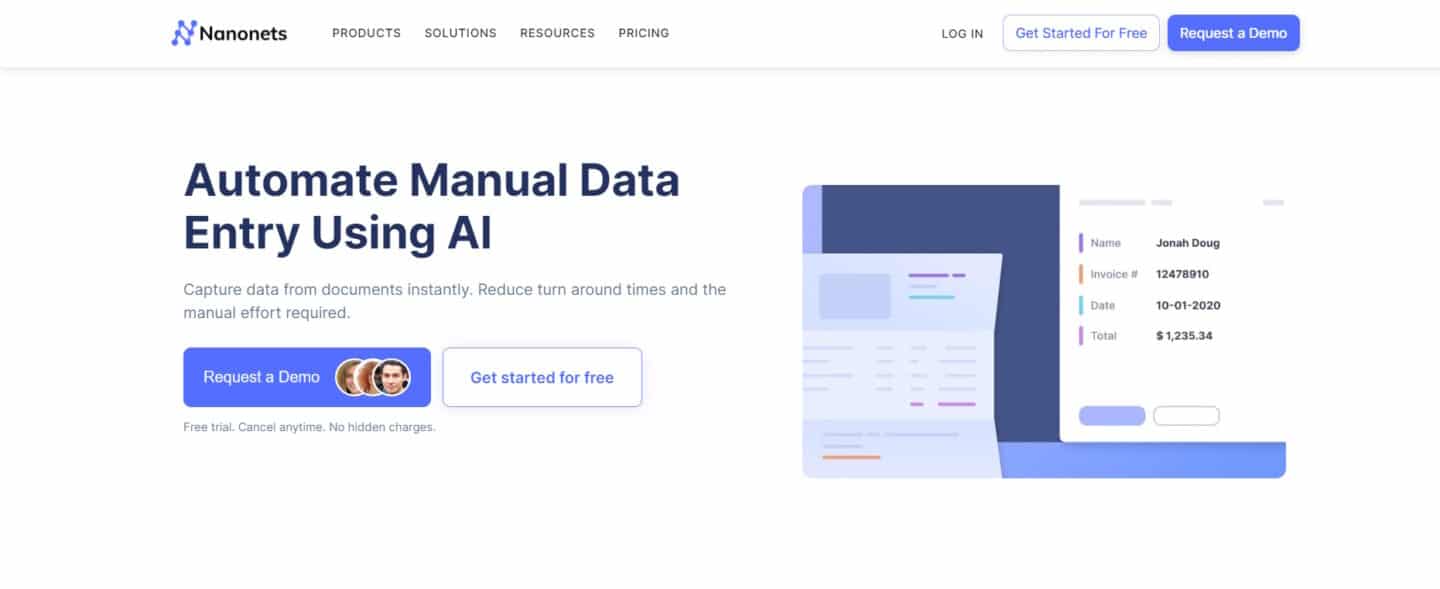

Nanonets

Nanonets is a machine learning platform that allows businesses to build custom deep learning models without writing any code. It is used for tasks such as document extraction, object detection, and image classification.

Using Nanonets OCR, organizations can extract electrical meter readings from odometers and transform food menus into structured data. The platform supports several types of documents such as ID cards, mortgage forms, invoices, income proofs, and purchase orders, among others.

Pros and Cons

- Pros: Nanonets excels in handling a broad range of documents with its cutting-edge AI and OCR technology, ensuring quick processing with high accuracy and backed by outstanding customer service.

- Cons: May have a steeper learning curve for new users due to its advanced features, could be more expensive than simpler solutions, and might offer more functionality than small businesses require, potentially making it less cost-effective for them.

Pricing

Nanonets offers three pricing tiers:

- Starter: Free for the first 500 pages, then $0.3/page. No monthly fee, pay as you go, with 3 starter models and limited fields.

- Pro: $499/month/model, includes 5000 pages, then $0.1/page. Offers auto-capture line items, up to 20 fields, and additional features like annotation services and customization hours.

- Enterprise: Custom pricing. Includes everything in Pro, with additional features like SSO/SAML Login, SLAs, dedicated account manager, and custom integrations.

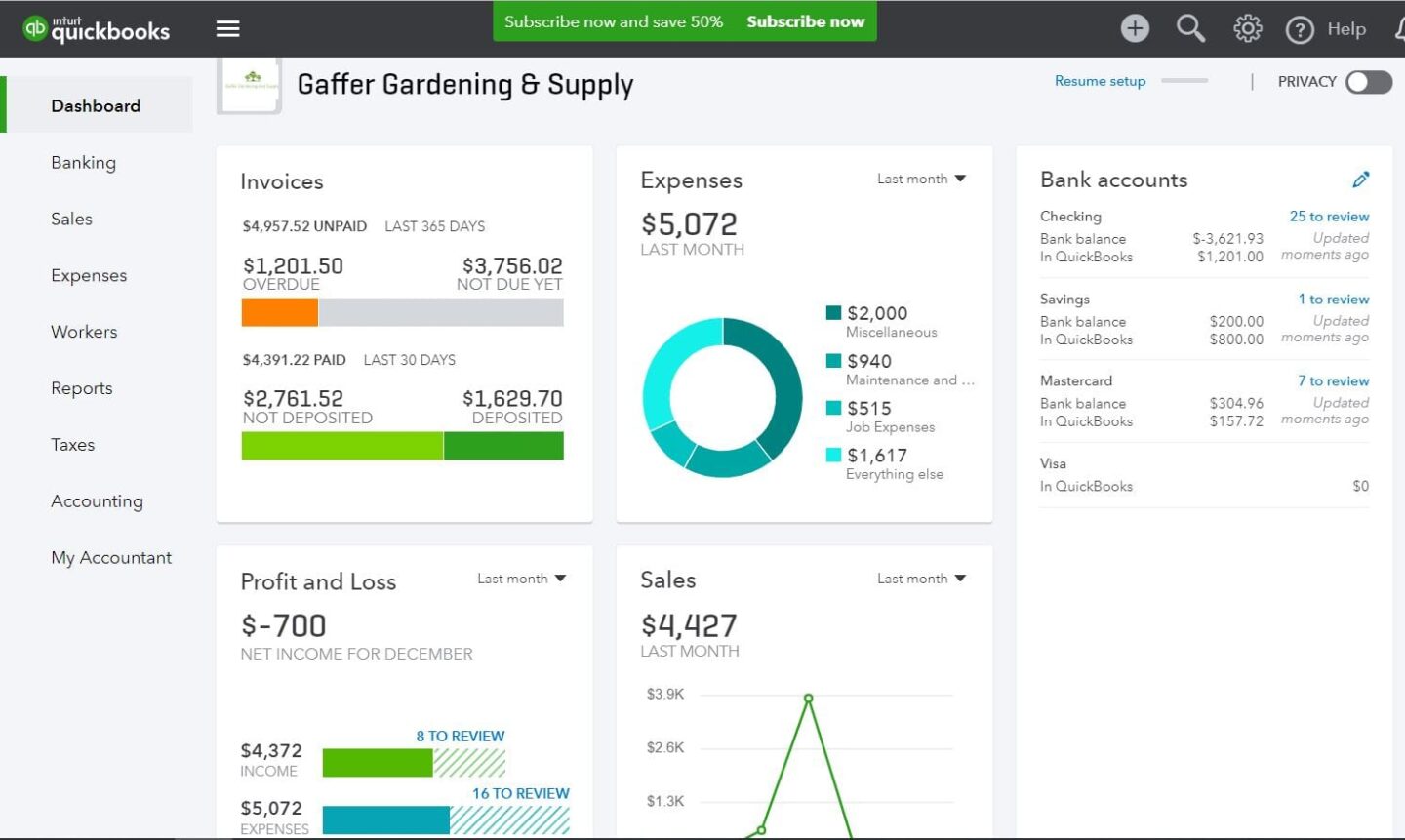

QuickBooks

QuickBooks Online is a comprehensive accounting solution designed specifically for small to medium-sized businesses. It offers a range of features aimed at simplifying financial management, from tracking sales and expenses to running payroll.

As a cloud-based platform, it provides the flexibility to manage your finances anytime, anywhere, making it a popular choice for businesses seeking efficient accounting software.

Pros and Cons

Pros: QuickBooks Online simplifies complex accounting tasks with its user-friendly interface and offers a comprehensive suite of features for complete financial management, making it suitable for a broad range of business needs.

Cons: QuickBooks Online provides limited customization options for reports and invoices compared to some competitors, which may be a drawback for businesses looking for highly customizable accounting solutions.

Pricing

Simple Start: Ideal for new micro businesses and the self-employed at US$18/month, with features like tracking income & expenses, custom invoices & quotes, and more for one user plus an accountant.

Essentials: Best for growing businesses at US$27/month, adding capabilities like managing bills & payments, tracking employee time, and support for three users plus an accountant.

Plus: Designed for established businesses at US$38/month, includes all Essentials features plus inventory tracking, project profitability, and budget management for five users plus an accountant.

ERP System (In General)

ERP (Enterprise Resource Planning) systems integrate various functions across a business into one complete system to streamline processes and information across the organization. These systems cover everything from production, inventory, and order management to accounting, human resources, and customer relations, enabling businesses to make data-driven decisions and improve operational efficiency.

Pros and Cons

- Pros: ERP systems offer a holistic view of business operations, enhancing decision-making and operational efficiency. They improve data accuracy, eliminate redundancies, and facilitate streamlined processes across departments.

- Cons: Implementing an ERP system can be costly and time-consuming, with a significant initial investment in software and training. Additionally, the complexity of ERP systems may require ongoing support and may be challenging for some users to navigate.

Pricing

Pricing for ERP systems varies widely depending on the provider, system complexity, customization level, and the number of users. Many ERP vendors offer a subscription-based model, charging a monthly fee per user.

Smaller businesses might expect to pay from a few hundred to several thousand dollars per month, while larger enterprises might incur costs in the tens of thousands for more comprehensive solutions.

For specific pricing, businesses should contact ERP vendors directly to obtain quotes based on their unique needs and the scale of their operations.

Phantombuster

PhantomBuster is a cloud-based automation and data extraction tool designed to enhance productivity and efficiency for marketers, developers, and sales teams. It allows users to automate various online tasks, scrape data from social media and websites, and integrate with numerous platforms to streamline workflows.

With PhantomBuster, businesses can expand their digital presence, generate leads, and gather valuable market insights without manual intervention.

Pros and Cons

Pros: PhantomBuster offers a wide range of automation tools with over 100 Phantoms and Flows, suitable for businesses aiming for growth. It’s easy to use for various technical levels.

Cons: New users may need time to learn how to use all features. The cost for full features may be high for small businesses or individuals.

Pricing

- Trial: 14 days free, 2h execution, 1k AI credits, 5 Phantom slots, limited export, +50 email credits.

- Starter ($56/month annually): 20h execution, 10k AI credits, 5 Phantom slots, unlimited export, priority support, +500 email credits.

- Pro ($128/month annually): 80h execution, 30k AI credits, 15 Phantom slots, unlimited export, account consultant, priority support, +2,500 email credits.

- Team ($352/month annually): 300h execution, 90k AI credits, 50 Phantom slots, unlimited export, account consultant, priority support, +10,000 email credits.

Zapier

Zapier is an online automation tool that connects your favorite apps, such as Gmail, Slack, Mailchimp, and more than 3,000 others. It enables you to automate repetitive tasks with workflows known as Zaps.

These Zaps can automatically move information between your web apps, so you can focus on your most important work. With Zapier, you can create connections to push data from one app to another using triggers and actions. This means you can automate parts of your business or personal tasks without needing to code or rely on developers to build the integration for you.

Pros and Cons

- Pros: Supports over 3,000 apps, offering vast integration options and it has a user-friendly interface that makes creating Zaps straightforward, even for non-technical users.

- Cons: The sheer number of options can be overwhelming for new users and advanced automation workflows require a paid plan, which may not suit all budgets.

Pricing

- Free Plan: For individuals or small teams just getting started with automation, offering basic features with a limit on the number of tasks and Zaps.

- Starter Plan: Begins at $19.99/month (billed annually), providing more tasks, Zaps, and access to premium apps.

- Professional Plan: For more extensive automation needs, priced at $49/month (billed annually), includes advanced features like unlimited Zaps and higher task limits.

- Team Plan: Aimed at teams needing to collaborate on workflows, starting at $299/month (billed annually), offering shared workspaces and user roles.

- Company Plan: For larger organizations requiring advanced control and support, with pricing available upon request.

Factors to Consider When Choosing an Automated Data Entry System

When you have chosen the right software for your business or accounting practice…

Ease of Integration

Finding a system that plays well with your existing setup is critical. It should slide into your current operations with minimal fuss, ensuring compatibility with your software and systems.

The ease of setting it up and the promise of smooth sailing when it’s time for upgrades can’t be overstated. You want a system that grows with you, not one that becomes a hurdle at every step of technological advancement. .

Scalability

As your business expands, so does the volume of data you handle. The system you choose should not just keep up but stay two steps ahead, ready to manage more information as your needs evolve.

It’s about flexibility too; as your business undergoes changes, whether they’re in scale, direction, or services, your data entry system should adapt right alongside, proving to be a versatile tool in your business toolkit.

Security Features

In these days for business and technology, security is non-negotiable. The right system will shield your data with robust encryption and ensure only authorized eyes have access through secure user authentication methods.

Moreover, staying within the lines of industry standards and data protection regulations is not just about compliance—it’s about protecting your business’s integrity and your customers’ trust.

Accuracy and Reliability

Data will be useless and futile if it is not accurate. The system you choose should have a commendable track record for precision, backed by solid validation mechanisms to catch and correct errors.

Consistency is another one you should look at, ensuring that every piece of data processed is handled with the same level of care and accuracy, day in and day out.

Vendor Reputation and Support

Last but not least, who you’re getting this system from matters as much as the system itself. Look for vendors who stand tall in their industry, with reviews and testimonials to back their claims.

The level of support and maintenance services they offer can make all the difference, turning potential headaches into smooth resolutions.

Conclusion

Automating your data entry can transform the efficiency, accuracy, and speed of processing information within your business. By using the power of technology, companies can redirect their focus from tedious manual tasks to more strategic initiatives, enhancing productivity and operational efficiency.

As the landscape of business operations continues to evolve, integrating automated data entry solutions stands out as a critical step for staying competitive and agile in today’s fast-paced market.

How DocuClipper Can Help Automating Your Data Entry

Ready to take the leap into automating your data entry? DocuClipper offers a robust solution, specializing in converting and analyzing crucial financial documents. With its advanced OCR technology,

DocuClipper streamlines the process of turning bank statements and other documents into digital, editable formats.

Say goodbye to the days of manual data entry and get on with automated data entry. Explore how DocuClipper can revolutionize your data handling by starting your journey towards automation today.

FAQs to Automated Data Entry

Here are some of the most frequently asked questions about automation in data entry for businesses:

Can AI automate data entry?

AI can significantly automate data entry by learning and mimicking the way humans input data. It can recognize patterns, interpret texts and images, and enter data into systems, reducing the need for manual entry.

How to use AI to automate work?

AI automates work by taking over repetitive tasks, such as data entry, customer service responses, and even complex decision-making processes. By integrating AI tools and platforms into your workflow, you can automate these tasks, allowing AI to handle them based on predefined rules and learning.

Can you automate data entry work?

With advancements in AI and machine learning, automating data entry work has become more accessible and efficient. Tools like DocuClipper utilize OCR technology to convert documents into digital formats automatically, eliminating the need for manual entry.

Why is data entry not automated?

Some data entry tasks may not be automated due to the complexity of the information, lack of suitable technology, or specific security and compliance requirements. However, many repetitive and structured data entry tasks are increasingly being automated with evolving technologies.

What is an example of automated data processing?

An example of automated data processing is the use of OCR technology to scan paper documents, such as invoices or bank statements, and convert them into editable and searchable digital formats. This process automates the extraction and processing of information from physical documents, making data more accessible and easier to manage.