Wells Fargo bank statements offer transactions for only up to 90 days, leaving professionals to rely on a PDF for processing bank statements. This limitation forces many to rely on tedious, manual data entry. This process is time-consuming and prone to errors.

Luckily, there’s a fast, precise solution: bank statement converters. In this guide, we’ll show you how to convert Wells Fargo bank statement to Excel, CSV, and QBO formats effortlessly.

Step 1: Upload Wells Fargo Bank Statement to DocuClipper

Start by logging into your DocuClipper account. New users can sign up for a free trial to get started. Once logged in, go to the “Convert” section under bank and credit card statements.

Drag and drop your Wells Fargo PDF statements, and you can upload multiple files at once.

You can also organize the files by adding tags or custom names. Alternatively, email the statements directly to the address listed in your account settings.

After uploading, find your files in the “Converted Files” section on the left menu, ready for the next steps in converting bank statements to Excel.

Step 2: Analyze Wells Fargo Bank Statement

Once your statement is uploaded, DocuClipper displays a side-by-side view of the statement alongside the extracted data in a spreadsheet format, complete with a dashboard.

This setup allows you to carefully review each bank transaction, checking for any discrepancies in amounts, dates, or totals that may appear due to bank errors.

If you’re working with scanned paper statements, be mindful of any projection errors from the scanning process, as these can affect data accuracy. This review stage is essential to ensure your data is precise before moving forward.

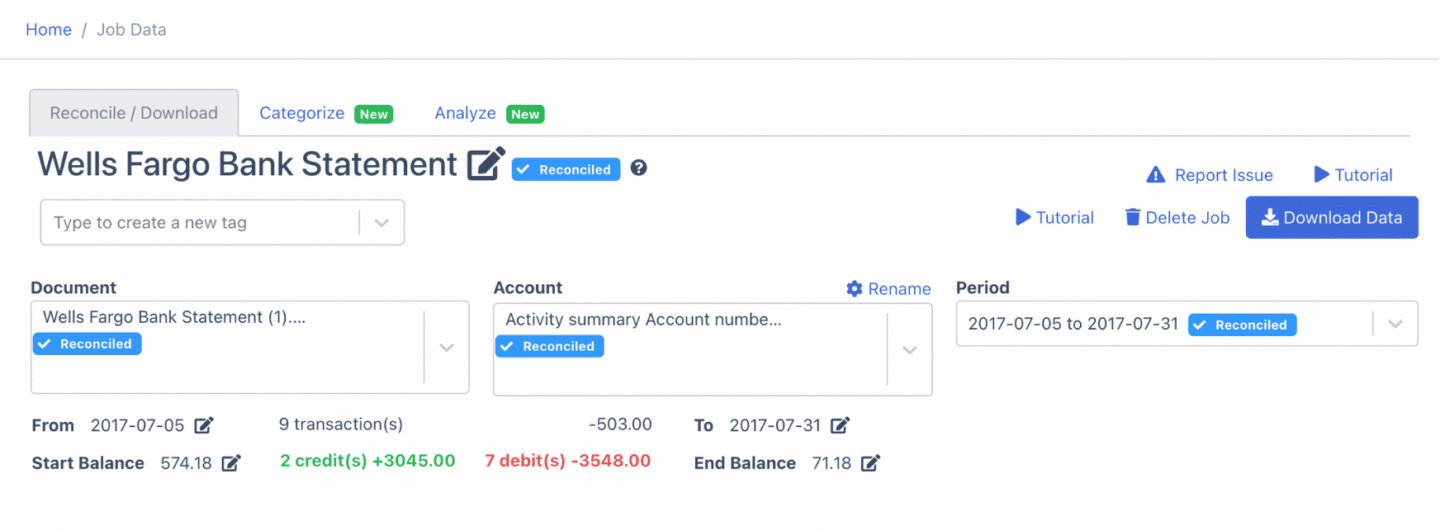

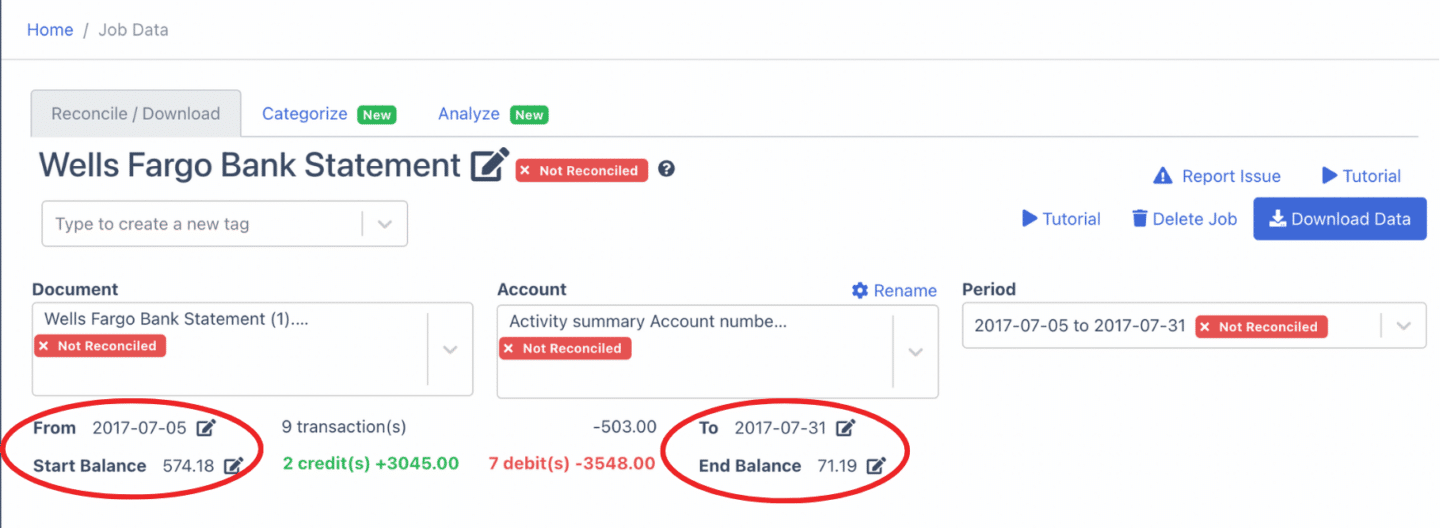

Step 3: Reconcile Wells Fargo Bank Statements

After reviewing, DocuClipper will automatically reconcile your bank statement data. If any discrepancies are detected, you’ll see that the bank statement reconciliation is incomplete.

To fix this, manually adjust any transactions, amounts, dates, or details by clicking the arrow beside the relevant data.

If additional entries are needed, select “Add Transaction,” input the details, and confirm that credits and debits are accurately categorized.

Once these adjustments are complete, your Wells Fargo statement will be fully reconciled and prepared for export.

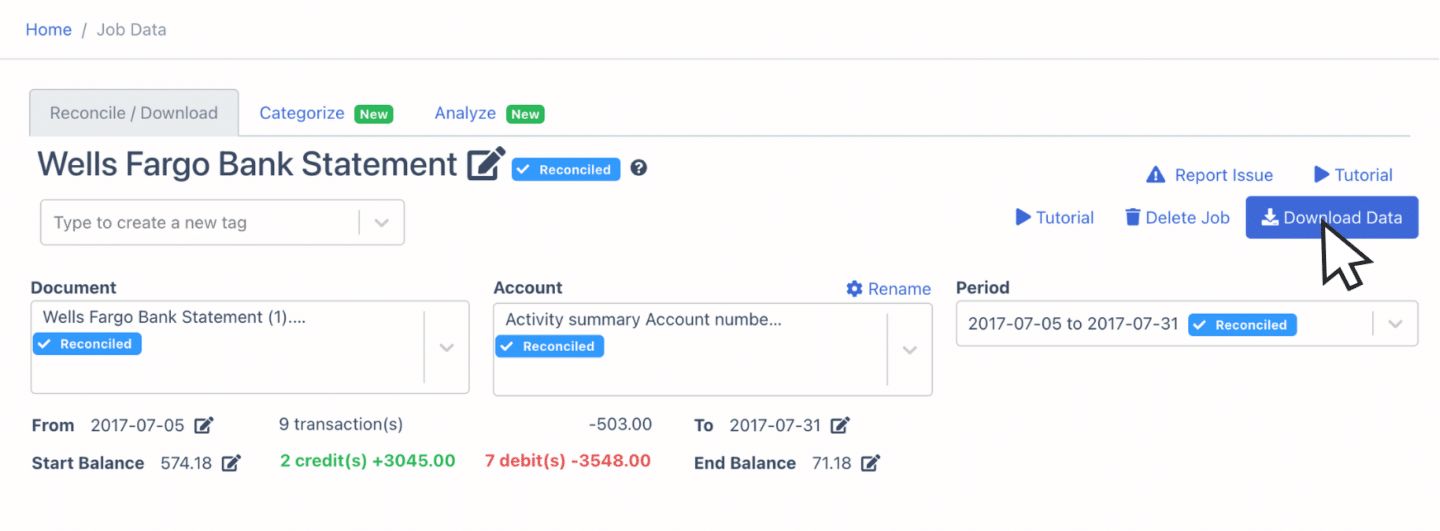

Step 4 Export Wells Fargo Bank Statement to Excel, CSV, QBO

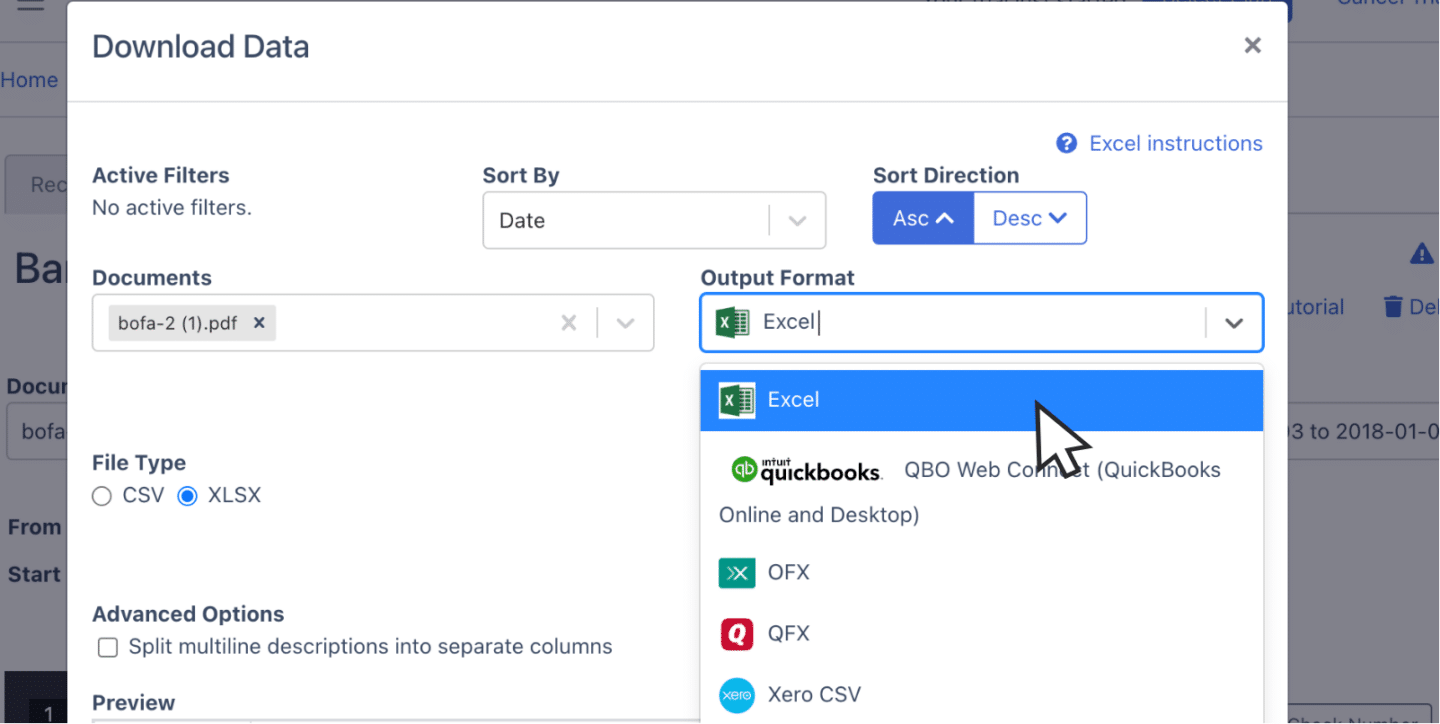

With your bank statement fully reconciled, you’re ready to export it to Excel, CSV, or QBO formats. Simply click “Download” to initiate the export and select your desired format.

Export Wells Fargo Bank Statement to Excel

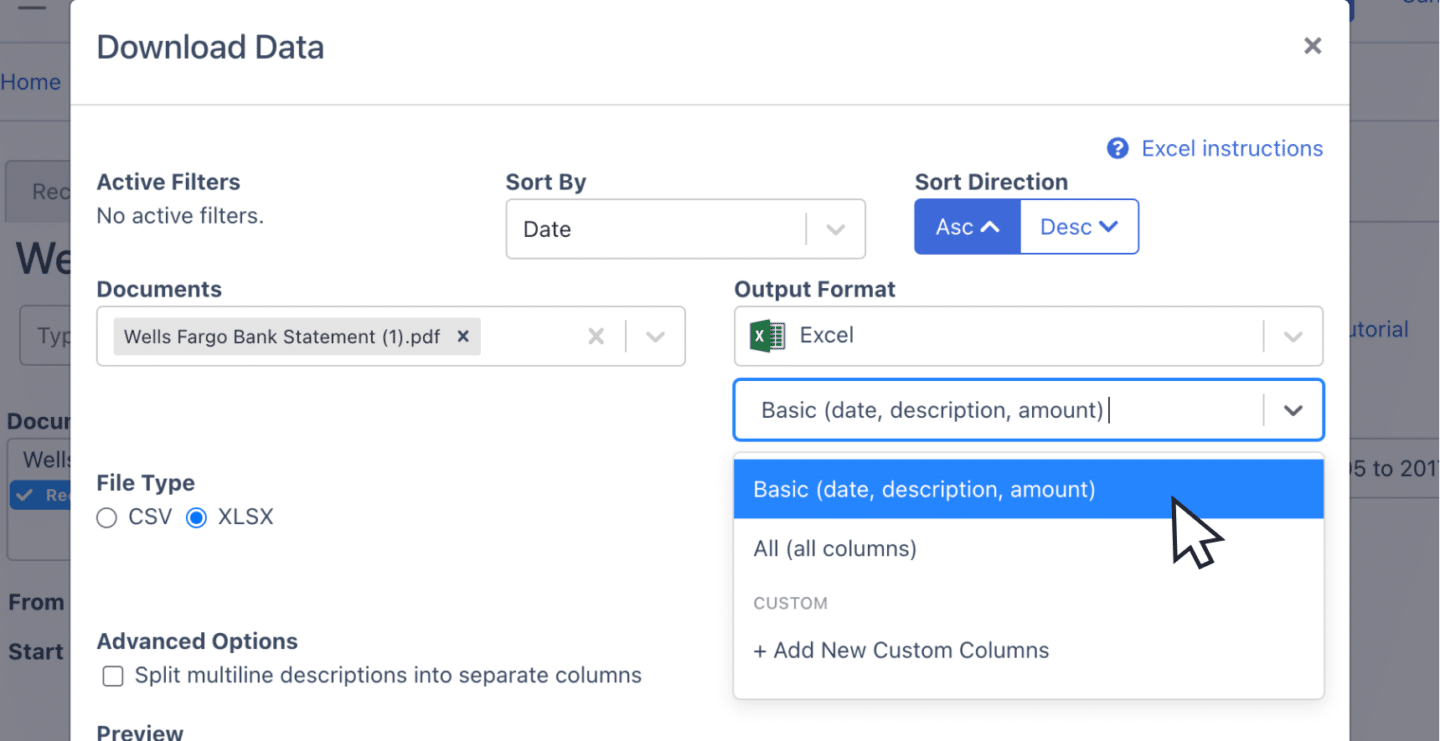

To export your Wells Fargo statement as an Excel file, open the export menu and select “Excel.” Choose the “XLSX” format for compatibility with most spreadsheet applications.

Once selected, click “Download” to save the Excel file, which will be available in your Downloads folder, ready for integration into your accounting tasks.

Export Wells Fargo Bank Statement to CSV

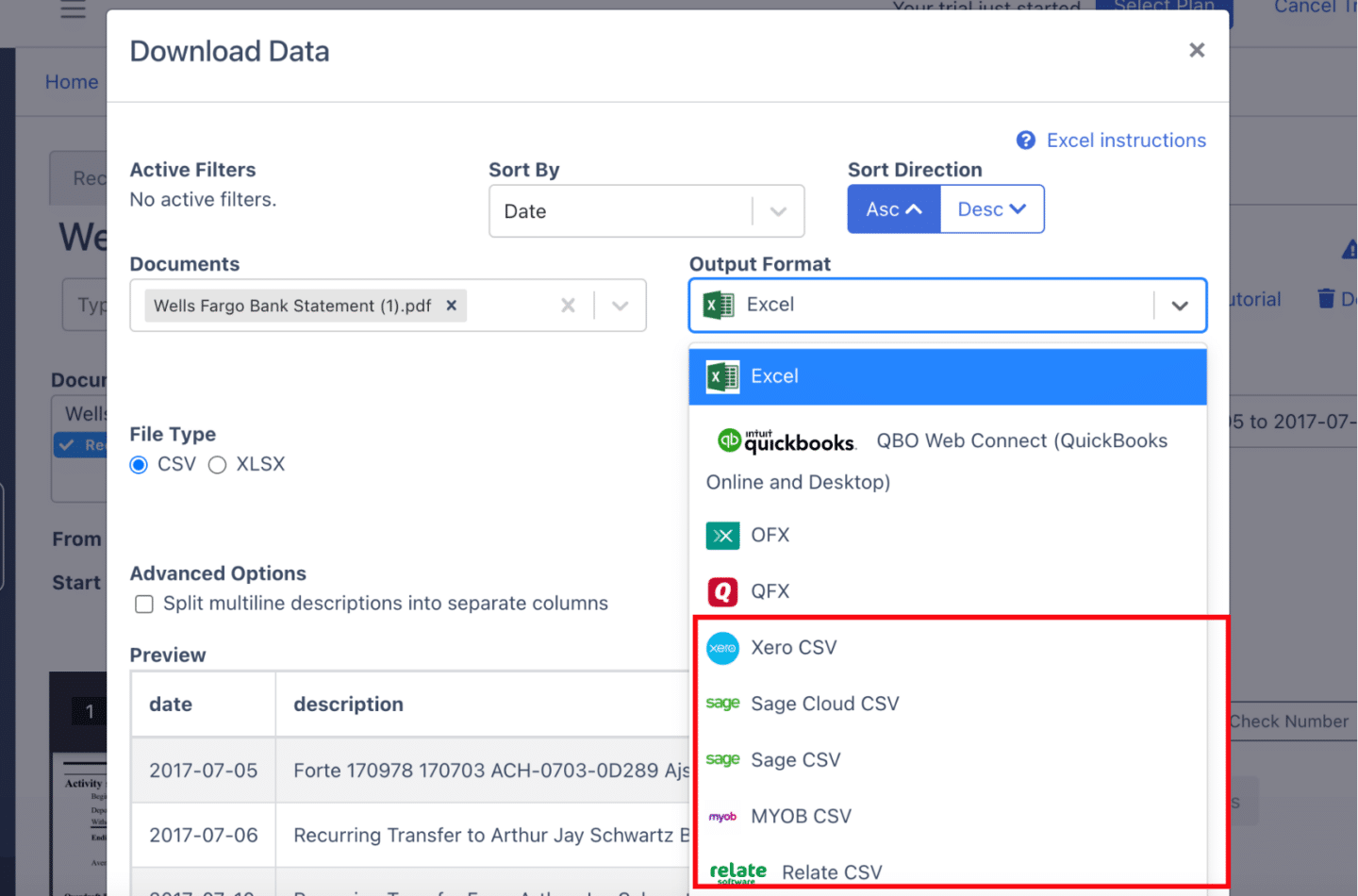

Many accounting tools, such as Quicken, Xero, Sage, MYOB, Relate, and NetSuite, support the CSV format.

To export your Wells Fargo statement as a CSV file, open the export menu, select “Excel,” and then choose “CSV” from the dropdown options. This ensures compatibility with your preferred accounting software.

Export Wells Fargo Bank Statement to QBO

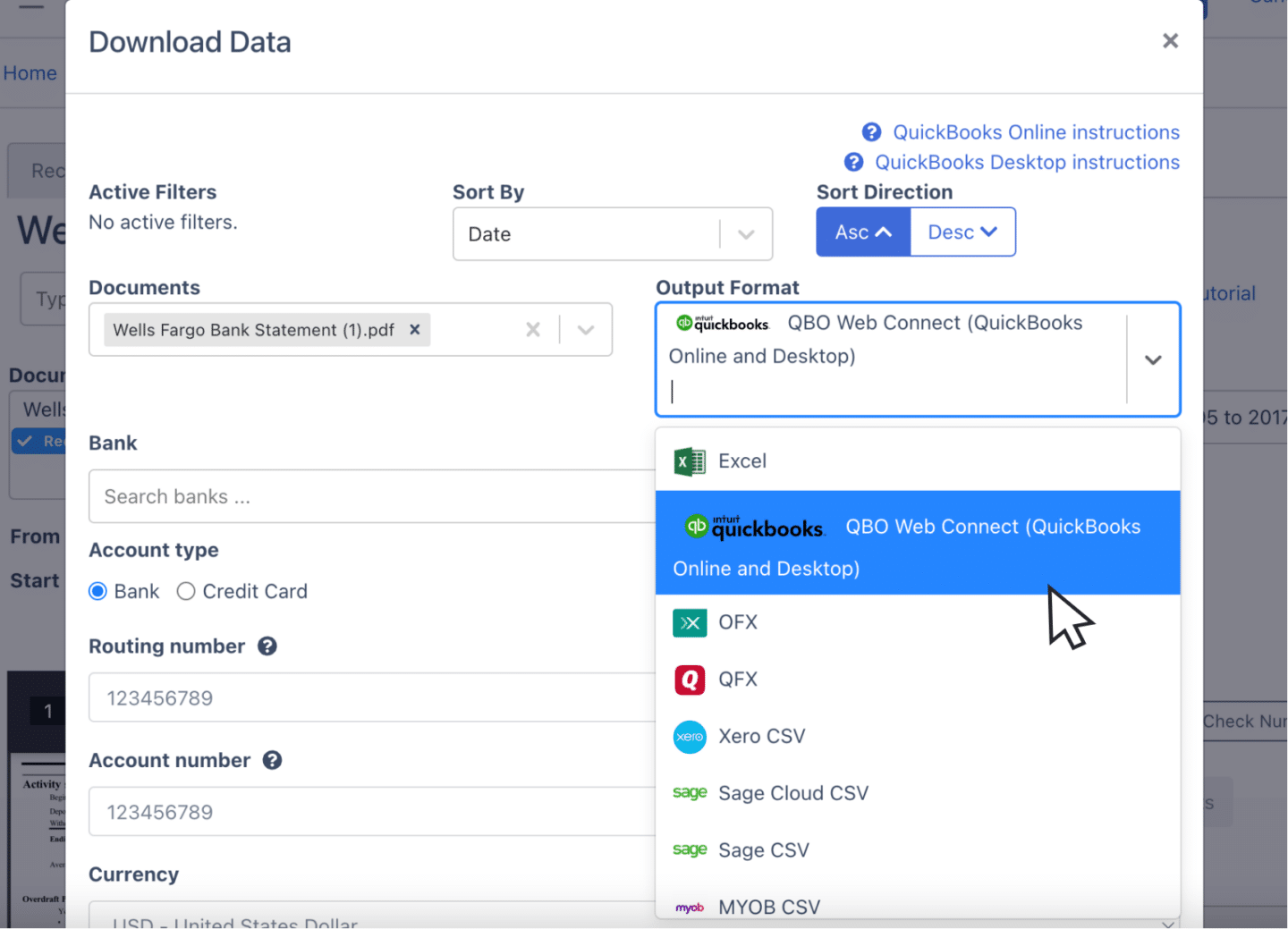

For QuickBooks users, exporting to QBO format ensures seamless integration.

Open the export menu and select the QBO option. Complete any required fields for setup. Once configured, simply download the file, which you can then import directly into QuickBooks for streamlined accounting.

Also, we have more guides on how to import bank statements into different software:

- Import bank statements into QuickBooks

- Import bank statements into Sage

- Import bank statements into Xero

- Import bank statements into NetSuite

Step 5: Configure the Output Format

Before finalizing the export, take a moment to review and configure the spreadsheet’s output format. You can customize details like date formats or rearrange column layouts to suit your specific needs.

DocuClipper’s default format can be easily modified by selecting customization options. For a fully personalized setup, click on “Customization” and adjust the spreadsheet layout to align with your exact requirements.

How to Download Wells Fargo Bank Statements

When you still haven’t downloaded the PDF statement of your Wells Fargo Bank Statements, here are the steps to acquire one:

- Log In: Visit the Wells Fargo website and sign in with your username and password.

- Select Account: Choose the account for which you need statements.

- Find Statements: In the account menu, go to “Statements & Documents” or “Statements.”

- Choose Period: Select the date range or statement period you want.

- Download: Click on the Download button. The spreadsheet should appear after clicking

Final Advice

Banks usually offer statements in limited formats like bank feeds or CSV, often leaving accountants with only PDF files. As the volume of these PDFs grows, managing and processing bank statements becomes more challenging.

DocuClipper improve this by converting PDFs into formats like Excel, CSV, or QBO—saving time, reducing errors, and enhancing productivity. Automating this task frees up time for more complex accounting work and helps cut operational costs.

Why Use DocuClipper to Convert Wells Fargo Bank Statements

DocuClipper is a web-based software made to convert PDF bank statements into formats like XLS, CSV, and QBO.

It uses automatic OCR technology to identify and extract data fields from bank statements. Additionally,

DocuClipper integrates with popular accounting software such as QuickBooks, Sage, and Xero, making data transfer and management easier.

Its transaction categorization feature allows all transactions to be neatly organized and assigned by groups. Beyond bank statements, DocuClipper can also process credit card statements, brokerage statements, receipts, and invoices.

FAQs About How to Convert Wells Fargo Bank Statement to Excel

Here are some frequently asked questions about converting Wells Fargo Bank Statement to Excel:

Can I export my Wells Fargo bank statement to Excel?

Yes, you can export your Wells Fargo bank statement to Excel, but it requires a conversion tool, as Wells Fargo only provides statements in PDF format. By using DocuClipper, you can quickly transform the PDF into an Excel file for easy data management and accounting.

How do I download a Wells Fargo bank statement to a CSV file?

To download a Wells Fargo bank statement as a CSV file, you’ll first need to download the statement in PDF format from your online banking account. Then, use DocuClipper to convert the PDF into a CSV file, ready for import into your accounting software.

How do I export a Wells Fargo bank statement to Excel?

To export a Wells Fargo bank statement to Excel, start by downloading the statement as a PDF from your online banking account. Then, use DocuClipper to convert the PDF file into Excel format (XLSX), allowing for easy data management and analysis.

How do I convert financial statements to Excel?

To convert financial statements like Profit & Loss (P&L), income statements, or cash flow statements to Excel, first download them as PDFs from your accounting or banking platform. Then, use a PDF-to-Excel converter or a financial document processing tool like DocuClipper. These tools use OCR technology to accurately extract and structure data into Excel, ensuring easy analysis and manipulation of financial information.

Learn More

Looking for more types of bank statements to convert? Check out our library about bank statement conversion:

- How to Convert Chime Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

- How to Convert HDFC Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

- How to Convert Chase Bank Statement to Excel, CSV, and QBO in 1 Minute or Less

Or use these resources to learn more about accounting: