Lenders, landlords, auditors, and other sellers and credit providers check the income of their clients to see if they qualify.

Proving income can be different for each one of us. Some earn through a wage, some through a business, and some in investments, and these have different documents to prove.

So to see things in a better picture, credit providers perform a bank statement verification for their clients.

What is Bank Statement Income Verification?

Bank statement income verification is the process of checking a person’s or business’s income stream through their bank statements.

Lenders, landlords, and credit providers must often check how much their clients earn. This helps them decide if a client is suitable for things like loans or renting property.

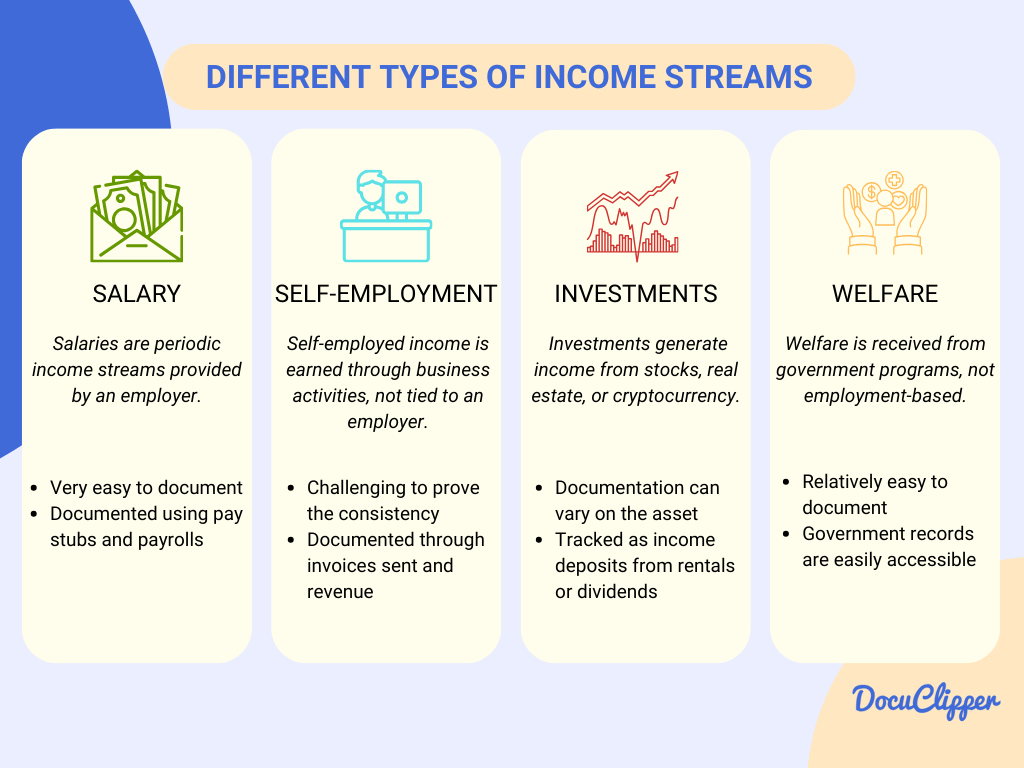

People earn money in different ways: some get a regular salary, and others run their businesses or make money from investments. Each of these has its way of showing income.

Companies might look at their bank statements to understand a client’s financial situation better. This shows not just how much someone earns, but also how they spend their money, which helps make decisions.

Learn more about the benefits of OCR for underwriting technology.

Common Proof of Income Documents

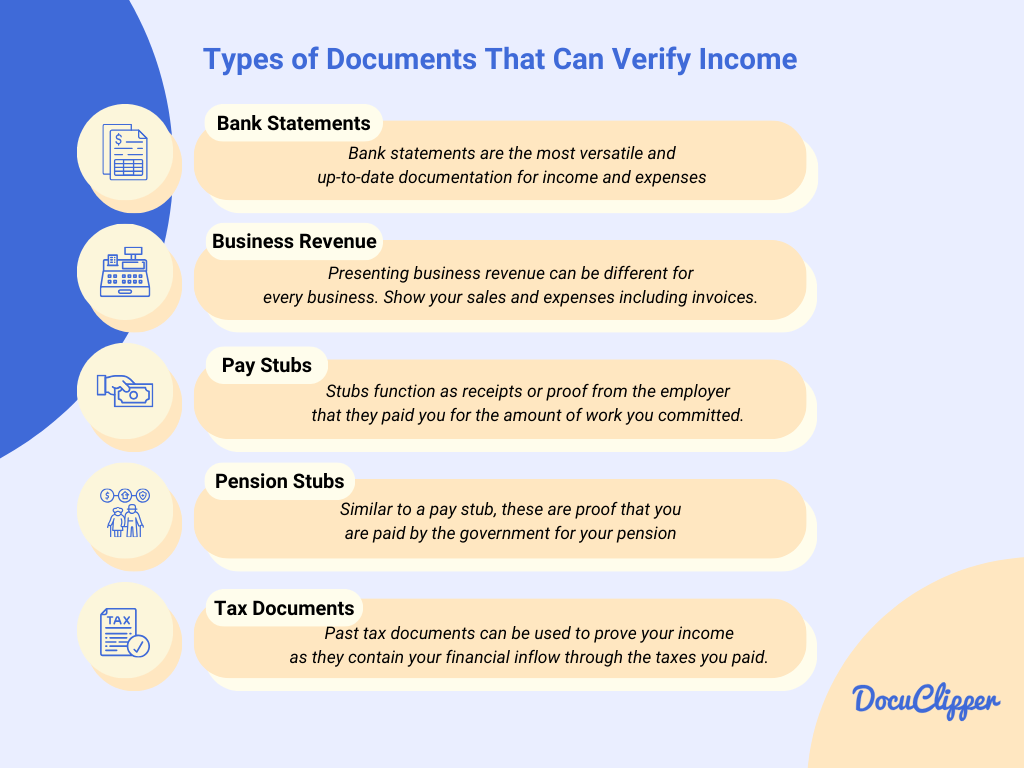

Bank statements are one way to demonstrate your income sources.

But you should ask for certified bank statements if you will use bank statements for income verification to avoid fake bank statements.

However, there are other options. They work well as a broad overview, combining information from various income streams.

Employees can use pay stubs to verify their earnings. Business owners might present records of their business sales and expenses. Retirees and investors can provide documents like pension statements, social security details, or investment portfolios to prove their income.

Another alternative is tax information. Showing your tax records can be enough to prove your income, as they reveal your tax obligations and, by extension, what you earn.

Why Use Bank Statement for Proof of Income Verification?

Bank statements are really useful because they show the most current details about a person’s or business income.

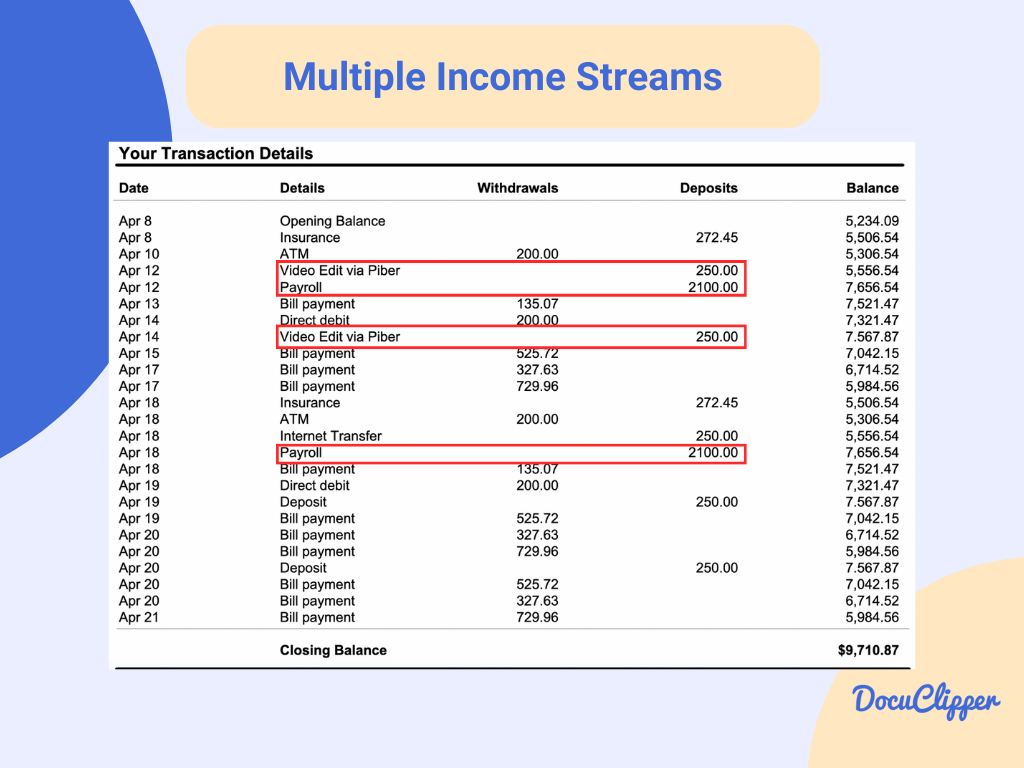

If you have money coming in from different places, a bank statement puts it all together in one clear view.

These statements don’t just show how much you earn; they also show how you spend your money. This helps others see if you’re good at managing your finances, which can be important when someone checks your financial situation.

What Should Be Included on the Bank Statements

In these bank statements, there are many things to include and should also avoid doing to leave a good impression on one who is checking.

Types of income to show

When you’re trying to make a good impression financially, it’s important to show all the different ways you make money. But remember, exaggerating your earnings can lead to issues like fraud and loss of trust.

Here’s a breakdown of the types of income you should show:

- Employment Income: This is what you earn from a regular job, usually the main source of income for most people. This is very easy to highlight.

- Self-employment Income: Income from freelance work, consulting, or running your own business falls under this category. It can vary, so provide detailed documentation.

- Investment Income: This varies for everyone. This includes earnings from stocks, bonds, real estate rentals, or other investments. It can fluctuate, so include historical data for context.

- Government Benefits: These might be regular government pensions or one-time welfare benefits. Lenders usually look for a consistent pattern in these benefits.

- Other Sources: If you have other income sources like royalties, alimony, or any other consistent revenue streams, be sure to include these as well.

Another key aspect to consider with your income streams is the timing and duration. It’s important to know how often you receive your income and for how long you’ve been receiving it. This information can give a clearer picture of your financial stability and reliability.

What To Avoid Including

When providing financial information, it’s just as important to know what to leave out as it is to know what to include.

Certain items can raise red flags for those reviewing your finances. Here are a few things to avoid:

- Unexplained Large Cash Deposits: If there are big deposits in your account that you can’t explain, this can look suspicious.

- Suspicious or Inconsistent Transactions: Any irregular activity or transactions that don’t fit your usual pattern can cause concern.

- Frequent Overdrafts or Non-Sufficient Funds: A history of overdrawing your account or having insufficient funds can indicate financial instability or poor money management.

How Bank Statement Income Verification Works

The process of verifying income through bank statements is generally consistent across different auditors and checkers. Here’s a step-by-step guide to how it works:

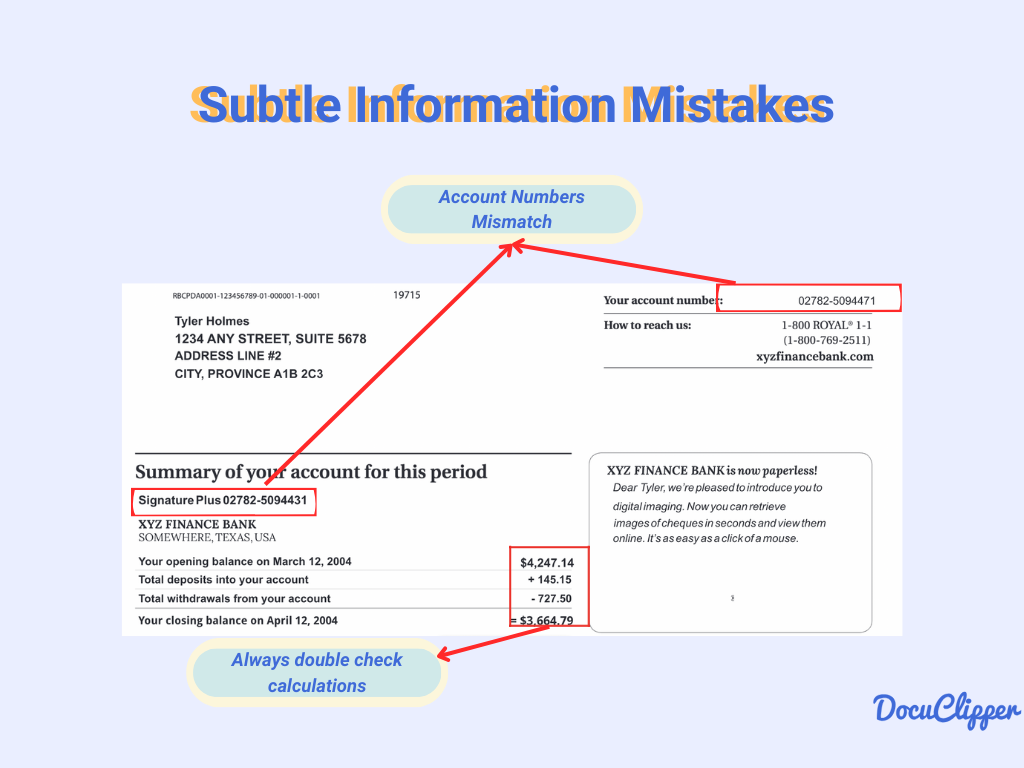

- Basic Information Inspection: The process begins with a thorough check of basic details such as the account number, name, address, and dates on the bank statement. This step ensures that the context and your personal information are correct and valid.

- Error Checking and Account Reconciliation: The next step involves looking for any unintended errors, like miscalculations, and ensuring that the checks and balances in the account match up. This helps to confirm the accuracy of the financial data.

- Transaction Review: Reviewing past transactions is crucial. This step checks whether income is being used appropriately and if there are any signs of financial insecurity, like the lack of savings or safety nets.

- Fraud Detection: Auditors look for signs of characteristics of a fake bank statement, such as discrete alterations in the statement or attempts to inflate income. This is a critical step in ensuring the authenticity of the financial information provided.

- Consistency and Stability Analysis: The final step often involves assessing the consistency and stability of the income. Auditors look for regular income patterns and compare them over different months or even years.

How DocuClipper Simplifies Bank Statement Income Verification

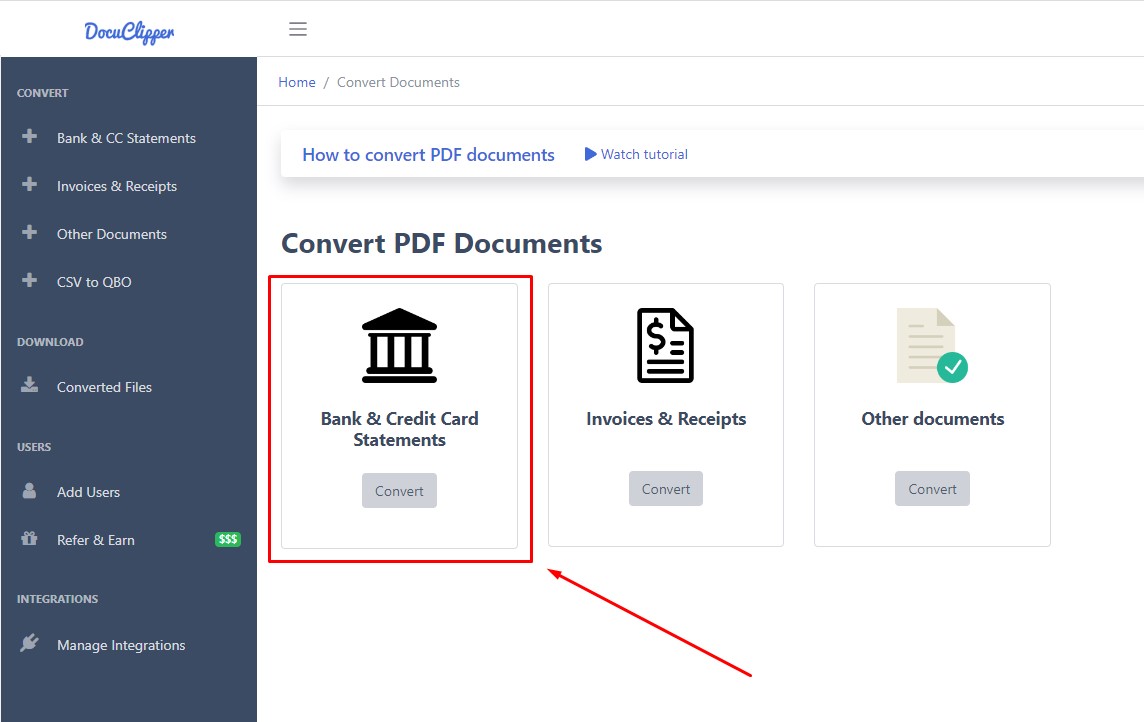

A typical bank statement income verification requires a lot of manual data entry and man hours to finish at least one. With OCR data entry software, DocuClippper can help you how to verify many bank statements in a few clicks.

Docuclipper is an OCR software that functions as a bank statement converter that converts PDF bank statements into editable versions like plain text and CSV. This OCR has an accuracy of 99.5% regarding bank statements.

Simplifying Bank Statement Income Verification with DocuClipper

Processing through income verification through bank statements is easier with DocuClipper. Let’s explore how this tool streamlines and enhances the verification process:

- Data Conversion to Spreadsheets

- Efficiency and Accuracy: DocuClipper converts bank statements into spreadsheets, reducing time and errors associated with manual data entry.

- Quick Review: This feature is particularly beneficial for financial analysts and loan officers who need to process financial information swiftly.

- Categorizing Transactions

- Income and Expense Tracking: The tool categorizes transactions, clearly distinguishing between incoming and outgoing funds. Learn more about Categorizing transactions.

- Financial Insight: This categorization aids in understanding an individual’s financial health by highlighting their income sources and spending patterns.

- Advanced Analysis Features

- Flow of Funds: Tracks the movement of money between accounts, providing insight into financial behaviors.

- Transfer Detection: Identifies internal transfers, distinguishing them from actual income for a more accurate financial assessment.

- Seamless Software Integration

- Broad Application: Extracted data from bank statements can be easily uploaded to various software platforms, including accounting tools and spreadsheets.

- In-depth Analysis: This feature allows for a thorough examination of an individual’s income, spending, and saving habits, enhancing the depth of financial analysis.

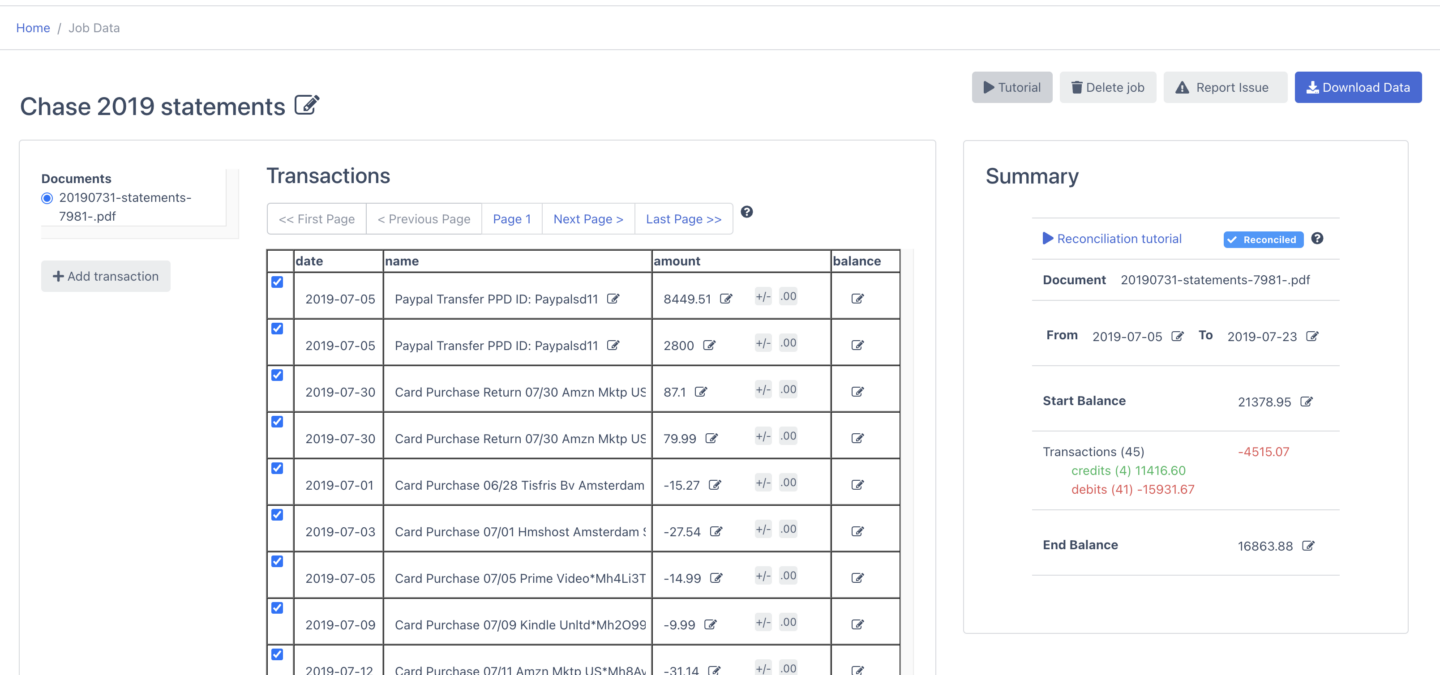

Using DocuClipper for bank statement income verification involves a streamlined and efficient process. Here’s how it typically works:

- Upload Bank Statements: Begin by uploading your bank statement documents to the DocuClipper platform. This is a straightforward process and the first step in digitizing your financial information.

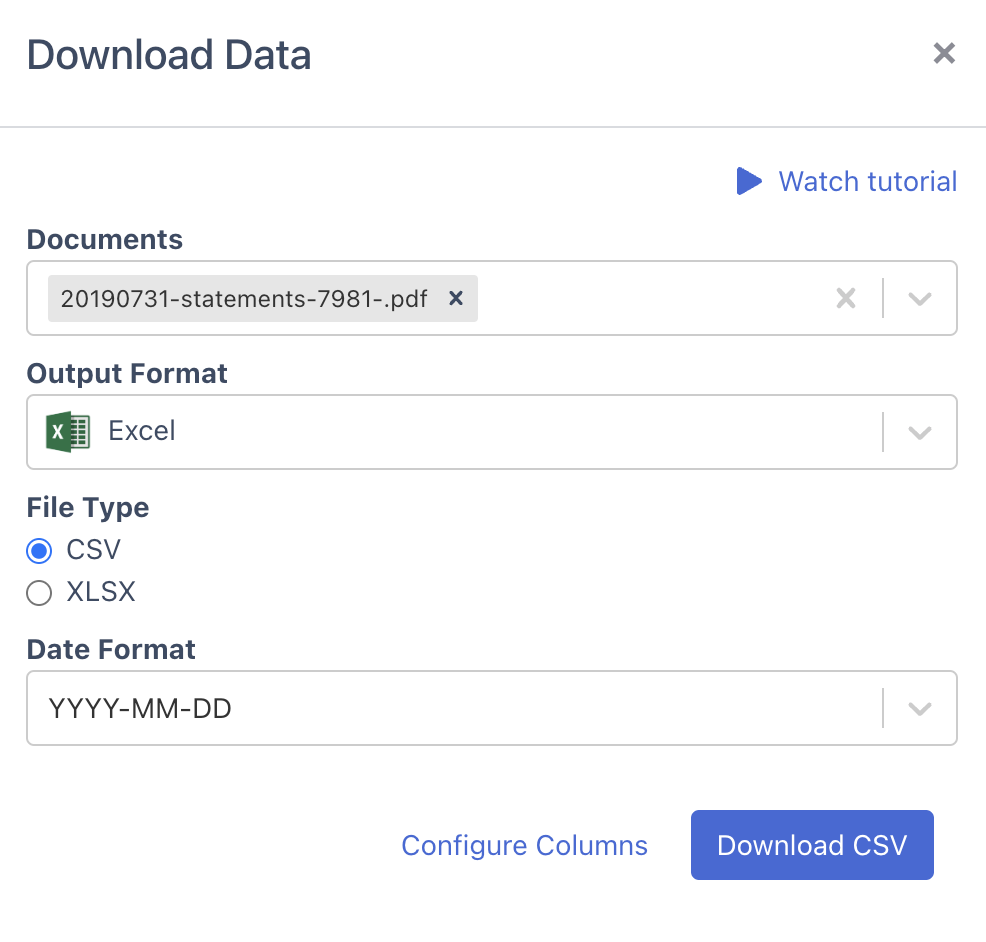

- Convert to CSV Format: Once uploaded, DocuClipper will convert your PDF bank statements into a CSV (Comma-Separated Values) format. This conversion makes the data easier to handle and analyze through spreadsheets.

- Bank Statement Reconciliation: The tool automatically reconciles the data in about 20 seconds. This means it will analyze and align the transactions to give a clear picture of the account’s status immediately after the uploaded statements.

- Transaction Categorization: The transactions are ready to be categorized after the reconciliation process. DocuClipper allows for transactions to be categorized either by default settings or according to categories provided by the user.

Conclusion

Bank statement income verification is a crucial aspect of financial assessment for lenders, landlords, auditors, and credit providers. This process offers a comprehensive view of one’s financial standing.

From understanding the different types of income and what to include (or avoid) in bank statements to using OCR technology for efficient verification, this guide provides an in-depth look at how bank statement income verification works.

FAQs about Bank Statement Income Verification

What is bank statement income verification?

It’s a process of evaluating a person’s or business’s income through their bank statements to assess financial stability and eligibility for loans, rentals, etc.

Why are bank statements used for income verification?

Bank statements provide a current and comprehensive view of income from various sources, along with spending patterns, making them a reliable source for financial assessment.

What types of income should be included in a bank statement?

Include diverse income types such as employment income, self-employment income, investment income, government benefits, and other consistent revenue streams.

What should be avoided when presenting bank statements?

Avoid including unexplained large cash deposits, suspicious transactions, and frequent overdrafts, as they can raise red flags.

Can DocuClipper handle different formats of bank statements?

Yes, DocuClipper can convert various formats of bank statements into CSV, making it versatile for different financial analysis needs.

What is the role of bank statement reconciliation in income verification?

Bank statement reconciliation ensures the accuracy of the financial data in the bank statements, confirming that all transactions and balances match up correctly.