Processing accounts payable is time-consuming and demanding. While e-invoices have streamlined ERP invoice processing, most vendors still send PDF invoices.

Manually entering data from PDF invoices into your ERP or accounting software is tedious, error-prone, and costly. As invoice volume grows, you may end up hiring extra help just to keep up, adding unnecessary expenses.

The solution is to automate this manual data entry with invoice automation software. Automation saves time, reduces errors, and allows you to focus on more important aspects of your business.

In this article, we’ll explore the best invoice automation software available to make invoice processing faster and easier for you.

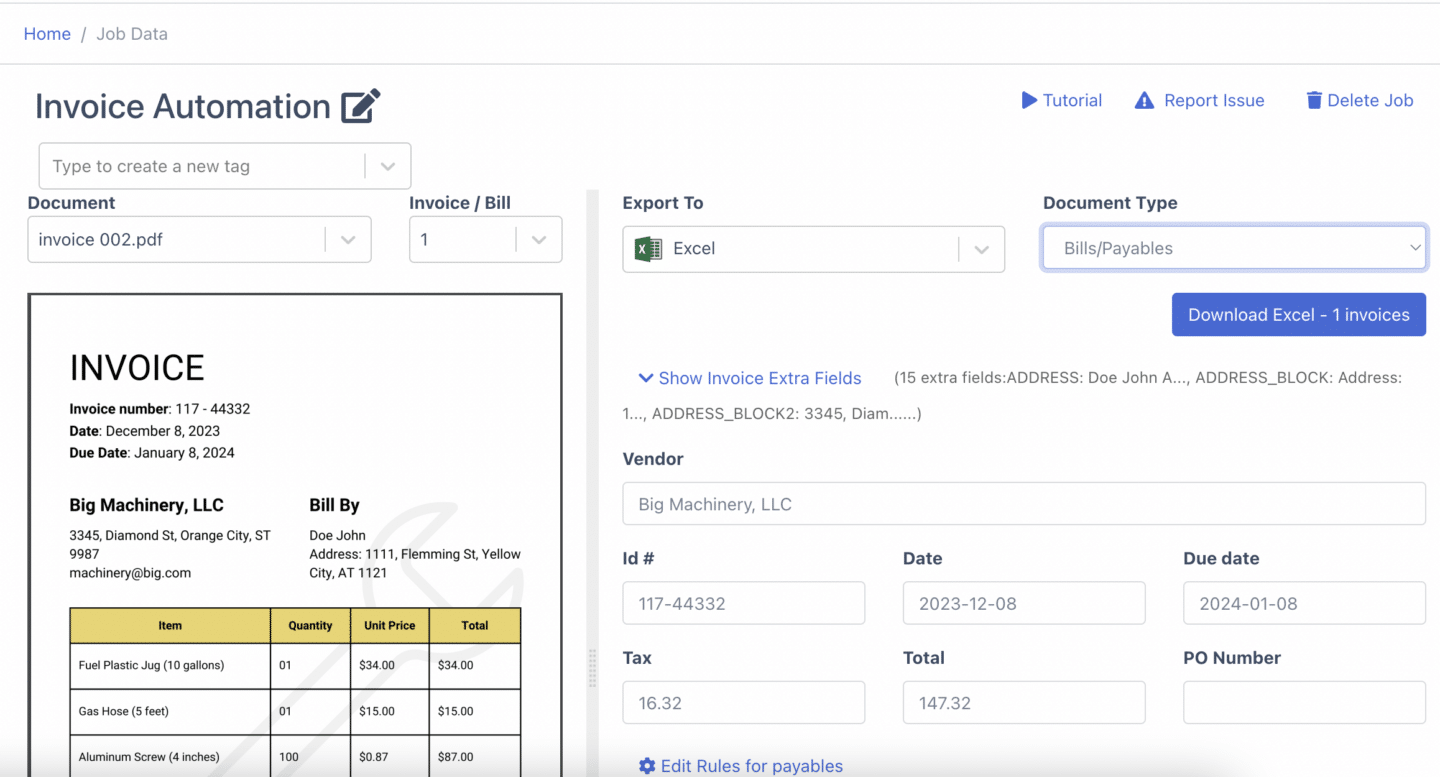

DocuClipper

DocuClipper is a powerful financial PDF converter designed to streamline document processing. It accurately converts PDF invoices, bank statements, credit card statements, receipts, tax forms, and brokerage statements into formats like XLS, CSV, QBO, and more.

With preset formats made for popular platforms such as QuickBooks, Sage, Xero, Quicken, and NetSuite, DocuClipper offers exceptional versatility.

It can process hundreds of invoices in seconds and stands out by charging per page rather than per line item. This makes it a cost-effective choice compared to other invoice conversion tools.

Pros

Here are some reasons why businesses love DocuClipper for their invoice automation needs:

- High Accuracy:: The platform analyzes and extracts data at an accuracy of 99.5%, ensuring your numbers are spot-on every time.

- Fast Processing: DocuClipper processes invoices in around 10 to 30 seconds, regardless of the number of invoices you want to process simultaneously.

- Affordable Pricing: Unlike other tools, DocuClipper charges per page, not per line item, making it budget-friendly for businesses of all sizes.

- Reliable and Bug-Free: Users consider its smooth, dependable performance and navigable design, which works as promised.

- Time-Saving Features: It simplifies document conversion and invoice data extraction, freeing up hours that can be spent on more important tasks.

- Minimal Orientation Requirement: The platform is designed to be straightforward, saving you time from the moment you start. No steep learning curves here.

- Excellent Customer Support: The responsive support team is always ready to help, making the experience even better.

Cons

- No Mobile App: All document processing can only be done in a desktop setting, there is no mobile feature at the moment.

- PDF-Only Focus: DocuClipper is restricted to invoice data extraction from PDFs but it is already enough to be uploaded to accounting or ERP software.

Pricing

- Starter Plan ($39/month): 200 pages per month with basic support. Includes invoice scanning, receipt data capture, bank statement conversion, unlimited users, and 30 days of data retention.

- Professional Plan ($74/month): 500 pages per month with basic support. Offers all Starter features plus transaction categorization and 1-year data retention.

- Business Plan ($159/month): 2,000 pages per month with dedicated support. It includes all professional features, plus file inventory, transfer detection, flow of funds tracking, API access, team management, and 2 years of data retention.

- Enterprise Plan (Custom Pricing): Custom page limits with dedicated support. It offers all business features, plus single sign-on, API keys, audit logs, dedicated queues, and 5 years of data retention.

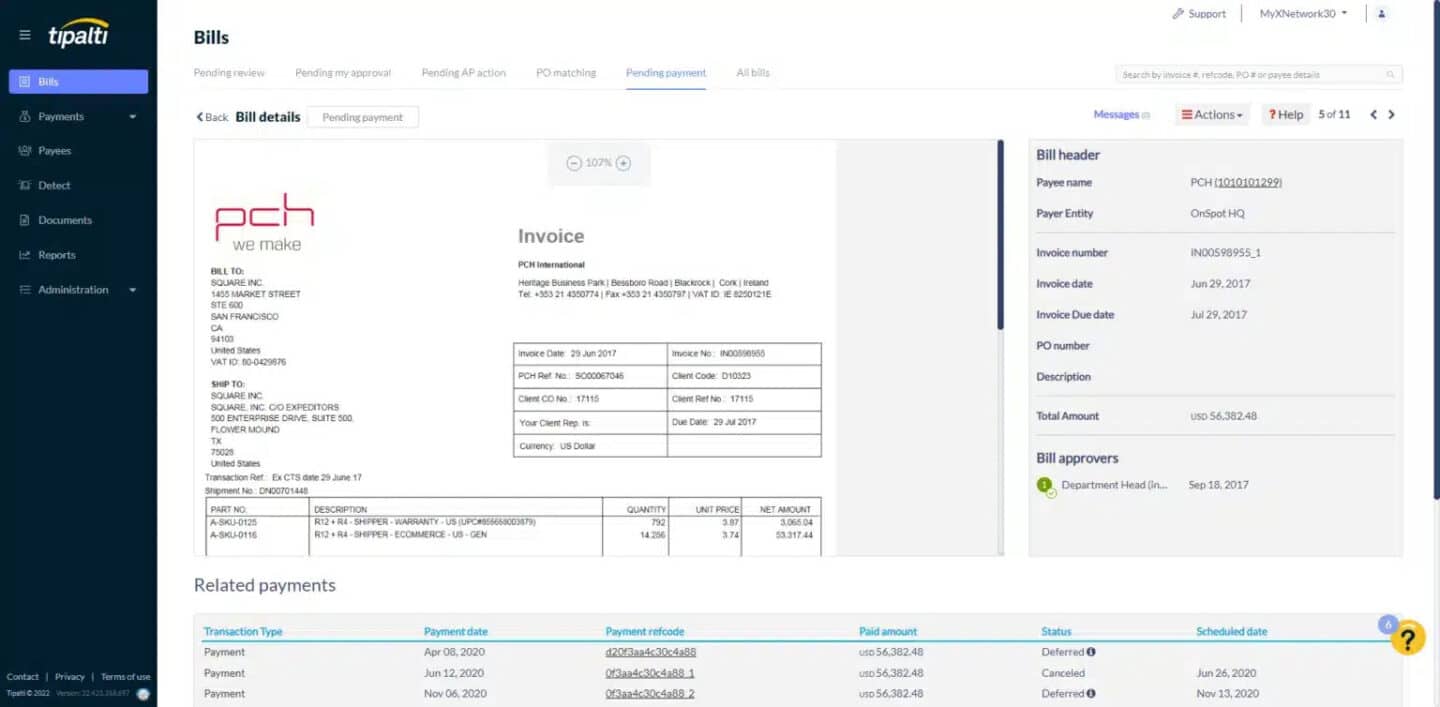

Tipalti

Tipalti is a comprehensive solution designed to automate your entire payables process and with its connected suite of features, it simplifies accounts payable, global payments, procurement, and employee expense management.

It streamlines onboarding for suppliers, partners, and freelancers. It also improves purchase order generation, makes faster invoice approvals, and eliminates manual invoice entry.

Tipalti integrates seamlessly with leading ERPs like NetSuite, QuickBooks, Xero, and Sage Intacct, offering instant reconciliation.

Pros

- Streamlined Workflow: Automates procure-to-pay processes, reducing time spent on invoice coding and approval.

- Supplier Hub: Vendors can track bill and payment status, update their information, and reduce email queries, improving overall communication.

- Efficient Approval Process: Provides a clear, simple bill approval workflow with a full audit log for transparency.

- AI-Powered Automation: AI and machine learning auto-populate bill fields after initial manual coding, improving efficiency.

- Strong Support: Offers smooth implementation and reliable customer support for ongoing needs.

Cons

Here are some challenges businesses might face with Tipalti:

- Lack of Cohesion Between Modules: Procurement and accounts payable are separate, making it harder to streamline processes.

- Complex Wallet Reconciliation: Reconciling Tipalti wallets can be tricky, and a direct bank feed integration would simplify things.

- Restrictive Procurement Features: Some features in the procurement system are more limited than expected.

- Occasional Slowness: The system speed can lag at times, though the essential features work well.

- Complicated Payment Batches: Handling bill credits within payment batches feels more tedious than it should.

- Vendor Portal Frustrations: Suppliers need unique logins for each instance, which adds unnecessary steps.

- Lengthy Onboarding: Getting suppliers onboarded took longer than expected for some businesses, requiring extra time and attention.

- Implementation Delays: Setup and integration can sometimes take longer than anticipated, depending on internal resources.

Pricing

- Standard Plan ($99/month): Includes invoice management, PO matching, global payouts, multi-entity support, currency management, tax compliance, payment reconciliation, ERP integrations, secure cloud storage, and Payments API.

- Custom Plan (Contact for Pricing): Made to your business needs. Includes all Standard features plus advanced options like multiple entities, additional currencies, international tax IDs, AI-powered fraud detection, self-billing mode, and more.

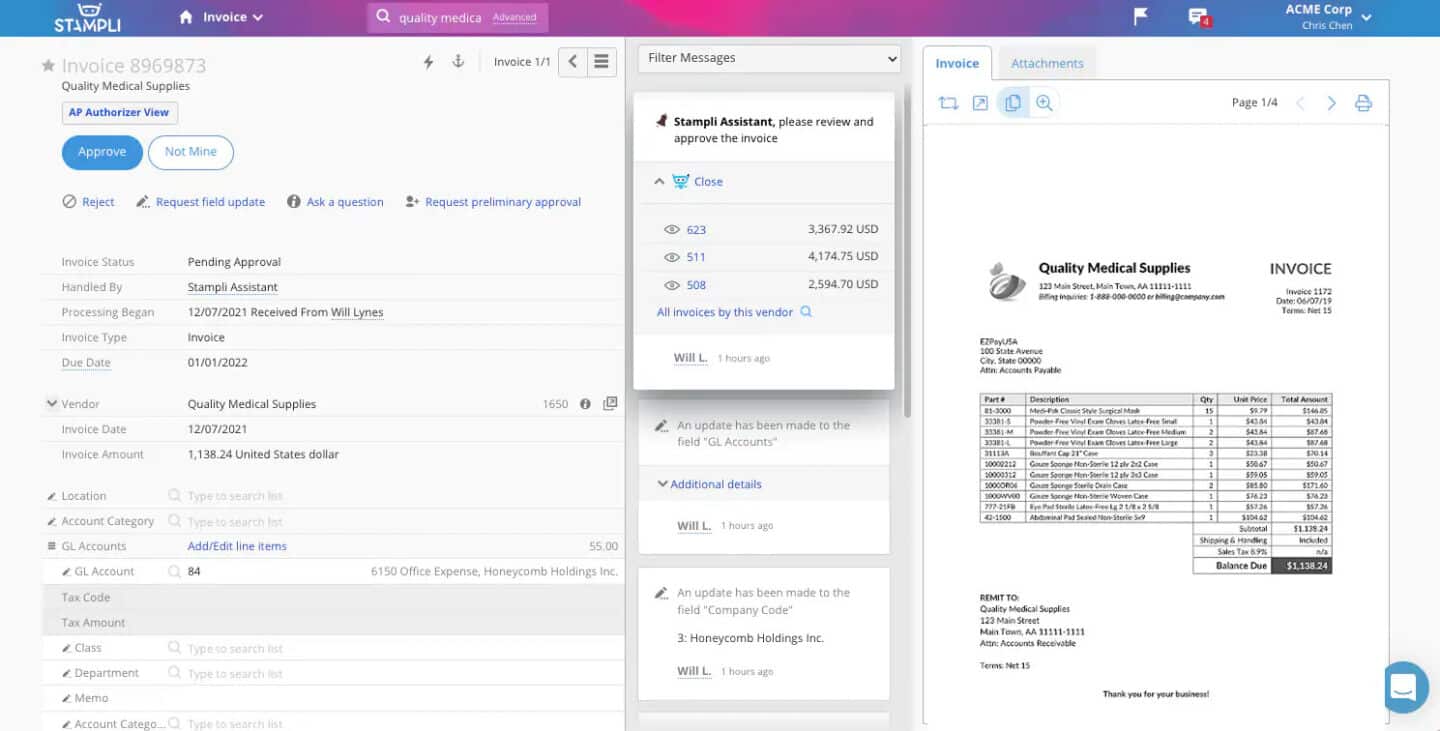

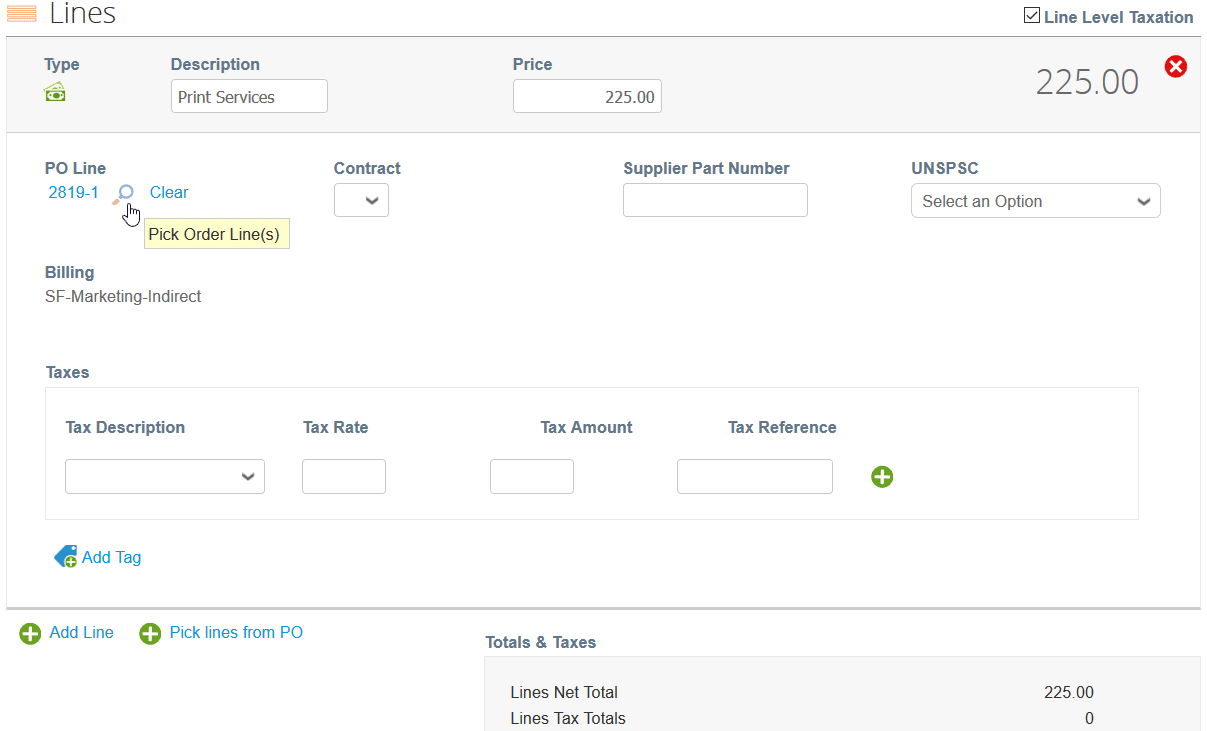

Stampli

Stampli is a finance automation platform made for accounts payable (AP), unlike other tools focused on payments or cash flow.

Stampli enhances productivity by centralizing invoice communication, documentation, and workflows into a single interface. It automates manual tasks with its AI assistant, Billy the Bot™.

Integrates with platforms like Microsoft, Oracle, Sage, SAP, QuickBooks, and more, Stampli adapts easily to your financial processes.

Pros

- Exceptional Integrations: Integrates flawlessly with ERP systems like Sage Intacct and other platforms, ensuring smooth workflows.

- User-Friendly Platform: The system is intuitive and easy to use for processing payments, managing corporate cards, and recording charges.

- Robust Approval Processes: Supports multiple approval workflows while maintaining strict internal controls aligned with company policies.

- Outstanding Customer Support: Quick and responsive support that listens to user concerns and works to resolve issues effectively.

- Convenient Communication: Features like chat make it easy to communicate with support and other stakeholders during the approval process.

Cons

- Limited Payment Information: Payment details are not directly available on the invoice page, making it less convenient to check payment status or provide remittance information.

- Slower ACH Payments: ACH payments take longer compared to some competitors, and the expedited payment option comes with added costs and limits on payment amounts.

- Duplicate Invoice Alerts: The system occasionally flags invoices as duplicates even when they are not, causing minor disruptions.

- Confusion with Multi-Entity Coding: The platform struggles when vendors are used across multiple entities, leading to errors in coding.

- Missing Features: Some features, like pre-planned approvers, are not yet implemented, requiring manual reference to external documents.

- AI Recommendations: Billy the Bot occasionally suggests incorrect approvers, adding extra review steps for users.

Pricing

Custom Plan (Contact for Pricing): Includes automated invoice capture and coding, flexible B2B payment options, and full ERP integrations. Offers features like audit-ready history, full visibility and control, customizable workflows, and a simple, fast setup.

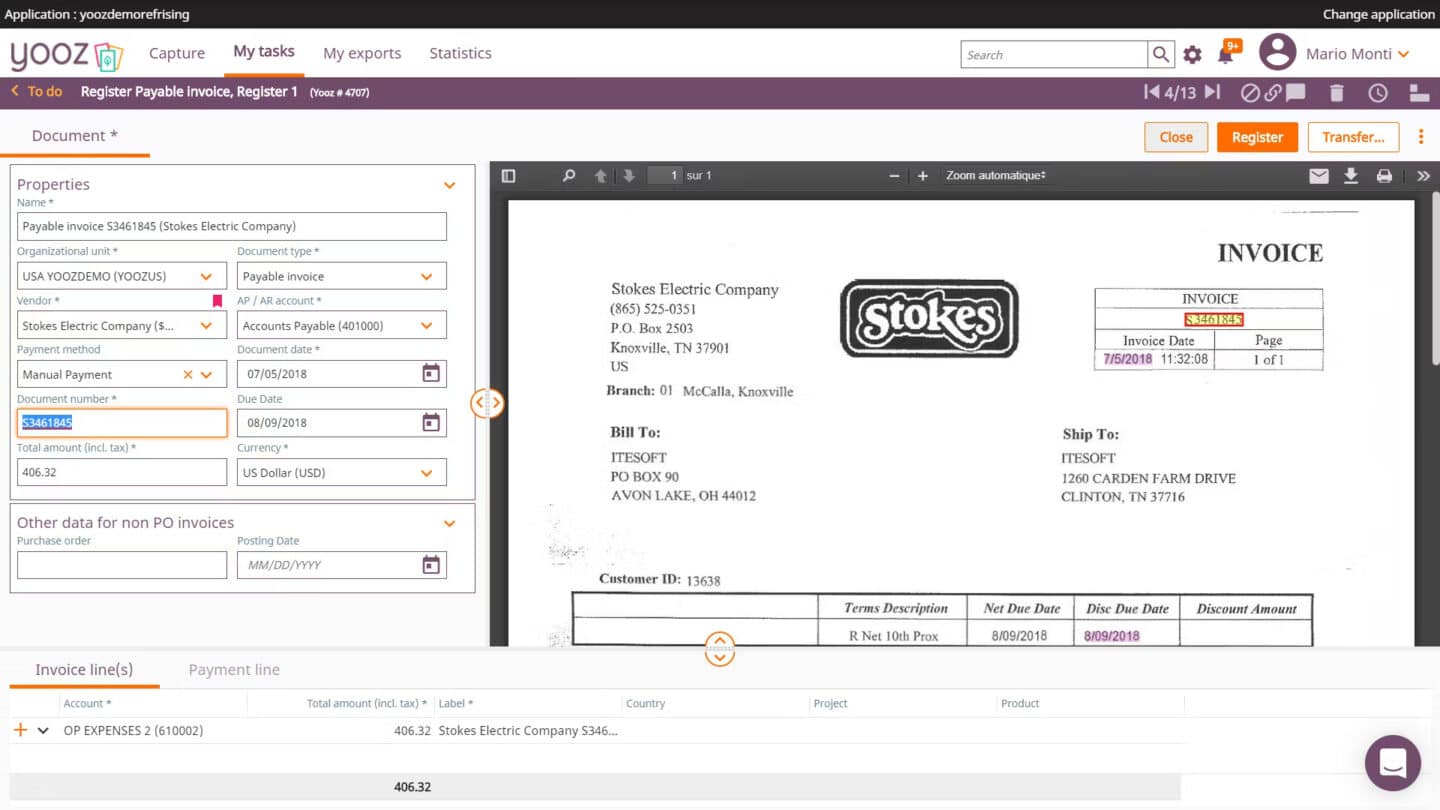

Yooz

Yooz is a cloud-based E-invoicing and Purchase-to-Pay (P2P) automation solution. It uses artificial intelligence (AI) and RPA technologies and provides automation, traceability, and customization.

Its solution integrates with information systems and ERPs through more than 250 native connectors.

Pros

- Centralized System: All invoices are managed in one place, making it easy to approve, track, and store them efficiently.

- Clear Workflow Visibility: Users can quickly see what tasks need attention and track the progress of invoices seamlessly.

- Flexible Usage: The platform supports daily, weekly, or monthly workflows, adapting to the company’s needs.

- Reliable Customer Support: Issues are minimal, and the support team is easy to reach and quick to resolve any problems.

Cons

- Occasional Bugs: Rare issues, such as invoices not fully integrating into connected systems like CDK, can cause disruptions.

- Frustrating Data Entry: Typing values into breakdowns can be inconsistent, with the system sometimes failing to register the first character, which slows down workflows.

- Clunky UI: The interface can feel awkward at times, especially for rerouting reports without administrator support.

- Limited Customization: Yooz primarily offers out-of-the-box functionality, with minimal options for customization.

- Supplier Recognition Issues: Incorrect supplier recognition can lead to invoices being processed under the wrong account.

- Inconsistent Detail Retention: While Yooz remembers some details, it doesn’t always function reliably, resulting in wasted time on manual corrections.

- Lack of User Flexibility: More flexibility for users within the same team would improve the overall experience.

Pricing

Yooz offers flexible pricing customized to your business. To view detailed pricing information and explore available plans, visit their official pricing page.

Plans typically include:

- Invoice automation and processing

- Purchase-to-Pay (P2P) workflow solutions

- AI and RPA-powered features

- ERP integrations with over 250 native connectors

Contact Yooz for a custom quote based on your organization’s requirements.

Coupa

Coupa is a leading spend management platform and it has an invoicing solution for automating manual invoice processing. The invoicing solution has features such as automated invoice validation, procurement integration, e-invoicing, and fraud detection.

Coupa also integrates with ERP systems, allowing businesses to accelerate invoice processing. It’s a solution built to provide measurable value beyond what your ERP system can deliver.

Pros

- Streamlined Processes: The platform reduces the need for extensive manual management, allowing businesses to automate tasks like e-invoicing and invoice matching.

- Integration ERP software: Coupa integrates smoothly with 160

- Efficient Vendor Management: Once vendors are linked, the system automatically processes and sends POs upon approval, saving time and effort.

Cons

- Session Timeout Issues: Users are frequently logged out after 10 minutes of inactivity, leading to frustration and the need to re-enter information.

- Format Verification Gaps: Address formatting errors can cause delays, requiring users to withdraw and resubmit requests.

- Repeated Client Registration: Re-registering for each client can take up to two hours, adding unnecessary workload.

- Confusing UI: The interface has too many notices and warnings, making navigation and usability challenging for both vendors and users.

- Limited Catalog Support: Insufficient resources for catalogs and cXML invoicing, making it difficult to find suppliers beyond Coupa Advantage.

- Vendor Navigation Issues: Vendors struggle with the system’s complexity, often getting lost in multiple screens or forms.

- Lack of Effective Customer Support: Customer support often redirects inquiries back to users without resolving the issues.

- Integration Challenges: Linking new and old systems for ordering and tracking items can be cumbersome.

Pricing

Coupa does not disclose its prices online. You have to contact them to get a quote for their services as they have many solutions that can integrate with your business.

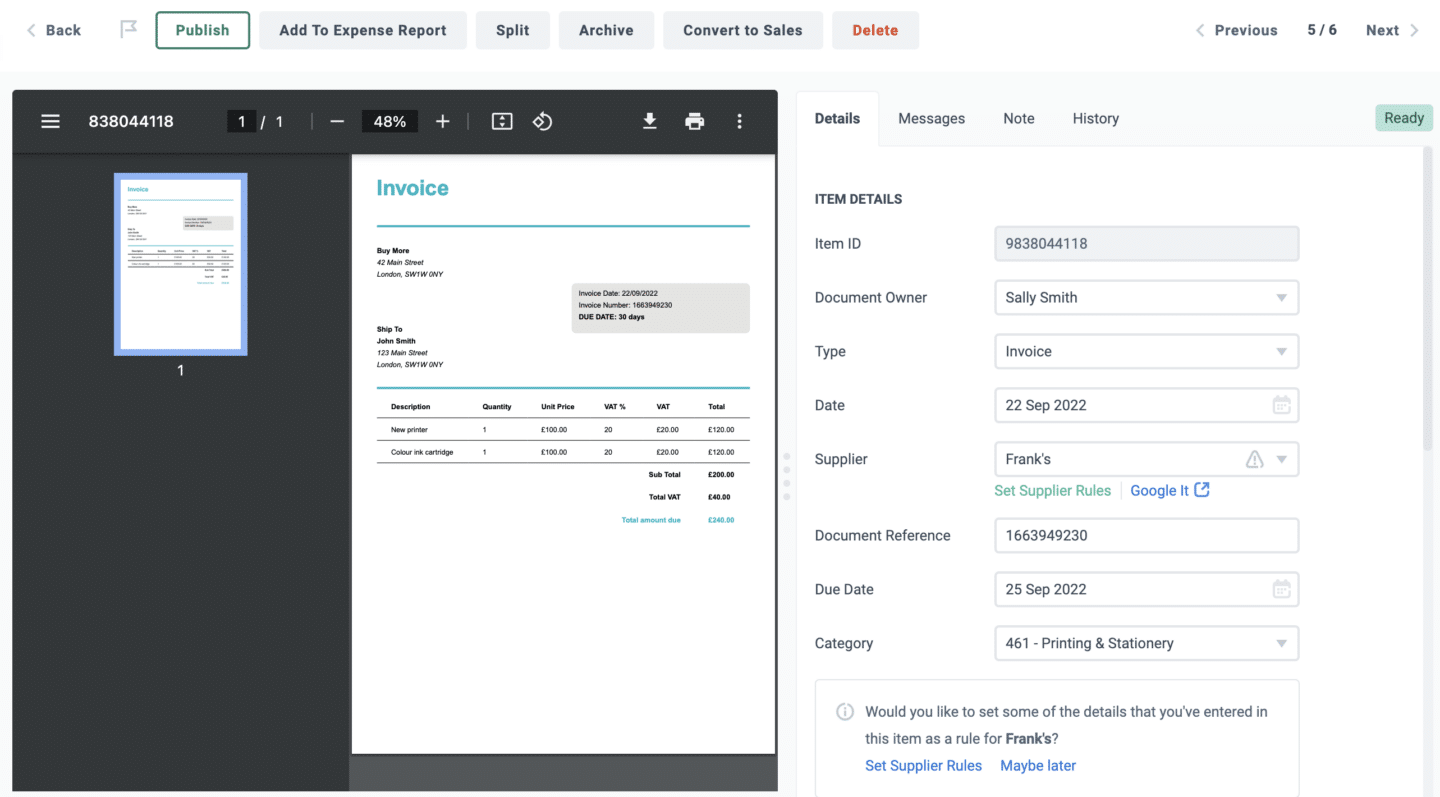

Dext

Dext is a tool designed to automate bookkeeping and streamline expense management. It can also automate invoice processes by easily extracting data from invoices and organizing, categorized, and assessing it.

Its ability to integrate with 30 accounting software makes it a versatile option for new users. Dext’s established process allows you to automate the majority of your invoice processing with OCR making it reflect directly to your accounting software.

Pros

- Automation Rules: Allows users to set up rules to automate repetitive tasks, improving efficiency.

- Mobile Upload: Upload documents via the mobile app so you can process them later on on a desktop.

- Efficient Document Capture: Automatically reads and captures invoice data accurately, meeting specific requirements.

- Real-Time Updates: Provides reliable online updates, ensuring the system remains accurate and current.

Cons

- Invoice Recognition Issues: The system doesn’t recognize invoice numbers, leading to duplicate entries and accounting errors.

- Export Limitations: Filtering and exporting data can be problematic, as users must scroll to select all items beyond the initial 50 displayed.

- Difficult Receipt Management: Managing receipts within expense reports can be challenging, especially when dealing with duplicates.

- High Costs: The pricing structure can be too wide, with some users being charged for more clients than they actually need.

- Billing Transparency Issues: Some users report being transitioned from monthly to annual plans without proper notice and facing unexpected fee increases.

- Poor Customer Support: Customers frequently encounter delays and unresolved issues, with responses often limited to vague escalations.

Pricing

Their pricing is in a business plan depending on the number of users

- $30.00/month: For up to 5 users and 250 documents per month. Includes 10 sheets of bank statement extraction, 5 line-item extractions, and 5 supplier statement extractions.

- $57.50/month: For up to 10 users and 500 documents per month. Includes 35 sheets of bank statement extraction, 30 line-item extractions, and 10 supplier statement extractions.

- $86.00/month (customizable, $7.50 per added user, document amount also scaled up): For up to 750 documents per month. Includes 60 sheets of bank statement extraction, 55 line-item extractions, and 15 supplier statement extractions.

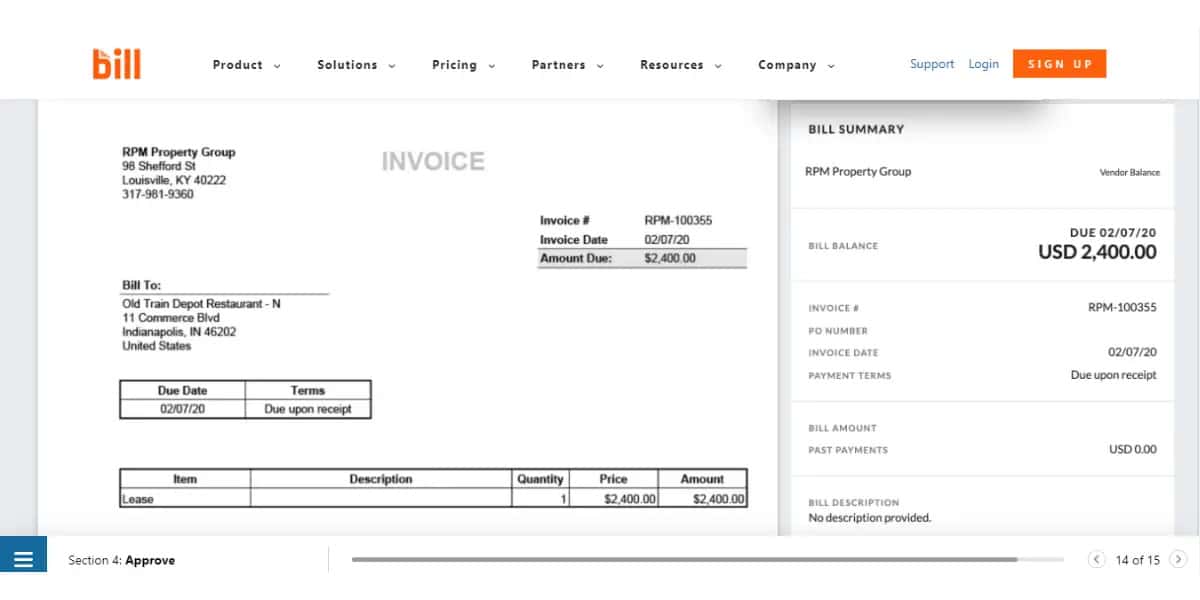

BILL

BILL is a financial operations platform MADE for SMBs, designed to streamline payables, receivables, and expense management. Its AP automation solution improves data extraction from invoices like amounts, dates, names, and other information.

It also devises an automated workflow for your invoice approval process, making it fit for your team. Lastly, it integrates well with widely-used accounting software and makes payment options within the platform.

Pros

- Seamless Integration: Easily integrates with accounting software like QuickBooks Online (QBO) and other accounting software.

- User-Friendly Interface: The platform is intuitive, with a minimal learning curve, making it accessible for users of all levels.

- Reliable Customer Support: Prompt and helpful support ensures issues are resolved quickly.

- Efficient AP/AR Implementation: Smooth setup for managing accounts payable and receivable transactions for clients.

- Comprehensive Approval Processes: Supports formal approval workflows, ideal for businesses

Cons

- Limited Bulk Download Options: Bills attached to the platform cannot be downloaded in bulk, requiring one-by-one downloads.

- PDF Parsing Issues: Parsing PDFs with multiple invoices can be challenging, reducing efficiency.

- Credit Card Processing Limitations: The internal credit card processing system lacks essential features like issuing credits or using external processors, causing confusion and disputes on customer statements.

- API Accessibility: The lack of a free API is a significant drawback, making integration harder compared to other providers.

- Occasional Support Gaps: Some support staff lack familiarity with the distinctions between payables and receivables modules, leading to delays in issue resolution.

- Complex Tasks: Certain tasks require multiple clicks and random text from emails can mistakenly be interpreted as invoices or bills.

Pricing

- Essentials Plan ($45/month): Manage payables or receivables with basic features. Includes manual import/export of CSV files, payment status tracking, ACH, check, credit card, and international wire transfers, as well as single or recurring invoices and automated email reminders.

- Team Plan ($55/month): Includes all Essentials features plus integration with QuickBooks Online, QuickBooks Pro/Premier, and Xero. Offers a centralized inbox, 360-degree vendor information, and custom user roles.

- Corporate Plan ($79/user/month): Automatic two-way sync with QuickBooks Online, QuickBooks Pro, QuickBooks Premier, and Xero. It also includes centralized bill management, the ability to pay via ACH, virtual card, credit card, and other methods, custom approval policies, user roles, and discounts for approver-only users.

- Enterprise Plan (Custom Pricing): Designed for large-scale businesses, this plan integrates with QuickBooks Enterprise, Oracle NetSuite, Sage Intacct, and Microsoft Dynamics. Includes advanced features like single sign-on, dual control, and custom data integration services.

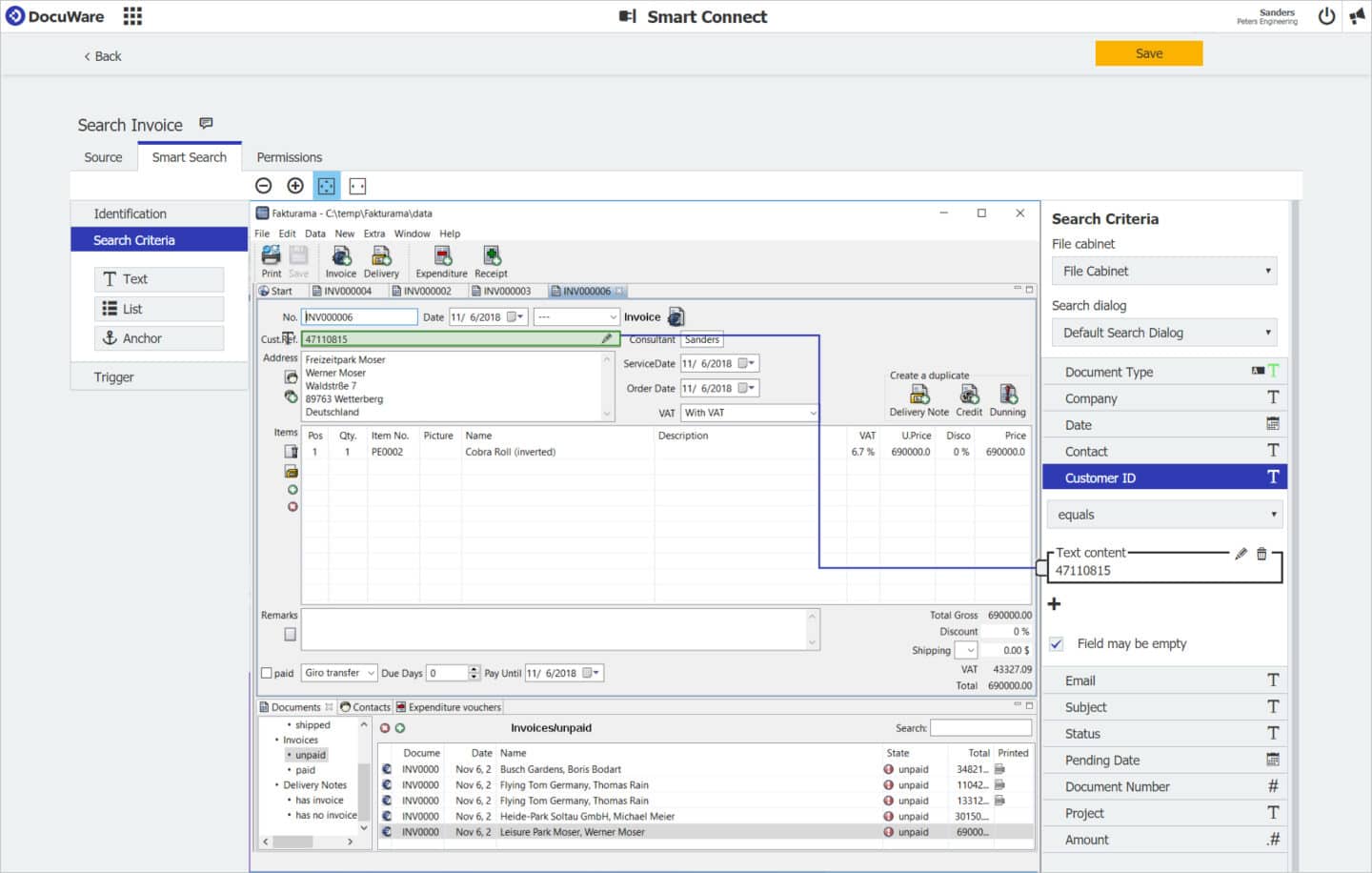

DocuWare

DocuWare is a comprehensive platform for capturing, processing, and managing business information. One of its solutions is automated invoice processing. You can upload your invoices directly from any format, such as paper, email, or XML.

You can also make approval workflows and it can organize each invoice according to your preference showing its status.

DocuWare can integrate with 500+ accounting software and ERP tools, making it a versatile and easy-to-adapt solution for any business.

Pros

- Seamless Paperless Transition: Converts paper-based workflows into fully digital, streamlined processes without limitations.

- Efficient Forms Management: Eliminates the need for internal paper documents by digitizing forms and creating a reliable digital trail.

- Database Integration: Supports integration with external and internal databases, enabling seamless data retrieval and management.

- ERP Compatibility: Works effectively with ERP systems, ensuring smooth workflow and data handling.

Cons

- Seamless Paperless Transition: Converts paper-based workflows into fully digital, streamlined processes without limitations.

- Efficient Forms Management: Eliminates the need for internal paper documents by digitizing forms and creating a reliable digital trail.

- Database Integration: Supports integration with external and internal databases, enabling seamless data retrieval and management.

- ERP Compatibility: Works effectively with ERP systems, ensuring smooth workflow and data handling.

- Enhanced Security: Provides a secure platform for managing documents, giving users peace of mind and reliable access to their files.

Pricing

Contact Docuware to know their pricing and get a quote.

What is Invoice Automation Software?

An invoice automation software is a tool that effectively eliminates the need for manual data entry during your Accounts Payable process.

These tools are a combination of AI, OCR, and document management that allows you to track, extract, and digitize the information from your invoices across all formats like paper invoices, PDF invoices, and e-Invoices.

Why is Invoice Automation Software Important for Businesses?

Here are some reasons why businesses should adapt invoice automation software for their accounts payable process:

- Cost Savings: Automation can reduce invoice processing costs by up to 92%. While manual processing costs average $40.70 per invoice, automation brings it down to just $3.34.

- Faster Processing: Automation shortens invoice processing time by up to 80%, giving you more time to focus on scaling your business.

- Improved Accuracy: These tools reduce exception rates by as much as 57%, ensuring more reliable data entry and fewer errors.

- Enhanced Security: With fewer human touchpoints, automation minimizes the risk of tampering or fraud during invoice processing.

How to Select the Best Invoice Automation Software

If you think the benefits of invoice automation will surely be helpful for your invoice process, here’s how you get started:

- Identify Automation Needs: Pinpoint areas in your current system that require automation. This often includes manual data entry for PDF invoices or manual verification processes like 3-way invoice matching. Consider how paperless invoice processing can transform your current workflow.

- Match Software to Needs: Choose the software that addresses your specific challenges. For example, an OCR invoice converter can help automate data entry from PDF invoices.

- Simplify Employee Training: Choose software that is intuitive and easy to use. This minimizes the need for extensive training and reduces implementation time.

- Evaluate Performance: Test the software to ensure it improves your process. If it’s too costly or complicates workflows, explore alternative options that better align with your needs.

Automate Your Invoice Processing with DocuClipper

DocuClipper is an invoice converter that effectively converts your PDF invoices to processable formats such as Excel, CSV, and QBO. It uses automated OCR technology to extract invoice data from PDF invoices.

If you are planning to get into automation, DocuClipper is the best choice because it is highly accurate with 98% OCR accuracy, it is highly scalable, you can process up to hundreds of invoices in just a few seconds, and it is cost-effective because it charges you per page and not per line item.

With these benefits, you can efficiently reduce your costs, improve your processing speed, and reduce the risk of having mistakes that will throw off your accounting flow.

DocuClipper can also process other documents such as bank and credit card statements, receipts, checks, tax forms, and brokerage statements.