One of the struggles in bookkeeping is data entry. This part of the process takes a lot of time and effort and there is no guarantee that it produces a perfect result.

That’s why businesses, professionals, and accounting firms are doing their best to reduce errors and time spent in data entry and researching for more efficient data entry processes.

What is Data Entry?

Data entry involves typing information into computers or other systems, like words or numbers.

In bookkeeping, it means turning financial information from formats you can’t change, like PDFs or paper copies, into formats you can edit, like Excel, text, or CSV files.

This time-consuming process requires consistent attention to detail to avoid minute mistakes that can lead to detrimental consequences when the information is analyzed.

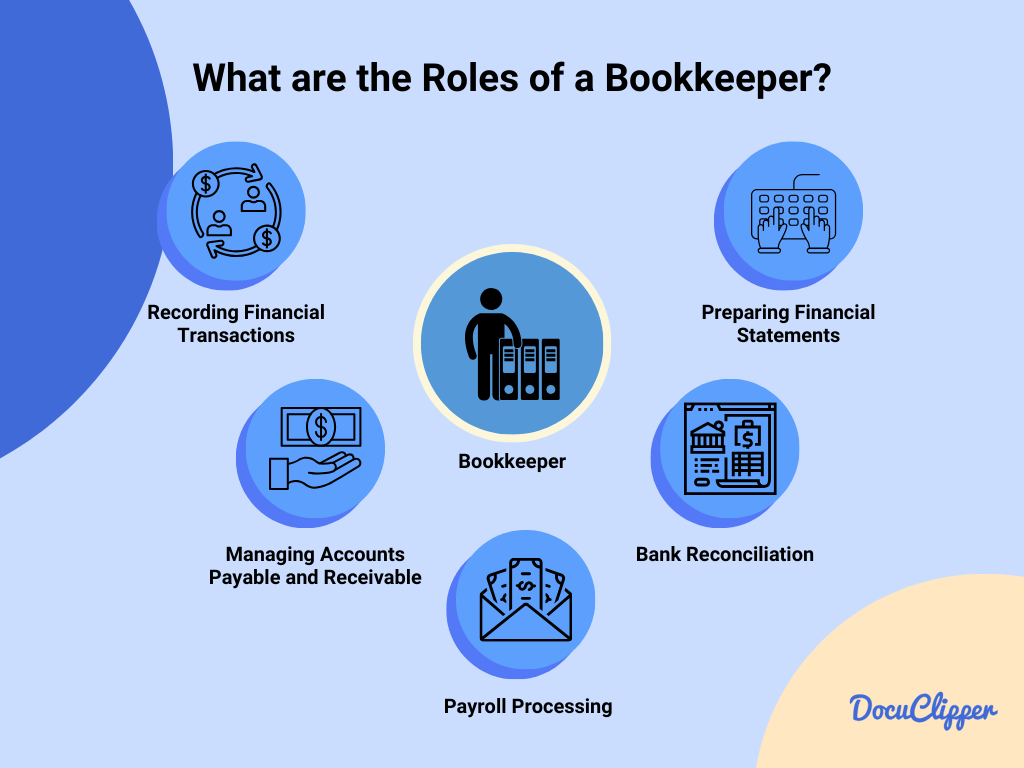

What is the Role of a Bookkeeper?

A bookkeeper’s job is to keep a detailed and accurate record of all the money a business spends and receives.

This includes tracking everything the business buys and sells, the money it takes in, and the payments it makes. These pre-accounting activities create the foundation for accurate financial reporting.

They make sure every financial move is documented and organized, so the business knows where its money is going and coming from.

What is a Bookkeeping Data Entry?

Bookkeeping data entry is the job of typing in all the details of a business’s money transactions, like sales or payments, into a special computer program.

This allows the bookkeepers, accountants, or accounting officers to compile all information in one single system or a single paper, making it easier to track and analyze.

Why is Bookkeeping Data Entry Important?

This process ensures that all the financial records of a business are correct and updated regularly.

Keeping accurate and current records allows businesses to see how well they’re doing with their finances.

Additionally, being up-to-date with financial records helps businesses meet their legal responsibilities related to finances and taxes. This makes post-accounting tasks like tax preparation and auditing much more manageable.

What is the Importance of Quality Data Entry?

When bookkeeping data is entered accurately and with attention to detail, it significantly reduces the likelihood of errors or mismatches in the financial records.

This diligent approach to data entry is crucial for maintaining the integrity of a business’s financial information.

Moreover, high-quality data entry in bookkeeping ensures that financial reports are dependable.

This reliability is essential for businesses to comply with regulatory requirements, prepare for audits, and plan their financial strategies with confidence.

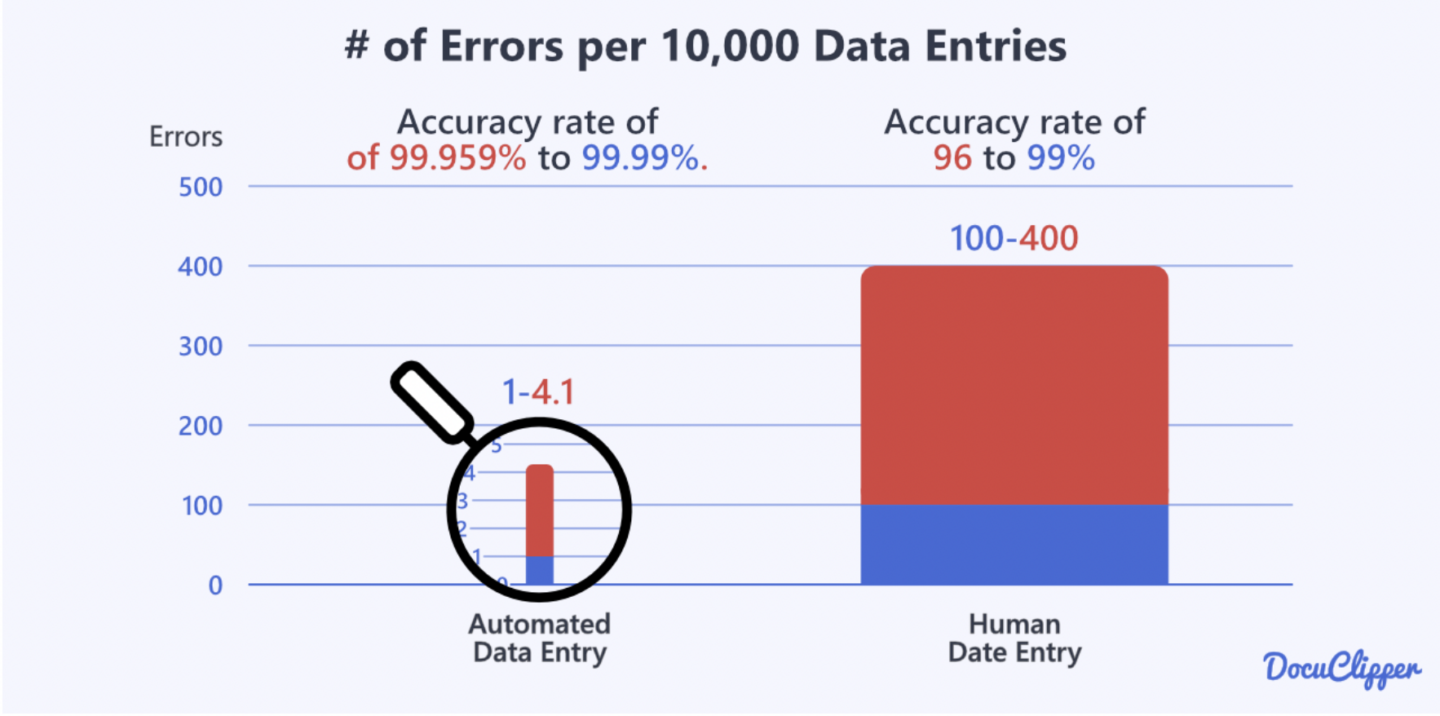

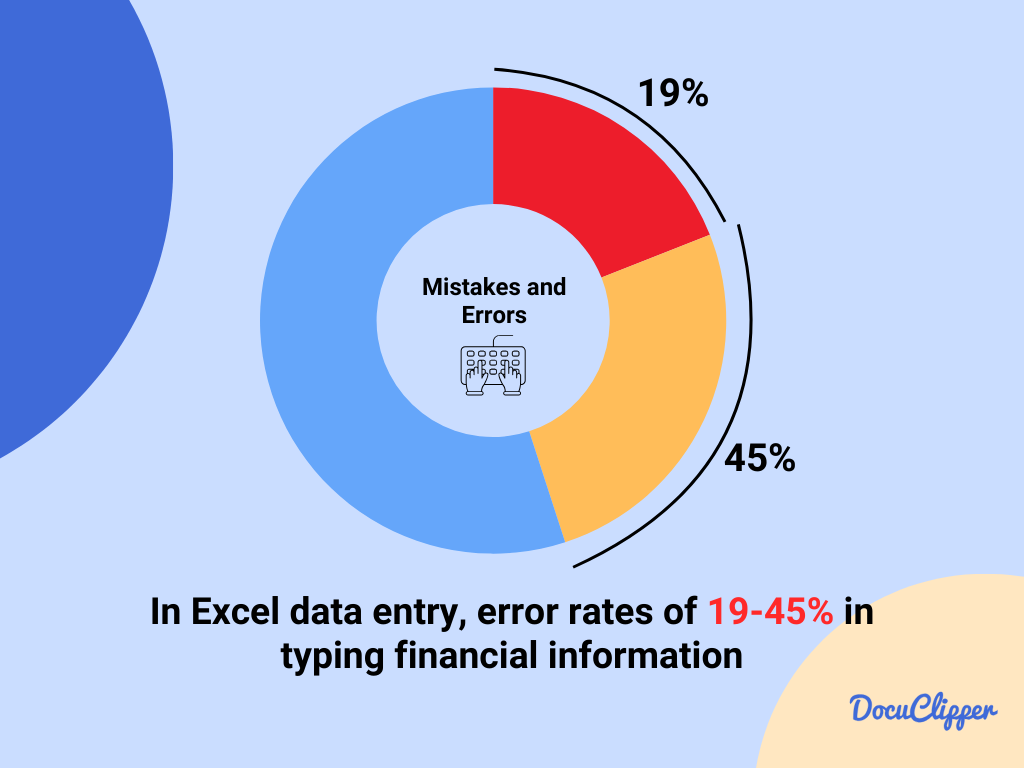

Nowadays, it is already realistic that automated data entry boasts an accuracy rate of 99.959% to 99.99%. In contrast, the accuracy rate for human data entry ranges from 96% to 99%.

In a much specific context, when typing into Excel sheets, human errors can range from 19% to 45%. With these numbers, automating and changing the ways of data entry can certainly improve accuracy and quality.

Overall automated data entry vs manual data entry, automated data entry is the superior choice in almost all situations especially when OCR accuracy is much higher than humans one.

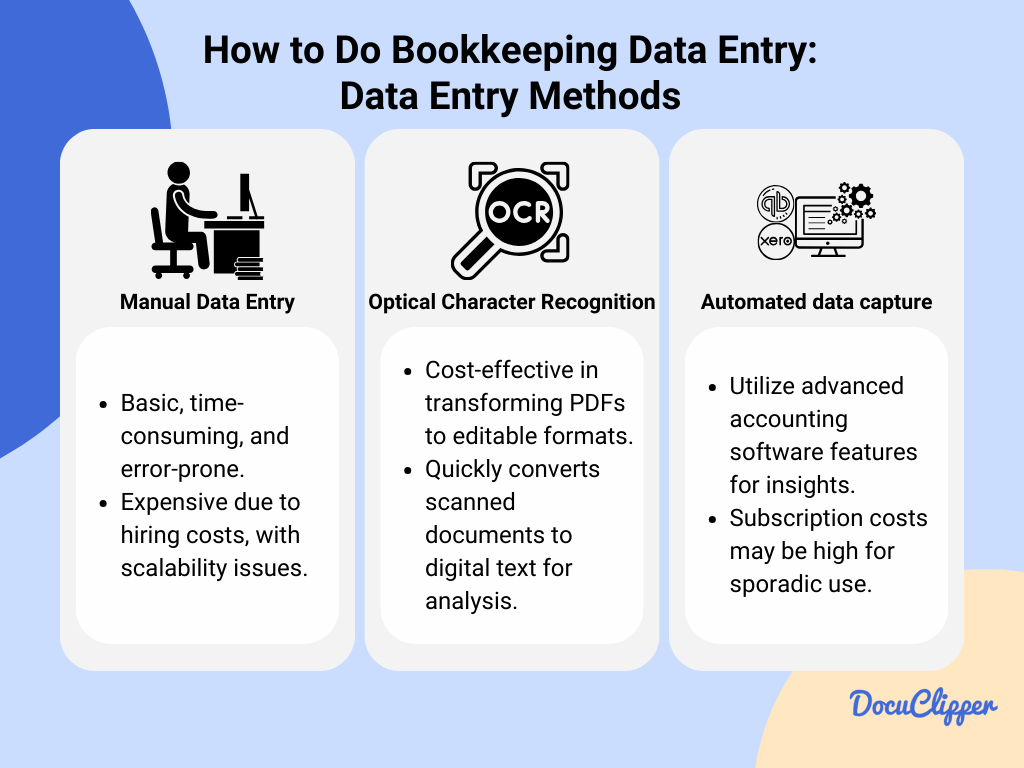

How to Do Bookkeeping Data Entry: Data Entry Methods

There are many ways to do bookkeeping nowadays, especially with the availability of modern technology. Here are some, along with a shortcut:

Manual data entry

Manual data entry involves typing information directly into a computer or system by hand, which is a basic and very time-consuming task.

Even using the copy-paste feature can lead to problems with formatting, making it a less efficient process.

Often, companies are hiring freelancers or data entry clerks to perform this. This can be very expensive, time-consuming, prone to errors, and hard to scale.

However due to these challenges, including the high costs of paying staff to do this work and the increased risk of errors, many companies are moving away from this method in search of better, more efficient ways to handle their data entry needs.

Do you want to know how to learn data entry? Visit our article to learn more.

Automated data capture (scanning & OCR)

Optical Character Recognition (OCR) is highly regarded as the most cost-effective solution for data entry. It is the preferred method for many accountants and bookkeepers to transform PDF bank statements into editable formats like XLS and CSV, and extract data from invoices, and receipts.

OCR software can quickly read text from images or scanned documents and convert it into a digital format that can be edited and analyzed.

Some OCR data extraction tools are even advanced enough to perform bank statement analysis quickly, making them incredibly useful for fast-paced financial processing and review.

Accounting integration platforms

These platforms are complex, using advanced features within accounting software for data analysis and insights. Instead of traditional data entry methods, they incorporate bank feed capabilities, allowing direct import of data from financial institutions. This streamlines the process data entry process using accounting software.

While OCR data entry is an option, the focus here is on features like bank feeds that automate data integration directly from the source. However, the subscription cost for these comprehensive platforms may be high for businesses that handle bookkeeping sporadically throughout the year.

Best Ways to Automate Bookkeeping Data Entry

Automation reduces the amount of manual data entry work by 80%. Lesser manual work means faster results and less time for wages, making it a win for businesses.

However, on many occasions, you will still need to outsource your bookkeeping but automating your bookkeeping data entry can definitely eliminate the need of outsourcing your data entry.

This conversion can be done using financial data extraction software that leverages OCR technology, which automatically extracts the text from PDFs and places it into a more manageable spreadsheet format.

We also recommend you to find some of the best virtual bookkeeping services to ensure your books are clean.

Since we already know what might be the best way for your data entry process, here’s how to automate your bookkeeping process, from receipt data entry to bank statement processing:

Centralize Your Operation

Put all your operations into one basket. This allows your data to be easily transferred from one function to another. For example, after uploading your data (in this case a bank statement), you can reconcile bank statements and categorize transactions right after.

This relieves a lot of lagging from transferring information and formatting issues.

Convert Your PDF Documents into Spreadsheet

The main problem with PDF documents is their formatting, which can be challenging to work with. A helpful solution is to convert these documents into spreadsheet formats, such as XLS (Excel) or CSV (Comma Separated Values).

This conversion can be done using OCR (Optical Character Recognition) technology, which automatically extracts the text from PDFs and places it into a more manageable spreadsheet format.

Alternatively, there’s the slow and manual method, which involves typing the information by hand into a spreadsheet.

Standardize Your Processes

Even with automation, it’s important to keep an eye on quality. Just because a process is automated doesn’t mean it will be perfect every time.

You should always look out for any mistakes or problems that could happen and fix them early. This way, you stop small errors from becoming bigger problems later.

Remember, while automation makes things faster and can reduce mistakes, checking your work and making improvements is key to keeping everything accurate and running smoothly.

Best Bookkeeping Automation Software

Here are some of the best software available in automating bookkeeping processes that have been helping many professionals and businesses in dealing with their finances:

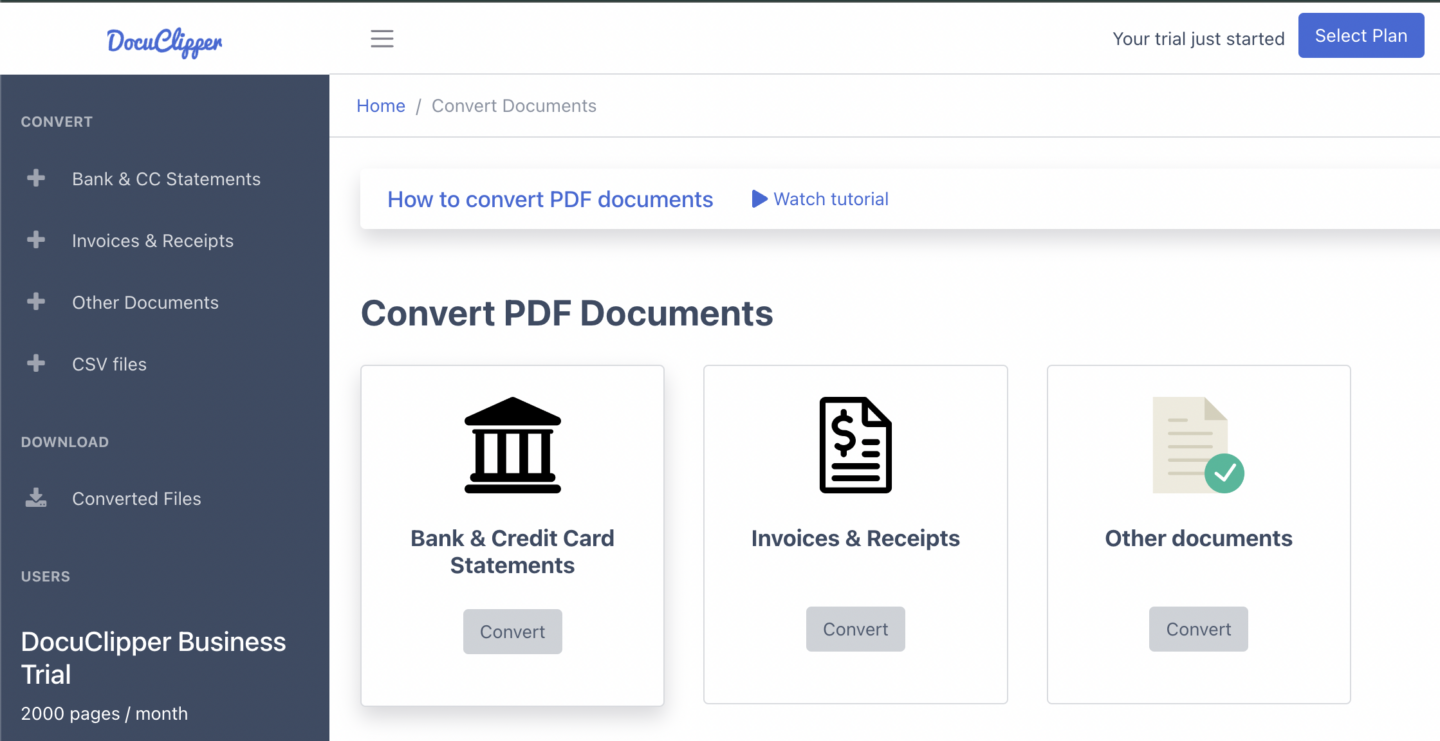

DocuClipper

DocuClipper is an OCR bank statement converter that converts bank statements into Excel, CSV, or QBO. This tool can easily link up with accounting software such as QuickBooks, Xero, and Sage. Allowing businesses to convert PDF to CSV for Xero or PDF to QBO or other software!

Additionally, DocuClipper offers helpful features such as automatic bank reconciliation, transaction categorization, and financial analysis. These features greatly lessen the workload involved in processing data, making it simpler and faster to manage financial information.

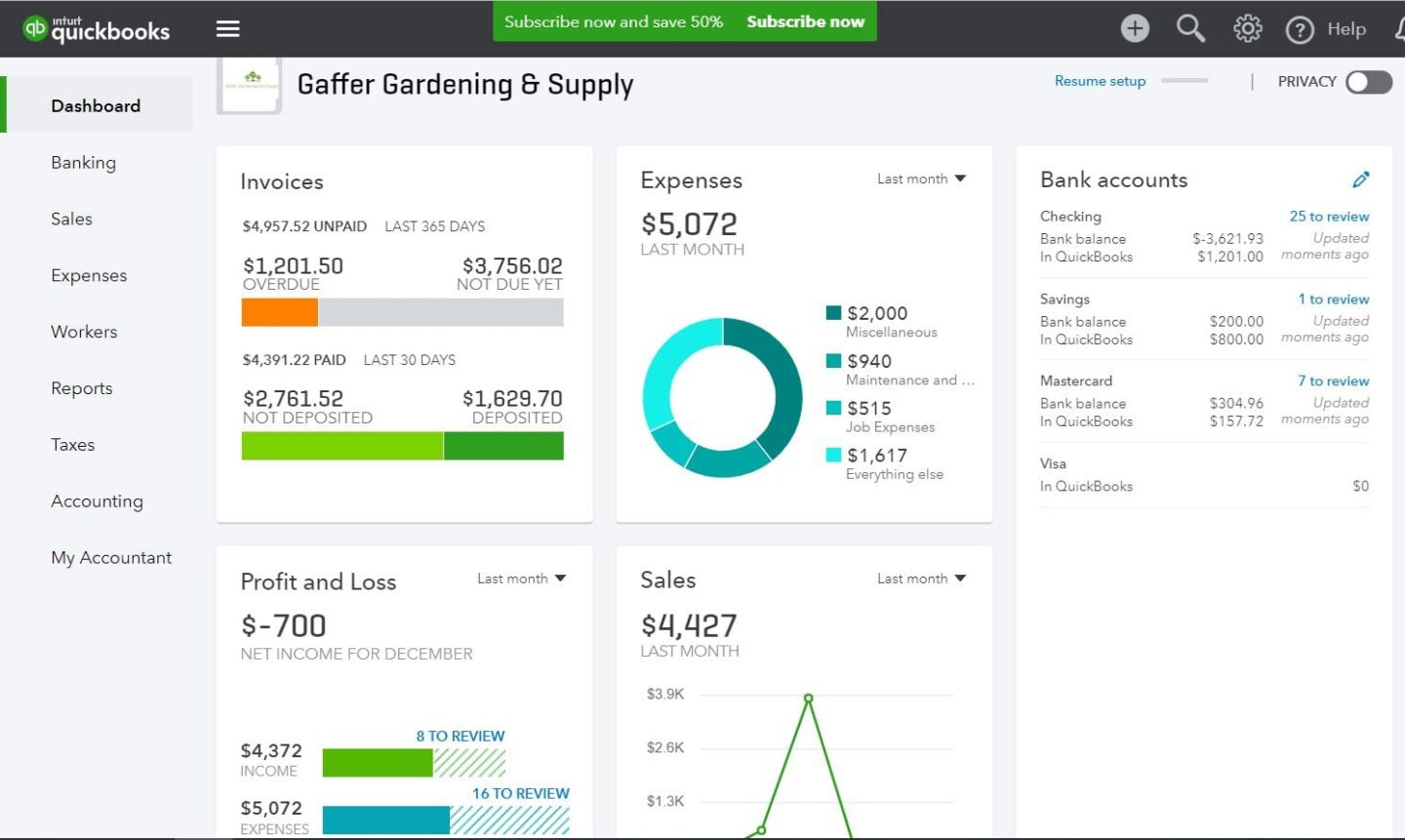

QuickBooks

Image Source

QuickBooks is a widely used accounting software that helps small to medium-sized businesses manage their financial operations. It supports invoicing, bill payments, payroll, and financial reporting among other features.

QuickBooks also offers cloud-based versions for easy access from anywhere.

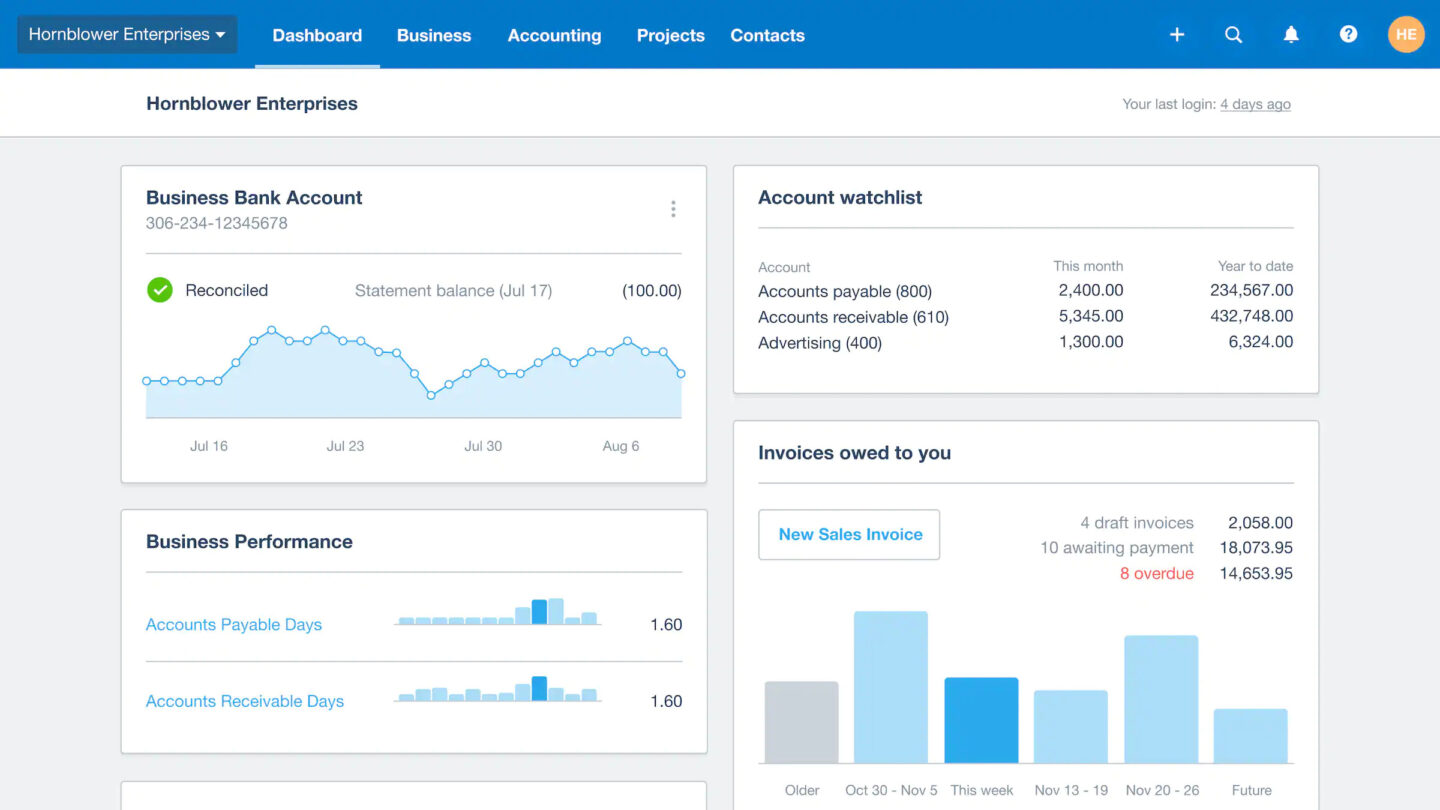

Xero

Xero is an online accounting software designed for small businesses. It enables users to manage invoicing, bank reconciliation, billing, and reporting from any device with an internet connection.

Xero stands out for its user-friendly interface and robust integration with a wide range of third-party apps and services.

ERP System (In general)

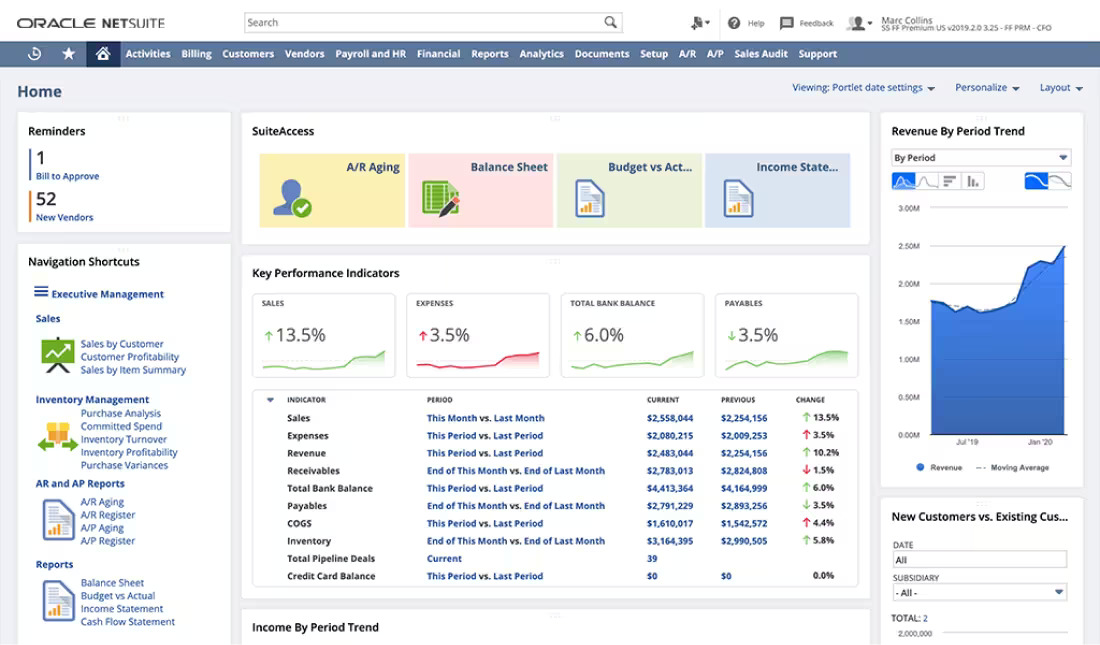

ERP (Enterprise Resource Planning) systems like NetSuite and Dynamics 365 Business Central provide comprehensive business management solutions. These systems cover a broad spectrum of operations beyond accounting, including inventory management, human resources, customer relationship management (CRM), and more.

They are designed to give businesses a unified platform for managing various aspects of their operations efficiently.

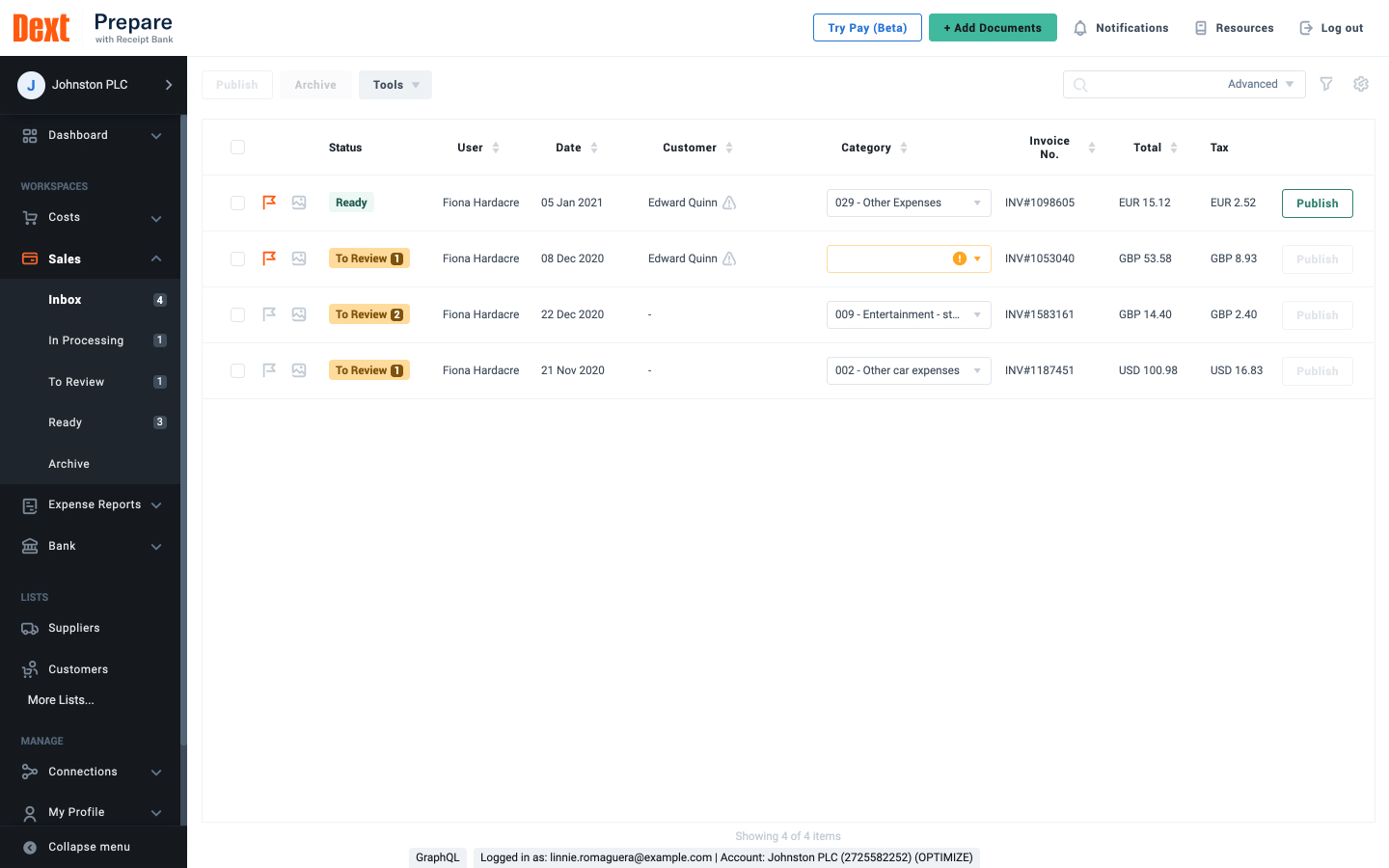

Dext Prepare

Dext Prepare specializes in automating the data entry process for receipts and invoices. It extracts key financial information and integrates directly with accounting software, including QuickBooks and Xero. This reduces manual data entry and improves the accuracy and efficiency of financial record-keeping.

Dext Prepare is particularly useful for businesses looking to streamline their expense management and financial reporting processes.

Conclusion

Bookkeeping data entry is a foundational aspect of managing a business’s financial health. It involves the precise recording of financial transactions, which is essential for accurate financial reporting, analysis, and decision-making.

With the advancement in technology, tools like OCR and integrated accounting software are streamlining this process, making it more efficient and less prone to errors.

FAQs about Bookkeeping Data Entry

Here are some frequently asked questions about data entry in bookkeeping and accounting:

What is bookkeeping data?

Bookkeeping data refers to the detailed records of a business’s financial transactions, including sales, purchases, payments, and receipts.

Can an accountant do data entry?

Yes, an accountant can do data entry, but typically, a bookkeeper or data entry clerk handles these tasks to allow accountants to focus on more complex financial analysis and reporting.

Is bookkeeping the same as journal entry?

Journal entry is a part of bookkeeping. It involves recording transactions in the journal as the first step of the accounting cycle, which is then compiled into financial statements.

What is financial data entry?

Financial data entry is the process of inputting financial transactions into an accounting system, which includes details about sales, purchases, and other financial activities.

What is the role of a bookkeeper in data entry?

A bookkeeper’s role in data entry involves accurately recording all financial transactions of a business into the accounting system, ensuring the data is up-to-date and correctly categorized.

What is an example of bookkeeping?

An example of bookkeeping is recording all details of a sale transaction, including the date, amount, and customer information, into the accounting software.

Is data entry the same as accounting?

Data entry is a part of accounting focused on the initial recording of transactions. Accounting encompasses a broader scope, including analyzing and interpreting financial data to create reports.

What is the main work of data entry?

The main work of data entry involves inputting, updating, and maintaining accurate information in a database or accounting system.

What type of role is data entry?

Data entry is a clerical role that requires attention to detail and proficiency in typing and using various data management systems. It’s essential in various fields, including accounting, where it supports accurate financial record-keeping.