Keeping things in order in your accounting department is a necessary task for your accounting team. Organizing invoices and receipts is one part of it.

Although these documents tend to pile up and will pose some sort of problem for your accounting team that affects their efficiency

In this blog, we’ll talk about how to organize invoices and receipts efficiently and why you should do it.

Why Should You Keep Invoices & Receipts?

Keeping invoices and receipts is essential for maintaining accurate records. These documents are far from useless—they’re necessary for tax compliance, audits, forensic investigations, IRS checks, proof of payments for warranty, and overall financial management.

Secure storage protects them from tampering and loss, ensuring they’re handy if the IRS comes knocking, you need to return something, you face a lawsuit, you need to investigate an internal issue, or for many more reasons.

And while IRS does not require physical copies of your invoices or receipts, it’s still a good idea to store them in case of system failure.

That’s why you can ensure compliance, enhance financial management, and protect your business interests by systematically organizing and retaining invoices and receipts.

Does the IRS Expect You to Store Physical Copies of Invoices or Receipts?

You do not need to store physical copies of your invoices and receipts for the IRS to look at. The IRS only requires a “summary” of all the business’s transactions. You just have to keep a record system which can be books, ledgers, or an electronic tracking system.

But, they might require these supporting documents when compelled to investigate your business. Having these readily available is great to avoid any escalation from them.

How to Organize Invoices & Receipts

It takes a few simple steps to organize and process your invoices and receipts.

Here are some steps for you to organize your invoices and receipts:

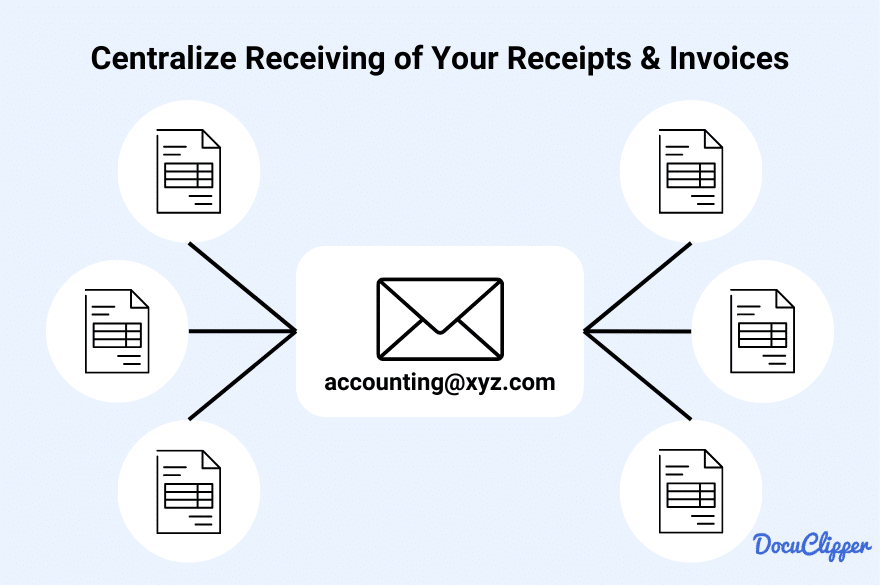

Step 1: Centralize Receiving of Your Receipts & Invoices

Centralize the input of your receipts and invoices to streamline your process. Whether you receive paper invoices or e-invoices depends on the transaction and your relationship with your customer or supplier.

Both formats are equally important, so accept whichever is provided.

To avoid confusion and ensure efficiency, designate a single channel for receiving all invoices and receipts, such as email or mail. This prevents your accounts payable team from being overwhelmed by multiple input sources, minimize the risk of overlooking received invoices, and helps maintain organized, consistent records.

Step 2: Digitalize Your Physical Invoices & Receipts

Digitalizing your physical invoices and receipts makes them easier to process, analyze, compile, and store.

Furthermore, as we said, IRS does not required physical copies of receipts or invoices. Therefore, having them store in digital format allows you to better manage your documents.

Use a scanner or your phone camera to create digital copies.

Ensure your scans are clean, neat, aligned, and have a clear resolution, as this will help when running OCR software to extract information from invoices and receipts automatically. OCR has limitations, so using proper preprocessing techniques can prevent unnecessary redos.

By digitalizing your documents, you streamline your workflow and make data management more efficient.

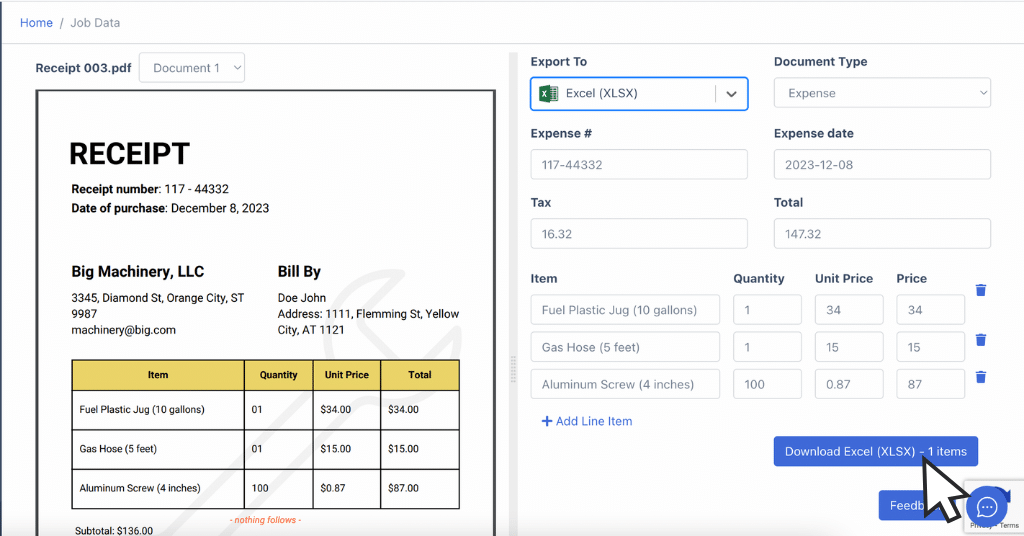

Step 3: Convert PDF Invoices & Receipts Into CSV

After digitalizing your invoices and receipts, convert your PDF invoices into Excel or CSV format. Use invoice OCR and receipt OCR software to accurately extract data such as dates, invoice numbers, amounts, quantities, and line items.

For example, with DocuClipper, you can upload multiple invoices and receipts, and it will process them in seconds, compiling all data into one CSV file.

The data will be prearranged into columns, making it easier to manage and extract information from each receipt or invoice. This step streamlines your workflow and ensures that all essential data is organized and accessible.

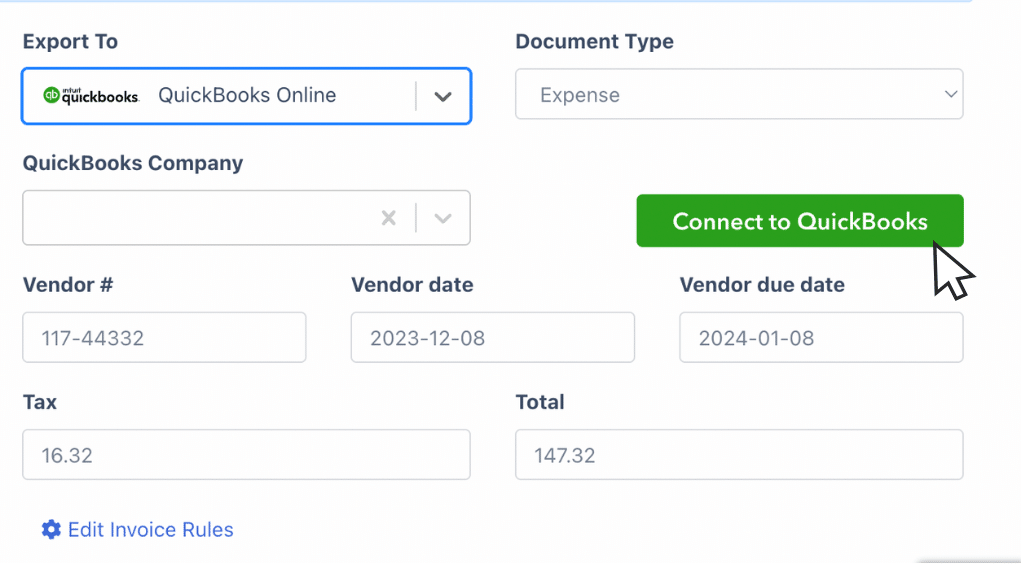

Step 4a: Attach Invoice or Receipt to the Transaction In Your ERP or Accounting Software

Once you’ve extracted data from your PDF invoices and receipts, upload your CSV file to your accounting software or ERP system. These platforms accept CSV files but check for any preferred column and row formats on their websites.

If you’re using QuickBooks, DocuClipper can automatically import receipts and invoices directly into QuickBooks without needing to download and upload the CSV file. Simply connect your DocuClipper account to your QuickBooks account.

Once in the platform, you can review each transaction in detail and attach the original PDF invoices and receipts as supporting documentation for complete and organized records.

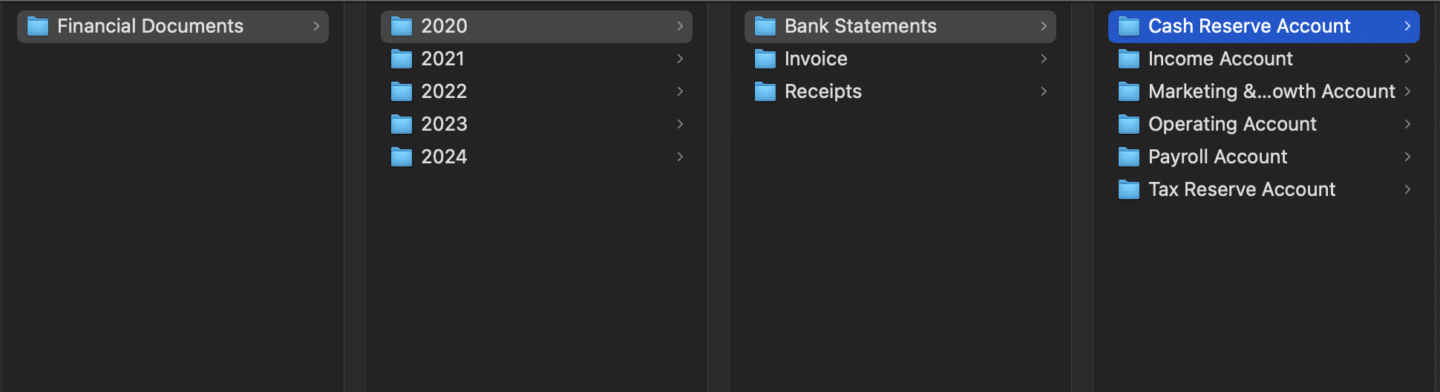

Step 4b: Create a Filing System to Store your Digitilized Receipts

If you’re not yet using accounting software, create your own filing system to store your digitalized receipts.

Start by organizing all your financial information into a single folder, and then separate it by year. For each year, create subcategories like “invoices,” “bank statements,” and “receipts.” Add more subcategories as needed based on the types of documents you handle.

Next, name each file so it can be automatically sorted chronologically. Begin filenames with the date, followed by a brief description. For example:

Receipts: “20240312_Amazon_OfficeSupplies_89.99_R1234.pdf” – This indicates a receipt from March 12, 2024, for office supplies from Amazon totaling $89.99, with receipt number 1234.

Invoices: “20240312_ClientXYZ_ConsultingServices_1200_I5678.pdf” – This indicates an invoice from March 12, 2024, for consulting services provided to Client XYZ, totaling $1200, with invoice number 5678.

How Long Should You Keep Your Receipts and Invoices?

Generally speaking, you should at least keep your receipt and invoices for three years. This is what most accountants advise because there are times that the IRS will demand supporting documents of your invoices and receipts. But some say you should keep it up to 5 years.

Also, you’ll need these as evidence when you are investigating some internal strifes in a business about embezzlement and overspending.

Best Tips to Manage and Organize Your Receipts and Invoices

As I said, organizing invoices and receipts is a good price for any business or person in case you need it in the future.

Therefore, here are some best tips to manage and organize your receipts and invoices:

- Regularly File and Organize Your Receipts & Invoices: Keep everything updated and organized on a biweekly or monthly basis. Separate receipts and invoices to avoid duplication and ensure clarity.

- Create Digital Backups of Your Financial Documents: Even if all your documents are saved in accounting software, save PDF copies in cloud storage or on hard drives as an extra backup in case of data corruption.

- Create a Standardized Process to Receive and File Your Documents: Develop a streamlined process so accounting personnel can easily transition from one task to another without confusion.

- Assign a Responsible Person for Filing: Typically, this task falls to an Accounts Payable person. Make sure someone is in charge to ensure consistency and accountability in the filing process.

- Don’t Overcomplicate the Filing System: Keep your organization simple. Overcomplicating can lead to confusion and inefficiency.

- Don’t Let Personal & Business Receipts Mix: Keep personal and business receipts separate since their taxes differ. Mixing them can complicate tracking business expenses and maintaining accurate records.

Conclusion

Despite invoices and receipts are different types of business documents, the organization is very similar.

Keeping all receipts and invoices is a standard procedure, yet not everyone manages to do it effectively.

Using the appropriate software and tools helps you and your business keep track of and store these documents efficiently, making them accessible during tax audits and internal investigations.

Utilizing tools like OCR allows you to efficiently store your data, transforming physical documents into searchable digital files.

By implementing these practices, you can streamline your documentation process, ensuring that all your financial records are well-organized and easily retrievable.

How Can DocuClipper Help Manage Your Invoices & Receipts?

DocuClipper can streamline the management of your invoices and receipts by easily converting your PDF files into XLS, CSV, and QBO formats.

It processes hundreds of PDFs in just seconds, allowing you to extract data from your documents quickly. This capability helps you organize and manage your business expenses more efficiently.

With DocuClipper, you can automate the extraction of important details like dates, invoice numbers, amounts, and line items, making it simpler to track and analyze your financial transactions. This tool ensures that your records are accurate, organized, and easily accessible for auditing, tax preparation, and internal reviews.

FAQs about How to Organize Invoices and Receipts

Here are some frequently asked questions about organizing your invoices and receipts for effective documentation for your business:

What’s the best way to organize receipts?

The best way to organize receipts is to digitize them using a scanner or a mobile app. Store the digital copies in a cloud-based system, categorized by date and type. This ensures easy access, searchability, and backup, reducing the risk of losing important documents and streamlining your record-keeping process.

How do you store receipts and invoices?

Store receipts and invoices by first digitizing them with a scanner or mobile app. Organize the digital files in a cloud storage system, categorizing them by date, vendor, and type. For physical copies, use labeled folders or binders. Regularly back up digital files to ensure they remain accessible and secure.

How to keep invoices organized?

To keep invoices organized, digitize them and store the digital files in a cloud-based system, categorized by date, client, and type. Use consistent file naming conventions for easy retrieval. Regularly update and back up your records. Implement a standardized process for receiving, scanning, and filing invoices promptly

What is the best way to keep track of receipts?

The best way to keep track of receipts is to digitize them immediately using a mobile app or scanner. Store the digital copies in a cloud-based system, categorized by date and type. Use accounting software to track and manage expenses, ensuring receipts are linked to specific transactions for easy reference and audit preparation.

Is there an app for organizing receipts?

Yes, several apps can help you organize receipts. These apps allow you to scan and digitize receipts, categorize expenses, and store everything in the cloud. They also integrate with accounting software, making it easier to manage and track your financial documents.

What is the best way to keep track of invoices?

The best way to keep track of invoices is to use accounting or ERP software that allows you to manage invoices digitally. These platforms provide features to create, send, and track invoices, monitor payment status, and organize invoices by client, date, and status. Automated reminders and reporting capabilities further streamline invoice management.

How do you effectively manage invoices?

Effectively manage invoices by using accounting software for digital creation, tracking, and automated reminders. Organize invoices by client or project for easy access. Monitor payment statuses to promptly follow up on overdue invoices. Generate reports for insights into financial performance. Integrate systems for streamlined operations and enhanced client relationships.

How do you arrange an invoice?

Arrange an invoice by including essential details: sender and recipient information, invoice number, date, payment terms, itemized list of goods or services provided with quantities and prices, subtotal, taxes, and total amount due. Ensure clarity and accuracy for seamless processing and compliance with accounting standards.

How do I sort out invoices?

To sort out invoices effectively, start by organizing them chronologically or alphabetically by vendor or client name. Use designated folders or digital folders within accounting software. Implement a consistent naming convention for digital files to facilitate easy retrieval. Regularly review and update your sorting system to maintain organization and accessibility.

How should I store invoices?

Store invoices securely by digitizing them and storing digital copies in a cloud-based storage system or dedicated accounting software. Organize them by date, vendor/client, and invoice number. For physical copies, use labeled folders or binders in a secure and accessible location. Regularly back up digital files to prevent loss and ensure easy retrieval.

Do invoices and receipts go together?

Invoices and receipts serve distinct purposes in accounting. An invoice requests payment for goods or services, while a receipt confirms payment received. They relate to the same transaction but are separate documents crucial for financial records and audits.

How do you structure a receipt?

Structure a receipt by including key details: vendor name and contact information, receipt number, date of transaction, an itemized list of purchased goods or services with quantities and prices, subtotal, taxes (if applicable), the total amount paid, payment method, and any additional terms or conditions.