Key takeaways:

- ERP invoice processing automates invoice management, integrating accounts payable workflows with other business functions to improve efficiency and accuracy.

- The process includes invoice receipt, data extraction, purchase order matching, approval, posting, and record-keeping, ensuring compliance and reducing manual effort.

- Automating invoice processing can cut costs by up to 80%, minimize errors, accelerate approvals, and enhance cash flow visibility.

- Manual invoice processing is slow, error-prone, and costly, leading to delays, compliance risks, and strained vendor relationships.

What is Invoice Processing

Invoice processing is the procedure of handling supplier invoices from receipt to payment. It includes data extraction, validation, approval, and payment.

Invoices are categorized into two types: those linked to a purchase order and those without an associated request. Each type requires a different approval workflow.

What is ERP Invoice Processing

ERP invoice processing involves handling invoices within an Enterprise Resource Planning (ERP) system and integrating accounts payable workflows with other business functions.

It automates invoice capture, validation, approval, and payment, ensuring efficiency, accuracy, and compliance across departments while recording transactions in the general ledger.

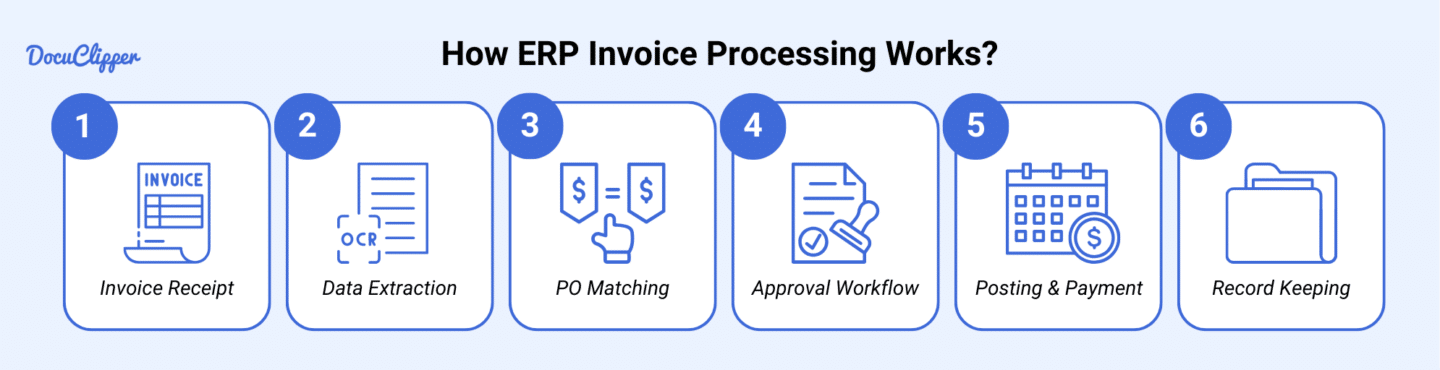

How ERP Invoice Processing Works?

Here is how ERP invoice processing works:

Step 1: Invoice Receipt

Your ERP system captures invoices from scanning, email, or EDI, but they come in different formats. Before processing, you need to convert the paper invoices to PDF.

Some businesses still provide paper or image invoices, so standardizing them makes it easier to run through the ERP. With all invoices in one format, the system can extract document data more efficiently.

Step 2: Data Extraction

Once your invoices are in PDF format, the ERP system scans them using an invoice OCR. It extracts invoice data like invoice numbers, dates, and amounts, along with line-item specifics such as quantities, prices, and descriptions.

The system then maps this data to the correct ERP fields automatically. As you process more invoices, machine learning improves accuracy, reducing errors and manual corrections.

Step 3: Purchase Order Matching

If the invoice is linked to a purchase order, the system automatically matches it with the corresponding PO. It verifies quantities, prices, and other details to ensure everything aligns. Three-way matching checks the invoice against the PO and the goods receipt. If there’s a discrepancy, the system flags it and routes it for review.

Step 4: Approval Workflow

Once the invoice passes matching, it’s routed for approval based on your predefined rules. Approvers get notified and can review invoices directly in the ERP system. The system tracks the approval status in real time and escalates overdue invoices to prevent delays.

Step 5: Posting & Payment

After approval, the invoice gets posted to the general ledger. The system schedules the payment based on due dates and available cash flow. Once the transfer is initiated, the ERP updates records automatically, ensuring accurate financial reporting.

Step 6: Record Keeping

Once the payment is processed, the system archives the invoice and maintains a full audit trail. You can easily search for past invoices and generate reports for audits, compliance, or financial analysis. Everything stays organized and accessible when you need it

Benefits of ERP Invoice Processing

Here’s why AP teams rely on ERP systems for automated invoice processing:

- Cost Reduction: Cuts processing costs by 60-80% by automating manual data entry tasks, reducing paper handling, and minimizing errors that require rework.

- Faster Processing: Speeds up invoice processing from weeks to hours with automated invoice data extraction, validation, and routing, helping you capture early payment discounts.

- Error Prevention: Reduces human errors with automated validation, three-way matching, and duplicate invoice detection, improving accuracy to 99%.

- Enhanced Visibility: Gives real-time tracking of invoice status, cash flow forecasting, and spend analytics through a centralized dashboard.

- Compliance & Control: Maintains regulatory compliance with consistent processing rules, automated audit trails, and secure document storage with role-based access.

- Vendor Relations: Strengthens supplier relationships by ensuring faster payments, transparent processing status, and fewer disputes.

Disadvantages of Manual Invoice Processing

Here are the disadvantages of using manual invoice processing:

- Time-Consuming: This takes 7 to 13 days per invoice, requiring hours of manual data entry, validation, and document filing.

- High Error Rates: This leads to a 4% error rate on average, causing payment delays, duplicate payments, and strained vendor relationships.

- Limited Visibility: Lacks real-time tracking, making it difficult to locate invoices, forecast cash flow, or analyze spending.

- Storage Problems: Requires physical storage, consuming a lot of vital space that can be useful for the business.

- Delayed Approvals: Slows down processing with physical routing, possibly losing invoices that can be out of reach and risk penalties from suppliers for late payments.

- Poor Compliance: Lacks audit trails and consistent controls, increasing fraud risks and regulatory non-compliance

Conclusion

Manual invoice processing is slow, error-prone, and expensive, leading to delays, compliance risks, and strained vendor relationships.

ERP invoice processing solves these issues by automating data capture, validation, and approvals, cutting costs and improving efficiency. By switching to an ERP system, you can streamline workflows and ensure accurate, timely payments.

How DocuClipper Can Help with ERP Invoice Processing

DocuClipper streamlines ERP invoice processing by extracting data from PDF invoices, making it easier to input information into your ERP system. It converts invoices into CSV or XLS formats and offers an OCR API for seamless integration with accounting software. It also processes bank statements, receipts, and tax forms.

Looking for more statistics? Check out these resources:

- Data Entry Statistics 2025

- Credit Card Debt Statistics 2025

- Accounts Payable Statistics 2025

- 7 Human Error Statistics 2025

- Accounting and Bookkeeping Statistics

Or use these resources to learn more about accounting and bookkeeping processes: