Manual data entry in accounting is already known to be time-consuming and prone to errors. The average person types 50 to 80 words per minute, but accounting tasks are far more complex so they can take more time and require more work.

Sifting through invoices, receipts, and bank statements to extract key data is very repetitive and will end up as a headache for you or your personnel.

This is where financial document data extraction software comes in, automating the process to cut time and minimize mistakes. These tools improve your workflow, enabling faster and more accurate bookkeeping data entry.

In this article, we’ll explore the best financial data extraction software available in the market, helping you overcome roadblocks in bookkeeping.

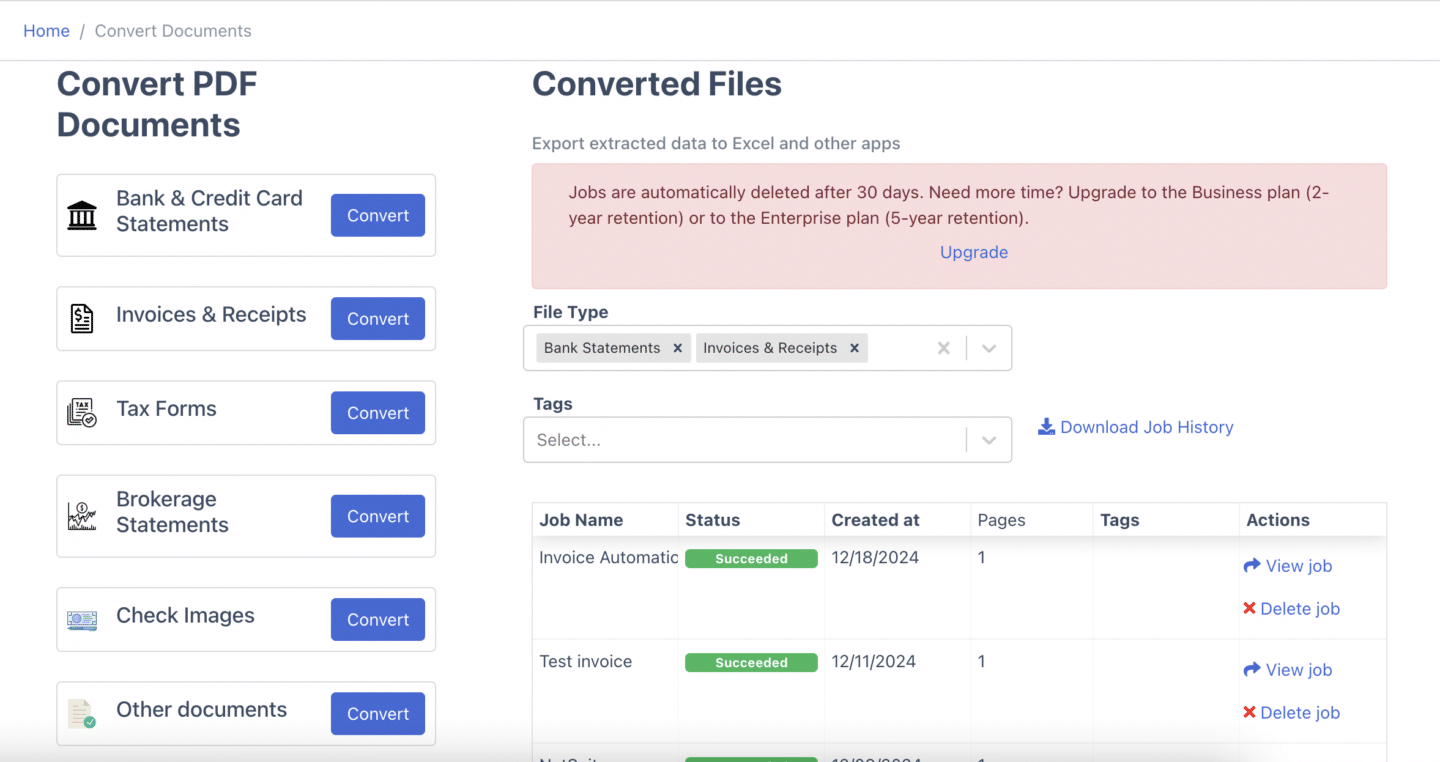

DocuClipper

DocuClipper is a financial PDF converter that extracts information to improve accounting and document processing. It converts PDFs, including invoices, bank statements, credit card statements, receipts, tax forms, and brokerage statements, into formats such as XLS, CSV, and QBO.

This OCR software is highly scalable, allowing you to process hundreds of documents within seconds and consolidate the data into a single spreadsheet. Its easy-to-use interface makes it accessible and straightforward to adopt for any accounting team.

Pros

- High Accuracy: Extracts data with a 99.5% OCR accuracy rate, the highest among its peers.

- Fast Processing: Processes financial documents in 10 to 30 seconds, regardless of the amount.

- Affordable Pricing: It charges per page instead of per line item, which is more cost-effective than its competitors.

- Reliable and Bug-Free: Reliable and dependable user experience with a well-designed interface.

- Time-Saving Features: Automates document conversion and data extraction, reducing hours of manual work.

- Minimal Orientation Requirement: User-friendly design eliminates steep learning curves, saving setup time.

- Excellent Customer Support: A responsive team that does smooth onboarding and quickly resolves user concerns.

Cons

- No Mobile App: All document processing can only be done in a desktop setting, there is no mobile feature at the moment.

- PDF-Only Focus: DocuClipper is restricted to financial documents from PDFs.

Pricing

- Starter Plan ($39/month): Includes 120 pages per month with basic support. Features invoice scanning, receipt data capture, bank statement conversion, unlimited users, and 30 days of data retention.

- Professional Plan ($74/month): Includes 500 pages per month with basic support. Offers all Starter Plan features along with transaction categorization and 1-year data retention.

- Business Plan ($159/month): Includes 2,000 pages per month with dedicated support. Adds file inventory, transfer detection, flow of funds tracking, API access, team management, and 2 years of data retention to the Professional Plan features.

- Enterprise Plan (Custom Pricing): Provides custom page limits with dedicated support. Includes all Business Plan features along with single sign-on, API keys, audit logs, dedicated queues, and 5 years of data retention.

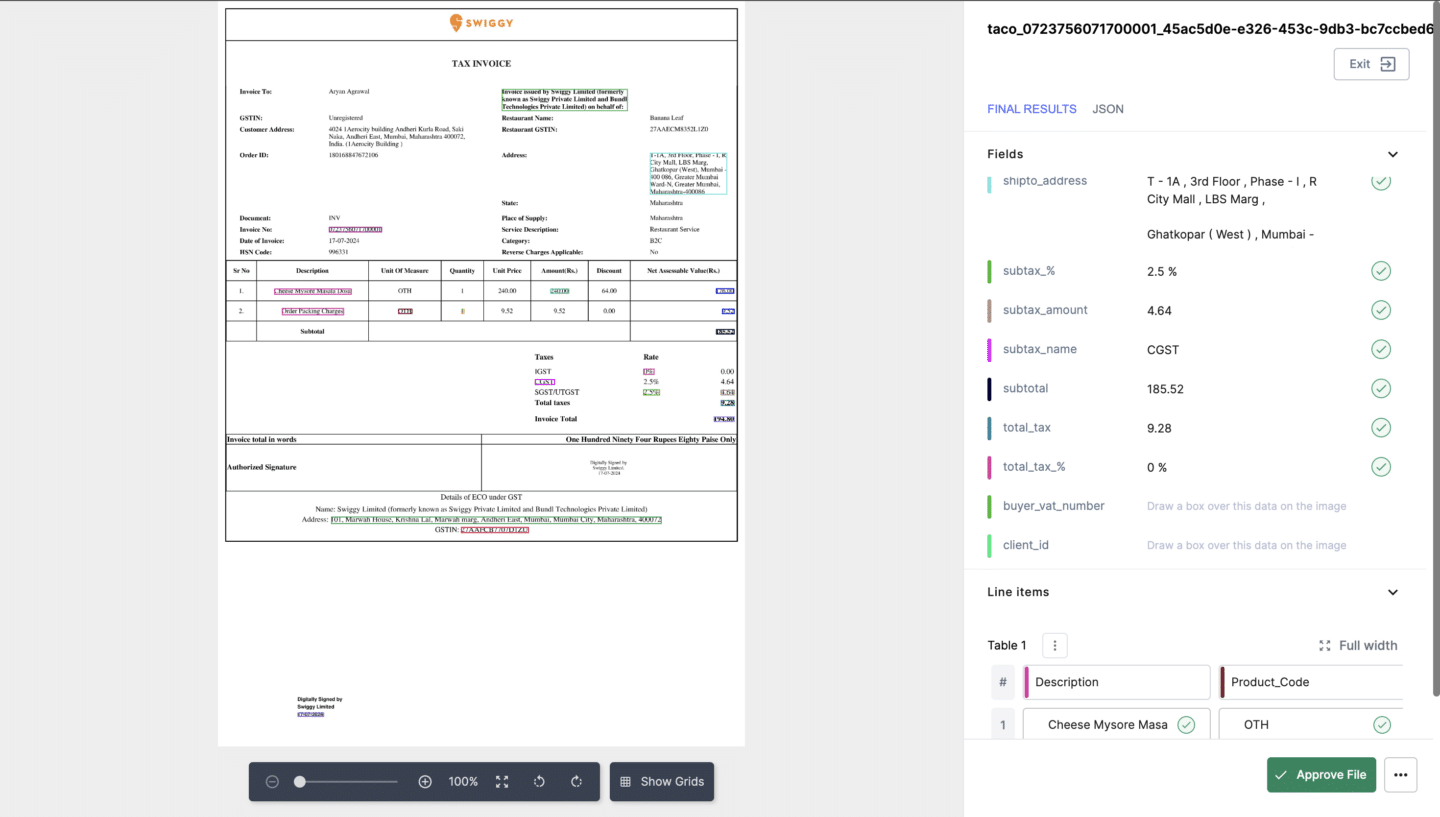

Nanonets

Nanonets specializes in processing unstructured documents like invoices, receipts, bank statements, POs, contracts, insurance claims, and healthcare forms, making them into structured outputs.

The platform scales seamlessly from small businesses to enterprise-grade automation, offering a high.

Pros

- Custom Model Training: Offers personalized model training and logic to match your business needs, making it smooth to integrate with ERP systems.

- Frequent Feature Updates: Continuously improves functionality based on user feedback.

- Seamless Setup: Provides comprehensive assistance during setup, easy to set up when you are still new.

- Extensive Integration Options: Supports a wide range of integrations, making it adaptable to various workflows.

Cons

- Opaque Models: It is difficult to understand or troubleshoot random issues, even with consistent document sources.

- Initial High Error Rate: Early scans had a significantly higher error ratio, requiring frequent intervention.

- Limited User Access Customization: User access cannot be restricted to specific models, which can be challenging when running a team.

- Inadequate Onboarding Experience: The initial onboarding lacked a overview of the product and its setup requirement according to some users.

- Cost Factor: The pricing is more feasible for businesses with larger document volumes, but too expensive for accounting firms that process smaller numbers.

Pricing

- Starter Plan: Free for up to 500 pages, with additional pages at $0.30 each. Features include limited fields, basic workflows, and automatic table capture, making it ideal for small-scale usage.

- Pro Plan: Custom pricing starting at 500+ pages per month. Offers advanced features such as custom data capture AI, team management, integration with platforms like MS Dynamics and SAP, and access to annotation services.

- Enterprise Plan: Completely customized pricing for large-scale needs. Includes all Pro features plus Single Sign-On, dedicated account management, custom integrations, white-labeled interfaces, and personalized onboarding.

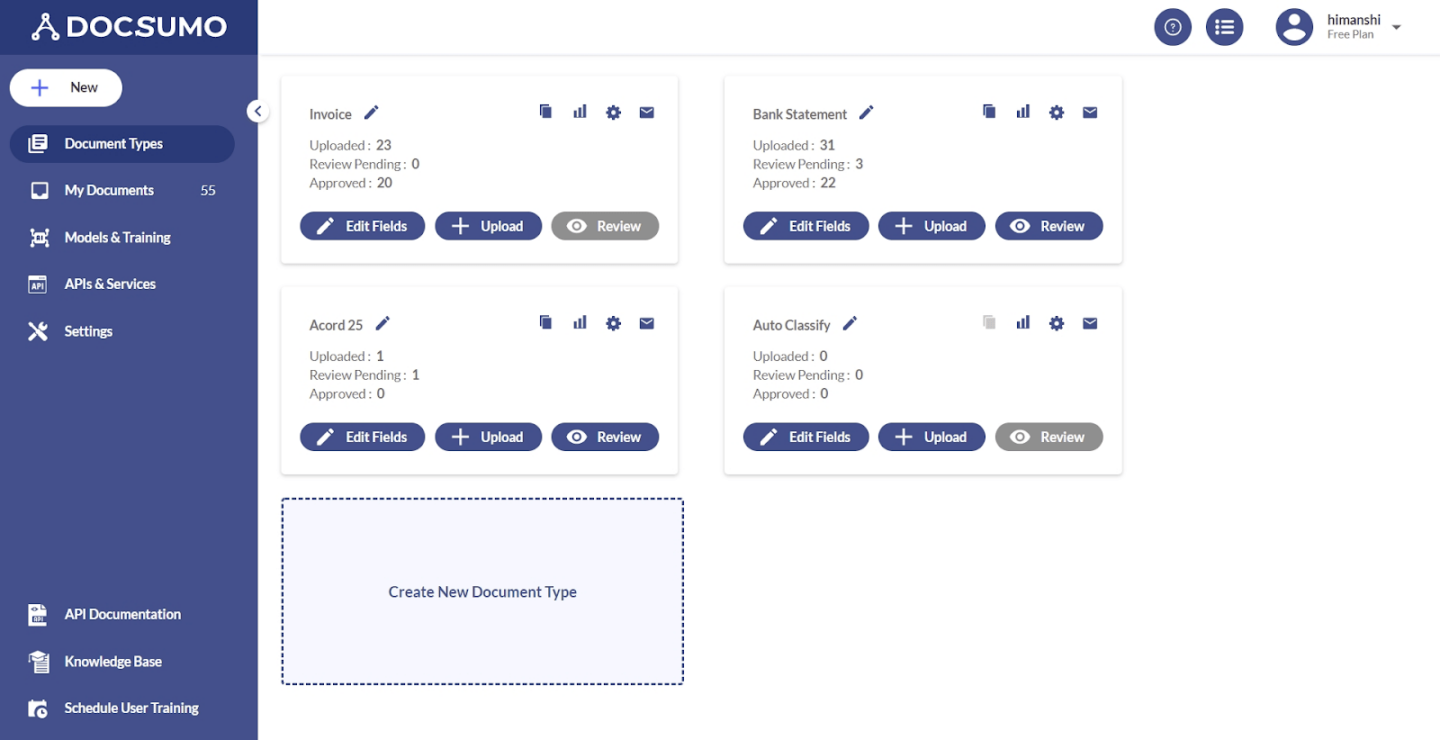

Docsumo

Docsumo is an intelligent document processing (IDP) solution for SMB lenders, insurers, CRE lenders, and investors to automate data extraction. It is Initially focused on automating invoice processing. It has expanded into a comprehensive data extraction tool for financial services across the United States.

Pros

- Custom Model Training: Models are quickly made to specific project requirements, with outputs that integrate easily into internal software.

- Responsive Team: The team is solutions-oriented, providing expert support to fine-tune models for edge cases.

- Improved Accuracy and Speed: Document extraction processes are significantly enhanced in terms of accuracy and efficiency.

- Exceptional Support: The team is knowledgeable, approachable, and always ready to assist, exceeding user expectations.

Cons

- Model Retraining: Even minor changes force retraining the models, which can be time-consuming and disrupt workflows.

- File Approval Limitations: The system times out when processing too many files at once.

- Steep Learning Curve: It takes more time than usual to learn how to use the software compared to competitors.

- Internet Dependency: The cloud-based nature of the software means a stable internet connection is essential, which can be a drawback for remote teams in areas with unreliable access.

- Parsing Challenges: It struggles sometimes with extracting data accurately from diverse or unstructured document formats.

- Setup Effort: Configuring the software to meet specific business needs can take considerable time, despite its user-friendly interface.

Pricing

- Free Plan: Process up to 100 pages monthly, includes one pre-trained model, email parsing, field/table extraction, and exports in CSV, Excel, or JSON. Single-user support and compliance with ISO, HIPAA, SOC-2, and GDPR.

- Growth Plan: $299/month for 1,000 pages, with features like three pre-trained models, API/webhook access, AI chat, support for five users, and consultation hours.

- Enterprise Plan: Custom pricing for large-scale operations, offering unlimited users, custom models, priority processing, Slack support, and extensive integrations.

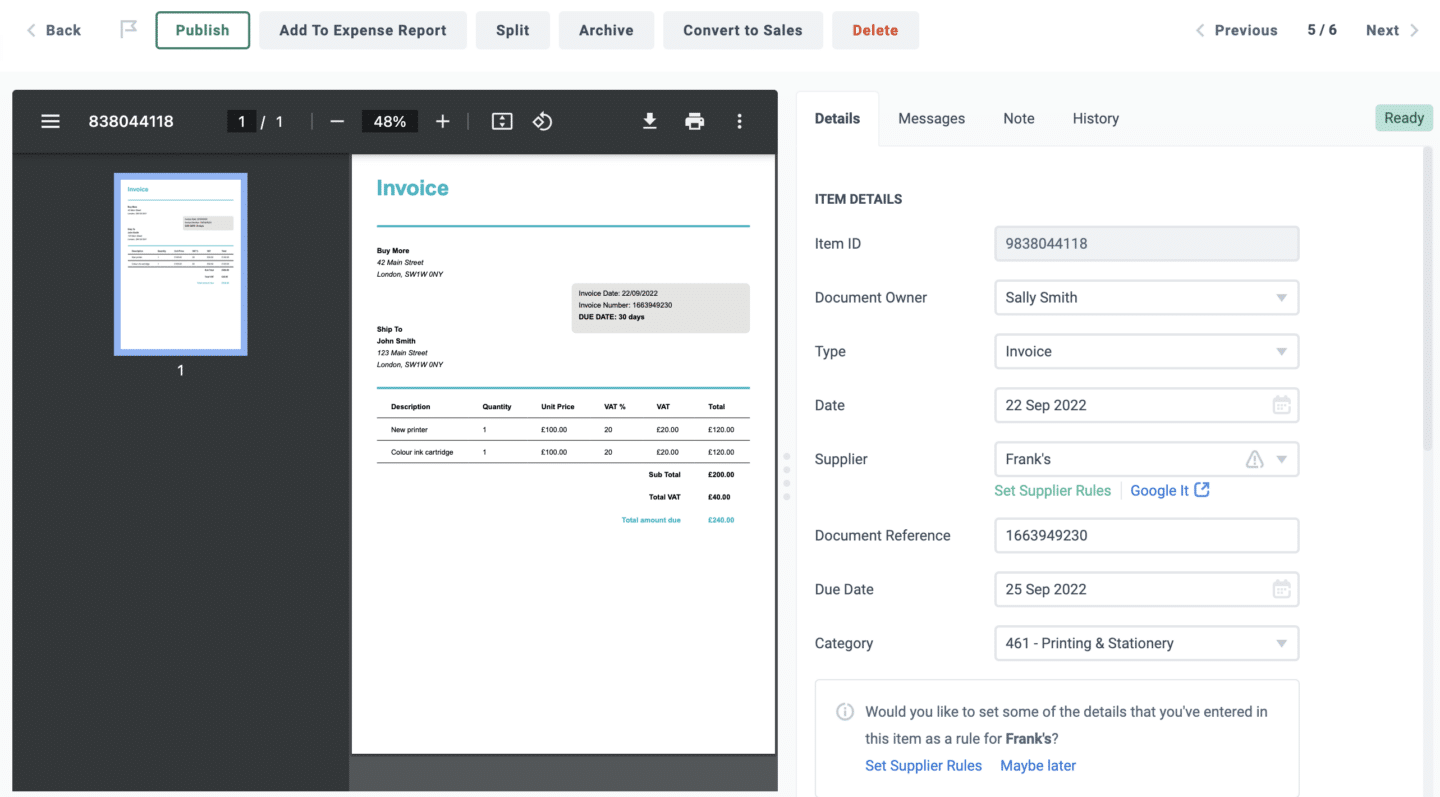

DextPrepare

DextPrepare is a financial data extraction tool to enhance data extraction for accounting tasks.

OCR technology extracts data from bank statements, invoices, and receipts accurately and quickly. It can integrate over 30 accounting software platforms,

DextPrepare is a versatile choice for both new and experienced users. Its automation capabilities reduce manual data entry, allowing extracted data to flow directly into your accounting software for streamlined workflows.

Pros

- Efficient Document Capture: Allows electronic capture of invoices and receipts, enabling smooth automated bookkeeping and secure document storage.

- Time-Saving Features: Simplifies workflows, helping businesses complete tasks quickly and efficiently.

- Accurate Data Recognition: Ensures high precision in extracting information, reducing manual corrections.

- Supplier Rules Functionality: Enhances bulk expense review and posting, making it highly efficient for managing large volumes of data.

Cons

- Problematic Filtering: Exporting filtered data, such as specific years, requires scrolling and manual selection, which can be time-consuming and inefficient.

- Difficulty Finding Receipts: Locating receipts linked to expense reports is challenging, especially when there are duplicates that require manual deletion.

- Cost Concerns: Pricing is considered high for smaller businesses, with users reporting it may not save time compared to traditional methods.

- Frequent Errors: Issues like GST misreadings, miscategorization, and inaccuracies require manual corrections, negating efficiency benefits.

- Poor Support: Customer support is slow to respond, lacks phone contact options, and users report frustration with long resolution times.

- Image Quality Issues: Blurred document images occasionally make data unreadable.

Pricing

Their pricing is in a business plan depending on the number of users

- $30.00/month: For up to 5 users and 250 documents per month. Includes 10 sheets of bank statement extraction, 5 line-item extractions, and 5 supplier statement extractions.

- $57.50/month: For up to 10 users and 500 documents per month. Includes 35 sheets of bank statement extraction, 30 line-item extractions, and 10 supplier statement extractions.

- $86.00/month (customizable, $7.50 per added user, document amount also scaled up): For up to 750 documents per month. Includes 60 sheets of bank statement extraction, 55 line-item extractions, and 15 supplier statement extractions.

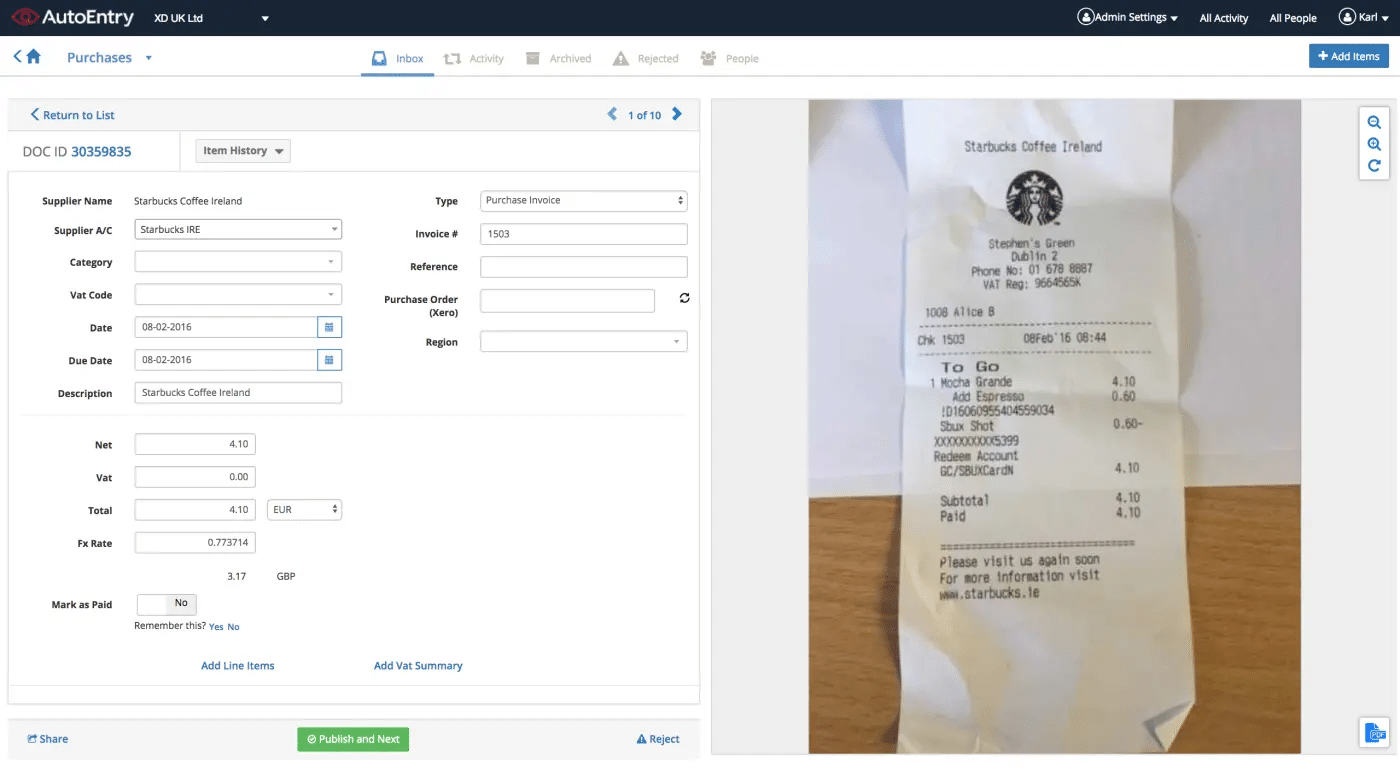

AutoEntry

AutoEntry is a data automation tool for accounting, designed to save time and enhance accuracy. It allows users to extract data automatically from receipts, invoices, and statements and upload it directly to accounting software like Xero, Sage, and QuickBooks.

The platform offers a mobile app for capturing information from paper on the go and provides fair, flexible pricing with no contracts or hidden charges.

Pros

- Line Item Extraction: Capable of extracting line items from invoices and handling simple categorizations.

- Seamless Integration: Integrates easily with Sage and 50 other accounting software.

- Ease of Use: A User-friendly interface making it smooth to navigate and efficient to retrieve data.

- Invoice Processing Automation: Automates tasks like invoice processing, memorizing defaults, and applying rules for descriptions and tax codes. https://www.docuclipper.com/blog/automated-invoice-processing/https://www.docuclipper.com/blog/automated-invoice-processing/

Cons

- No Lookup Table Uploading: This does not support the ability to upload lookup tables.

- Invoice Rejection Issues: Rejected invoices require manual intervention and support assistance, as the “Move to Inbox” feature does not function reliably.

- Frequent Software Issues: Encountered problems with invoices failing to upload into accounting software, causing delays and frustration.

- Customer Service Concerns: Reports of poor customer service, including unresolved issues, long response times, and refusal to process refunds after cancellations.

- Questionable Time Savings: Some users report negligible time savings due to frequent glitches and inefficiencies, detracting from the tool’s value.

Pricing

AutoEntry offers a range of pay-as-you-go subscription plans, each including all standard features, compatibility with major accounting software, and a free trial with 25 credits:

- Bronze: $12/month for 50 credits ($0.24 per credit).

- Silver: $23/month for 100 credits ($0.23 per credit).

- Gold: $44/month for 200 credits ($0.22 per credit).

- Platinum: $98/month for 500 credits ($0.20 per credit).

- Diamond: $285/month for 1,500 credits ($0.19 per credit).

- Sapphire: $450/month for 2,500 credits ($0.18 per credit).

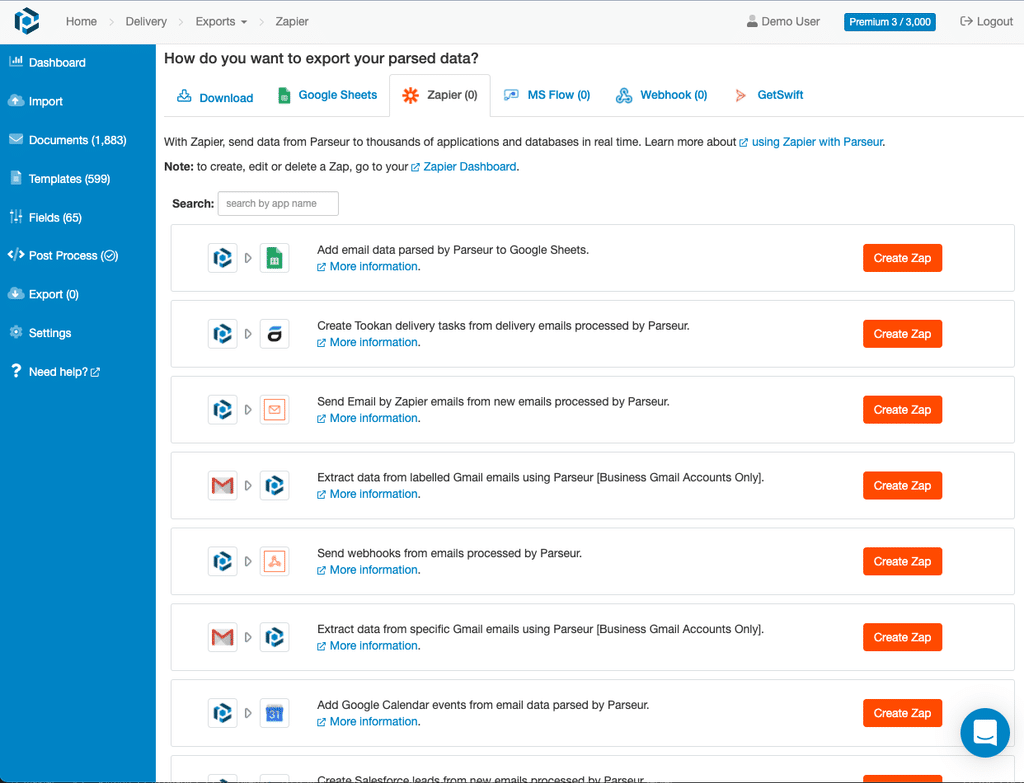

Parseur

Parseur is a document processing software designed for SMBs and enterprises, using AI to automate data extraction.

It extracts information from PDFs and emails and integrates with hundreds of widely-used apps and databases, including Excel and Google Sheets. Parseur simplifies workflows by processing similar document types, saving hours of manual effort and reducing errors.

Pros

- User-Friendly: Simplifies complex configurations, enabling tasks to be set up in minutes, even for first-time users.

- Quick Results: Designed for ease and speed, providing fast and accurate data extraction with minimal effort.

- Exceptional Support: Offers round-the-clock assistance, with a responsive team ready to resolve queries efficiently.

- Streamlined Workflow: Reduces the time spent on manual processes, making it an ideal solution for busy professionals.

- Competitive Pricing: Features a flexible and affordable pricing model, ensuring value for businesses of all sizes.

Cons

- Template Sensitivity: Parsing is highly sensitive to changes in email code, requiring frequent template adjustments to ensure accuracy.

- Design Limitations: The software’s design could be improved, although it does not significantly impact functionality.

Pricing

Parseur offers a range of subscription plans to accommodate various document processing needs:

- Free Plan: Process up to 20 pages per month at no cost. This plan includes unlimited mailboxes, unlimited extracted fields, access to both AI and template parsing engines, and a 90-day document retention period.

- Base Tier: Designed for entry-level automation, this tier allows processing up to 3,000 pages per month. It offers unlimited mailboxes and extracted fields, access to AI and template parsing engines, and a one-year document retention period.

- Scale Tier: Suited for heavy-duty processing, this tier supports up to 1 million pages per month. It includes advanced post-processing features, multi-user accounts for up to 100 users, unlimited document retention, and the lowest cost per page.

- Enterprise Tier: Customizable plans for large organizations, capable of processing up to 10 million pages per month. This tier offers unlimited mailboxes and extracted fields, advanced post-processing, and tailored solutions to meet specific business requirements.

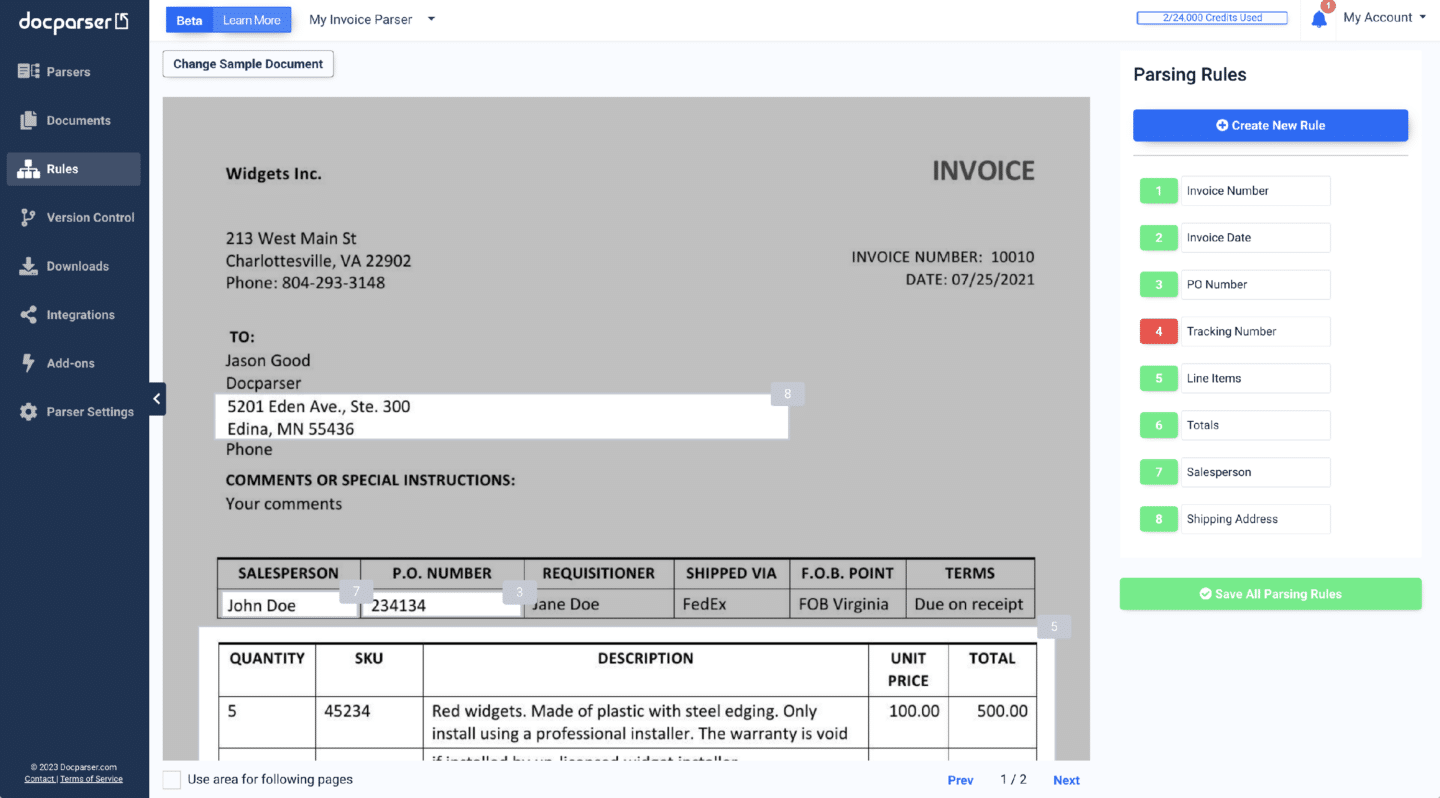

Docparser

Docparser is a powerful data extraction tool that automates the process of extracting valuable data from documents. With its user-friendly interface and advanced features, Docparser makes it easy for businesses to streamline their document processing workflows and eliminate manual data entry.

With Docparser, you can quickly and accurately extract data from a wide range of document types including PDF, MS Word, DOCX, JPG, TIFF, PNG, CSV, XLS, TXT, and XML. Whether you need to extract customer information from sales invoices, financial data from bank statements, or shipping details from delivery receipts, Docparser makes it simple and efficient.

Pros

- Ease of Use: Docparser features an intuitive interface, making it simple to navigate and operate.

- Accurate Data Extraction: Provides reliable results, ensuring precision in extracting essential information.

- Customizable Parsing Rules: Allows users to customize parsing rules for specific requirements, enhancing flexibility.

- Seamless Integration: Easily connects with tools like QuickBooks, streamlining workflows for accounting and data management.

Cons

- Time-Consuming Setup: Processing complex documents can be time-intensive, and occasional formatting issues may require manual adjustments.

- Initial Bulk Upload Challenges: Uploading large batches of documents was initially problematic, though the team provided a workaround.

- Steep Learning Curve for Non-Tech Users: While tech-savvy users may adapt quickly, others might find the onboarding process overwhelming due to the extensive customization options.

- Lack of Local Currency Pricing: Pricing is available only in USD, which could be inconvenient for international users.

Pricing

- Starter: $39/month for 100 parsing credits. Includes up to 15 parsers, integrations with Excel, CSV, JSON, and Google Sheets, and premium template access.

- Professional: $74/month for 250 parsing credits. Adds support for up to 50 parsers, smart tables, multi-factor authentication, and one free parsing setup.

- Business: $159/month for 1,000 parsing credits. Includes all Professional features plus up to 500 parsers, multi-layout parsers, parser version control, and priority support.

- Enterprise: Custom pricing with unlimited parsers, extended document retention, white labeling, and all Business features.

What is a Financial Data Extraction Software

Financial data extraction software helps you automate the collection and organization of financial data from invoices, receipts, bank statements, and other financial documents.

Instead of manually entering numbers into spreadsheets, the software does the work for you, converting raw data from uneditable PDFs into somewhere easily to analyze like a spreadsheet.

It smoothens your accounting workflow, saves time, and simplifies financial reporting, giving you more efficiency and precision in managing your business data.

Benefits of a Financial Data Extraction Software

So why do businesses use financial data extraction software? Here are some major reasons:

- Enhanced Accuracy: Automating data extraction significantly reduces human error, making all financial data for reporting and analysis reliable.

- Cost Efficiency: Automated processes, including receipt data entry, invoice data entry, and other document data entry automation, save time and eliminate the high costs associated with paying wages for data entry specialists freeing up resources for more demanding tasks.

- Faster Decision-Making: Real-time access to clean, organized data allows businesses to identify trends quickly, make decisions, and respond to market changes driectly.

- Fraud Prevention: AI-powered or automated extractors detect and flag suspicious transactions by analyzing patterns, making it easy for you to detect for forensic cases.

- Improved Scalability: Automatic data processing enables businesses to cover data from multiple sources with lesser resoruces, allowing for growth without the need for additional manual input.

Typical Financial Documents to Extract Data From

The usual documents that are being extracted data from using a financial data extraction software are:

Financial data extraction software is designed to handle a wide range of documents, including:

- Bank Statements: For transaction tracking and reconciliation.

- Invoices: To improve accounts payable and receivable processes.

- Receipts: For expense tracking and audits.

- Payroll Documents: To manage employee compensation records.

- Purchase Orders: To monitor procurement and inventory management.

- Tax Forms: To prepare for tax and reporting.

- Brokerage Statements: For investment tracking and portfolio analysis.

- Checks: For accurate payment processing.

- Contracts: To extract financial terms and obligations.

- Expense Reports: To categorize and validate company expenses.

- Credit Card Statements: For identifying spending patterns and reconciling accounts.

How to Select the Right Financial Data Extraction Software for Your Business

When choosing the best AI or OCR data extraction software for your business here are things that you should consider.

- Usability: Assess whether your business needs data extraction software. If you frequently handle large volumes of financial documents with challenges, you need to have one. For minimal document processing, manual methods are enough.

- Cost: Check the software’s cost against your workload. Automation is often cost-effective for high-volume tasks, but for smaller workloads, it could be even.

- Ease of Use: Ensure the software is user-friendly and requires minimal training for your team. Look for tools with responsive customer support to address queries efficiently.

- Software Integration: Confirm compatibility with your existing accounting tools like QuickBooks, Xero, or Sage. Seamless integration reduces manual data transfers and enhances workflow efficiency.

Final Advice

Businesses and accounting firms are adapting automation to improve their accounting processes. Manual data entry and invoice processing often carry hidden costs that can significantly impact expenses.

Investing in automation reduces these costs and boosts efficiency almost immediately after implementation, giving you both short-term and long-term benefits for your business.

FAQs about the Best Financial Data Extraction Software

Here are some frequently asked questions about the best financial data extraction software:

What software is used for financial data extraction?

Financial data extraction software includes tools like DocuClipper, Nanonets, Docsumo, DextPrepare, AutoEntry, Parseur, and Docparser. These solutions automate data extraction from documents such as invoices, receipts, and bank statements, improving accuracy and efficiency while integrating seamlessly with popular accounting platforms like QuickBooks, Xero, and Sage.

Where can I pull financial data?

You can pull financial data from various sources, including bank statements, invoices, receipts, payroll records, tax forms, brokerage statements, purchase orders, and financial reports. Using financial data extraction software simplifies this process by automating data collection from these documents and integrating it into your accounting systems.

How to automate data extraction from bank statements?

To automate bank statement data extraction, use software like DocuClipper, Nanonets, or Docparser. These tools leverage OCR and AI to extract transaction details accurately. Simply upload your bank statements in PDF or image format, and the software converts the data into structured formats like CSV or Excel, ready for integration.

How to extract data from financial statements?

To extract data from financial statements, use tools like Docsumo, Parseur, or Docparser. These solutions automate the process by identifying key data points in PDFs or other document formats and converting them into structured outputs like Excel or CSV. This eliminates manual entry and ensures accuracy.

Is there an AI that can read financial statements?

Yes, AI-powered tools like Nanonets, Docsumo, and Docparser can read financial statements. These tools use advanced algorithms to extract, analyze, and organize data from various financial documents, ensuring accuracy and efficiency in tasks like reporting and reconciliation.