Imagine trying to make smart financial decisions without the numbers to back them up, it’s like flying a plane blindfolded.

Data extraction is the process of retrieving or pulling data from various sources and converting it into a usable and meaningful format for your further analysis, reporting, or storage.

Whether you’re a business owner tracking expenses, an investor analyzing trends, or an accountant preparing statements, financial data extraction helps you quickly and accurately access the details you need.

What is a Financial Data Extraction

Financial data extraction is the process of starting with raw and unfiltered financial data and converting it into usable and meaningful data. It is the crucial first step in making your data usable.

It allows you to collect the specific data you need for analysis, reporting, taxes, compliance, or integration into other systems.

For example: Let’s say you’re a small business owner who receives dozens of invoices every month from suppliers.

Your process can be manual or automated to extract data from the invoices. Manual methods involve human effort to read, interpret, and input data.

Automated methods, on the other hand, use technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP), to extract data from diverse formats.

Common Ways of Financial Data Extraction

When it comes to extracting financial data from your documents, your business has several options, each comes with its pros and cons.

Manual Data Extraction

Manual data entry and extraction as the name suggests is where you review financial documents like bank statements, invoices, or receipts and manually input the details into a system.

Manual data entry allows you flexibility which enables you to handle unstructured or complex data that automated tools might struggle to process correctly.

While straightforward, this method can be time-consuming and prone to human error leading to significant inefficiencies and inaccuracies. More than 40% of employees mentioned that 25% of their workweek is spent on data entry

Automated Data Extraction

Automated data extraction is using technology to extract relevant information from various sources without manual intervention.

It streamlines data collection, reduces errors, and ensures efficiency in handling large volumes of data.

Automated systems, especially those using OCR (Optical Character Recognition) technology, can achieve accuracy rates of 98-99%, which is significantly higher than manual data entry.

Common ways of automated extraction are:

- Optical Character Recognition (OCR): OCR software enables you to convert text from scanned images and printed documents, into editable formats. It is ideal for digitizing paper-based records and extracting data.

- Artificial intelligence (AI) – Natural language understanding (NLU): AI with NLU helps you extract meaningful data from documents. This approach focuses on providing more accurate and insightful data retrieval. Tools like DocuClipper specialize in financial data extraction, making the process even more efficient.

- Machine learning (ML): ML automates data extraction by training algorithms. With each input, the system learns and improves, making it highly effective for processing diverse data.

- Deep Learning: Deep learning uses networks to analyze and extract data from complex sources, such as audio, video, or highly unstructured documents.

Outsourced Data Extraction

Outsourced data extraction involves delegating the task of extracting, processing, and organizing data to a third-party service provider.

Outsourcing reduces the need for in-house resources, such as specialized tools and trained staff, lowering your overall operational costs.

Businesses often opt for outsourcing when they lack the resources, expertise, or time to handle data extraction in-house.

However, sharing sensitive financial information with third-party providers may increase the risk of data breaches or unauthorized access. In the past years, Private banks in India have reported 205 data breaches and state-owned banks reported 41 breaches.

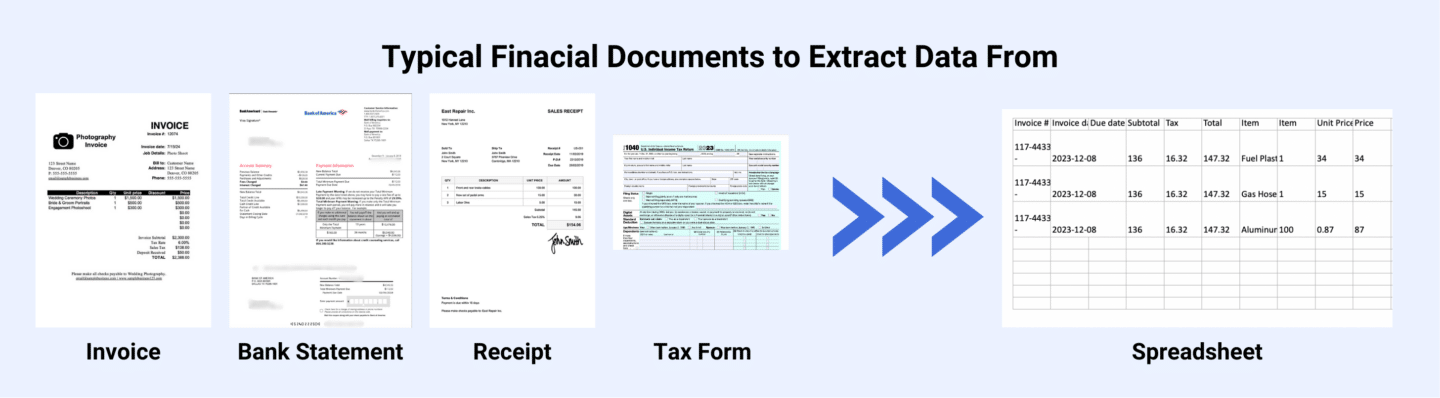

Typical Financial Documents to Extract Data From

There are huge numbers of documents from which you can extract data but when it comes to numbers the most regularly used financial documents can be some of the following:

- Bank Statements: Bank statements provide you with details about deposits, withdrawals, and balances. Extracting this data is crucial for reconciliation, cash flow analysis, and financial planning.

- Invoices & Receipts: Invoice and receipts record your expenses. Extracting data from your invoices helps track spending, categorize costs, and ensure accurate accounting.

- Tax Forms: Tax forms document income expenses and tax amounts. Extracting data from them simplifies tax preparation, compliance, and financial audits.

- Financial Statements: Financial statements include your balance sheet, income statement, and cash flow statement. Extracting data from these documents helps assess financial performance and make strategic decisions.

- Income statement: Income statements give details about your company’s revenue, expenses, and profits over a specific period. Extracting this data helps evaluate profitability and cost management.

- Balance sheets: They provide details about your assets and liabilities. Extracting data will support your performance analysis and decision-making.

- Cash flow statements: These track the movement of cash in and out of your business. Extracting this data helps analyze liquidity, operational efficiency, and financial stability.

- Trial balance: Trial balance lists all account balances in the general ledger. Extracting data ensures that credits and debits are equal, serving as a preliminary check for financial accuracy.

How to Extract Data from Financial Documents [in 4 Steps]

Data can come from various sources in your personal or business finances. This can include databases, spreadsheets, bank statements, or invoices and receipts.

Let us understand how you can extract data from financial documents:

Step 1: Gather and Organize Documents

Start by gathering all your financial files in one convenient location. These could be PDFs, images, or spreadsheets containing the data you need.

Once everything is collected, take a moment to classify the documents by type or source, for example, separating invoices from receipts. This simple step helps you stay organized, making the extraction process smoother and avoiding unnecessary confusion later.

If you have paper documents, don’t forget to digitize them using a scanner or a mobile app. Converting them into digital formats like PDFs or images ensures they’re ready for efficient processing, saving you time and effort in the long run.

Step 2: Choose an Automation Tool

When it comes to extracting data, choose an OCR tool specifically designed for financial documents. This ensures greater accuracy, faster processing, and better handling of different layouts.

Generic PDF converters often fall short when dealing with complex financial records, so it’s best to avoid them.

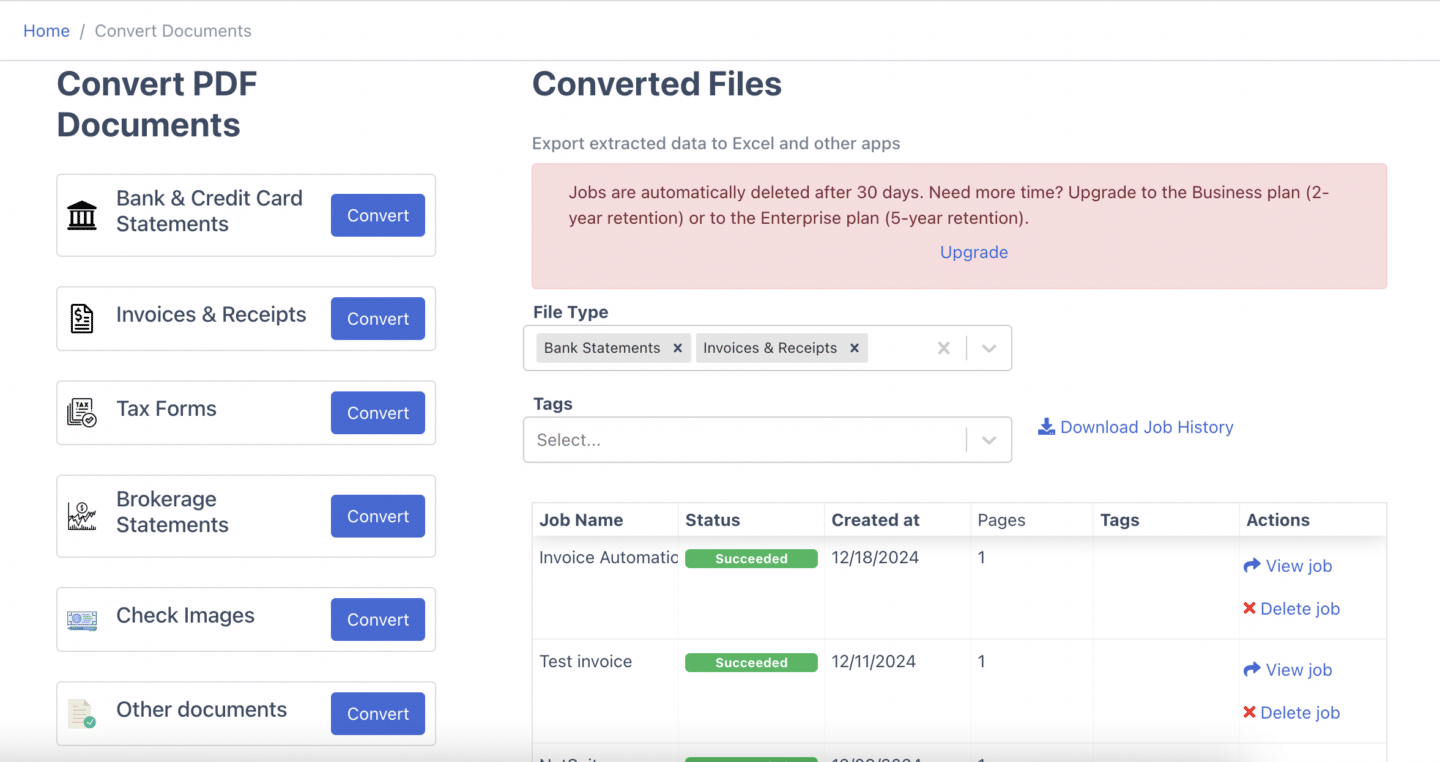

A great option is DocuClipper, a specialized tool built for financial data extraction. It works efficiently with invoices, receipts, and bank statements, supporting a variety of formats and layouts to make your job easier.

Step 3: Run Batch Processing

Upload all your documents, bank statements should go into the Bank Statement OCR section, and invoices and receipts are placed in the Invoice OCR and Receipt OCR sections.

This approach allows DocuClipper to process each document type efficiently and accurately.

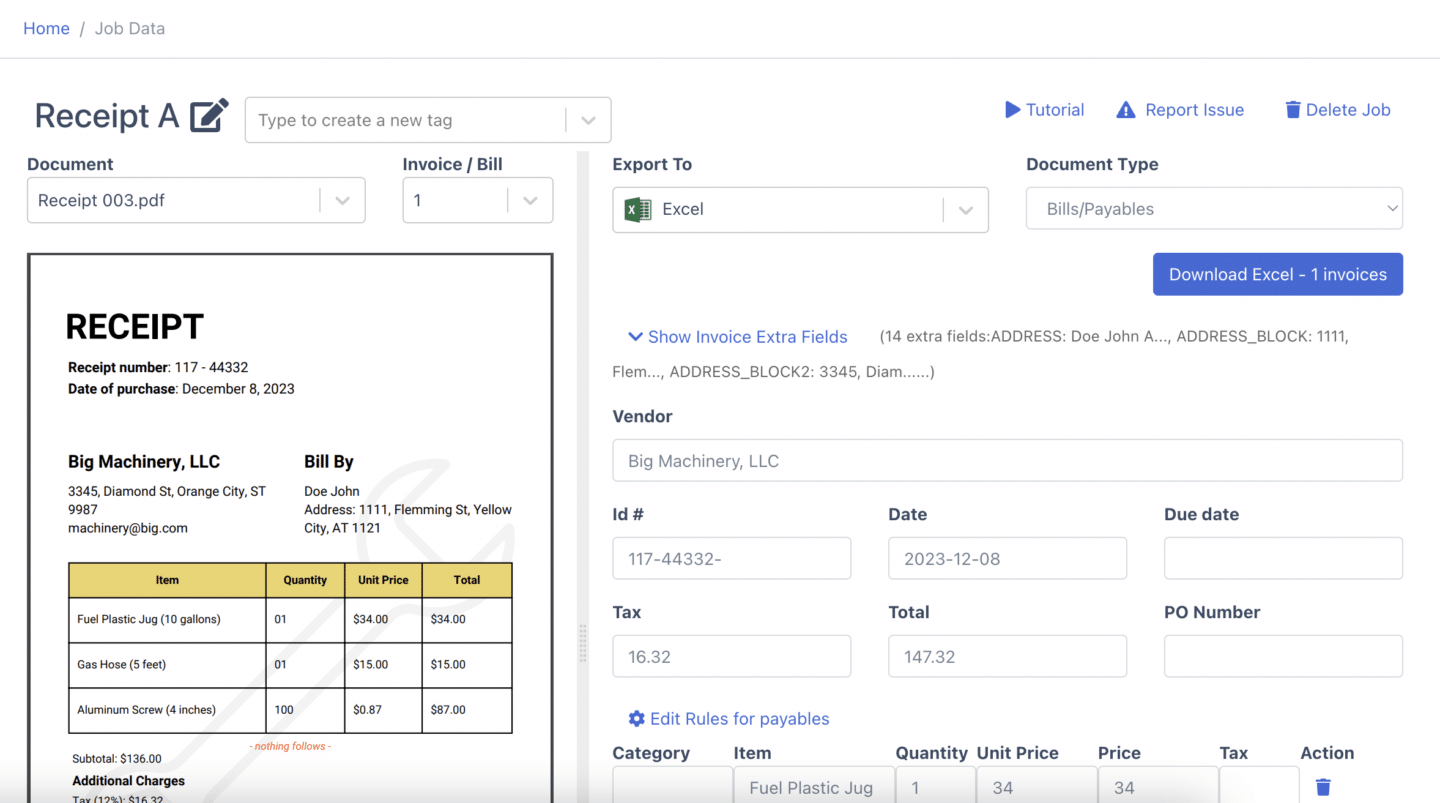

Step 4: Validate Extracted Data

Review the extracted data for any errors or inaccuracies that may have occurred during the OCR process. Correct any discrepancies before exporting the final data to ensure it is accurate and reliable.

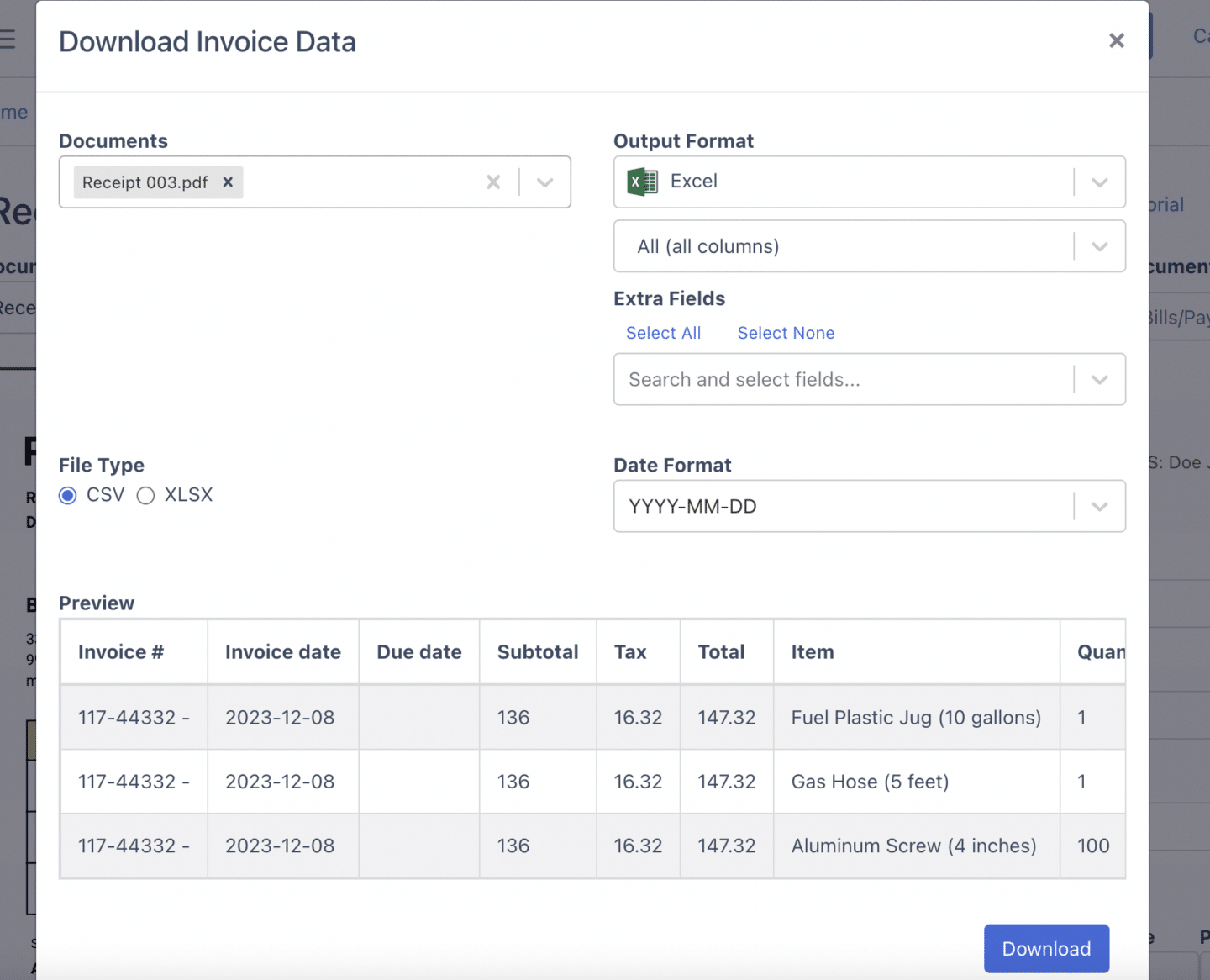

Step 5: Export or Import the Financial Data

After validation, you can export the extracted data to a spreadsheet for further analysis or record-keeping.

Alternatively, import the data directly into QuickBooks for seamless integration with your financial management system.

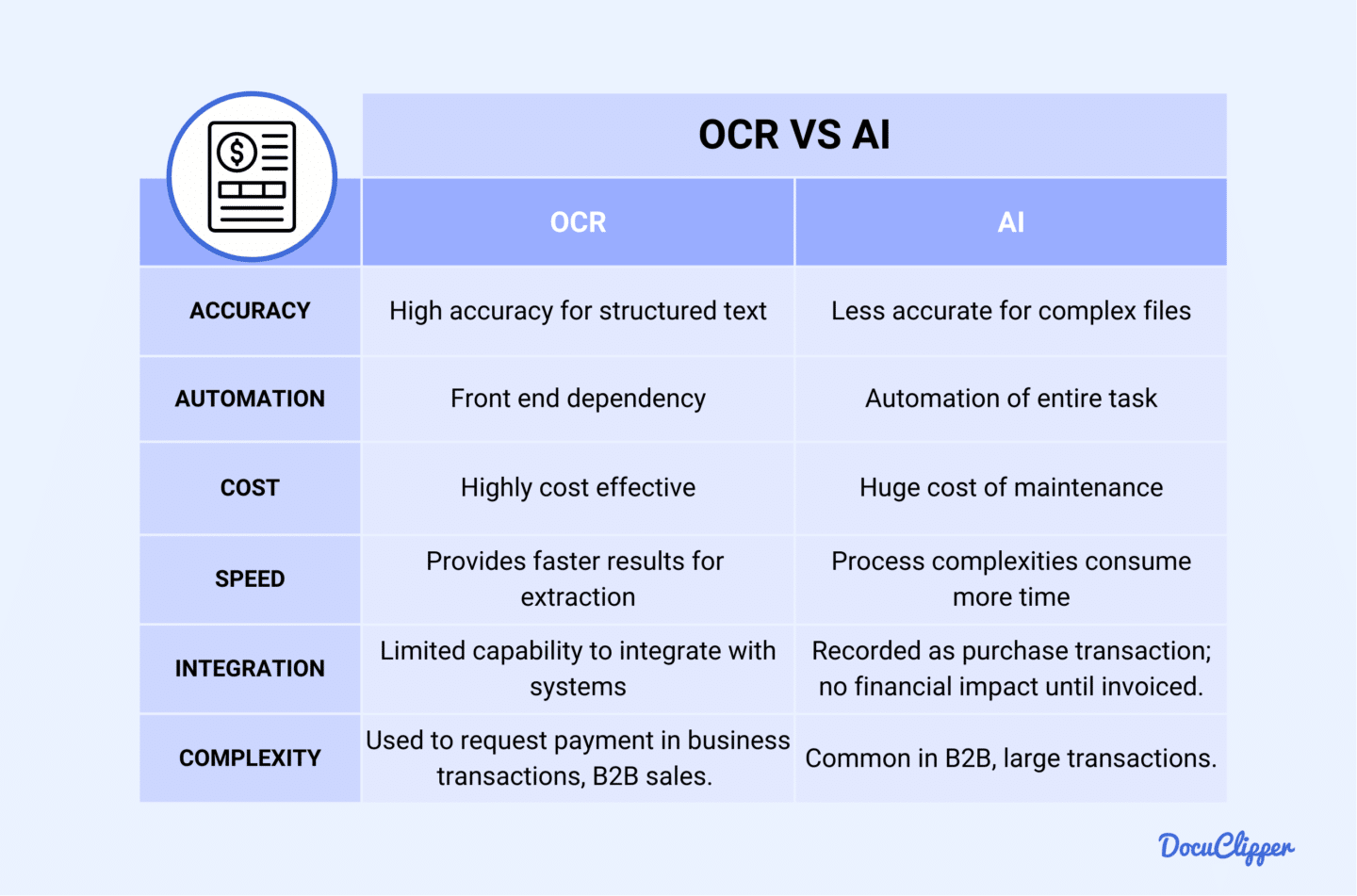

AI vs OCR for Financial Data Extraction

When it comes to extracting data, you have two powerful options: AI and OCR. While OCR focuses on recognizing text from structured documents, AI takes it further by understanding unstructured data and complex patterns, giving you more flexibility and insights.

OCR

OCR is a tool for extracting financial data from documents like invoices, receipts, and bank statements. It helps you quickly scan and convert printed or handwritten text into editable data.

The advantages for your business include speed, accuracy, and cost-effectiveness, especially for handling large volumes of routine documents.

However, OCR’s reliance on document formatting and quality can be an issue, as poor-quality scans or inconsistent layouts may lead to inaccurate data extraction in financial documents.

By reducing manual errors and labor costs, OCR ensures efficient data capturing and processing, allowing you to focus on important financial tasks.

AI

AI is powerful for extracting financial data from unstructured sources like emails, contracts, or reports. It can analyze your complex data, recognize patterns, and understand context, making it perfect for tasks like invoice automation.

The main advantages for your business are AI’s ability to improve over time, handle diverse data formats, and provide deeper insights.

However, Ethical and privacy concerns arise with AI in financial data extraction, as your sensitive data may be mishandled or exposed during processing, leading to potential breaches or misuse.

The risk of bias in AI for financial data extraction exists, as algorithms may unknowingly favor certain patterns or groups, leading to inaccurate or unfair results

AI helps reduce errors, streamlines workflows, and improves decision-making, especially in dynamic financial environments where recognizing patterns and trends is key.

The major differences between OCR and AI are their functionalities and application scopes.

OCR offers high accuracy in structured text recognition, cost-effectiveness, and is time-efficient, but struggles with complex texts and image quality.

AI, on the other hand, excels in learning, adaptation, handling large data sets, and innovative problem-solving, but faces challenges like high costs, ethical concerns, and dependency on data quality.

The choice between them depends on specific task requirements and resources of your business.

Common Use Cases and Applications

Let us explore how you can you apply data extraction in your daily life in your business or while handling your personal finances:

- Accounts Payable/Receivable automation: Automating data extraction makes managing your invoices and payment records quite easy. It pulls details like due dates and vendor info instantly, helping your business process payments faster and avoid errors. For example, companies like SAP use automation to streamline cash flow and cut manual work.

- Bank statement reconciliation: You can save hours processing bank statements by using automated tools that match transactions with your records. These systems quickly spot discrepancies, ensuring your financial audits are more accurate. Think of how QuickBooks simplifies this for small businesses by processing bank transactions every day.

- Financial compliance and reporting: Automated tools gather data for tax filings and audits, ensuring you stay compliant with regulations. You’ll have clear, organized records, reducing risks. Big firms like Deloitte rely on these solutions to handle complex reporting seamlessly.

- Investment analysis and research: With data extraction, you can pull market trends, stock prices, and key metrics effortlessly. This gives your business a competitive edge in making smart investment decisions. For instance, Bloomberg’s tools help traders analyze financial markets in real time.

Benefits of Automated Financial Data Extraction

Automated financial data extraction offers numerous benefits, making your processes faster, more accurate, and more efficient. By reducing manual effort, it helps you handle large volumes of data seamlessly, ensuring better decision-making and minimizing errors.

- Improved accuracy and reduced errors: Automated financial data entry and extraction makes your work more accurate by reducing human error. The software will extract the data from your documents, ensuring nothing is missed or misread.

- Time and cost savings: Automating financial data extraction saves you time and money by quickly scanning and extracting key details. Studies show it can save 30-40% of the time spent on manual tasks, while also reducing the need for extra staff or outsourcing.

- Enhanced compliance and audit trails: Automation will log every action, so you always have a record of how your data was handled and by whom.

This transparency helps with audits and ensures you stay on top of regulations. Automation also helps you maintain accurate and easily retrievable financial records by reducing errors and improving accessibility.

- Scalability and efficiency gains: Automated financial data extraction helps scale your business easily. It handles large amounts of data without adding manual labour. The software can process documents from multiple sources at once, speeding up workflows. A study showed that firms who utilised data with the use of automated data extraction have 5 to 6% higher returns than those who didn’t.

Future Trends and Developments

With emerging technologies in financial data extraction software such as AI, cloud computing, cheaper processing, advanced microchips, machine learning, and improved OCR, the financial data extraction process is becoming increasingly automated.

These advancements reduce the need for human intervention, streamlining the process.

As a result, financial data can be seamlessly extracted from PDFs and quickly imported into financial software, drastically improving efficiency and speed.

Here, you are going to look at some of the future advances that will make financial data extraction even easier, faster, more accurate, and more efficient.

As per Big Data Analytics in Cloud Computing: An Overview, SpringerOpen) Technology like cloud computing is now offering scalable storage and processing, enabling you to handle large datasets efficiently while cutting costs.

Another study by (Internet of Things and Data Analytics, IEEE) shows IoT is generating massive real-time data from connected devices, creating opportunities to optimize operations and predict failures.

These technologies are reshaping data management today.

AI and advanced NLP capabilities: AI and NLP are advancing quickly, transforming how you process unstructured data.

New developments in these technologies allow models to understand context, detect patterns, and generate human-like language.

According to the market insights report, the market size for text-based NLP is set to increase from USD 8.21 billion in 2024 to USD 33.04 billion in 2030.

Industry-specific innovations: In 2019, you would have noticed that the BFSI sector led the global data extraction market, and it’s likely to maintain that dominance.

This is because financial institutions like yours are increasingly using data extraction tools to analyze large amounts of customer financial data.

However, the education sector is expected to grow the fastest in the coming years. Schools are adopting these tools to manage student records, track academic performance, and analyze achievements.

This provides you with a structured framework to handle both educational content and student data more efficiently.

Conclusion

At present, simplifying financial data extraction means utilizing automation for the best of your business. With AI-powered tools, you can say goodbye to tedious manual work and handle financial data faster and more accurately.

Financial data extraction plays a vital role in every aspect of your business, from streamlining operations to making informed decisions.

Automation saves you time, reduces costs, and improves compliance while keeping your business ready to scale. It’s your smart solution for staying ahead in a complex, fast-paced digital world.

Accurately & Affordably Extract Data from Your Financial Documents with DocuClipper

Manually processing financial data can be time-consuming and prone to errors.

With DocuClipper, you can accurately and affordably extract data from all your financial documents in just a few clicks.

Whether you need an Invoice OCR solution, a bank statement converter, or a tool to efficiently extract data from financial documents, DocuClipper has you covered.

Ready to simplify your financial data extraction? Try DocuClipper today and see the difference it makes!

FAQs about Financial Data Extraction

Let us understand data extraction in financial documents with the help of the following FAQs:

What is extraction in finance?

Extraction in finance refers to the process of collecting and retrieving relevant financial data from various documents, such as invoices, bank statements, and financial reports. This data is then organized, analyzed, and used for decision-making, accounting and reporting.

What is an example of financial data extraction?

An example of financial data extraction is using software to scan invoices and automatically extract key details such as vendor names, amounts, and payment dates. This extracted data can then be organized into your spreadsheet or accounting system, saving time and reducing errors compared to manual entry.

How to extract financial information?

To extract financial information, first identify the key data you need, such as amounts, dates, or vendor details. Then, use tools like Optical Character Recognition (OCR) for scanned documents, or financial software and APIs to pull data from digital files or online platforms, organizing it for analysis or reporting.

What is an example of financial data?

An example of financial data includes information like sales revenue, operating expenses, net profit, balance sheets, income statements, and cash flow statements.

What are the three data extraction techniques?

The three common data extraction techniques are:

- Manual Extraction: Involves manually collecting data from documents or databases.

- OCR: Scans and converts printed or handwritten text into machine-readable data.

- Automated Extraction: Uses software tools or APIs to automatically gather data from structured or unstructured sources.

How to collect financial data?

To collect financial data, gather relevant documents like invoices, bank statements, and financial reports. Use software tools or APIs to extract data from digital files or databases automatically. You can also use Optical Character Recognition (OCR) for scanned documents. Organize the data into structured formats for analysis.

How to extract financial data from PDF?

To extract financial data from a PDF, use Docuclipper which uses tools like OCR. This tool scans the document, converting text into machine-readable data.