If you’ve ever requested a CSV format from Truist Bank, you know they only provide data for up to 18 months.

This becomes a roadblock when you need to process statements from older dates, leaving you with piles of PDFs to manually input into a spreadsheet.

But don’t worry—we have a solution to save you time. In this article, we’ll guide how to convert Truist Bank statements to Excel, CSV, and QBO using a bank statement converter.

To get you started, upload your Truist bank statement in here and follow the steps below:

Step 1: Upload Truist Bank Statement to DocuClipper

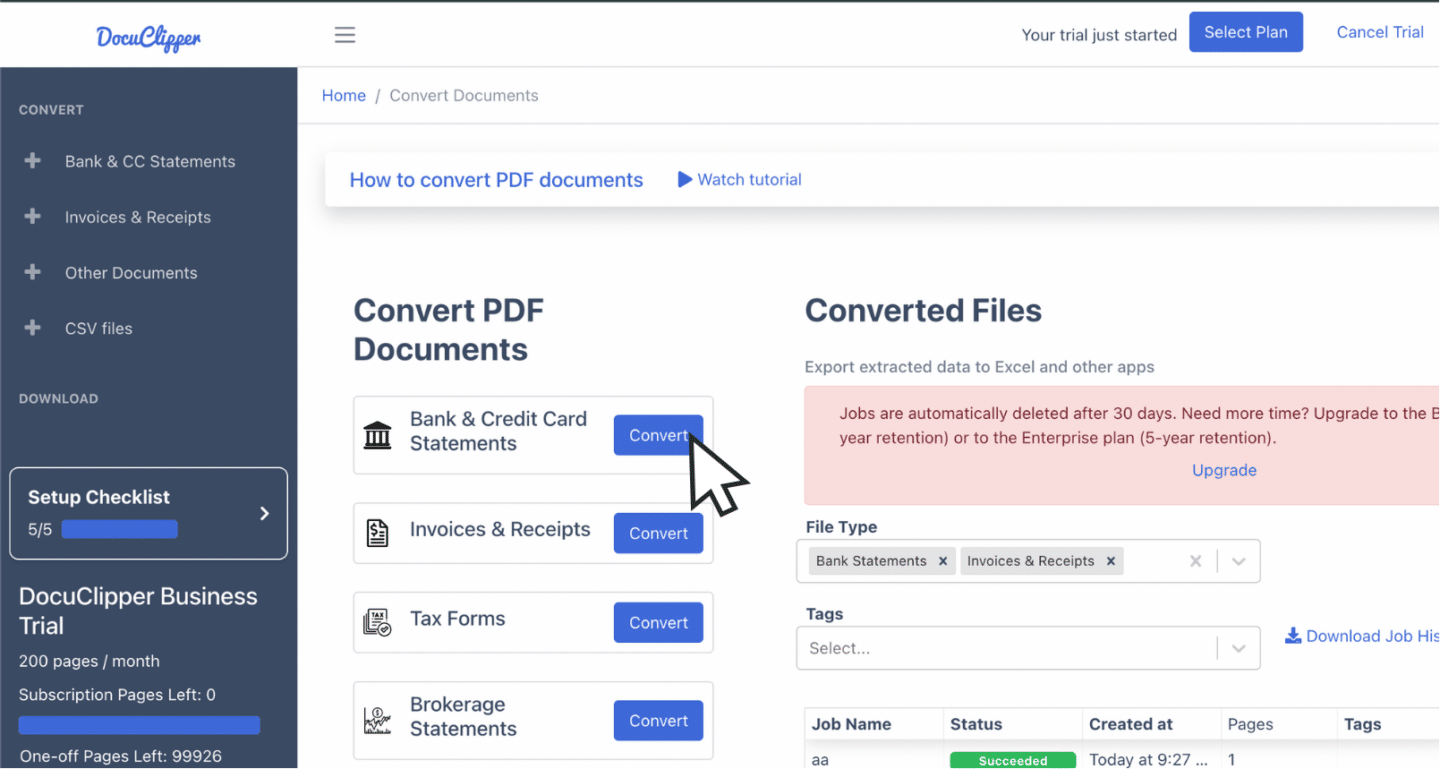

Start by logging into your DocuClipper account. If you don’t have one yet, you can easily sign up for a free trial.

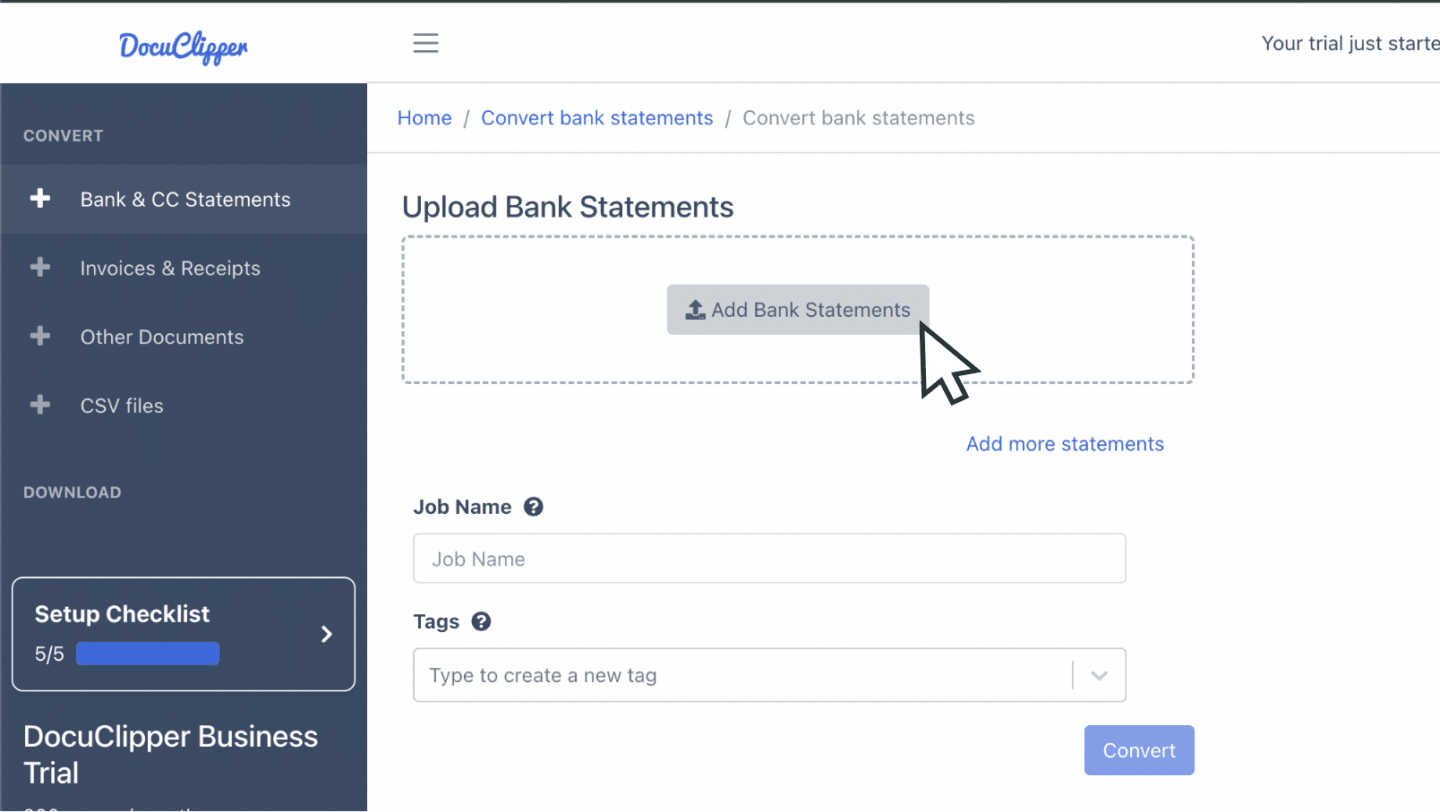

Once logged in, go to the “Convert” section beside Bank Statements. From there, you can drag and drop your Truist bank statement PDFs.

If you only have paper copies, scan them into PDF format. Be sure to make it clear and observe proper preprocessing to avoid any inaccuracies during the conversion.

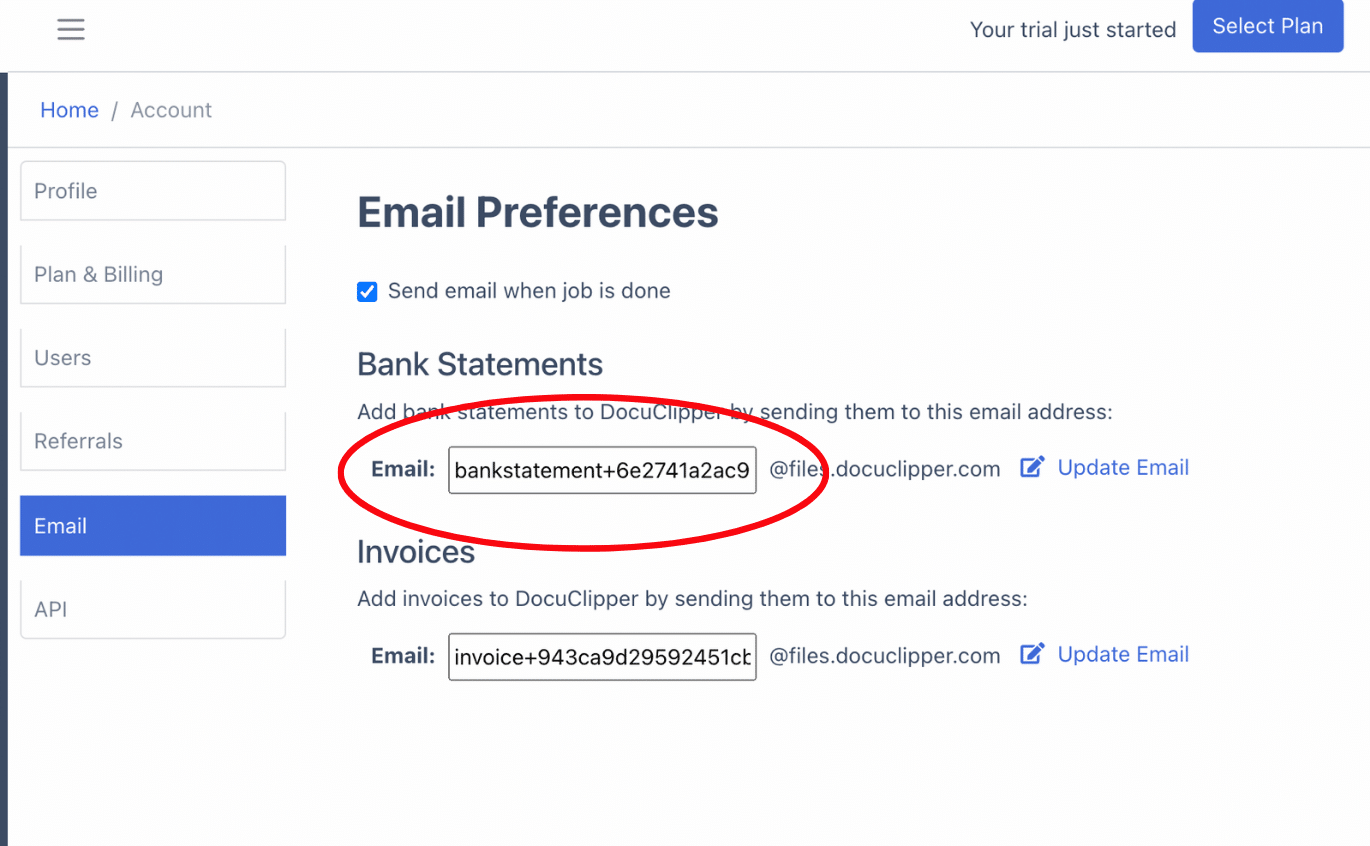

You can also upload your statements by emailing them to the unique address provided in your settings.

You’ll be able to see the uploaded files in the “converted” section.

Once all files are uploaded, click “Convert” to begin the process.

Step 2: Analyze Truist Bank Statement

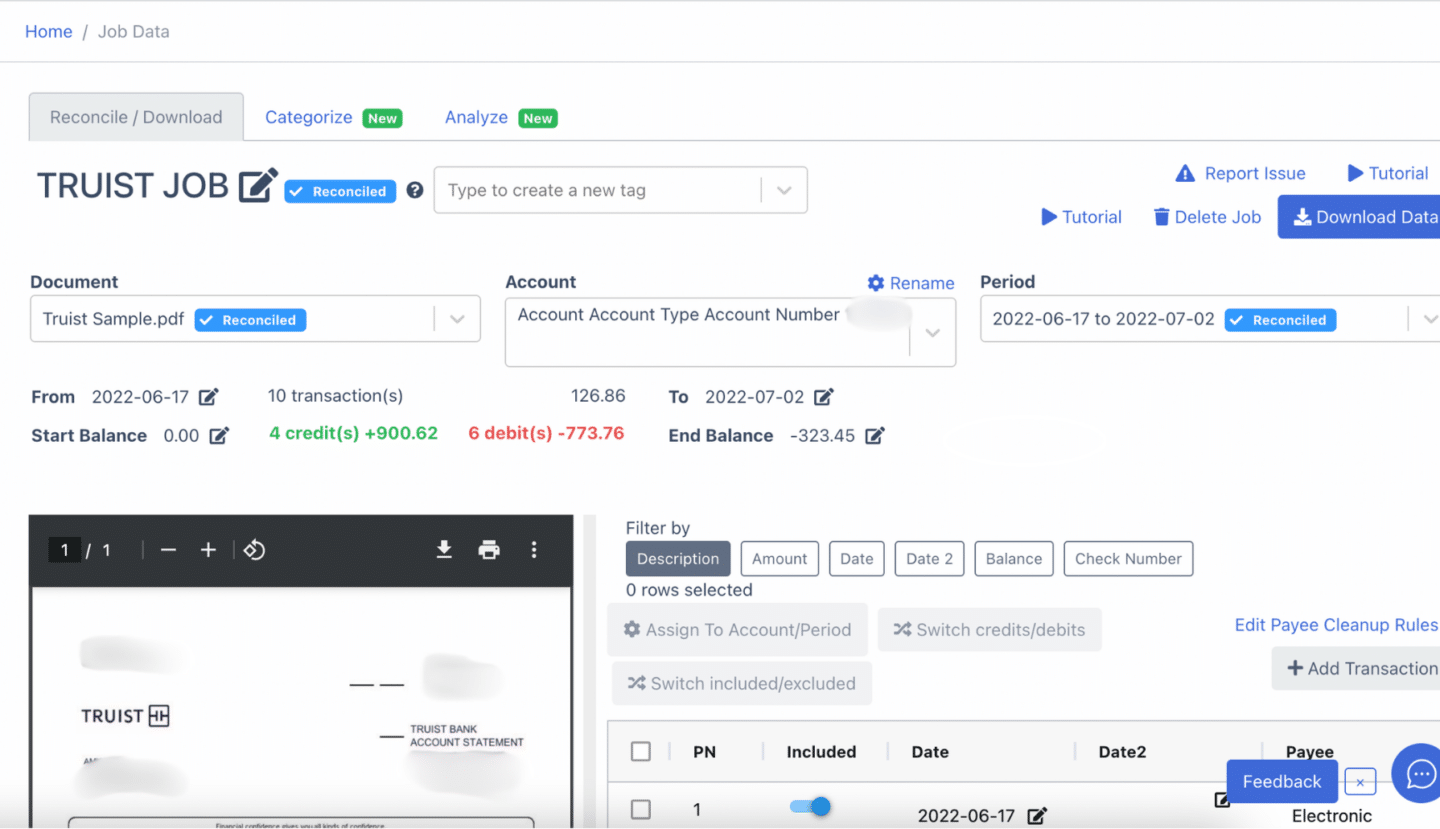

During the conversion process, you’ll see a side-by-side view of your original statement, extracted data, and the resulting spreadsheet. This is the time to check for any discrepancies.

Although extremely rare, banks may occasionally issue statements with errors or the processing could make a mistake too.

Also, if you use scanned paper statements, projection errors can occur during the scanning phase.

Take a moment to review the data and ensure everything is accurate before moving forward.

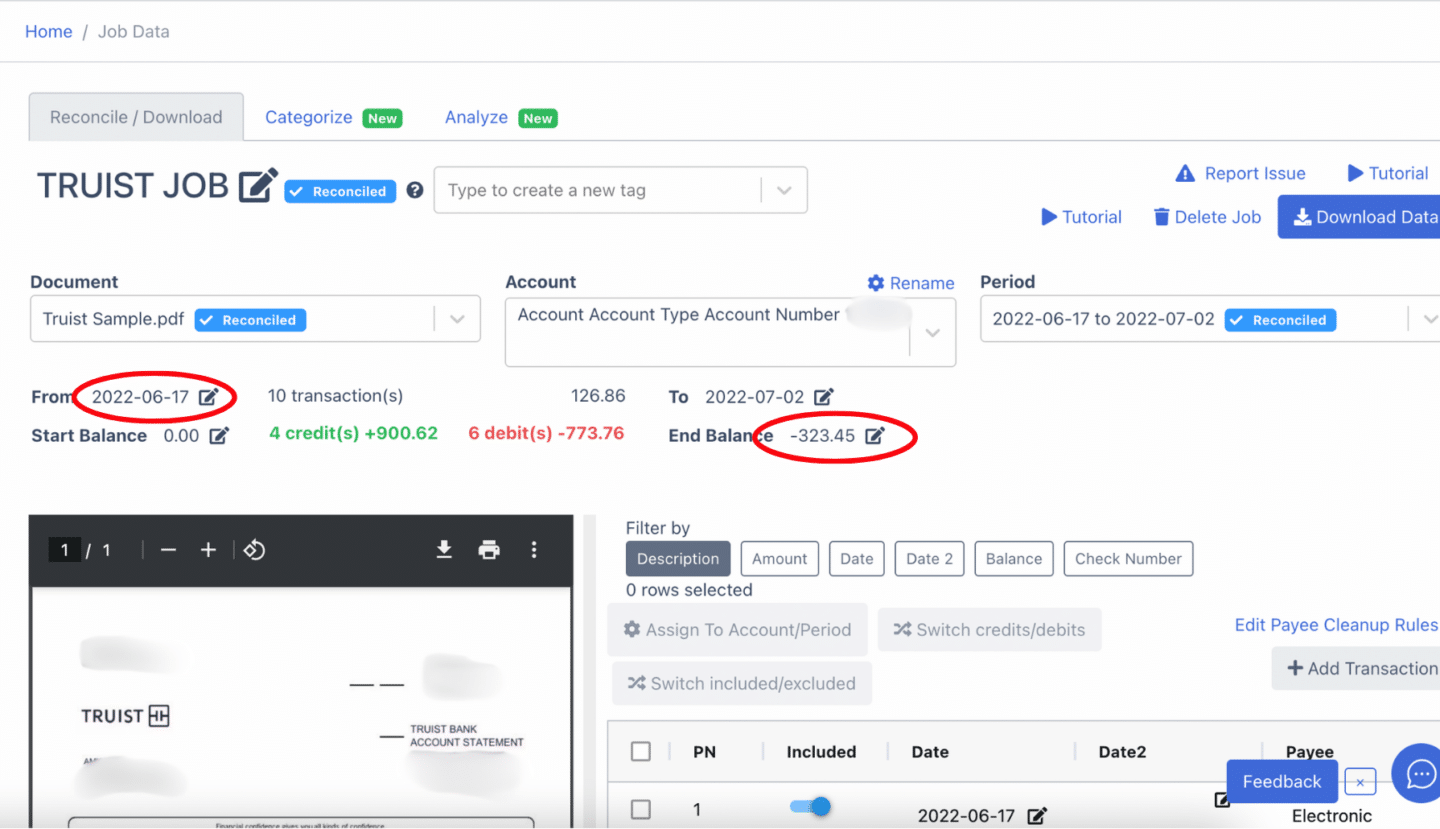

Step 3: Reconcile Truist Bank Statements

After reviewing, DocuClipper will automatically check if the bank statement is reconciled.

If any discrepancies are found, you can adjust the amounts, dates, or transactions within the application by clicking on the field arrow on the right side of it.

If a transaction is missing, simply click “Add Transaction” and manually enter the details. Be sure that you have to distinguish it between credit and debit.

Once all adjustments are made, your Truist bank statement will be fully reconciled and ready for export.

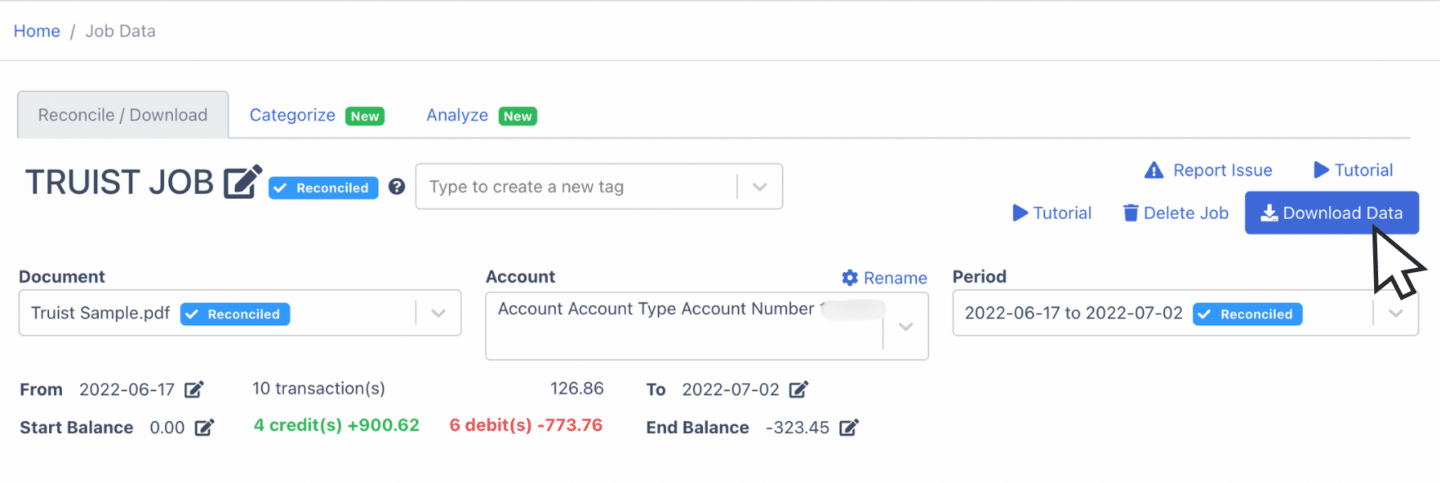

Step 4 Export Truist Bank Statement to Excel, CSV, QBO

Once the statement is already reconciled, you are now ready to export your Truist bank statements to Excel, CSV, and QBO.

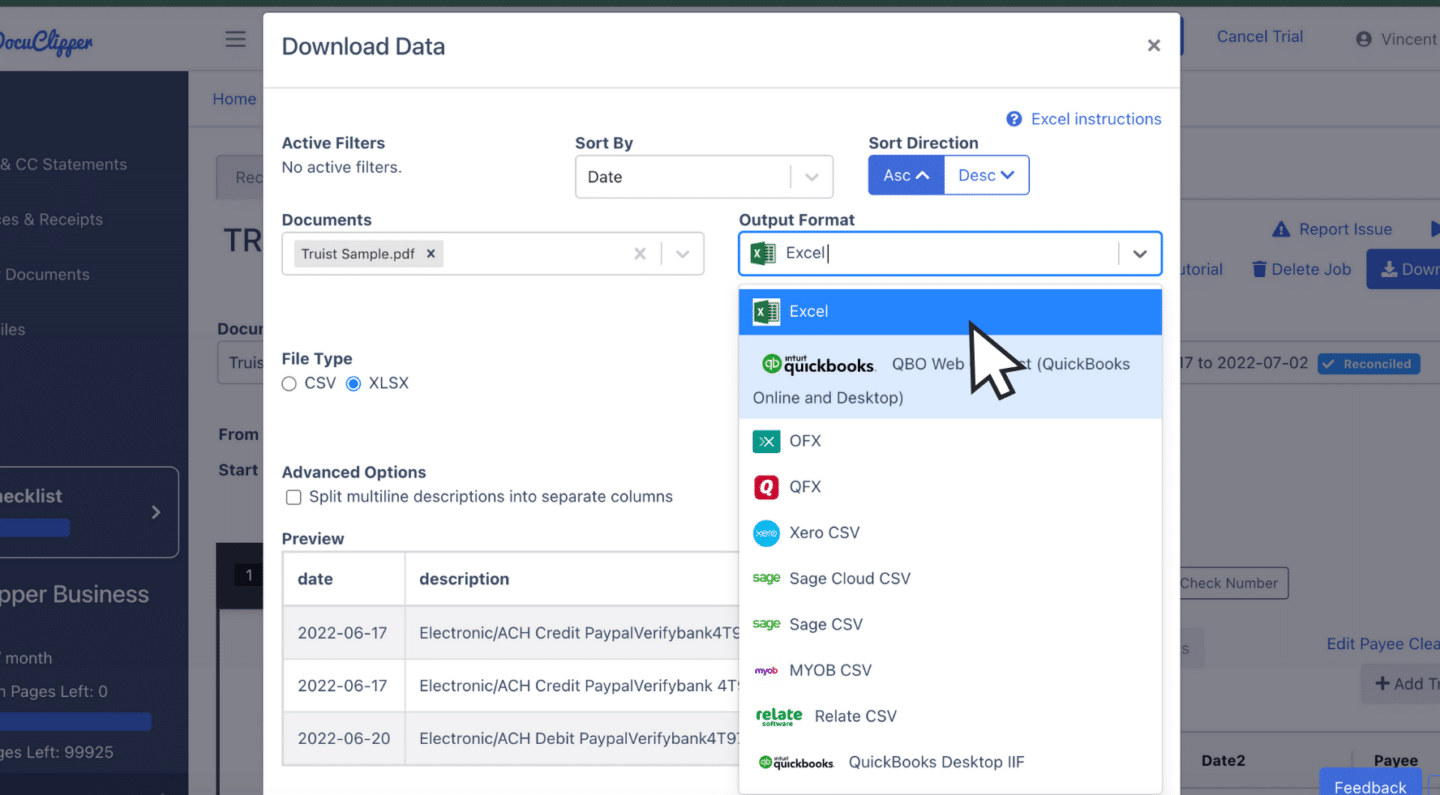

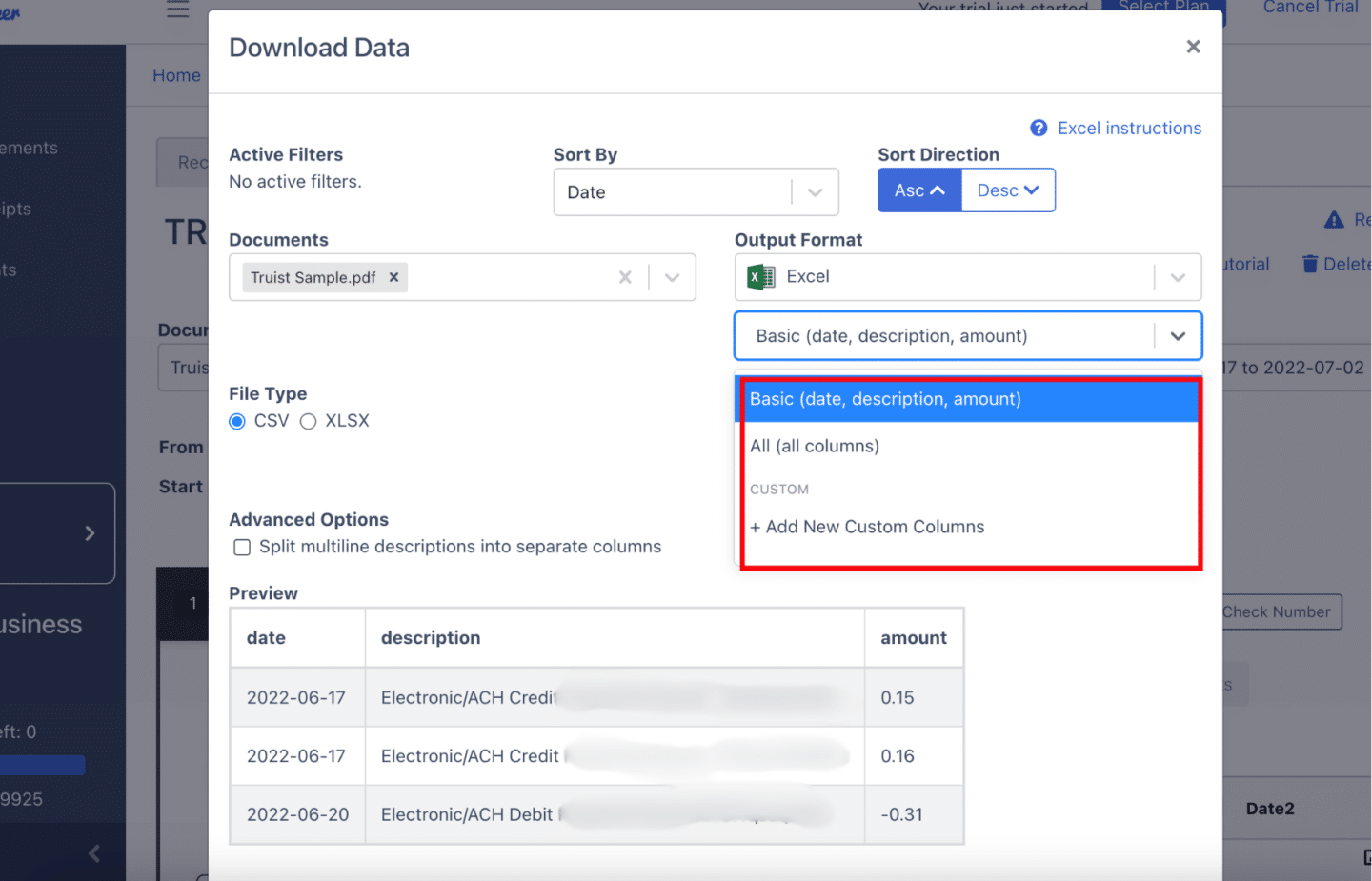

Export Truist Bank Statement to Excel

To export your Truist bank statement to Excel, first, toggle down the export bar and click “Excel.”

Next, at the middle left, choose the “XLSX” format by clicking the tick button.

Once selected, click “Download” to save the Excel file to your computer. The file will be available in your Downloads folder, ready for your accounting tasks.

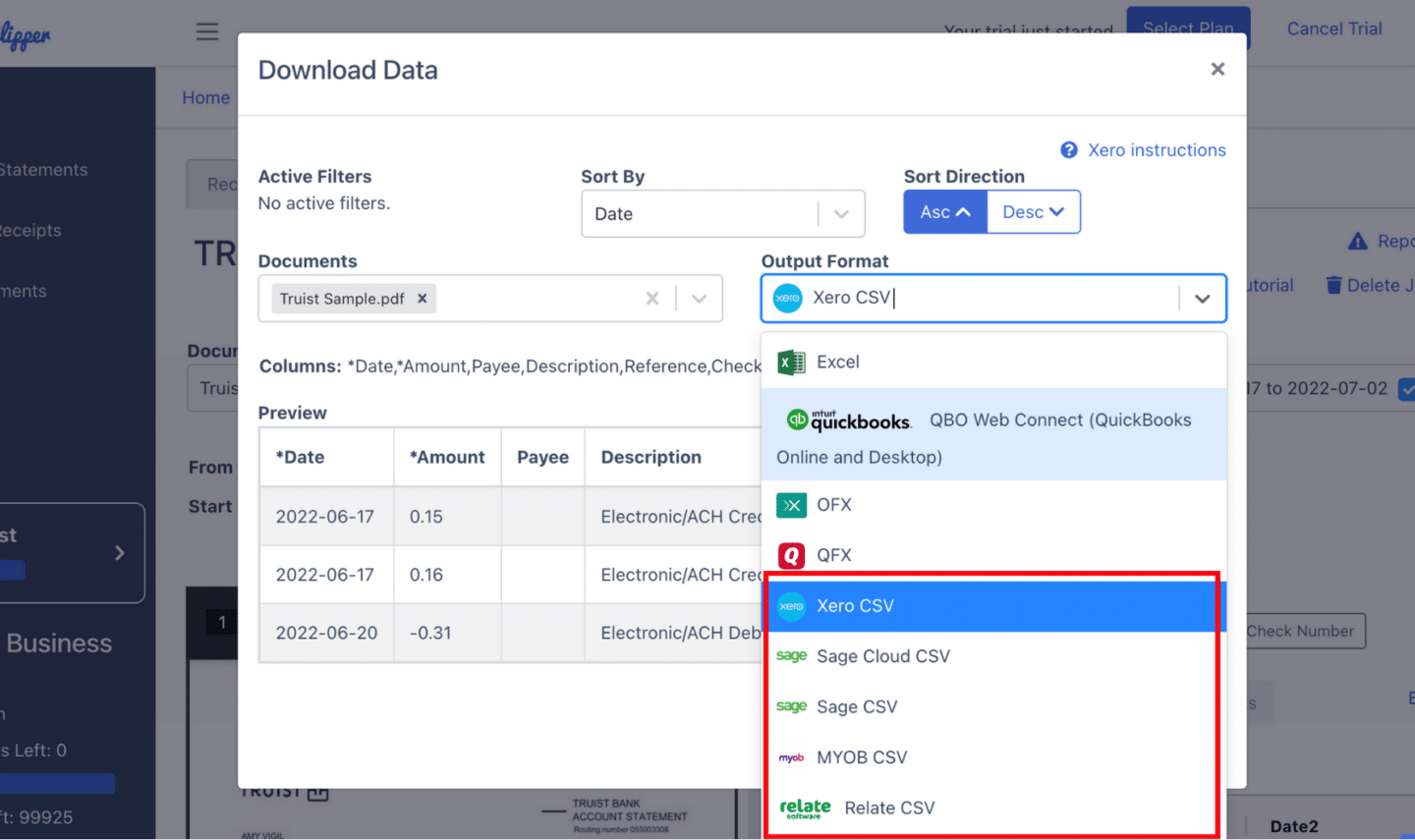

Export Truist Bank Statement to CSV

Most accounting software requires a CSV format to import bank statement data.

Similar with the Excel export, toggle down the export bar and select “Excel.”

After, choose the “CSV” file format.

If you’re using software like Quicken, Xero, Sage, MYOB, Relate, and NetSuitet, make sure to select the appropriate option in the toggle bar as these software have specific formats.

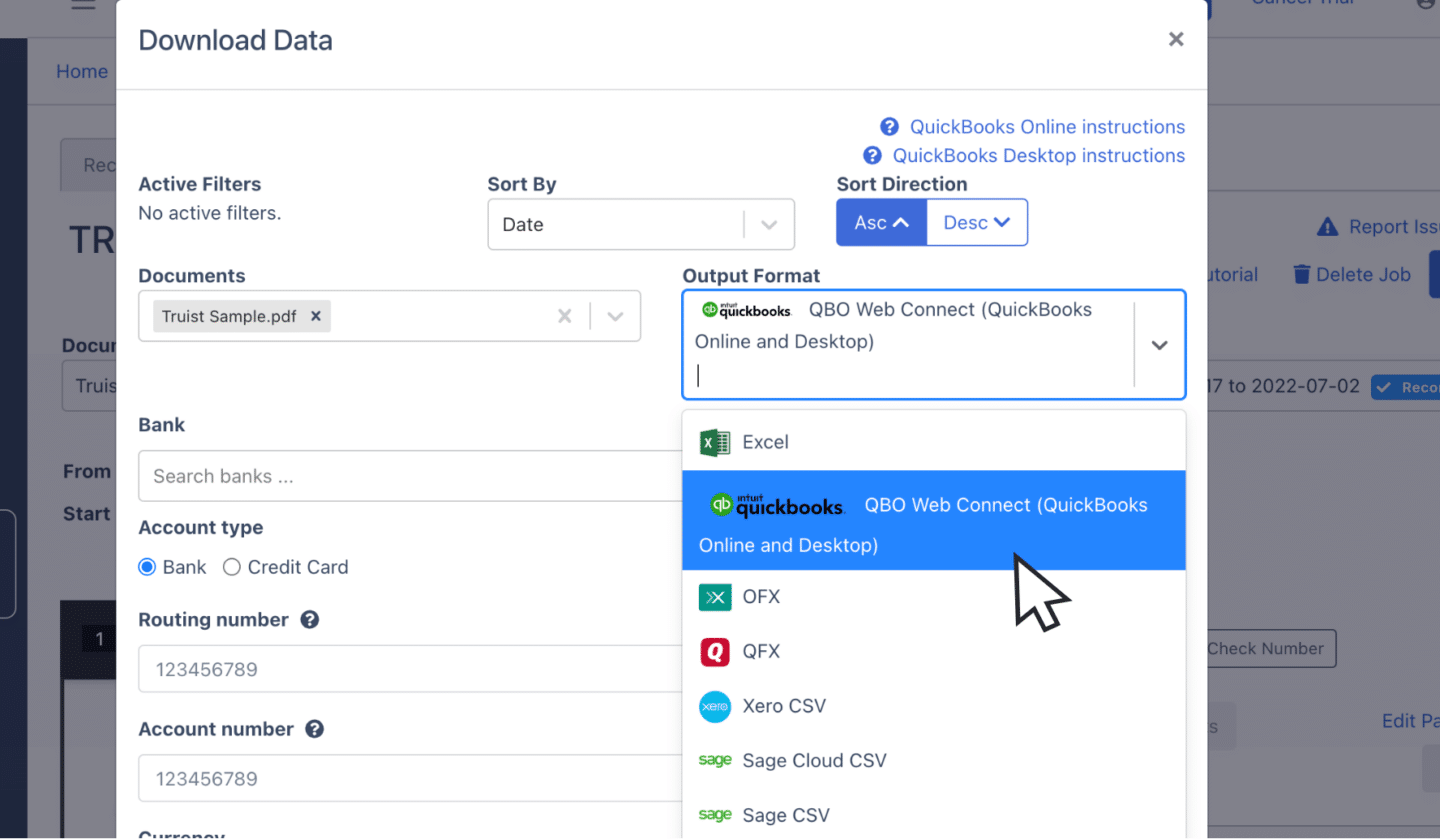

Export Truist Bank Statement to QBO

If you’re using QuickBooks, QBO is the most compatible format.

Toggle down the export bar and select “QuickBooks.”

After selecting QuickBooks, you may need to fill in additional fields with relevant information about the bank statement.

Once completed, you’re ready to export the file for use in QuickBooks.

Also, we have more guides on how to import bank statements into different software:

- Import bank statements into QuickBooks

- Import bank statements into Sage

- Import bank statements into Xero

- Import bank statements into NetSuite

Step 5: Configure the Output Format

Before exporting, you’ll have the last time to see the possible output format of your spreadsheet.

You can edit the date formats and even the column organization. DocuClipper has a default setting but if you are planning to customize your own, you can click here and make your own.

How to Download Truist Bank Statement

Downloading your Truist Bank statements can be done through its online banking portal. Here are its steps

- Log in to Truist Online Banking: Visit the Truist Bank website and sign in to your account

- Access Statements: Once logged in, go to the “Accounts” section and choose the account.

- Find the Statements Section: Under your account overview, click on the “Documents” or “Statements” tab.

- Select the Statement Period: Choose the statement period you need from the list of available statements.

- Download the Statement: Click on the download option to save the statement in PDF format to your device.

Final Advice

Banks are only limited to the bank feeds and CSV formats they can provide, so most accountants are compelled to use a PDF bank statement.

One of the biggest challenges that you can face in processing bank statements is handling PDF or paper formats. The headaches can scale as the frequency increases.

DocuClipper helps overcome this by converting PDFs into formats like Excel, CSV, or QBO.

This saves time and also reduces manual errors and boosts your productivity.

Automating these tasks allows you to focus on more complex accounting issues while also cutting costs.

Why Use DocuClipper to Convert Truist Bank Statements

DocuClipper is a web-based software made to convert PDF bank statements into formats like XLS, CSV, and QBO.

It uses automatic OCR technology to identify and extract data fields from bank statements. Additionally,

DocuClipper integrates with popular accounting software such as QuickBooks, Sage, and Xero, making data transfer and management easier.

Its transaction categorization feature allows all transactions to be neatly organized and assigned by groups. Beyond bank statements, DocuClipper can also process credit card statements, brokerage statements, receipts, and invoices.

Frequently Asked Questions

Here are some frequently asked questions about converting truist bank statements to Excel:

How can I convert Truist bank statements from PDF format?

To convert Truist bank statements from PDF format, you can use a tool like DocuClipper. Simply upload your PDF statement, and DocuClipper will convert it into formats such as Excel, CSV, or QBO. This process is quick, accurate, and eliminates the need for manual data entry.

Can I convert my PDF Truist bank statement to CSV?

Yes, you can easily convert your PDF Truist bank statement to CSV using a tool like DocuClipper. After uploading your PDF statement, select CSV as the export format. This allows you to import the data into most accounting software, simplifying your workflow and improving accuracy.

Can I convert my Truist bank statement to QBO?

Yes, you can convert your Truist bank statement to QBO using DocuClipper. After uploading your Truist bank statement, simply choose the QuickBooks (QBO) format for export. This ensures seamless integration with QuickBooks, making it easier to manage your financial data directly within your accounting software

Does Truist provide CSV formats of bank statements 5 years ago?

No, Truist only provides CSV formats for bank statements up to 18 months. For older statements, you’ll need to rely on PDF versions, which can be converted to CSV using tools like DocuClipper. This allows you to handle older statements efficiently without manual data entry.

Learn more

Looking for more types of bank statements to convert? Check out our library about bank statement conversion:

- How to Convert M&T Bank Statement to Excel

- How to Convert PNC Bank Statement to Excel, CSV, and QBO

- How to Convert Chase Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

Or use these resources to learn more about accounting:

- How to Convert CSV to QBO Format for QuickBooks Online & Desktop

- How To Automatically Categorize Bank Transactions in Excel: Template Included

- How OCR Data Entry Works & Why It’s So Popular