Reviewing bank statements is time-consuming, error-prone, and inefficient—especially when handling large volumes. That’s where bank statement analyzer software comes in.

These tools automatically extract, categorize, and verify financial data from scanned or PDF statements, saving you hours of manual work. Whether you’re a lender assessing credit risk, an accountant preparing reports, or a business verifying income and expenses, bank statement analyzers simplify your workflow.

They improve accuracy, reduce fraud risk, and accelerate decision-making with AI-powered analysis and audit-ready exports.

In this guide, you’ll discover the best bank statement analyzer software to streamline your financial review process.

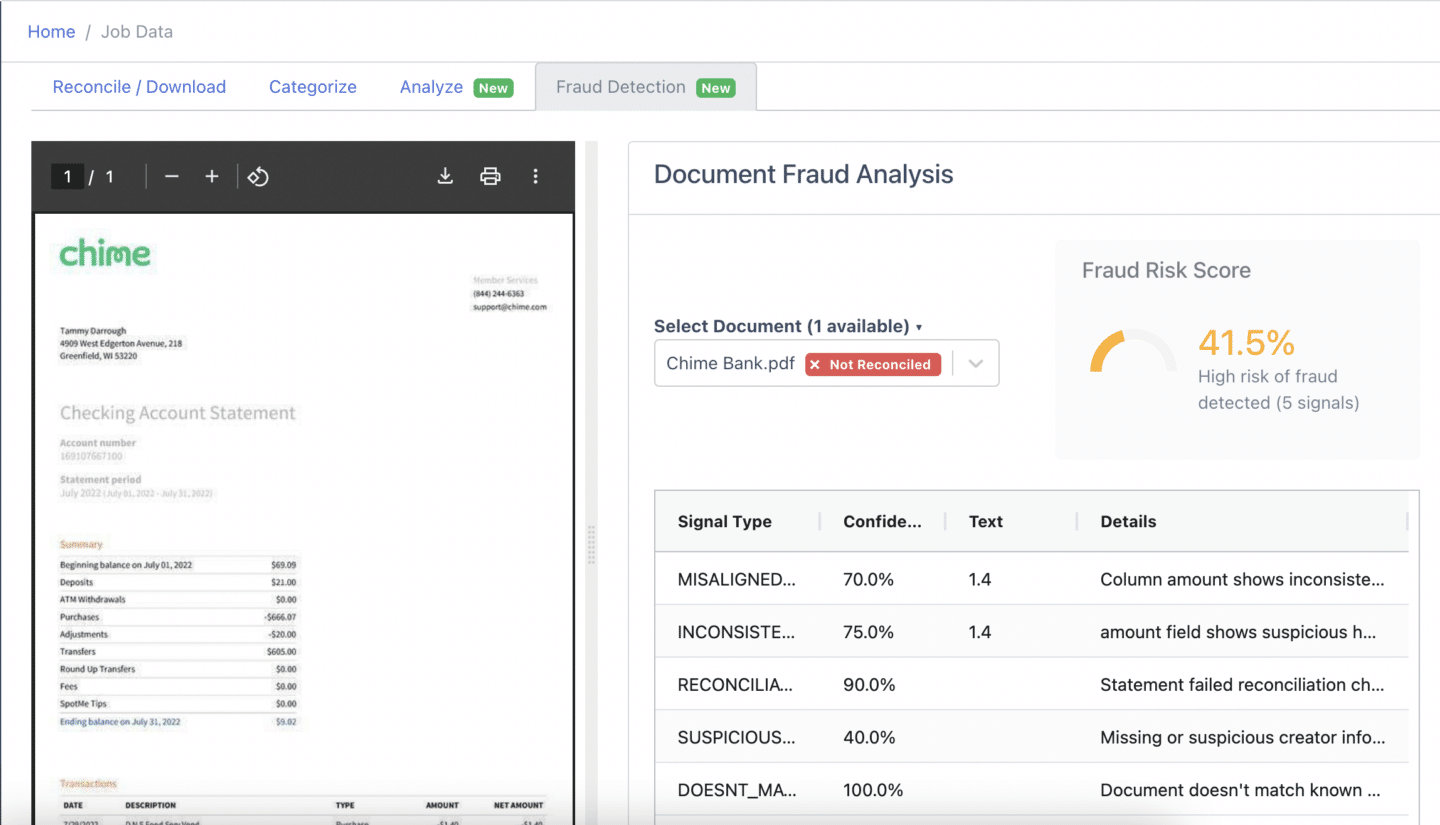

DocuClipper

DocuClipper is a cloud-based bank statement analyzer that helps you convert scanned or PDF bank statements into structured Excel, CSV, or QuickBooks formats. It uses advanced OCR (Optical Character Recognition) to extract, categorize, and format transaction data with 97% to 99% accuracy, eliminating the need for manual data entry.

Designed with accounting workflows in mind, DocuClipper enables fast, secure, and reliable bank statement analysis—ideal for audits, reconciliations, and financial reporting. It’s especially useful for bookkeepers, accountants, and lenders who deal with large volumes of transaction data regularly.

Pros

- User-Friendly Interface – Upload PDF statements and export clean data into Excel, CSV, or QuickBooks in seconds.

- Cost-Effective Solution – Entry-level plans start at $39/month, making it accessible for small businesses and freelancers.

- High Accuracy – Extracts line items and transaction metadata with 97–99% precision.

- Rapid Processing – Processes hundreds of pages instantly to speed up financial workflows.

- Strong Security Measures – SOC 2 compliant, AES 256-bit encrypted, hosted on secure Amazon servers.

Cons

- No Mobile App – Lacks a mobile scanner app for uploading paper statements on the go.

- Not Ideal for Low Volume – May be less cost-efficient for users with minimal bank statement analysis needs.

Pricing

- Starter – $39/month: 200 pages/month, CSV & QuickBooks export, 30-day retention, unlimited users.

- Professional – $74/month: 500 pages/month, includes transaction categorization, 1-year retention.

- Business – $159/month: 2,000 pages/month, advanced reporting, priority support, 2-year retention.

- Enterprise – Custom: Custom limits, SSO, 5-year retention, tailored onboarding.

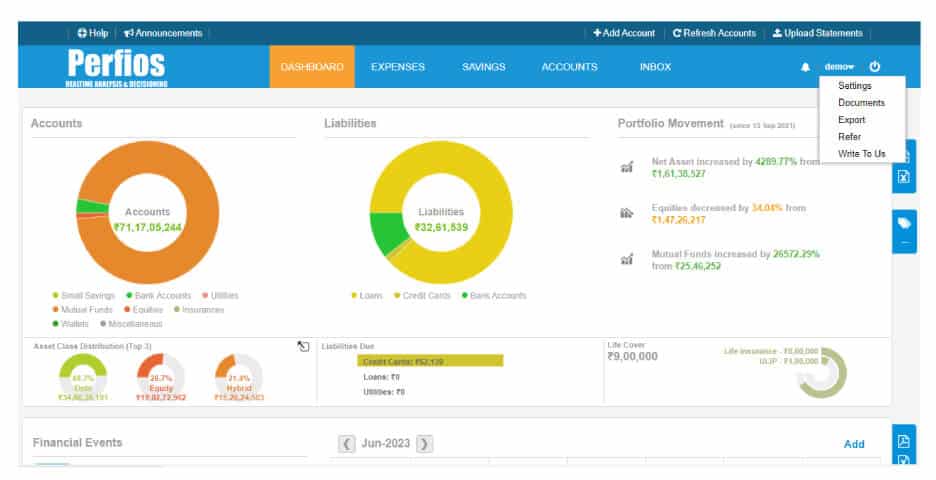

Perfios

Perfios is a powerful bank statement analyzer designed to assess borrower creditworthiness and detect document fraud. It extracts and analyzes data from bank statements and other financial documents, helping lenders make fast, accurate credit decisions with confidence.

Pros

- Minimalist Interface – Clean and easy-to-navigate design for a smoother user experience

- Comprehensive Features – Includes tools for budgeting, financial planning, and credit evaluation

- Account Integration – Syncs credit cards and bank accounts into a single dashboard

- Versatile Solutions – Supports multiple use cases including lending, insurance, and compliance

- Reliable Support – Backed by a professional team committed to continuous product improvement

Cons

- Limited Customization – UI and error handling aren’t flexible, with no manual account aggregation options

- Support Issues – Customer support can be unresponsive or difficult to reach post-purchase

- High Cost – Pricing may be steep for some users, especially due to the extensive feature set

- Weak Categorization – Payment categorization is often inaccurate and may require manual corrections

- Redundant Features – Some features may not add clear value, depending on your use case

Pricing

Perfios offers three pricing tiers. The Free Forever plan includes a complete view of all account types, support for unlimited accounts, 15 auto-update accounts, 4 statement uploads per month (upload only), and 2 document storage slots. It also includes basic features like PDF/Excel/HTML report exports, SMS and email alerts, password backup, and simple chart reporting.

The Gold plan, priced at approximately $5.84/year (₹499/year), upgrades you to unlimited auto-update accounts, 10 statement uploads per month, and 10 document storage slots. It also provides enhanced reporting tools, export options, alerts, and support for dividend and equity bonus tracking.

The Platinum plan, costing around $17.52/year (₹1,499/year), unlocks unlimited uploads and storage, full reporting with tables and graphs, and all advanced handling features such as split tracking and automated updates. It’s ideal for users seeking a more powerful and scalable analysis solution.

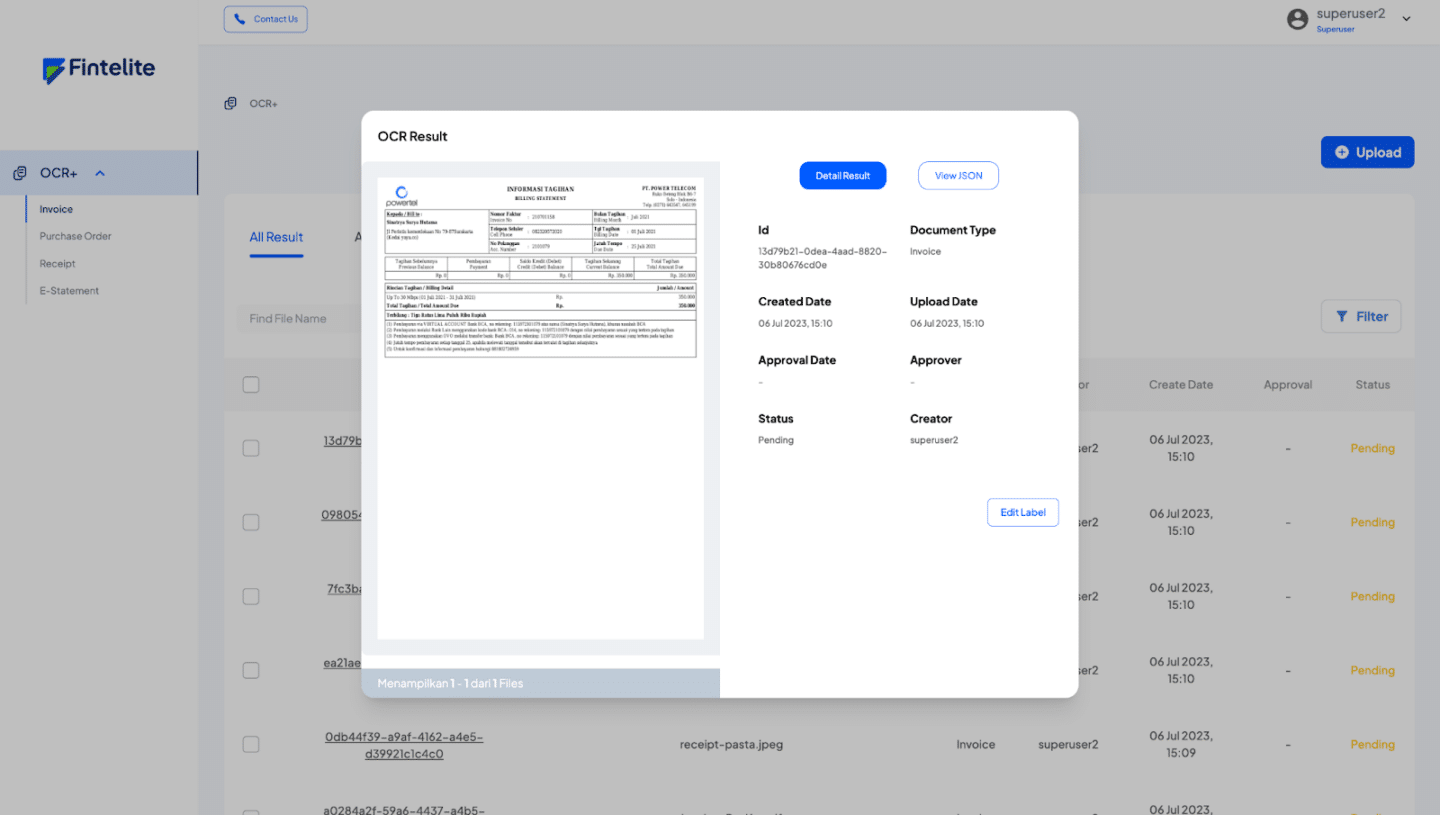

Fintelite AI

Fintelite AI is a modern bank statement analyzer that helps lenders make faster, smarter, and safer loan decisions. It uses advanced artificial intelligence to analyze bank statements and enrich transaction data, giving you a comprehensive view of borrower financial health. With built-in fraud detection and automated analysis, Fintelite empowers lenders to reduce risk, speed up approvals, and serve customers more efficiently.

Pros

- AI-Powered Analysis – Leverages artificial intelligence to deliver accurate and automated bank statement analysis.

- Transaction Enrichment – Goes beyond raw data by extracting valuable insights from transaction details.

- Fraud Detection – Identifies suspicious patterns and anomalies to help reduce lending risk.

- Faster Approvals – Enables quicker, data-driven lending decisions, improving turnaround time.

- Scalable Solution – Suitable for both small lenders and large financial institutions.

Cons

- No Public Pricing – Requires contacting sales for a quote, which may not suit smaller teams needing quick adoption.

- Limited Visibility – Less documentation and public user feedback compared to more established tools.

- Integration Complexity – May require development resources for seamless integration with existing systems.

- Lack of Customization Options – Fewer manual controls for analysts who prefer hands-on data manipulation.

Pricing

Contact their sales representatives to know more.

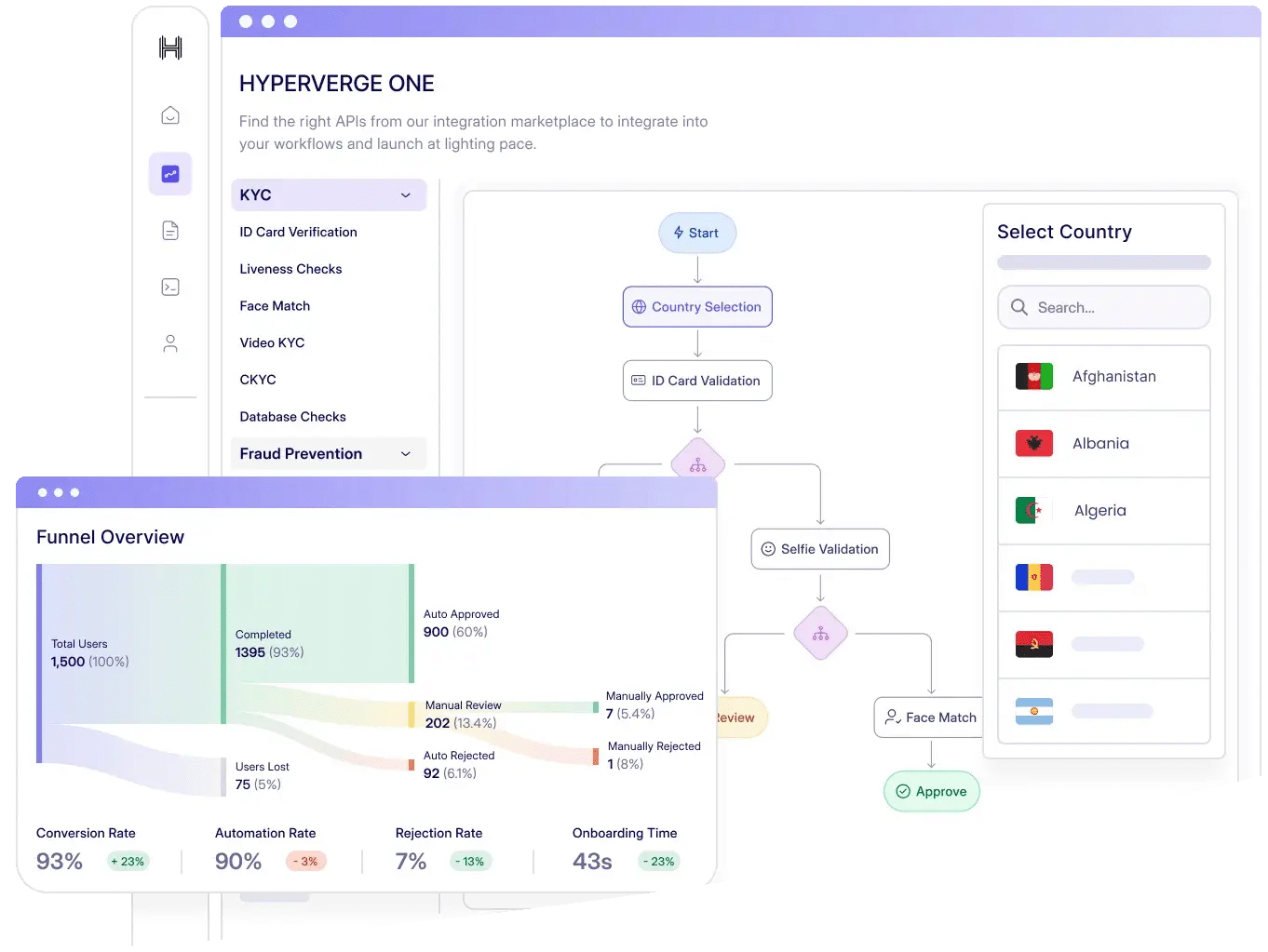

Hyperverge

While primarily known for contract lifecycle management, Hyperverge also offers robust AI capabilities that extend into bank statement analysis. With over 13 years of AI expertise and a proven track record of processing over a billion documents,

Hyperverge is a trusted solution for institutions that require fast, accurate, and secure document verification. Its bank statement analyzer capabilities are built on the same infrastructure, making it ideal for high-volume processing, fraud detection, and data extraction in the financial sector.

Pros

- Automated Workflows – Enables faster approvals by automating contract and document processes.

- AI Clause Detection – Quickly identifies essential information using built-in AI for smarter reviews.

- User Interface – Clean, intuitive design that’s easy to use across teams.

- Customer Support – Highly responsive team that offers personalized integration assistance

Cons

- Limited Documentation – Some features lack detailed user guides or tutorial videos, which may slow down adoption.

- Short-Term Usage Feedback – Due to limited time using the tool, long-term limitations or issues are not yet fully known.

Pricing

Contact sales representative to get a quote.

Cygnet FinAlyze

Cygnet FinAlyze is a data-driven bank statement analyzer that helps financial institutions streamline credit evaluations from onboarding to loan disbursement. Built to digitize the entire credit risk lifecycle, it enables underwriters, credit managers, and business heads to make faster, more informed lending decisions.

Whether you’re working with small or large borrowers, Cygnet FinAlyze delivers customized financial insights to assess creditworthiness with speed and accuracy.

Pros

- Customer Support – Responsive support team that assists with implementation and ongoing issues.

- Technical Assistance – Helpful software support from the Cygnet team ensures smoother operations.

- Processing Speed – Fast data handling enables quicker analysis of bank statements and financial documents.

- Initial Reporting – Generates immediate insights and summaries to speed up credit evaluations.

Cons

- Feature Limitations – Some advanced settings and features are missing, which may limit flexibility.

- Scalability Issues – Certain recommendations may not be well-suited for larger organizations.

- Customization Gaps – Limited ability to tailor the platform to specific business or workflow needs.

Pricing

Cygnet Finalyze pricing is available upon request.

IDfy

IDfy is a powerful identity verification platform that also offers capabilities relevant to financial document analysis and compliance. While its core strength lies in video KYC and biometric verification, IDfy’s modular system supports bank statement verification as part of its fraud prevention suite. Businesses can use it to authenticate customer identities, validate financial documents, and ensure a secure onboarding process—all through AI-powered automation.

Pros

- Advanced Technology – Utilizes AI, facial recognition, and biometric tools for efficient verification.

- User Interface – Simple and intuitive platform that’s easy to navigate across verification modules.

- Data Security – Ensures strong compliance with data protection standards and encryption protocols.

- Fraud Prevention – Detects tampered documents and suspicious activity with high accuracy.

- Customization Options – Offers flexible configuration to match specific business and compliance needs.

Cons

- High Cost – Services may be expensive, especially for smaller businesses or startups.

- Integration Complexity – Integrating IDfy into existing systems can be technically challenging.

- Accuracy Issues – Occasional false positives or negatives may occur in identity verification and OCR output.

- Reliability Concerns – Platform uptime and OCR performance can be inconsistent, especially with Aadhaar-related checks.

- Limited Flexibility – Verification packages may lack customization options for specific use cases, though improvements are underway.

Pricing

IDfy pricing is available upon request.

What is a Bank Statement Analyzer?

A bank statement analyzer is a software tool that automatically extracts, categorizes, and interprets financial data from bank statements. It uses technologies like OCR (Optical Character Recognition) and AI to convert PDFs or scanned statements into structured formats like Excel or CSV.

These tools are commonly used for bank statement audits, financial verification, and credit risk analysis, helping businesses reduce manual data entry, detect fraud, and make informed financial decisions quickly.

Why is a Bank Statement Analyzer Important for Businesses?

A bank statement analyzer is essential for businesses that handle large volumes of financial data. It simplifies bank statement audits, improves bank statement verification, and reduces manual errors by automating data extraction.

Businesses can quickly assess cash flow, verify income, detect suspicious activity, and streamline financial decision-making. For lenders, it accelerates loan approvals and enhances fraud detection. Overall, it boosts efficiency, accuracy, and compliance across financial operations.

Key Features to Look For in a Bank Statement Analyzer Software

Here are the key features you should check when picking a bank statement aalyzer:

- OCR Accuracy – Reliable extraction of transaction data from scanned or PDF bank statements with minimal errors.

- Bank Statement Verification – Tools to detect tampering, duplicate entries, or inconsistencies in uploaded statements.

- Transaction Categorization – Automatic classification of credits, debits, income, and expenses for easier analysis.

- Audit-Ready Reports – Exportable summaries in Excel or CSV formats to support bank statement audits.

- Integrations – Compatibility with accounting software like QuickBooks, Xero, or custom loan systems.

- Fraud Detection – AI models that flag suspicious activity or anomalies in financial behavior.

- Security Compliance – End-to-end encryption and access controls to meet data privacy regulations.