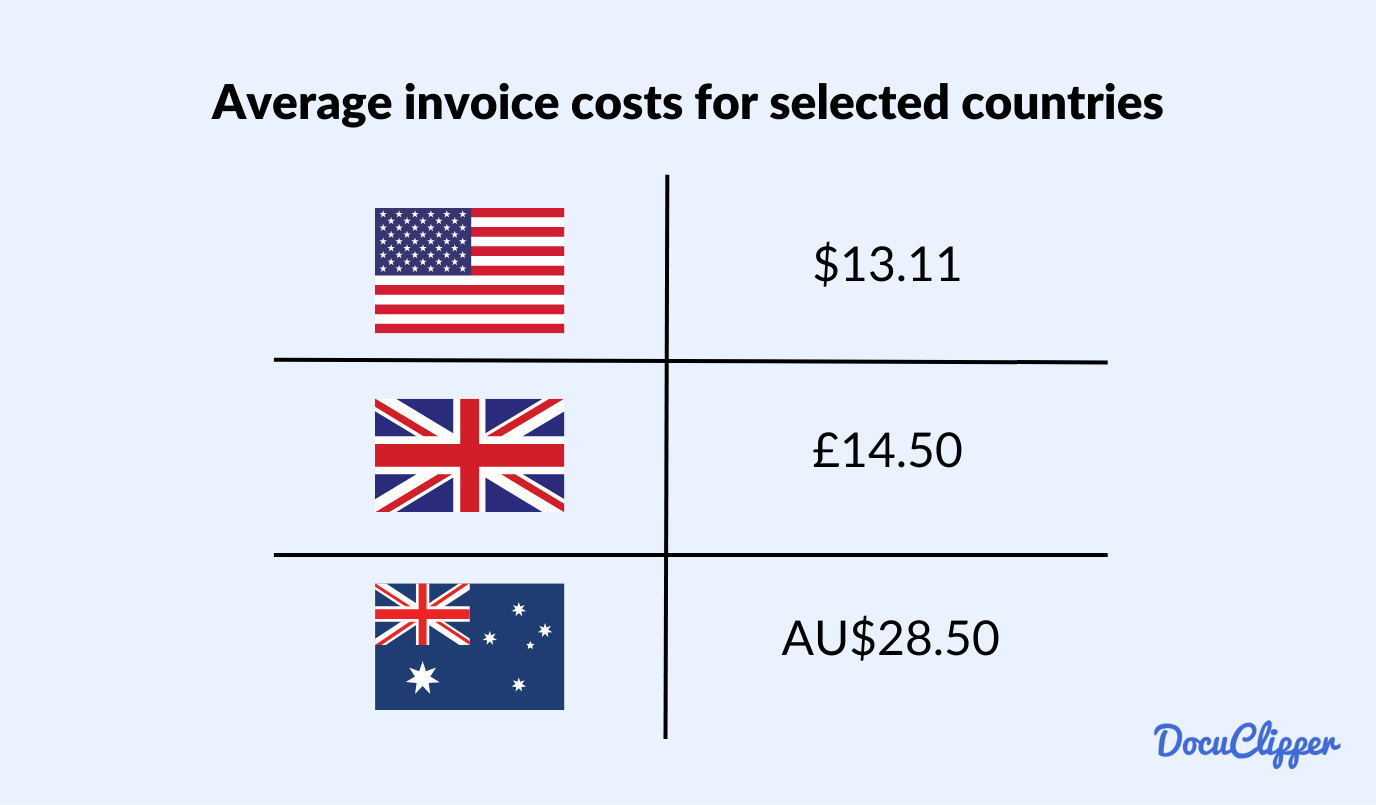

The cost to process an invoice varies greatly from country to country based on the average salary in each country.

However, what all countries have in common when it comes to processing invoices is that manual invoice processing is significantly more expensive, prone to errors, and time-consuming compared to using automated invoice processing software.

In this article, we’re going to show you the average cost of processing invoices manually versus automatically, and how you can save money on invoice processing.

How Much Does an Invoice Cost to Process in the US

In the United States, the cost to process an invoice can vary widely. According to Ardent Partners’ State of ePayables report, the average cost to process a single invoice is $13.11.

Smaller businesses often face higher costs, while Adobe estimates the cost at between $15 and $40 per invoice.

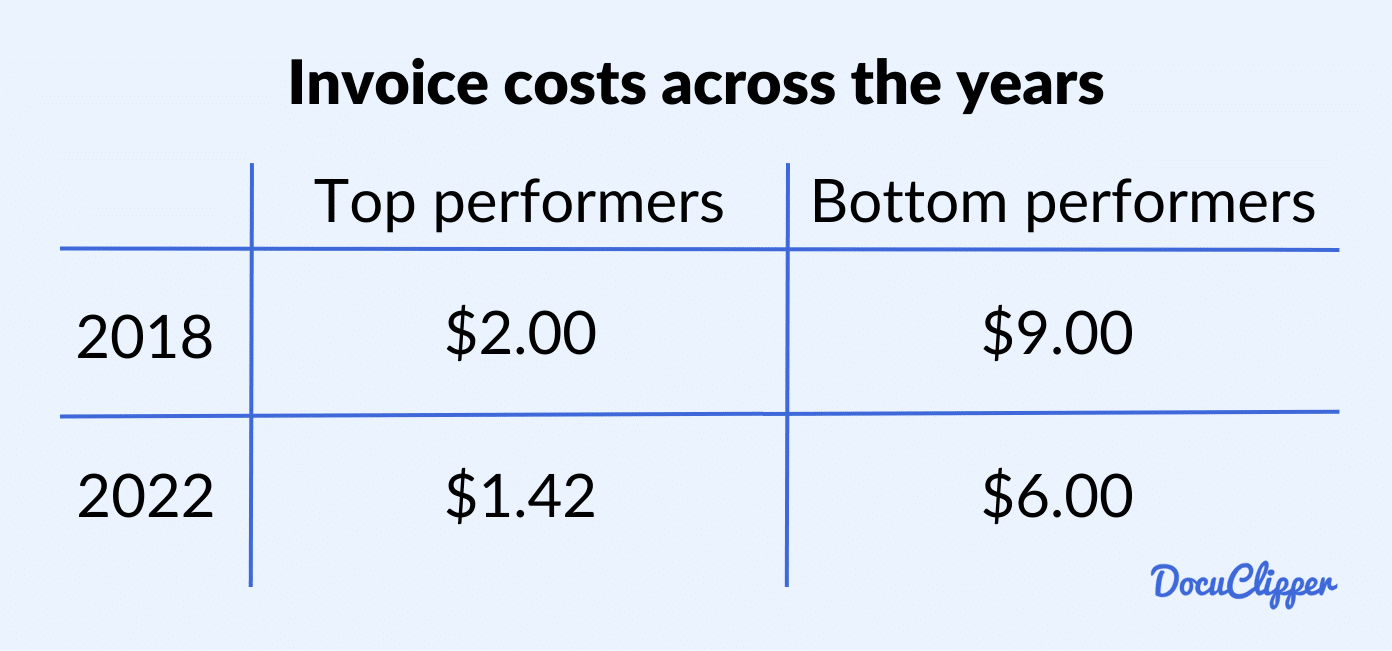

Historically, costs have decreased for top performers: in 2018, bottom performers spent $9 per invoice, median performers spent $3.94, and top performers spent as little as $2. By 2022, APQC found that top performers spent just $1.42 per invoice, while bottom performers still faced costs of $6 per invoice.

How Much Does an Invoice Cost to Process in the UK

In the UK, processing an invoice can cost anywhere from £4 to £25, depending on the complexity of the task. For invoices that involve more manual work or errors, this cost can rise to as much as £50 per invoice.

However, by implementing accounts payable automation, you can significantly reduce these expenses.

Automated processes typically cut costs by 60-80%, bringing the average cost per invoice down to £5 or less.

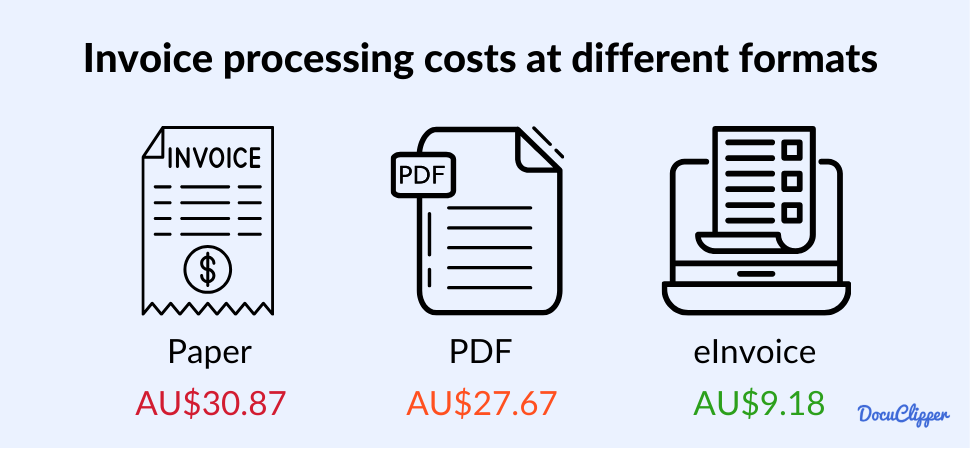

How Much Does an Invoice Cost to Process in Australia

In Australia, the cost of processing invoices varies depending on the format. Mark Stockwell of the Australian Taxation Office (ATO) estimates that handling a paper or emailed PDF invoice typically costs between $27 and $30.

A study conducted by the ATO, in collaboration with Deloitte Access Economics, breaks down these costs further.

On average, processing a PDF invoice will cost you AU$27.67, while dealing with a paper invoice is even higher at AU$30.87.

However, switching to e-invoicing can significantly cut your costs, reducing the average expense to just AU$9.18 per invoice.

Factors Affecting Invoice Processing Costs

Invoice processing consists of a lot of factors that affect cost, spanning both pre-accounting tasks like data capture and invoice validation, and post-accounting activities such as payment processing and reconciliation. Here are some notable aspects that can create swings in expenses:

Manual vs. Automated Processing

When it comes to invoice processing, the method you use plays a big role in cost. You might assume that automation is more expensive due to the software investment, but it’s actually the opposite.

Automated invoice data entry allows your business to scale more efficiently with less manual effort.

According to the Institute of Finance & Management (IOFM), manual processing can cost as much as $16 per invoice, while automation can bring that cost down to as little as $3 per invoice.

Manual processing involves labor and material expenses, such as paper, which can quickly add up, especially as your invoice volume increases. By automating the process, you not only reduce costs but also improve efficiency, making it a more cost-effective solution in the long run.

Volume of Invoices:

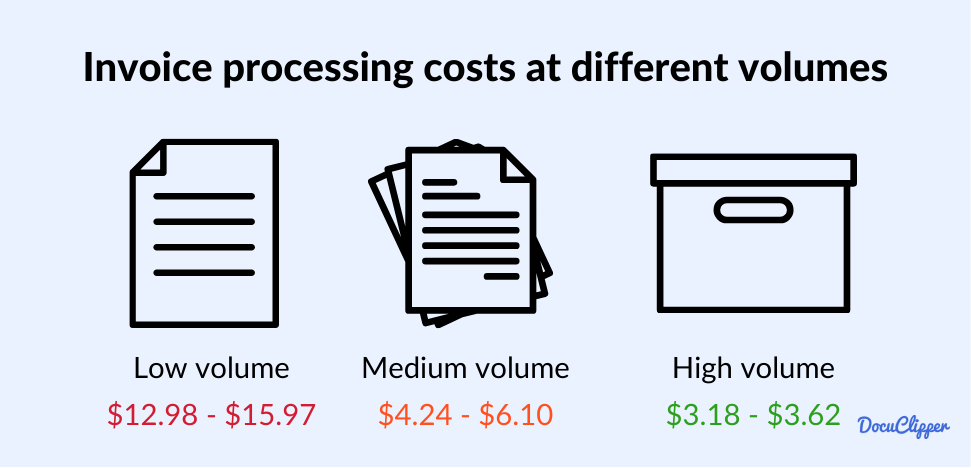

The number of invoices your team can process daily varies, but on average, an accountant can handle around 32-40 invoices per day. If your invoice volume exceeds this, you may need to hire additional staff, effectively doubling your processing costs.

According to Anna Leo, invoice processing costs differ across industries. For organizations with a low invoice volume, processing can cost between $12.98 and $15.97 per invoice. For moderate volumes, the cost drops to $4.24 to $6.10 per invoice. High-volume organizations enjoy the lowest costs, with processing expenses ranging from $3.18 to $3.62 per invoice.

However, whether your processing is manual or automated plays a significant role in determining these costs, with automation generally providing more savings, especially at higher volumes.

Complexity of Invoices:

The complexity of your invoices can greatly impact processing costs. Industry studies reveal that manual processing costs can range from $5 to $20 per invoice, depending on the size of your organization and the complexity involved.

More complex invoices typically require additional time and effort, which drives up costs. This can be an issue when the invoices you receive are from different countries where their invoice formats are different than the usual

Labor Costs:

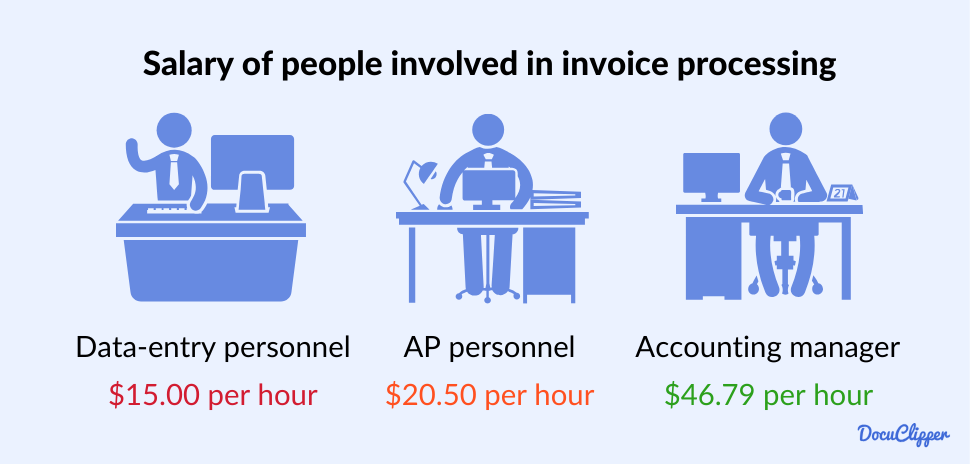

When it comes to processing invoices, accountants aren’t doing most of the heavy lifting. Instead, the bulk of the work falls to clerical staff and supporting personnel. These teams handle essential tasks like data entry, initial reviews, and approvals.

Data entry personnel typically earn around $15 per hour, focusing on accurately entering invoice details into the system.

Accounts Payable (AP) personnel, who manage invoice workflows and ensure timely payments, make about $20.50 per hour

Meanwhile, accounting managers, who oversee the entire process and provide final approvals, earn an average of $46.79 per hour.

These labor costs can add up quickly, especially for businesses with high invoice volumes and when they invest more time.

Breakdown of Invoice Processing Costs

The costs associated with invoice processing are multifaceted, comprising direct, indirect, and hidden expenses that can quickly add up.

Direct Costs

Direct costs are the most immediate and tangible expenses involved in processing invoices.

- Labor costs are a key component, determined by the number of hours and personnel needed to handle your invoice volume. The more invoices you process, the more staff hours are required, increasing overall costs.

- Software and tools used in the process can range widely in price—from $20 to 1,000 per month—depending on the services you choose. Basic plans can handle low-volume tasks, like data extraction, while more advanced options come at a higher price but offer greater automation and efficiency.

Indirect Costs

Indirect costs may not always be obvious, but they play a significant role in your bottom line.

Training and onboarding

New employees in accounts payable can be a time-consuming process, resulting in a temporary productivity dip. Even experienced hires require a day or two to get acclimated to your company’s workflow.

Error correction

When errors occur, such as discrepancies in invoice details, the process of correcting and verifying these mistakes can take up to three days. This not only increases labor costs but also creates a backlog in newer invoices, causing delays.

Hidden Costs

Hidden costs can be the most surprising as this can tip off your business budget and might lead you to significant losses.

- Delayed payments: Suppliers often impose late fees of 1-2% per month on overdue invoices. These penalties can accumulate quickly if your accounts payable team needs to catch up.

- Lost invoices: This is the most unnoticeable cost. While requesting a new invoice from a vendor may seem minor, the repercussions are more severe during audits. Missing invoices can lead to serious legal or financial penalties, depending on your jurisdiction.

Why is Invoice Processing Cost a Concern for Businesses?

Invoice processing costs are a significant concern for businesses because reducing them directly impacts profitability.

Every dollar saved in this routine process can be redirected toward growth and innovation. By cutting costs without sacrificing productivity, you open the door to higher profits and better cash flow.

This is especially important when you consider that, according to Versapay’s State of Digitization in B2B Finance report, 82% of companies lose revenue due to invoicing conflicts, with 85% reporting underpaid invoices as a result.

Eliminating these revenue losses through more efficient processing not only saves money but also strengthens your financial position. Streamlining this area is an essential step toward driving business success and long-term sustainability.

Best Practices to Reduce Invoice Costs

To reduce invoice costs, here are some best practices for you to apply:

- Implement AP Software: Modernize your workflow by adopting paperless invoice processing and automating invoice workflows, which can help you significantly reduce losses. Automation improves efficiency, allowing your team to focus on higher-value tasks.

- Use Invoice Data Extraction Software: Automate the data entry process with software that quickly and accurately extracts invoice data. This reduces errors and speeds up the entire process, saving you time and money.

- Adopt E-Signature Software: Use e-signature software to streamline the approval process, eliminating the need for printing and scanning. This speeds up processing times and reduces delays in invoice approvals.

- Create a Standardized Invoice Processing Workflow: Develop a clear, standardized system with feedback loops to ensure consistent efficiency. This reduces the time spent on processing and increases overall productivity within your accounts payable team.

How DocuClipper Can Help?

DocuClipper is a powerful invoice data extraction tool that simplifies the conversion of e-invoices in PDF format to Excel, CSV, and QBO.

These formats can be easily imported into your ERP software, and with DocuClipper’s API integration, you can automate the entire process. If you use QuickBooks, DocuClipper connects seamlessly, automatically syncing all invoice data without the need for manual downloads or uploads. You can also extract data from your invoices through email attachments since invoices are often sent via email.

Beyond invoices, DocuClipper also manages receipts, bank statements, credit card statements, and brokerage statements with 99.5% accuracy.

Additionally, it features transaction categorization, allowing you to break down and track each transaction with ease, making your financial management more efficient and precise.

Conclusion

Reducing invoice processing costs is essential for enhancing profitability and efficiency. By adopting automation tools like DocuClipper, you can streamline your workflow, minimize errors, and reduce labor costs. Implementing best practices and modernizing your accounts payable process can transform your business operations, saving time and money.

Frequently Asked Questions

Here are some frequently asked questions about invoice costs:

What is the average cost to process an invoice?

The average cost to process an invoice varies. Manual processing can cost anywhere from $5 to $20 per invoice, while automation can bring that down to as low as $3 per invoice.

How can automation reduce invoice processing costs?

Automation reduces costs by minimizing labor, eliminating errors, and speeding up the overall process. It allows for more efficient handling of invoices, significantly lowering the manual work and associated costs involved in traditional processing.

What are the hidden costs of invoice processing?

Hidden costs include penalties for delayed payments, errors that require reprocessing, and lost invoices. These costs can add up over time and impact your profitability, making it crucial to implement efficient processing systems.

What are the benefits of using AP automation software?

AP automation software saves time, reduces errors, and cuts processing costs by streamlining the entire invoice workflow. It allows for faster, more accurate handling of invoices, ultimately improving cash flow and vendor relationships while minimizing manual effort.