Handling financial documents like tax forms, bank and credit card statements, payrolls, invoices, and receipts is a routine part of accounting. But when these documents come in PDF format, as they often do from banks, B2B transactions, and government agencies, you are stuck with a major problem: manually entering data into a spreadsheet.

This process is slow, frustrating, and prone to errors. A single mistyped number can throw off an entire reconciliation, leading to wasted hours double-checking figures. The more statements you process, the greater the risk of mistakes and inefficiencies.

Fortunately, there is a way to eliminate manual data entry. In this article, you will learn how to convert PDF financial statements to Excel quickly and accurately using DocuClipper, an OCR financial document converter.

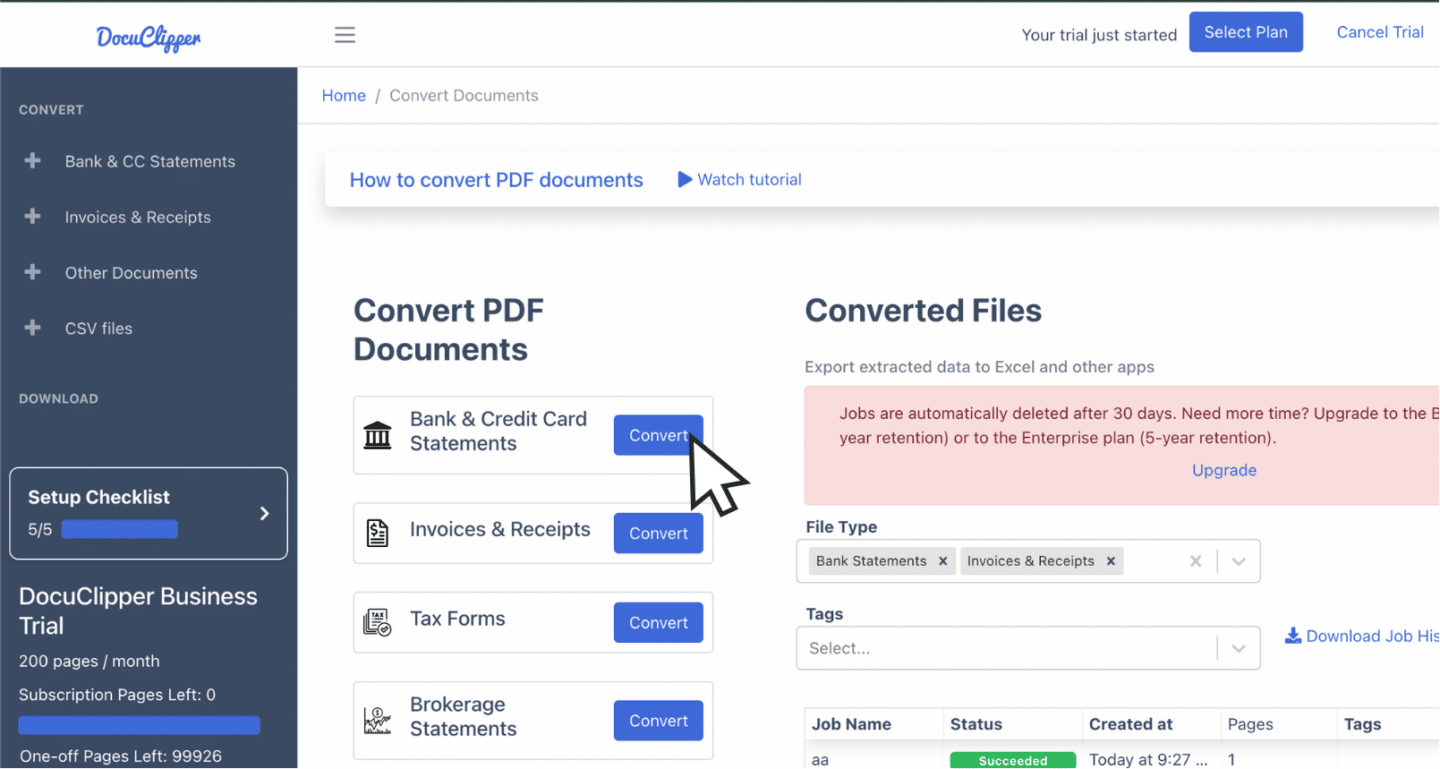

Step 1: Upload Your Financial Statements

To get started, you will use DocuClipper, an OCR-powered financial document converter that extracts data from PDF statements and converts them into Excel, CSV, or QBO formats.

First, ensure you have your PDF financial statement ready. If your statement is not in PDF format, you will need to convert it while following proper OCR preprocessing techniques to ensure accuracy.

Next, log in to your DocuClipper account. If you do not have an account, you can start with a free trial.

Once inside, navigate to the bank and credit card statements section. Assign a job name for the conversion, then drag and drop the PDF statements you need to convert. You can upload multiple statements at once, making bulk processing quick and efficient.

Step 2: Automatic Data Extraction

Once your PDF statements are uploaded, DocuClipper’s AI-powered technology automatically extracts key financial data with high accuracy. It identifies all transactions along with their dates and descriptions, ensuring no details are missed.

The software also captures opening and closing balances for both bank and credit card accounts, along with statement periods and account details.

Additionally, it extracts credit and debit amounts, including charges and payments for credit cards. Any interest charges and fees are also identified, giving you a complete and structured dataset without the need for manual data entry.

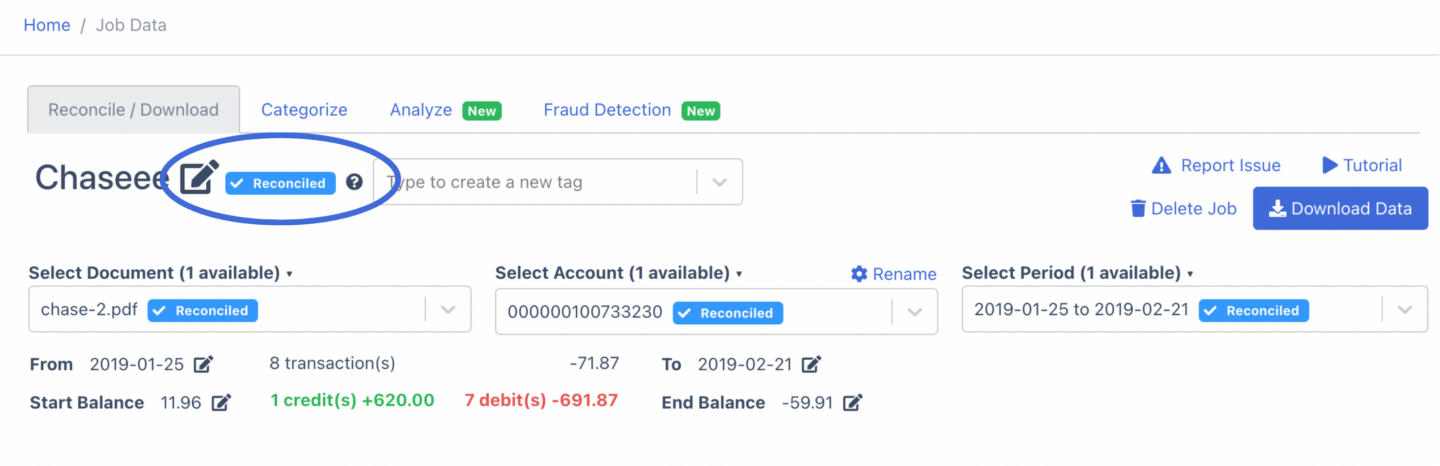

Step 3: Automatic Reconciliation (for Bank & Credit Card Statements)

After extracting the data, DocuClipper automatically reconciles your bank and credit card statements to ensure accuracy.

It compares transaction totals against statement summaries, verifies opening and closing balances, and checks individual transaction amounts for discrepancies.

The reconciliation status appears in the top right corner, giving you real-time confirmation that the data is accurate and complete. This automated process eliminates manual errors and ensures that your financial records are consistent.

Here’s a video showing how to reconcile the statements:

Reconcile bank statements in DocuClipper (howto)

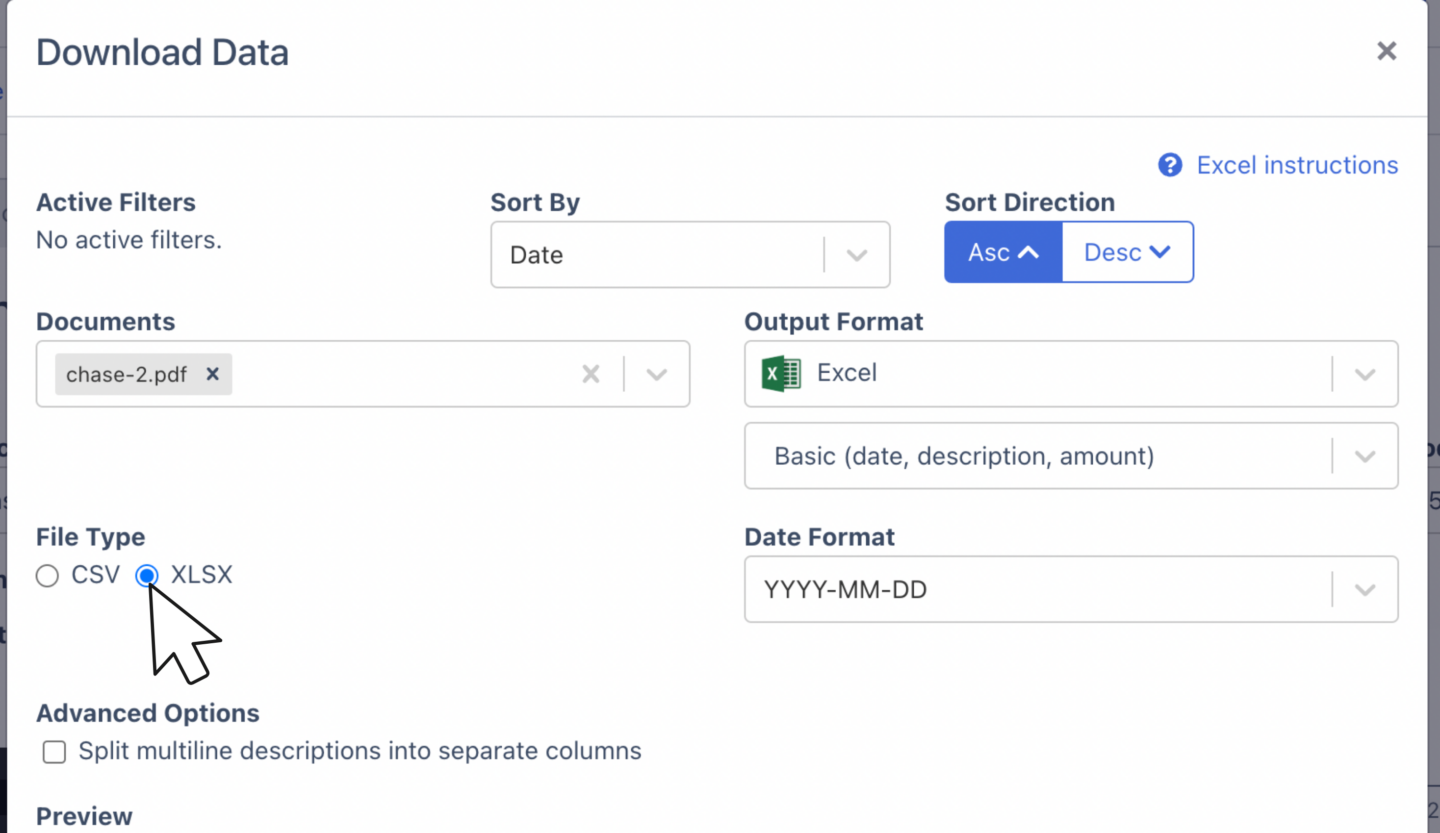

Step 4: Download Your Excel or CSV File

With your bank statement fully reconciled, you are now ready to export it in Excel, CSV, or QBO format. Simply click Download Data to start the export and select your preferred format.

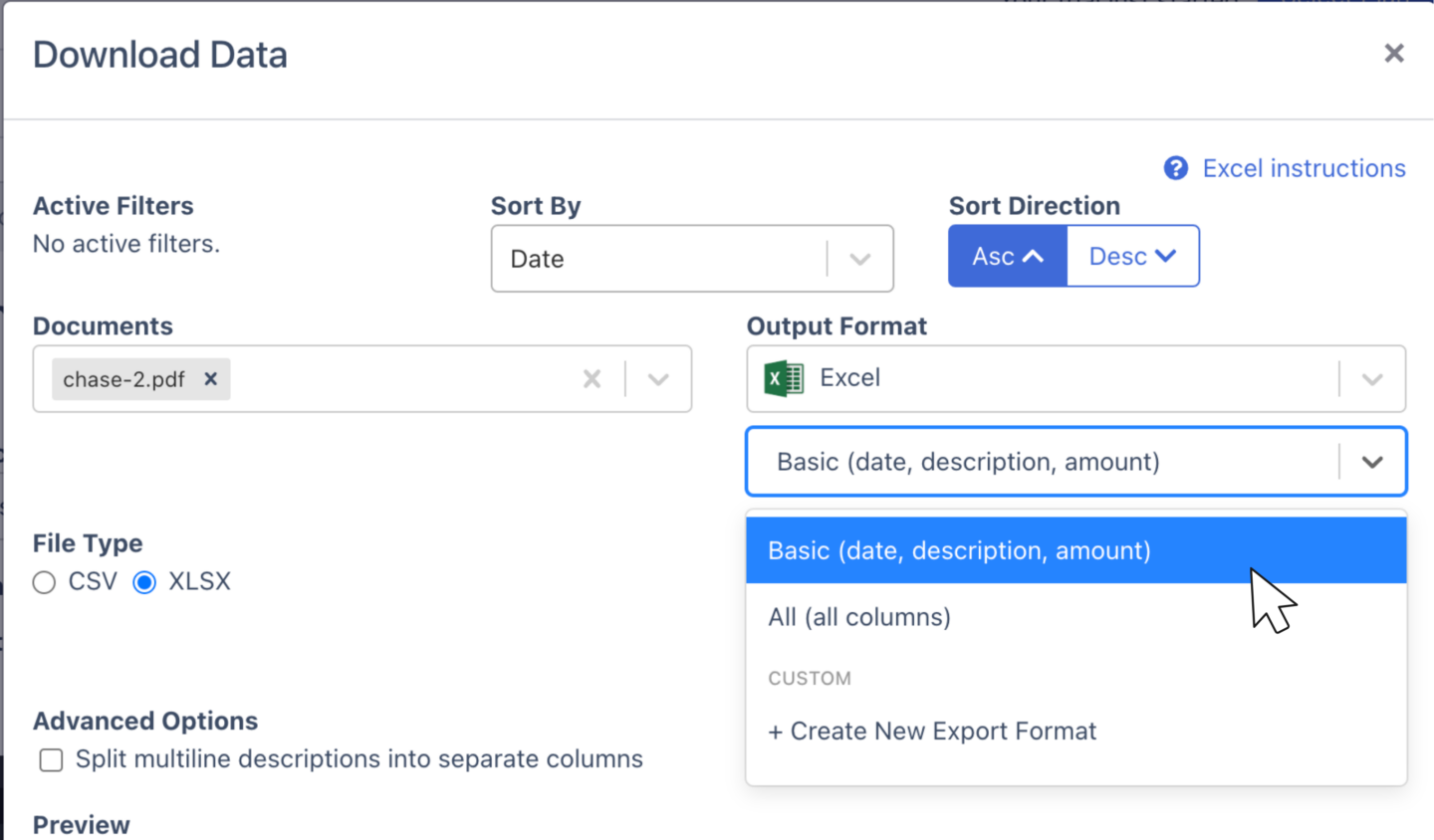

Export Bank Statement to Excel

Excel is the most widely used format for financial analysis and accounting. It provides a structured layout that allows you to organize, filter, and analyze transactions efficiently.

To export your bank statement as an Excel file, open the Download Data menu and select Excel as the format. Choose XLSX to ensure compatibility with most spreadsheet applications.

Once selected, click Download Data to save the file. The downloaded Excel file will be available in your Downloads folder, ready for use in your accounting workflows.

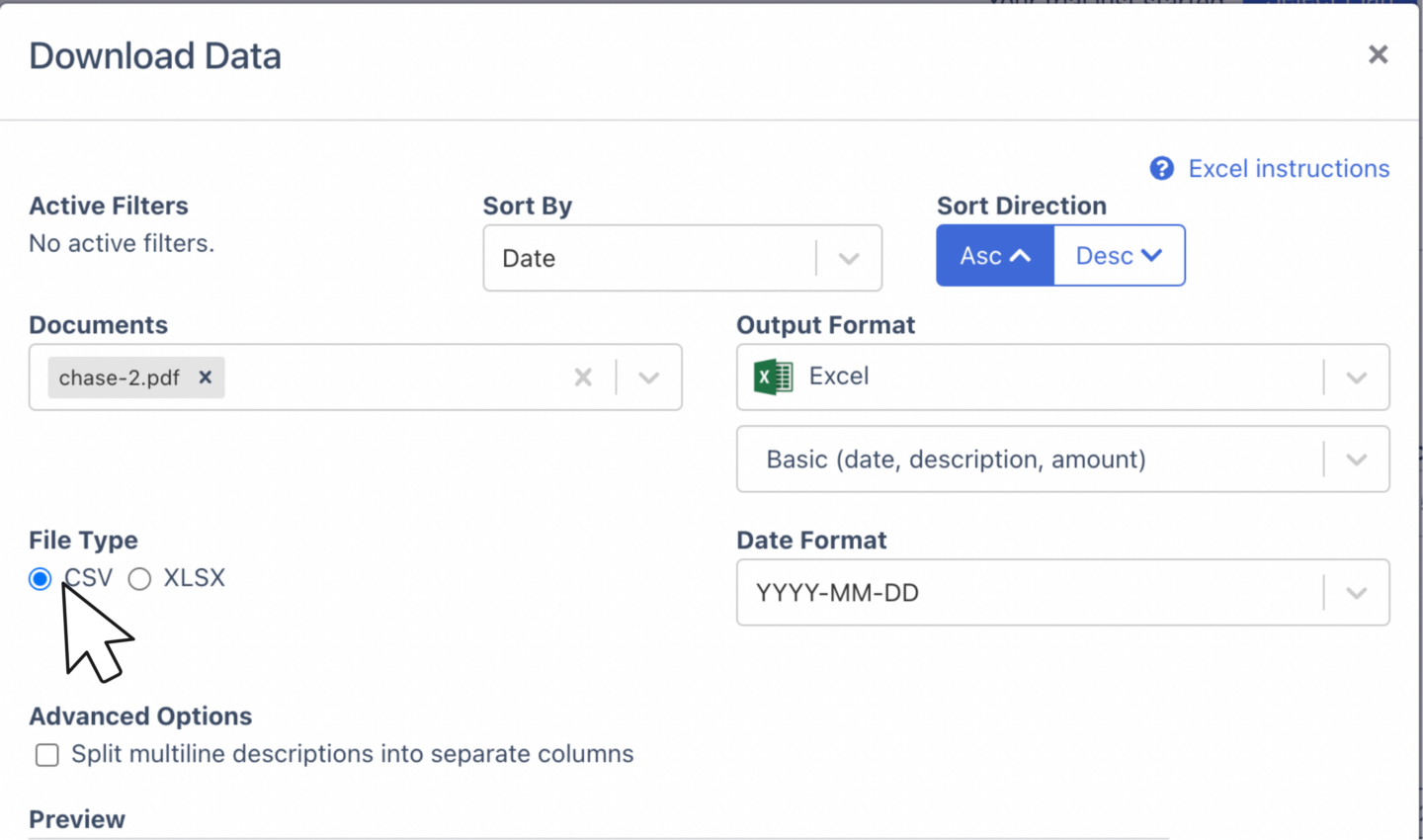

Export Bank Statement to CSV

Many accounting tools, such as Quicken, Xero, Sage, MYOB, Relate, and NetSuite, support the CSV format.

- Open the Download Data menu

- Select Excel as the format

- Choose CSV from the dropdown options

- Click Download Data

This format ensures compatibility with various accounting software for seamless data import.

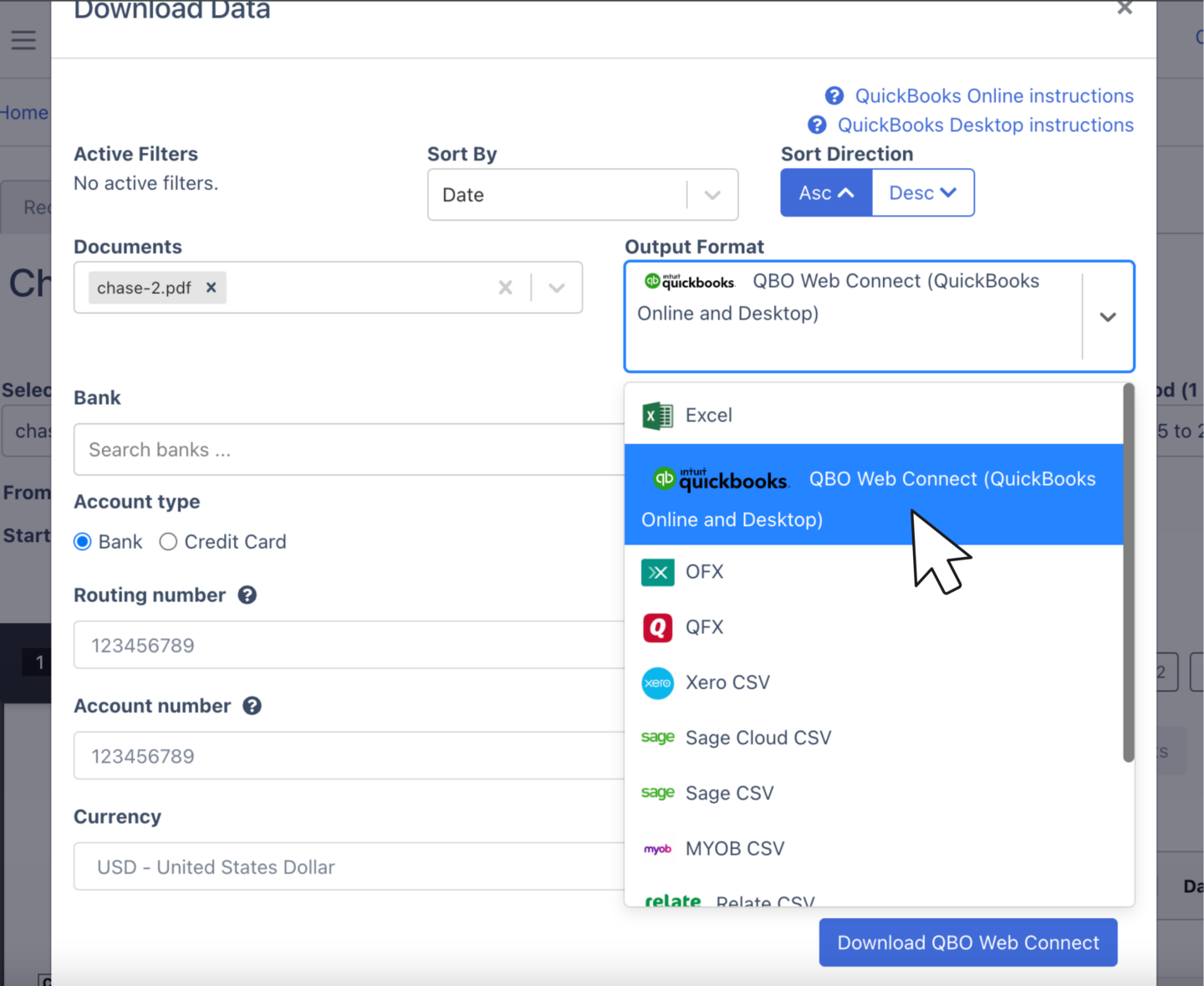

Export Bank Statement to QBO

For QuickBooks users, exporting to QBO format ensures direct integration with QuickBooks Online and QuickBooks Desktop.

- Open the Download Data menu

- Select the QBO option

- Complete any required fields for setup

- Click Download Data

Once downloaded, you can import the file into QuickBooks for a streamlined accounting process.

Step 5: Configure the Output Format

DocuClipper offers flexibility in customizing the output of your financial data to suit your specific needs. Here’s how you can configure the output format:

- Access the Download Window: After processing your documents, navigate to the download section within DocuClipper.

- Choose the Output Format: Select your desired file type—Excel (.xlsx) or CSV (.csv)—depending on your requirements.

- Adjust Date Format: Customize the date format to match your regional or organizational standard.

- Select Columns: Decide which columns to include in your output. DocuClipper supports fields such as “date,” “date2,” “amount,” “debit,” “credit,” “balance,” “account number,” and more. You can select specific columns or choose “All Columns” to mirror the entire summary table.

- Preview the Output: Utilize the preview feature to see how your data will appear in the selected format, ensuring it meets your expectations before downloading.

For a visual guide on customizing the output format with DocuClipper, you can watch the following video:

Conclusion

Manually converting PDF bank or credit card statements into Excel or CSV formats can be a time-consuming and error-prone task. However, with DocuClipper’s AI-enhanced bank statement converter, this process becomes efficient and accurate.

By automating data extraction, reconciliation, and customization, DocuClipper streamlines your workflow, allowing you to focus on more critical accounting tasks.

Using such technology not only saves valuable time but also enhances the precision of your financial records, ultimately contributing to better financial management.

What DocuClipper Can Also Do!

DocuClipper goes beyond just converting bank statements to Excel. It can extract data from invoices, receipts, tax forms, and brokerage reports, making it a versatile tool for accounting professionals.

In addition to data extraction, DocuClipper includes advanced features that streamline financial management. It’s fraud detection capability helps identify suspicious transactions in bank and credit card statements, reducing the risk of errors or unauthorized activity.

Transaction categorization automates expense tracking, ensuring that financial records remain organized and easy to analyze.

For businesses handling large volumes of transactions, DocuClipper provides financial analysis tools that help track the flow of funds, offering better insights into cash flow and spending patterns. These features simplify reconciliation, improve accuracy, and enhance overall financial reporting, making accounting tasks more efficient.