Reading a brokerage statement can seem tricky, but it’s key to smart investing.

In this blog, we’ll break down how to understand your statement easily. We’ll point out the important parts to look at, explain what they mean, and show you how they can influence your investment decisions.

This knowledge will help you keep track of your investments and make better choices, whether you’re just starting or have been investing for years.

What is a Brokerage Statement?

A brokerage statement is a report from your bank or broker that shows all your investments. It lists what you own, its current value, and any recent transactions like buying or selling stocks and getting dividends.

This report helps you see how your investments are performing. By reviewing it often, you can respond to market shifts or explore new investment opportunities quickly.

Why is It Important to Read Your Brokerage Statement?

It is important because it helps you with managing your portfolio wisely. It helps you monitor your investments’ performance and adjust your strategy as needed.

Also, during tax season, this statement is invaluable as it contains the necessary information to report your investment income. Regularly checking your brokerage statement keeps you informed about your financial health.

How to Read a Brokerage Statement: Step-by-Step

When you’re looking at your brokerage statement, think of it as a summary of your investment activity.

However, before we get started, brokerage statements can have different names of their tables as well as different layouts.

In this article, we’re using a brokerage statement from Interactive Broker.

Here’s how you can read it without getting bogged down by details:

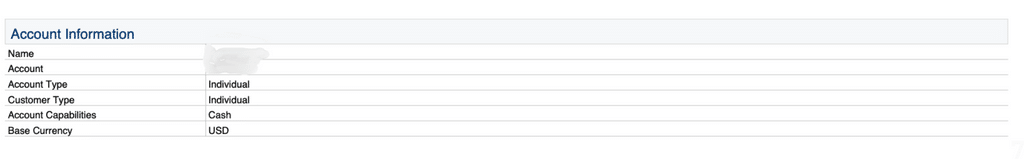

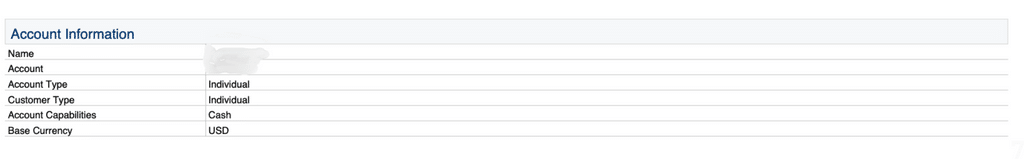

First, check your account details to make sure everything looks correct—your name, account type, and number should all be as you expect. This helps you confirm that the statement is yours and everything is set up as it should be.

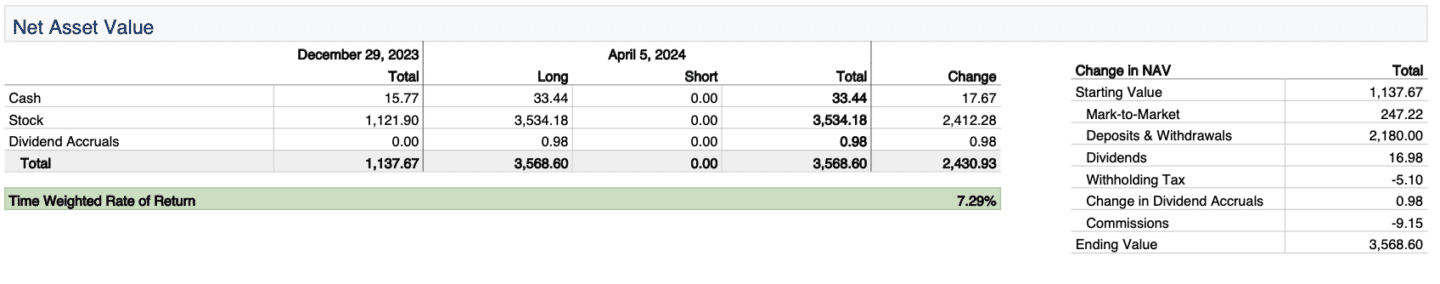

Next, look at the net asset value section. This part tells you the total value of your investments at the beginning and end of the period. It shows if your investments have gained or lost value, giving you a quick idea of how things are going.

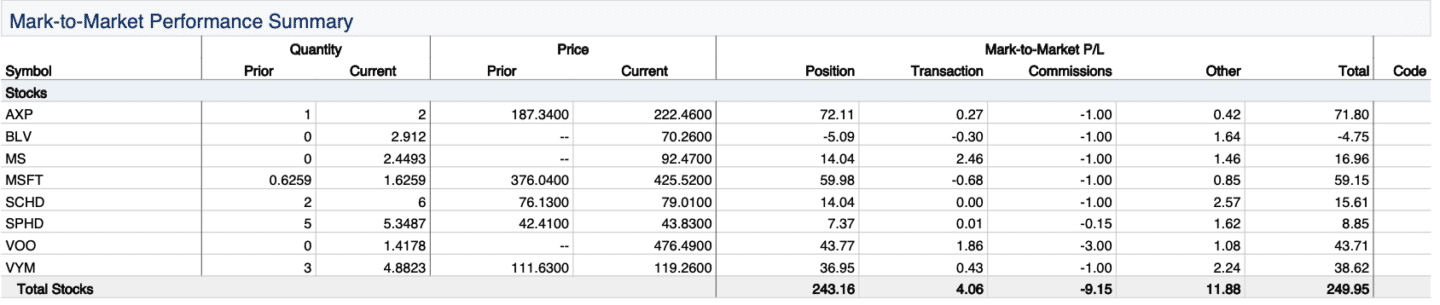

Then, review the performance of your individual investments in the mark-to-market performance summary. This section lists each of your investments, showing how their prices have changed over the period and whether you’ve made or lost money on them. It’s important to see which investments are doing well and which aren’t.

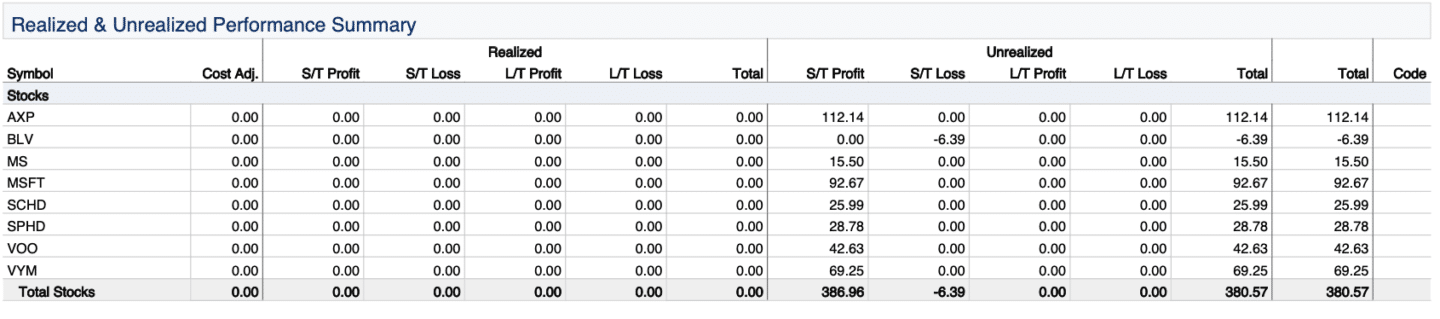

You’ll also see a breakdown of realized and unrealized gains and losses. Realized results come from actions like selling stocks and show if you’ve made a profit or loss. Unrealized results show what could happen if you sold certain stocks now, based on current market prices.

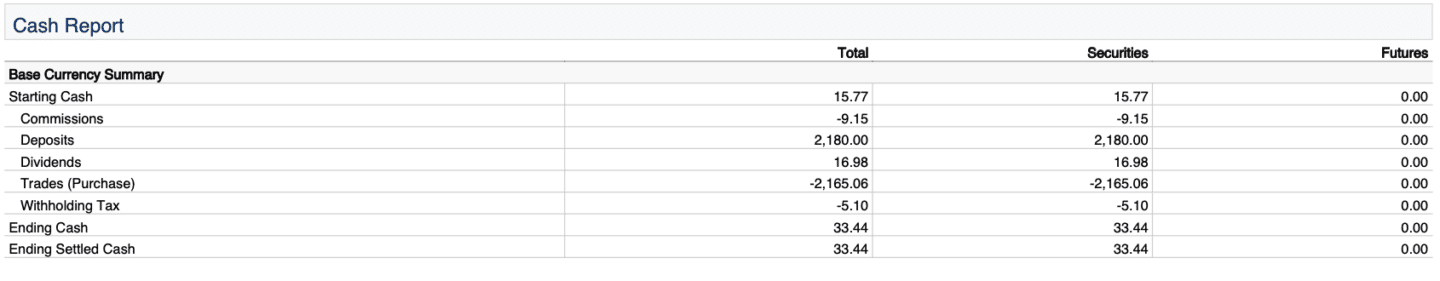

Don’t forget to look at the cash report, which tracks the money coming in and out of your account from things like buying or selling stocks and receiving dividends. This helps you see how much cash you have on hand.

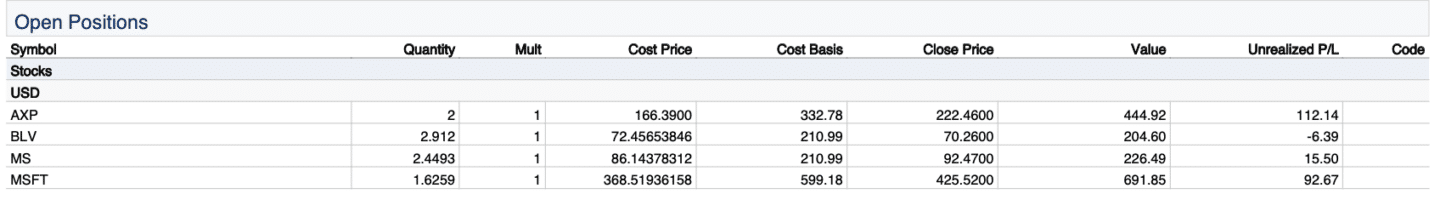

Check your open positions, which are the investments you currently hold. This section shows how much you paid for them, their current market prices, and how many you own. It’s useful for keeping track of what you have and thinking about whether to buy more or sell some.

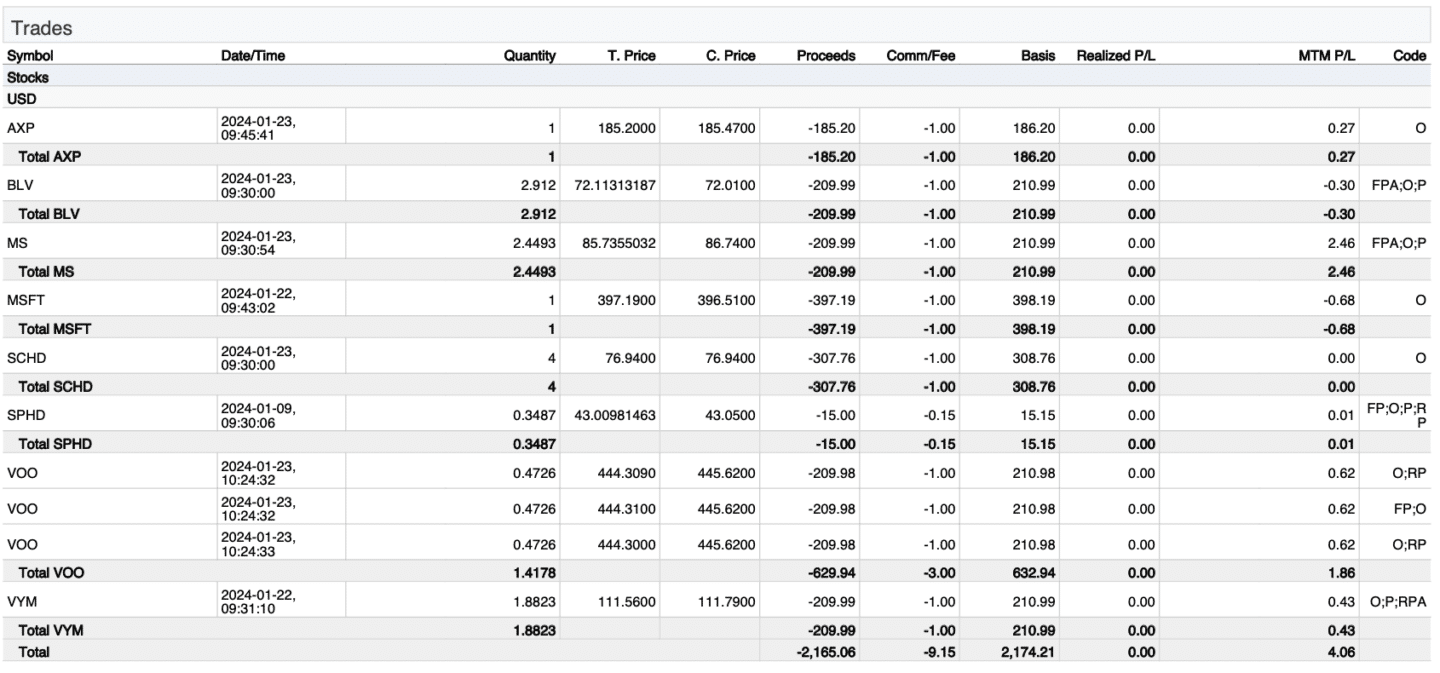

Make sure the trades section accurately reflects your buying and selling activity. This includes detailed info like the date, what you traded, and how much you paid or received. It’s essential to ensure everything matches your records.

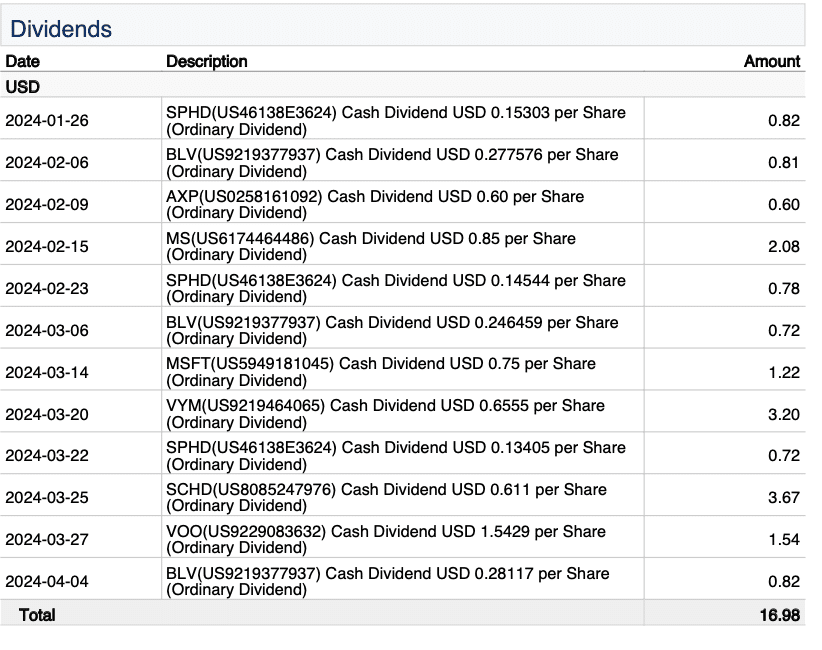

Pay attention to any dividends you’ve received and taxes withheld, especially around tax time. This information helps you understand how much you’re earning from your investments and any tax obligations.

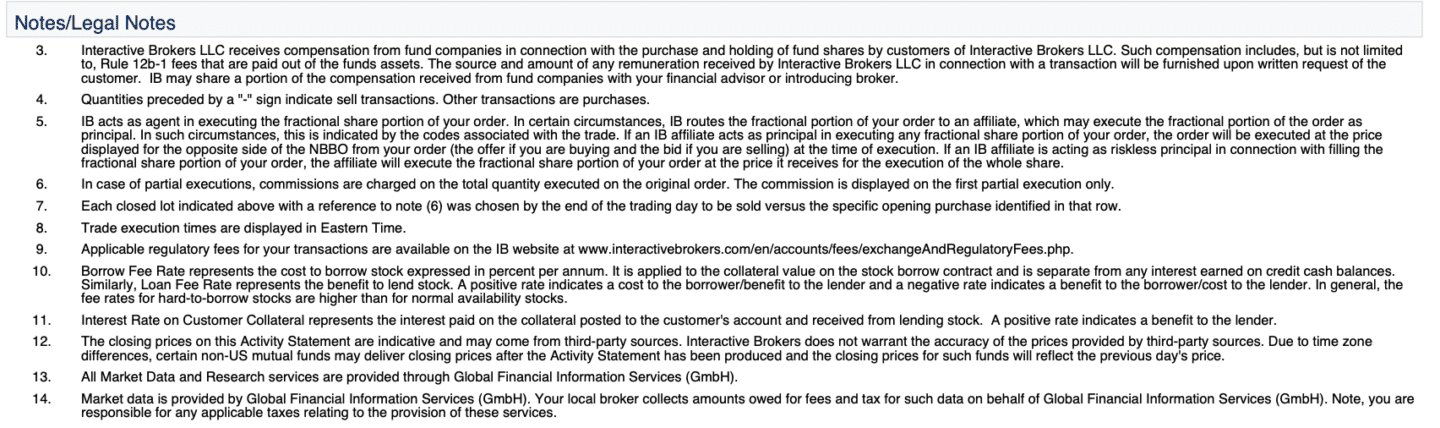

Finally, always read any additional notes or legal information. This might include updates on brokerage services or trading rules that could affect your account.

By going through your brokerage statement this way, you can keep a clear eye on your investments and make better decisions about how to manage them.

Common Abbreviations on a Brokerage Statement

Like bank statements, brokerage statements also consist of many abbreviations that are quite difficult to understand and wrap our heads around.

Here are some of the commonly used terms that are being used.

- ADR – American Depositary Receipt Fee: Charges related to holding foreign stocks.

- AFx – Automatic Foreign Exchange: Currency conversion due to international trading.

- B – Automatic Buy-in: Purchases made automatically to cover a short position.

- Bo – Borrow: Indicates a loan is taken, typically for leverage.

- C – Closing Trade: A transaction that closes an open position.

- CD – Cash Delivery: Delivery of cash instead of securities.

- CP – Complex Position: Refers to positions involving multiple types of securities.

- Ex – Exercise: Act of buying or selling the underlying asset in an options contract.

- FP – Fractional Portion: Part of a trade involving less than one full share.

- G – Guaranteed Account Trade: Trading within a guaranteed account.

- HFR – Hedge Fund Redemption: Withdrawing investments from a hedge fund.

- IM – Internal Matching: Part of a trade matched within the broker’s system.

- LI – Last In, First Out: A method to calculate gains and losses, using the most recently bought assets first.

- Po – Posting of Interest or Dividends: Recording earnings from dividends or interest.

- R – Dividend Reinvestment: Automatically using dividends to buy more shares.

- RE – Redemption: The process of selling shares back to a fund.

- RP – Riskless Principal for Fractional Shares: The broker’s affiliate acts as a principal in a risk-free capacity during fractional share transactions.

- SL – Specific Lot: Choosing specific shares to sell for tax purposes.

- ST – Short Term: Gains or losses on assets held for a short duration.

More terms are being used in a brokerage statement. One institution can vary from one another.

Talk with your broker, financial advisor, or banker when you want to clarify and ask for financial advice.

How US and Non-US Citizens Pay Taxes on Dividends

Dividends are a form of income earned from investments in stocks, and how they are taxed can vary significantly depending on whether the investor is a US citizen or a non-US citizen.

Understanding these differences is crucial for managing investment returns and complying with tax regulations. Here’s a breakdown of how dividend taxation works for both groups:

US Citizens: Tax on Dividends

US citizens are required to report all dividend income on their tax returns. The rate at which dividends are taxed depends on whether they qualify as ordinary or qualified dividends.

According to the Internal Revenue Code (IRC), Non-qualified dividends are taxed at the individual’s normal income tax rate, which can vary from 10% to 37%. Qualified dividends benefit from lower capital gains rates, which are 0%, 15%, or 20%, based on overall taxable income.

Non-US Citizens: Tax on US Stock Dividends

Non-US citizens, or non-resident aliens, face a different tax situation. According to Investopedia, Nonresident aliens are subject to a dividend tax rate of 30% on dividends paid out by U.S. companies. This tax is withheld at the source by the brokerage firm managing the investments.

This means the broker automatically deducts the tax before distributing the net dividend to the investor. This process ensures compliance with US tax laws, which require withholding to capture taxes from earnings generated within the US by foreign investors.

How to Spot Errors on Your Brokerage Statement

Ensuring the accuracy of your brokerage statement is essential for maintaining the health of your financial portfolio. Regularly reviewing your statement helps you identify and correct errors promptly. Here’s how you can do it effectively:

1. Verify Personal Information: Always start by checking your personal information such as your name, account number, and contact details on the statement. Incorrect personal information could be a sign of errors in statement processing or potential security issues. It’s important that your broker has your correct details to prevent any mix-ups or fraud.

2. Cross-check Account Balances: Look at the net value table on your statement and compare it to the closing balance from your last statement. These amounts should match unless there’s been an adjustment or unresolved issue carried over. Any mismatch without a clear reason should be questioned as it might indicate a mistake in recording transactions.

3. Review Transaction Details: Go through each transaction listed on your statement, including purchases, sales, dividends received, and fees. Make sure every transaction is one you authorized and that it’s correctly listed with the right date and amount. Double-check for any transactions that appear twice or any that you don’t recognize, as these could be errors or unauthorized activity.

4. Analyze Investment Performance: Evaluate how your investments are reported to have performed. If the reported gains, losses, or dividends don’t seem to reflect market conditions or expected outcomes based on your knowledge of the investments, there might be an error in how performances are being reported.

5. Check Dividend and Interest Posts: Ensure all dividends and interest expected from your investments are reported. Every payment should be listed, and the amounts should accurately reflect your shareholdings and the dividend rates announced by the issuing companies.

6. Confirm Tax Withholdings: For non-US citizens, it’s crucial to check that the correct tax rate was applied to dividends. Incorrect withholding could lead to compliance issues with tax authorities or result in you paying more or less tax than you should.

7. Compare with Your Records: Align your brokerage statement against your own trading records and any communications you’ve had with your broker. This step can help uncover any misreported trades or administrative mistakes that might not be immediately obvious.

8. Look for Fees and Charges: Review any fees or other charges deducted from your account. Confirm each fee or charge against your brokerage agreement to ensure it’s valid. Unexpected or high fees should be queried as there could be errors or signs of hidden charges.

9. Verify Closing Prices: Check that the closing prices of securities on your statement match those reported in the market. Errors in pricing securities at market close can misrepresent the value of your investments.

10. Contact Your Broker Immediately: If you spot any discrepancies, reach out to your broker right away to discuss them. Keep detailed records of all communications regarding discrepancies, so you have a clear record of how and when each issue was addressed.

What to Do If You Find an Error on Your Bank Statement

Finding a mistake on your bank statement can be worrying, but it’s important to handle it quickly. Here’s a simple guide on what to do if you spot an error:

1. Double-check the Error: First, make sure there really is a mistake. Review the transaction again and compare it with your online account. Sometimes, a transaction might just be under a different name than you expected.

2. Collect Your Proof: Gather any documents that show the transaction is wrong, like screenshots of your brokerage online account. This will help when you explain the problem to your bank.

3. Contact Your BrokerQuickly: Call your broker as soon as you think there’s a mistake. Many brokers also let you send a message through their website. It’s a good idea to follow up your phone call with a written message so there’s a record of you reporting the issue.

4. Talk It Over: When you speak to the broker, be clear about what the problem is and provide any evidence you have. The customer service will tell you what they need to fix it and how long it might take.

5. Keep Checking In: If the broker doesn’t fix the error right away, don’t just wait. Keep in touch with them to make sure they are working on it. Sometimes these things can take a while to get sorted out.

6. Save All Your Communications: Keep notes or copies of all your talks and messages with the broker. Write down who you spoke to, when, and what was said. This can be very useful if there are delays or problems in getting the error fixed.

7. Watch Your Account: Keep an eye on your broker statements to make sure the error gets corrected and that no new mistakes happen. Regular checks can help you catch problems early.

8. Know Your Rights: Learn about your rights when it comes to investment errors. Many places have rules that protect you by requiring brokers to fix errors within a certain time.

How to Spot Fake Brokerage Statement

Fake brokerage statements can be a major red flag, indicating potential fraud or manipulation.

Knowing how to identify a suspicious statement is crucial for protecting your business interest.

Here are key indicators to watch for:

1. Wrong or Poor Quality Logos: Genuine statements should have high-quality, accurate logos. Be cautious if the logo looks incorrect or is poorly printed, as it might indicate a counterfeit document.

2. Generic or Missing Transaction Descriptions: Authentic statements provide detailed descriptions of each transaction. Vague entries like “stock purchase” without specifying which stock were purchased are suspicious. Every transaction should be clearly detailed to ensure transparency.

3. Balancing Act: Always check whether the closing balance of your last statement matches the opening balance of the current statement. Discrepancies here could suggest that figures have been altered.

4. Unrealistic Performance: Be wary of statements showing exceptionally high returns without any losses or risks. Investment markets are naturally volatile, and returns that seem too good to be true may indeed be fabricated.

5. Printing Issues: Reputable brokers usually produce statements of high quality. Watch out for documents with inconsistent fonts, misalignments, or overall poor print quality, as these can all be signs of a forgery.

6. Watermarks: Some brokers use watermarked paper for added security. If watermarks are usually present but are missing on a new statement, it could be a cause for concern.

7. Too Many Round Numbers: Investment figures are rarely rounded off to neat numbers like $1,000.00. Overly rounded figures such as these can suggest that the numbers have been made up.

8. Wrong Calculations: Double-check the math on the statement. Incorrect calculations can be a clear indicator of errors or intentional tampering.

9. Missing Data: A complete statement should include all relevant financial details such as taxes, fees, and dividends. Omissions of this data might indicate someone has altered the document.

10. Contact the Broker: If you have any doubts about the authenticity of a statement, the best course of action is to contact the brokerage directly using official contact information. Verify the statement’s legitimacy directly with them to avoid potential scams.

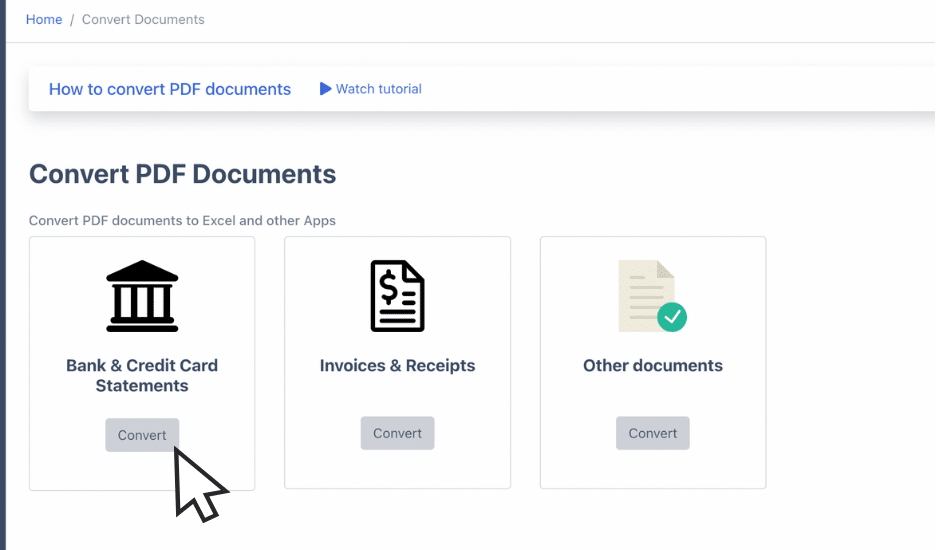

How to Convert Brokerage Statement to CSV, Excel, or QBO

Analyzing your brokerage statements can provide valuable insights into your investment activities and overall financial health.

However, reviewing pages of transactions and investment activities can be a time-consuming task.

Converting your brokerage statements into Excel or CSV can simplify this process significantly. With DocuClipper, you can easily convert your brokerage statements to Excel or CSV formats. Here’s how you can do it:

- Select the Brokerage Statement Converter: Log into DocuClipper and select “Brokerage & Investment Statements”.

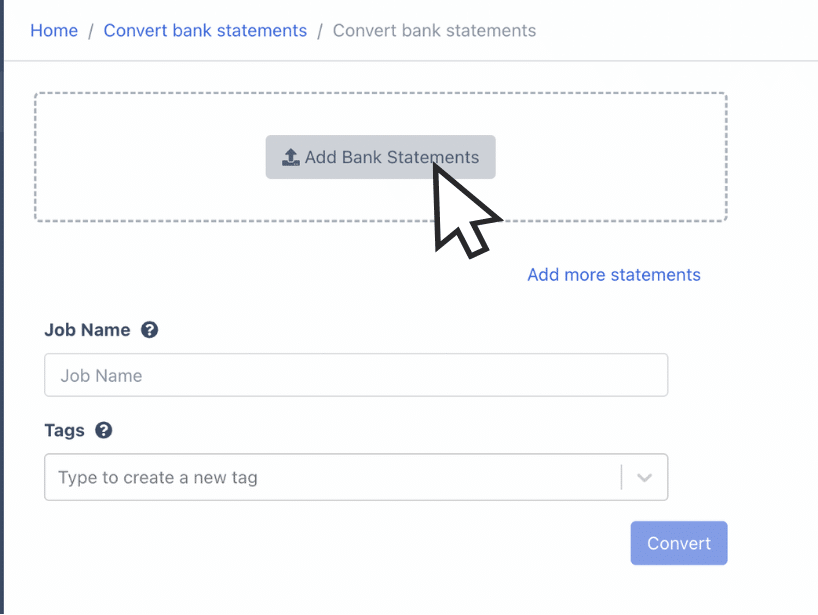

- Upload Your Brokerage Statements: Drag and drop one or more statements into the platform. DocuClipper works with any text or scanned brokerage statement and can process multiple statements simultaneously. Click on convert.

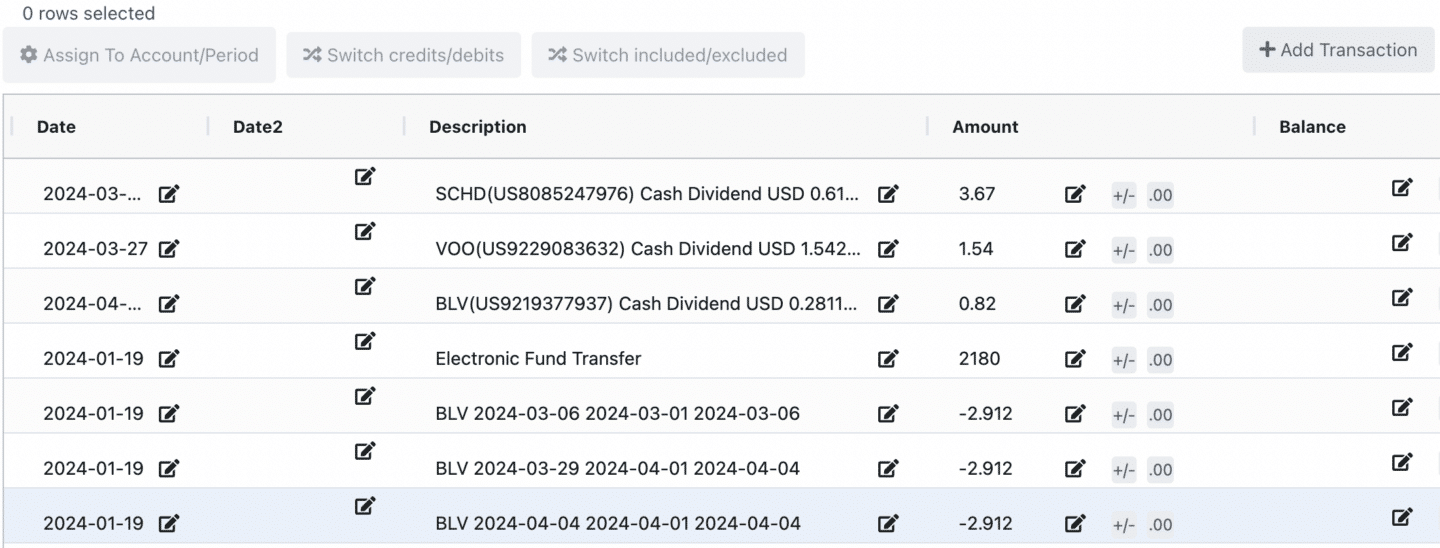

- Transactions are Extracted Automatically: DocuClipper’s OCR technology extracts all the transactions from your brokerage statements, creating a detailed extract that includes additional data like balances, dates, transaction types, etc.

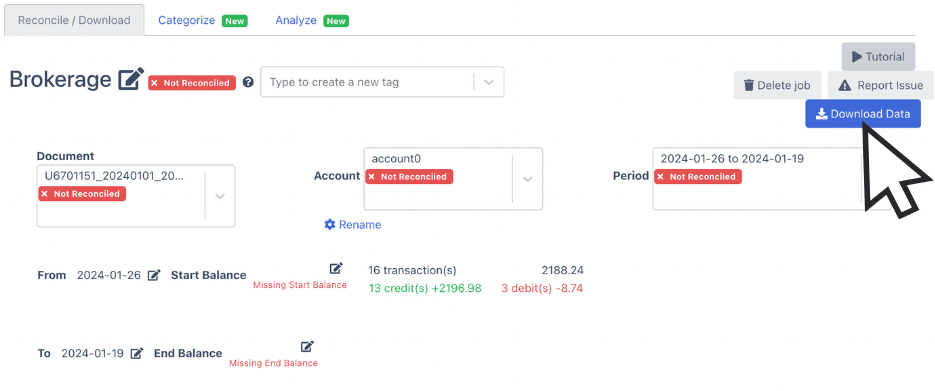

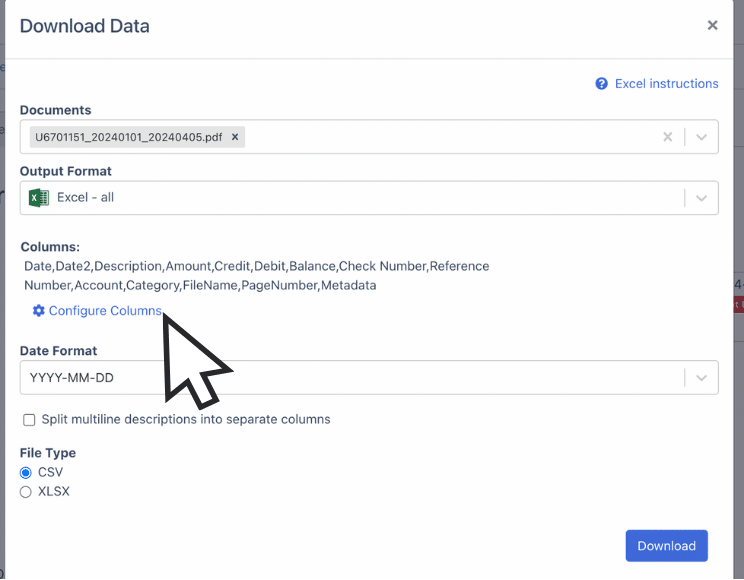

- Convert Brokerage Statement to Excel or CSV: Click on “Download data”. Choose “Excel” as the output format if you prefer an Excel file, or select CSV for a CSV file. Click on “Download Data”, and the spreadsheet will be downloaded to your computer.

- Configure the Output Format: With DocuClipper, you can choose which columns to include in the output. Supported fields include “date”, “transaction type”, “amount”, “buy/sell”, “security name”, “account number”, and more.

Conclusion

Learning how to read your brokerage statement well helps you understand how your investments are doing and make smarter financial choices.

Checking your statement regularly allows you to monitor how well your investments are performing, spot any errors quickly, and make sure your investment plans match your financial goals.

By getting familiar with each part of your statement, you can manage your investments better, whether you’re just starting out or you have lots of experience. This active approach not only protects your current investments but also sets you up for future financial success.

FAQs about Brokerage Statement

Here are some frequently asked questions about how to read a brokerage statement:

What does journaled mean on brokerage statement?

When you see “journaled” on a brokerage statement, it refers to the transfer of securities or cash within your accounts without physically moving the assets, typically between different types of accounts.

What does it mean when funds are journaled?

Journaled funds are funds transferred internally within a brokerage, from one account to another, often for purposes such as rebalancing or meeting margin requirements.

What does journaled shares mean?

Journaled shares are shares that have been transferred from one section of your investment portfolio to another or between different accounts, recorded without an actual buy or sell order.

What does journalizing the transactions mean?

To journalize transactions in the context of brokerage means to record transfers of cash or securities internally in the accounting records of the brokerage, noting the movement between accounts.

How do you read shares?

Reading shares on a brokerage statement involves reviewing the quantity owned, the purchase price, current market value, and any changes such as dividends or stock splits, to understand your investment’s performance.

What is the meaning of journaled in accounting?

In accounting, “journaled” refers to the act of recording transactions in the journal, which is the first step in the accounting cycle, documenting all the financial activities of a business.