Working for a client with an M&T bank statement can be problematic as the CSV format can only be accessed using an eBanking app. Also when you access it through bank feeds, you’ll be charged $9.95 per month.

These are unnecessary costs and you’ll end up only working a PDF bank statement for your bookkeeping task. But this will lead to manually typing every entry into an Excel file.

Luckily, we have a solution for that. In this article, we’ll talk about how to convert M&T bank statement to Excel and how to use a bank statement converter.

To get you started, upload your M&T bank statement in here and follow the steps below:

Step 1: Upload M&T Bank Statement to DocuClipper

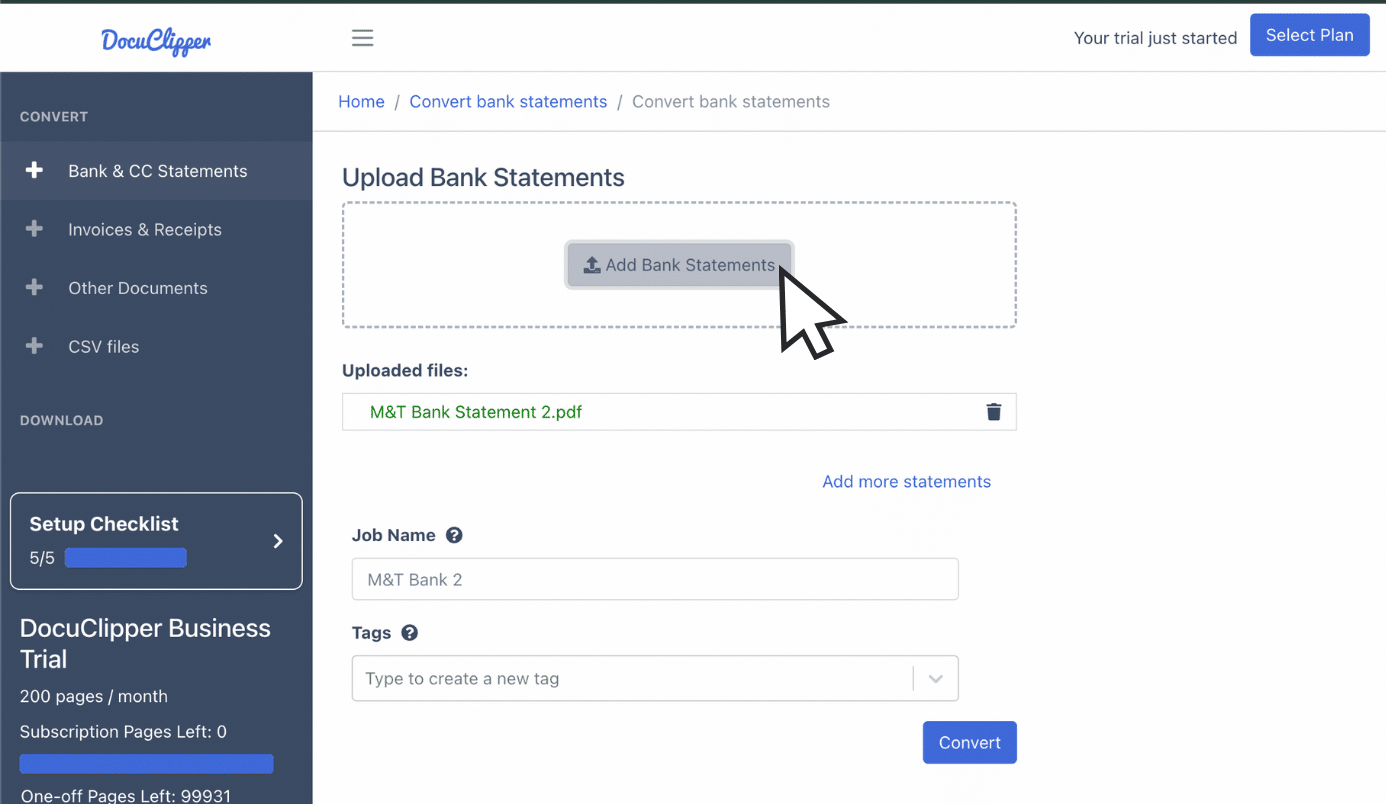

First, to convert bank statements, you need to have a PDF version of your M&T bank statement.

You can either obtain this directly from the bank or receive it from a client. If you only have a hard copy, use a paper scanner to scan the document and obtain a PDF copy.

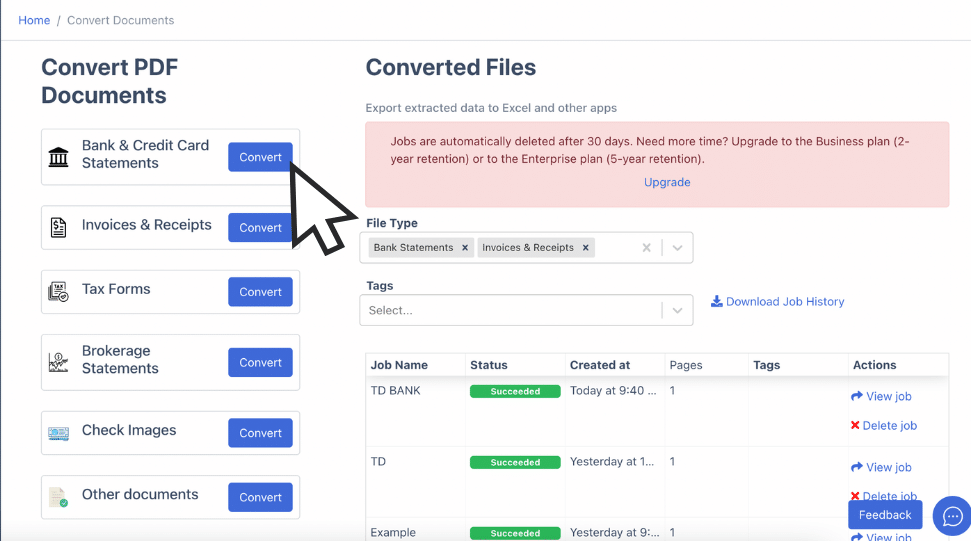

Then log in to your DocuClipper account and click “bank statement” to enter the section.

Drag and drop the PDF file(s) from your computer. Add a job name and relevant tags so you can track it much more easily.

Click “Convert” to start processing your bank statement into Excel format.

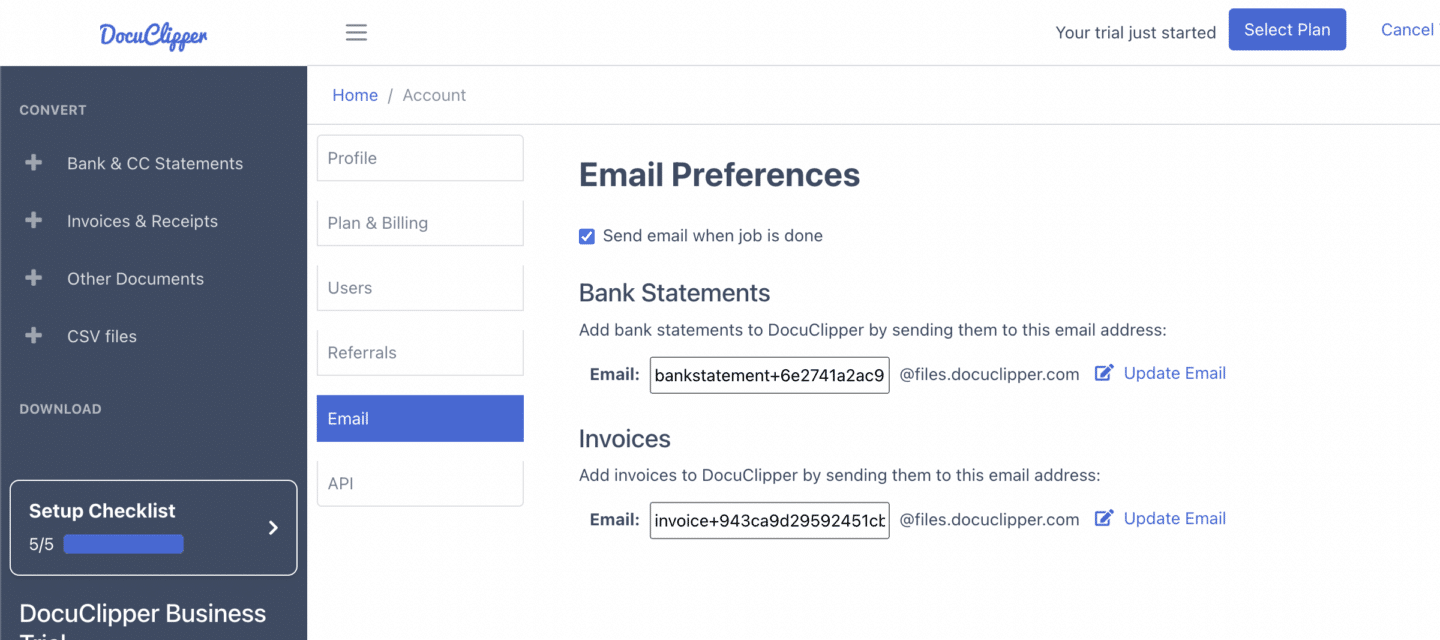

Another alternative is to upload statements through email. To set this up go to settings, locate the email section, and use the custom email address provided.

You can send the files by attaching them to this email. Be sure also that the PDF files are not encrypted.

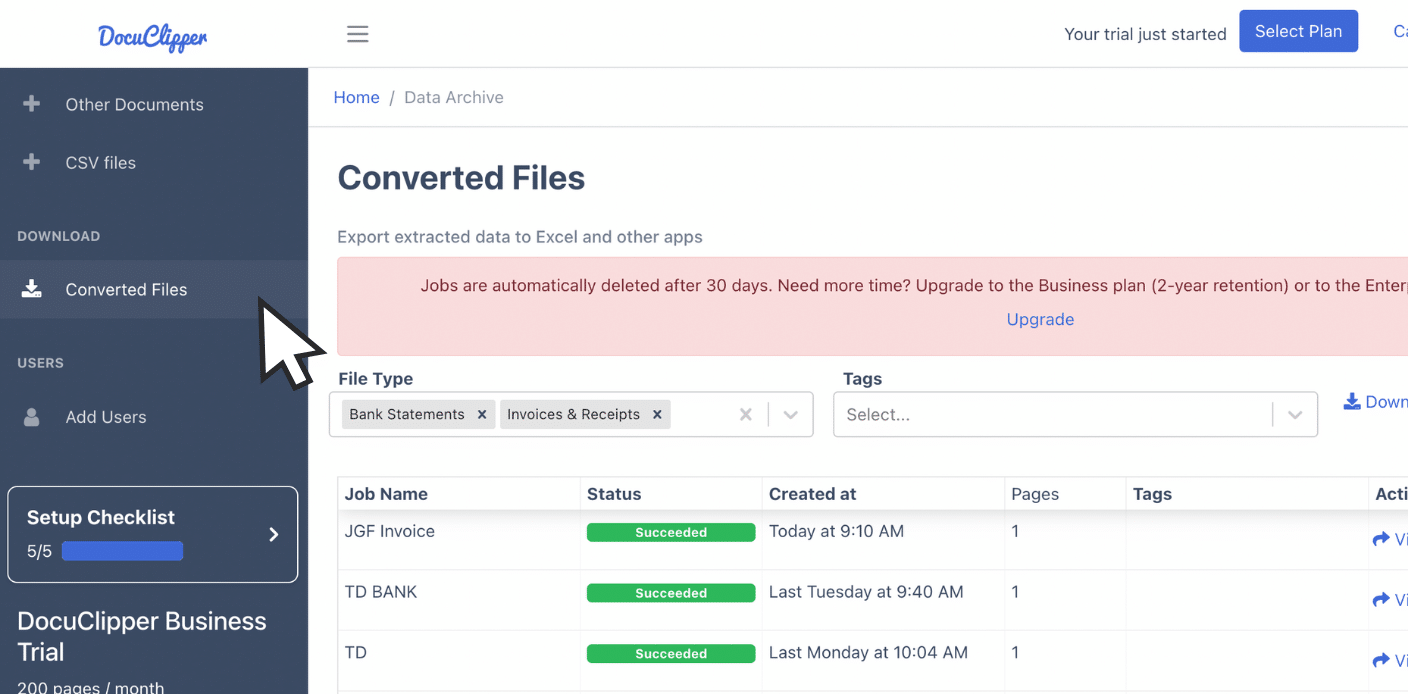

Uploaded files will appear under the “Converted Files” section on the left sidebar.

Step 2: Analyze M&T Bank Statement

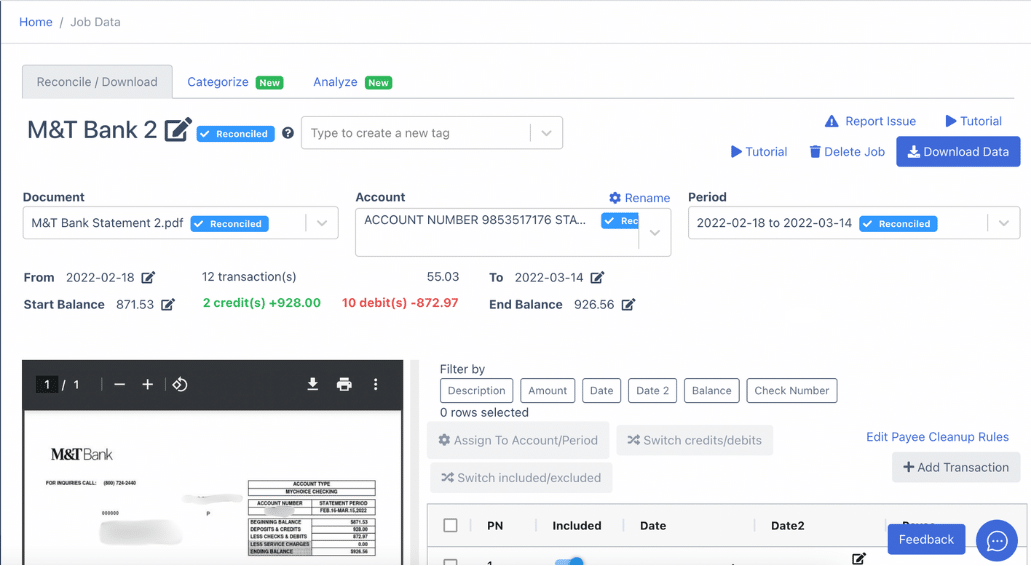

After uploading your bank statement, you’ll see a side-by-side preview of your bank statement and the projected spreadsheet of the statement.

In this phase, you can review if the OCR (Optical Character Recognition) has accurately captured all the necessary details from the statement.

Check if the data matches with the bank statement and ensure that all transactions, amounts, dates, and descriptions are accurately extracted.

If you spot any discrepancies between the spreadsheet and the bank statement, you can manually correct them at the next step.

Step 3: Reconcile M&T Bank Statements

DocuClipper will attempt to reconcile your M&T bank statements after clicking “convert”.

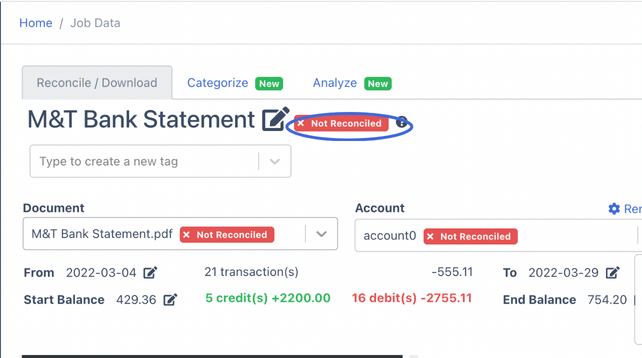

In rare cases, bank statement reconciliation might be unsuccessful. This usually happens due to discrepancies in balances, transactions, dates, debits, or credits.

Here is a non-reconciled example:

In some instances, OCR errors may occur due to unclear text from low-quality scans. Employ proper preprocessing techniques within your scans to improve the quality of your statements.

If discrepancies are found, DocuClipper allows you to manually adjust the fields.

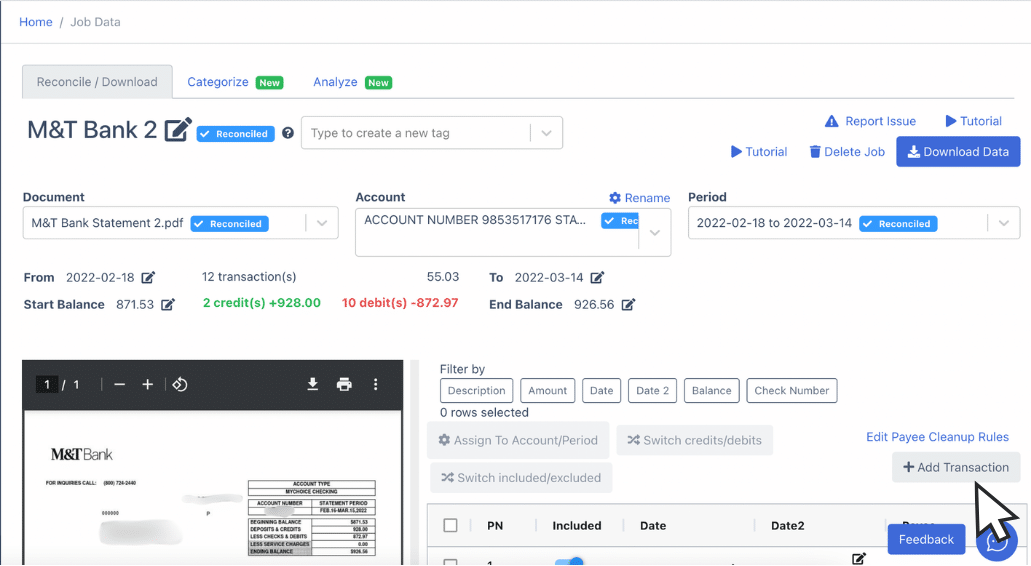

To add missing bank transactions, click the “Add Transactions” bar and fill in the necessary details.

After clicking, in this section, you can fill in the details regarding the transaction that you want to add up.

If you need to update balances, simply click the relevant field within the dashboard and input the correct data.

Step 4 Export M&T Bank Statement to Excel, CSV, QBO

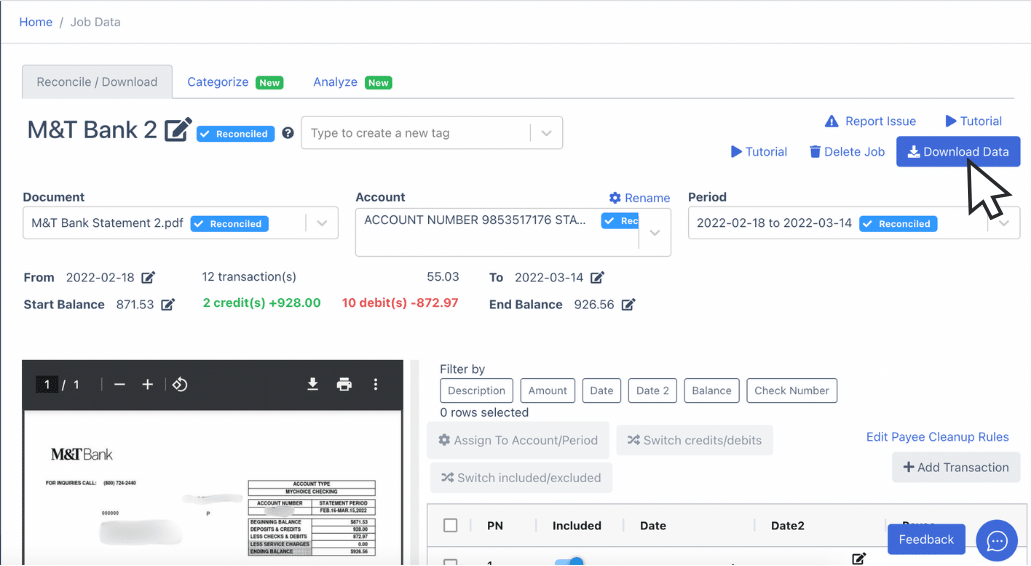

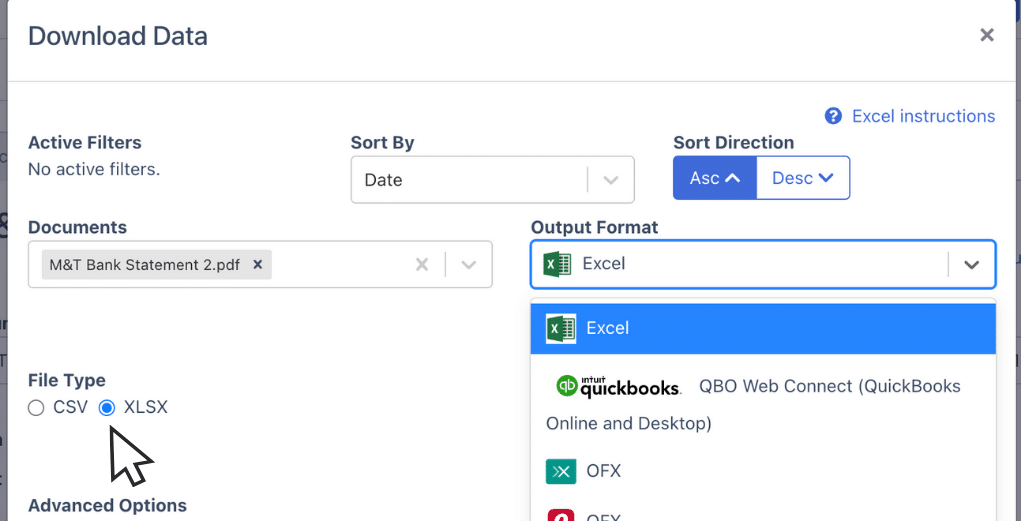

Once you are satisfied with the preview of your spreadsheet and the statement is reconciled, you are ready to export your spreadsheets. Click “download data” to see the export menu.

Export M&T Bank Statement to Excel

If you need an Excel copy of your M&T bank statement, click the toggle bar and select “Excel” from the dropdown menu.

Choose the XLSX file type to ensure it exports in the correct format.

After selecting, click “Download” to save the Excel file to your computer. You’ll see the file in your Downloads folder.

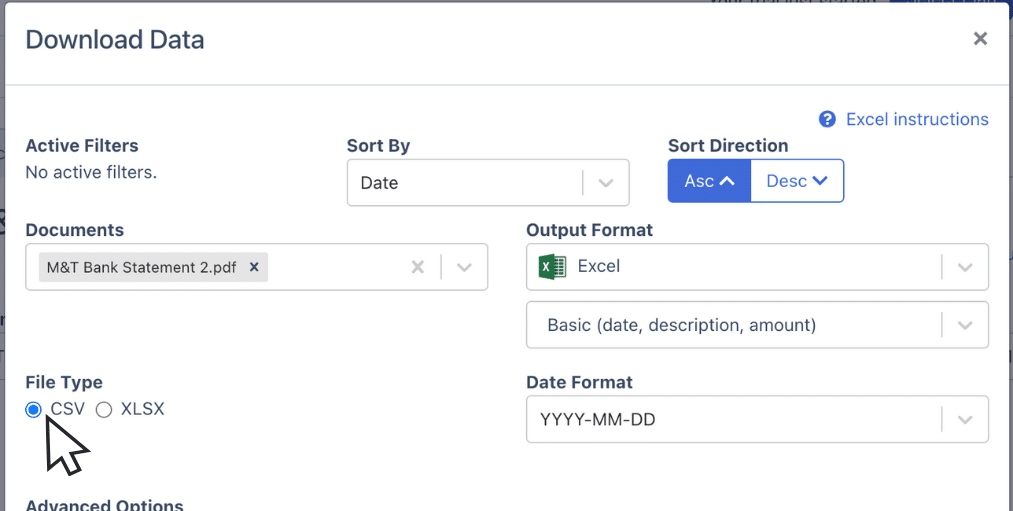

Export M&T Bank Statement to CSV

Most accounting software prefers CSV format when importing bank statement data.

You can easily download your M&T bank statement in CSV format for this purpose using DocuClipper.

Like in exporting to Excel, click on the appropriate toggle bar and select “Excel.”

Choose the CSV file type.

Once selected, click “Download” to save the CSV file to your computer, and you can see the file in your Downloads folder.

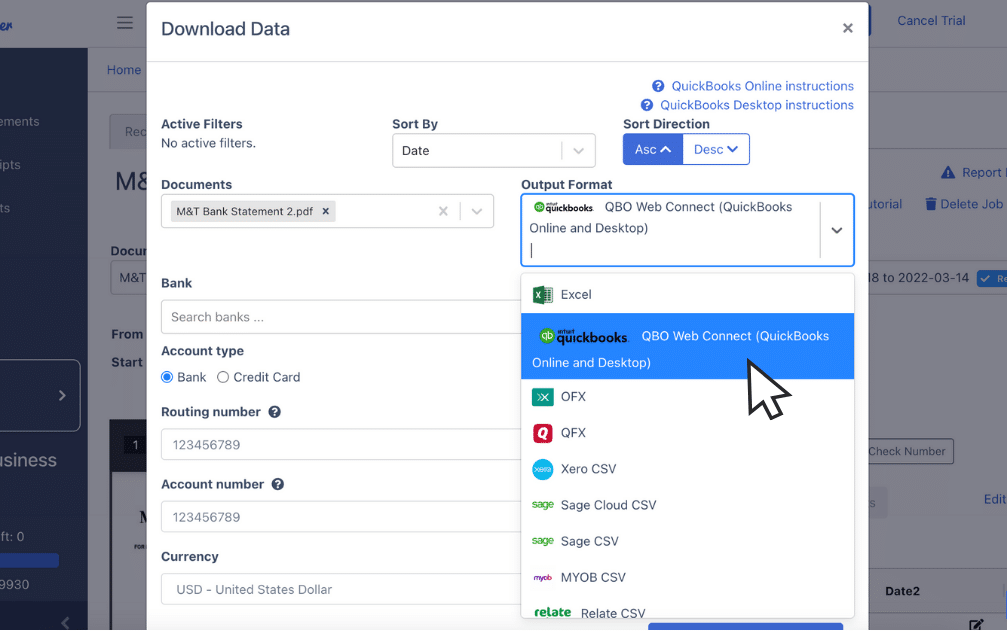

Export M&T Bank Statement to QBO

Docuclipper allows you to export a more compatible format to QuickBooks through QBO.

To export your M&T bank statement in QBO format, toggle down the bar and select “QBO.”

Follow the on-screen prompts to complete the export.

You’ll need to provide additional information, such as the routing number, account number, and currency.

Once everything is set, your QBO file will be ready for direct upload into QuickBooks for easy financial management.

Also, we have more guides on how to import bank statements into different software:

- Import bank statements into QuickBooks

- Import bank statements into Sage

- Import bank statements into Xero

- Import bank statements into NetSuite

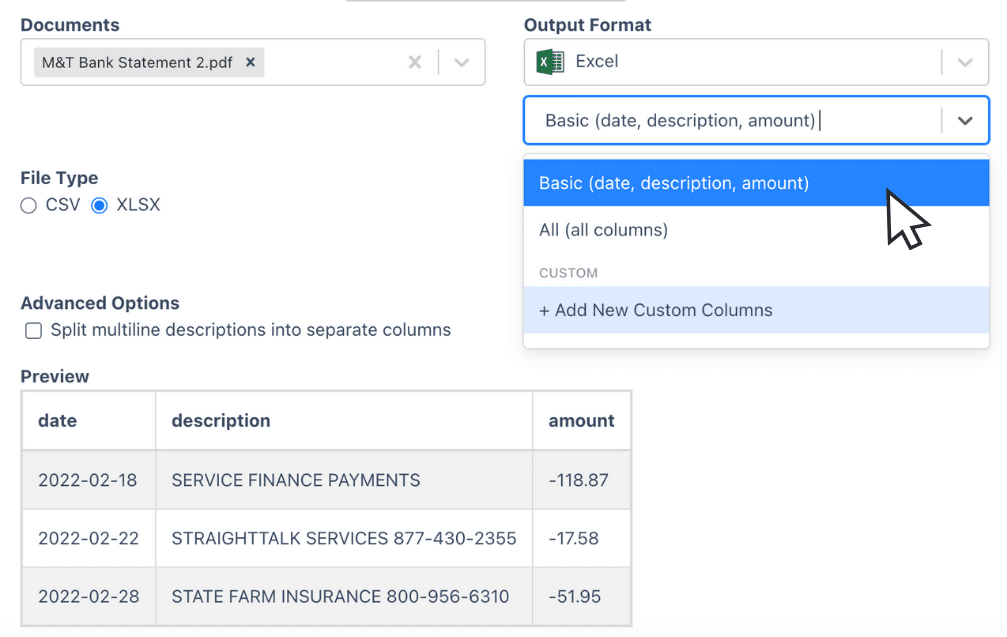

Step 5: Configure the Output Format

Before exporting, you can review the spreadsheet. This preview lets you see how the data will be formatted once exported.

You can also use DocuClipper’s default column settings for a standard layout.

If you prefer something different, you can customize the columns based on your needs, selecting specific data fields you want included.

Final Advice

One of the biggest challenges in handling bank statements is working with PDF or paper formats, which make it difficult to analyze or import data into accounting software.

DocuClipper can convert these formats into editable files, such as Excel, CSV, or QBO. This saves you time, reduces manual errors, and improves your productivity in the bookkeeping process.

Automating these tasks allows you to focus on more in-depth accounting problems and it can save you overall cost.

Why Use DocuClipper to Convert M&T Bank Statements

DocuClipper is a web-based tool that converts PDF bank statements into various formats like XLS, CSV, and QBO with ease. It utilizes advanced Optical Character Recognition (OCR) technology to accurately detect data fields and neatly organize them.

DocuClipper also integrates with widely used accounting software like QuickBooks, Sage, and Xero, making data transfer and management easier. It has a transaction categorization feature that keeps you on track of spending and maintains accurate accounting records.

In addition to bank statements, DocuClipper processes credit card statements, brokerage statements, receipts, and invoices.

FAQs about M&T Bank Statement to Excel

Here are some frequently asked questions about M&T Bank Statement to Excel:

How do I change my bank statement to Excel?

To change your bank statement to Excel, upload the PDF version to a tool like DocuClipper. It will extract the data, and you can then select “Excel” as the export format to download the file to your computer.

Can you export US bank statements to Excel?

Yes, you can export US bank statements to Excel using tools like DocuClipper. Simply upload the PDF version of your bank statement, and the tool will extract the necessary data. Once processed, select “Excel” as the export format and download the file, providing a fully editable spreadsheet for easy management.

Can I download my bank statement as a CSV file?

Yes, you can download your bank statement as a CSV file using tools like DocuClipper. After uploading your PDF bank statement, the software extracts the data and allows you to select “CSV” as the export format. Once selected, you can download the file. CSV files are widely compatible with most accounting software, making them ideal for data management and analysis.

Can you Download bank transactions to Excel?

Yes, you can download your bank statement as a CSV file using tools like DocuClipper. After uploading your PDF statement, the software extracts the data, allowing you to select “CSV” as the export format. CSV files are widely compatible with most accounting software, making them an excellent choice for managing and analyzing financial data.

Learn more

Looking for more types of bank statements to convert? Check out our library about bank statement conversion:

- How to Convert PNC Bank Statement to Excel, CSV, and QBO

- Convert TD Bank Statements to Excel, CSV, and QBO

- How to Convert Halifax Bank Statement to CSV, Excel, and QBO in a Minute or Less

Or use these resources to learn more about accounting:

- 101 Bank Statement Abbreviations & Other Bank Related Jargon

- What is Bank Statement Analysis and How to Do It

- 6 Best Forensic Accounting Software