Have you ever wondered how long to keep bank statements? Managing piles of financial paperwork and documents is a common headache.

With easy online access and digital statements now the norm, you may be tempted to discard older records.

However, keeping your bank statements organized provides protection, simplifies taxes and budgeting, and gives you vital access to your financial history when needed.

This article will explain why keeping bank statements matters, ideal retention periods for different needs, how to store statements, and tips for secure disposal when the time comes.

You’ll learn best practices to retain statements as long as necessary and utilize them to take control of your finances.

Why Keeping Bank Statements is Important

Bank statements provide detailed records of all bank transactions and activity related to your bank accounts. Having access to your statements can be very valuable for several reasons such as:

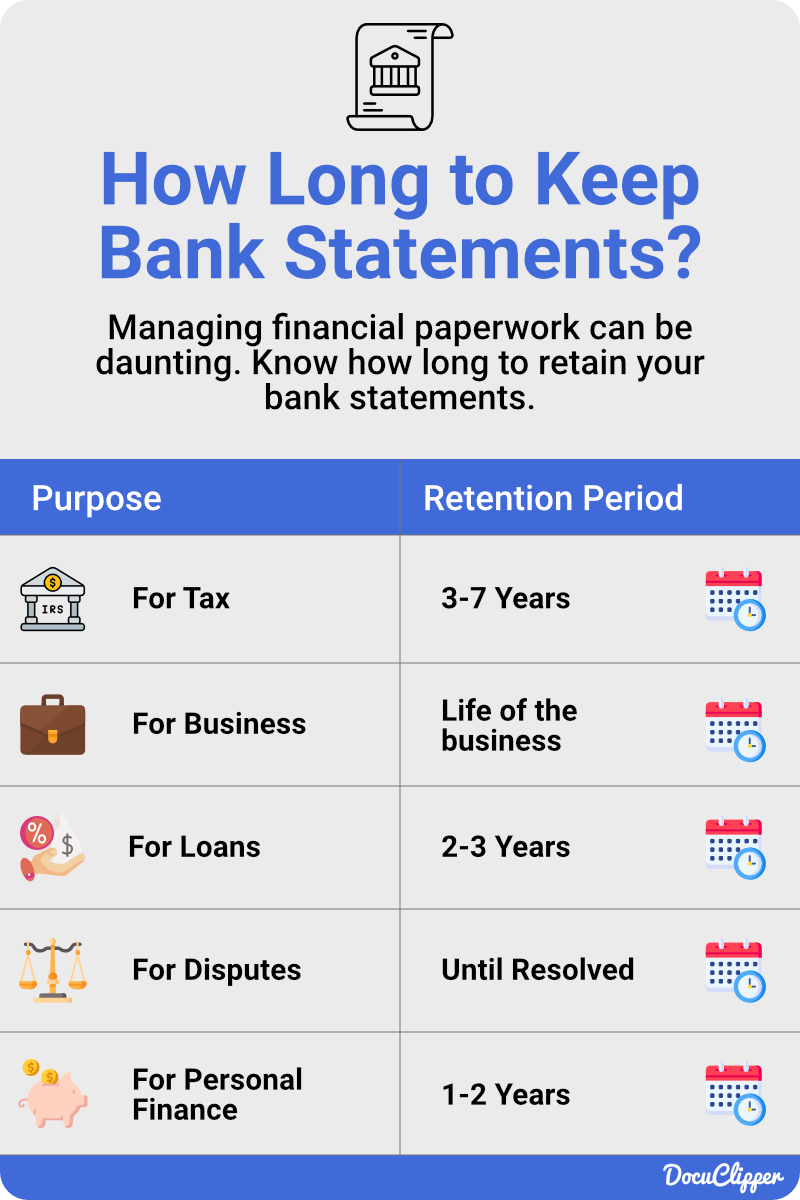

For Tax Purposes:

- Bank statements help provide evidence of income, deductions, business expenses, and other financial information needed when filing taxes.

- The IRS recommends keeping bank statements and records for at least 3 to 7 years in case of an audit.

For Business Expenses and Accounting:

- Business owners need bank statements to keep track of business expenses, revenue, operating expenses, payroll, taxes, and other transactions. Bank statements serve as key supporting documentation.

- Statements should be kept for the life of the business as long as it remains open and operational. (Learn how to categorize business expenses.)

When Applying for Loans

- Lenders commonly request copies of bank statements when reviewing applications for loans or lines of credit.

- Statements help demonstrate cash flow, savings, and responsible money management. Keeping at least 2 years of statements is recommended.

Disputing Fraudulent Transactions

- Bank statements provide proof of unauthorized charges or fraudulent activity related to your accounts.

- Statements should be kept until the dispute is investigated and resolved.

Personal Finance Tracking

- Reviewing bank statements helps identify spending habits, budget effectively, set financial goals, and verify all transaction activity on your accounts.

- Keeping at least 1 to 2 years of statements is useful for personal financial management and security.

Having access to your bank statements protects you financially, provides valuable records, and ensures you can utilize your account history whenever needed.

Especially if your account is already closed, as it’s quite a big hassle to get bank statements from a closed account.

How Long to Keep Bank Statements

When you’re determining how long to retain bank statements, there are several purposes of why you should keep them. Based on that you can determine how long you should keep your bank statements.

Here are some general recommendations recommended by accountants and the IRS:

- For Tax Purposes: You should keep your statements for at least 3 to 7 years. The IRS typically has 3 years to audit after you file taxes, but accountants and bookkeepers often recommend keeping 6 to 7 years of statements to be safe.

- For Business: Keep your bank statements for the life of the business as long as it remains open. This provides support for deductions, expenses, payroll, and other transactions and you will significantly ease the life of your accountant.

- For Loans: Keep at least 2 to 3 years of the most recent bank statements. This gives lenders enough history to verify income, savings, and spending habits and improve your chances of getting loans.

- For Disputes: Keep statements until any disputes about fraudulent charges or accounting discrepancies are resolved. You may need statements for proof and evidence.

- For Personal Finance: Keep at least the past year of printed or digital bank statements. As more history is accumulated, keep the most recent 1-2 years minimum for budgeting and tracking.

- Indefinitely: For long-term financing like mortgages, or for your own peace of mind, you may want to keep bank statements indefinitely if feasible. This provides maximum financial security.

However, we always recommend talking to your accountant or financial advisor about retention times tailored to your specific financial situation and needs.

But you can use these general recommendations as a guideline for most situations.

To learn more we recommend you read these additional resources:

- How to Read a Bank Statement and Actually Understanding It

- How to Do Bank Statement Reconciliation (Manually and automatically)

How Long Are My Bank Statements Available?

According to your local laws and regulations, banks are legally obligated to keep records of customer bank statements for 5-7 years in most cases.

This requirement ensures statements remain available if needed for tax purposes, audits, or financial reviews.

While some banks may keep statements longer digitally, the 5-7-year retention period is the minimum that can be expected based on legal standards.

Knowing these regulatory retention requirements can give you peace of mind about your bank properly maintaining your financial records for a reasonable period of time.

Converting Bank Statements to Excel

Converting your downloaded bank statements into Excel spreadsheets can provide additional benefits for tracking finances and running reports.

Excel allows you to organize, analyze, and work with your statement data more efficiently.

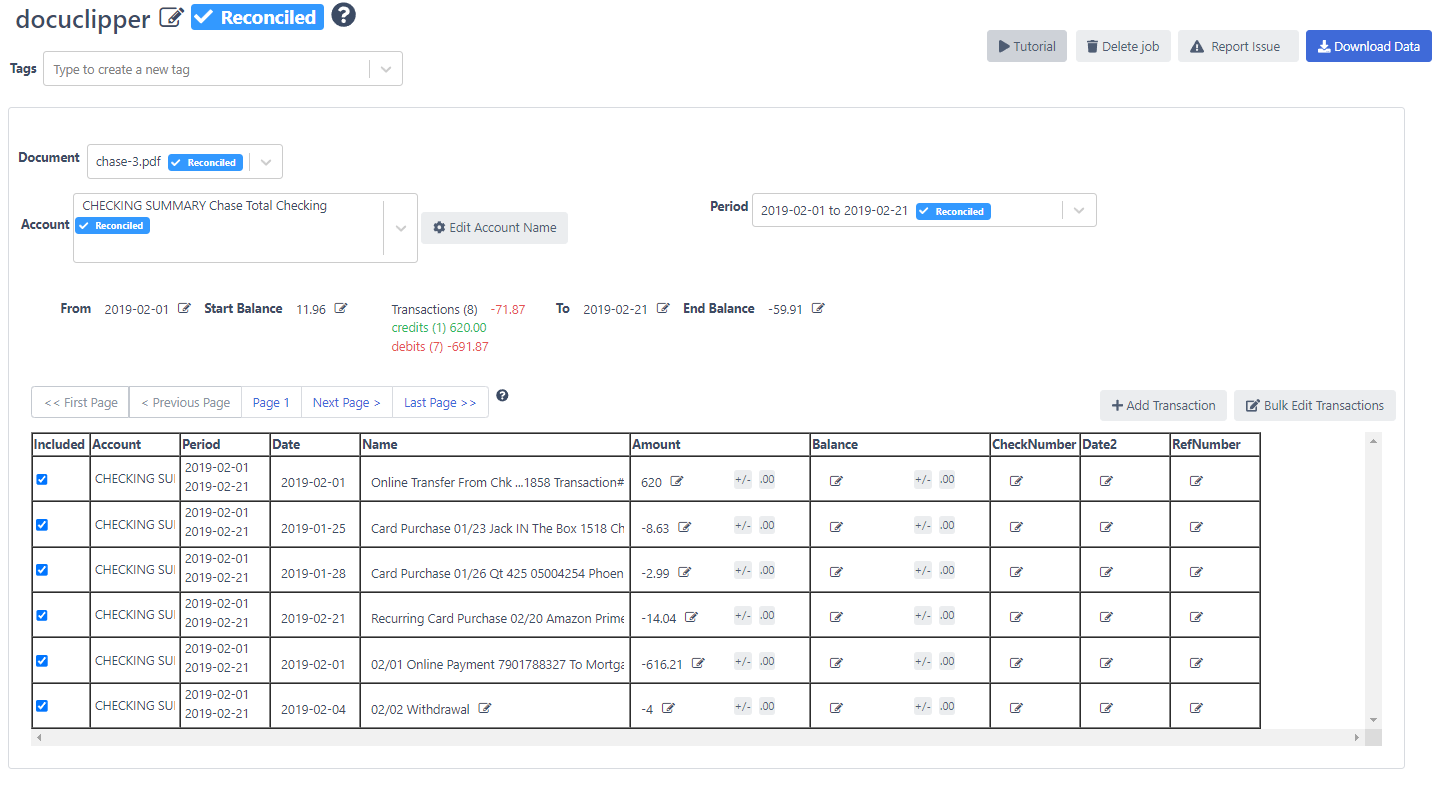

DocuClipper is a bank statement converter that easily converts PDF bank statements into Excel automatically, saving you the hassle of manual data entry.

With DocuClipper, you can quickly convert statements from any bank into spreadsheets to simplify reconciling accounts, creating budgets, and performing cash flow analysis.

The data visibility and flexibility provided by Excel combined with DocuClipper’s automated conversion deliver convenient financial management capabilities with minimal effort.

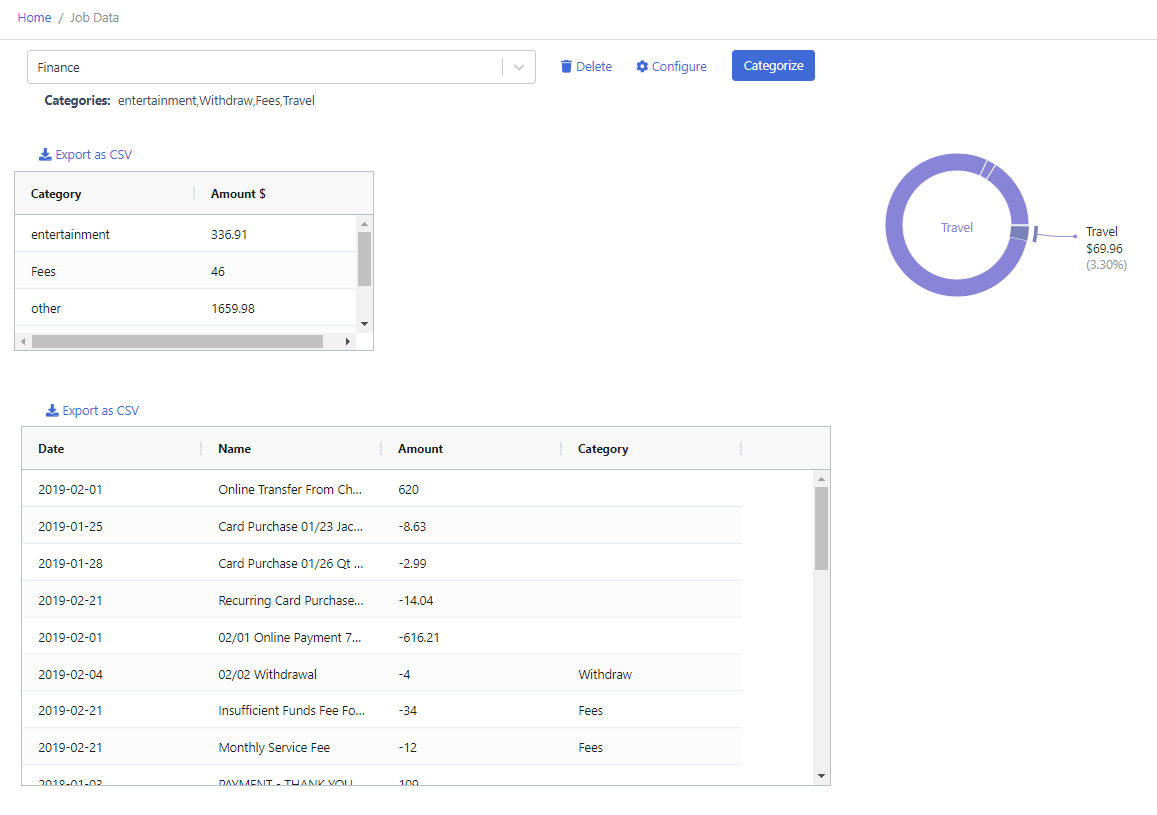

Another key benefit provided by DocuClipper is intelligent transaction categorization. When converting statements to Excel, DocuClipper can automatically categorize various transactions based on keyword recognition.

This saves you the hassle of manually assigning business expense categories to each transaction entry.

Additional recommended articles to learn more about bank statement conversions and transaction categorization:

- What is Transaction Categorization and Why Is it Important for Accountants?

- How to Convert Bank Statements to Excel, CSV, or QBO

- How to Import Bank Statements into QuickBooks Online: Easy Step-by-Step Guide

Or for more basic needs, you can use Excel to categorize your bank transactions.

We have a transaction categorization and expense spreadsheet here that you can download.

Tips for Organizing and Storing Statements

When it comes to developing a system to organize and store your bank statements, either physically or digitally it’s essential that you have a proven system that helps you to store them, locate them, as well as prevent any loss of these records.

Here are some of the best practices according to accounting experts and our customers:

- Leverage online banking and download statements regularly to have digital copies. Make downloading statements part of your monthly financial routine.

- For paper statements, invest in folders, binders, or filing cabinets. Categorize based on year and month for easy access. Label and date folders clearly.

- For digital storage, create folders on your computer organized by year and month. Cloud backup services can provide offsite storage and syncing across devices.

- Consider scanning paper statements to have both physical and digital copies. Scanners with document feeders can make digitization easier.

- Improve searchability by using descriptive filenames like “Checking Statement July 2022” rather than just numbers.

- Set reminders to periodically review statements for discrepancies, unused subscriptions, fraudulent charges, etc.

- Destroy statements securely once you pass retention time limits. Use shredders or services to dispose of sensitive information.

Just keeping your bank statements is not enough. Organizing both digital and paper records makes accessing your bank statements much easier while also ensuring the security and protection of your financial information. Developing good habits is essential here

How to Safely Dispose of Old Bank Statements

Once you feel that you no longer need to keep your records of bank statements, it is also important to properly destroy them to avoid sensitive information being compromised.

With that here are some tips for secure disposal according to accounting and bookkeeping experts and our customers.

- Shred – Use a cross-cut shredder to shred paper statements and documents into tiny confetti-like pieces. This prevents the information from being reconstructed.

- Incinerate – Safely burn paper statements to fully destroy them beyond recognition. This renders the information irrecoverable.

- Delete – Completely delete any digital bank statement files stored on devices or cloud accounts. Also, empty the deleted items folder.

- Erase – For storage media like CDs, USB drives, or hard disks, use disk wiping software to overwrite the data multiple times. This makes recovery impossible.

- Encrypt – Consider encrypting any bank statement files prior to disposal to add an extra layer of protection.

- Use a destruction service – Companies like Shred-it can securely destroy documents and records while providing a certificate of destruction.

The key is destroying old statements so no sensitive data can ever be retrieved or reconstructed. Take every precaution to make old bank records unrecoverable.

Final Advice

Maintaining proper records of your bank statements is critical for financial security, personal accounting, taxes, and more. To summarize our article here are the key recommendations:

- Retain bank statements for at least 3-7 years for tax purposes and audits. Keeping 6-7 years is ideal.

- Whenever possible, utilize online banking and download digital PDF statements regularly. This ensures access.

- Categorize statements by year and month. Use binders, folders, or cloud storage to organize.

- Scan paper statements to have digital backups if desired. Shred papers when done.

- Convert statements to Excel using services like DocuClipper for advanced tracking.

- Safely destroy statements beyond recovery once they pass your retention period.

- Check with your accountant or financial advisor for guidance tailored to your situation.

Keeping bank statements organized provides protection, simplifies taxes, assists with budgets and cash flow analysis, and gives you vital access to your financial history. Treat statement retention as an essential financial practice.

FAQs about How Long to Keep Bank Statements

Here we’re going to answer some of the commonly asked questions about how long to keep bank statements:

Is it worth keeping old bank statements?

Yes, keeping old bank statements is essential. They provide a record of transactions, assist in tax preparations, support business accounting, and help in resolving disputes. Retain them for 3-7 years for tax purposes and longer for business needs. Digital storage can simplify organization and access.

What records should be kept for 7 years?

Records to keep for 7 years include tax return documents, W-2 and 1099 forms, bank and credit card statements, canceled checks, and receipts for tax-deductible expenses. This duration ensures compliance with IRS audit requirements, as the agency can challenge tax returns within this period. Proper retention aids in accurate tax filings and dispute resolutions.

How long should I keep bills and bank statements?

Bills should be kept for at least one year, especially if they support tax deductions. Bank statements should be retained for 3-7 years, aligning with IRS audit guidelines. After verifying a bill’s accuracy and payment, it can be discarded, while bank statements have longer-term relevance for tax, business, and personal finance purposes. Digital storage can offer organized and space-saving solutions.

Should I shred 20 year old bank statements?

Yes, you should shred 20-year-old bank statements. They’re well beyond the recommended retention period of 3-7 years for tax and audit purposes. Shredding ensures your personal and financial information remains confidential, protecting against potential identity theft or fraud. Always use a cross-cut shredder for added security.