Despite automation being all around us, over 49% of businesses still process invoices manually. This inefficiency costs organizations time, money, and competitive advantage in today’s fast-paced business environment.

In this comprehensive guide to automated invoice processing, we’ll explore how automating your invoice workflow can transform your accounts payable department and deliver significant benefits to your business.

From reduced processing times to improved accuracy and significant cost savings, automatic invoice processing systems have become essential for businesses looking to stay competitive.

What is Automated Invoice Processing?

Automated invoice processing is a system that processes invoices with minimal or no human intervention. It utilizes a series of software, such as OCR, ERP, and accounting software to process both traditional and e-invoice formats, overseen by people and can be customized throughout the invoice process.

By implementing this system, you can streamline your invoice management, reduce errors, and save time.

The software automates tasks such as data extraction, invoice validation, and approval, ensuring a smooth and efficient workflow.

This not only enhances invoice accuracy but also allows your team to focus on more strategic activities, ultimately improving your business’s overall efficiency and productivity.

Challenges of Manual Invoice Processing

Before diving into the benefits of automated invoice processing, it’s important to understand the challenges that manual methods present: invoice processing

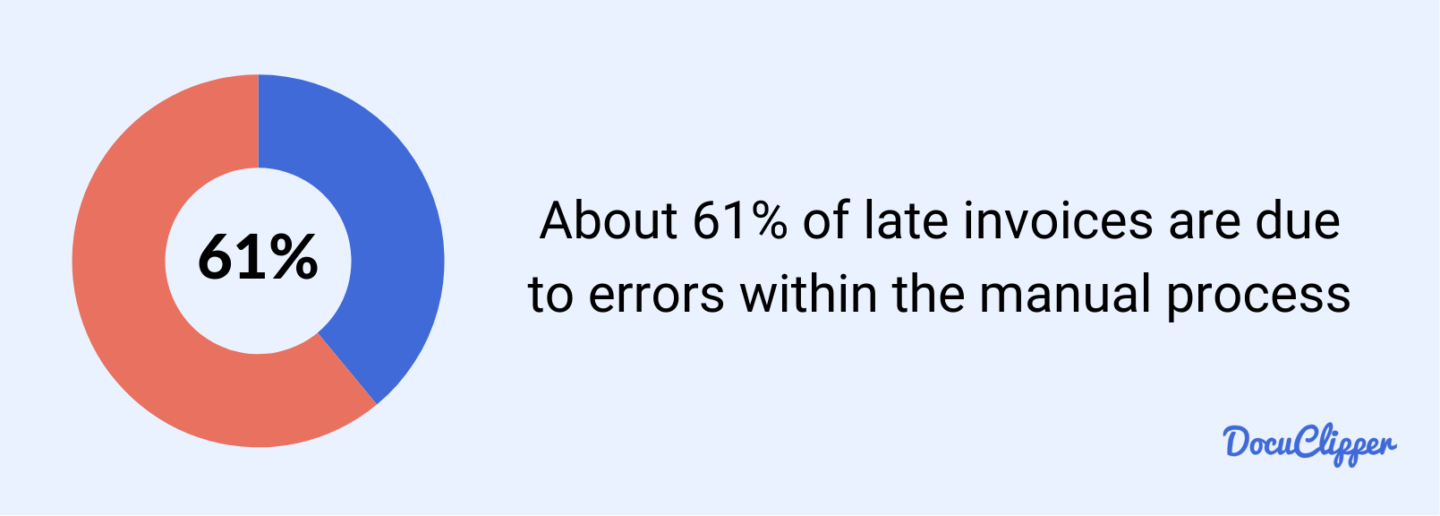

- Error-Prone Processes: About 61% of late invoices are due to errors within the manual process. These errors can lead to duplicate payments, missed payments, or incorrect payment amounts.

- Time-Consuming Workflows: Manual invoice processing is traditionally slow. The process involves manual typing, verification, and circulation among multiple people. The average time to process an invoice manually is 14.6 days.

- High Processing Costs: The cost to process a single invoice manually can range from $10-$30, depending on industry and complexity. This includes labor costs, physical storage, and error correction.

- Limited Visibility: Manual processes make it difficult to track invoice status, creating challenges for cash flow management and financial forecasting.

- Storage and Retrieval Issues: Physical storage of paper invoices creates problems with document retrieval, audit preparation, and disaster recovery.

Recent research indicates that organizations still using manual processing spend up to 20 hours per week on invoice-related tasks that could be automated.

Why is Automated Invoice Processing Important for Businesses?

Invoice processing is a foundational function of any business, and automating it can resolve numerous issues.

Firstly, manual invoice processing is prone to errors. About 61% of late invoices are due to errors within the manual process.

These late invoices can lead to penalties, additional costs, and strained client-supplier relationships.

Moreover, manual invoice processing is traditionally slow. The process involves manual typing, verification, and circulation among multiple people, consuming a lot of time.

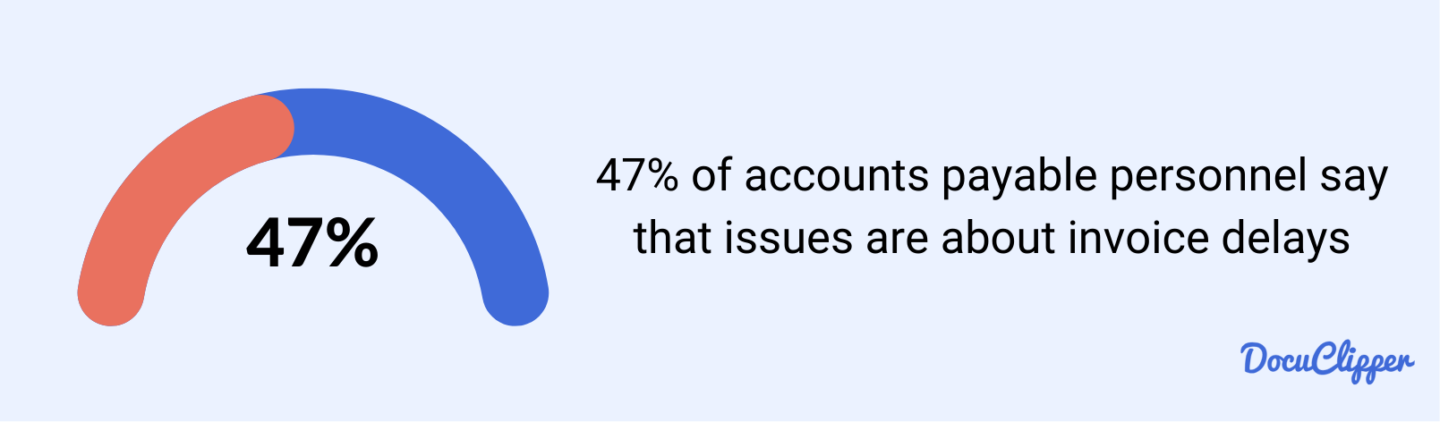

One of the biggest issues accounts payable personnel face is slow invoice approval, with 47% complaining about its delay. A slow approval process can lead to more late invoices, further complicating matters.

Additionally, employing people to manually process invoices is costly. Salaries vary based on the skill levels required, but automating the process can significantly reduce these costs by up to 90%.

Automation eliminates the need for extensive manual intervention, allowing you to allocate your resources more efficiently.

One of the major advantages of automated invoice processing is the seamless integration with accounting systems.

These automated systems can easily integrate all your invoice data into ERP systems or accounting software.

This integration ensures that your financial data is always up-to-date and accurate, resulting in better financial management and reporting.

Automating invoice processing also enhances overall efficiency.

The time and effort required to process invoices manually are substantially reduced, allowing your team to focus on more strategic tasks.

In fact, The average time to process an invoice manually is 14.6 days.

It also minimizes errors associated with manual invoice data entry and processing, ensuring greater accuracy.

Types of Automated Invoice Processing Solutions

When considering implementing automatic invoice processing, you have several options to choose from:

1. Deployment Models

- Cloud-Based Solutions: Accessible from anywhere, requiring minimal IT infrastructure and offering scalability.

- On-Premises Solutions: Hosted within your organization’s servers, providing greater control but requiring more maintenance.

- Hybrid Solutions: Combining elements of both cloud and on-premises deployments.

2. Solution Scope

- End-to-End Platforms: Comprehensive solutions handling the entire invoice lifecycle.

- Modular Components: Specialized tools addressing specific aspects of invoice processing (capture, approval, payment).

- Integration-Focused Solutions: Systems designed to work with existing ERP and accounting platforms.

3. Technology Approach

- Rule-Based Systems: Traditional automation following predefined rules and workflows.

- AI-Powered Solutions: Leveraging machine learning and artificial intelligence to improve accuracy and handling of exceptions. Many modern accounts payable OCR software solutions use AI to enhance extraction capabilities.

- Blockchain-Enhanced Platforms: Emerging solutions using blockchain for verification and security.

For more details on OCR technology that powers automated invoice processing, check out [our guide to OCR technology for invoice processing].

How Does Automated Invoice Processing Work?

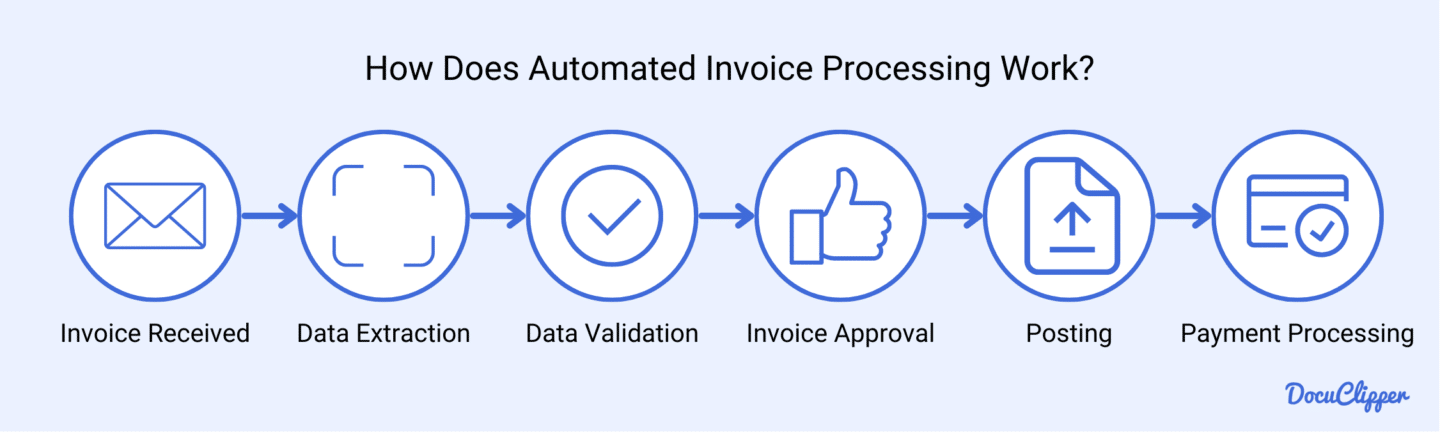

Automated invoice processing follows a systematic workflow to ensure efficiency and accuracy. Here’s a step-by-step breakdown:

- Invoice Received: Invoices are received in a centralized location and automatically sent to invoice data extraction software. If it’s a paper invoice, it is digitally captured using a scanner and then sent to an OCR tool called invoice parser. This step ensures all invoices, whether digital or paper, are digitilized ready for automated processing.

- Data Extraction: The system extract invoice data from pdf, including the invoice number, date, supplier details, line items, amounts, and terms. This data is then automatically sent to the data validation process in your accounting or ERP software. Tools like DocuClipper can be used for this purpose, making the extraction process efficient and accurate.

- Invoice Reconciliation: The extracted data is validated against predefined rules and the information in the company’s ERP or accounting system. This validation process includes checking for duplicate invoices, verifying supplier details, and ensuring that amounts and extracted line items match purchase orders and receipts. The typical validation process is 3-way matching, 4-way matching, or 2-way matching.

- Invoice Approval Workflow: At this stage, the invoice undergoes a series of steps to determine whether it should be approved or rejected for payment. Although automated, the final approval must be performed by a person to ensure accuracy and compliance with company policies. This human oversight adds an extra layer of validation to the automated process.

- Posting: Once the invoice is approved, the validated data is automatically posted to the company’s accounting or ERP system. This posting ensures that financial records are updated with the latest transactions, reflecting the approved invoices. It helps maintain accurate and up-to-date financial records.

- Payment Processing: Payment schedules are created based on the terms agreed with suppliers. The system can also automate the payment execution process through electronic funds transfer (EFT), ACH, or other payment methods. Automating the payment process ensures timely payments and can improve supplier relationships.

Now, this does not mean you need to automated the entire process at once. Usually, companies start with the last 4 steps as common accounting software such as QuickBooks, Xero, or Sage allows you to set these rules.

While if your company only processes a few invoices a month, then you might not need OCR solution.

But once you start to process more and more invoices, then having also invoice OCR software becomes crucial for the reasons mentioned above.

Top Benefits of Automated Invoice Processing Software

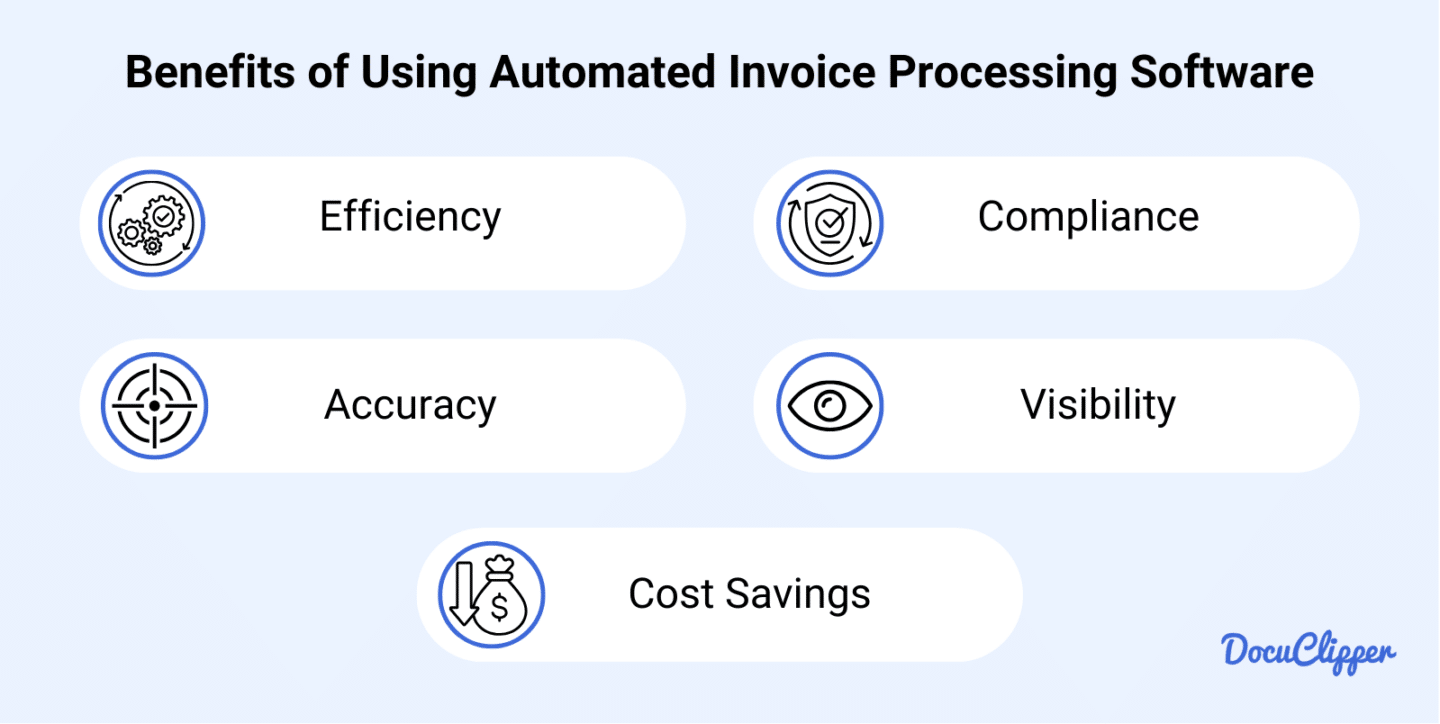

There are many benefits of using an automated process for your invoice processing workflow, here are its notable ones:

- Efficiency: Automated invoice processing enhances overall efficiency by greatly reducing the time and effort required for manual invoice processing. Additionally, automation minimizes errors associated with manual data entry and processing, ensuring much better data accuracy in your financial records.

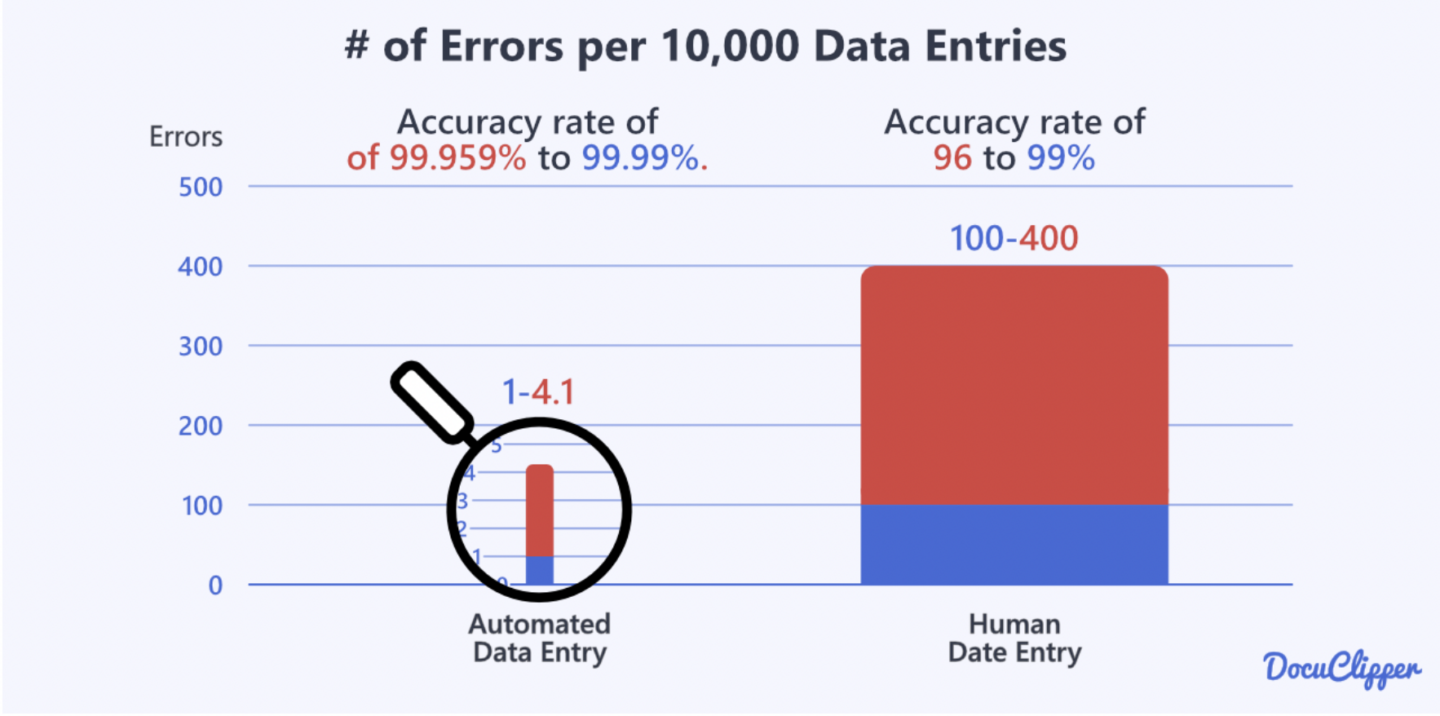

- Accuracy: Automated systems utilize advanced OCR and data extraction software to capture invoice details with high accuracy using OCR. This significantly reduces the errors that occur with manual data entry, such as incorrect amounts and duplicate entries. Automated validation processes further ensure the data’s correctness, matching it against predefined rules and existing records, resulting in reliable financial records.

- Cost Savings: By reducing the need for manual intervention, automated invoice processing lowers operational costs associated with labor. Automation accelerates the invoice processing cycle, improving cash flow and reducing the costs related to late payments, such as interest and penalties. Additionally, faster processing enables you to take advantage of early payment discounts offered by suppliers.

- Compliance: Automation ensures compliance with internal policies and external regulations through automated validation and audit trails. This compliance is important for maintaining accurate records and avoiding legal issues.

- Visibility: Automated systems provide real-time visibility into the invoice processing status and financial commitments. This visibility enables better decision-making and financial planning, as you can track the progress of invoices and payments accurately.

Overall, automated invoice processing will become increasingly important as your business grows and the amount of invoices needed to be processed grows.

It will hugely simplify and standardize your operational procedures ultimately resulting in better financial outcomes for your business.

Implementation Guide for Automated Invoice Processing

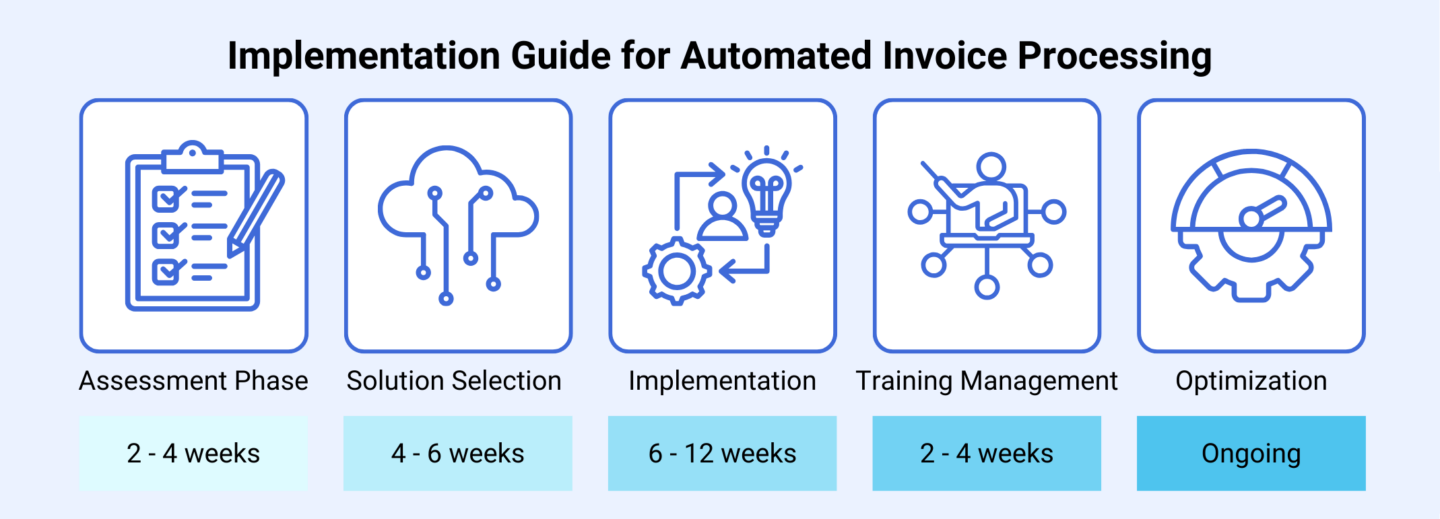

Implementing automatic invoice processing requires careful planning and execution.

Here’s a step-by-step guide:

1. Assessment Phase (2-4 weeks)

- Analyze current invoice processing workflows

- Identify pain points and inefficiencies

- Establish key performance indicators (KPIs)

- Determine budget and resource allocation

2. Solution Selection (4-6 weeks)

- Define requirements for your automated system

- Research available solutions in the market

- Request demonstrations from potential vendors

- Evaluate solutions against your specific needs

3. Implementation (6-12 weeks)

- Configure the system to match your business rules

- Integrate with existing accounting and ERP systems

- Migrate historical data if necessary

- Test thoroughly with various invoice types

4. Training and Change Management (2-4 weeks)

- Train key users and administrators

- Develop documentation and process guides

- Address resistance to change through clear communication

- Implement a phased roll-out approach

5. Optimization (Ongoing)

- Monitor system performance against KPIs

- Gather user feedback for improvements

- Refine automation rules and workflows

- Expand automation to additional processes

Research indicates that 39% of businesses that implemented automated invoice processing reported ROI within 6 months, with another 35% seeing returns within the first year.

ROI of Automated Invoice Processing

Understanding the return on investment for automated invoice processing can help build the business case for implementation:

Direct Cost Savings

- Labor cost reduction: 40-80% depending on previous process efficiency

- Error reduction: Typical reduction of exception handling by 60-90%

- Early payment discounts: Average capture increases from 21% to 75%

Indirect Benefits

- Staff reallocation to higher-value activities

- Improved supplier relationships through timely payments

- Enhanced compliance and reduced audit costs

- Better cash flow management and forecasting

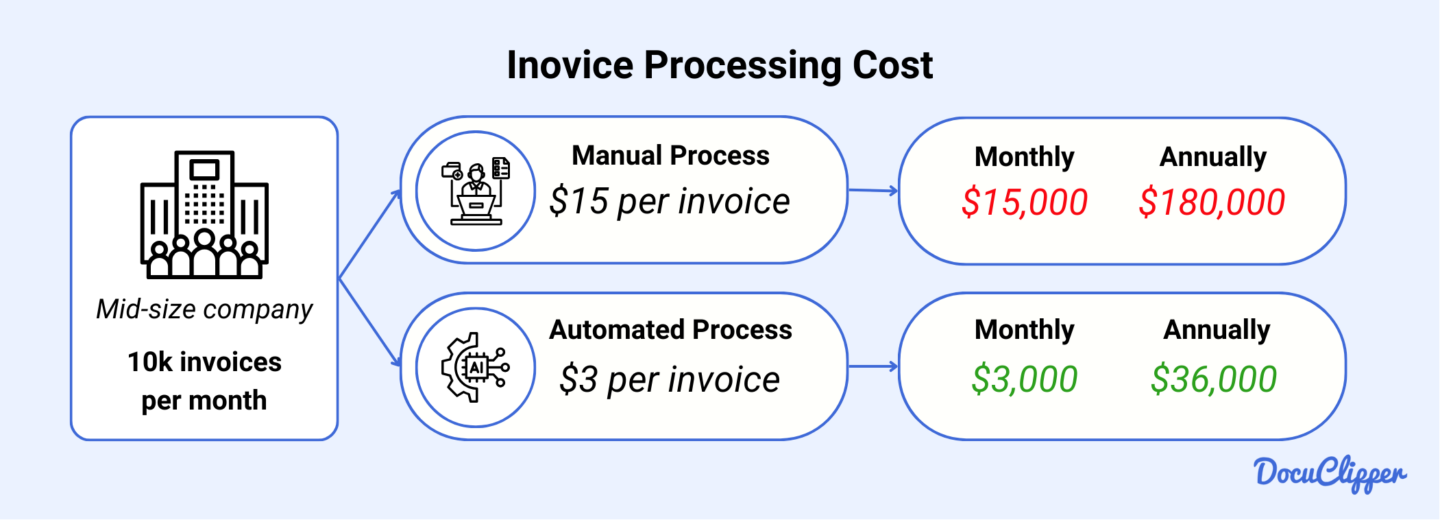

Sample ROI Calculation

For a mid-sized company processing 1,000 invoices monthly:

- Manual processing cost: $15 per invoice = $15,000 monthly

- Automated processing cost: $3 per invoice = $3,000 monthly

- Monthly savings: $12,000

- Annual savings: $144,000

- Implementation cost: $75,000

- ROI period: Approximately 6 months

Find out how automatic invoice processing compares to [manual processes in our detailed comparison] across different business sizes.

Future of Invoice Processing Automation

The landscape of automated invoice processing continues to evolve with emerging technologies:

Artificial Intelligence Advancements

Advanced AI algorithms are improving extraction accuracy beyond 95%, even for complex or non-standardized invoices. Machine learning models can now predict coding for new vendors based on historical patterns, further reducing manual intervention.

Blockchain Integration

Blockchain technology is beginning to be incorporated into invoice processing to create immutable audit trails and verify the authenticity of invoices, reducing fraud and duplicate payments.

Mobile-First Approaches

In 2024, over 75% of forward-thinking companies are using some form of invoice automation, with mobile approval workflows becoming the standard for businesses of all sizes. This allows managers to approve invoices from anywhere, reducing bottlenecks.

Predictive Analytics

Next-generation systems are implementing predictive capabilities to forecast cash flow needs, identify potentially fraudulent invoices, and optimize payment timing for maximum financial benefit.

Conclusion

Applying automation in business processes like accounts payable, accounting, and marketing offers numerous benefits. By implementing automated invoice processing, you significantly enhance efficiency, accuracy, and cost savings.

This modern approach smoothens operations, reduces errors, and achieves compliance, ultimately improving your business’s overall productivity and financial health. Transitioning to automation is not just a trend but a strategic move to stay competitive and efficient in today’s fast-paced business environment.

Why Choose DocuClipper for Invoice Data Extraction?

DocuClipper is an excellent choice for invoice data extraction as it eliminates much of the manual intervention needed for capturing data from invoices.

As a cloud-based OCR software, DocuClipper extracts data from receipts, invoices, and financial statements from PDF forms into formats like XLS, CSV, and QBO with high accuracy. These formats can be easily analyzed and integrated into accounting and ERP software, providing enhanced visibility and simplifying invoice approval and verification processes. It can also automatically import invoices into Quickbooks, skipping the exporting and importing process.

DocuClipper’s efficiency and precision make it an indispensable tool for modern businesses looking to streamline their invoice processing.

FAQs about Automated Invoice Processing

Here are some frequently asked questions about automated invoice processing:

How do I automate my invoicing?

To automate your invoicing, implement an automated invoice processing system. This involves using software to capture, extract, and validate invoice data, integrate it into your accounting system, and set up automated approval workflows and payment schedules, reducing manual intervention and errors.

What is the automated invoice entry method?

The automated invoice entry method uses software to capture invoice data, extract essential details through OCR data capture, and validate the information against predefined rules. This data is then automatically entered into your accounting or ERP system, streamlining the process and minimizing manual input errors.

What is AI invoice processing?

AI invoice processing utilizes artificial intelligence to automate and enhance invoice management. This includes using machine learning and OCR technologies to capture, extract, and validate invoice data. AI algorithms improve accuracy, detect inconsistencies, and streamline workflows, making the entire process faster, more efficient, and error-free.

Can invoice processing be automated?

Yes, invoice processing can be automated using specialized software. This automation involves capturing invoice data, extracting essential details, validating the information, and integrating it into your accounting system. Automated workflows handle approvals and payments, significantly reducing manual intervention, improving accuracy, and enhancing efficiency.

What is the difference between automated and electronic invoice processing?

Electronic invoice processing refers to handling digital invoices (e-invoices), while automated invoice processing uses technology to automate the entire process from receipt to payment. Electronic processing is about the format, while automation addresses the workflow regardless of invoice format.

How much can a business save with automated invoice processing?

Businesses typically save 60-80% on invoice processing costs through automation. This includes reduced labor costs, fewer errors requiring correction, captured early payment discounts, and improved cash flow management. ROI is usually achieved within 6-12 months of implementation.

What are the security considerations for automated invoice processing?

Key security considerations include data encryption, access controls, secure cloud storage, audit trails, compliance with data protection regulations, and fraud detection capabilities. Modern systems should offer multi-factor authentication and regular security updates.

How does automated invoice processing handle exceptions and special cases?

Advanced systems use AI to identify exceptions and route them to appropriate personnel for review. Rules can be created for handling specific scenarios, and machine learning improves exception handling over time by learning from human decisions.

What are the key features to look for in automated invoice processing software?

Look for high OCR accuracy, integration capabilities with your existing systems, customizable workflows, mobile accessibility, robust reporting, exception handling, and scalability. Vendor support and implementation services are also critical factors.

How does automated invoice processing integrate with ERP systems?

Integration usually occurs through APIs, pre-built connectors, or custom integration. The automated system should sync bidirectionally with your ERP, sharing vendor data, general ledger codes, and payment information while pushing processed invoice data back to the ERP.

What industries benefit most from automated invoice processing?

While all industries benefit, those with high invoice volumes see the greatest impact, including manufacturing, retail, distribution, healthcare, construction, and professional services. Companies with complex approval workflows or strict compliance requirements also see significant advantages.