Quickbooks is already an integral part of the accounting process for many businesses or accounting practices.

Yet the majority of financial documents are not made compatible with QuickBooks in the first place. That’s why some are compelled to input data manually.

In this comprehensive guide, we’ll talk about how you can avoid this manual data entry process and make it easier with the best PDF to QBO converter software available in the market in 2025.

The Best PDF to QBO Converter Software at a Glance

Here are the top QBO converter software options you can choose from in 2025:

| Software | Standout features |

| DocuClipper | High-accuracy OCR, automatic conversion, custom categories, fraud detection, and strong security measures |

| MoneyThumb | Data extraction from bank statements, powerful analysis tools, cloud-based, and robust security |

| Propersoft | Automatic document settings, export flexibility, supports multiple formats, and responsive support |

| AutoEntry | Automatic data extraction, error checking, financial report generation, and multiple upload methods |

| Rightworks Transaction Pro | Bulk import/export/delete, user-friendly interface, reduces data management time, and seamless QuickBooks integration |

| Nanonets | Machine learning for custom OCR, supports various document types, high precision, and fast processing |

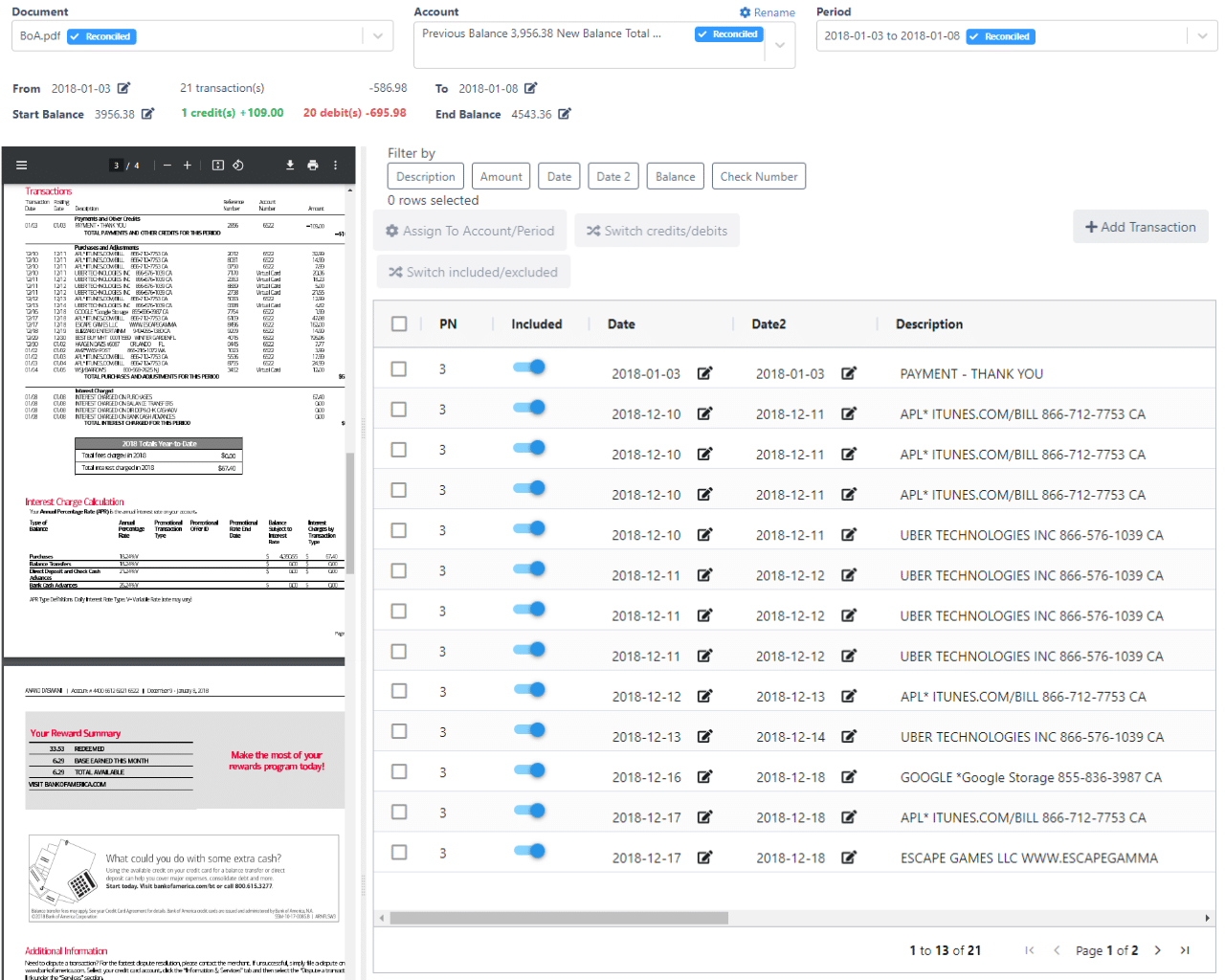

1. DocuClipper

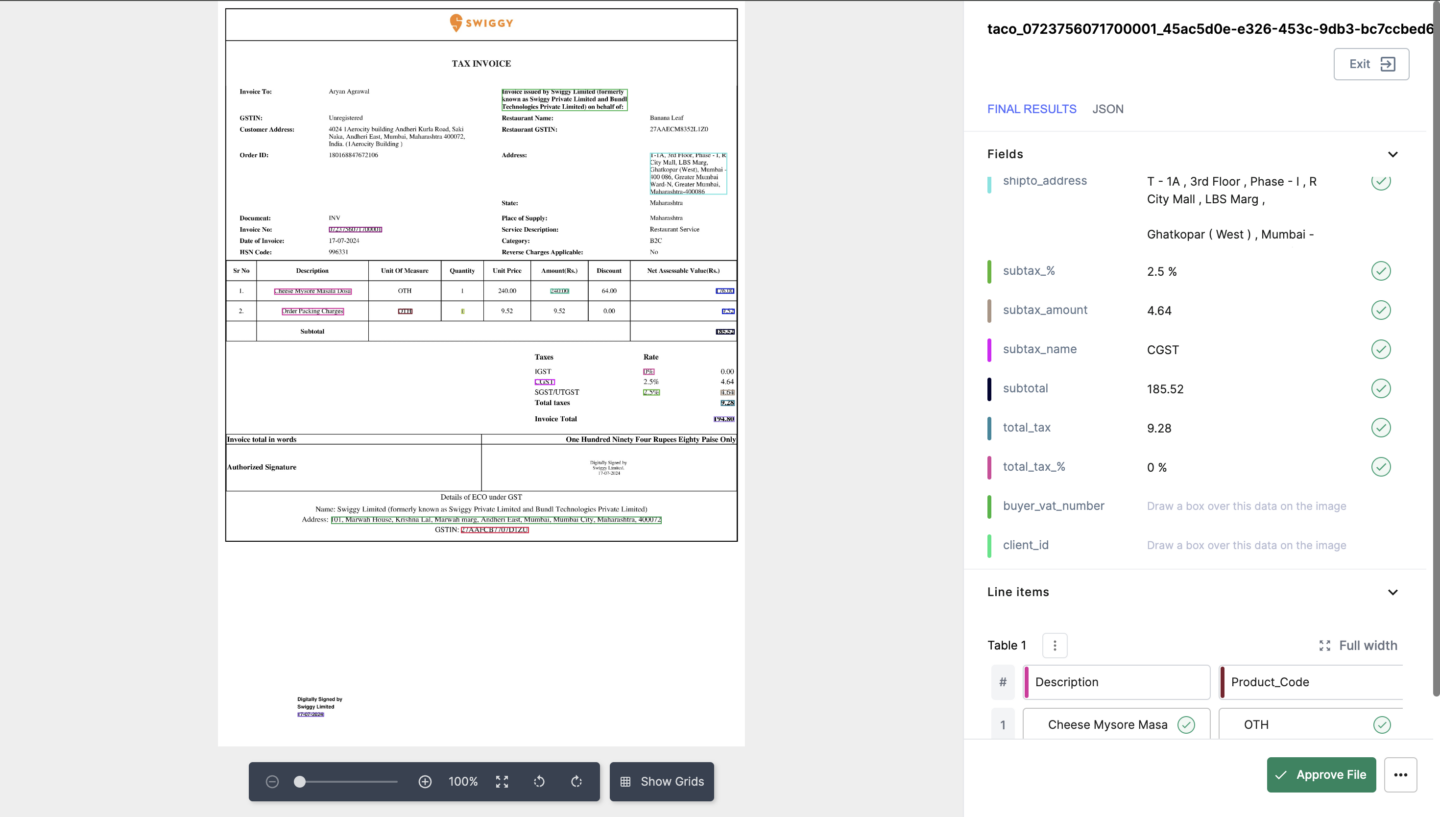

As one of the top bank statement converter software and versatile financial document data extraction apps available, DocuClipper stands out. This OCR tool efficiently extracts data from scanned or PDF bank statements, credit card statements, invoices, receipts, checks, and brokerage statements.

Utilizing advanced OCR technology, it converts documents into structured formats like Excel, QBO, or CSV with 99% accuracy and impressive speed.

It seamlessly imports bank transactions into QuickBooks, Xero, or Sage. By setting up your DocuClipper account, you can directly connect it to QuickBooks online, bypassing the CSV importing step and streamlining your data upload process.

Key Features

- Automatically converts bank statements into Excel or CSV, whether scanned or PDF

- Highly accurate OCR with 99% accuracy for bank statements

- Extracts data automatically from financial documents without needing parsing templates

- Supports all invoices, receipts, and bank statements

- Processes hundreds of documents in seconds

- Custom categories for grouping transactions and clarifying analysis

- Filters and examines transfers to identify fraudulent and preference payments

- Uses latest security measures including SOC 2 compliance, Amazon servers, and AES 256-Bit SSL encryption

- Offers financial investigation tools like file inventory, transaction categorization, transfer detection, and flow of funds analysis

Pros

- Easy to use: DocuClipper is a web-based app that simplifies uploading PDF bank statements and converting them into Excel, QuickBooks, and CSV formats

- Affordable: Ideal for small businesses, starting at just $39 per month for 120 pages

- Accurate: Utilizes OCR technology to ensure highly accurate data conversion from financial documents

- Secure: Keeps your data encrypted and stored on secure servers, ensuring maximum protection

- Direct QBO integration: Connects directly with QuickBooks Online for seamless importing

Cons

- Limited integrations: DocuClipper lacks extensive integration options with other automated bookkeeping and ERP software

- No mobile app: There is no mobile or camera app available for scanning invoices and receipts directly into PDF format

Pricing

Monthly Pricing:

- Starter: $39/month for 120 pages

- Professional: $74/month for 500 pages

- Business: $159/month for 2000 pages

- Enterprise: Custom pricing for a custom number of pages. Contact DocuClipper for details

Annual Pricing (Save 30%):

- Starter: $27/month for 120 pages per month

- Professional: $52/month for 500 pages per month

- Business: $111/month for 2000 pages per month

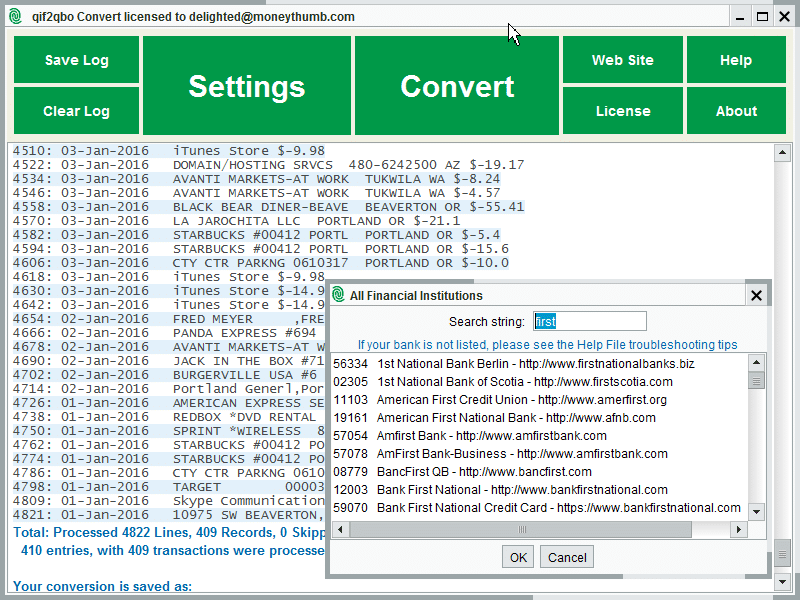

2. MoneyThumb

MoneyThumb is designed to convert PDF bank statements into formats like CSV, QBO, and QFX, compatible with major accounting platforms such as QuickBooks, Quicken, and Xero. Trusted by businesses and individuals globally, MoneyThumb is recognized by industry leaders like Accounting Today and The Financial Brand.

However, recently, many customers have noted that MoneyThumb has not been proactive in maintaining the platform, developing new features, or staying competitive.

Key Features

- Automatic data extraction: MoneyThumb simplifies tracking spending, identifying trends, and spotting potential issues by extracting data from bank statements

- Powerful analysis tools: These tools assist in monitoring spending patterns and identifying financial trends

- Cloud-based: Access MoneyThumb from anywhere with an internet connection, providing flexibility and convenience

- Advanced security: MoneyThumb employs the latest security measures to ensure your data is protected

Pros

- Easy conversion: MoneyThumb simplifies converting PDF statements into formats compatible with accounting software, saving you time and effort on data entry in bookkeeping

- High accuracy: The tool boasts high accuracy in conversions, minimizing errors compared to manual data entry

- Flexible format support: MoneyThumb supports multiple file formats for both input and output, offering greater flexibility

- Time-saving: It accelerates the data entry process, eliminating the need for manual transaction input and boosting efficiency

Cons

- Paid service: MoneyThumb’s cost may be too high for some small businesses or individuals

- Learning curve: As with any new software, there may be a learning period to use MoneyThumb effectively

- Compatibility issues: There may be problems with certain banking or credit card PDFs or specific accounting software

- Reduced maintenance: The platform is less frequently updated, which could affect its performance and the availability of new features

Pricing

MoneyThumb provides pricing details for their QuickBooks converter product, with options for individual users, small businesses, and professionals:

- Individual Plan: $24.95/month for 5 conversions per month ($5.00 per conversion)

- Standard Plan: $49.95/month for 20 conversions per month ($2.50 per conversion)

- Pro Plan: $99.95/month for 60 conversions per month ($1.67 per conversion)

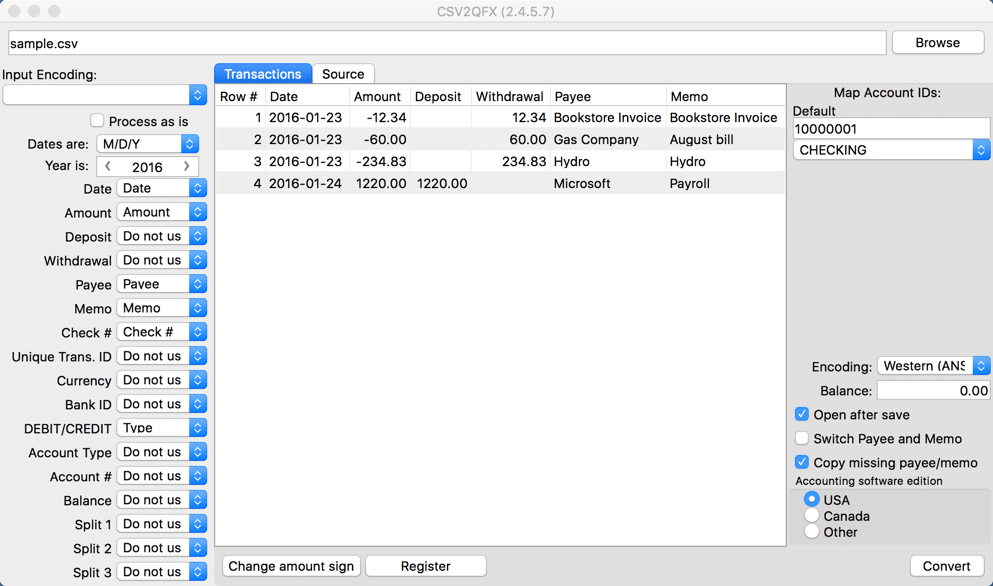

3. Propersoft

ProperSoft develops software tools to convert transaction files, like bank or credit card statements, into various formats for seamless import into accounting and personal finance software.

Their products eliminate the need for manual data entry by converting transaction files into compatible formats for easy import into your accounting system, saving you time and reducing errors.

Key Features

- Automatic settings: Automatically configures number and date formats

- Export compatibility: Works with documents exported from your existing accounting software or downloaded from online banking

- Transaction editing: Exclude or edit transactions during conversion

- CSV export: Export as CSV and work on transactions in Excel before final conversion

- Multi-format support: Use the ProperConvert app to view and convert files to and from multiple formats

Pros

- Offline operation: Works without an internet connection, giving you flexibility and convenience

- One-time payment: Pay once for perpetual use, making it a cost-effective long-term solution

- Responsive support: Benefit from a helpful and responsive support team that enhances your user experience

- Versatile format support: Supports various file formats, increasing the tool’s versatility

Cons

- Accuracy limitations: May not offer the highest accuracy for bank or credit card statements, potentially leading to errors

- Document limitations: Restricted in the types of documents it can convert

- Outdated interface: The user interface is not modern, which could affect usability

- Less efficient: Not as straightforward, making multiple file conversions less efficient

Pricing

ProperSoft offers three types of licenses:

- Monthly License: $19.99 per month, includes access for one user, all converters, formats, apps, ongoing premium support, and free updates

- Yearly License: $119.99 per year, offering the same features as the monthly license at a 50% discount

- Lifetime License: $199.99 one-time payment, includes all converters, formats, apps, and premium support for 24 months, with free updates

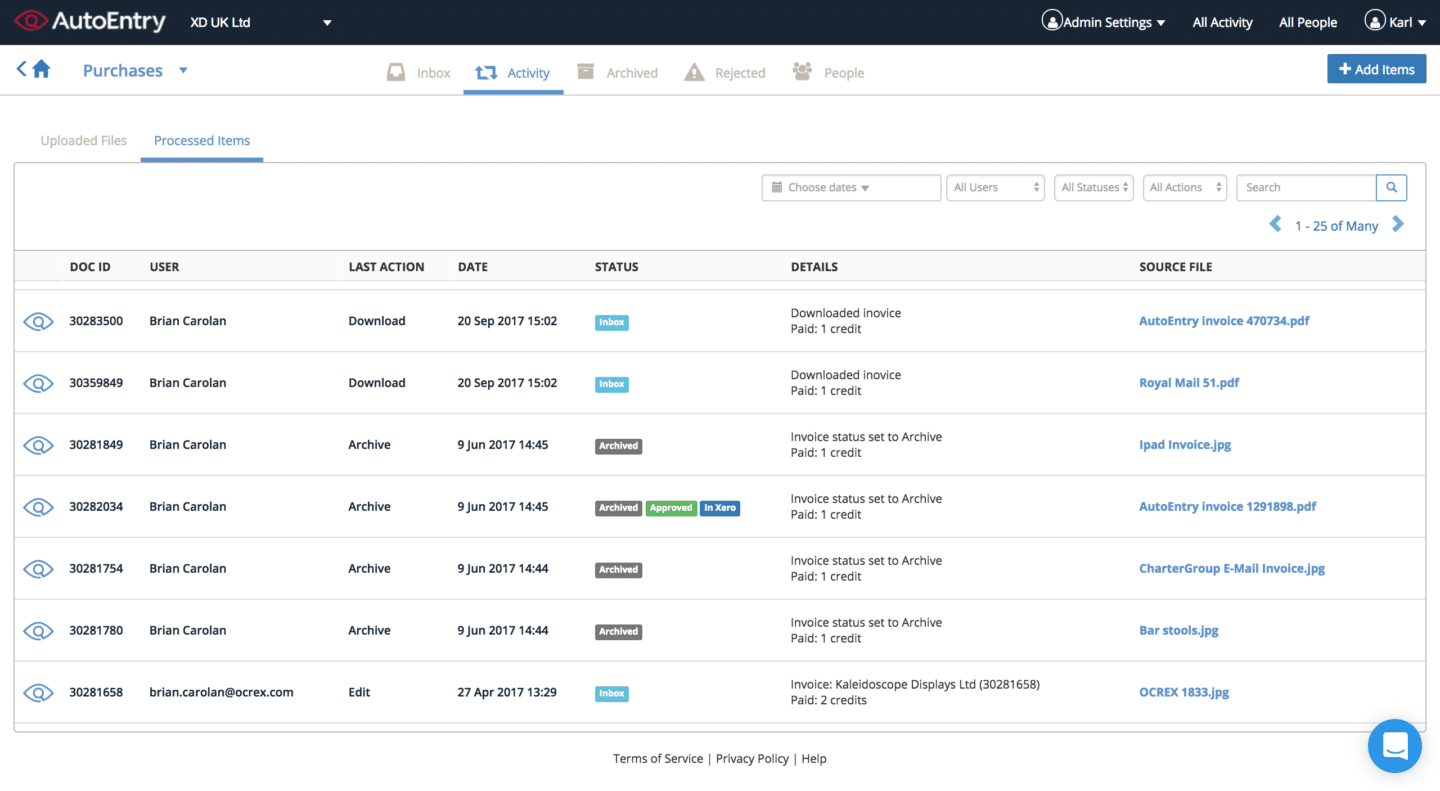

4. AutoEntry

AutoEntry is a cloud-based data entry automation software that helps businesses save time and money by automating the process of entering data into accounting software. AutoEntry can automatically extract data from invoices, receipts, and bank statements, and then classify and categorize it into the correct accounts in your accounting software.

Key Features

- Automatic data extraction: Extracts data from invoices, receipts, and bank statements

- Data classification: Classifies and categorizes data into the correct accounts in your accounting software

- Error checking: Validates data for errors before entry into your accounting system

- Report generation: Produces reports on your financial data

- Software integration: Integrates with various accounting software programs

Pros

- Automates data entry: AutoEntry automates the process of entering data into your accounting software

- Streamlines process: Enhances the efficiency and effectiveness of your financial workflows

- Seamless integration: Integrates smoothly with accounting software like QuickBooks, Xero, Sage, and more, streamlining your workflow

- Financial insights: Provides valuable insights into your business’s financial performance

- Multiple upload methods: Allows document uploads via email, mobile app, scanner, or cloud storage services like Dropbox or Google Drive

Cons

- Steeper learning curve: AutoEntry may be challenging to learn, especially if you’re not tech-savvy

- Variable processing time: Processing can take from several minutes to several hours

- Subscription-based: Operates on a subscription model, which might not be cost-effective for all businesses

Pricing

AutoEntry uses a credit system where tasks consume a certain number of credits. All plans offer unlimited cloud storage, users, and clients for accountants and bookkeepers.

Pricing in Euros (€):

- Bronze: €13.50/month for 50 credits

- Silver: €26/month for 100 credits

- Gold: €46/month for 200 credits

- Platinum: €110/month for 500 credits

- Diamond: €295/month for 1500 credits

- Sapphire: €465/month for 2500 credits

Credit Usage:

- 1 Credit: Standard extraction for purchase/sale invoices, receipts, and bills

- 2 Credits: Extraction of line items for purchase/sale invoices, bills, and supplier statements

- 3 Credits: Per page for bank or credit card statements

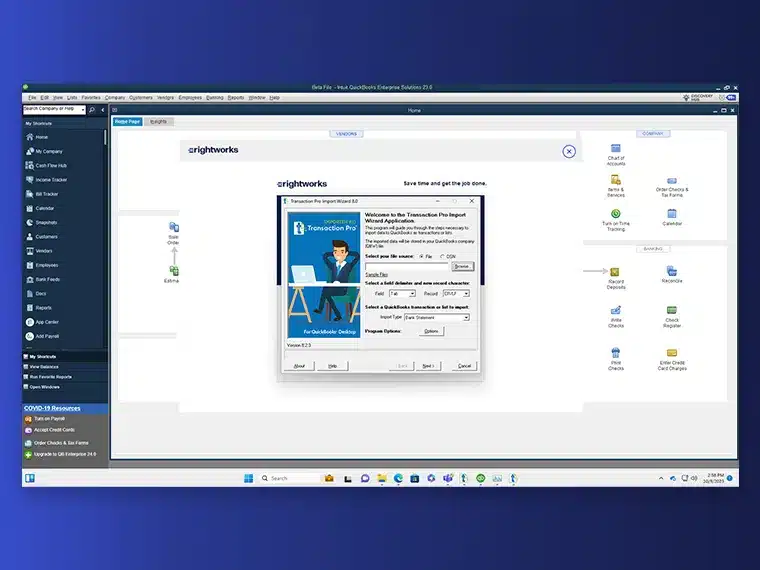

5. Rightworks Transaction Pro

Optimize QuickBooks with Transaction Pro, designed to enhance efficiency and minimize errors. This software allows you to bulk import, export, and delete transactional and list data from Excel and CSV files into QuickBooks Online, saving you hours of manual data entry. With Transaction Pro, you can manage accounting data needs swiftly and accurately, streamlining your workflow and eliminating tedious manual input.

Key Features

- Importer: Eliminate manual data entry and reduce errors by importing lists and transactions into QuickBooks. Supports over 20 transaction and list types. Easily map your columns by fields

- Exporter: Simplify data exporting for reporting, analysis, or migrating to another QuickBooks company. Export only the necessary columns and send to CSV

- Deleter: Maintain accurate and up-to-date QuickBooks data by removing unwanted or outdated large company files. Perform batch deletions efficiently

Pros

- Time-saving: Significantly reduces the time spent on data management tasks

- User-friendly interface: Allows seamless integration with QuickBooks, making it easy to use

- Effortless operation: Simplifies your work, making data handling effortless and efficient

Cons

- Performance lag: May experience delays, especially with large datasets or complex operations

- Manual work: Manual operations could be improved, and the software’s licensing and activation process is not optimal

- Version issues: You might need to install a different version for use on a remote desktop, which can be inconvenient

Pricing

- Importer for QBD: $199 one-time purchase for unlimited company files and record imports, including online chat and 1-year email support

- PRO for QBD: $299 one-time purchase for unlimited company files, record imports, exports, and deletions, with online chat and 1-year email support

- Essentials for QBO: $10 per month for importer and exporter tools for one QBO company, with unlimited users, admin portal, 200 rows of data per month, online chat, and email support

- Growth for QBO: $30 per month for full suite for up to three QBO companies, including importer, exporter, deleter tools, unlimited users, admin portal, record import/export/delete, online chat, and email support

6. Nanonets

Nanonets is a machine learning platform that enables businesses to create custom deep learning models without coding, used for tasks like document extraction, object detection, and image classification.

With Nanonets OCR, organizations can extract data from various documents, such as electrical meter readings, ID cards, mortgage forms, invoices, income proofs, and purchase orders, transforming them into structured data.

Key Features

- Machine learning models: Develop and deploy models to classify and extract data from invoices, receipts, and contracts, reducing manual data entry

- Custom models: Create models without extensive programming by defining document structures and specifying the data to extract

- Pre-built models: Utilize customizable models like Driver License OCR, Passport OCR, and ID Card OCR for common scenarios, supporting multiple languages and layouts

- OCR and AI: Apply these technologies to various documents, including receipts, invoices, and purchase orders

- File format support: Handle popular formats like PDF, JPG, PNG, and TIFF, offering flexibility with existing data

Pros

- Versatile document support: Handles a vast range of document types, catering to different needs

- Advanced AI and OCR: Utilizes state-of-the-art technology for superior data extraction

- Responsive support: Offers excellent assistance, promptly addressing your queries and issues

- High precision: Ensures reliable data extraction from various document formats

- Fast processing: Enhances operational efficiency by processing documents quickly, saving valuable time

Cons

- Overwhelming features: The advanced capabilities and wide document support may be overwhelming if you’re new to AI and OCR technology

- Steep learning curve: Despite excellent customer service, fully utilizing all features can be challenging

- Time-consuming customization: Customizing models to fit specific needs can take considerable time

- Premium pricing: High accuracy and fast processing come at a premium, which may not be cost-effective for small-scale users

- Resource requirements: Advanced AI processing may require robust system resources, which could be a limitation for some users

Pricing

- Starter: Free for the first 500 pages, then $0.3/page. No monthly fee, pay as you go, with 3 starter models and limited fields

- Pro: $499/month per model, includes 5000 pages, then $0.1/page. Offers data capture line items, up to 20 fields, and additional features like annotation services and customization hours

- Enterprise: Custom pricing. Includes everything in Pro, plus features like SSO/SAML Login, SLAs, a dedicated account manager, and custom integrations

What is a PDF to QBO Converter?

A PDF to QBO converter is specialized software designed to automatically transform PDF financial documents into a format that’s directly compatible with QuickBooks. This conversion simplifies the process of importing various types of financial files—including bank statements, credit card statements, invoices, and receipts—into QuickBooks.

By converting these documents into QBO format, you can streamline your accounting tasks, eliminate manual data entry, and ensure your financial data is accurately and efficiently integrated into your QuickBooks system.

Most PDF to QBO converters utilize OCR (Optical Character Recognition) technology. These OCR data extraction tools typically first convert PDF financial statements to XLS or CSV, but the best ones can convert directly to QBO format for seamless QuickBooks integration.

What is QBO and Why Convert PDF to QBO?

QBO stands for QuickBooks Online, a file format specifically designed for QuickBooks accounting software.

A QBO file contains transaction data formatted for easy import into QuickBooks Online or QuickBooks Desktop, organizing details like dates, amounts, descriptions, and payees into a structured file optimized for QuickBooks. This conversion bridges the gap between PDF source documents and your QuickBooks chart of accounts.

Key reasons to convert PDFs to QBO include:

- Avoid manual data entry: Import transactions with a few clicks, eliminating tedious manual entry

- Compatibility: Works for both QuickBooks Desktop and Online

- Error reduction: Minimizes mistakes from manual data entry

- Time savings: Speeds up workflow, saving time and money

- Structured data: Organizes unstructured PDF data into a standardized format

- Simpler than CSV: Avoids challenges with templates, mapping, and formatting issues in CSV files

- Faster transaction categorization: Streamlines categorizing bank or credit card transactions, reducing errors

Key Features to Look for in a PDF to QBO Converter

When selecting a PDF to QBO converter, consider these essential features:

- Accuracy and reliability: Ensure the tool is reliable and accurate to avoid costly errors

- Ease of use: Look for a user-friendly interface that is easy for new users to learn

- Speed of conversion: Opt for a converter that processes documents quickly, ideally in under 30 seconds

- Integration capabilities: Make sure it is compatible with your accounting software

- Security and data privacy: Since you handle confidential financial documents, the converter must be secure and protect your data

- OCR quality: Higher quality OCR technology means better data extraction from your documents

- Customer support: Responsive support is important when you encounter issues

- QuickBooks compatibility: Ensure the tool works with your version of QuickBooks (Online or Desktop)

- Transaction categorization: Look for tools that help automatically categorize your transactions

How to Select the Right PDF to QBO Converter for Your Business

Choosing the right PDF to QBO converter for your accounting tasks involves several steps to ensure it meets your needs:

- Identify workflow integration: Determine where in your workflow a converter would be most beneficial. Pinpoint tasks that will be streamlined by using the converter.

- Test with a demo: Try a demo version to see if it suits your needs and is user-friendly for your team.

- Evaluate pricing: Select a pricing plan that aligns with your budget and usage requirements, ensuring it provides good value.

- Check document compatibility: Ensure the converter works well with your specific document types and formats.

- Assess security features: Verify the tool has strong security measures to protect your financial data.

- Implement and train: Start integrating the converter into your workflow and provide training for your team to maximize its effectiveness. This ensures smooth adoption and optimal use.

Conclusion

Using a PDF to QBO converter significantly speeds up the processing of financial documents and streamlines your accounting workflows. However, with many options available, it’s crucial to evaluate each one carefully.

Consider the pros and cons of each software, focusing on aspects like accuracy, ease of use, speed, integration capabilities, and security. Test different converters to see which one best fits your workflow and budget.

Choose the one that offers the best balance of price and utility for your specific needs. Investing time in selecting the right converter will streamline your accounting processes and enhance efficiency, ultimately saving you valuable time and reducing errors in your financial data management.

Among the options reviewed, DocuClipper stands out as the best PDF to QBO converter due to its high accuracy, affordable pricing, and user-friendly interface. With DocuClipper, you can directly link your account with QuickBooks, eliminating the need for manual exports and imports.

Try DocuClipper PDF to QBO Converter for Free

Automatically convert all your PDF bank, credit card, and brokerage statements, invoices, and receipts into QBO format, and seamlessly import them into QuickBooks within seconds.

Choosing the right converter can significantly enhance your workflow, saving you time and reducing errors. DocuClipper stands out as the best PDF to QBO converter due to its affordable pricing, highest accuracy, and ease of use. With this software, you don’t even have to download it as QBO, you can automatically link up your DocuClipper and QuickBooks account, cutting out the exporting and importing process.

Try DocuClipper today with a free trial and experience the efficiency and reliability it brings to your accounting processes.

FAQs about Best PDF to QBO Converter

Here are some frequently asked questions about PDF to QBO converters:

How do I convert a file to QBO?

To convert a file to QBO, use a PDF to QBO converter software. Upload your PDF financial document to the converter, and it will automatically process and convert the file into QBO format, ready for import into QuickBooks.

Can you convert an Excel file to QBO file?

Yes, you can convert an Excel file to QBO using specific converter tools that support Excel to QBO conversion. These tools will map your Excel data to the appropriate QBO format.

What format is QBO?

QBO is a file format used by QuickBooks Online and QuickBooks Desktop. It contains transaction data such as dates, amounts, descriptions, and payees, formatted for easy import into QuickBooks.

What is the best program to convert PDF to QBO?

The best program to convert PDF to QBO depends on your specific needs. Popular options include DocuClipper, MoneyThumb, and AutoEntry, each offering different features, pricing, and integration capabilities. For most small to medium businesses, DocuClipper offers the best combination of accuracy, ease of use, and value.

How to convert PDF to QBO format?

To convert a PDF to QBO, upload your PDF document to a PDF to QBO converter tool. The software will extract the necessary data and convert it into QBO format, which you can then import into QuickBooks.

How do I upload a PDF bank statement to QBO?

First, convert the PDF bank statement to QBO format using a PDF to QBO converter. Once converted, log in to QuickBooks, navigate to the banking section, and upload the QBO file. The transactions will then be imported into your QuickBooks account.