Looking for efficient Docparser alternatives to streamline your document data extraction process? This guide explores top-notch options, their features, pros, cons, and pricing to help you make an informed decision.

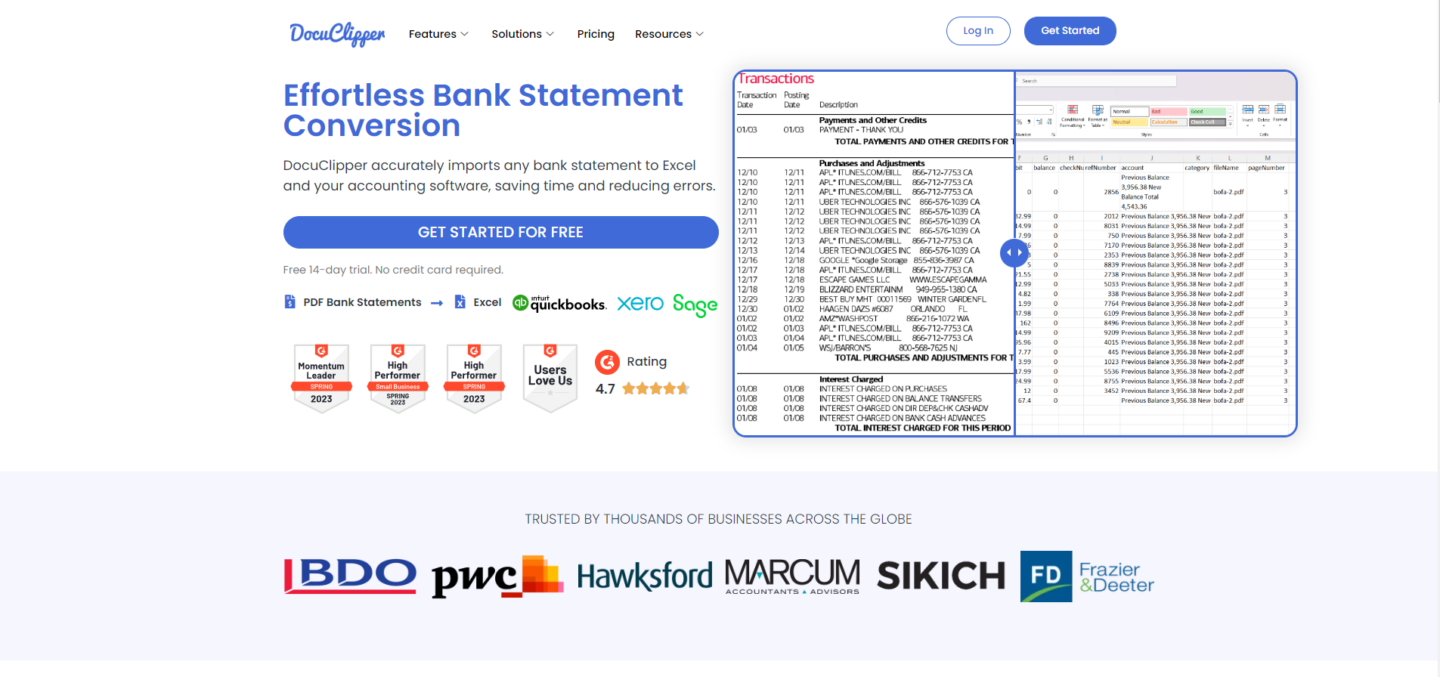

1. DocuClipper

The first and one of the best bank statement converter software on the market is DocuClipper.

DocuClipper is an OCR software tool that extracts data from scanned or PDF bank statements, invoices, receipts, checks, credit card statements, and brokerage statements.

It uses advanced OCR technology to convert documents into structured formats like Excel or CSV with 99% accuracy and great speed, and easily imports bank transactions into QuickBooks, Xero, or Sage.

DocuClipper bank statement converter can be used to automate the process of data entry, which can free up employees to focus on more important tasks. DocuClipper can also help businesses improve their financial reporting by providing accurate and timely data.

DocuClipper is a great way to save time and money, and it can help you improve your business’s financial reporting. If you’re looking for a way to automate your data entry process, DocuClipper is an excellent option.

Key Features

- Automatically converts any bank statements into Excel or CSV, whether scanned or PDF.

- Highly accurate bank statement OCR with 99% accuracy.

- Very fast processing converting documents into editable files in seconds.

- Provides bank reconciliation to ensure 100% conversion accuracy.

- Easily imports data into QuickBooks, Xero, or Sage.

- Users can set up custom categories for each case and group transactions to clarify the analysis.

- DocuClipper can filter and examine transfers to identify fraudulent transfers and preference payments.

- The platform can visualize the flow of funds from a list of sources into accounts or legal entities and out to a list of uses.

- DocuClipper uses the latest security measures to protect your data.

- Automatically detects multiple accounts in a single statement.

- Provides excellent financial investigation features such as file inventory, transaction categorization, transfer detection, and flow of funds.

Pros

- Easy to use: DocuClipper is a web-based application that is very easy to use. You can upload your documents in PDF format and will automatically convert them into a variety of formats, including Excel, QuickBooks, and CSV.

- Affordable: DocuClipper is very affordable, especially for small businesses.

- Accurate: DocuClipper is very accurate. The software uses optical character recognition (OCR) technology to convert your bank statements into text, which ensures that all of the data is accurately entered.

- Secure: DocuClipper is a secure application. Your data is encrypted and stored on secure servers.

Cons

- Limited direct integrations into ERP software

- No camera app is available to scan and convert physical documents directly.

- Cost: Depending on the pricing plan, DocuClipper might not be cost-effective for all businesses or individuals, especially those with low-volume data extraction needs.

Pricing

Here’s a brief explanation of DocuClipper’s pricing:

Monthly Pricing:

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details

Annual Pricing (Save 20%):

- Starter: $27/month for 200 pages per month.

- Professional: $52/month for 500 pages per month.

- Business: $111/month for 2000 pages per month.

Overall, DocuClipper is the best bank statement extraction software, allowing anybody to process bank statements at scale fast and accurately. Also check out DocuClipper vs Docparser alternative.

2. AutoEntry

AutoEntry is a cloud-based data entry automation software that helps businesses save time and money by automating the process of entering data into accounting software. AutoEntry can automatically extract data from invoices, receipts, and bank statements, and then classify and categorize it into the correct accounts in your accounting software.

Key Features

- AutoEntry can automatically extract data from invoices, receipts, and bank statements.

- AutoEntry can classify and categorize data into the correct accounts in your accounting software.

- AutoEntry can check data for errors before it is entered into your accounting software.

- AutoEntry can generate reports on your financial data.

- AutoEntry can integrate with a variety of accounting software programs.

Pros

- AutoEntry can automate the process of entering data into your accounting software.

- AutoEntry can help you streamline your business’s financial processes, making them more efficient and effective.

- AutoEntry integrates well with a variety of accounting software such as QuickBooks, Xero, Sage, and others, which can streamline your workflow.

- AutoEntry can provide you with valuable insights into your business’s financial performance.

- It allows users to upload documents through various methods including email, mobile app, scanner, or via cloud storage like Dropbox or Google Drive.

Cons

- AutoEntry has a steeper learning curve, especially for those who are not tech-savvy.

- Processing can take somewhere between several minutes to several hours.

- AutoEntry operates on a subscription basis, which may not be cost-effective for all businesses.

Pricing

AutoEntry uses a credit system, where different tasks cost a certain number of credits. All plans include unlimited cloud storage, unlimited users, and unlimited clients for accountants and bookkeepers.

Pricing in Euros (€):

- Bronze: €13.50/month for 50 credits.

- Silver: €26/month for 100 credits.

- Gold: €46/month for 200 credits.

- Platinum: €110/month for 500 credits.

- Diamond: €295/month for 1500 credits.

- Sapphire: €465/month for 2500 credits.

Credit Usage:

- 1 Credit: Standard extraction for purchase/sale invoices, receipts, and bills.

- 2 Credits: Extraction of line items for purchase/sale invoices, bills, and supplier statements.

- 3 Credits: Per page for bank or credit card statements.

Please note, that the actual prices may vary depending on the currency you choose.

To learn more visit AutoEntry alternatives and DocuClipper vs AutoEntry alternative.

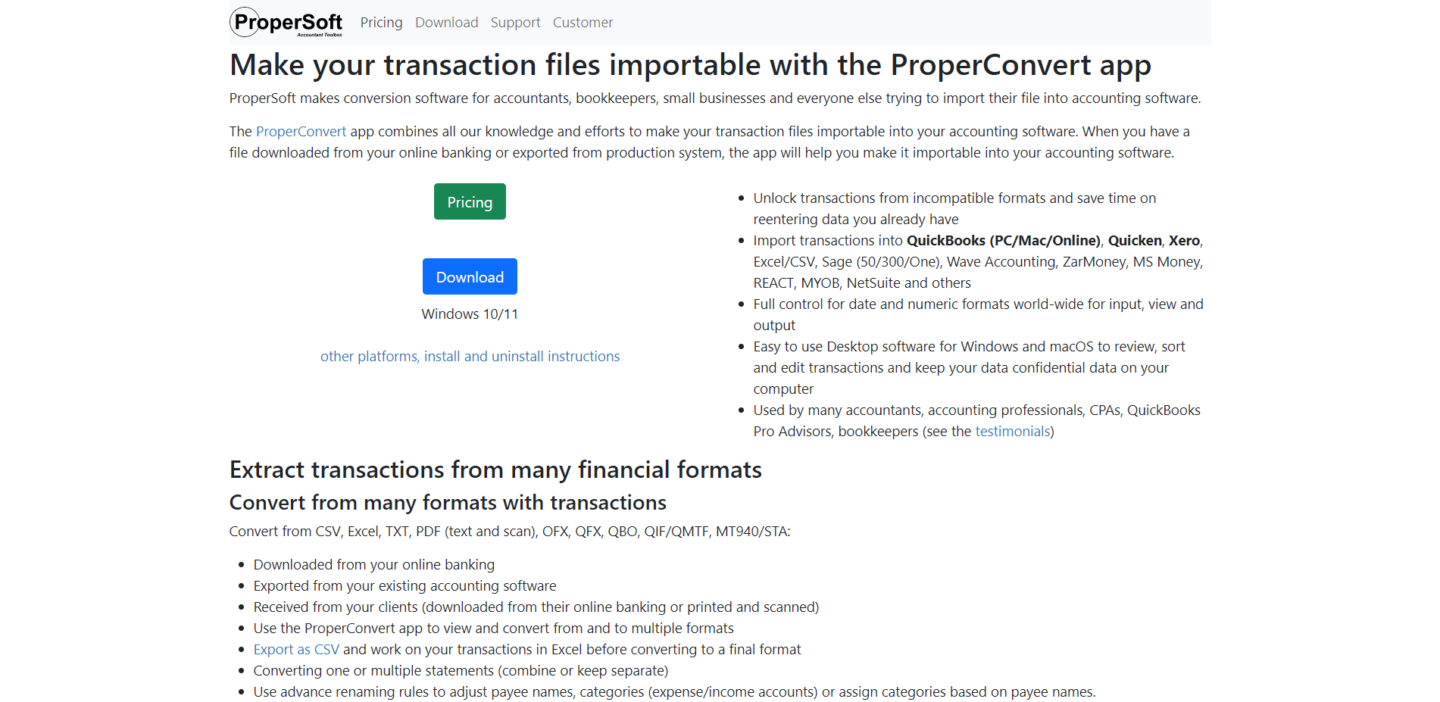

3. ProperSoft

ProperSoft is a company that creates software tools designed to convert transaction files, such as bank or credit card statements, into different formats for easy import into accounting and personal finance software.

Their products help users avoid manual data entry by converting transaction files into a compatible format for import into accounting software.

Key Features

- Automatically determine your document setting for number and date formats.

- Exported from your existing accounting software

- Downloaded from your online banking

- Exclude or edit any transaction during conversion.

- Export as CSV and work on your transactions in Excel before converting to a final format

- Use the ProperConvert app to view and convert from and to multiple formats

Pros

- Operates without internet, providing flexibility and convenience.

- One-time payment for perpetual use, offering long-term cost-effectiveness.

- Helpful and responsive support team enhances user experience.

- Supports a variety of file formats, increasing versatility.

Cons

- Not the highest for bank or credit card statements, potentially causing errors.

- Limits the types of documents that can be converted.

- The user interface is not modern, which may affect usability.

- Not as straightforward, making multiple file conversions less efficient.

Pricing

ProperSoft offers three types of licenses: Monthly, Yearly, and Lifetime.

- Monthly License: Costs $19.99 per month. It includes access for one user, all converters, formats, apps, ongoing premium support, and always free updates.

- Yearly License: Costs $119.99 per year. It includes the same features as the monthly license but at a discounted rate (save 50%).

- Lifetime License: Costs $199.99 as a one-time payment. It includes all converters, formats, apps, and premium support for 24 months, with always free updates.

Please note that all prices are in US dollars and the final price in your local currency may include applicable local tax.

To learn more, you can also check out the best ProperSoft alternatives and DocuClipper vs ProperSoft alternatives.

4. Docsumo

Docsumo is a document AI software that helps businesses extract data from all document types, templates, layouts, and tables with 10X efficiency and over 95% accuracy.

Docsumo uses intelligent OCR technology to convert unstructured documents into structured data that can be easily analyzed and processed. This data can be used to automate workflows, improve decision-making, and gain insights into business operations.

Key Features

- Docsumo can extract data from various types of documents, including invoices, receipts, bank statements, and more.

- Docsumo can automatically classify documents based on their content and layout.

- Docsumo can validate extracted data against predefined rules or external databases.

- Docsumo can integrate with other business systems, such as accounting software, ERP systems, and CRM platforms.

- Docsumo provides APIs that allow businesses to integrate its capabilities into their own applications or systems.

Pros

- Docsumo supports a broad range of documents for processing, making it versatile for various business needs.

- Docsumo is scalable, making it a suitable choice for businesses of all sizes, from startups to large enterprises.

- Docsumo can handle all document layouts, providing flexibility in document processing.

- Docsumo is known for its excellent customer service, providing users with prompt and helpful support.

Cons

- The cost of Docsumo can be a deterrent for some businesses, particularly small businesses or startups with tight budgets.

- Because Docsumo focuses on many types of documents, it may not offer the highest level of accuracy for specific document types.

- Setting up Docsumo can require some time and effort, which might be a drawback for businesses looking for a quick start.

- Docsumo can be complex to learn initially, particularly for users who are not tech-savvy. This could lead to a longer onboarding process.

Pricing

Docsumo offers three pricing tiers:

- Growth: Priced at $500+/month, ideal for startups, automates 1-2 document types, includes 3 users, and offers basic machine learning capabilities.

- Business: Custom pricing, perfect for businesses needing to capture specific data points, includes 10 users, and offers advanced features like email parsing and validation.

- Enterprise: Custom pricing, designed for enterprises processing multiple document types, offers unlimited users, advanced analytics, and custom workflow implementation.

For more information also visit Docsumo alternatives and competitors or the DocuClipper vs Docsumo alternative comparison.

5. MoneyThumb

MoneyThumb is designed to convert bank statements in PDF format into different file formats, such as CSV, QBO, and QFX. The software is compatible with major accounting platforms like QuickBooks, Quicken, and Xero.

MoneyThumb is a trusted partner for businesses and individuals of all sizes. The company’s products and services are used by thousands of customers around the world, and MoneyThumb has been recognized by industry publications such as Accounting Today and The Financial Brand.

However, recently many of the customers reported that MoneyThumb has been not so active in maintaining the platform, developing the features, and keeping up with their competitors.

Key Features

- MoneyThumb can automatically extract data from bank statements, making it easy to track spending, identify trends, and spot potential problems.

- MoneyThumb offers a variety of powerful analysis tools that can help you track spending, identify trends, and spot potential problems.

- MoneyThumb is a cloud-based application, so you can access it from anywhere with an internet connection.

- MoneyThumb uses the latest security measures to protect your data.

Pros

- MoneyThumb makes it easy to convert PDF statements into a format that can be read by accounting software. This can save significant time and effort in data entry.

- MoneyThumb claims a high level of accuracy in its conversions, reducing the risk of errors that could occur with manual data entry.

- MoneyThumb supports conversion from and to multiple file formats, making it more flexible than some other tools.

- It speeds up the process of data entry and thus, helps to save time. You no longer need to manually input each transaction.

Cons

- MoneyThumb is a paid service, and its cost might be unaffordable for some small businesses or individuals.

- Like any new software, there can be a learning curve to understanding how to use MoneyThumb effectively.

- There could potentially be compatibility issues with certain banking or credit card PDFs or with specific accounting software.

- The platform is being less maintained, which could impact its performance or feature updates.

Pricing

MoneyThumb does not publicly list the pricing for all of its products on its website. To get detailed pricing information for specific products, you would need to contact MoneyThumb directly.

However, for their QuickBooks converter product, they do provide pricing details. The cost varies depending on the plan you choose, with options for individual users, small businesses, and professionals such as accountants and bookkeepers.

- Individual Plan: $24.95/month for 5 conversions per month. This equates to $5.00 per conversion.

- Standard Plan: $49.95/month for 20 conversions per month. This equates to $2.50 per conversion.

- Pro Plan: $99.95/month for 60 conversions per month. This equates to $1.67 per conversion.

Additionally, check out these resources as well MoneyThumb vs DocuClipper and the best Moneythumb alternatives.

6. Valid8 Financial

Valid8 Financial is a forensic accounting software or OCR forensic accounting and financial investigations professionals. The platform extracts and reconciles banking transactions from multiple sources, creating a database of financial evidence.

This process allows for a comprehensive and efficient financial investigation, turning any PDF statement into a source of actionable intelligence in less than 24 hours.

Key Features

- Valid8 Financial can transform native or non-native PDF statements from any institution in any format into a database of evidence.

- The platform uses automated reconciliation to visualize missing, duplicate, and incorrect data

- Valid8 Financial can filter and examine transfers to identify fraudulent transfers and preference payments.

- The platform can visualize the flow of funds from a list of sources into accounts or legal entities and out to a list of uses.

- Users can set up custom categories for each case and group transactions to clarify analysis.

- Valid8 Financial allows users to use Microsoft Excel to clean up data then load all changes back into the platform to maintain version control.

- It can filter and examine transfers to identify fraudulent transfers and preference payments.

Pros

- Valid8 Financial software helps financial institutions stay compliant with a wide range of regulations, including AML, KYC, and PCI DSS.

- Valid8 Financial software helps financial institutions reduce risk by providing a centralized platform for managing data and transactions.

- Valid8 Financial software automates many of the tasks involved in compliance and risk management, freeing up staff to focus on other priorities.

- Valid8 Financial software is scalable to meet the needs of financial institutions of all sizes.

Cons

- Valid8 Financial software can be complex to use. This is especially true for financial institutions that have a lot of data and transactions.

- Valid8 Financial software is not the cheapest option on the market. However, the cost of the software may be offset by the benefits it provides, such as increased compliance and reduced risk.

- Valid8 Financial software relies on third-party data sources for some of its functionality. This means that the accuracy of the software is dependent on the accuracy of the third-party data.

- Valid8 Financial software is not as customizable as some other compliance and risk management solutions.

Pricing

Valid8 Financial does not provide pricing information directly on their website. For detailed pricing information, potential customers are encouraged to contact the Valid8 Financial team directly or schedule a free demo.

To learn more also check out the best Valid8 Financial alternatives and competitors, the best forensic accounting software, and DocuClipper vs Valid8 alternative.

7. Dext Prepare

Dext Prepare is a cloud-based document management and automation software that helps businesses streamline their financial processes.

With Dext Prepare, businesses can easily capture, extract, and organize their bank statements, invoices, receipts, and other financial documents. Dext Prepare can also automatically match documents to transactions in accounting software, helping businesses to save time and money.

Key Features

- Dext Prepare can capture documents from a variety of sources, including scanners, mobile devices, and email.

- Dext Prepare can automatically extract key data from documents, such as the date, amount, and vendor.

- Dext Prepare can organize documents into folders and projects.

- Dext Prepare allows users to collaborate on documents.

- Dext Prepare can generate reports on document data.

- Dext Prepare can integrate with accounting software.

Pros

- Time-saving: Automates data entry, reducing manual input.

- Improved accuracy: Uses OCR technology to minimize human errors.

- Organization and storage: Centralizes storage for digitized financial documents.

- Integration: Seamlessly transfers data into various accounting systems.

Cons

- OCR reliance: Potential inaccuracies in data extraction due to OCR limitations.

- Setup and learning curve: Initial time and effort required for implementation.

- Cost considerations: Paid service, potentially costly for smaller businesses or low-volume users.

Pricing

For Accounting or Bookkeeping Firms:

- Streamline 10: $218.49/month for up to 10 clients. Ideal for sole practitioners and small firms.

- Streamline 20: $366.84/month for up to 20 clients. Suitable for mid-size practices.

- Streamline 50: $757.84/month for up to 50 clients. Perfect for larger practices.

For Small to Medium Businesses:

- Business Plus: $27/month for up to 5 users and 300 monthly documents. Suitable for small to medium businesses.

- Premium: $53/month for up to 20 users and 3,000 monthly documents. Ideal for bigger businesses.

- Enterprise: $80/month for up to 30 users and 4,000 monthly documents. Designed for larger enterprises.

Also, check out Dext Prepare alternatives and competitors and DocuClipper vs Dext Prepare alternative.

8. Hubdoc

Hubdoc is a cloud-based document management platform that simplifies OCR data capture and organization. It imports bank statements and other financial documents, automatically extracting key data and syncing it with accounting software such as QuickBooks and Xero.

While Hubdoc generally performs well in extracting data from standard bank statements, it may not be as effective with more complex or specialized statement formats. In such cases, manual intervention or adjustments may be required to ensure the accuracy of the extracted data.

If you have specific requirements for extracting data from bank statements, it’s advisable to evaluate Hubdoc’s capabilities with your specific statement formats and consider alternative specialized solutions that focus specifically on bank statement data extraction.

Key Features

- Hubdoc seamlessly integrates with Xero and Quickbooks.

- Hubdoc has an Android and iPhone mobile application to easily capture bills and receipts.

- Online storage to store and share your financial documents.

Pros

- Hubdoc allows you to easily gather financial documents such as bank statements, receipts, and invoices from various sources, including email, mobile uploads, and direct integrations with financial institutions.

- The software utilizes OCR technology to extract relevant data from uploaded documents, reducing the need for manual data entry.

- Hubdoc provides a centralized platform for storing and managing financial documents.

- Hubdoc integrates with popular accounting software platforms, allowing for the seamless transfer of data and documents into the accounting system.

Cons

- Hubdoc may still encounter challenges when extracting data from certain types of documents.

- Hubdoc is primarily designed for basic document types like receipts, invoices, and bank statements.

- For smaller businesses or individuals with limited budgets, the cost may be a factor to consider when evaluating the software.

- Hubdoc heavily relies on integrations with accounting software and financial institutions. Any changes or disruptions in those integrations could potentially impact the seamless flow of data and documents.

Pricing

Hubdoc costs $12 USD per month. This includes automatic data extraction from bills, statements, invoices, and receipts, seamless syncing with Xero and QuickBooks Online, unlimited usage, multiple collaborators, friendly tech support, and easy backup options. It’s available for both smartphones and tablets (Apple and Android).

However, the pricing does not state if there are any limitations in terms of the number of documents you can process.

Furthermore, visit the best Hubdoc alternatives and DocuClipper vs Hubdoc alternative to learn more.

9. Nanonets

Nanonets is a machine learning platform that allows businesses to build custom deep learning models without writing any code. It is used for tasks such as document extraction, object detection, and image classification.

Using Nanonets OCR, organizations can extract electrical meter readings from odometers and transform food menus into structured data. The platform supports several types of documents such as ID cards, mortgage forms, invoices, income proofs and purchase orders, among others.

Pros

- Supports a wide variety of document types.

- Uses advanced AI with OCR technology.

- Offers excellent customer service.

- Provides high accuracy for diverse documents.

- Ensures fast data processing.

Cons

- Supports a wide variety of document types.

- Uses advanced AI with OCR technology.

- Offers excellent customer service.

- Provides high accuracy for diverse documents.

- Ensures fast data processing.

Pricing

Nanonets offers three pricing tiers:

- Starter: Free for the first 500 pages, then $0.3/page. No monthly fee, pay as you go, with 3 starter models and limited fields.

- Pro: $499/month/model, includes 5000 pages, then $0.1/page. Offers auto-capture line items, up to 20 fields, and additional features like annotation services and customisation hours.

- Enterprise: Custom pricing. Includes everything in Pro, with additional features like SSO/SAML Login, SLAs, dedicated account manager, and custom integrations.

To learn more visit also Nanonets alternatives.

Comparison Table of Docparser Alternatives

Here’s a comparison table that summarizes the key features, benefits, and pricing of Docparser and its alternatives:

| Software | Key Features | Benefits | Drawbacks | Pricing |

|---|---|---|---|---|

| Docparser | Extracts data from PDFs, supports custom parsing rules, integrates with various platforms | Customizable, supports complex documents, high accuracy | Learning curve, cost can be high for small businesses | Starts at $39/month |

| DocuClipper | Extracts data from bank statements, supports Excel and CSV, integrates with QuickBooks, Xero, Sage | High accuracy, fast processing, secure, very affordable, easy to scale, great customer support | Limited to financial documents | Starts at $29/month |

| AutoEntry | Extracts data from invoices, receipts, bank statements, integrates with various accounting software | Automates data entry, checks for errors, generates reports | Steeper learning curve, processing, can take time, relatively expensive | Starts at €13.50/month |

| MoneyThumb | Converts bank statements to CSV, QBO, QFX, compatible with major accounting platforms | High accuracy, supports multiple file formats, saves time | Expensive, learning curve, less maintained | Starts at $24.95/month |

| Dext Prepare | Captures, extracts, and organizes financial documents, matches documents to transactions | Streamlines financial processes, provides insights, integrates with accounting software | Relies on OCR, setup and learning curve, cost considerations | Starts at $27/month |

| Hubdoc | Imports bank statements, extracts key data, syncs with accounting software | Simplifies data capture, reduces manual data entry, centralizes document management | Challenges with certain document types, relies on integrations, cost considerations | $12/month |

What is Docparser?

Docparser is a document parser software that extracts data from Word, PDF, and image-based documents using Zonal OCR technology, advanced pattern recognition, and the help of anchor keywords.

It is a cloud-based solution that can be used to automate the extraction of data from documents. It can be used to extract data from a variety of document types, including invoices, contracts, and letters.

Why Consider Docparser Alternatives?

Considering Docparser alternatives can be beneficial for several reasons:

- Processing Speed: If your business handles a high volume of documents and needs faster processing times than what Docparser offers, alternatives might provide quicker data extraction and processing capabilities.

- Cost: Docparser can be expensive, especially for larger businesses. Several other document parsers are more affordable.

- Features: Docparser does not offer all of the features that some businesses need. For example, it does not have a built-in OCR engine.

- Integrations: Docparser does not integrate with all of the third-party applications that some businesses use.

- Support: Docparser’s customer support can be slow to respond.

- User Experience: The ease of use and user interface of a tool can significantly impact productivity. If users find Docparser’s interface challenging to navigate or its processes complicated, an alternative with a more user-friendly interface might be a better fit.

- Specific Features: Different businesses have unique needs. Docparser might not have specific features that your business requires for its document parsing needs. Alternatives might offer these specific features that are more aligned with your business requirements.

Key Features to Look for in a Docparser Alternative

When seeking a Docparser alternative for your financial management needs, there are several key features to consider that can significantly enhance your efficiency and accuracy.

- Accuracy of Conversion: The tool should provide high accuracy in data extraction and conversion. This ensures that the data you’re working with is reliable, reducing the risk of errors that could lead to financial discrepancies.

- Speed of Conversion: The speed at which the tool can process and convert documents is crucial. A faster conversion rate means less waiting time, enabling you to work more efficiently and make timely decisions.

- Supported Banks: The tool should support a wide range of banks and financial institutions. This ensures compatibility with your financial documents, regardless of their origin.

- Ease of Use: The user interface should be intuitive and user-friendly. This reduces the learning curve and allows users of all tech-skill levels to use the tool effectively.

- Support: Excellent customer support is essential. Whether it’s through live chat, email, or a comprehensive knowledge base, the provider should offer prompt and helpful support to assist with any issues or queries.

- Advanced Features: Look for advanced features like integration with accounting software, automation of repetitive tasks, and customizable workflows. These features can greatly enhance productivity and streamline your financial processes.

- Cost-Effectiveness: Finally, consider the pricing structure. The tool should offer good value for money. While free tools may be appealing, they often lack advanced features and support. Conversely, the most expensive tools may offer features that you don’t need. Find a tool that fits your budget and meets your specific needs.

In conclusion, the best Docparser alternative for your business will depend on your specific needs and circumstances. By considering the features outlined above, you can make an informed decision that will benefit your business in the long run.

Conclusion

In conclusion, while Docparser is a powerful tool for document data extraction, alternatives like DocuClipper, AutoEntry, MoneyThumb, Dext Prepare, and Hubdoc offer unique features and benefits that may better suit your specific needs.

These alternatives vary in terms of accuracy, speed, supported banks, ease of use, customer support, advanced features, and cost-effectiveness. It’s crucial to consider these factors and align them with your business requirements.

Remember, many of these tools offer free trials or demos, so take advantage of these opportunities to find the best fit for your business.

Try DocuClipper for Free Today

Ready to transform your financial management process? Try DocuClipper today! With its powerful features and user-friendly interface, DocuClipper makes bank statement conversion a breeze.

Say goodbye to manual data entry and hello to accuracy and efficiency. Don’t just take our word for it, experience the difference yourself.

Start your free trial now and see how DocuClipper can revolutionize your financial workflow. Click here to get started!

Frequently Asked Questions about Best Docparser Alternatives

To learn more about Docparser alternatives and competitors, here we are going to answer some of the FAQs:

Who are the competitors of Docparser?

The main competitors of Docparser include DocuClipper, AutoEntry, MoneyThumb, Dext Prepare, and Hubdoc. These tools offer similar document data extraction services, each with its unique features and benefits.

Is there a free version of Docparser?

Yes, Docparser offers a free plan that allows you to parse 30-150 pages per month. The free plan includes all of the basic features of Docparser, such as the ability to create parsers, extract data from documents, and integrate with third-party applications.

If you need to parse more than 150 pages per month, Docparser offers a variety of paid plans that start at $39 per month. The paid plans include additional features, such as the ability to parse scanned documents, create custom parsers, and access customer support.

Is DocuClipper better than Docparser?

Whether DocuClipper is better than Docparser depends on specific business needs. DocuClipper excels in extracting data from bank statements with high accuracy and speed, and it’s cost-effective and very user-friendly. However, Docparser offers robust customization options. It’s advisable to consider your requirements and possibly test both tools to determine the best fit.

Is Docparser worth it?

Docparser can be worth it for businesses needing to extract data from various document types. It offers high accuracy, custom parsing rules, and integration with different platforms. However, its value depends on your specific needs, volume of documents, and budget. Always consider these factors and possibly test the tool before deciding.