All entrepreneurial and accounting ventures should know how to keep track of business expenses. Expenses are liabilities for businesses and a huge obligation for the owner or finance team to track.

Tracking your expenses is vital for many businesses, even on a personal level as it gives you a whole picture of your financial health.

In this blog, we’ll talk about how to track your business expenses:

Step 1: Open Business Account

After completing the company registration process, open a bank account for your business. Talk to your bank as there are many classifications, it can be savings, checking, joint, and many more. Business accounts have certain benefits that can help you run and transact your money in and out of the bank with lesser hassle and fees.

With a business account from a bank, they will send you monthly bank statements where you can see the entire flow of your money given in a specific time frame.

Take Control of Your Finances – Grab Our Transaction Categorization Spreadsheet Instantly!

Step 2: Select Expense Tracking Method

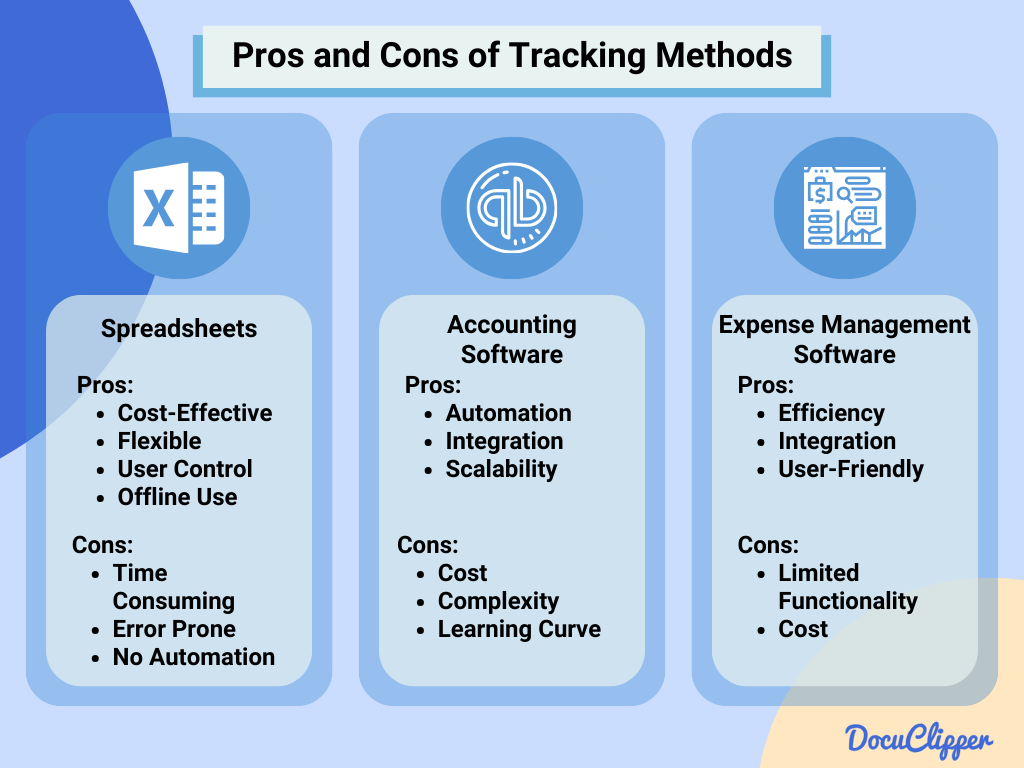

There are lots of different ways to keep track of business spending, and they use various tools. Some tools are simple, while others are more advanced and can do things automatically. Big and modern businesses often use these advanced tools.

Each method has its pros and cons, so there’s no one best way to do it. But some ways are better for certain needs. Here are some tools and software that businesses use to help you decide:

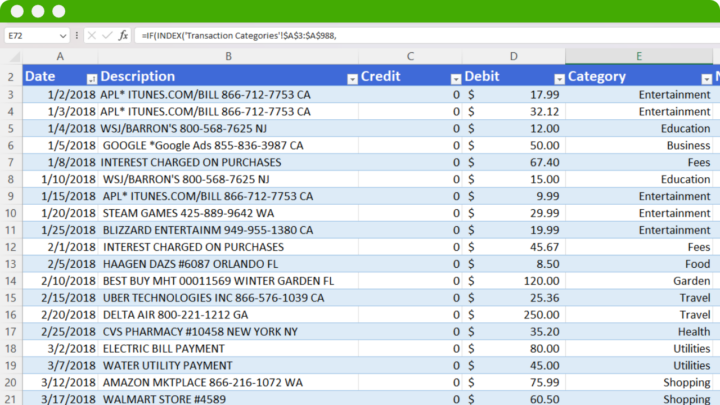

Spreadsheet

Use Microsoft Excel or Google Sheets to enter and organize your expenses manually. Good for those who prefer a hands-on approach and have a moderate number of transactions.

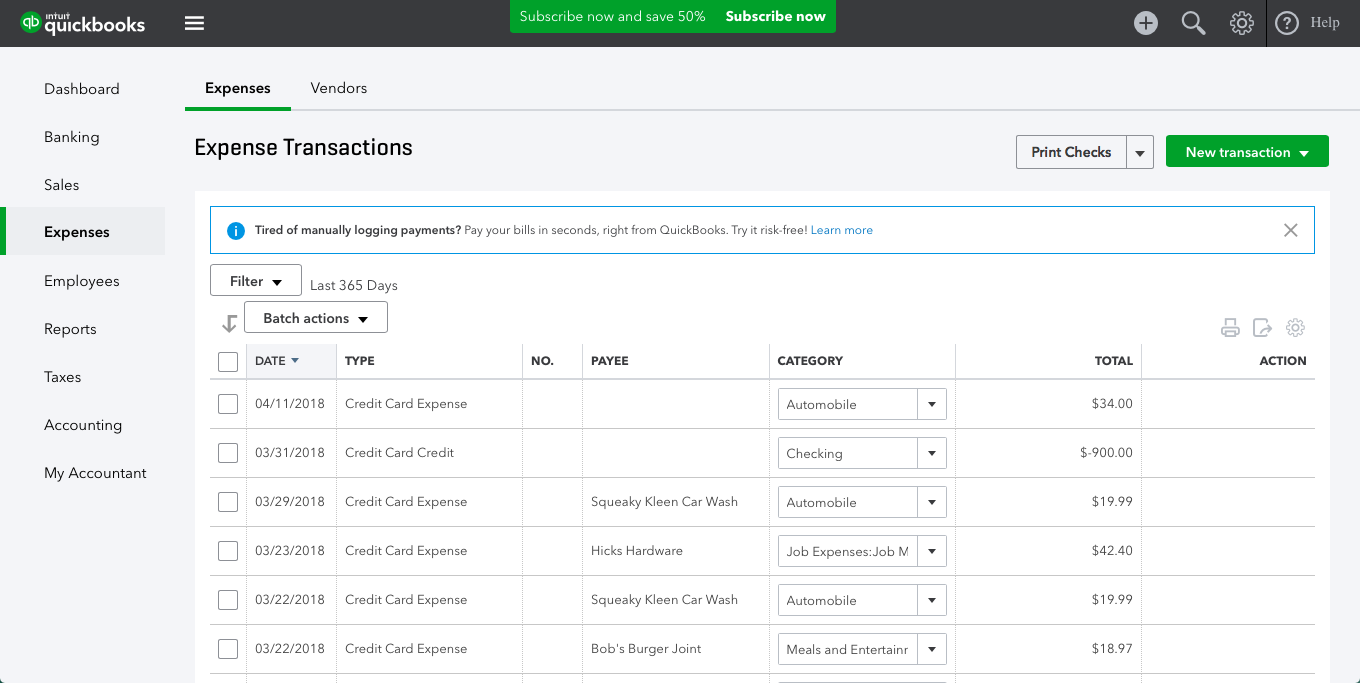

Accounting Software

Comprehensive solutions like QuickBooks or Xero, not only track expenses but also manage invoices, payroll, and reports. Ideal for businesses looking for an all-in-one financial management tool.

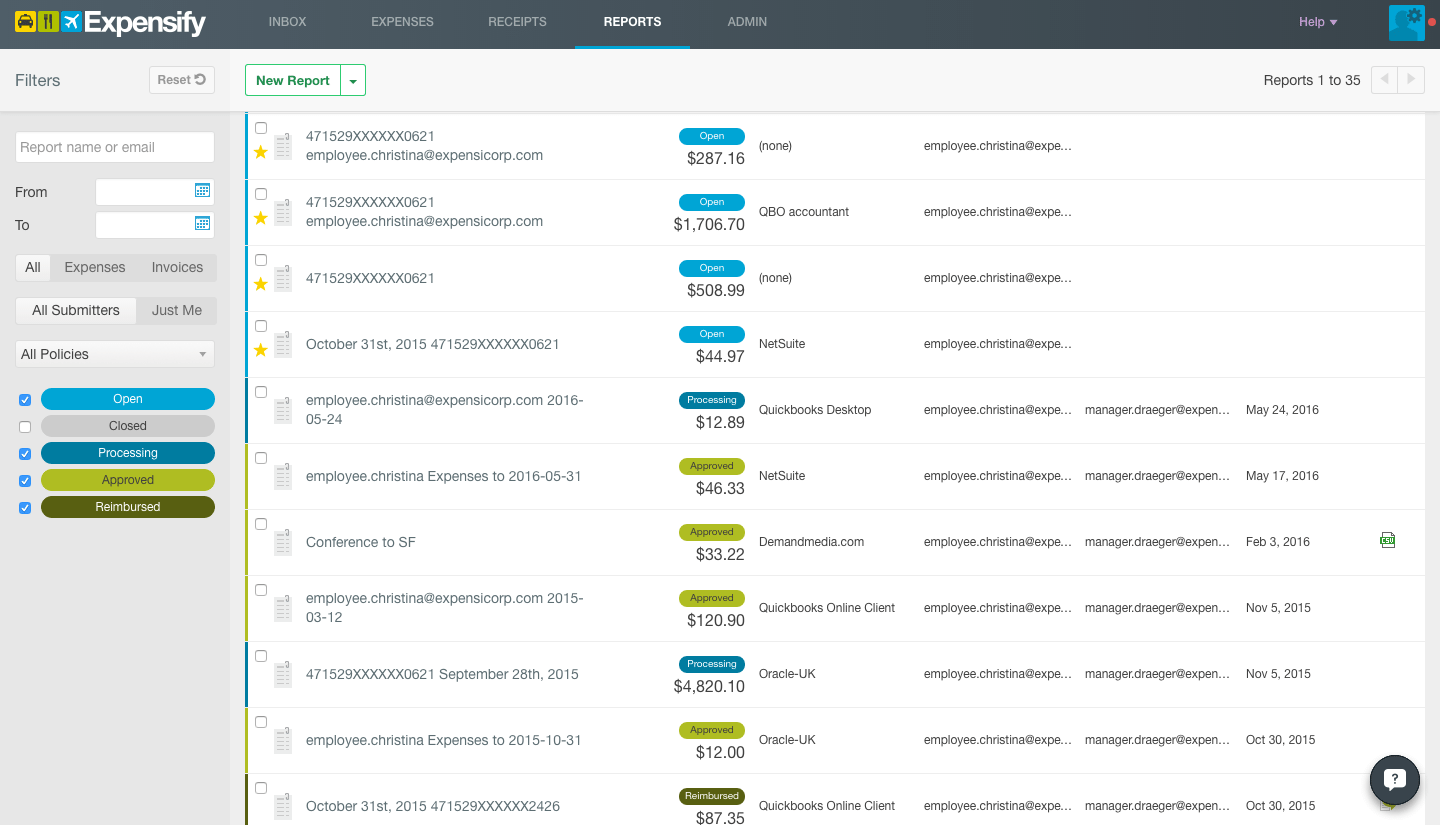

Expense Tracking Software

Specialized apps such as Expensify or Receipt Bank focus solely on tracking expenses. They often feature receipt scanning, categorization, and integration with accounting software. Perfect for businesses that need to streamline expense recording and reporting.

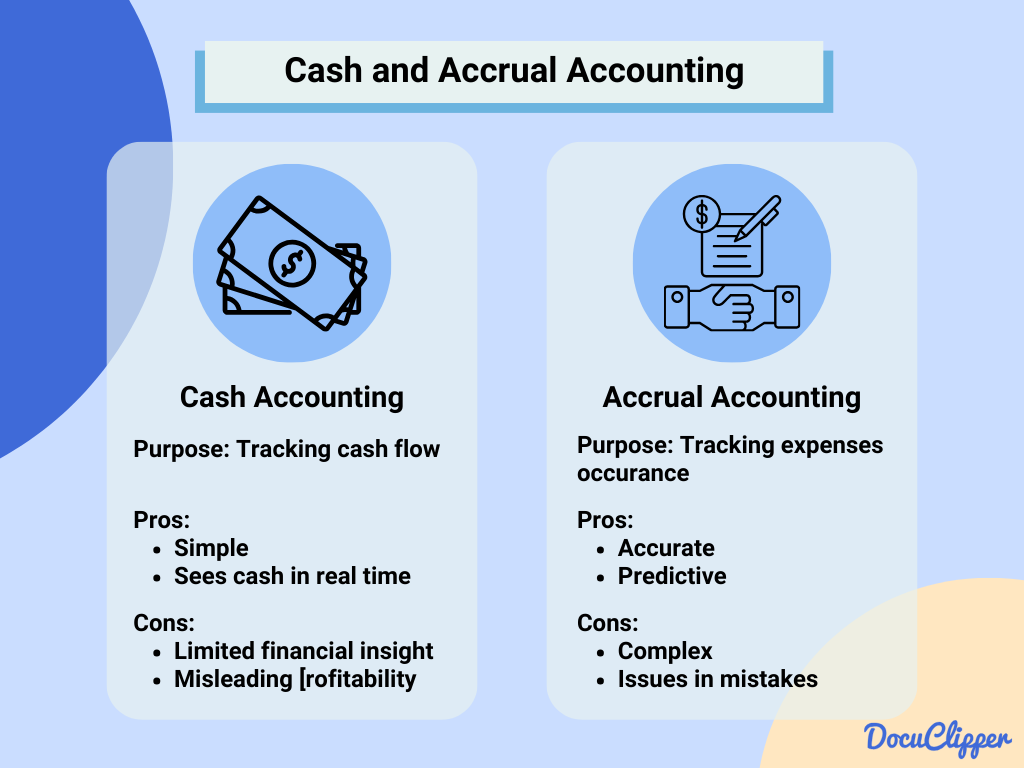

Step 3: Select Cash or Accrual Accounting

When recording your business expenses, you need to pick an accounting method: cash or accrual.

- Cash accounting is simple – you record expenses when you pay them. It’s straightforward and great for small businesses.

- Accrual accounting is a bit more complex. You record expenses when you owe them, not just when you pay. This gives a fuller picture of your finances, which is useful for bigger businesses.

Choosing the right method matters a lot. Cash accounting makes it easy to see how much cash you have right now, but it might miss what you owe or are owed.

Accrual accounting shows everything – what’s coming in and going out, even if no cash has moved yet, but it’s harder to track it.

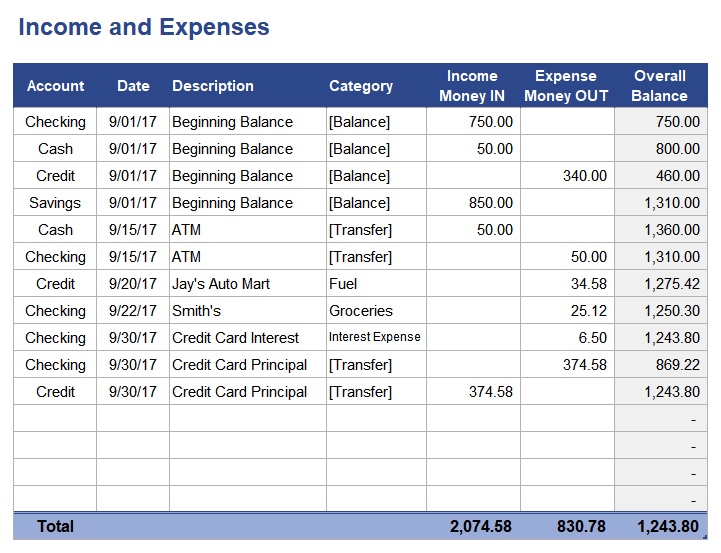

Step 4: Create Business Expense Categories

All business expenses fall into various business expense categories, ranging from basic ones like utilities, rent, and supplies, to unexpected ones like excessive maintenance, legal issues, and damages.

Categorizing business expenses helps you understand where your business spends the most money. Make the categories as detailed as possible to have a better understanding of them.

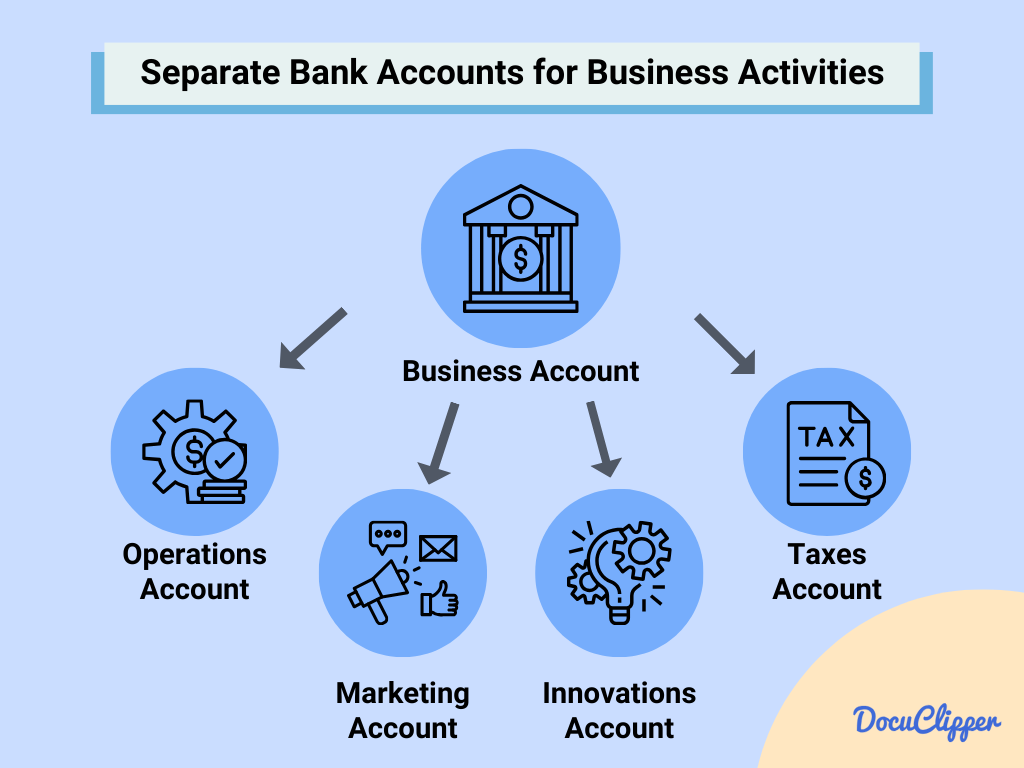

Step 5: Set Up Separate Bank Accounts

Mixing your personal and business finances is a massive no for many entrepreneurs. These can create problems when you run everything in just one bank account. Most businesses have separate accounts for innovation, marketing, operations, and taxes.

Be sure to track your expenses across the different bank accounts for you to be able to see expenses running in a bigger picture.

Step 6: Connect Bank Feed or Convert PDF statements

When you are done with categorizing possible expenses across separate bank accounts, you can start looking at bank feeds and bank statements as proof. Each bank account holds different bank statements, so it is important to look at each one.

To keep your expense tracking up to date, you’ll need to import your bank transactions into your chosen method. You can either use expense tracking software, or accounting software. or manually type it into a spreadsheet. Here are ways to connect your PDF statements easily:

- Bank Feed Connection: This feature is available in most accounting and expense tracking software. It links your software directly to your bank account, automatically importing transactions. This keeps your records accurate and up to date without manual entry.

- Converting Bank or Credit Card Statements: If you’re using a spreadsheet or if your software doesn’t support direct bank feeds, you can convert bank or credit card statements into a compatible format (usually CSV) and import them.

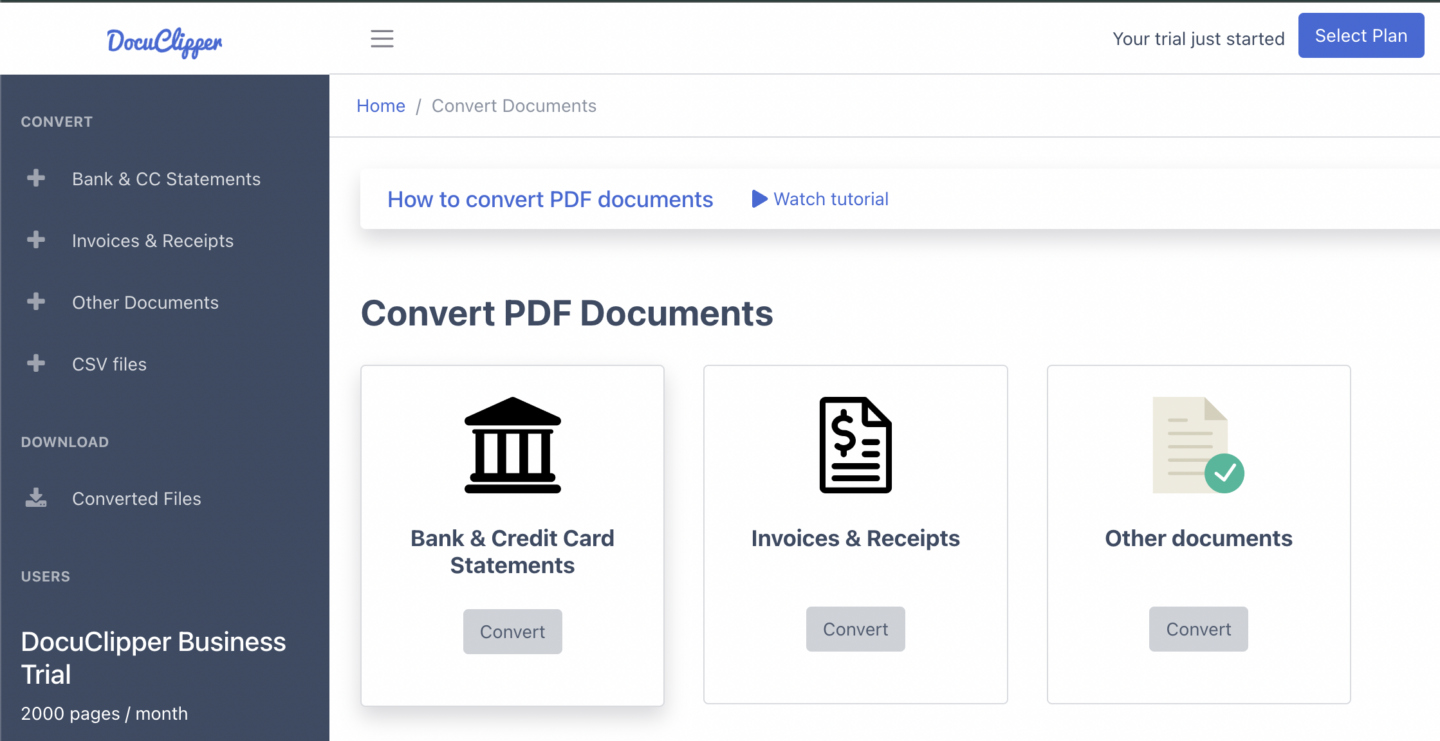

Without a bank feed, you’ll rely on manual updates, typically from PDF statements. Tools like DocuClipper can simplify converting these statements into a manageable format, easing the manual entry of data into your tracking system.

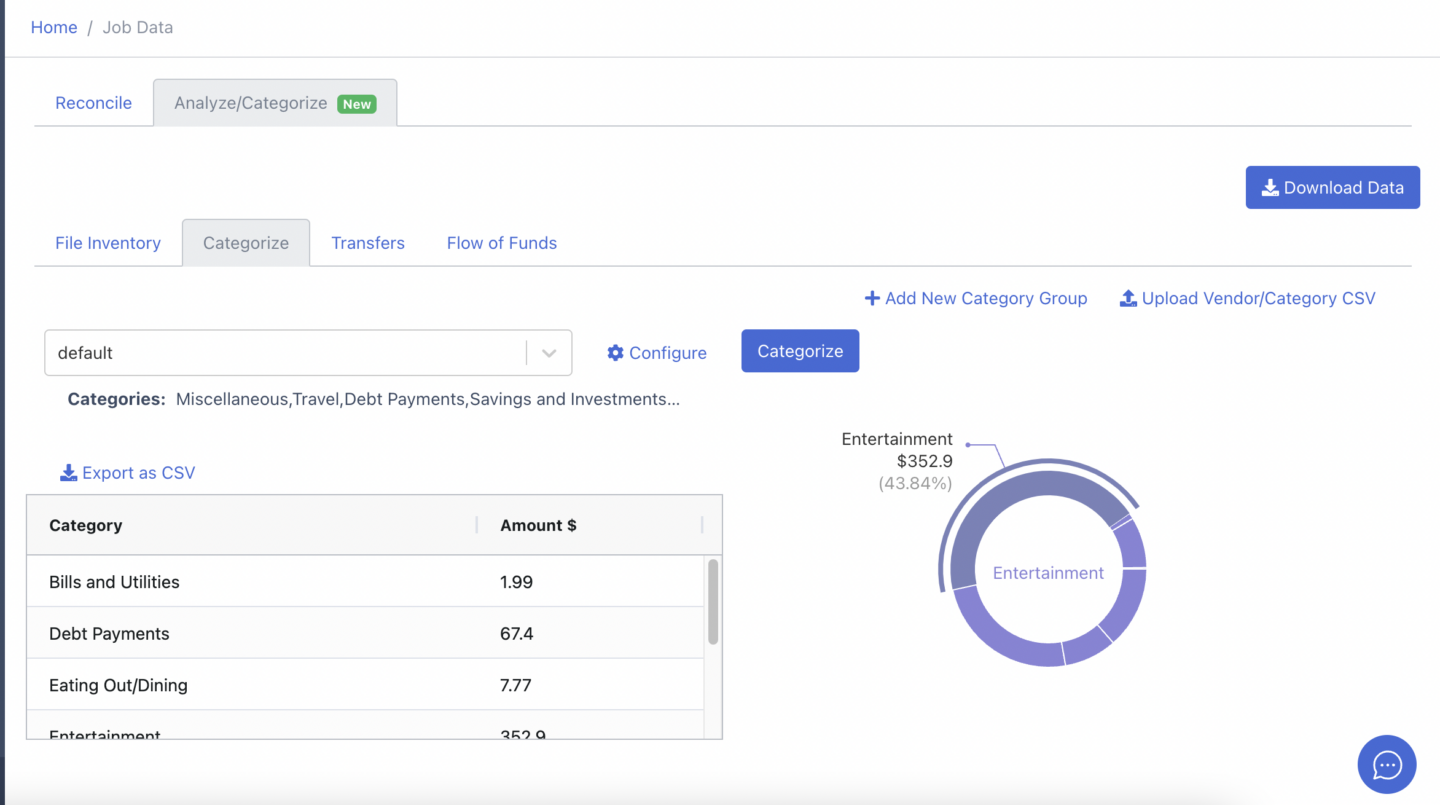

Docuclipper is an OCR bank statement converter that converts bank statements that are PDF to QBO or CSV.

it can help you record expenses with its transaction categorization feature. This feature allows you to categorize transactions that can be an expense with complete details like dates, transaction numbers, and vendors or receivers.

Bank statements can certainly be references in tracking expenses and transactions, visit these blogs to learn more about the tips for using them in the best way:

Step 7: File Your Receipts & Invoices

Keeping a digital record of receipts and invoices is essential for tracking expenses, preparing for tax season, and maintaining financial clarity. Converting paper documents into digital format can simplify this process.

OCR and other accounting software automate the conversion of invoices and receipts from physical or PDF formats into digital data, saving time and reducing errors. This step involves:

- Scanning or uploading documents: Use a scanner or a mobile app designed for scanning documents to convert your physical receipts and invoices into digital formats.

- Data extraction: Invoice converters or accounting software can extract relevant data (such as dates, amounts, and vendors) from scanned images or PDFs, converting them into a structured format like in a bank feed or spreadsheet.

- Organizing digital files: Store the digital copies in a well-organized file system or a cloud-based storage solution, categorizing them in a way that makes retrieval easy.

Keeping proof of payments as long as possible as these can be used in serious situations like tax audits and financial investigations. If no receipts are available or you suspect that receipts are fraudulent, bank statements are a great alternative.

Bank statements only have a limited time of validity depending on the purpose.

For more information and recommendations, we recommend reading our article on How Long to Keep Bank Statements.

Step 8: Record Expenses on Regular Basis

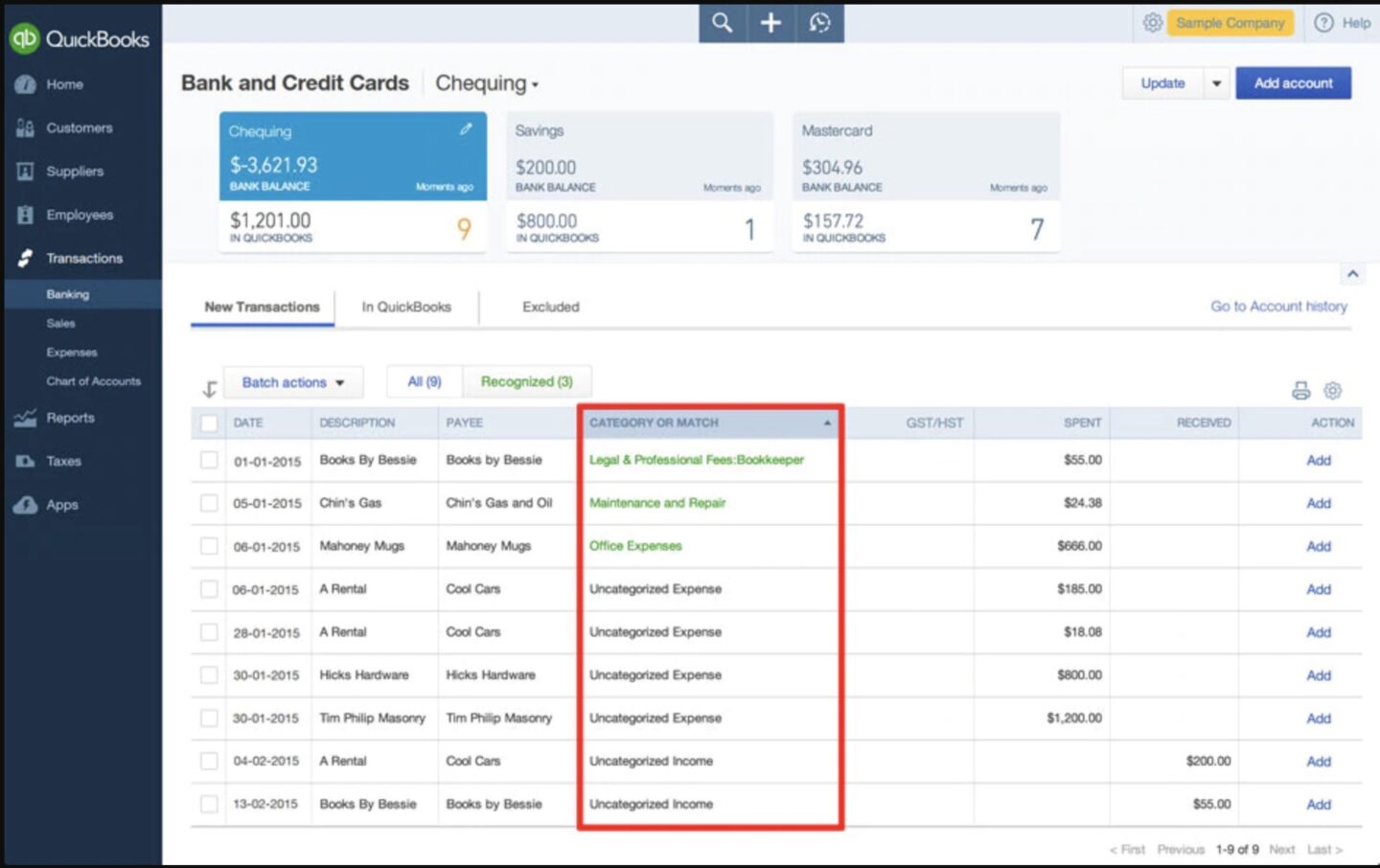

Keeping your expense records up to date depends on your setup. If you’re using software with a bank feed, your transactions will automatically update. Just ensure the bank feed is correctly connected and configured to categorize expenses accurately.

However, you sometimes need to review the important transactions if the accounting system categorizes them. In some cases, especially with new transactions, you will need to categorize them yourself.

After that, often accounting software will remember this information and do it automatically. So regularly check your accounting software to review any transactions.

Additionally, make sure that the expenses in your records match up with the bank statements in your bank feeds and bank statements. Any discrepancies should be reported and called out to anyone directly assigned to it like the bank or an employee.

Step 9: Conduct Regular Bank Reconciliation & Accounting Audit

And the last step is to conduct regular bank reconciliation and accounting audits.

Conducting regular bank reconciliations and accounting audits is crucial for maintaining accurate financial records. This process involves comparing your internal records against your bank statements to spot any discrepancies.

Regular checks help catch errors, fraud, or inconsistencies, ensuring your financial health remains strong. This practice also prepares your business for tax season and financial planning, making it easier to report income, manage cash flow, and plan for future expenses.

If you are not really confident in reading and analyzing bank statements, check out this article: How to Read a Bank Statement and Actually Understanding It

What are Business Expenses?

Business expenses are the costs incurred in the operation of a business. These can include rent, salaries, supplies, utilities, and any other costs necessary for a business to function and generate revenue.

Why Is it Important to Track Business Expenses?

Tracking these expenses accurately is important for managing finances, optimizing operations, and determining the profitability of the business.

It helps in managing cash flow, ensuring that the business doesn’t spend more than it earns. It’s also for tax purposes; accurately recorded expenses can significantly reduce your taxable income, lowering your tax liability.

Moreover, understanding where money is being spent can reveal opportunities for cost savings and more efficient resource allocation.

Best Practices for Tracking Business Expenses

Here are some practices that some successful businesses use to track their expenses:

- Use Software: Employing accounting or expense tracking software can simplify the process of recording and organizing expenses.

- Regular Updates: Keep your expense records up-to-date by entering transactions regularly, rather than letting them pile up.

- Categorize Expenses: Organize your expenses into categories to better understand spending patterns and identify areas for savings.

- Keep Receipts: Maintain digital or physical copies of receipts and invoices for tax purposes and verify the expenses if ever questioned.

- Review Regularly: Periodically review your expenses to ensure accuracy and to adjust budgeting strategies as needed.

How DocuClipper Can Help?

Do you need a simple expense tracker or accounting software a little too much for you? Is typing every expense manually such a hassle as you face your spreadsheet? DocuClipper is the match for you.

DocuClipper makes it easy to handle your business money matters, especially if you find other accounting software too complicated. If you’ve had trouble changing PDF statements into a format your accounting system can use, DocuClipper can help.

It not only changes your PDF bank statements so they’re easy to work with but also sorts your bank transactions into categories automatically. You can even set up your categories to organize everything just the way you like.

Conclusion

Efficiently tracking and managing business expenses is essential for financial health and operational efficiency. Utilizing many tools and expertise to make this process smoother and removes a lot of strains in the financial processes for businesses.

Tools like DocuClipper provide valuable support in simplifying this process, catering to the needs of businesses struggling with traditional accounting software or manual methods.

FAQs about How to Keep Track of Business Expenses

Here are some frequently asked questions about keeping track of your business expenses:

What is the easiest way to track business expenses?

The easiest way is using software that automates the process, like expense tracking apps or accounting software with expense categorization features.

How do I organize my business expenses?

Categorize your expenses into clear, manageable groups (e.g., utilities, rent, supplies) and use accounting software to keep track of these categories.

How do I keep up with my business expenses?

Regularly update your expense records, whether manually or through automated software, to ensure accurate tracking.

What do I need to keep track of for my small business?

Keep track of all income, expenses, receipts, invoices, and any other financial transactions related to your business.

Can I use Excel to track business expenses?

Yes, Excel can be used for tracking expenses through customized spreadsheets, but it requires manual entry and categorization.

What if I need to track business expenses from PDF bank & credit card statements?

Tools like DocuClipper can convert PDF statements into a format that’s easy to categorize and import into your accounting software.

How do I keep track of receipts?

Digitize receipts using a scanner or mobile scanning app and store them in a cloud service or with your accounting software for easy access and organization.

How do I organize my monthly expenses?

Create a budget with categories for all your expenses, track them against actual spending each month, and adjust as needed for better financial management.

Related Articles

- How to Convert PDF to CSV for Xero

- Ultimate Guide to Automated Bookkeeping: Saving Time & Money

- Outsourced Bookkeeping: Benefits, Costs, and How To Outsource Bookkeeping

- How to Do Bookkeeping Data Entry with Less Time & Errors

- Manual Data Entry vs Automated Data Entry: Differences, Pros, Cons, Which to Choose & When