Key takeaways:

- Check for visual inconsistencies like mismatched fonts, pixelation, misaligned text, and irregular spacing—common signs of document tampering.

- Review content carefully for grammar issues, contradictory or missing information, and incorrect details that don’t align with official formats.

- Verify security features such as watermarks, holograms, paper texture, and UV-reactive elements to confirm document authenticity.

- Use digital verification methods like metadata inspection, PDF layer analysis, and digital signature checks to uncover behind-the-scenes manipulation.

- Rely on advanced tools like DocuClipper to automate verification of bank statements, detect fraud risk, and generate detailed audit-ready reports.

Visual Indicators

Start by examining the document for any visual inconsistencies that may signal tampering or forgery.

- Inconsistent fonts or formatting: Pay close attention to changes in font type, size, or spacing. These variations often indicate that parts of the document were edited separately.

- Poor quality or pixelation: Zoom in on areas like text, signatures, or logos. Blurriness or pixelation—especially in what should be clean, high-resolution sections—can suggest manipulation.

- Misaligned text or elements: Check if text boxes, lines, or logos are off-center or slightly shifted. Misalignment is a common sign of elements being added or replaced.

- Unusual color variations: Look for inconsistent coloring in backgrounds, watermarks, or security features. Faded or uneven tones could mean sections were digitally altered.

- Irregular spacing: Examine the spacing between letters, words, or lines. If it feels off compared to the rest of the document, it might have been tampered with.

Content-Based Red Flags

After checking for visual issues, shift your focus to the actual content. Even well-designed documents can reveal fraud through what they say—or fail to say.

- Grammatical or spelling errors: Look for typos, awkward phrasing, or grammar mistakes. Legitimate documents typically go through multiple reviews and shouldn’t contain obvious errors.

- Inconsistent information: Watch for contradictions, like mismatched names, dates, or account numbers within the same document. These can indicate falsified or poorly altered content.

- Missing information: Check if any standard fields or required details are left blank. Missing sections—like page numbers, official references, or totals—can be a red flag.

- Unusual language or phrasing: Be alert to terminology that seems off or doesn’t match the tone of typical business or official language. It could be a sign the document wasn’t professionally created.

- Incorrect details: Verify the accuracy of key data points. Look out for impossible dates, invalid addresses, or identification numbers that don’t follow standard formats.

Security Feature Verification

To dig deeper, assess the document’s built-in security features. These are often the hardest to replicate and can help you confirm authenticity.

- Missing or altered security features: Check for tampered or absent elements like holograms, watermarks, or microprinting. If these features look suspicious or are missing altogether, the document may be fake.

- Paper quality and texture: Feel the paper. Official documents often use high-quality or specialized paper that’s hard to duplicate. A flimsy or unusual texture could be a warning sign.

- UV light response: Use a UV light to check for invisible markers. Many genuine documents include hidden features—such as glowing threads or symbols—that only appear under ultraviolet light.

- Embossed seals or stamps: Run your fingers over any seals or stamps. Authentic ones usually have a noticeable texture and proper depth. A flat or printed imitation is a strong red flag.

Digital Document Verification

When you’re reviewing a digital file, there are several behind-the-scenes checks you can perform to catch signs of tampering.

- Metadata examination: Inspect the file’s metadata to see when it was created, last modified, and which software was used. Inconsistencies—like a creation date that doesn’t match the document’s content—can reveal manipulation.

- Digital signature verification: If the document includes a digital signature, make sure it’s valid and issued by a trusted authority. Invalid or missing signatures often indicate the document has been altered.

- PDF layer analysis: Analyze the document’s layers to detect edits. Changes like added text boxes or image overlays in separate layers are a clear sign that the file may not be original.

Advanced Verification Methods

For high-stakes situations, go beyond visual and digital checks by using external and professional verification techniques.

- Cross-reference with issuing authorities: Reach out directly to the organization that supposedly issued the document. A quick confirmation can often verify whether the document is legitimate or fabricated.

- Database verification: Compare the document’s details with official records when available. Whether it’s financial data, ID numbers, or transaction logs, reliable databases can help confirm accuracy.

- Specialized authentication tools: Use advanced tools like document verification software or forensic scanners. These are designed to detect subtle forms of fraud that manual checks might miss.

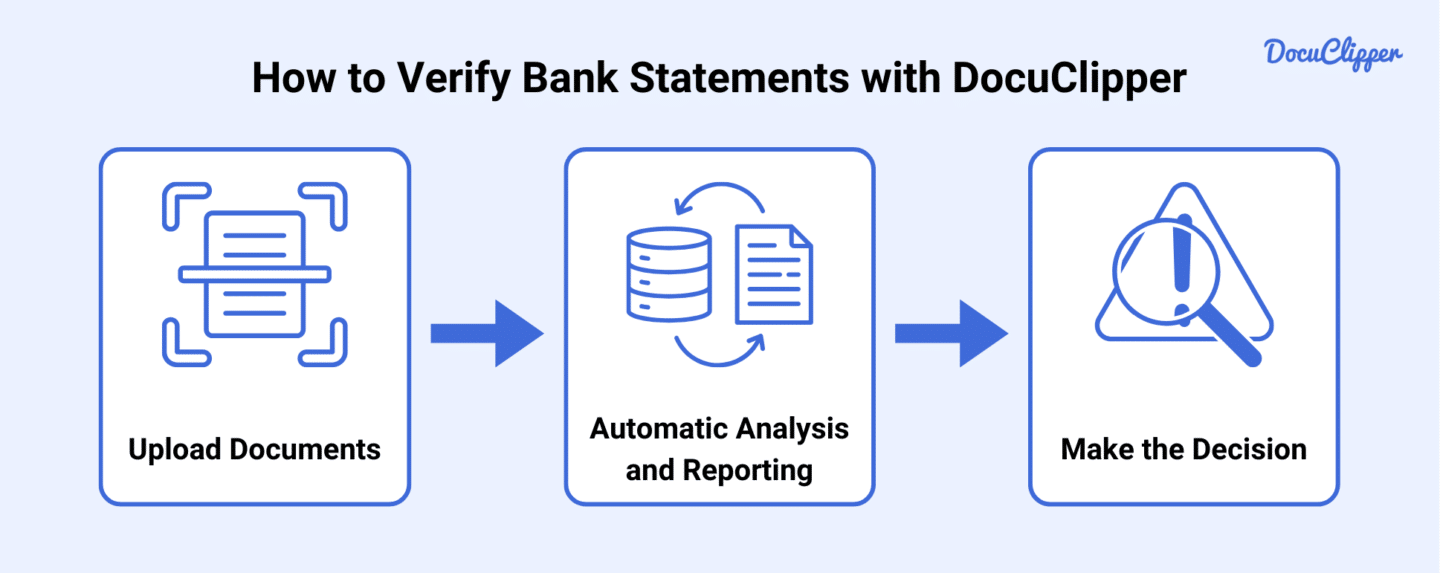

How to Verify Bank Statements with DocuClipper

When you’re dealing with a specific document like a bank statement, you need a more specialized approach. Visual inspection alone isn’t enough. That’s where DocuClipper comes in—it gives you a secure, automated way to verify bank statements using AI-powered analysis.

Step 1: Upload Documents

Start by logging into your secure DocuClipper account. From the dashboard, select the “Upload Document” option.

Drag and drop your bank statement files or use the file browser to select them manually. DocuClipper supports multiple formats, including PDF, JPG, and PNG.

Once uploaded, your files are automatically encrypted to protect sensitive financial data. Confirm the upload to initiate the verification process—no manual setup needed.

Step 2: Automatic Analysis and Reporting

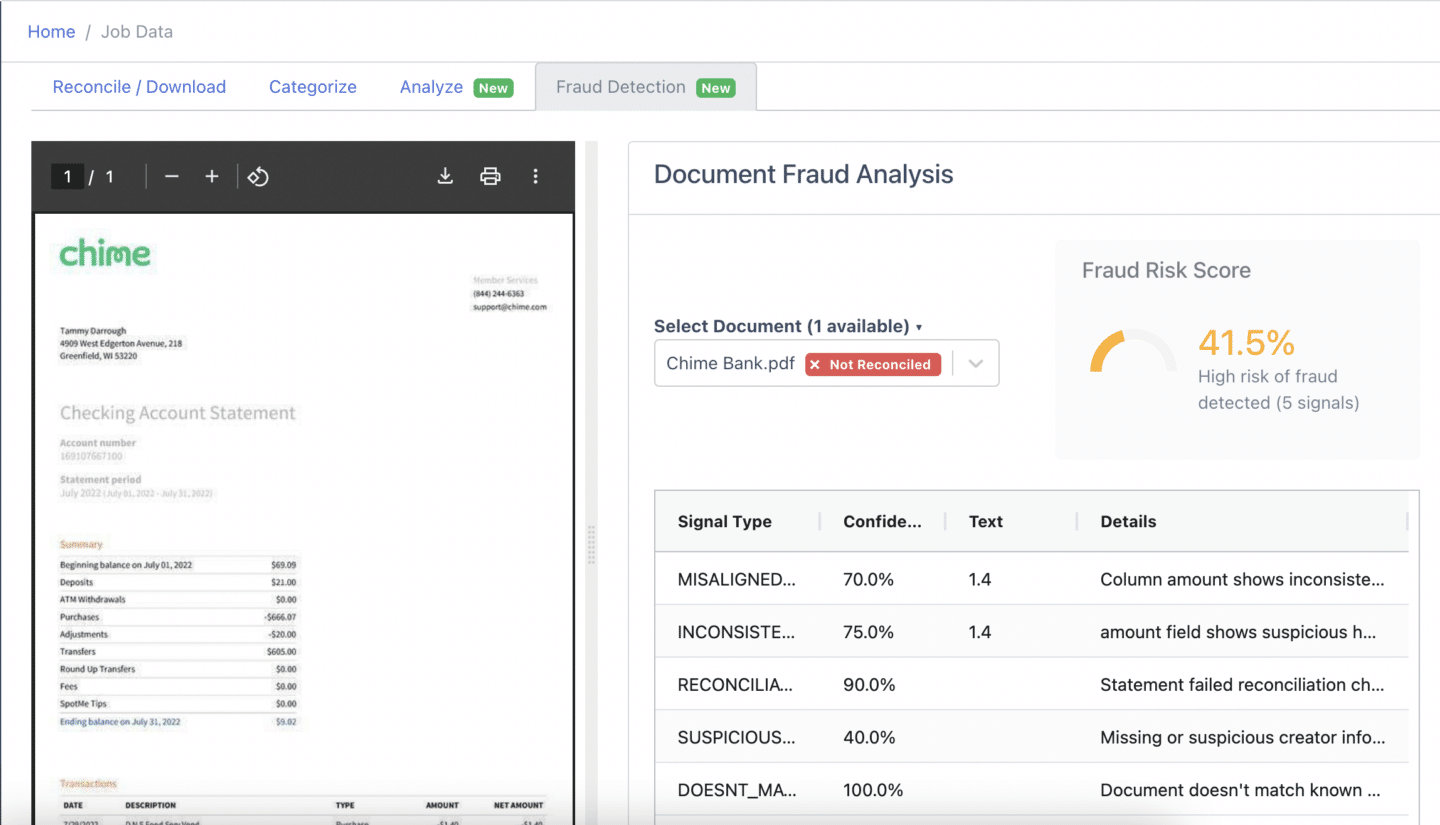

Once your document is uploaded, DocuClipper’s AI engine gets to work instantly. It analyzes your bank statement through three layers of verification:

- Structural analysis: It checks the layout, font consistency, spacing, and formatting to catch signs of tampering.

- Transactional analysis: It verifies transaction dates, amounts, running balances, and overall mathematical accuracy to detect inconsistencies or unusual patterns.

- Metadata analysis: It inspects hidden properties like file creation dates, software history, and digital fingerprints to identify potential manipulation.

Your document is also compared against thousands of verified bank templates for added accuracy. Any suspicious elements are flagged and assigned a confidence rating.

You’ll receive a detailed report showing:

- A fraud risk score

- Specific issues with exact locations

- Confidence levels for each flagged item

- Visual highlights to guide your review

Step 3: Make the Decision

After the analysis, review the verification report and fraud risk assessment carefully. Look at the highlighted issues to understand exactly where potential problems lie.

Pay close attention to the severity and confidence level of each flagged item. Use this insight to decide whether further verification is needed.

Document your final decision along with any supporting evidence to maintain a clear audit trail. Then, continue with your accounts payable workflow according to your internal verification policy.

Be sure to save the report—it’s useful for future reference and compliance documentation.

FAQs about How to Detect Fraudulent Documents

Frequently asked questions about how to identify fraudulent documents:

How do you identify a fraudulent document?

You can identify a fraudulent document by checking for visual inconsistencies, content errors, missing security features, and signs of digital tampering. Use tools like DocuClipper to perform automated checks for formatting issues, transaction errors, and metadata manipulation.

How to check if a document is original or fake?

To check if a document is original or fake, examine visual details like fonts, alignment, and quality. Look for missing security features and verify content accuracy. For digital files, inspect metadata and use verification tools like DocuClipper to detect edits, validate structure, and cross-check against known templates for authenticity.

How can you detect counterfeit documents?

You can detect counterfeit documents by looking for signs like inconsistent formatting, spelling errors, and altered security features. Use UV light for hidden markers and feel for paper texture. For digital files, examine metadata, run PDF layer analysis, and use verification software like DocuClipper to identify tampering or mismatched data.

How do you detect forgery in a document?

You can detect forgery by examining inconsistencies in formatting, unusual language, and suspicious edits. Look for altered signatures, irregular spacing, or mismatched fonts. For digital files, check metadata, file history, and layer structures to identify unauthorized modifications or tampering.

How do you prove a document is authentic?

To prove a document is authentic, verify its security features like watermarks, holograms, and official seals. Check for consistent formatting and accurate information. For digital files, review metadata, confirm digital signatures, and ensure the file hasn’t been modified. Cross-reference the content with official records or the issuing authority when possible.

How to avoid falsification of documents?

To avoid falsification, implement strict document-handling protocols and limit access to sensitive files. Use secure storage, watermarking, and version control for digital documents. Rely on official templates and verified sources. Train staff to recognize red flags and use authentication methods like digital signatures or tamper-evident features to maintain document integrity.

How do I scan a document like the original?

To scan a document like the original, use a high-resolution scanner set to at least 300 DPI. Align the paper properly to avoid cropping or distortion. Save the file in a lossless format, like PDF or PNG, to preserve quality. Ensure good lighting and clean the scanner bed for clear, accurate results.