You already know manual invoice processing is being replaced by automation, but are you certain how big the gap is? If the improvement isn’t even that big, why would you bother investing in software and training?

In this article, we’ll show you how automated invoice processing leaves manual methods in the dust.

You’ll discover the industry standards that top-performing businesses follow and learn how many invoices can be processed in a day with automation.

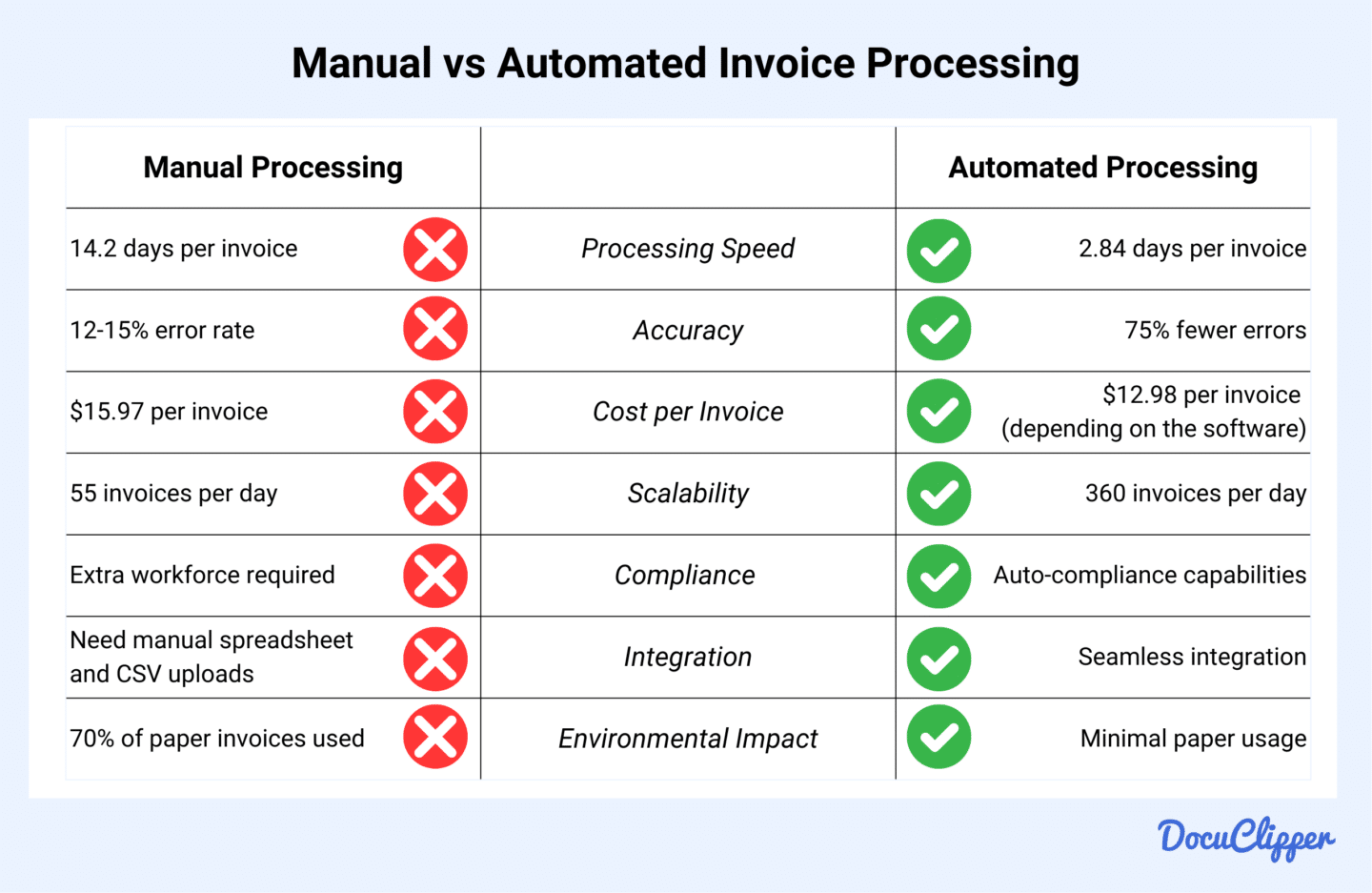

Manual vs Automated Invoice Processing

Manual and automated invoice processing have significant differences and these differences will bring many changes to your invoice process efficiency, here is an overview:

| Category | Manual Process | Automated Process |

| Processing Speed | 14.2 days per invoice | 2.84 days per invoice |

| Accuracy & Error Rates | 12-15% error rate | 75% fewer errors |

| Cost per Invoice | $15.97 per invoice | $12.98 per invoice (can be lower depending on the invoice data extraction software cost) |

| Scalability | 55 invoices per day | 360 invoices per day |

| Compliance & Audit Trail | Extra workforce required | Auto-compliance capabilities |

| Integration Capabilities | Need manual Spreadsheet and CSV uploads | Seamless software integration |

| Environmental Impact | 70% of paper invoices used | Minimal paper usage |

Processing Speed

Speed is the most noticeable advantage of automation. Automating your invoice process can cut processing time by up to 80%. The reason why it’s slow is due to the time spent manually inputting data, validating processes, and correcting errors from these steps.

To put into practice, the average manual processing time for accounts payable across industries is 14.2 days per invoice. If you automate this it’ll slow down to just 2.84 days or even faster for businesses that do well in their AP process.

Accuracy & Error Rates

Errors in invoice processing can significantly impact efficiency and drain resources. Mistakes slow down workflow and lead to rework. 68% of businesses report errors on more than one percent of their invoices in business-to-business transactions.

Processing invoices manually has error rates ranging from 12 to 15 percent, depending on staff proficiency. However, adopting automated data entry solutions can reduce errors by up to 75 percent, ensuring a smoother and more reliable process.

Cost per Invoice

According to the IOFM, for low invoice volumes, fewer than 20,000 annually, the average cost to process a single invoice is $12.98 with automation and $15.97 without automation.

For moderate invoice volumes, annually 20,000 to 100,000, the cost per invoice is $4.24 with automation and $6.10 manually.

For high-volume accounts payable, over 100,000 invoices annually, the cost drops to $3.18 with automation and $3.62 manually.

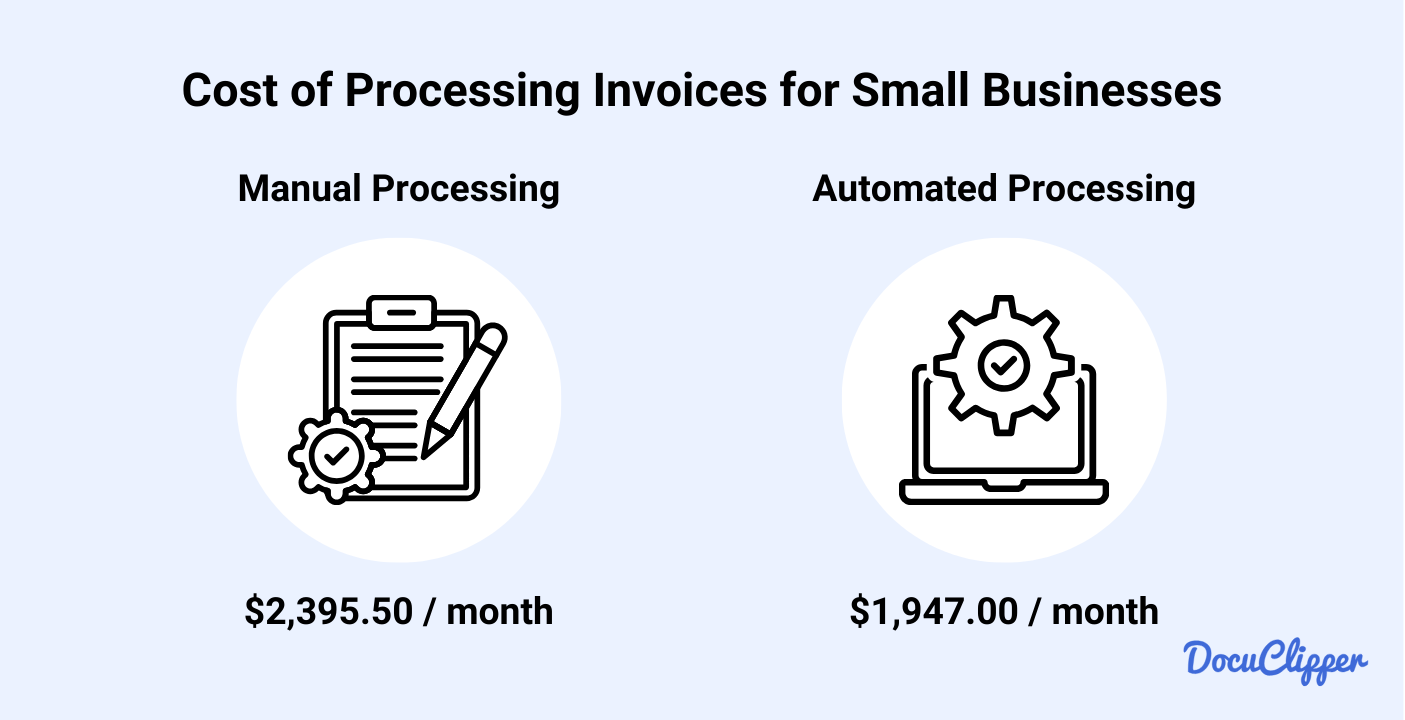

To put it more digestible for you, here is a practical breakdown:

Let’s consider a small business processing 150 invoices per month. When processing manually, assuming a cost of $15.97 per invoice, the total monthly expense would be $2,395.50.

If they had used automated methods, with a cost of $12.98 per invoice, the total monthly expense would have dropped to $1,947. That small business would have saved $448.50 every month.

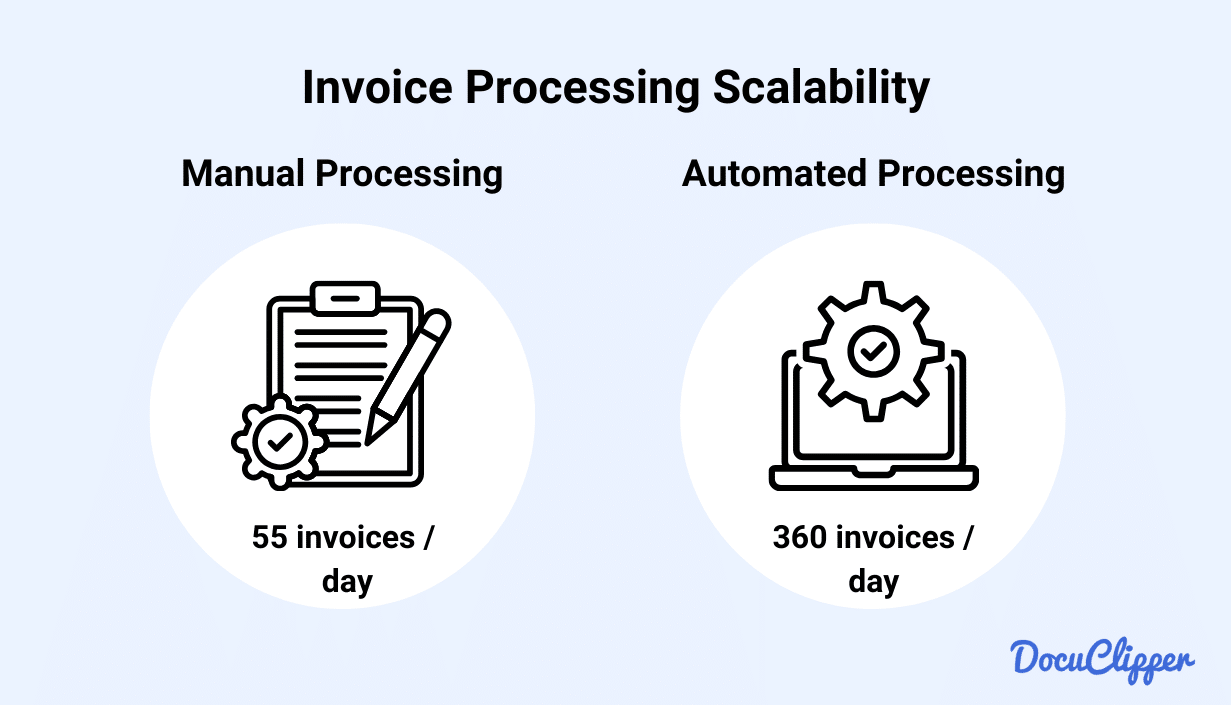

Scalability

An accounting team can typically process around 55.24 invoices per day manually. However, if you have a team that underperforms, this number may drop to fewer than 30 invoices per day, depending on staff volume.

If you have an automated invoice processing system, it can handle up to 360 invoices per day, way past to what a standard team can do. Manual processing stands no chance in the aspect of scalability.

Compliance & Audit Trail

Errors in invoicing and record-keeping can lead to compliance issues and additional work during audits or tax season. Automated systems can easily be programmed to record and format information ready to what your local and national laws need.

Well to comply manually, you will have to allocate another set of workforce or hours for you to prepare during tax time.

Integration Capabilities

Automated systems can easily be integrated into accounting or ERP software through connections.

Manually doing it will force you to type everything in a spreadsheet and upload it via CSV to these systems. It adds more time and possible instances to input wrong data within your system.

Environmental Impact

This is often underestimated as paper has been a huge waste during invoice processing. 70% of invoices being processed are still in paper format. If you use automated means, you’ll have less waste in your processes and contribute by going green.

Summary of Automated vs Manual Invoice Processing

Manual invoice processing provides hands-on control, making it suitable only if you have smaller workloads but this will certainly limit you when the volume increases.

Automated processing is significantly efficient, accurate, and scalable by a mile. The decision to automate often depends on invoice volume, cost considerations, and the need for compliance and integration.

So, the choice remains yours whether you will start investing in automation or remain a spectator to your competitors’ increased efficiency.

Factors Affecting Daily Invoice Processing Volume

An invoice process has many steps, and with each step there can be setbacks that can affect the efficiency of your invoice rate.

- Invoice complexity and type: Invoice format differs depending on the company or legal requirements. Adjusting to new formats can slow down the process, but e-invoices, another form of automated invoice processing, are faster as they integrate easily with ERP systems.

- Staff expertise and training: High-performing personnel can process invoices at a higher rate with fewer errors, reducing the need for corrections. But training new personnel to reach this level, requires time and resources.

- Available technology and tools: Tools like invoice scanners OCR, and ERP software cuts manual data entry time and reduce errors.

- Quality of incoming documents: Misprinted or inaccurate documents slow progress, as disputes or re-submissions are necessary to proceed.

- Approval workflow efficiency: Complex, multi-level approval processes create bottlenecks. Streamlined workflows enable faster invoice processing.

Industry Benchmarks and Standards

Benchmarks and invoice metric standards differ from country, industry, and even era. So all of these mentioned can vary from time to time but the majority of the industry tries to adapt.

Small Business Processing Rates

According to AMI-Partners, a typical small-to-medium business (SMB) works with around 190 suppliers and vendors. If each vendor is paid just once per month, let’s they have to process 2,280 checks issued annually.

While this is a hypothetical metric, actual numbers can vary widely depending on the industry and the business’s operational performance.

Enterprise-Level Processing Volumes

Approximately half of all businesses process 500 invoices each month. High-performing organizations, as observed by Proactis, can process over 40,000 invoices per full-time employee annually, with top performers exceeding 90,000 invoices.

Despite these impressive figures, enterprise-level businesses often take between 3 to 17 days to process a single invoice. This delay is primarily due to the complex filters and validation steps required for approvals.

Cost per Invoice Metrics

According to industry metrics, processing paper invoices costs average between $12 and $30. For larger businesses with more complex accounts payable processes, costs can rise significantly, reaching nearly $440 per invoice in some cases.

For automated means according to the AQPC in 2023, the cost to process an invoice ranged from $1.77 for top performers to $10.89 for the bottom 3 quarters.

How to Optimize Invoice Processing Speed

Improving invoice processing enhances cash flow and strengthens supplier relationships. Here are some best practices to help you achieve this:

- Standardize procedures: Create clear, consistent steps for processing and managing invoices to minimize errors affecting your efficiency.

- Automate invoice processes: Use tools like OCR for data entry and invoice matching, reducing the time and manual effort needed.

- Make approval workflows: Make sure that approval workflows are smooth and accurate, adding layers of verification for authenticity and catching discrepancies.

- Monitor payment schedules: Track due dates and payment terms to avoid delays, penalties or missed payments.

- Maintain detailed records: Organize the records of invoices, payments, and other related documents for future reference and audits.

- Review and update procedures: Assess and refine your processes to address inefficiencies and integrate new technologies.

- Train and orient staff: Provide ongoing training to ensure your team is equipped with the latest procedures, tools, and best practices.

Process Invoices Faster with DocuClipper

DouClipper allows you to speed up your invoice data entry process accurately by eliminating manual data entry. It uses OCR technology to recognize characters from fields PDF invoices and organize them into spreadsheet formats like XLS and CSV, which you can easily upload to your ERP system.

It can cover any invoice and receipt format making it a versatile choice for your invoice processing and it is very easy to use, making the transition from manual to automated very easy.

FAQs About How Many Invoices Can Be Processed in a Day

Here are some frequently asked questions about improving your invoice processing speed;

How many invoices can be processed in an hour?

The number of invoices processed in an hour depends on the method used. Manually, an average employee can process 4 to 5 invoices per hour due to the time required for data entry and validation. Automated systems, however, can handle up to 50 invoices or more per hour.

How many invoices are considered high volume?

High-volume invoice processing typically refers to handling more than 100,000 invoices annually. This equates to approximately 8,300 invoices per month or around 275 per day. Businesses with high volumes often require automated systems to maintain efficiency and accuracy.

What is the limit for invoicing?

There is no strict limit for invoicing, as it depends on the capacity of your system and processes. For manual invoicing, the limit is constrained by the time and resources available. Automated systems, however, can handle virtually unlimited invoices, provided your software and infrastructure are capable of supporting the required volume.

Is there a time limit for invoicing?

Yes, the time limit for issuing invoices often depends on local regulations and contractual agreements. In many cases, invoices must be issued within a specific timeframe, such as 30 days after goods or services are delivered. Delayed invoicing can lead to payment disputes or non-compliance with legal requirements, so it’s important to adhere to these deadlines. Always check your local laws and client agreements for specific guidelines.

What is the maximum number in an invoice?

The maximum number of line items or details in an invoice depends on the invoicing system you use. Most modern accounting or ERP systems can handle thousands of line items per invoice without any issues. However, manual or outdated systems may have limitations, such as a few hundred line items, before performance or usability becomes a concern. Always ensure your invoicing tool meets your business’s requirements.

What is the standard invoice processing time?

The standard invoice processing time varies depending on the method used. For manual processing, it typically takes 14 to 21 days to complete due to invoice data extraction, validations, and approvals. Automated systems significantly reduce this time, processing invoices in as little as 3 to 5 days, depending on the efficiency of the workflow and tools used.

How many copies of invoices should be issued?

Typically, two copies of an invoice should be issued. One is sent to the customer for their records and payment processing, while the other is retained by the issuer for record-keeping and auditing purposes. In some cases, additional copies may be required for legal compliance or internal use, depending on the industry or jurisdiction.