Are bank statements hard to understand and organize? Do they help you make smarter money choices, or are they just too much to handle?

Dealing with lots of bank statements during tax time or audits can be overwhelming, and getting the details right can be tough.

This blog will explain what a bank statement audit is and show you a simple way to review your bank statements accurately.

What is a Bank Statement Audit

A bank statement audit is a detailed check of a company or person’s bank statements and money dealings.

This is part of a bigger financial review and involves a lot of steps and can take quite a bit of time.

Usually, outside groups like investors, loan companies, and tax officials do these audits. They want to make sure the business or person can meet their money obligations and aren’t spending more than they have.

Why Conducting Bank Statement Audit is Important

Companies or individuals have various reasons for doing bank statement audits. Even though their purposes may differ, the steps followed in these audits are often similar.

Here are some of the reasons why bank statement audits are important in different contexts.

Detect Financial Fraud or Misappropriation of Funds

Monitoring bank transactions for income is a critical tool for detecting corruption and financial mismanagement within organizations. Reviewing spending reveals unauthorized payments, inflated costs, and unnecessary purchases, which can severely damage financial health.

By proactively safeguarding funds and ensuring transparency, this approach bolsters an organization’s financial well-being.

Verify Legitimate Business Payments and Expenses

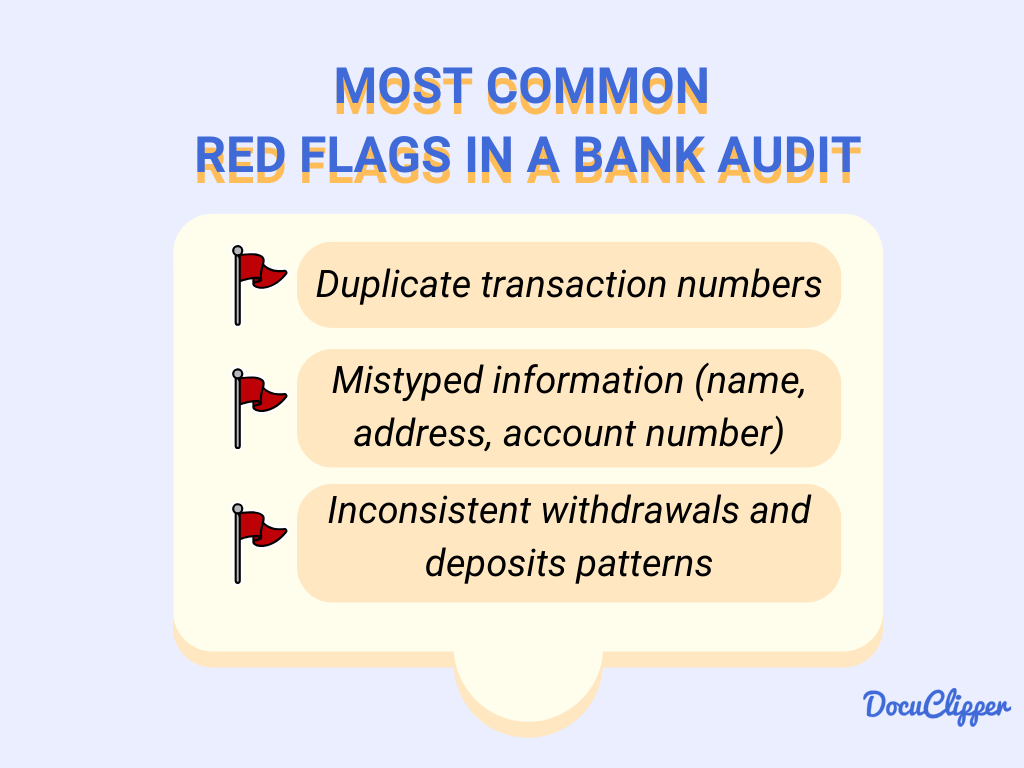

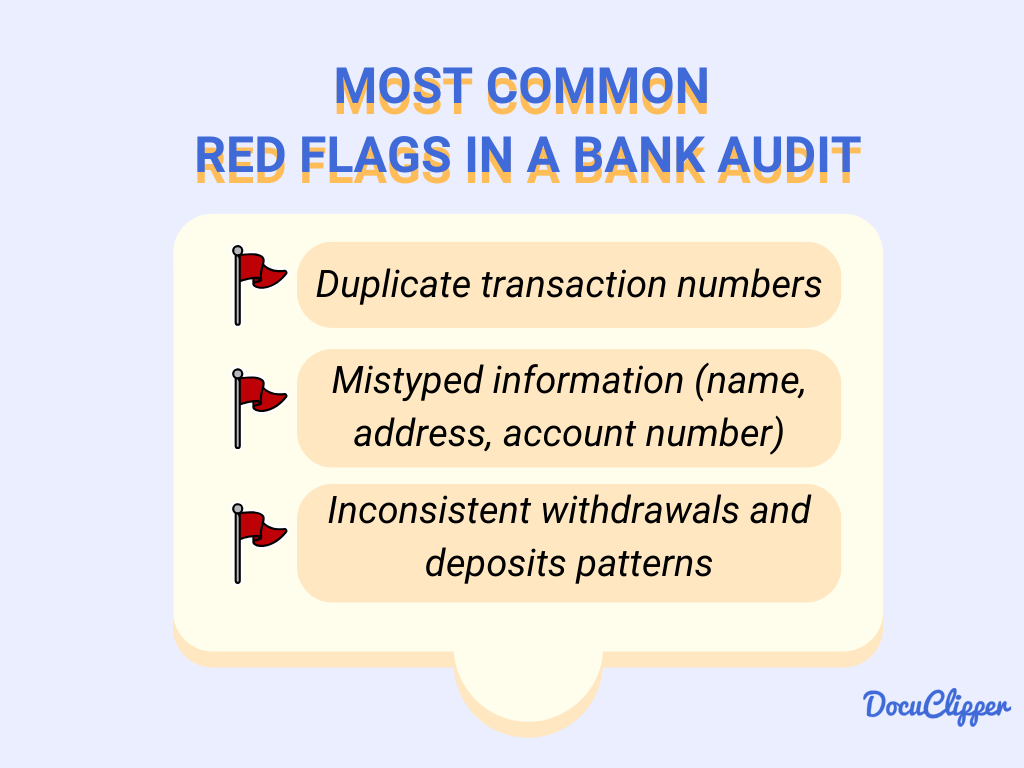

Business decisions rely on financial information, but hidden inefficiencies and intentional misbehavior can blur the picture. Audits act as financial clarifiers, reviewing bank statements to detect red flags. It detects unauthorized payments, inflated costs, and wasteful spending.

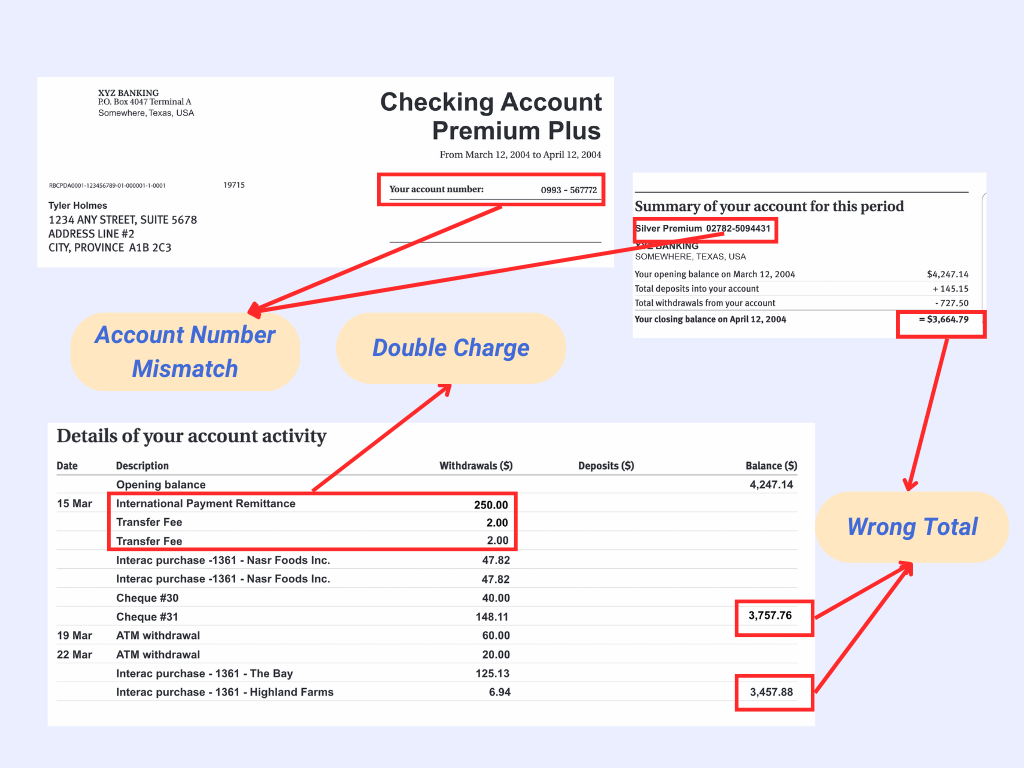

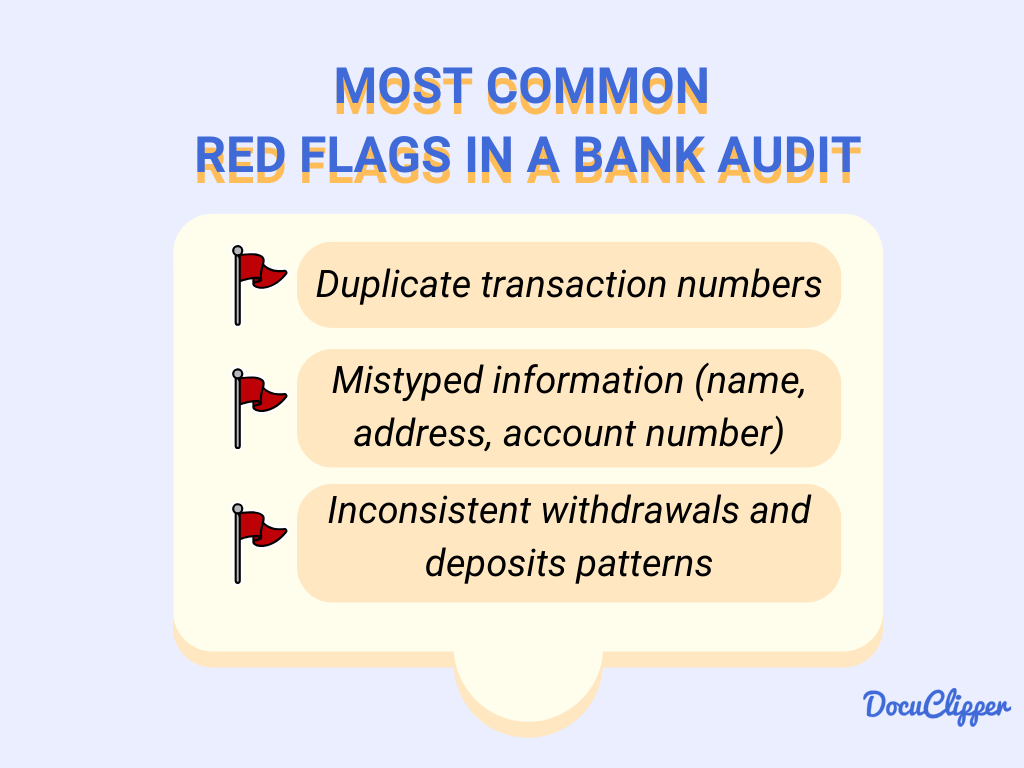

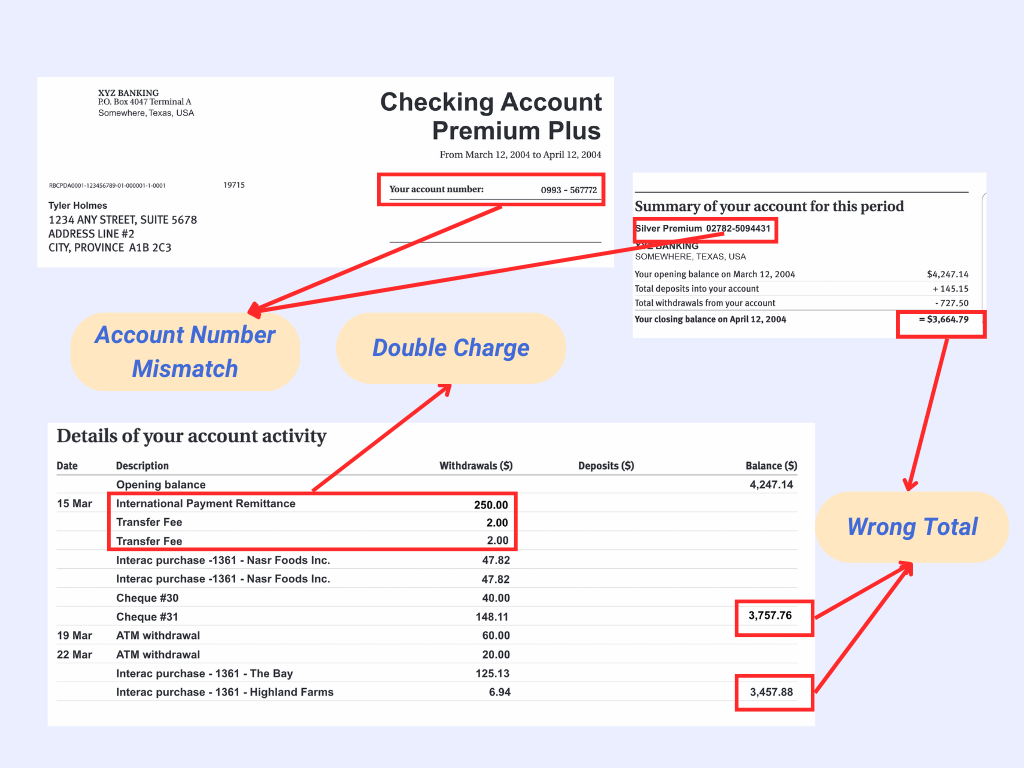

Identify Unintended Errors or Discrepancies

Even though it’s rare, there are mistakes in bank transactions in different accounts. Analyzing bank statements and comparing them with another record, like a ledger, can spot these errors. These findings can then be shown to the bank to correct the mistakes.

Some examples of errors are duplicates and uneven prices and transactions.

Comply with Regulations or Trace Funds (For Audits, Investigations)

Government agencies review bank statements and transactions to check if the taxes paid match the actual income. This ensures that individuals and businesses are paying the right amount of taxes based on their true earnings.

Categorize each transaction to distinguish the purpose of the money being used to ensure facts for investigatory purposes.

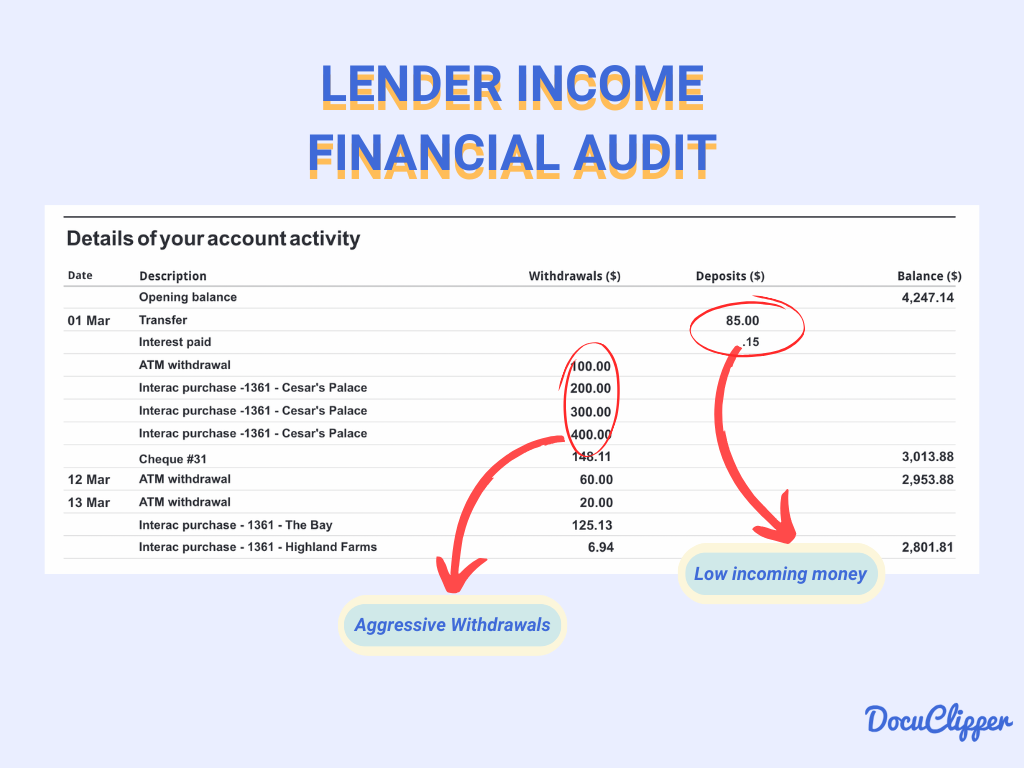

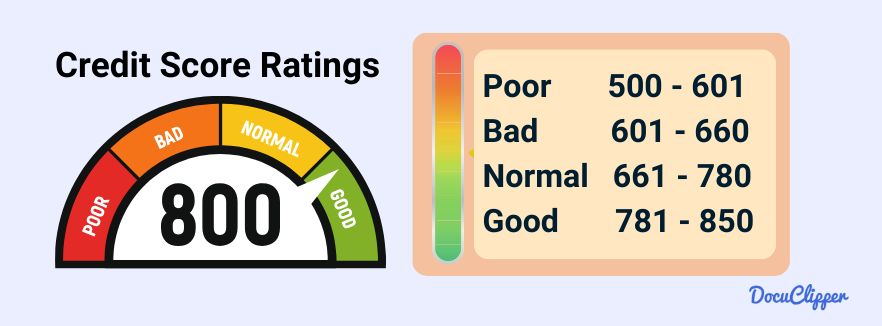

Assessing Borrower’s Financial Health

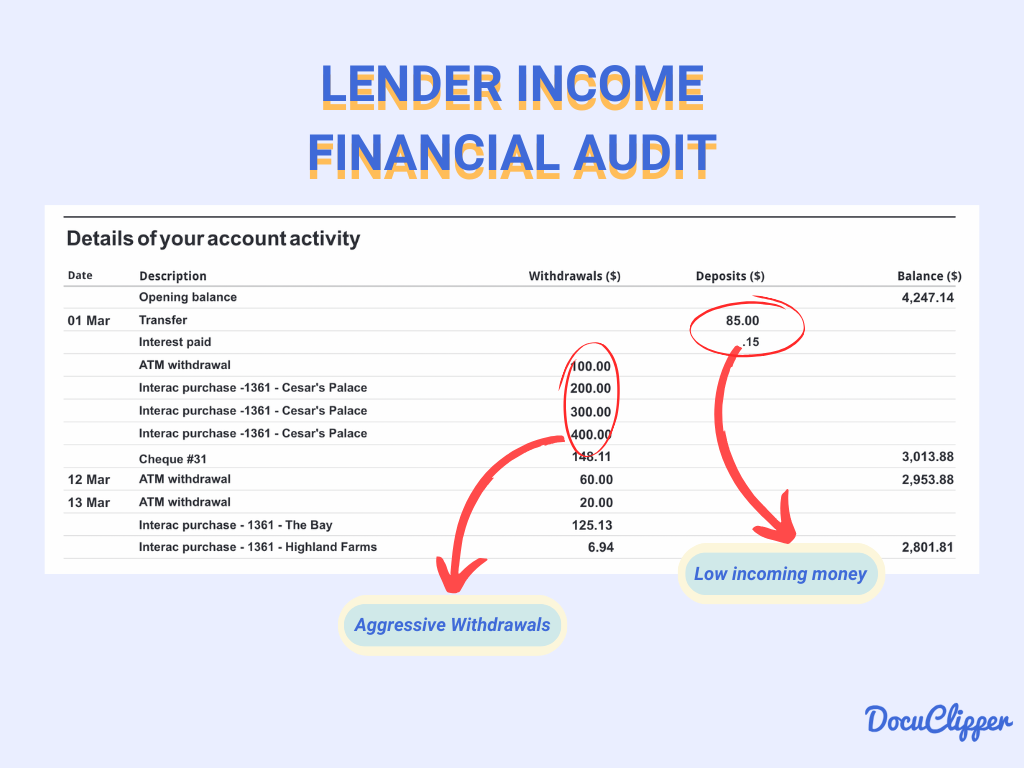

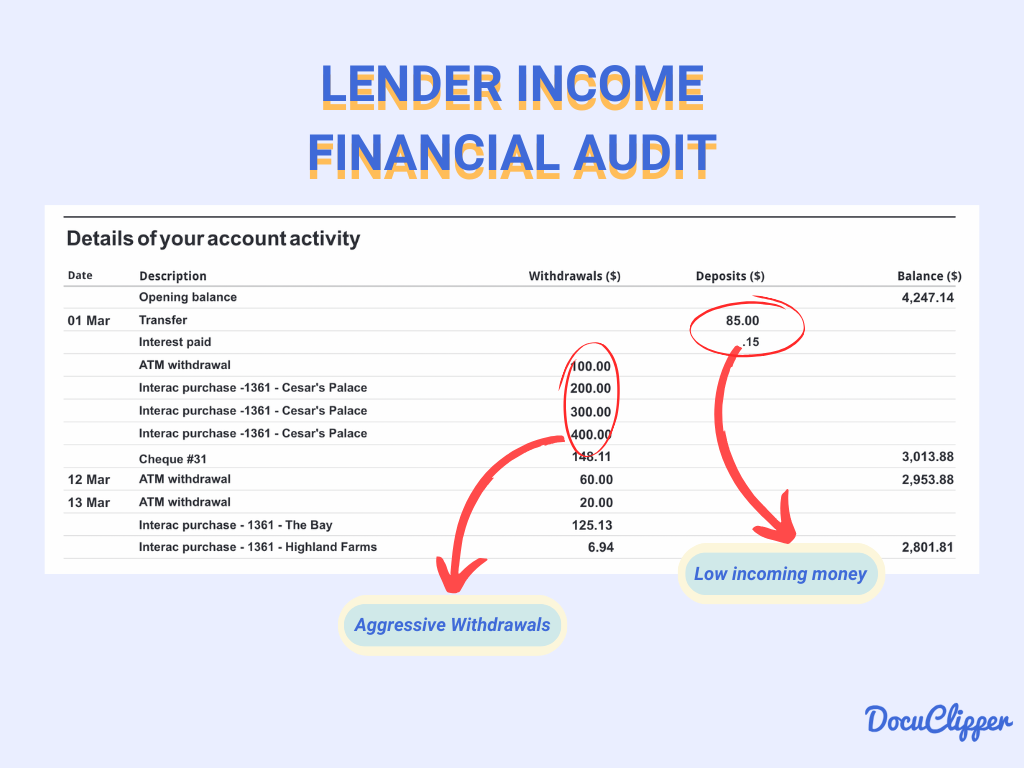

Lenders use audits to see if someone is pretending to be in better financial shape than they are, just to get loans with better terms and lower interest rates.

This helps lenders avoid risky loans and ensures they’re lending money to people or businesses who are truly financially stable.

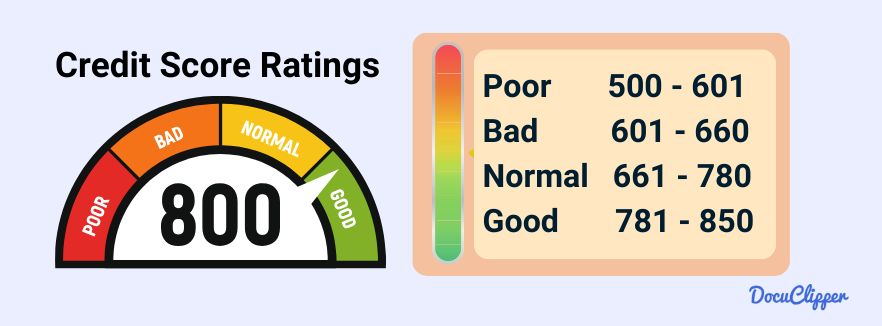

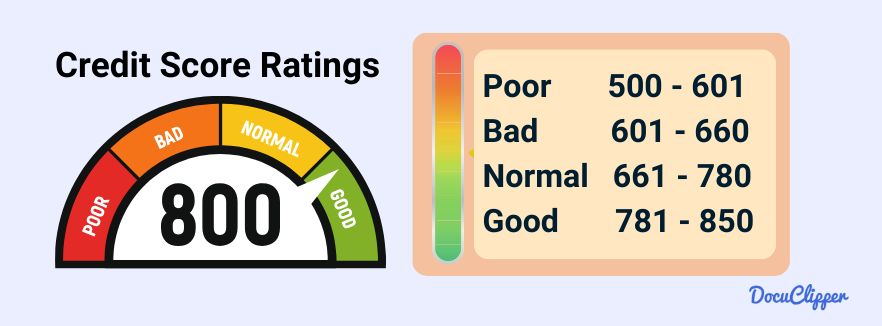

They also assess cash flow that comes in bank accounts and credit score ratings of potential borrowers. Learn more about the benefits of OCR for underwriting.

Analyzing Financial Settlements in Family Law Cases

In divorce and custody situations, looking at bank statements shows how much money each person makes and has saved. This is important for making fair decisions about things like alimony, child support, and splitting up assets.

Learn more about the benefits of OCR for Family Law industry.

How to Perform a Bank Statement Audit

Auditing a bank statement can be a time-consuming task that requires careful attention to detail and accurate data entry into spreadsheets. To do it correctly, you need to follow some pointers.

1. Gather all Relevant Bank Statements

When doing a bank statement audit, it’s important to collect only the information that’s relevant to the audit’s purpose. Filler data can be a nuisance during audits. For business audits, make sure to separate any personal or unrelated accounts.

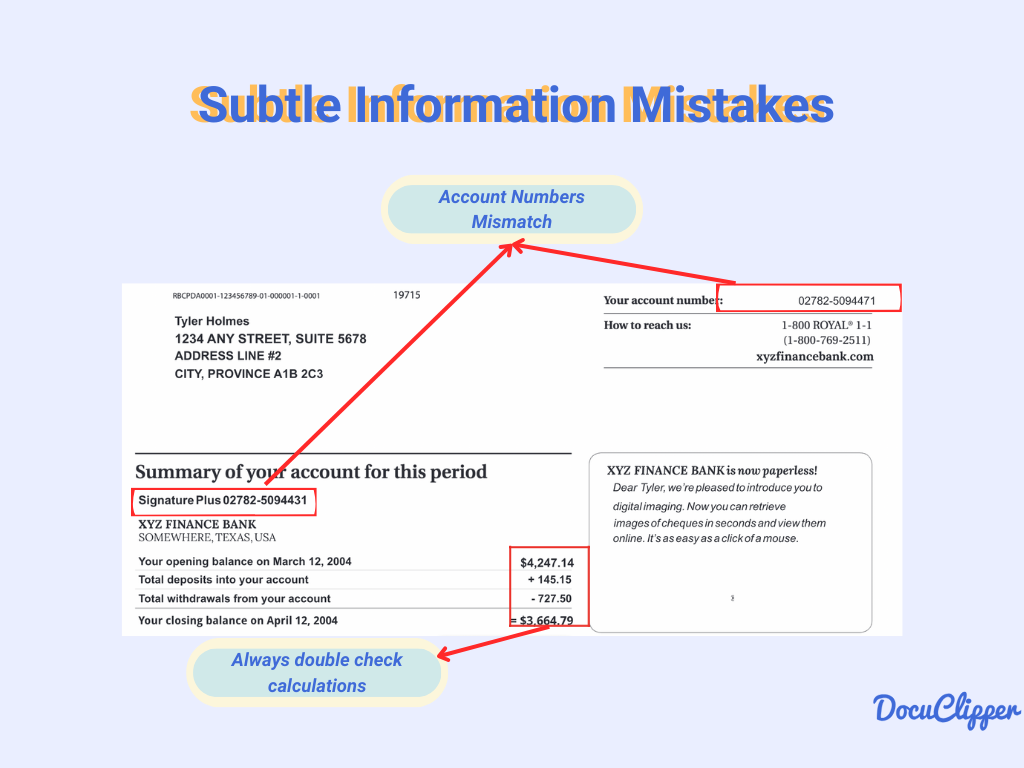

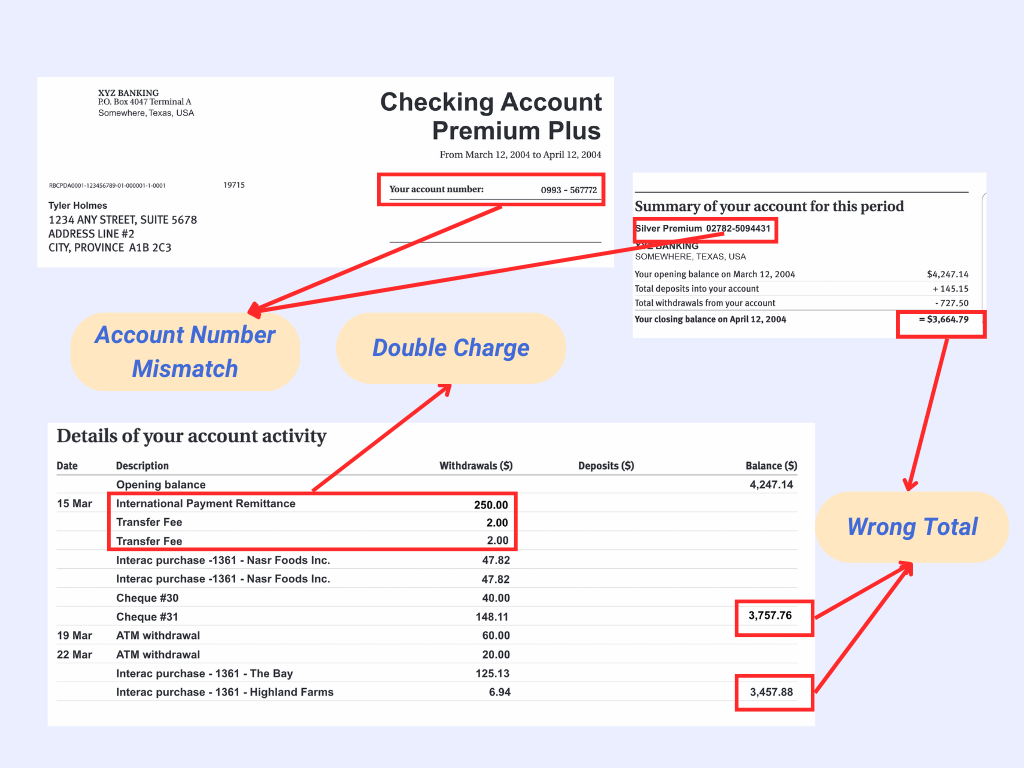

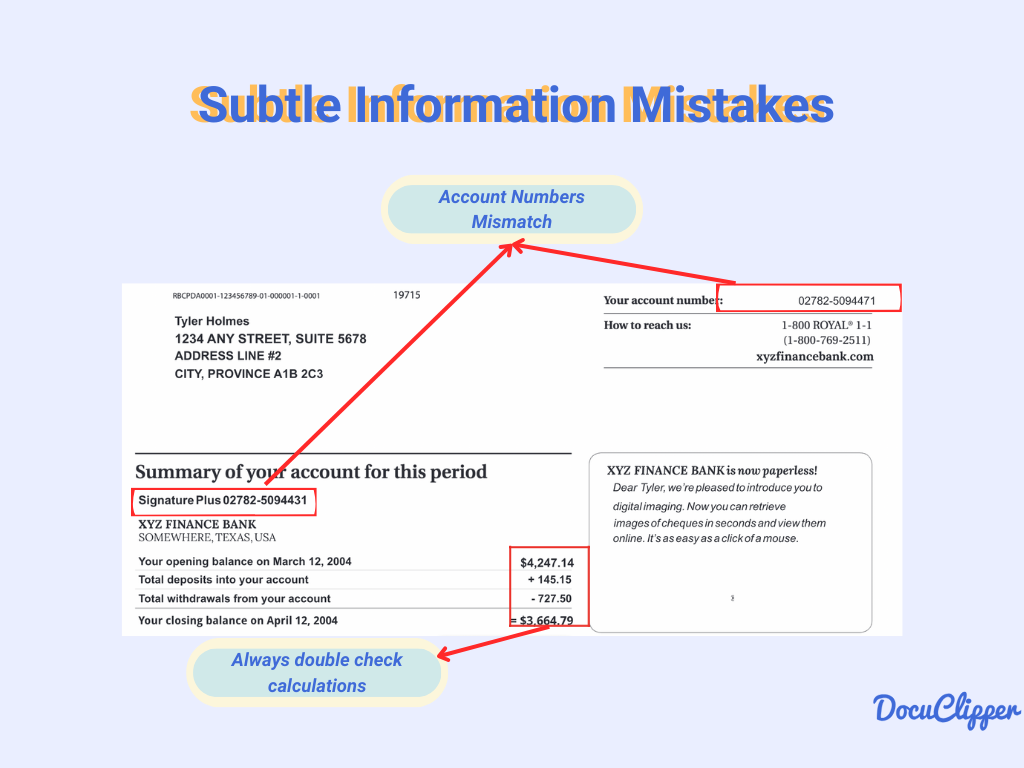

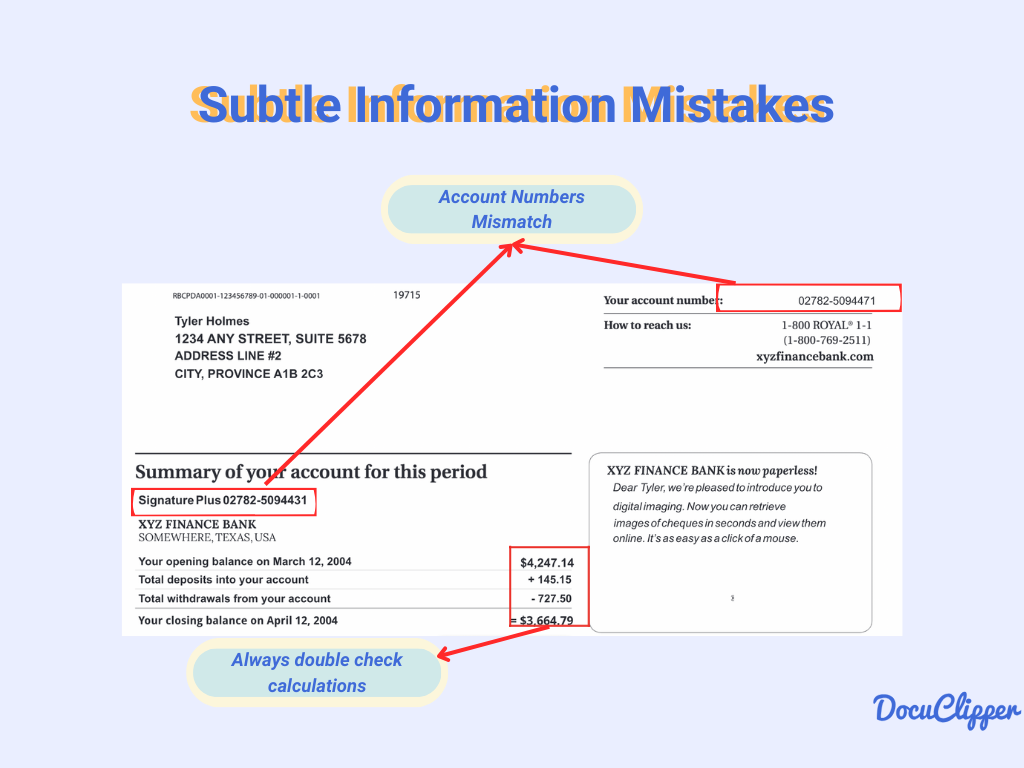

2. Verify Personal & Bank Details on Bank Statements

When auditing bank statements, it’s important to verify basic details like the account number, currency, routing number, and name. Small errors are important to catch because the statements could be linked to a different account.

It’s better to catch and report any errors to the bank as soon as possible. Banks are more able to quickly fix and address issues when they are disputed promptly, as problems haven’t had time to build up yet.

If you’re doing this for a client, we also recommend to ask for certified bank statements.

3. Review transactions for accuracy and correct timing

Examine every transaction amount carefully, down to the smallest dollar and cent. Small discrepancies can add up to significant amounts over time. Even what seems like a minor error can lead to substantial financial losses.

Additionally, it’s important to verify that the date and time of each transaction match the agreed-upon time when it was made.

4. Trace transactions to supporting documentation

Using supporting documents like invoices, payrolls, and receipts is crucial for verifying and cross-checking the transactions recorded in bank statements. These documents confirm that the orders were placed and transactions occurred as stated.

This stage is also where you can begin to note any questionable activities or concerns about the people involved in the transactions.

5. Look for suspicious payments

If there is a lack of proper supporting documentation, you can start suspecting transactions. However, the absence of documentation doesn’t infer suspicions. You can investigate further by asking for alternative ways they can provide support or clarification.

It’s also vital to be cautious about questionable recipients and sources of transactions, as these could be involved in fraudulent activities or schemes. Keeping an eye out for these red flags is an important part of the audit process.

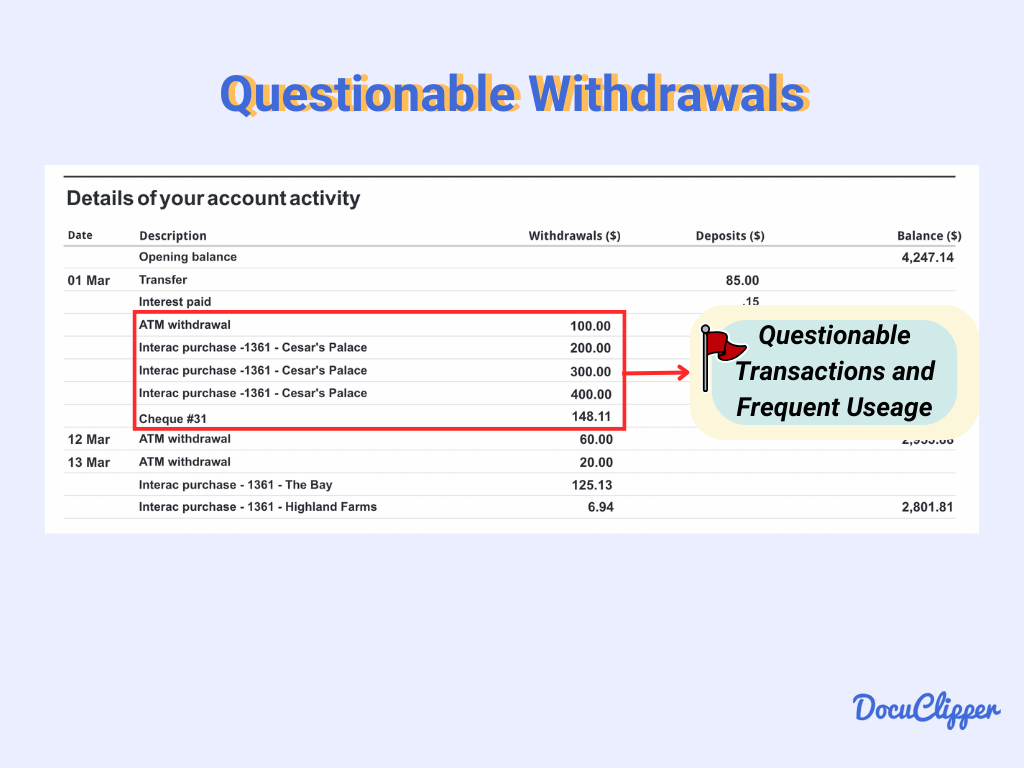

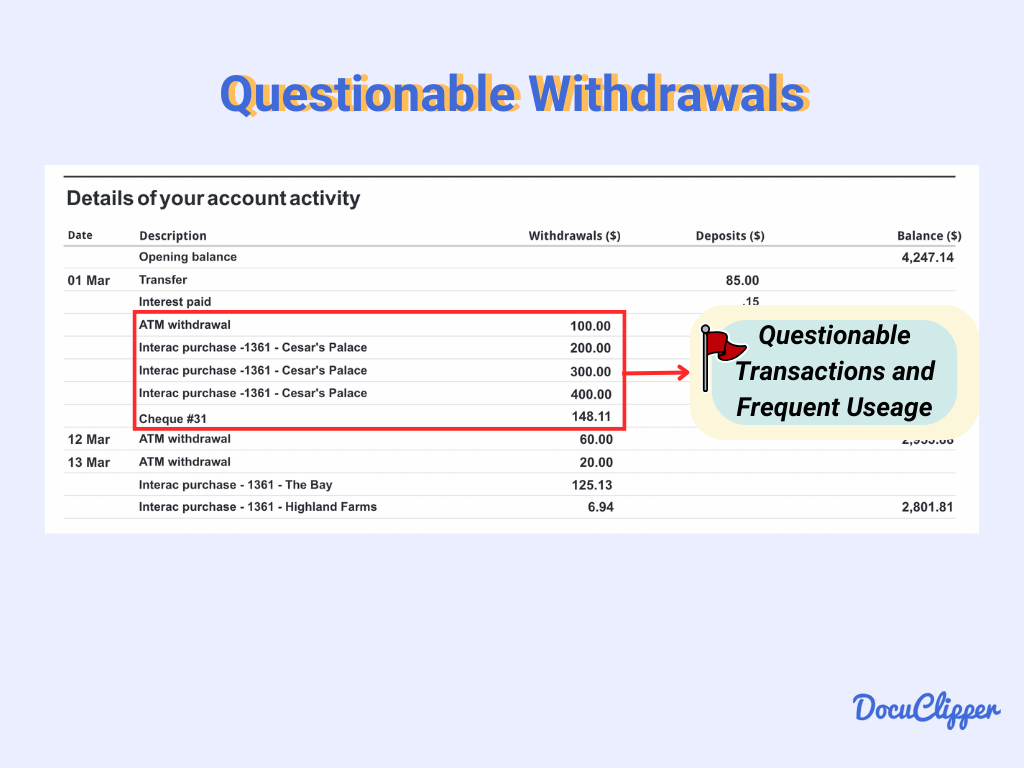

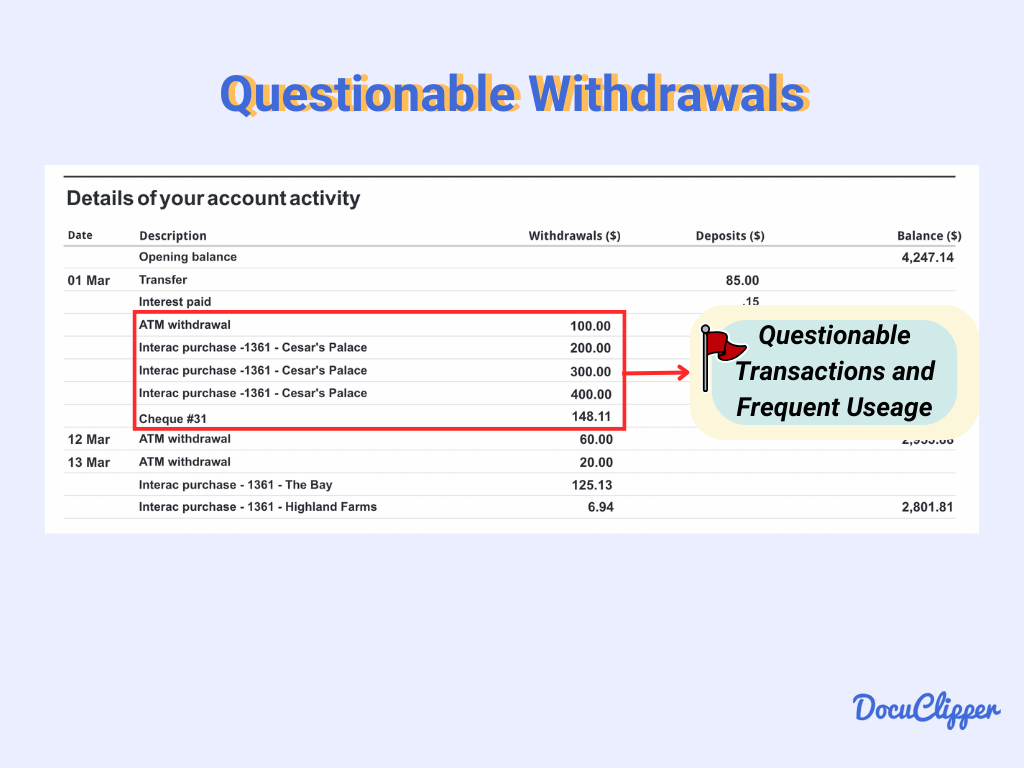

6. Flag inconsistent withdrawals

In bank statement audits, it’s normal to see that money is taken out on a set schedule and in consistent amounts. If there’s a break in this pattern, like withdrawals happening at random times or for different amounts, it’s a big warning sign.

These kinds of irregularities can point to strange or suspicious activities, especially since withdrawals are the main way to take money out of an account.

7. Check payee names on checks

When cross-referencing checks and deposits, it’s important to check that the senders listed in your records match those on the bank statements. This step ensures that each transaction’s details, like the sender and amount, are accurate and helps detect any false bank statements.

8. Verify automatic payments/debits

Automating routine payments like bills and subscriptions streamlines finances, but convenience has pitfalls. The ease of “set it and forget it” can make things more complacent, potentially missing costly errors or red flags like unusual charges or inflated fees.

Regularly reviewing automated transactions, even the seemingly mundane ones, is vital for catching inconsistencies and safeguarding financial health.

Are bank statements hard to understand and organize? Do they help you make smarter money choices, or are they just too much to handle?

Dealing with lots of bank statements during tax time or audits can be overwhelming, and getting the details right can be tough.

This blog will explain what a bank statement audit is and show you a simple way to review your bank statements accurately.

What is a Bank Statement Audit

A bank statement audit is a detailed check of a company or person’s bank statements and money dealings.

This is part of a bigger financial review and involves a lot of steps and can take quite a bit of time.

Usually, outside groups like investors, loan companies, and tax officials do these audits. They want to make sure the business or person can meet their money obligations and aren’t spending more than they have.

Why Conducting Bank Statement Audit is Important

Companies or individuals have various reasons for doing bank statement audits. Even though their purposes may differ, the steps followed in these audits are often similar.

Here are some of the reasons why bank statement audits are important in different contexts.

Detect Financial Fraud or Misappropriation of Funds

Monitoring bank transactions for income is a critical tool for detecting corruption and financial mismanagement within organizations. Reviewing spending reveals unauthorized payments, inflated costs, and unnecessary purchases, which can severely damage financial health.

By proactively safeguarding funds and ensuring transparency, this approach bolsters an organization’s financial well-being.

Verify Legitimate Business Payments and Expenses

Business decisions rely on financial information, but hidden inefficiencies and intentional misbehavior can blur the picture. Audits act as financial clarifiers, reviewing bank statements to detect red flags. It detects unauthorized payments, inflated costs, and wasteful spending.

Identify Unintended Errors or Discrepancies

Even though it’s rare, there are mistakes in bank transactions in different accounts. Analyzing bank statements and comparing them with another record, like a ledger, can spot these errors. These findings can then be shown to the bank to correct the mistakes.

Some examples of errors are duplicates and uneven prices and transactions.

Comply with Regulations or Trace Funds (For Audits, Investigations)

Government agencies review bank statements and transactions to check if the taxes paid match the actual income. This ensures that individuals and businesses are paying the right amount of taxes based on their true earnings.

Categorize each transaction to distinguish the purpose of the money being used to ensure facts for investigatory purposes.

Assessing Borrower’s Financial Health

Lenders use audits to see if someone is pretending to be in better financial shape than they are, just to get loans with better terms and lower interest rates.

This helps lenders avoid risky loans and ensures they’re lending money to people or businesses who are truly financially stable.

They also assess cash flow that comes in bank accounts and credit score ratings of potential borrowers. Learn more about the benefits of OCR for underwriting.

Analyzing Financial Settlements in Family Law Cases

In divorce and custody situations, looking at bank statements shows how much money each person makes and has saved. This is important for making fair decisions about things like alimony, child support, and splitting up assets.

Learn more about the benefits of OCR for Family Law industry.

How to Perform a Bank Statement Audit

Auditing a bank statement can be a time-consuming task that requires careful attention to detail and accurate data entry into spreadsheets. To do it correctly, you need to follow some pointers.

1. Gather all Relevant Bank Statements

When doing a bank statement audit, it’s important to collect only the information that’s relevant to the audit’s purpose. Filler data can be a nuisance during audits. For business audits, make sure to separate any personal or unrelated accounts.

2. Verify Personal & Bank Details on Bank Statements

When auditing bank statements, it’s important to verify basic details like the account number, currency, routing number, and name. Small errors are important to catch because the statements could be linked to a different account.

It’s better to catch and report any errors to the bank as soon as possible. Banks are more able to quickly fix and address issues when they are disputed promptly, as problems haven’t had time to build up yet.

If you’re doing this for a client, we also recommend to ask for certified bank statements.

3. Review transactions for accuracy and correct timing

Examine every transaction amount carefully, down to the smallest dollar and cent. Small discrepancies can add up to significant amounts over time. Even what seems like a minor error can lead to substantial financial losses.

Additionally, it’s important to verify that the date and time of each transaction match the agreed-upon time when it was made.

4. Trace transactions to supporting documentation

Using supporting documents like invoices, payrolls, and receipts is crucial for verifying and cross-checking the transactions recorded in bank statements. These documents confirm that the orders were placed and transactions occurred as stated.

This stage is also where you can begin to note any questionable activities or concerns about the people involved in the transactions.

5. Look for suspicious payments

If there is a lack of proper supporting documentation, you can start suspecting transactions. However, the absence of documentation doesn’t infer suspicions. You can investigate further by asking for alternative ways they can provide support or clarification.

It’s also vital to be cautious about questionable recipients and sources of transactions, as these could be involved in fraudulent activities or schemes. Keeping an eye out for these red flags is an important part of the audit process.

6. Flag inconsistent withdrawals

In bank statement audits, it’s normal to see that money is taken out on a set schedule and in consistent amounts. If there’s a break in this pattern, like withdrawals happening at random times or for different amounts, it’s a big warning sign.

These kinds of irregularities can point to strange or suspicious activities, especially since withdrawals are the main way to take money out of an account.

7. Check payee names on checks

When cross-referencing checks and deposits, it’s important to check that the senders listed in your records match those on the bank statements. This step ensures that each transaction’s details, like the sender and amount, are accurate and helps detect any false bank statements.

8. Verify automatic payments/debits

Automating routine payments like bills and subscriptions streamlines finances, but convenience has pitfalls. The ease of “set it and forget it” can make things more complacent, potentially missing costly errors or red flags like unusual charges or inflated fees.

Regularly reviewing automated transactions, even the seemingly mundane ones, is vital for catching inconsistencies and safeguarding financial health.

Are bank statements hard to understand and organize? Do they help you make smarter money choices, or are they just too much to handle?

Dealing with lots of bank statements during tax time or audits can be overwhelming, and getting the details right can be tough.

This blog will explain what a bank statement audit is and show you a simple way to review your bank statements accurately.

What is a Bank Statement Audit

A bank statement audit is a detailed check of a company or person’s bank statements and money dealings.

This is part of a bigger financial review and involves a lot of steps and can take quite a bit of time.

Usually, outside groups like investors, loan companies, and tax officials do these audits. They want to make sure the business or person can meet their money obligations and aren’t spending more than they have.

Why Conducting Bank Statement Audit is Important

Companies or individuals have various reasons for doing bank statement audits. Even though their purposes may differ, the steps followed in these audits are often similar.

Here are some of the reasons why bank statement audits are important in different contexts.

Detect Financial Fraud or Misappropriation of Funds

Monitoring bank transactions for income is a critical tool for detecting corruption and financial mismanagement within organizations. Reviewing spending reveals unauthorized payments, inflated costs, and unnecessary purchases, which can severely damage financial health.

By proactively safeguarding funds and ensuring transparency, this approach bolsters an organization’s financial well-being.

Verify Legitimate Business Payments and Expenses

Business decisions rely on financial information, but hidden inefficiencies and intentional misbehavior can blur the picture. Audits act as financial clarifiers, reviewing bank statements to detect red flags. It detects unauthorized payments, inflated costs, and wasteful spending.

Identify Unintended Errors or Discrepancies

Even though it’s rare, there are mistakes in bank transactions in different accounts. Analyzing bank statements and comparing them with another record, like a ledger, can spot these errors. These findings can then be shown to the bank to correct the mistakes.

Some examples of errors are duplicates and uneven prices and transactions.

Comply with Regulations or Trace Funds (For Audits, Investigations)

Government agencies review bank statements and transactions to check if the taxes paid match the actual income. This ensures that individuals and businesses are paying the right amount of taxes based on their true earnings.

Categorize each transaction to distinguish the purpose of the money being used to ensure facts for investigatory purposes.

Assessing Borrower’s Financial Health

Lenders use audits to see if someone is pretending to be in better financial shape than they are, just to get loans with better terms and lower interest rates.

This helps lenders avoid risky loans and ensures they’re lending money to people or businesses who are truly financially stable.

They also assess cash flow that comes in bank accounts and credit score ratings of potential borrowers. Learn more about the benefits of OCR for underwriting.

Analyzing Financial Settlements in Family Law Cases

In divorce and custody situations, looking at bank statements shows how much money each person makes and has saved. This is important for making fair decisions about things like alimony, child support, and splitting up assets.

Learn more about the benefits of OCR for Family Law industry.

How to Perform a Bank Statement Audit

Auditing a bank statement can be a time-consuming task that requires careful attention to detail and accurate data entry into spreadsheets. To do it correctly, you need to follow some pointers.

1. Gather all Relevant Bank Statements

When doing a bank statement audit, it’s important to collect only the information that’s relevant to the audit’s purpose. Filler data can be a nuisance during audits. For business audits, make sure to separate any personal or unrelated accounts.

2. Verify Personal & Bank Details on Bank Statements

When auditing bank statements, it’s important to verify basic details like the account number, currency, routing number, and name. Small errors are important to catch because the statements could be linked to a different account.

It’s better to catch and report any errors to the bank as soon as possible. Banks are more able to quickly fix and address issues when they are disputed promptly, as problems haven’t had time to build up yet.

If you’re doing this for a client, we also recommend to ask for certified bank statements.

3. Review transactions for accuracy and correct timing

Examine every transaction amount carefully, down to the smallest dollar and cent. Small discrepancies can add up to significant amounts over time. Even what seems like a minor error can lead to substantial financial losses.

Additionally, it’s important to verify that the date and time of each transaction match the agreed-upon time when it was made.

4. Trace transactions to supporting documentation

Using supporting documents like invoices, payrolls, and receipts is crucial for verifying and cross-checking the transactions recorded in bank statements. These documents confirm that the orders were placed and transactions occurred as stated.

This stage is also where you can begin to note any questionable activities or concerns about the people involved in the transactions.

5. Look for suspicious payments

If there is a lack of proper supporting documentation, you can start suspecting transactions. However, the absence of documentation doesn’t infer suspicions. You can investigate further by asking for alternative ways they can provide support or clarification.

It’s also vital to be cautious about questionable recipients and sources of transactions, as these could be involved in fraudulent activities or schemes. Keeping an eye out for these red flags is an important part of the audit process.

6. Flag inconsistent withdrawals

In bank statement audits, it’s normal to see that money is taken out on a set schedule and in consistent amounts. If there’s a break in this pattern, like withdrawals happening at random times or for different amounts, it’s a big warning sign.

These kinds of irregularities can point to strange or suspicious activities, especially since withdrawals are the main way to take money out of an account.

7. Check payee names on checks

When cross-referencing checks and deposits, it’s important to check that the senders listed in your records match those on the bank statements. This step ensures that each transaction’s details, like the sender and amount, are accurate and helps detect any false bank statements.

8. Verify automatic payments/debits

Automating routine payments like bills and subscriptions streamlines finances, but convenience has pitfalls. The ease of “set it and forget it” can make things more complacent, potentially missing costly errors or red flags like unusual charges or inflated fees.

Regularly reviewing automated transactions, even the seemingly mundane ones, is vital for catching inconsistencies and safeguarding financial health.

9. Use a Bank Statement Analyzer to Automate the Audit Process

Using a bank statement analyzer significantly streamlines the audit process while improving accuracy. These specialized tools automatically extract transaction data from statements, categorize expenses, flag suspicious activities, and generate comprehensive reports.

A bank statement analyzer like DocuClipper can reduce manual data entry time by up to 90%, allowing auditors to focus on analysis rather than data gathering. This technology is especially valuable when auditing multiple months or accounts simultaneously.

For businesses conducting regular audits, a bank statement analyzer ensures consistent methodology across all reviews, improving the reliability of findings over time.

Convert PDF Bank Statements to Excel for Faster Audits

Instead of manually pulling out each bank statement, you can use a bank statement converter. These converters can quickly extract all the information and put it into a spreadsheet, making the data easier to work with and present. See the next section for the shortcut.

One such tool is DocuClipper, which you can use to transform formatted bank statements into Excel files.

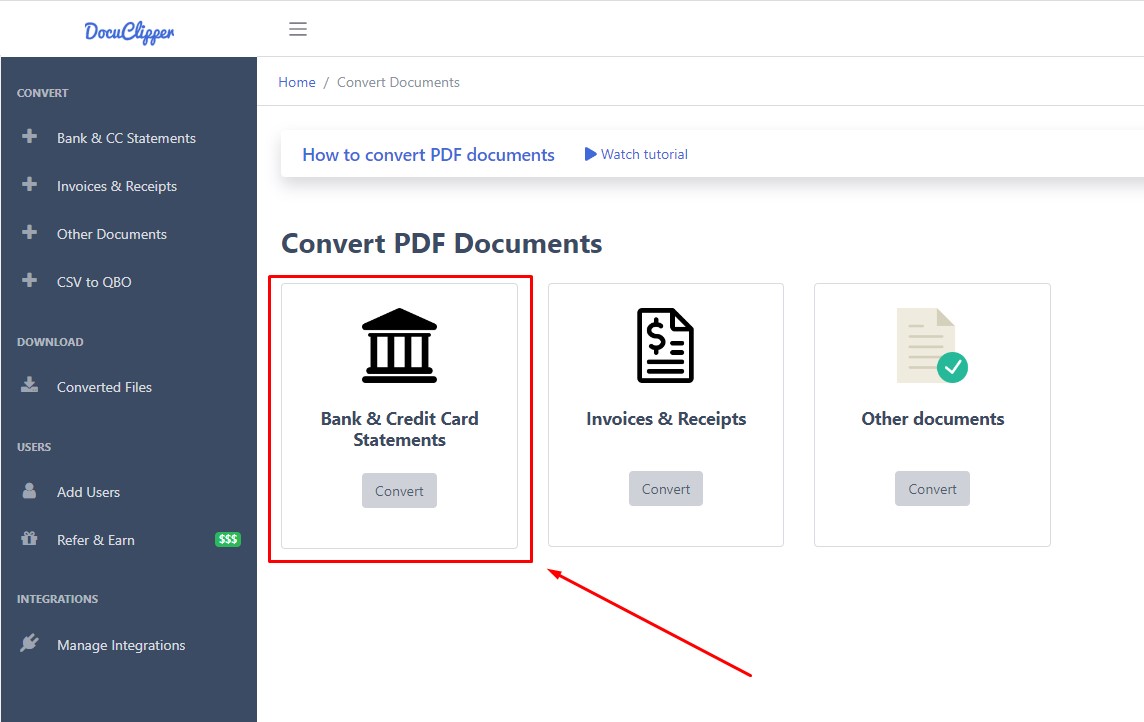

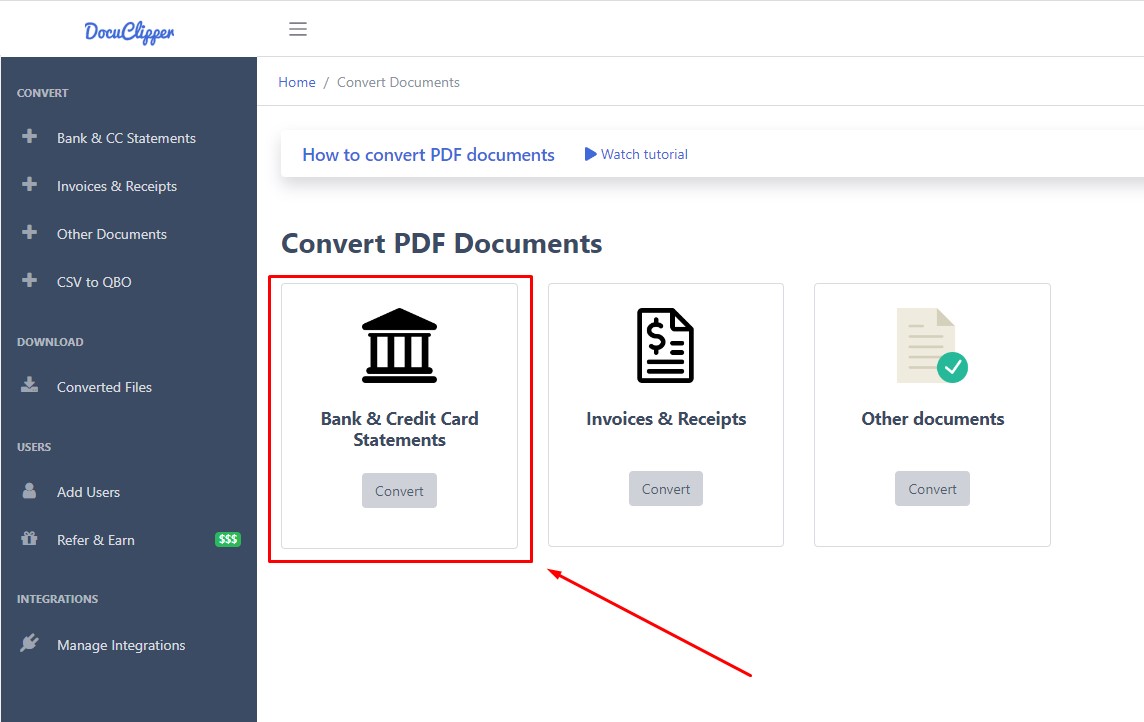

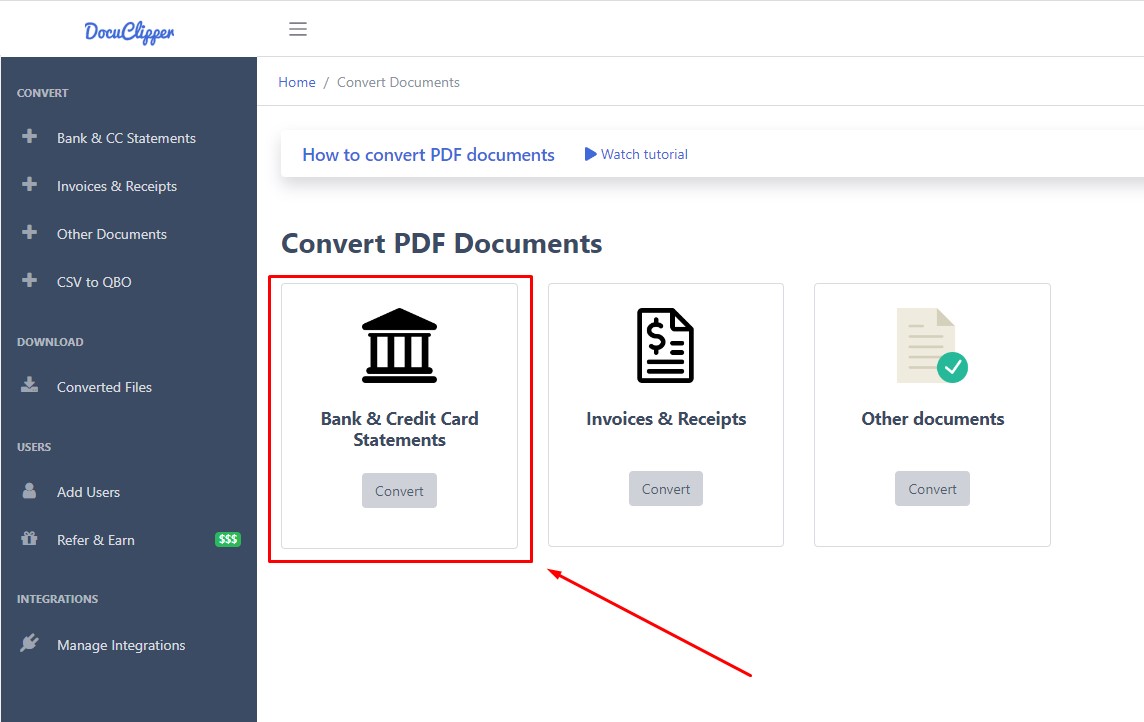

Step 1: Select the Bank Statement Converter

First, log into DocuClipper and choose the “Bank & Credit Card Statements” option. Then, drag and drop your bank statements into the platform. DocuClipper works with both text and scanned statements, using Optical Character Recognition technology to read them.

Step 2: Transactions are Extracted Automatically

DocuClipper’s Bank Statement converter gathers all transaction details, creating a complete extract that encompasses balances, dates, account numbers, and other relevant data.

Step 3: Reconcile the Bank Statements

The next step is to reconcile the bank statements.

The DocuClipper bank statement reconciliation tool matches transaction totals with the summary details on the statement. When everything lines up correctly, the statement is marked as reconciled.

This feature saves time and reduces the need for manual checks. You can view the status of the reconciliation in the summary table, which is located at the top right of the page.

Additionally, there is a video available that demonstrates how to reconcile the statements using DocuClipper.

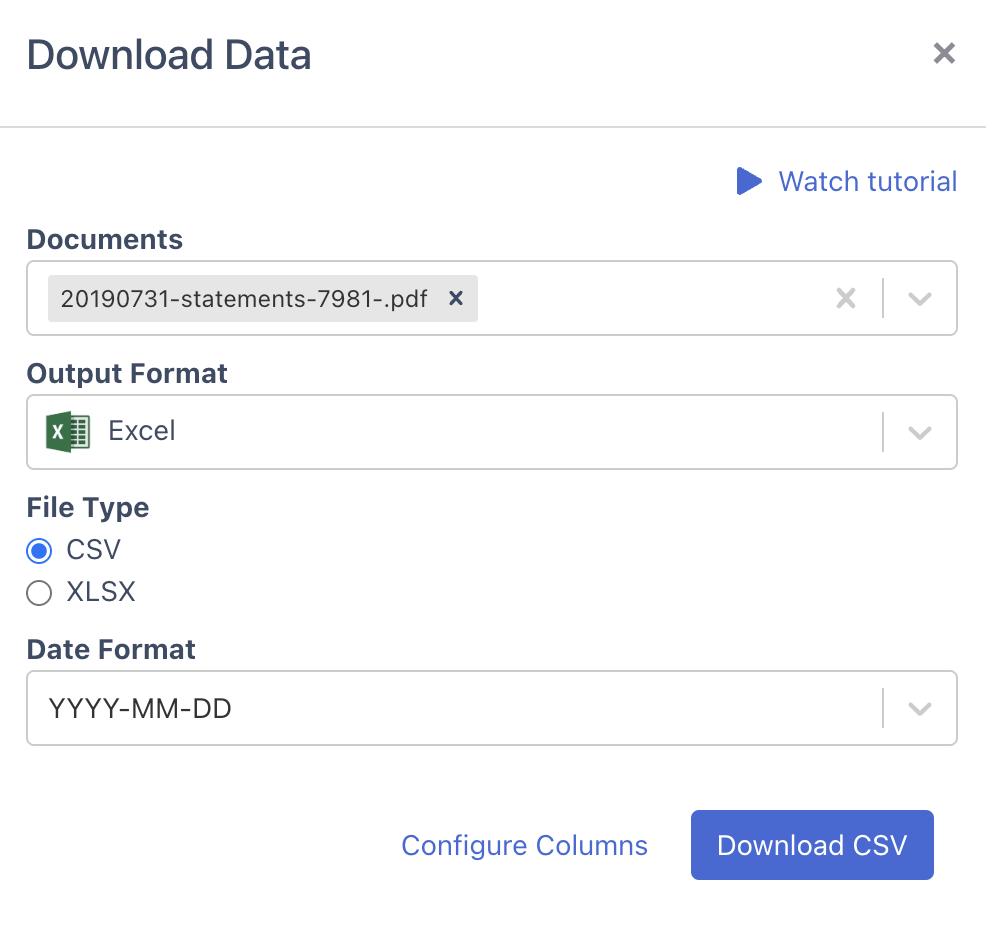

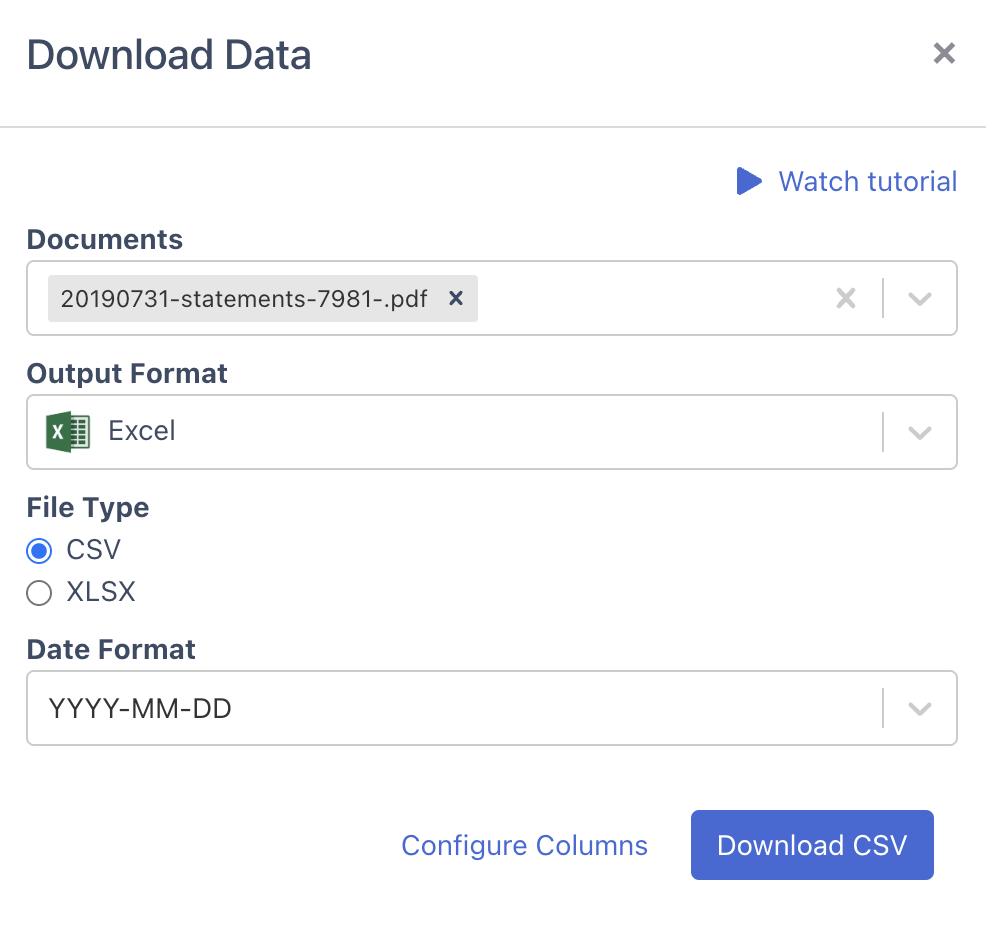

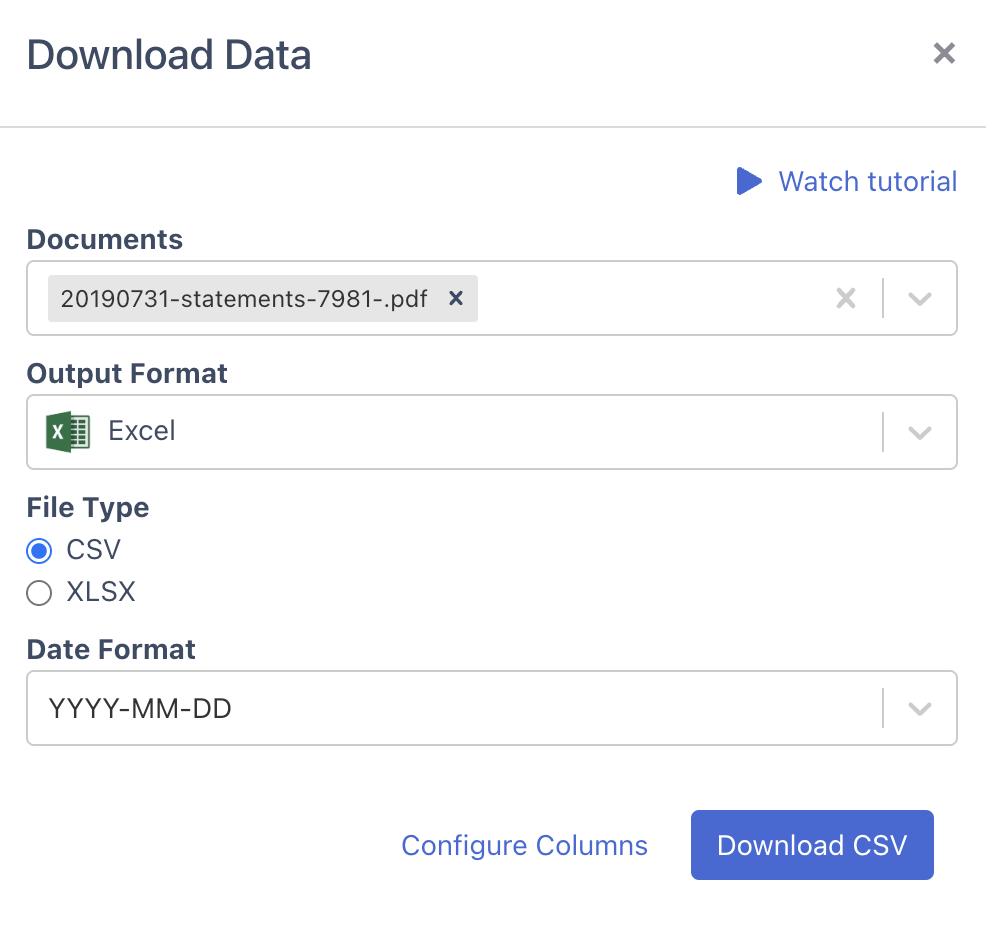

Step 4: Convert Bank Statement to Excel

To download the data, click on “Download data”. Then, choose “Excel” as your output format and select XLSX. Lastly, click on “Download Data” again, and the spreadsheet will download to your computer.

Conclusion

Bank statement audits are crucial for clear financial analysis. Tools like DocuClipper Finacial Analysis streamline this process, converting statements into Excel for faster, more efficient audits.

Modern approaches enhance financial transparency, allow for quicker analysis, and aids in effective financial management, ensuring accuracy in handling financial affairs.

DocuClipper is considered the easiest OCR bank statement converter on the market with our automatic bank statement recognition feature. With that, we can automatically recognize thousands of different bank statements around the world.

Frequently Asked Questions About Bank Statement Audit

Here are some frequently asked questions that people also while reading about bank statement audits:

Why do auditors need bank statements?

Auditors use bank statements to track the financial activity of individuals, companies, or businesses, ensuring accuracy in financial reporting.

Do auditors look at bank statements?

Yes, auditors examine bank statements closely as they are key in tracking financial information and verifying transaction accuracy.

Related Articles:

- 9 Best OCR Software for Accounts Payable

- How to Perform Bank Statement Verification

- The 6 Best OCR Software for Accountants & Bookkeepers to Improve Your Workflow

- Why Is It Important to Reconcile Your Bank Statements

Convert PDF Bank Statements to Excel for Faster Audits

Instead of manually pulling out each bank statement, you can use a bank statement converter. These converters can quickly extract all the information and put it into a spreadsheet, making the data easier to work with and present. See the next section for the shortcut.

One such tool is DocuClipper, which you can use to transform formatted bank statements into Excel files.

Step 1: Select the Bank Statement Converter

First, log into DocuClipper and choose the “Bank & Credit Card Statements” option. Then, drag and drop your bank statements into the platform. DocuClipper works with both text and scanned statements, using Optical Character Recognition technology to read them.

Step 2: Transactions are Extracted Automatically

DocuClipper’s Bank Statement converter gathers all transaction details, creating a complete extract that encompasses balances, dates, account numbers, and other relevant data.

Step 3: Reconcile the Bank Statements

The next step is to reconcile the bank statements.

The DocuClipper bank statement reconciliation tool matches transaction totals with the summary details on the statement. When everything lines up correctly, the statement is marked as reconciled.

This feature saves time and reduces the need for manual checks. You can view the status of the reconciliation in the summary table, which is located at the top right of the page.

Additionally, there is a video available that demonstrates how to reconcile the statements using DocuClipper.

Step 4: Convert Bank Statement to Excel

To download the data, click on “Download data”. Then, choose “Excel” as your output format and select XLSX. Lastly, click on “Download Data” again, and the spreadsheet will download to your computer.

Conclusion

Bank statement audits are crucial for clear financial analysis. Tools like DocuClipper Finacial Analysis streamline this process, converting statements into Excel for faster, more efficient audits.

Modern approaches enhance financial transparency, allow for quicker analysis, and aids in effective financial management, ensuring accuracy in handling financial affairs.

DocuClipper is considered the easiest OCR bank statement converter on the market with our automatic bank statement recognition feature. With that, we can automatically recognize thousands of different bank statements around the world.

Frequently Asked Questions About Bank Statement Audit

Here are some frequently asked questions that people also while reading about bank statement audits:

Why do auditors need bank statements?

Auditors use bank statements to track the financial activity of individuals, companies, or businesses, ensuring accuracy in financial reporting.

Do auditors look at bank statements?

Yes, auditors examine bank statements closely as they are key in tracking financial information and verifying transaction accuracy.

Related Articles:

- 9 Best OCR Software for Accounts Payable

- How to Perform Bank Statement Verification

- The 6 Best OCR Software for Accountants & Bookkeepers to Improve Your Workflow

- Why Is It Important to Reconcile Your Bank Statements

Convert PDF Bank Statements to Excel for Faster Audits

Instead of manually pulling out each bank statement, you can use a bank statement converter. These converters can quickly extract all the information and put it into a spreadsheet, making the data easier to work with and present. See the next section for the shortcut.

One such tool is DocuClipper, which you can use to transform formatted bank statements into Excel files.

Step 1: Select the Bank Statement Converter

First, log into DocuClipper and choose the “Bank & Credit Card Statements” option. Then, drag and drop your bank statements into the platform. DocuClipper works with both text and scanned statements, using Optical Character Recognition technology to read them.

Step 2: Transactions are Extracted Automatically

DocuClipper’s Bank Statement converter gathers all transaction details, creating a complete extract that encompasses balances, dates, account numbers, and other relevant data.

Step 3: Reconcile the Bank Statements

The next step is to reconcile the bank statements.

The DocuClipper bank statement reconciliation tool matches transaction totals with the summary details on the statement. When everything lines up correctly, the statement is marked as reconciled.

This feature saves time and reduces the need for manual checks. You can view the status of the reconciliation in the summary table, which is located at the top right of the page.

Additionally, there is a video available that demonstrates how to reconcile the statements using DocuClipper.

Step 4: Convert Bank Statement to Excel

To download the data, click on “Download data”. Then, choose “Excel” as your output format and select XLSX. Lastly, click on “Download Data” again, and the spreadsheet will download to your computer.

Conclusion

Bank statement audits are crucial for clear financial analysis. Tools like DocuClipper Finacial Analysis streamline this process, converting statements into Excel for faster, more efficient audits.

Modern approaches enhance financial transparency, allow for quicker analysis, and aids in effective financial management, ensuring accuracy in handling financial affairs.

DocuClipper is considered the easiest OCR bank statement converter on the market with our automatic bank statement recognition feature. With that, we can automatically recognize thousands of different bank statements around the world.

Frequently Asked Questions About Bank Statement Audit

Here are some frequently asked questions that people also while reading about bank statement audits:

Why do auditors need bank statements?

Auditors use bank statements to track the financial activity of individuals, companies, or businesses, ensuring accuracy in financial reporting.

Do auditors look at bank statements?

Yes, auditors examine bank statements closely as they are key in tracking financial information and verifying transaction accuracy.