Key Takeaways

- Bookkeeping clean-up helps you organize financial records, correct errors, and maintain accurate financial statements.

- Disorganized books lead to compliance issues, tax penalties, and inaccurate financial reporting, making clean-up essential for financial stability.

- Using bookkeeping software and automation reduces manual errors, streamlines reconciliation, and simplifies financial management.

- Regular reconciliations, proper expense categorization, and internal controls help prevent future bookkeeping issues.

- Hiring a professional bookkeeper can save time and ensure compliance if your records are severely disorganized or you’re preparing for an audit.

What is Bookkeeping Clean Up?

Bookkeeping clean-up is the process of reviewing, organizing, and correcting financial records to ensure they are accurate, complete, and up-to-date.

You address past errors, reconcile transactions, and categorize expenses properly. Catch-up bookkeeping and bookkeeping clean up are often used interchangeably, but both involve fixing inconsistencies and filling in missing financial data.

If your records are disorganized, you can’t track cash flow accurately, file taxes correctly, or make informed business decisions. Cleaning up your books helps you stay compliant, avoid penalties, and prepare for audits. It also ensures financial reports reflect your business’s true financial health.

Whether you’ve neglected your books for months or just need to correct mistakes, bookkeeping clean up brings clarity, prevents future issues, and keeps your accounting system running smoothly.

Why is Bookkeeping Clean Up Important?

Keeping your books clean isn’t just about organization—it’s essential for maintaining financial accuracy and making informed decisions. When your records are up to date, you avoid compliance issues, reduce tax headaches, and gain better control over your business’s financial health. Here’s why bookkeeping clean up matters:

- Prevents inaccurate financial reporting: When your books are messy, your financial statements don’t reflect reality. You might overestimate revenue, miscalculate expenses, or miss critical financial trends, leading to poor business decisions.

- Ensures compliance and avoids penalties: Tax agencies and regulatory bodies require accurate records. If your books are disorganized, you could face fines, late fees, or even audits, which can disrupt your business and cost you money.

- Makes tax preparation easier: Clean books help you categorize expenses correctly and track deductible costs. This reduces errors in tax filings, prevents overpayments, and ensures you claim all eligible deductions.

- Strengthens client trust and credibility: If you run an accounting business, well-maintained books show professionalism. Clients rely on you for accuracy, and clean financial records build long-term trust and business relationships.

- Improves financial decision-making: Accurate records allow you to track cash flow, measure profitability, and identify areas for growth. Without clean books, you could be making decisions based on outdated or incorrect data.

- Saves time and reduces stress: Fixing messy records at the last minute is time-consuming and frustrating. When your books are up to date, you avoid scrambling during tax season or financial reviews.

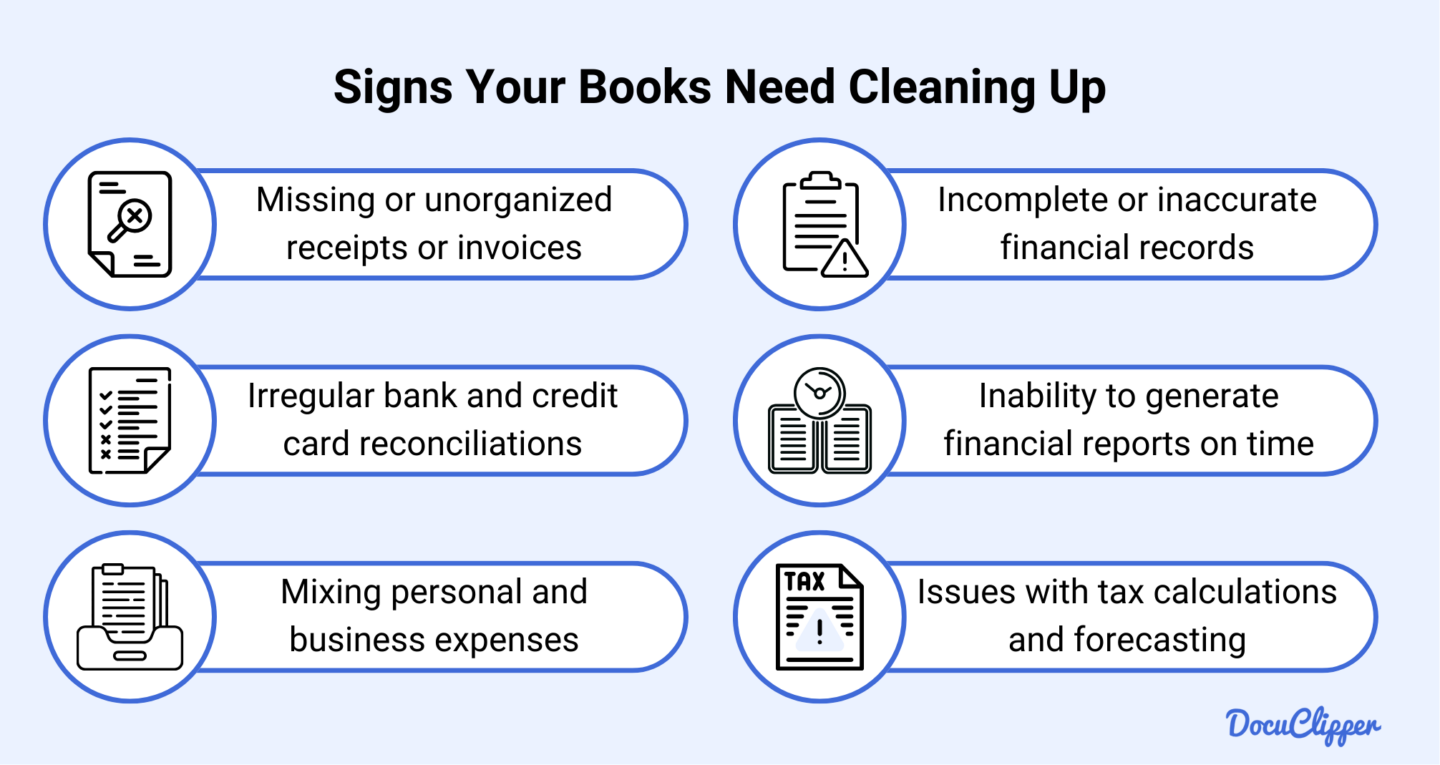

Signs Your Books Need Cleaning Up

It’s easy to delay bookkeeping or rely on quick fixes, but disorganized records can create serious financial problems. If your books are messy, you might struggle with expenses, miss key financial details, or run into compliance issues. Here are clear signs that you need a bookkeeping clean up:

- Missing or unorganized receipts or invoices: You can’t find key financial documents, making tax filing and financial reporting difficult. Without proper records, you risk misreporting income and expenses.

- Irregular bank and credit card reconciliations: You’re not matching transactions consistently, which allows errors and discrepancies to go unnoticed. This leads to inaccurate reports and cash flow mismanagement.

- Mixing personal and business expenses: Your business and personal transactions aren’t separated, creating tax complications and unreliable financial reports. This also increases the risk of compliance issues.

- Incomplete or inaccurate financial records: Transactions are missing or categorized incorrectly, making it impossible to assess your true financial position. This can lead to poor decision-making and tax filing errors.

- Inability to generate financial reports on time: You struggle to produce profit and loss statements, balance sheets, or cash flow reports when needed, signaling bookkeeping delays.

- Issues with tax calculations and forecasting: You’re unsure about tax estimates or struggling to categorize expenses for deductions, increasing the risk of penalties and missed savings.

Step-by-Step Bookkeeping Clean-Up Process Checklist

Cleaning up your books can feel overwhelming, but breaking it down into clear steps makes the process manageable. Whether you’re catching up on months of records or just fixing inconsistencies, following a structured approach ensures accuracy and efficiency. Use this checklist to get your financial records organized and up to date.

Step 1: Gather All Financial Documents

Before starting cleanup, gather all essential financial records to ensure accuracy. Collect bank and credit card statements for the cleanup period, along with receipts, invoices, and expense records to track income and expenses. Gather payroll records and tax documents to verify wage payments and deductions.

If applicable, include loan statements to track balances and interest. Having all documents in one place helps prevent missing transactions and ensures a smoother cleanup.

Having all your financial records in one place will help you move through the bookkeeping clean up efficiently while reducing the risk of missing important transactions.

Step 2: Set Up Your Workspace and Tools

A well-organized system makes bookkeeping cleanup easier. Choose bookkeeping software if you’re not already using one to streamline reconciliations and reporting. Ensure you have access to financial accounts to avoid login delays.

Create a filing system for both physical and digital documents to keep records easily accessible. Finally, establish a backup system to protect financial data from accidental loss. A structured setup saves time and prevents errors.

Step 3: Establish Your Baseline and Cleanup Timeline

Before diving into bookkeeping cleanup, you need to assess how much work is required. Start by determining how far back your cleanup needs to go. If records have been neglected for months or even years, setting a clear scope helps you stay focused.

Identify a “known good” starting point—the last time your books were accurate and fully reconciled. This serves as your reference point, allowing you to catch and correct errors from that point forward.

To stay on track, break the cleanup process into manageable phases. Set realistic timeline goals for each stage, ensuring you’re not overwhelmed.

Use a checklist to monitor progress. Listing tasks such as reconciling accounts, categorizing expenses, and verifying records keeps you organized.

Finally, set aside dedicated time blocks for cleanup work. Regular, focused sessions prevent the process from dragging on and help you complete it efficiently.

Step 4: Review and Standardize Chart of Accounts

A well-organized chart of accounts is essential for accurate bookkeeping. If your account structure is inconsistent, it can lead to misclassified transactions and reporting errors. Start by examining your current account setup to ensure it aligns with your business needs and financial reporting standards.

Look for duplicate accounts that may have been created by mistake and consolidate them where necessary. Having multiple accounts for the same category can confuse and make reporting more complicated. At the same time, identify missing accounts that are needed for proper categorization and create them to maintain a complete and accurate financial structure.

Next, standardize naming conventions to keep your chart of accounts clear and consistent. This makes it easier to track expenses and revenue while ensuring accuracy across financial reports.

Finally, align your chart of accounts with tax reporting requirements to simplify tax preparation and compliance. A well-structured chart ensures that financial data flows correctly into tax forms, minimizing errors and making tax filing more efficient.

Step 5: Reconcile Bank and Credit Card Accounts

Now that your financial documents are gathered, your workspace is organized, and your chart of accounts is standardized, it’s time to reconcile your bank and credit card accounts.

This step ensures that your recorded transactions match actual bank activity, preventing discrepancies that could lead to inaccurate financial reports.

If your chart of accounts wasn’t properly structured before, miscategorized transactions could create errors that need correction after reconciliation. By following these steps, you can verify that all financial data is accurate and up to date.

Checklist for Reconciling Bank and Credit Card Accounts:

☐ Gather your bank and credit card statements: Download statements for the cleanup period to compare against your books.

☐ Compare each transaction with accounting records: Match every deposit, withdrawal, and payment in your bank statements to your bookkeeping system.

☐ Identify and enter missing transactions: Look for transactions in the bank statement that aren’t recorded in your books and enter them correctly.

☐ Resolve discrepancies: Investigate mismatches between your statements and books. Common issues include duplicate entries, missing transactions, or incorrect amounts.

☐ Check for bank fees and interest charges: Ensure all bank charges, overdraft fees, and interest payments are recorded to maintain accuracy.

☐ Verify cleared and outstanding checks: Confirm that issued checks have cleared. If any remain outstanding for too long, follow up with the recipient.

☐ Review for unauthorized transactions: Look for unusual or fraudulent charges and flag anything that requires further investigation.

☐ Document reconciliation adjustments: Keep a record of corrections made during the process to maintain accuracy in future reconciliations.

By following these steps in order, you ensure that your financial records match your actual cash flow, reducing the risk of errors and financial mismanagement.

Step 6: Clean Up Accounts Receivable

Cleaning up accounts receivable ensures that your records accurately reflect what customers owe you and helps improve cash flow. Start by reviewing all outstanding customer invoices to confirm they are correctly recorded and not overdue.

Matching payments received with open invoices ensures that your books reflect the latest transactions and that no payments go unaccounted for.

Next, identify any duplicate or erroneous invoices. Incorrect entries can cause confusion and lead to disputes or overstatements in revenue. Resolving these errors keeps your records clean and prevents unnecessary follow-ups with customers.

If any invoices remain unpaid or disputed, contact customers to clarify outstanding balances and determine a resolution. Following up consistently on overdue invoices helps prevent cash flow problems.

Finally, generate an accounts receivable aging report to categorize overdue invoices by time period. This allows you to prioritize collections, set clear payment deadlines, and implement a strategy for following up with customers. Keeping your accounts receivable clean ensures that your business collects payments efficiently and maintains accurate financial records.

Step 7: Organize Accounts Payable

Keeping accounts payable organized ensures you stay on top of vendor payments and avoid late fees. Review all vendor statements and outstanding bills to confirm unpaid amounts. Verify payment status to ensure no invoices are missed or duplicated.

Next, remove duplicate vendor entries and consolidate records to streamline tracking. Match purchase orders to invoices and payments to verify that every recorded expense is accurate.

Finally, create a payment schedule for outstanding obligations. Setting clear due dates helps maintain cash flow and strong vendor relationships while preventing overdue penalties.

Step 8: Correct Expense Categorization

Accurate expense categorization ensures that your financial reports reflect the true nature of your spending. Review all expenses to confirm they are properly classified according to your chart of accounts. Fix any miscategorized expenses to prevent inaccurate reporting and tax complications.

Assign uncategorized expenses to the appropriate accounts to ensure that every transaction is accounted for. Maintain consistency across similar expenses so that reporting remains accurate and easy to analyze.

Flag any unusual or high-value transactions for further investigation. Identifying discrepancies early helps prevent errors, improves budgeting, and ensures compliance with tax regulations.

Step 9: Review Fixed Assets and Inventory

Keeping track of fixed assets and inventory ensures accurate financial reporting and helps prevent discrepancies in valuation. Update the fixed asset register to reflect current assets and verify that all acquisitions and disposals are properly documented.

Check depreciation calculations to ensure they are accurate and in line with accounting standards. Reconcile physical inventory with accounting records to identify any discrepancies, such as missing or excess stock.

If necessary, update asset values to reflect their current worth. Maintaining accurate records of fixed assets and inventory improves financial transparency and ensures compliance with reporting requirements.

Step 10: Organize Tax Documentation

Organizing tax documentation ensures compliance and simplifies tax filing. Separate and store all tax-related documents, including income records, expense receipts, and prior tax returns, to keep everything easily accessible.

Verify that all tax-deductible expenses are correctly classified to maximize deductions and avoid errors. Review sales tax collections and payments to ensure they align with tax regulations and reporting requirements.

Organize payroll tax documentation, including employee withholdings and employer tax contributions, to avoid compliance issues. Double-check that all necessary tax forms are prepared and filed on time to prevent penalties and ensure smooth tax reporting.

Step 11: Verify Financial Statements

Verifying financial statements ensures that your books accurately reflect your business’s financial position. Start by generating a trial balance to confirm that debits and credits align correctly. Any discrepancies at this stage indicate errors that need further review.

Review balance sheet accounts to ensure assets, liabilities, and equity are correctly recorded. Analyze the income statement for inconsistencies, such as missing revenue or misclassified expenses, that could distort profitability.

Make necessary adjusting entries to correct errors and ensure all financial data is accurate. Once all adjustments are made, generate corrected financial statements to provide a clear and reliable overview of your business’s financial health.

Step 12: Document Procedures and Implement Controls

After cleaning up your books, documenting procedures ensures consistency and prevents future errors. Keep a record of all corrections and adjustments made during the cleanup process to maintain transparency and provide a reference for future bookkeeping.

Create written procedures outlining how financial tasks should be handled, including transaction categorization, reconciliations, and reporting. Clearly define responsibilities for bookkeeping tasks to ensure accountability and avoid mismanagement.

Implement internal controls such as approval workflows and separation of duties to minimize errors and reduce the risk of fraud. Set up a regular review schedule to maintain clean books and catch discrepancies before they become major issues.

Step 13: Final Review and Reporting

Before closing the cleanup process, conduct a final review of all accounts to ensure accuracy and completeness. Double-check reconciliations, expense categorizations, and outstanding transactions to confirm that everything is properly recorded.

Generate key financial reports, including the profit and loss statement, balance sheet, and cash flow statement. Compare the cleaned-up books with previous versions to identify improvements and ensure past errors have been corrected.

Document any remaining issues that need attention and outline any adjustments that may still be required. Finally, schedule regular maintenance reviews to keep financial records accurate and prevent future backlogs.

Step 14: Plan for the Future

Keeping your books clean isn’t just a one-time task—it requires ongoing maintenance. Set up automated bookkeeping systems where possible to streamline transaction tracking, reconciliations, and reporting. Automation reduces manual errors and saves time.

Create a calendar for regular reconciliations to ensure transactions are reviewed and categorized on time. Scheduling periodic bookkeeping reviews helps catch discrepancies early and keeps financial records accurate.

For complex bookkeeping issues, consider professional consultation to ensure compliance and best practices. Training relevant team members on updated bookkeeping procedures ensures consistency and prevents future errors. A proactive approach keeps your financial records organized and your business running smoothly.

Tools and Software for Effective Bookkeeping Cleanup

Using the right tools makes bookkeeping cleanup faster and more efficient. You can pre-accounting, improve accuracy, and streamline reconciliations to save time. Here are some of the best tools to help you clean up your books:

- QuickBooks Online: If you run a small or medium business, QuickBooks Online gives you everything you need for bookkeeping cleanup. You can reconcile bank accounts, categorize expenses, and generate financial reports with ease. Its integrations help you automate processes and reduce errors.

- DocuClipper: If you’re dealing with months of backlogged receipts and invoices, DocuClipper can help. It extracts data from PDFs in bulk and converts them into organized spreadsheets or direct QuickBooks imports. This eliminates tedious data entry and speeds up your bookkeeping cleanup.

- Xero: With its cloud-based system and strong reconciliation features, Xero makes it easy for you to manage bulk transactions. You get clear financial data visualizations, helping you spot discrepancies quickly.

- Dext Prepare (formerly Receipt Bank): You don’t have to manually enter receipt and invoice details anymore. Dext Prepare extracts key information, categorizes expenses, and syncs directly with your accounting software, saving you time.

- SmartVault: If you need a secure way to store and organize financial documents, SmartVault helps you keep everything in one place. Its structured system makes it easier for you to maintain clean records and retrieve documents when needed.

Preventing Future Bookkeeping Issues

Once your books are cleaned up, keeping them that way requires a structured approach. Implementing consistent processes, leveraging automation, and maintaining regular reviews help prevent errors from piling up again. Here’s how you can maintain clean financial records long-term:

- Establish consistent systems and processes: Standardize bookkeeping procedures, set clear financial record-keeping policies, and maintain an organized chart of accounts. A structured system reduces errors and keeps financial data reliable.

- Follow a regular maintenance schedule: Assign daily, weekly, monthly, and annual bookkeeping tasks to ensure records stay up to date. Regular reconciliations, financial reviews, and audit preparations help avoid last-minute errors.

- Use technology and automation: Selecting the right bookkeeping software, automating data entry, and setting up cloud backups reduce manual work and prevent data loss. Automated reconciliation and receipt capture tools improve efficiency and accuracy.

- Train staff and define responsibilities: Clearly assign bookkeeping tasks and cross-train employees to avoid dependency on one person. Ongoing education on best practices ensures that financial processes remain consistent and error-free.

- Implement internal controls and oversight: Set up approval workflows, separation of duties, and exception reporting systems to minimize fraud and human error. Regular internal audits strengthen financial accountability.

- Monitor financial health proactively: Track key financial metrics, review statements regularly, and set up early warning systems for discrepancies. Monitoring cash flow and budget variances helps identify issues before they escalate.

- Work with financial professionals: Consult accountants or bookkeepers for complex financial matters. Establish review schedules and maintain clear communication with financial advisors to ensure compliance and strategic planning.

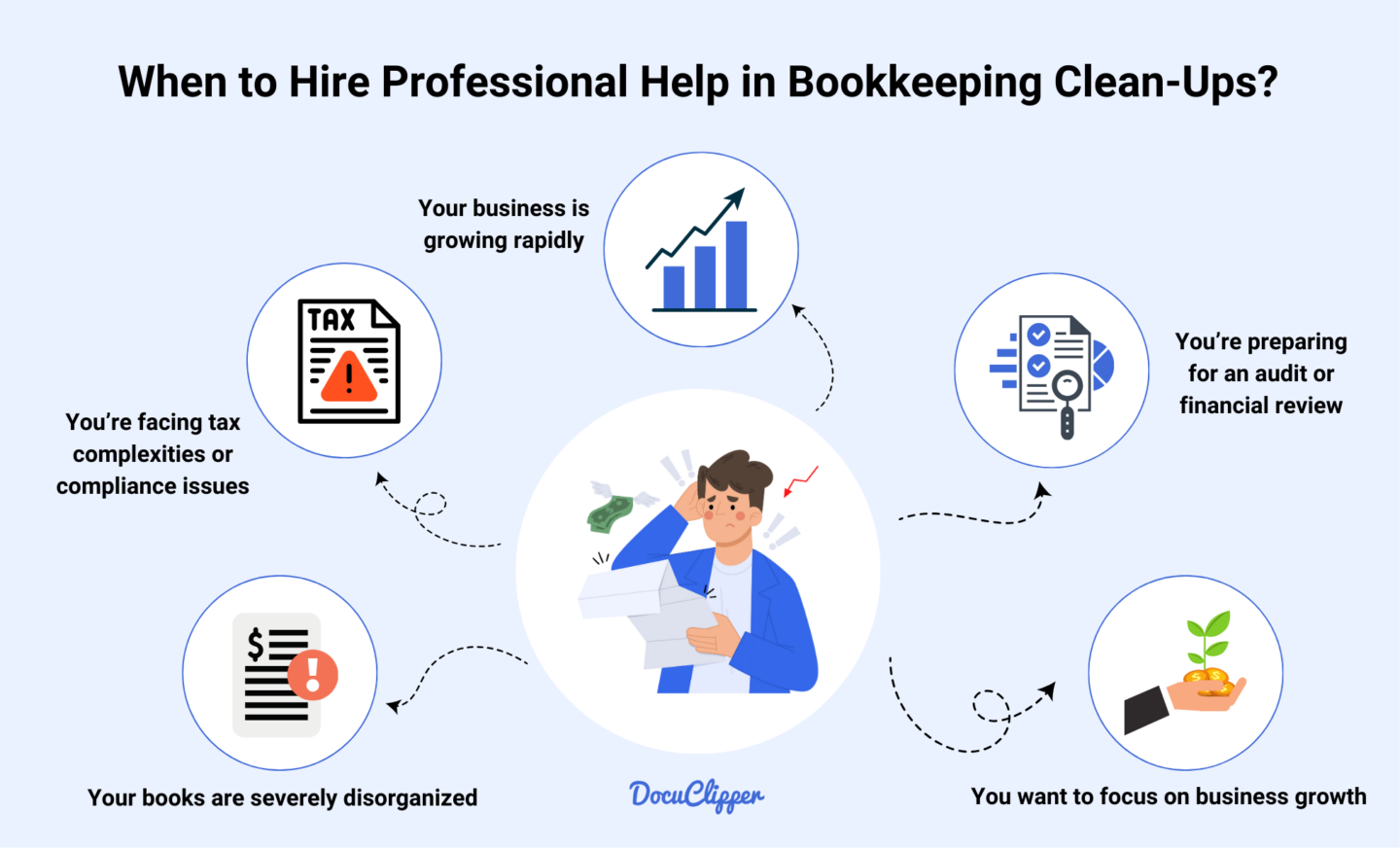

When to Hire Professional Help

Handling bookkeeping on your own can be manageable, but certain situations call for professional expertise. If you find yourself in any of the following scenarios, it may be time to hire a bookkeeper or accountant:

- Your books are severely disorganized: If you’re months or years behind on bookkeeping, have missing records, or struggle to reconcile accounts, a professional can clean up your books efficiently.

- You’re facing tax complexities or compliance issues: If you’re unsure about tax deductions, sales tax filings, or payroll taxes, an accountant ensures compliance and helps you avoid penalties.

- Your business is growing rapidly: When transaction volume increases, managing books manually becomes overwhelming. A professional helps you maintain accuracy while scaling operations.

- You’re preparing for an audit or financial review: If you’re facing an audit, lender review, or investor scrutiny, a professional can ensure your financial statements are in order and support you through the process.

- You want to focus on business growth: If bookkeeping takes too much of your time, outsourcing bookkeeping allows you to concentrate on growing your business while ensuring financial accuracy.

FAQs about Bookkeeping Clean Up

Here are frequently asked questions about bookkeeping clean-ups:

What are the 5 stages of bookkeeping?

Bookkeeping follows five key stages: recording transactions to track all financial activity, classifying transactions to organize them into categories, reconciling accounts to ensure records match bank statements, generating financial reports like profit and loss statements, and analyzing financial data to support decision-making. These steps ensure accurate and reliable financial records.

How to do catch up bookkeeping?

Catch-up bookkeeping involves gathering all missing financial records, categorizing transactions, and reconciling accounts to bring books up to date. Start by collecting bank statements, invoices, and receipts. Then, enter and categorize transactions, ensuring accuracy. Reconcile accounts to match financial records with actual transactions. Finally, generate financial reports and review for errors.

What is the difference between catch up and clean up bookkeeping?

Catch-up bookkeeping focuses on recording and reconciling past transactions to bring financial records up to date. Clean-up bookkeeping goes further by correcting errors, reorganizing accounts, and ensuring financial statements are accurate. While catch-up bookkeeping fills in missing data, clean-up bookkeeping improves accuracy and compliance for better financial management.

What are the four steps of bookkeeping?

Bookkeeping follows four key steps: recording transactions to document all income and expenses, classifying transactions into appropriate accounts, reconciling accounts to ensure financial records match bank statements, and generating financial reports like profit and loss statements to analyze business performance. These steps keep financial records accurate and organized.

What is the golden rule of bookkeeping?

The golden rule of bookkeeping follows the double-entry accounting system, which ensures every transaction has two equal and opposite entries. The three core principles are: Debit what comes in, credit what goes out; Debit expenses and losses, credit income and gains; Debit the receiver, credit the giver. This keeps financial records balanced and accurate.

What is bookkeeping workflow?

Bookkeeping workflow is the structured process of managing financial records, ensuring accuracy and efficiency. It includes recording transactions, classifying income and expenses, reconciling accounts, reviewing financial reports, and ensuring compliance with tax and regulatory requirements. A well-organized workflow helps maintain accurate books and simplifies financial decision-making

What is full cycle bookkeeping?

Full-cycle bookkeeping covers the entire financial process, from recording transactions to closing the books. It includes tracking income and expenses, reconciling accounts, managing accounts payable and receivable, preparing financial statements, and closing the accounting period. This ensures accurate records and smooth financial reporting for businesses.