Handling financial audits for clients becomes a hassle when bank statements aren’t available in CSV format for Xero.

Instead of efficiently uploading data, you’re stuck manually entering totals, dates, and bank transactions into spreadsheets.

This tedious process not only consumes valuable time but also increases the likelihood of costly errors. Fortunately, there’s a better way to streamline this task.

In this article, we’ll explore the best PDF to CSV converter for Xero, highlighting their features, pros and cons, and pricing, so you can save time and improve accuracy in your financial data management.

The Best PDF to QBO Converter at a Glance

| Software | Best for |

| DocuClipper | Accurate bank statement and financial document conversion tool. |

| Hubdoc | Cloud-based document management with easy OCR extraction |

| MoneyThumb | Converting PDF bank statements for Xero and QuickBooks |

| Propersoft | Flexible multi-format conversions with offline access |

| MMC Convert | Migrating historical accounting data to Xero |

| FormX.ai | Automating data extraction with customizable AI models |

| Adobe Acrobat |

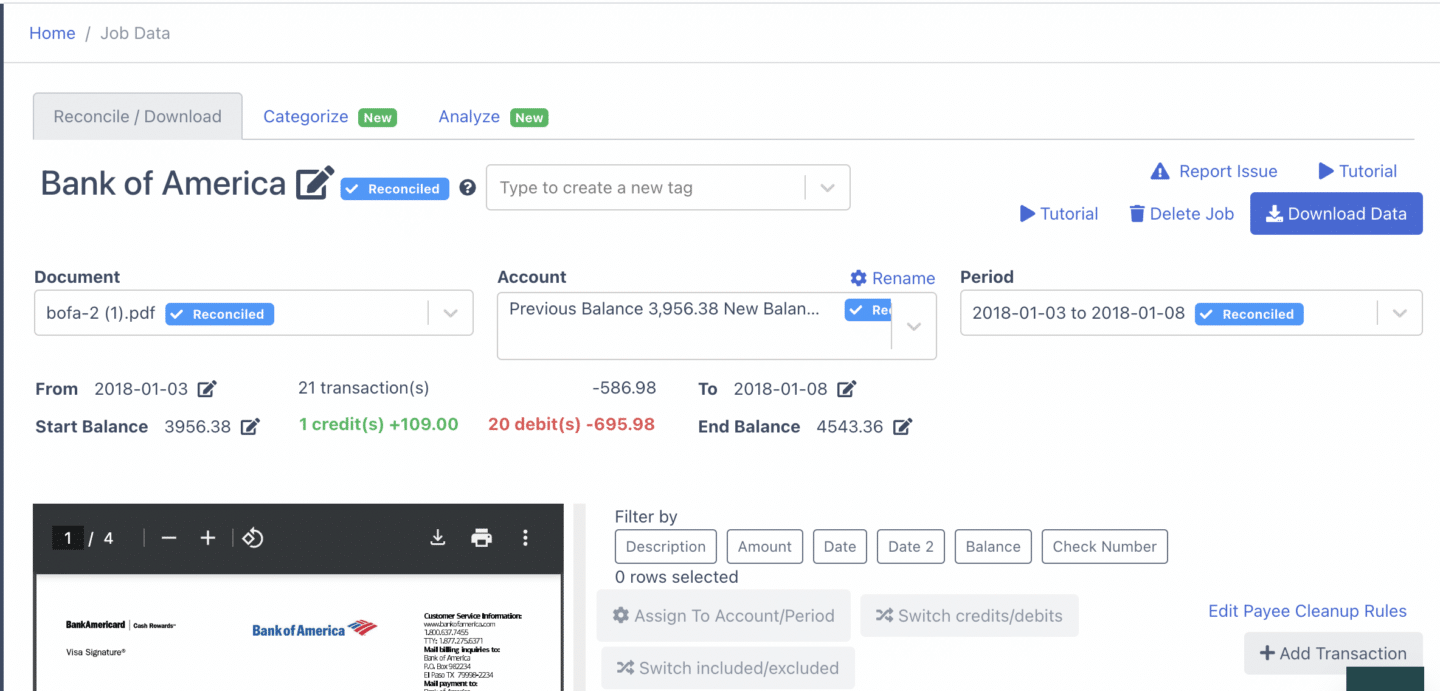

1. DocuClipper

DocuClipper is a top OCR software that converts PDFs to CSV for Xero, efficiently handling bank, credit card, and brokerage statements and even invoices and receipts.

This best bank statement converter extracts data from from financial documents, reducing the hassle of data entry.

Using advanced OCR technology and specialized algorithms for financial documents, DocuClipper ensures high accuracy and fast processing. This tool is perfect for businesses aiming to reduce manual data entry, improve accuracy, and streamline financial document management, making it an essential solution for saving time and boosting efficiency.

Key Features

- Extensive Format Support: Handles various documents, including invoices, receipts, and bank statements.

- Automated Data Entry: Extracts data from financial documents without needing parsing templates.

- Batch Processing: Processes hundreds of documents simultaneously for efficiency.

- Robust Security: SOC 2 compliant with AES 256-Bit SSL encryption and secure Amazon servers to protect your data.

- Customizable Output: Allows flexible spreadsheet downloads with fields like dates, descriptions, credit, debit, and more.

- Transaction Categorization: Automatically categorizes transactions using keywords for easier analysis.

- Financial Insights: Provides tools to analyze cash flow, spending trends, and detect fraudulent transactions.

Pros

- High Accuracy: Delivers exceptional accuracy in converting bank, credit card, and brokerage statements.

- Fast Processing: Quickly processes documents, regardless of the volume.

- User-Friendly Interface: Easy to use with little to no training required.

- Affordable OCR: Offers comprehensive financial document OCR at a competitive price.

- Excellent Customer Support: Provides responsive and helpful customer service.

- Handles Large Volumes: Efficiently processes a large number of documents without issues.

Cons

- Limited Integrations: Lacks a wide range of direct integrations with other software.

- No Mobile App: Does not have any mobile application for scanning documents into PDF format

Pricing

DocuClipper offers four pricing tiers:

- Starter ($39/mo): Designed for independent accountants, includes 200 pages per month, bank statement and CSV conversions, unlimited users, accounting integrations, batch processing, customizable output, and 30-day data retention.

- Professional ($74/mo): Suited for small businesses with 500 pages per month, transaction categorization, and 1-year data retention.

- Business ($159/mo): Ideal for larger firms, offering 2,000 pages per month, advanced reporting, premium support with a dedicated account manager, faster processing, API access, and 2-year data retention.

- Enterprise: Customizable for large firms, including negotiable page limits, single sign-on, and 5-year data retention. Pricing is available upon request.

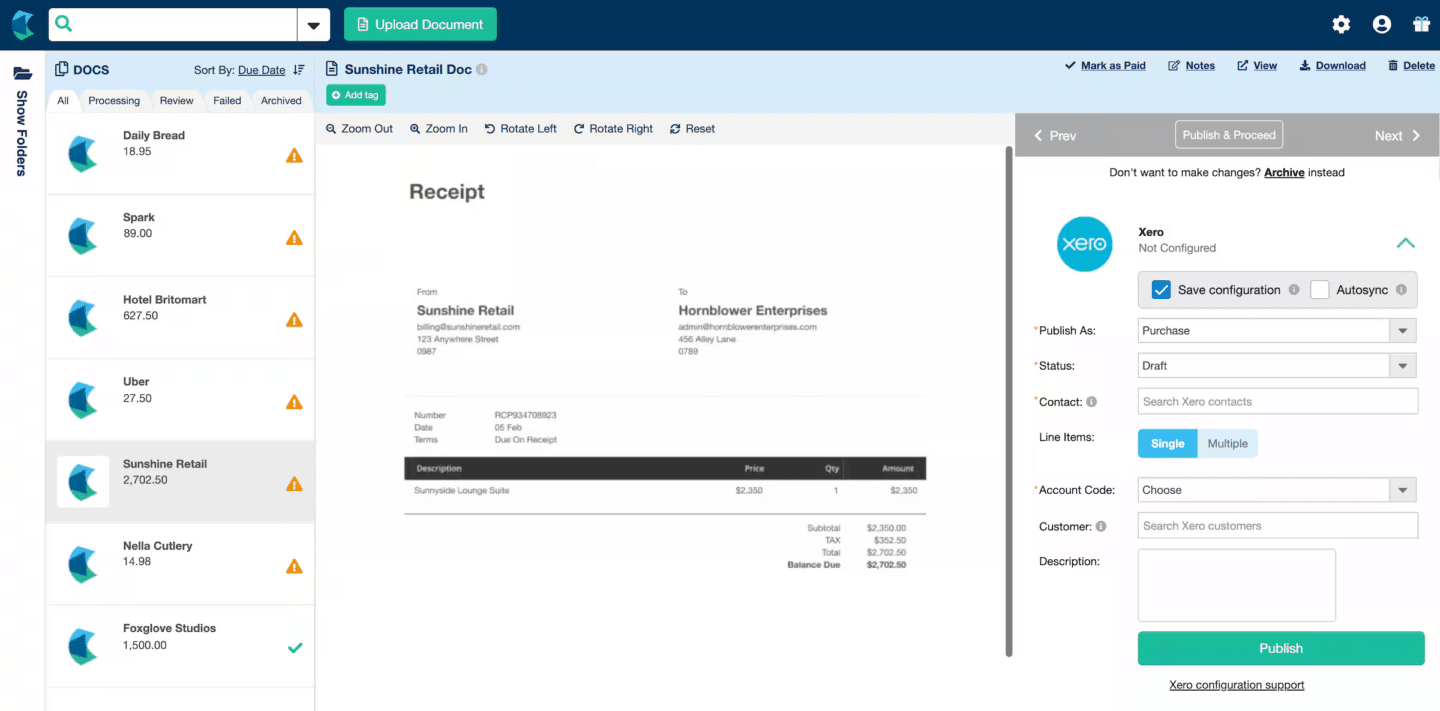

2. Hubdoc

Hubdoc is a cloud-based platform that streamlines document management by automating OCR data capture and organization. It imports financial documents, including bank statements, and extracts essential data for seamless syncing with accounting tools like QuickBooks and Xero.

While Hubdoc works well with standard bank statements, it may struggle with more complex formats, often requiring manual corrections to maintain accuracy. For businesses with specialized needs, evaluating Hubdoc’s performance with your specific documents and exploring alternative OCR-focused solutions may be necessary to ensure optimal data extraction results.

Key Features

- Seamless Integration: Works effortlessly with Xero and QuickBooks for streamlined accounting.

- Mobile App Access: Available on Android and iPhone, enabling easy capture of bills and receipts on the go.

- Cloud Storage: Provides secure online storage for organizing and sharing financial documents.

Pros

- Easy Document Collection: Gathers bank statements, receipts, and invoices from multiple sources, including email, mobile uploads, and direct integrations with financial institutions.

- Automated Data Extraction: Uses OCR technology to extract invoice data from documents, minimizing manual data entry.

- Centralized Document Management: Offers a single platform for organizing and managing financial documents.

- Accounting Software Integration: Seamlessly integrates with popular platforms like Xero

Cons

- Inconsistent Data Extraction: Struggles with extracting data from more complex or non-standard documents.

- Limited Document Types: Primarily suited for basic documents like receipts, invoices, and bank statements.

- Cost Consideration: May not be cost-effective for smaller businesses or individuals with tight budgets.

- Dependency on Integrations: Heavily relies on accounting software and financial institution integrations, which could disrupt data flow if issues arise.

Pricing

Hubdoc is priced at $12 USD per month. This plan includes automatic data extraction from bills, statements, invoices, and receipts, as well as seamless syncing with Xero and QuickBooks Online. The subscription allows for unlimited usage, multiple collaborators, tech support, and easy backup options. The service is available on both smartphones and tablets (iOS and Android).

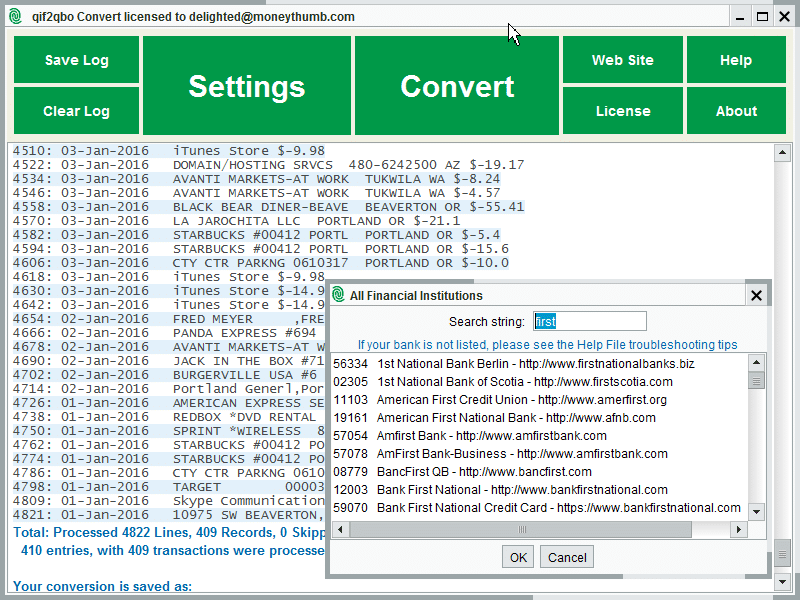

3. MoneyThumb

MoneyThumb is a conversion software that converts PDF bank statements into various file formats, including CSV, QBO, and QFX. It’s compatible with major accounting platforms like Xero, making it a solution for both businesses and individuals. MoneyThumb is well-regarded in the industry, with recognition from publications like Accounting Today and The Financial Brand.

Key Features

- Automatic Data Extraction: Easily extracts data from bank statements for tracking spending, identifying trends, and detecting potential issues.

- Bank Statement Analysis Tools: Offers tools to analyze spending patterns and monitor financial trends.

- Cloud-Based Access: Accessible from anywhere with an internet connection, ensuring convenience and flexibility.

- Advanced Security: Utilizes modern security protocols to protect your sensitive financial data.

Pros

- Easy Conversion: Simplifies the process of converting PDF statements into formats compatible with accounting software, saving time and effort.

- High Accuracy: Claims a high level of accuracy in conversions, reducing errors associated with manual data entry.

- Multi-Format Support: Converts documents to and from various file formats, offering greater flexibility than many other tools.

- Time-Saving: Speeds up data entry by automating transaction input, eliminating the need for manual entry.

Cons

- Cost: As a paid service, MoneyThumb may be too expensive for small businesses or individuals.

- Learning Curve: New users may face a learning curve in effectively using the software.

- Compatibility Issues: Certain banking or credit card PDFs and specific accounting software may experience compatibility problems.

- Lack of Updates: The platform has seen less maintenance recently, which could affect performance and delay feature improvements

Pricing

MoneyThumb does not provide public pricing for all its products. To obtain detailed pricing information for specific tools, you’ll need to contact MoneyThumb directly. However, pricing for their QuickBooks converter product is available:

Individual Plan: $24.95/month for 5 conversions, equivalent to $5.00 per conversion.

Standard Plan: $49.95/month for 20 conversions, bringing the cost to $2.50 per conversion.

Pro Plan: $99.95/month for 60 conversions, making it $1.67 per conversion.

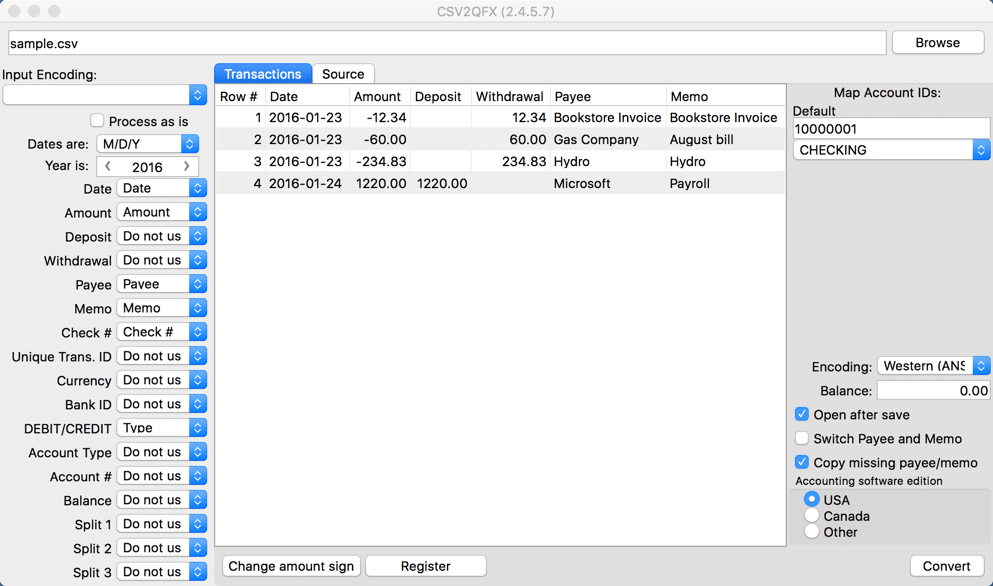

4. Propersoft

ProperSoft specializes in developing software that converts transaction files, like bank and credit card statements, into various formats for seamless import into accounting and personal finance platforms.

Their tools streamline the data entry process, eliminating the need for manual input by ensuring compatibility with accounting software. This makes ProperSoft’s products essential for businesses and individuals looking to automate financial data processing and minimize human error.

Key Features

- Automatic Formatting: Automatically identifies and sets document formats for numbers and dates.

- Direct Export: Allows exporting from your existing accounting software.

- Bank Statement Downloads: Supports downloading statements directly from your online banking.

- Transaction Editing: Provides the ability to exclude or edit transactions during conversion.

- CSV Export: Enables exporting as CSV to work on transactions in Excel before final conversion.

- Multi-Format Conversion: Use the ProperConvert app to convert between multiple file formats easily.

Pros

- Offline Functionality: Operates without needing an internet connection, offering flexibility and convenience.

- One-Time Payment: Provides a perpetual license with a single payment, making it cost-effective in the long run.

- Responsive Support: Offers helpful and responsive customer support for a better user experience.

- Multi-Format Support: Supports a wide range of file formats, enhancing versatility in conversions.

Cons

- Limited Accuracy: May struggle with bank or credit card statements, leading to potential errors.

- Restricted Document Types: Supports fewer types of documents for conversion.

- Outdated Interface: The user interface is not modern, potentially impacting ease of use.

- Less Efficient for Multiple Files: Converting multiple files can be less straightforward and more time-consuming compared to other tools.

Pricing

ProperSoft offers three licensing options:

- Monthly License: $19.99 per month, includes access for one user, all converters, formats, apps, premium support, and free updates.

- Yearly License: $119.99 per year, offering the same features as the monthly plan at a 50% discount.

- Lifetime License: $199.99 as a one-time payment, providing access to all converters, formats, apps, 24 months of premium support, and free updates for life.

5. MMC Convert

MMC Convert specializes in migrating historical data from various accounting software to Xero. Using proprietary tools, MMC Convert offers accurate and reliable data migration services.

Businesses can easily switch from software like QuickBooks Online, QuickBooks Desktop, Sage, MYOB, and more, along with a multi-year transactional history.

Key Features

- Complex Data Handling: Supports multi-currency, payroll, attachments, and custom charts of accounts for seamless data migration.

- Onboarding Support: Offers a free 30-minute onboarding support call with every completed conversion to ensure a smooth transition to Xero.

Pros

- User-Friendly: Xero’s ease of use is highly appreciated, making the transition smoother.

- Excellent Customer Support: MMC Convert provides great service, with team members like Ankit offering regular follow-ups and support throughout the process.

- Clear Communication: They keep clients informed at every stage, responding promptly to emails and queries.

- Accurate Data Migration: Data is migrated accurately without any tampering, ensuring reliability.

- Guided Support: Offers easy-to-follow guidance and help sections, making the process straightforward and error-free.

Cons

- Delayed Migration: The migration process took 5-6 weeks instead of the promised 7 days, partially due to Xero access issues. Reconciliation issues like unreconciled transactions and rounding errors also arose.

- Data Mismatch: Some amounts didn’t align with bank statements, causing frustration during reconciliation.

- Employee Interchangeability: Could improve the ease of employees working across different sites.

- Time Lag: There’s a noticeable lapse between data import and platform use, requiring re-entry during the transition period to maintain data integrity.

- Minor Security Concerns: A few small security concerns, though not significant enough to deter usage.

Pricing

Contact their website and submit relevant information for you to get a quote.

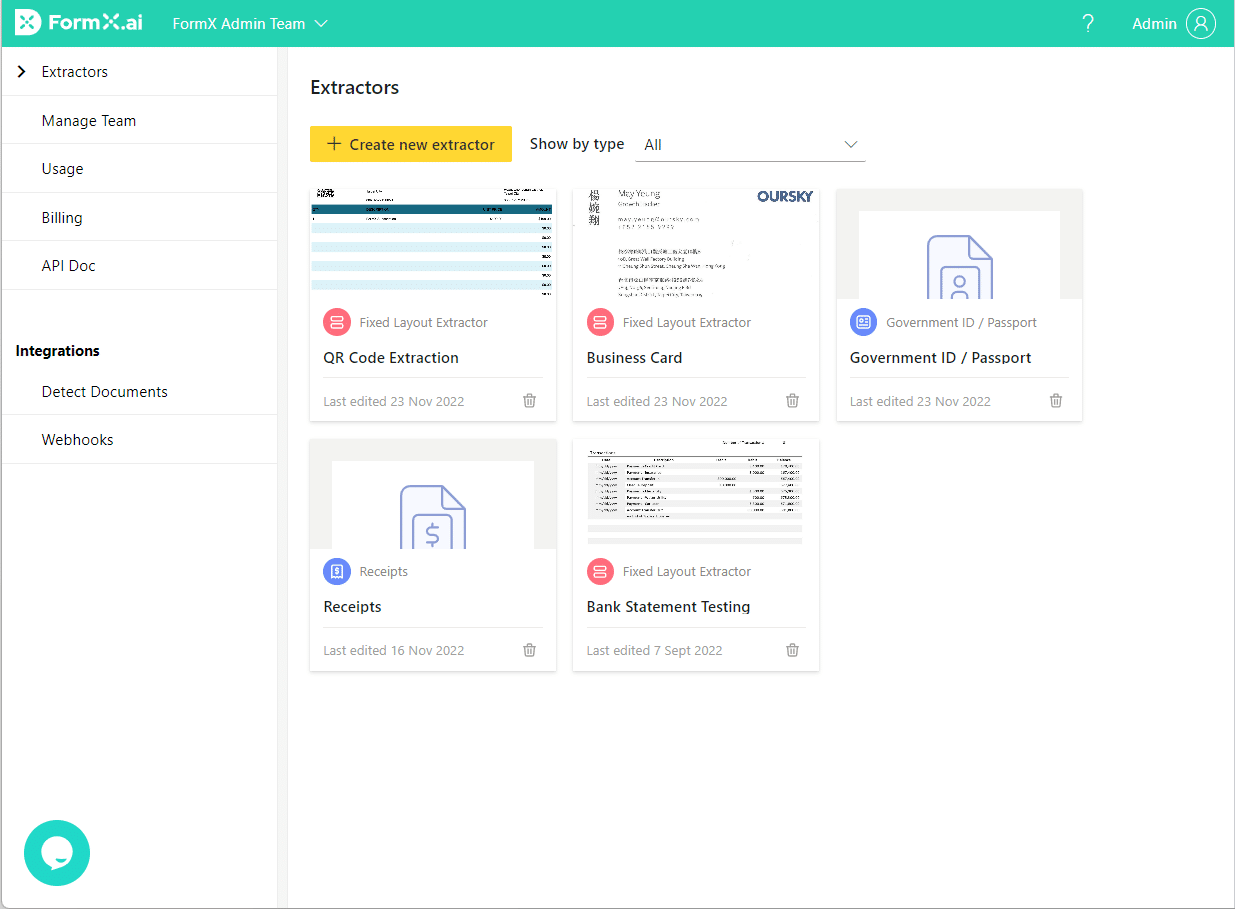

6. FormX.ai

FormX.ai is an Intelligent Document Processing (IDP) solution designed to help businesses automate data extraction from various documents, such as IDs, passports, receipts, invoices, and bank statements, for workflow automation and data analytics.

In addition to pre-built extractors, FormX enables users to create and train custom extractors using machine learning—no coding required. By automating data entry, businesses can reduce processing costs by 90%, enhance customer experience, and greatly boost operational efficiency.

Key Features

- Document Classification: The Detect Document API automatically classifies multiple documents in a single image or PDF and returns coordinates for image splitting.

- Simple API Integration: API-based extraction delivers results in JSON format, making it easy for both businesses and developers to use.

- User-Friendly Portal: Easily configure and train extractors through an intuitive web portal without any coding knowledge.

- Continuous AI Learning: Train custom extraction models using continuous AI learning by labeling and uploading sample documents to improve accuracy over time.

Pros

- Time-Saving Automation: Automates data extraction from documents, eliminating the need for manual input and saving significant time.

- Accurate Image Conversion: Converts inserted images or raw data into the required formats with impressive accuracy.

- Enjoyable Document Scanning: The document scanning feature is user-friendly and efficient.

- Smooth Data Extraction: Provides a hassle-free experience with high-quality, accurate data extraction.

Cons

- Expensive for Startups: Pricing may be a bit high for smaller businesses or startups.

- Occasional Image Errors: Sometimes struggles to interpret images accurately, leading to blank fields or incorrect data, requiring manual error checking.

- Limited Customization: Lacks advanced customization options, limiting control over parser settings.

- User Experience: Could be more user-friendly, with room for improvement in interface design and additional output formats to enhance usability.

Pricing

- Free Trial: $0.00 – Includes 100 pages with no custom extractor.

- Starter Plan: $299.00 per month – Includes 1,000 pages, no SLA, email support only, with a cost of $0.10 per page after exceeding 1,000 pages.

- Enterprise Plan: Contact for pricing – Tailored for organizations requiring additional security, control, and higher volume. Includes all Starter features, with a standard or customized SLA, dedicated account manager, client onboarding, white-labeled UI, personalized team training, and private cloud deployment

7. Adobe Acrobat

Adobe Acrobat is an all-in-one PDF and e-signature solution designed to streamline document management for businesses of all sizes. With Acrobat, users can create, edit, convert, share, sign, and combine documents seamlessly on one platform, enhancing collaboration across teams, regardless of their location.

Key Features

- Microsoft Integration: Seamlessly integrates with Microsoft 365, Teams, Outlook, and more, allowing users to create, edit, share, and sign documents directly from their favorite Microsoft apps.

- Wide App Compatibility: Connects with popular platforms like Google, Box, and others to enhance document management workflows.

- Liquid Mode: Optimizes PDFs for small-screen viewing, eliminating the need to pinch and zoom.

- File Protection: Provides advanced protection to prevent documents from being copied, changed, or printed without permission.

- Compliance & Standards: Helps organizations meet compliance standards such as GLBA and FERPA, and supports ISO 32000 standards for electronic document exchange, including specialized formats like PDF/A, PDF/E, and PDF/X

Pros

- Comprehensive Toolset: Offers a wide range of tools for creating, modifying, and organizing PDF documents, catering to various needs.

- Industry Standard: Widely recognized and trusted as the leading PDF software in the market.

- Adobe Creative Cloud Integration: Integrates seamlessly with other Adobe products, enhancing workflows for Creative Cloud users.

- Strong Security: Provides robust security features to safeguard sensitive information stored in PDFs, ensuring data protection.

Cons

- Subscription-Based: Full access requires a monthly or yearly subscription, which may be costly for smaller businesses or individual users.

- Steep Learning Curve: The interface can be challenging for users unfamiliar with PDF editing tools.

- Pricey: The software is expensive, especially if you’re not utilizing all of its advanced features.

- Performance Issues: Can slow down older devices, making it less efficient for some users.

- Extra Paywalls: Certain tools are locked behind additional paywalls, even with an active subscription, which may feel restrictive.

Pricing

- Acrobat Pro for Teams: Starts at $22.19 per license/month with annual discounts. Includes e-signatures, advanced PDF tools, unlimited signatures, export, edit, conversion, and compatibility with Windows/Mac. Features audit trails, 24/7 support, and integrations with Microsoft 365 and Box.

- Acrobat Standard DC for Teams: Starts at $14.99 per license/month (Windows only). Offers basic PDF tools, e-signatures, unlimited signatures, export, editing, mobile scanning, and Microsoft 365 and Box integration, with audit trails and admin console access.

What is PDF to CSV Converter for Xero?

A PDF to CSV Converter for Xero is a tool designed to convert PDF documents, like bank statements, into a CSV format that Xero can easily process.

This software allows users to convert multiple PDFs at once, transforming both standard and scanned documents into CSV files.

Automating this conversion process simplifies data import into Xero, reducing manual effort and ensuring compatibility with the accounting platform.

Why is PDF to CSV Converter for Xero Important?

A PDF to CSV converter for Xero is essential due to its efficiency and advantages over manual data entry. Converting PDFs to CSV for Xero provides significant benefits:

- Speed: OCR converters can process bank statements or invoices in seconds, far surpassing the manual typing speed of 50 to 80 words per minute.

- Compatibility: Xero requires precise formatting for financial statements, and a converter ensures accurate formatting, avoiding errors common with manual processes.

- Accuracy: With OCR technology software can convert bank statements with 99.6% accuracy, greatly exceeding manual data entry.

- Scalability: Automated tools can handle hundreds of documents within minutes, vastly improving efficiency over manual entry.

How do You Select PDF to CSV Converter for Xero

To efficiently import data into Xero, converting PDF bank statements to CSV is crucial since Xero doesn’t support direct PDF imports. Here’s how to choose the right converter:

- High OCR Accuracy & Reliability: Opt for software known for high accuracy to reduce errors during imports.

- Xero Compatibility: Ensure the converter formats CSV files according to Xero’s requirements.

- Scanned Documents: Select a tool with OCR capabilities for extracting data from scanned PDFs.

- Batch Processing: Choose a converter that handles multiple PDFs at once to save time.

- Security: Prioritize software with strong security features to protect your financial data.

FAQs about Best PDF to CSV Converter for Xero

Here are some frequently asked questions about PDF to CSV converters that is compatible with Xero.

How to convert PDF to CSV for Xero?

Choose a converter that offers high accuracy, formats CSVs to meet Xero’s requirements, and supports OCR for scanned documents. Look for batch processing capabilities to handle multiple files efficiently, and ensure the tool provides strong security for safeguarding sensitive financial data.

What is the best PDF to CSV converter for Xero?

The best PDF to CSV converter for Xero depends on your needs, but top options include DocuClipper for its accuracy and batch processing, MoneyThumb for multi-format support, and Hubdoc for seamless integration with Xero. Each offers strong OCR capabilities and security to ensure efficient and accurate data conversion.

What is the most accurate PDF to CSV converter fo Xero?

DocuClipper is is the best OCR software and most accurate PDF to CSV converters for Xero. It uses advanced OCR technology tailored for financial documents, ensuring precise data extraction from bank statements, invoices, and receipts, with a high level of accuracy that minimizes errors during conversion.