Banks give out various papers for different reasons and this can be a lot for people who don’t dwell on accounting. These can be bank statements, certificates, credit card statements, asset reports, and many more.

When it’s time to do your taxes, you need a bank statement. This shows the money you’ve made and spent. If you’re borrowing money, renting a place, or applying for a visa, you need a bank certificate. This proves you have enough money for these financial actions.

What is a Bank Statement?

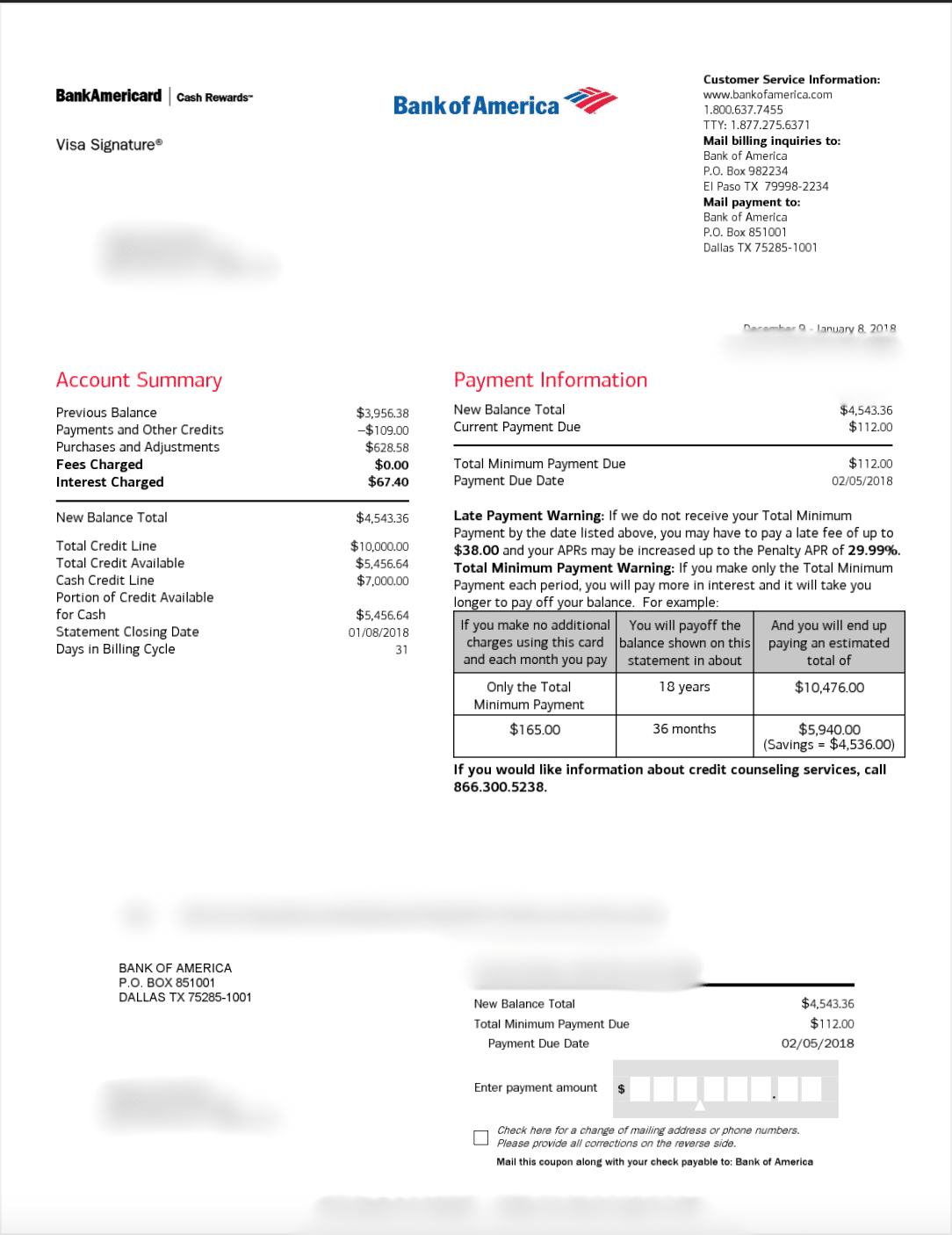

A bank statement is a document provided by your bank that lists all the bank transactions in your account over a certain period. It shows deposits, withdrawals, and the balance of your account, making it easy to see where your money is coming from and going.

This statement is important for managing your finances, as it helps you track your spending and income. It can also serve as proof of your financial status when you’re applying for loans or credit cards, or need to verify your income and expenses for purposes.

What is a Bank Certificate?

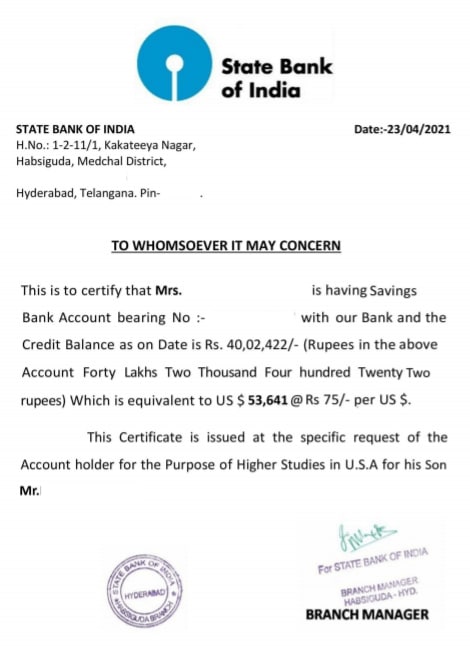

A bank certificate is an official document from your bank that verifies you have a certain amount of money in your account. It’s used to prove your financial stability and capability to pay for something, such as a loan or rent.

Unlike a bank statement, a bank certificate does not detail your transactions. It simply states your account balance at a specific moment. It is required when you’re making significant financial commitments, like buying a house, renting an apartment, or applying for a visa.

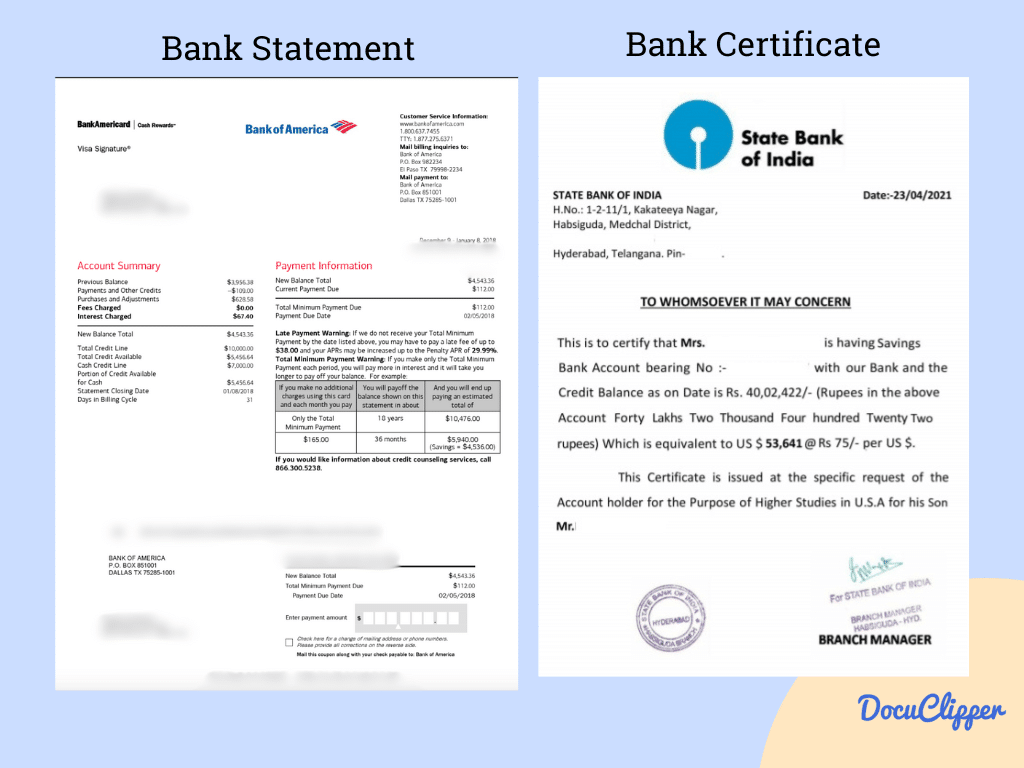

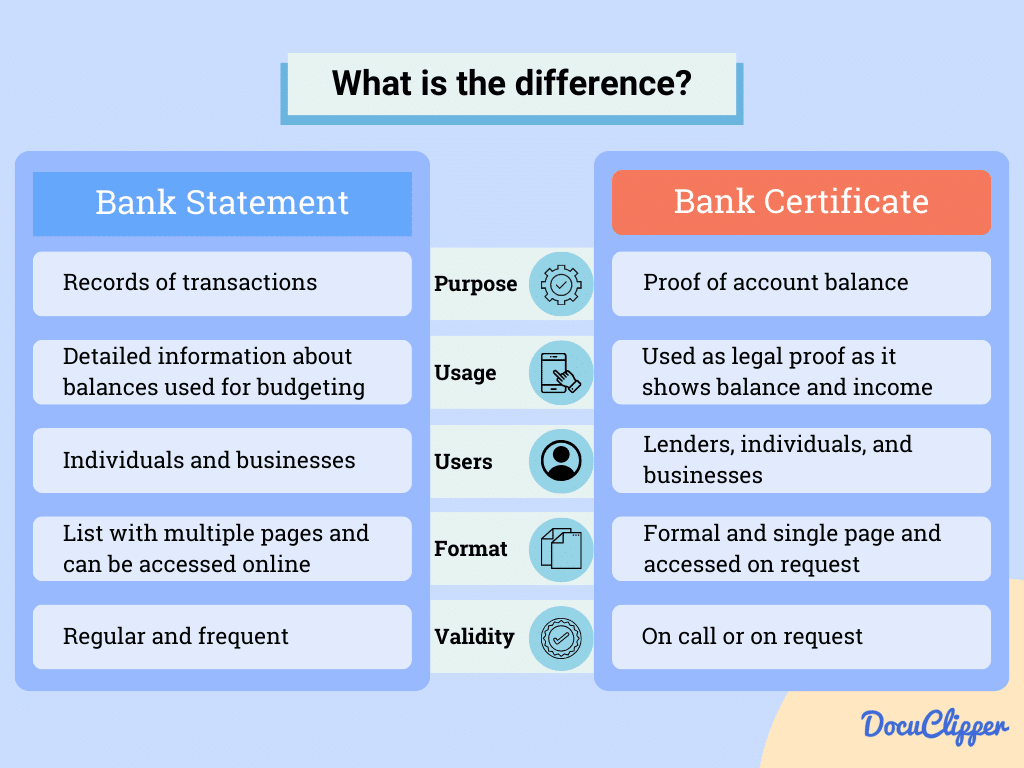

Bank Statement vs Bank Certificate: The Key Differences

| Feature | Bank Statement | Bank Certificate |

| Purpose | Record of transactions | Proof of account balance |

| Usage | Budgeting, monitoring, reconciliation | Legal, financial proof |

| Information | Detailed transactions, balances | Account balance, holder’s name, amount in the account |

| Users | Individuals, businesses, financial planners | Individuals, businesses, legal proceedings |

| Format | List, multiple pages | Formal, single page |

| Accessibility | Monthly, online, or mail | On request, sometimes with a fee |

| Validity | Ongoing, reflects past activity | Specific point in time, short-term validity |

| Timing | Regular intervals | On-demand |

Purpose and Usage

Bank Statement

A bank statement is a detailed report of what’s happening in your bank account for a certain time. It’s for keeping an eye on what money comes in and goes out, making sure everything adds up right, and planning how to spend or save your money.

It’s very important for keeping your finances straight and spotting any mistakes or unusual transactions.

Bank Certificate

A bank certificate is like a proof of legitimacy that shows you have a certain amount of money in your account at a specific moment.

It’s used when you need to show someone officially that you’ve got enough dough for something important, like getting a loan, renting a place, or moving to another country.

Information Provided

Bank Statement

This lists how much money you had at the start and end of the period, what you’ve put in or taken out, any fees you’ve paid, and any interest you’ve earned. It gives you the nitty-gritty on each transaction, like when it happened, what it was for, how much it was, and where it went or came from.

Bank Certificate:

It shows how much money you had when the bank wrote the certificate, plus your name and sometimes your account number. But it doesn’t get into what you’ve been buying or how you’ve been spending your money.

Users

Bank Statement

Here are the people who’ll use bank statements regularly:

- Individuals use it to keep their money matters in order, from everyday budgeting to spotting stuff they didn’t buy.

- Businesses need it to keep track of their cash flow, prepare for taxes, and make financial reports.

- Accountants and Financial Planners dive into these statements to figure out financial strategies and advice.

Bank Certificate

Here are some people with the causes why they need bank certificates:

- Individuals might need one for big life steps like applying for visas, getting loans, or proving they can pay for a big purchase.

- Businesses use it to show they’re financially solid to partners, investors, or the law.

- Lawyers and Legal Reps might need it in court to show someone can pay up as promised

Format and Accessibility

Bank Statement

- Format: Bank statements are detailed records that list all your account activities over a period, usually presented in a multi-page document. This format includes all transactions, balances, and changes in your account.

- Accessibility: Banks offer these statements monthly and can provide them in various accessible formats upon request to accommodate people. This includes large print, braille, or digital formats that are compatible with screen readers.

Bank Certificate

- Format: A bank certificate is a concise document, typically a single page, that certifies your account balance at a certain date. It’s a straightforward declaration without the detailed transaction history found in bank statements.

- Accessibility: To obtain a bank certificate, you usually need to request it specifically from your bank. Banks can accommodate customers by offering the certificate in accessible formats, such as large print or braille, or as a digital document that can be read by screen readers.

Validity and Timing

Bank Statement

- Validity: Bank statements provide ongoing, up-to-date records of your financial transactions, offering a continuous overview of your financial health.

- Timing: Issued monthly, they allow for regular tracking and management of your finances, covering all activity from the previous month.

Bank Certificate

- Validity: Snapshot of an account at a specific point in time; considered valid for a short period after issuance.

- Timing: Issued on demand and not at regular intervals.

Summary of Bank Statement vs Bank Certificate

Bank statements and bank certificates serve different purposes. Bank statements are monthly records that show all your transactions, helping you track your money. They automatically come to you each month.

Bank certificates, however, are one-time documents that prove how much money you have at a certain moment. You get them only when you ask, usually for situations like applying for a loan or moving abroad.

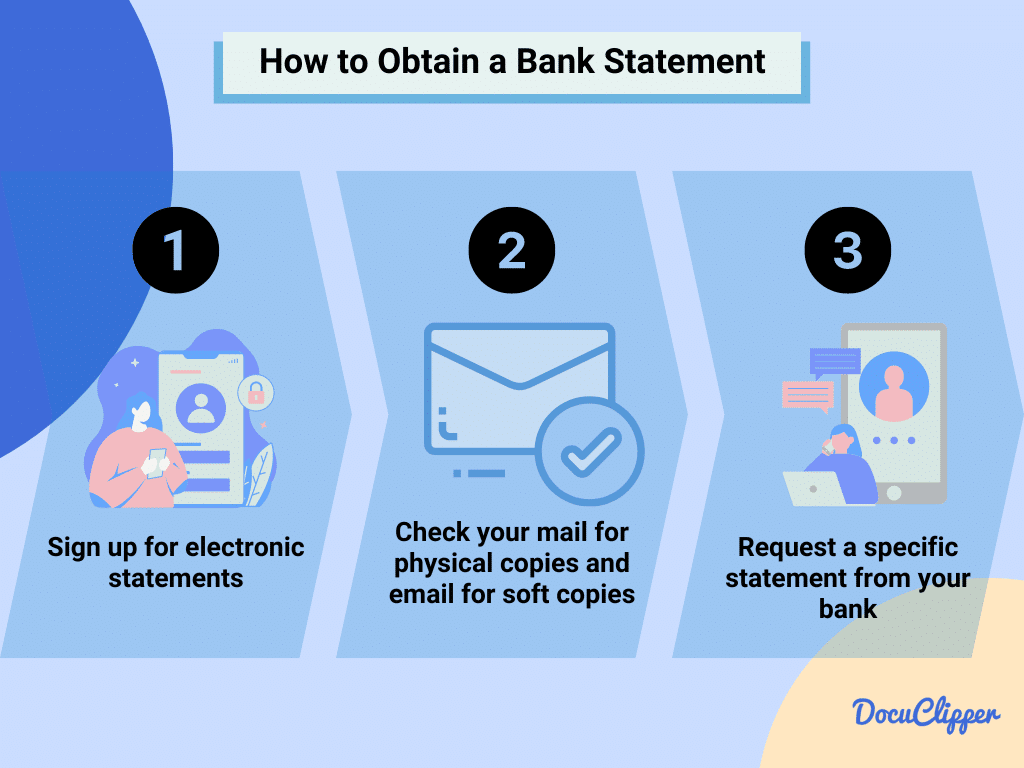

How to Obtain Bank Statements

Getting a bank statement is as easy as waiting. Here are the steps to set it up:

- Sign up for electronic statements through your bank’s online banking platform for immediate access.

- Check your mail for physical copies if you’ve opted for mailed statements.

- Request a specific statement from your bank if you need information from a particular period. This can often be done online, over the phone, or in person at a branch.

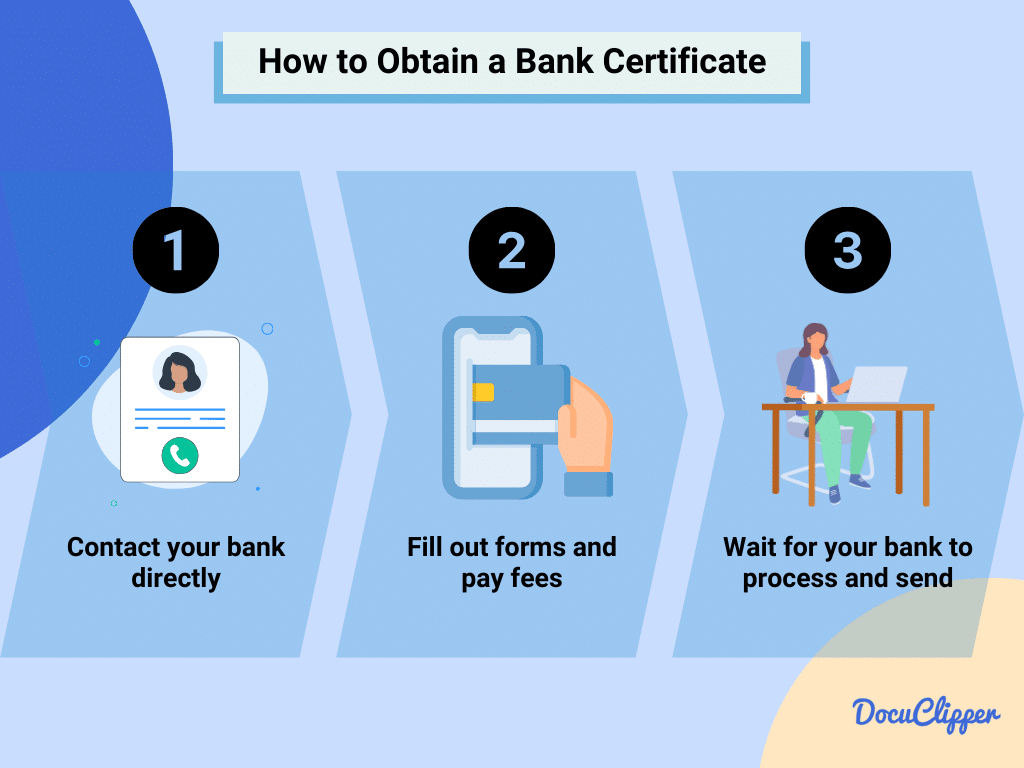

How to Obtain a Bank Certificate

Getting a bank certificate is slightly different and might be more difficult than getting a bank statement. Here are some steps:

- Contact your bank directly, which can typically be done through visiting a local branch, logging into your online banking portal, or calling customer service.

- Fill out any required forms or provide necessary details about your account and the reason for the certificate request.

- Pay any applicable fees that might be associated with the issuance of the bank certificate.

- Wait for the bank to process your request and provide you with the certificate, either in person, by mail, or electronically, depending on the bank’s practices and your preference.

Why is a Bank Statement Important?

A bank statement is essential for keeping an eye on your finances, helping you budget wisely, and spotting any unusual or unauthorized transactions quickly. It plays a crucial role in managing your money effectively and ensuring financial security.

If you want to learn more about bank statements and how to use them well, here are some articles:

Why is a Bank Certificate Important?

A bank certificate is important for showing you have the financial means needed for big steps or transactions, like applying for a loan, renting a property, or moving to a new country. It acts as proof of your financial health when you need to establish trust in financial or legal situations.

Unlike statements, bank certificates are rarely tampered with or forged. Fake bank statements are huge problems for financial institutions and bank certificates can certainly prove their validity.

Conclusion

Understanding the difference between bank statements and bank certificates is key to managing your money well. Bank statements give you a detailed look at your transactions, helping you keep track of what you spend and earn. They’re great for budgeting and catching any mistakes.

Bank certificates, however, are used to show how much money you have at a certain time, important when you’re looking to rent a place, get a loan, or handle big financial decisions.

Knowing when and how to use these documents can make handling your finances more straightforward. Whether you’re planning your budget with a bank statement or proving your financial health with a bank certificate, both play important roles in your financial journey.

How DocuClipper Can Help?

DocuClipper is a tool for individuals and businesses looking to streamline their financial management. With its ability to convert PDF bank statements into more accessible formats like Excel, CSV, or QBO, users can effortlessly manage their finances without manual data entry.

Beyond mere conversion, DocuClipper’s bank statement analysis feature offers deep insights into financial transactions, enabling users to understand their cash flow, spending patterns, and overall financial health better.

Additionally, categorizing bank transactions becomes a breeze with DocuClipper, simplifying the process of organizing financial data for accounting, budgeting, or auditing purposes.

FAQs about Bank Statement and Bank Certificate

Here are some of the most frequently asked questions about bank statements and bank certificates:

Is a bank certificate the same as a statement?

No, a bank certificate is not the same as a statement. A bank certificate is a document from the bank confirming the account balance at a specific moment, whereas a bank statement lists transactions over a period.

Is a bank statement the same as proof of account?

Yes, a bank statement can serve as proof of account, showing the existence of the account and the transactions that have occurred over a specified period.

Is a bank statement a bank document?

Yes, a bank statement is an official document issued by the bank that details the transactions in an account over a specific period.

How do I verify my bank certificate?

To verify a bank certificate, contact the issuing bank directly. They can confirm the authenticity of the document and the details it contains.

What does a bank statement prove?

A bank statement proves the financial transactions that have occurred in an account over a given period. It shows deposits, withdrawals, and the ending balance, providing transparency into an individual’s or business’s financial activity.

Is a bank statement proof of receipt?

A bank statement can serve as proof of receipt for transactions that have been processed through the account, showing both incoming and outgoing payments.

Related Articles:

- Purchase Order vs Invoice: What are the Differences

- How OCR Data Entry Works & Why It’s So Popular

- Ultimate Guide to Automated Bookkeeping: Saving Time & Money

- What is Transaction Categorization and Why Is it Important for Accountants?

- How to Read a Brokerage Statement

- How Long to Keep a Brokerage Statement

- What is a certified bank statement