This guide helps you to better understand your bank statements, explaining their purpose, importance, and how to read bank statements.

We’ll break down the key components, common terms, and how to spot errors or fraud. We’ll also discuss how to convert statements into Excel or CSV for easier bank statement analysis.

Whether you’re an individual or a business, understanding your bank statement is the first step toward better financial decisions.

So, let’s dive in and decode your bank statement!

What is a Bank Statement?

A bank statement, also known as an account statement, is an official document provided by your bank. It is typically issued every month and summarizes all the bank transactions in your account for that given period.

This comprehensive summary includes all your financial transactions, such as deposits, withdrawals, and accrued interest, along with the opening and closing balances for the period.

This document serves as a ledger of your monetary activities. Regular examination of your bank statements can assist in tracking expenses, spotting potential accounting discrepancies, and identifying fraudulent activities.

Bank statements also include vital account information, such as account numbers.

Why It’s Important to Read Your Bank Statement

Understanding your bank statement is more than just knowing what’s in your account.

It’s about financial awareness and security and it can be one of the first steps to improve your financial decisions, save more money, and better manage your financials.

Especially when so many small businesses do not even have an accountant. Around 70% of small businesses don’t have an accountant. (Accounting Statistics)

With that here are some of the main reasons why you should know how to read your bank statements:

- Budget Management: Your bank statement lists all your transactions, making it a valuable tool for tracking your income and expenses. This can help you manage your budget effectively and identify areas where you might need to cut back. This applies to both personal and business financial management.

- Spot Unauthorized Transactions: Regularly reviewing your bank statement can help you identify any unauthorized transactions or discrepancies. The sooner you spot these, the quicker you can report them to your bank and get back your money. In fact, over 127 million U.S adults have been a victim of credit card fraud and over 32 billion has been lost. (Source)

- Avoid Unnecessary Fees: Many people are unaware of the fees their bank charges. By reading your bank statement, you can identify any fees you’re being charged and take steps to avoid them in the future. In fact, Americans pay billions of dollars every year in “junk fees.” (Source)

- Tax Preparation: Your bank statement provides a record of your income and expenses, which can be helpful when it’s time to file your taxes, resulting in saving you a significant portion of your taxes.

- Credit Applications: When applying for credit, lenders may ask to see your bank statements to verify your income and financial stability. Understanding your bank statements can give you a good understanding of what are your chances of getting a loan.

How to Read a Bank Statement: Step-by-Step Guide

Bank statements, while seemingly complex, can be easily understood once you know what to look for.

They are designed to provide a detailed overview of your financial activities, and each section serves a specific purpose.

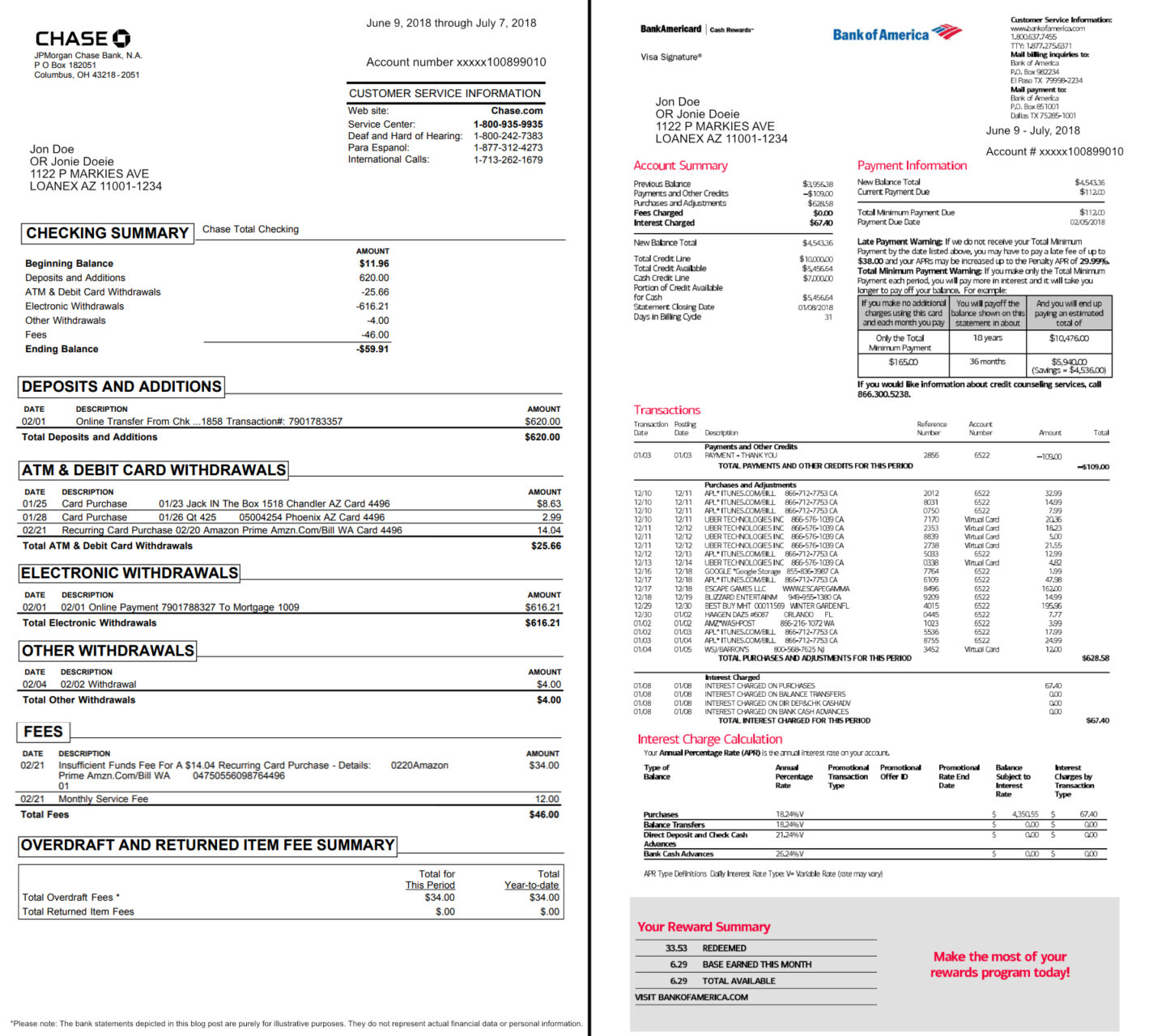

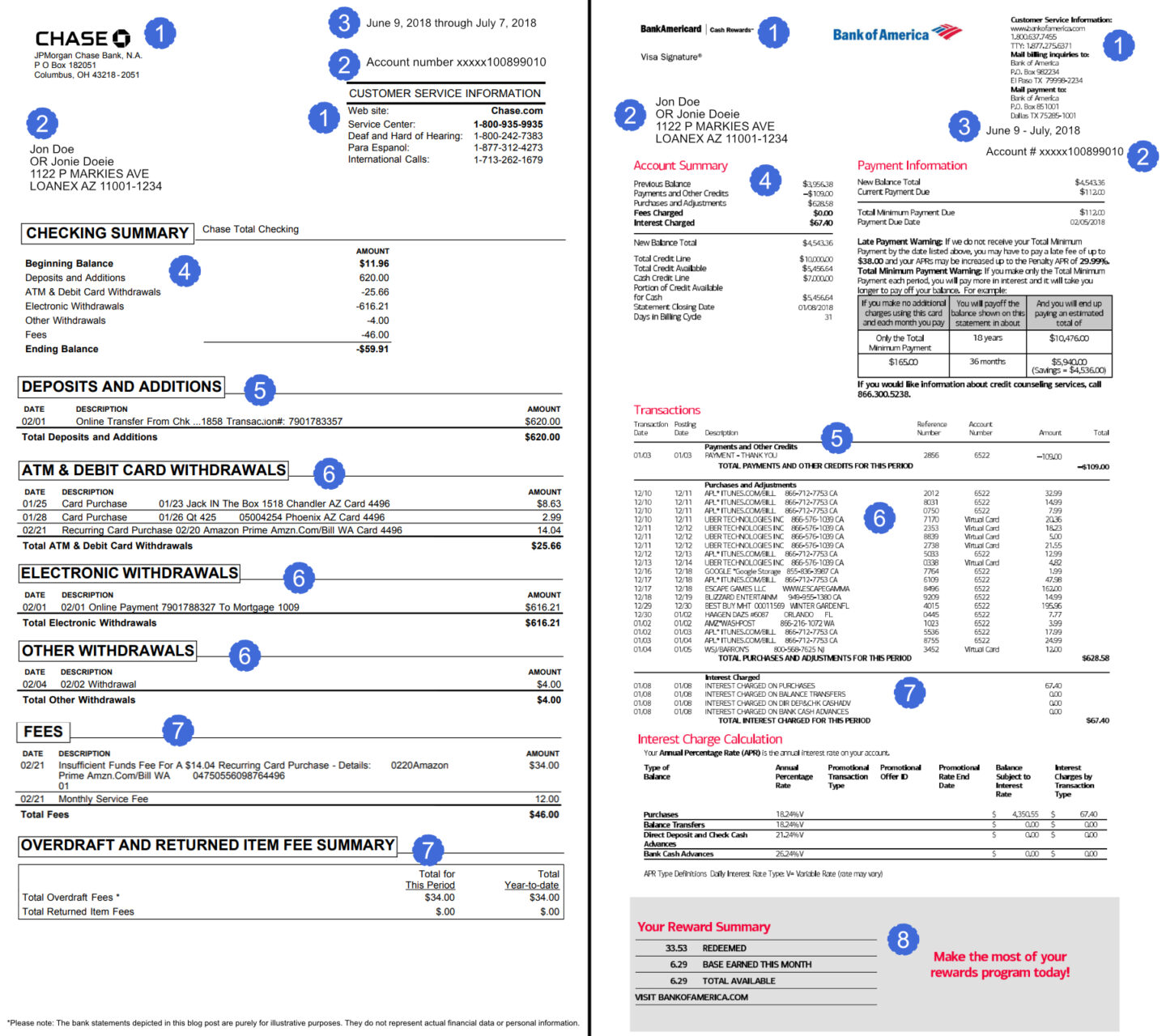

Here’s a breakdown of the key components of a bank statement and how to effectively read and understand each section:

- Bank Information: This includes the bank’s name, address, and contact information.

- Account Information: This section contains your name, address, and account number.

- Statement Period: This indicates the start and end dates for the transactions listed on the statement.

- Opening/Closing Balance AKA Account Summary: It provides an overview of your account activity for the statement period. It includes your opening balance (the amount in your account at the beginning of the period), total deposits, total withdrawals, and your closing balance (the amount in your account at the end of the period).

- Deposits: This section lists all the deposits made into the account during the statement period. Each entry typically includes the date of the transaction, a description, and the amount credited to the account.

- Transaction Details: This section lists all the transactions that occurred during the statement period. Transactions are typically listed in chronological order and include details such as the date, description (e.g., ATM withdrawal, check number, direct deposit), amount, and running balance after each transaction.

- Fees: Any fees charged by the bank, such as monthly service fees or overdraft fees, will be listed in this section.

- Interest Information: If your account earns interest, this section will show how much interest was earned during the statement period.

Remember, the layout and content of bank statements can vary between different banks. If there’s something you don’t understand in your statement, don’t hesitate to contact your bank for clarification.

Of course, the most important component of your bank statement is the transaction details. Here is where you can see everything related to your spending and it’s where you will spend most of your time analyzing your financials.

Common Terms on a Bank Statement

Your bank statement can be filled with

financial jargon that may seem confusing. Here are some common terms you’ll find on your bank statement and what they mean:

- Account Number: This is your unique identifier for your bank account.

- Statement Period: The period of time that your bank statement covers, usually a month.

- Opening/Closing Balance: The opening balance is the amount of money in your account at the very start of the statement period, right after the bank has processed all of the previous day’s transactions. The closing balance, on the other hand, is the amount of money in your account at the very end of the statement period, after all of the transactions for that period have been accounted for.

- Deposits: Any money added to your account, such as salary payments, cash or check deposits, or transfers from other accounts.

- Withdrawals: Any money taken out of your account, including ATM withdrawals, checks written, debit card purchases, or transfers to other accounts. These are your transaction details.

- Overdraft: This term appears when you withdraw more money than is available in your account, resulting in a negative balance.

- Interest Earned: If you have an interest-bearing account, this shows the amount of interest your account has earned during the statement period.

- Fees: Any charges incurred during the statement period, such as monthly service fees, overdraft fees, or ATM fees.

- Pending Transactions: These are transactions that have been made but are not yet fully processed.

- YTD Totals: This stands for “Year to Date” totals, which show the cumulative amount of deposits, withdrawals, fees, and interest for the year up to the end of the statement period.

Understanding these terms can help you better navigate your bank statement and manage your finances effectively, as well as understand how you manage your financials.

Additionally, visit our article on commonly used bank statement abbreviations.

How to Spot Errors or Fraud on Your Bank Statement

Spotting errors or potential fraud on your bank statement is crucial to maintaining the integrity of your finances as well as saving a lot of money.

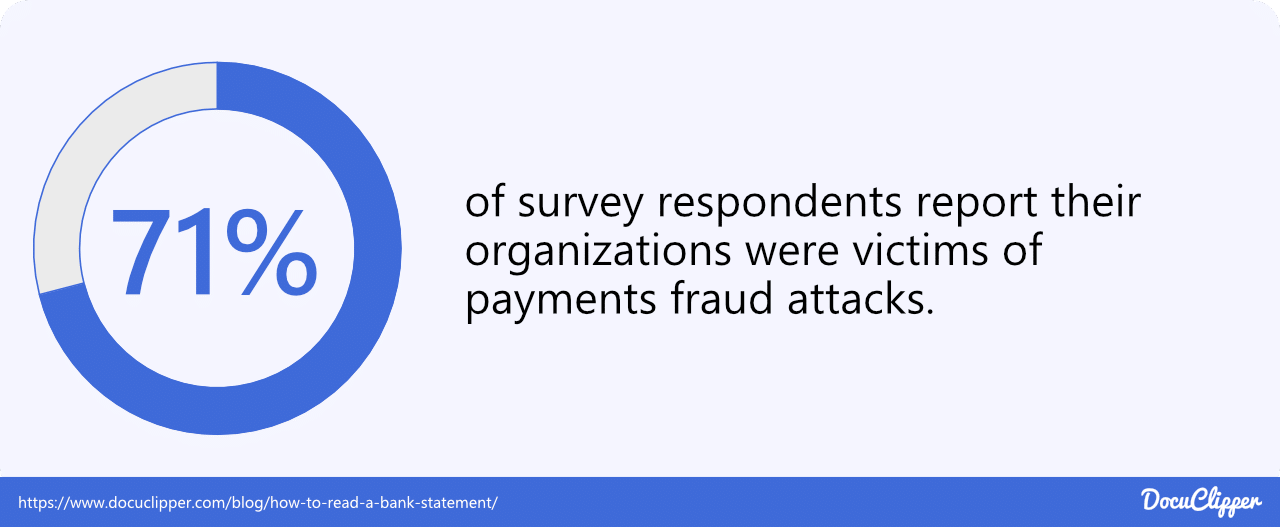

According to the PwC research, 51% of surveyed organizations say they experienced fraud in the past two years, the highest level in our 20 years of research.

Additionally, 71% of survey respondents report their organizations were victims of payments fraud attacks.

With that being said, main individuals and organizations have experienced some kind of financial error or fraud resulting in financial losses.

That’s why, knowing how to identify errors or fraud on your bank statements is crucial to saving your money and becoming better at preventing any future errors or fraud from happening to you:

So here’s how you can do it:

- Regularly Review Your Statement: The first step to spotting errors or fraud is to regularly review your bank statement. Don’t just glance at your closing balance; take the time to go through each transaction and take note of any that you do not recognize.

- Keep Your Bank Statements: Keeping your bank statements ensures you can review any old bank statements in case of potential errors or frauds.

- Compare Receipts: Keep your receipts and compare them with the transactions listed on your bank statement. Look for any discrepancies in amounts or transactions that you don’t recognize. Additionally, ensure your receipts match your purchases, especially at restaurants it’s common to get overcharged, or even pay different bills.

- Check for Unauthorized Transactions: Be on the lookout for transactions you didn’t authorize. This could be a sign of fraudulent activity. These could be small amounts, as fraudsters often test with small transactions to see if they go unnoticed.

- Review Recurring Charges: Make sure all recurring charges, like subscriptions or automatic bill payments, are correct as well as wanted. Sometimes you might continue to be charged for a service you’ve canceled or forgot to cancel.

- Monitor for Duplicate Charges: Sometimes a merchant might accidentally charge you twice for the same service or product. Keep an eye out for duplicate transactions.

- Look for Incorrect Fees: Banks sometimes make mistakes and charge incorrect fees. Check that any fees charged align with your account terms. Trust me, these are happening more often than you would like.

If you spot any errors or potential fraud, contact your bank immediately. The sooner you report the issue, the quicker it can be resolved.

Additionally, also ensure that you ALWAYS DOUBLE CHECK your receipts before you pay for anything, especially at restaurants. It’s quite common you might get the wrong items charged, double charged, or even someone else bills.

While these errors are often only unintentional human mistakes, they can be expensive and sometimes it can be hard to get your money back.

Lastly, always double-check if the error or fraud is really an error or fraudulent transaction. Sometimes we just forgot we bought something.

Check your phone for any pictures/videos or conversations that could remind you that you made purchases that you don’t recognize.

However, if you really cannot remember, then for safety reasons, you should follow the steps in the next section.

If you’re reviewing multiple statements or historical data, using a bank statement converter can help standardize your records, while a bank statement analyzer can automatically flag unusual transactions, making it easier to spot patterns or anomalies that might indicate fraud.

What to Do If You Find an Error on Your Bank Statement

Finding an error on your bank statement can be alarming, but it’s important to act quickly and calmly to resolve the issue. Here’s what you should do:

- Confirm the Error: Before contacting your bank, double-check to make sure the error is not a misunderstanding on your part. Compare your bank statement with your own records (videos, pictures, conversations) and receipts. “Sometimes” we buy something we don’t even remember.

- Contact Your Bank: If you’re sure there’s an error, contact your bank as soon as possible. Most banks have a specific time frame in which you must report errors (usually within 60 days of the statement date).

- Provide Details: When reporting the error, provide as much detail as possible. This includes the transaction date, amount, and why you believe it’s an error as well as any additional proof of it’s an error or fraud.

- Follow Up in Writing: After contacting your bank, follow up with a written email. This provides a record of your report and helps ensure the issue is addressed.

- Keep Records: Keep a record of all communications with your bank regarding the error. This includes dates of communication, who you spoke with, and what was discussed.

- Monitor Your Account: Keep an eye on your account to ensure the error is corrected and no further errors occur.

Remember, these things can happen to anybody, including you without you even knowing. That’s why it’s important to know how to read your bank statements to prevent any of these things.

How to Spot Fake Bank Statements

Bank statements are used by organizations and individuals alike as a reliable source of information regarding their financial status.

They provide a detailed record of all transactions that have occurred over a specific period, making them an essential tool for financial planning and management.

However, nowadays digital manipulation has become increasingly sophisticated, and the incidence of fake bank statements has risen.

In fact, the percentage of fake bank statement use increased from 15% to 29%.

These fraudulent documents can be used for a variety of illicit purposes, from securing loans under false pretenses to committing identity theft.

Thus knowing how to spot fake bank statements is crucial especially if you are dealing with bank statements on a regular basis.

Here are the common traces of faked bank accounts:

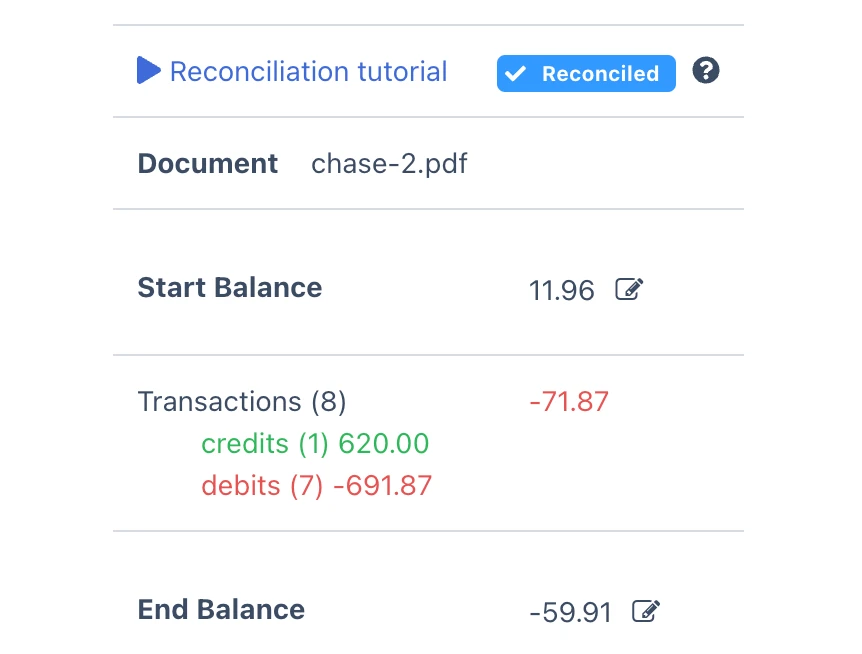

- Reconcile the Bank Statement: One of the most effective ways to identify a fake bank statement is to reconcile the statement. Reconciliation involves comparing the bank statement to your own financial records to ensure they match. If the numbers don’t line up, it could be a sign that the bank statement is fake.

- Check for Poor Quality: Many fake bank statements are of poor quality. They may be blurry, have inconsistent fonts, or show signs of being altered.

- Look for Incorrect Logos or Bank Information: Fake bank statements often have incorrect or outdated logos. The bank’s contact information might also be incorrect or missing.

- Examine the Numbers: Numbers that don’t add up correctly or transactions that don’t follow a logical sequence can be a sign of a fake bank statement.

- Check the Account Holder’s Information: The account holder’s information should be consistent throughout the statement. Any inconsistencies could be a sign of a fake statement.

- Look for Generic or Missing Transaction Descriptions: Real bank statements usually have detailed transaction descriptions. If the descriptions are generic, missing, or don’t make sense, the statement could be fake.

- Contact the Bank: If you’re unsure about the authenticity of a bank statement, contact the bank directly. They can verify whether the statement is genuine.

Remember it’s illegal to use a fake bank statement. If you suspect someone is using a fake bank statement, report it to the appropriate authorities.

Additionally, DocuClipper bank statement converter automatically reconciles bank statements in seconds, helping you to quickly spot fake bank statements.

Convert Bank Statements to Excel or CSV for Financial Analysis

Analyzing your bank statements can provide valuable insights into your financial habits and overall financial health.

However, sifting through pages of transactions can be a time-consuming task.

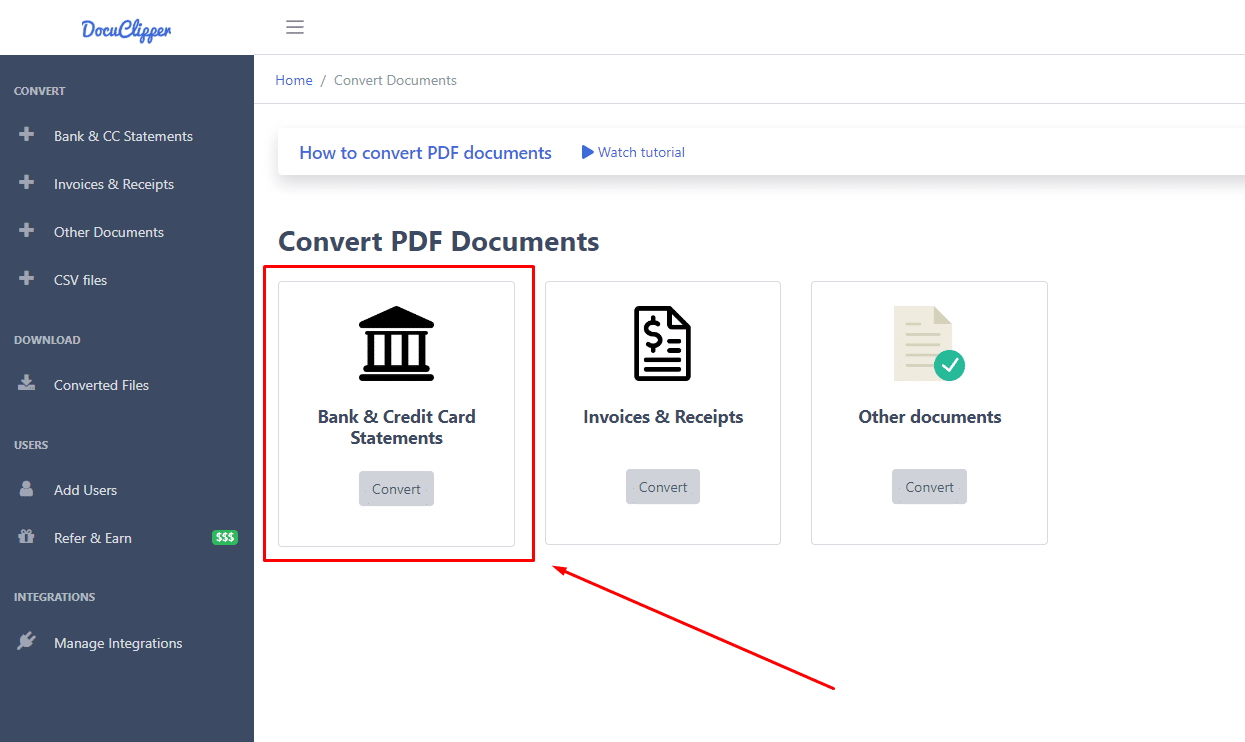

Converting your bank statements into Excel or CSV can make this process much easier. With DocuClipper, you can easily convert your bank statements to Excel or CSV formats. Here’s how you can do it:

Step 1: Select the Bank Statement Converter: Log into DocuClipper and select “Bank & Credit Card Statements”.

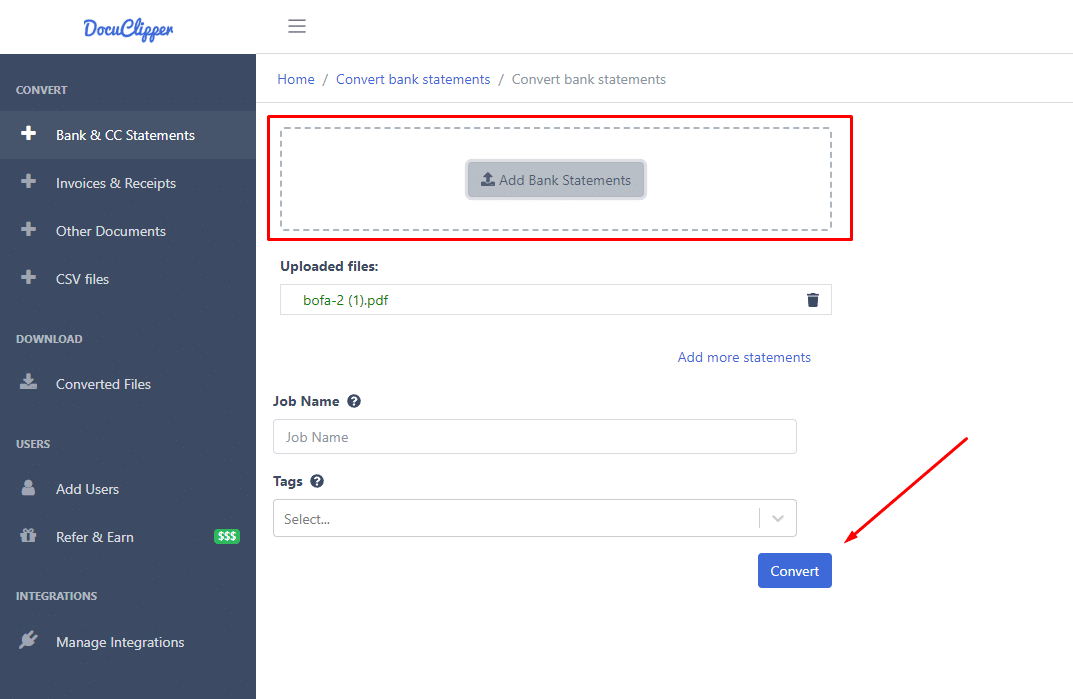

Step 2: Upload Your Bank Statements: Drag and drop one or more statements. DocuClipper works with any text or scanned bank statement and can process multiple statements at the same time. Click on convert.

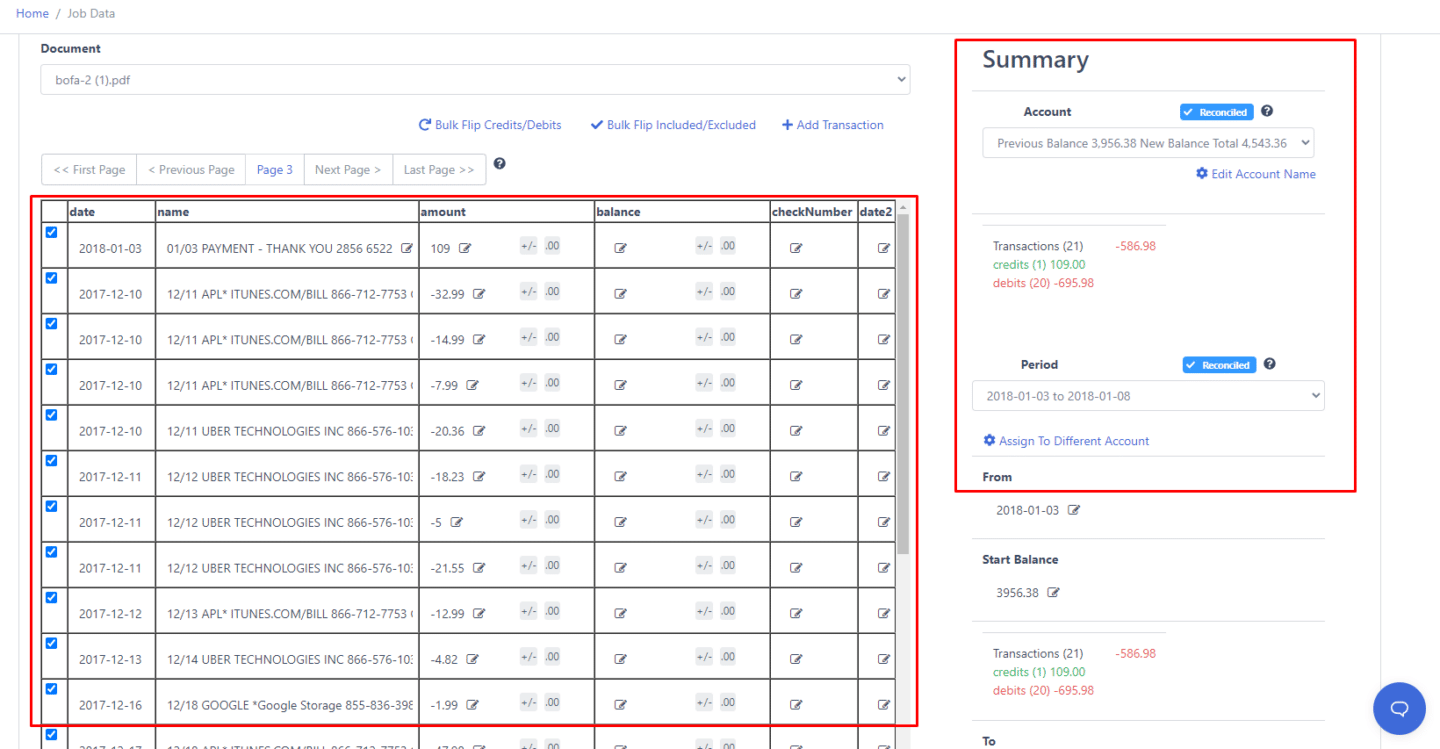

Step 3: Transactions are Extracted Automatically: DocuClipper Bank statement OCR extracts all the transactions, creating a comprehensive bank extract that includes other data like balances, dates, account numbers, etc.

Step 4: Reconcile the Bank Statements: DocuClipper compares transaction totals to summary information on the statement. If everything checks out, the statement is identified as reconciled, saving you time and manual review. You can see the reconciliation status on the summary table (top right of the page).

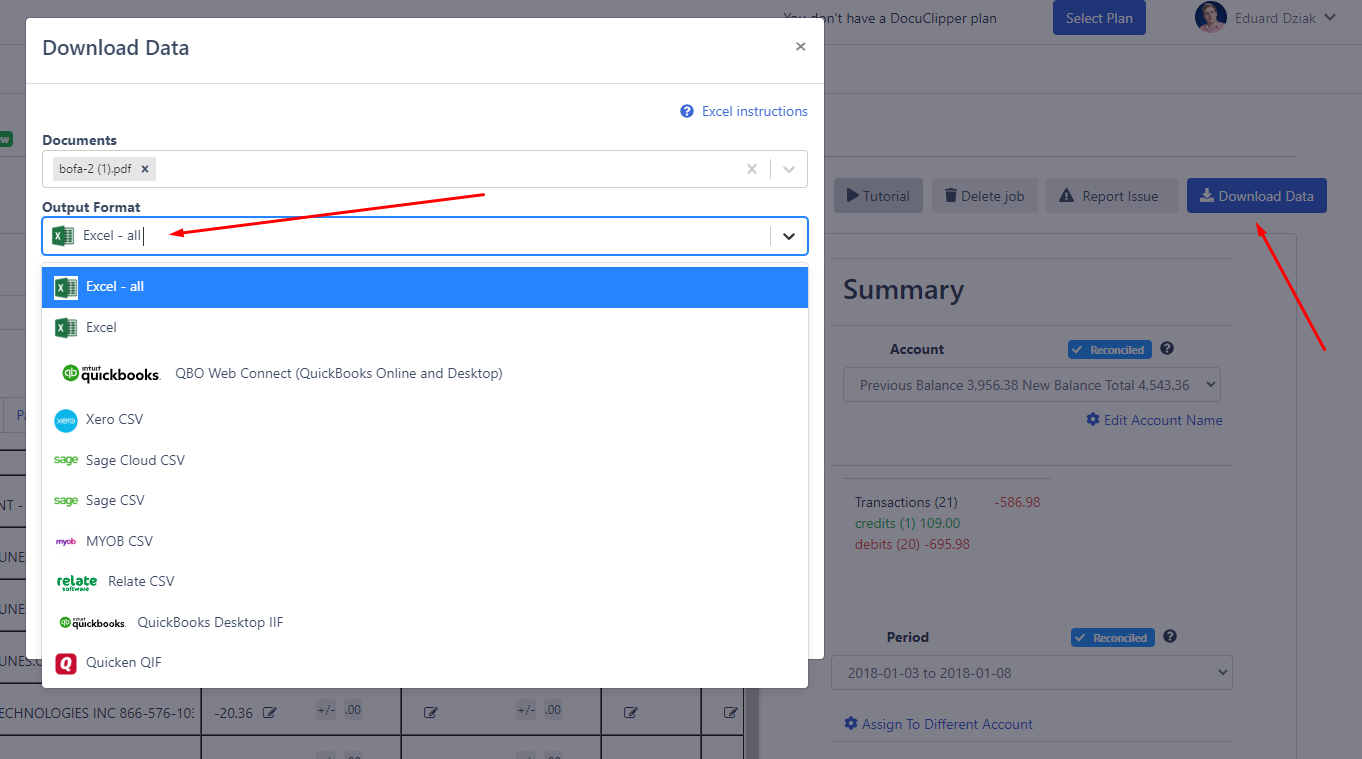

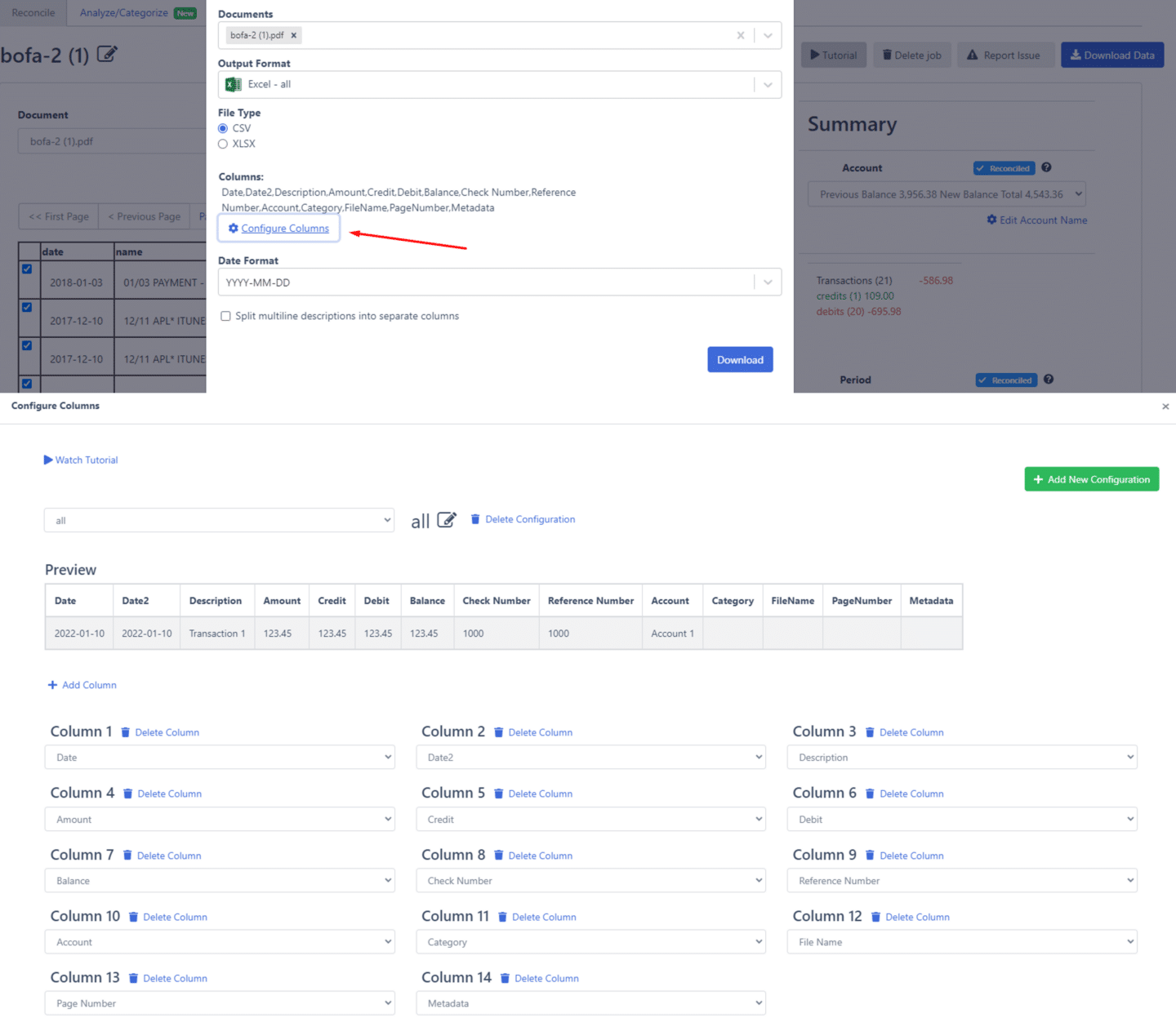

Step 5: Convert Bank Statement to Excel or CSV: Click on “Download data”. Select “Excel” as the output format. If you want an Excel file, select XLSX. If you want a CSV file, select CSV. Click on “Download Data” and the spreadsheet will be downloaded to your computer.

Step 6: Configure the Output Format: With DocuClipper, you can choose which columns to include in the output. Supported fields are “date”, “date2”, “amount”, “debit”, “credit”, “balance”, “account number” and more.

Analyzing and managing your bank statements becomes much easier when you’re able to convert them into Excel or CSV giving you better options for analyzing your bank transactions.

DocuClipper is the best bank statement converter on the market with 99.5% OCR accuracy for any bank statements and 50k customers worldwide.

For more information:

- How to Convert Bank Statements to Excel or CSV

- A Step-by-Step Guide to Import Bank Statements into QuickBooks

- What is OCR Bank Statement Technology and Why It is So Important

Conclusion

In conclusion, understanding how to read your bank statement is a crucial skill that can enhance your financial literacy, help you manage your budget, spot errors or fraud, and even prevent financial statement fraud.

With tools like DocuClipper, you can easily convert your bank statements into Excel or CSV formats for better financial analysis.

Remember, your financial health is in your hands, and it all starts with understanding your bank statement.

Better Manage Bank Statements with DocuClipper

Whether you’re an individual looking to better understand your spending habits or a business aiming to reconcile bank statements quickly and accurately, DocuClipper is the tool for you.

With just a few clicks, you can convert and reconcile your bank statements into Excel or CSV formats, saving you time and ensuring accuracy.

Say goodbye to manual data entry and hello to efficient, precise financial analysis. Don’t just read your bank statement, understand and reconcile it with DocuClipper. Sign up for a free trial now and experience the difference! Sign Up for a Free Trial

Frequently Asked Questions about How to Read a Bank Statement

In this section, we’re going to answer related FAQs on how to read and understand bank statements.

How do I understand my bank statement?

To understand your bank statement, review key sections: Bank Information (bank's name, address, contact info), Account Information (your name, address, account number), Statement Period (start and end dates of transactions), Opening/Closing Balance (account activity summary), Deposits (money added to your account), Transaction Details (all transactions), Fees (charges incurred), and Interest Information (interest earned). Regularly review your statement to track expenses, spot errors, and identify unauthorized transactions.

What do the numbers mean on my bank statement?

The numbers on your bank statement represent financial transactions and balances. 'Opening Balance' is your account's starting amount for the statement period. 'Deposits' and 'Withdrawals' are funds added or removed from your account. Each transaction includes a 'Reference Number', a unique identifier for tracking. 'Closing Balance' is your account's final amount after all transactions. 'Fees' are any charges incurred, and 'Interest Earned' shows accrued interest. These numbers provide a detailed record of your account activity.

What 5 things will be shown on your bank statement?

A bank statement typically shows:

1) Personal Information: Your name and address.

2) Account Information: Your account number and type.

3) Transaction History: Details of deposits, withdrawals, fees, and interest.

4) Opening/Closing Balances: The money in your account at the start and end of the statement period.

5) Bank Contact Information: Your bank's contact details for queries or disputes.

What are the most common transactions that appear on a bank statement?

The most common transactions on a bank statement include:

1) Deposits: Money added to the account, such as salary payments or transfers.

2) Withdrawals: Money taken out, like ATM withdrawals or debit card purchases.

3) Fees: Charges by the bank, like monthly service fees or overdraft fees.

4) Interest: Amount earned if the account accrues interest.

5) Automatic Payments: Recurring bills or subscriptions paid directly from the account.

Why should you read your bank statement?

Reading your bank statement is crucial for financial management. It helps you track income and expenses, aiding in effective budgeting. Regular review can help spot unauthorized transactions or discrepancies, protecting against fraud. It also allows you to identify and avoid unnecessary fees. Furthermore, bank statements are essential for tax preparation and can be required for credit applications.

What are the numbers at the bottom of a bank statement?

The numbers at the bottom of a bank statement usually represent the 'Routing Number', 'Account Number', and 'Check Number'. The 'Routing Number' identifies your bank, the 'Account Number' is your specific account identifier, and the 'Check Number' corresponds to individual checks issued. These numbers are typically found on physical checks but may also appear on online or PDF bank statements.