Not all invoices are made equal, and a single invoice can cause major problems when it’s unchecked.

It can be incorrect amounts, missing line items, calculation errors, or tax discrepancies, these mistakes can affect your relationship with your client or vendor, lead to disputes, and affect your accounting efficiency.

If things go worse, they can lead to compliance issues with tax authorities or even legal complications.

The good thing is that you can get rid of these by improving your invoice accuracy.

In this article, we’ll cover what invoice accuracy means, why it’s crucial for your business, how to calculate it, and ways to ensure every invoice you send is accurate.

What is Invoice Accuracy

Invoice accuracy refers to the precision of the information within invoices, whether it’s the names, amounts, dates, summaries, or other information regarding the transaction.

A bad invoice accuracy means there’s information like line items that didn’t reflect the actual order. Or, it could be that the names or addresses are not aligned with the end of the transaction.

Or the calculation could be wrong. Sometimes decibels move in the wrong direction, and many more potential mistakes can appear in the invoice.

Perfect invoice accuracy means there isn’t a single flaw. It’s what every client or vendor ideally wants to receive.

Why is Invoice Accuracy Important

We kind of already know why having high invoice accuracy is ideal, but here is a better breakdown of it:

- Better Financial Accuracy: Having accurate invoices can let you run through your accounting and auditing process, creating fewer roadblocks resulting in higher efficiency for your team and less of a cost for your business.

- Improved Customer Trust and Satisfaction: Invoice discrepancies can affect your client or customer relationships. Studies show that 35% of businesses struggle with collections due to poor communication and this could be caused by invoice accuracy. You can improve this by giving more accurate invoices for them to trust and rely on you more.

- Improved Vendor Relationships: Around 13% of invoices are disputed due to errors. These disputes consume time and resources in both ways that will affect your relationship. Accurate invoices reduce the prevalence of disputes and will improve your relationship.

- Improved Operational Efficiency: More than 30% of U.S.-based SMBs deal with late payments in their invoices, often caused by inaccurate invoices that they have to process for about 15 days annually. This can affect your efficiency, especially in the AP department.

- Compliance and Legal Obligations: The Rolls-Royce Holdings Plc v Goodrich Corporation case shows that suppliers who invoice at prices lower, even in the case of accidents than the contracted amount can still claim the price as cited in the contract. Then Goodrich, the supplier, issued invoices with incorrect prices, and the court ruled they were still entitled to recover the full contractual amount from Rolls-Royce. So its important to have everything accurate to the detail.

- Minimized Disputes: Research estimates that 15% to 20% of invoice disputes are invalid and this is likely caused by inaccuracies. Putting a lot of effort into these disputes wastes time, and improving accuracy can reduce this number and free up more time.

Overall, you can see how inaccurate invoices can cause a lot of trouble for your business whether you’re the vendor or supplier, it can cost you in some cases millions of dollars to correct the mistake.

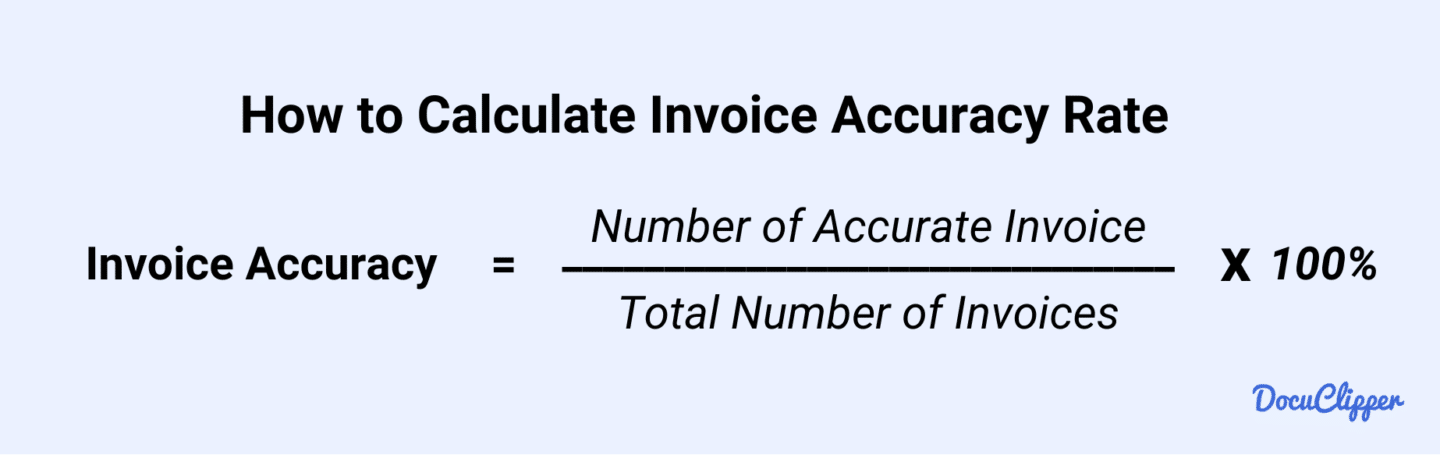

How to Calculate Invoice Accuracy Rate

The accuracy rate of invoices is not typically seen as individual invoices but as the invoices you have sent out as a whole towards a particular customer or your entire customer base.

To know how accurate your invoices are, you should check first your invoice accuracy rate through this formula:

Invoice accuracy = # of accurate invoices/total # of invoices x 100 = x%

The closer you are to 100 the better. However, some independent benchmarks have a 95 to 98 percent of tolerance.

While no margin of error is being accepted in the AP field, invoices just have to be perfect before being sent out. As the data entry principle says, 1-10-100, the cost of a mistake in entries snowballs into tenfold in cost.

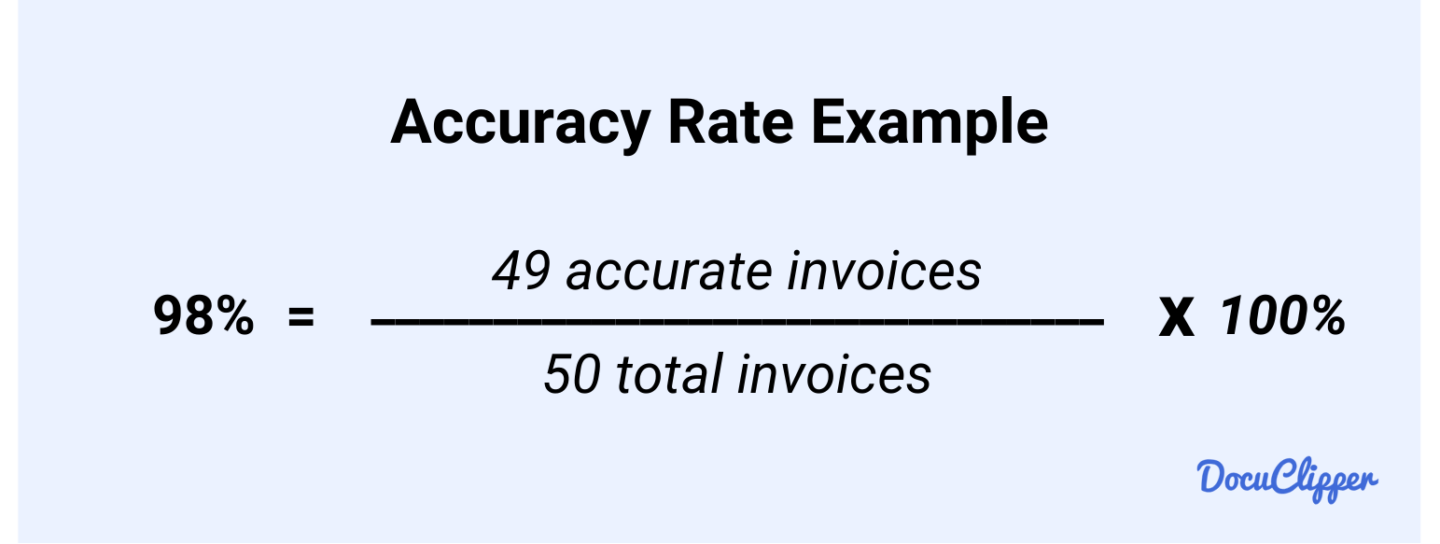

For example, if you sent 50 invoices to a client and 1 was inaccurate, your accuracy rate would be:

(49 ÷ 50) × 100 = 98%

While it is within the benchmark, it is not to celebrate with. Invoice processing cost runs from $5 – $20, and putting it to 10 times due to the mistake and you will start dedicating more time to fix it, possible logistical meetups, and miscellaneous costs.

That single invoice mistake can cost you $50 or more.

How to Validate Invoices?

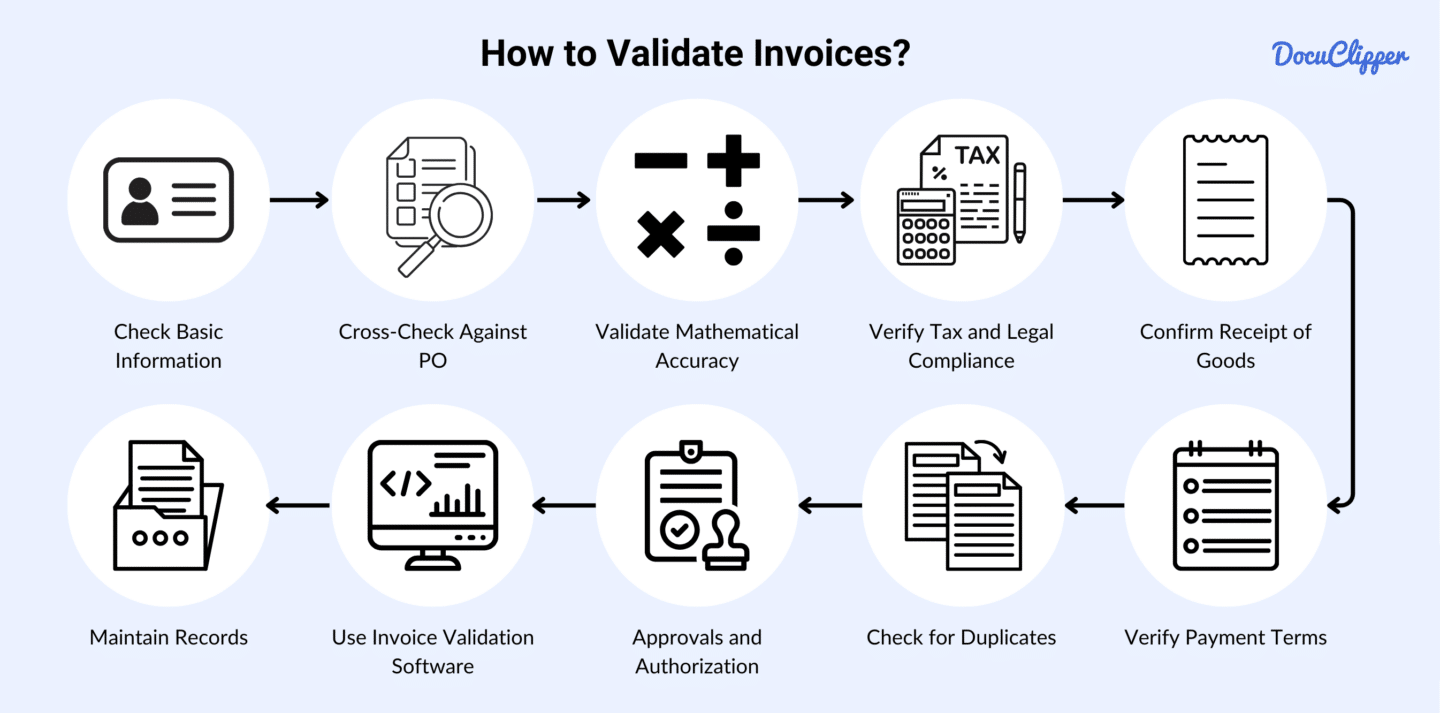

To get rid of these unnecessary costs and possible fraud, it takes careful invoice validation to detect inaccuracies, here are the steps:

- Check the Basic Information: The first that you have to do the most fundamental part, is to check the vendor and customer names. Check if they have given you an invoice that is not even meant for you or questionable data intervals or address

- Cross-Check Against Purchase Orders (PO): After checking the names, dates, addresses, and contacts, next is your check if it aligns with the PO. All items within the invoices should be reflected in the PO that you have sent. Any overcharges or undercharges should be called out ASAP.

- Validate Mathematical Accuracy: When the PO check is done, you need to calculate the summary and the amount of the line items. It should come up well with the product or service value along with the quantities.

- Verify Tax and Legal Compliance: Tax requirements can vary from each place. So you have to check if the tax is topped off at each. You also have to ensure that it is formatted well based on the legal compliance of the country like font size, disclosure of terms, and amount placement. Errors here can cause problems during tax filing.

- Confirm Receipt of Goods or Services: During the later part of the validation like when you already received the goods or services, you can validate if the receipt of goods or services reflects the amount and items in your invoice. This is to ensure that you should only be paying on what you received or get refunds for underserving.

- Verify Payment Terms: You should be clear about payment terms. Usually, as a buyer you will have an agreement with the seller. You need to check if these terms are placed clearly and on what is agreed like on the minutes of a meeting or a signed contract.

- Check for Duplicates: Check for duplicates, sometimes the seller might have accidentally doubled or double-copied the invoice and sent you 2 separate invoices, or the line items can be added twice causing an inflated price, call them out if this happens, this is likely an honest mistake.

- Approvals and Authorization: Invoices need to be evaluated and approved by higher accounting or finance staff, typical of an invoice approval workflow. Invoices without stamps or signatures should be flagged for review.

- Use Invoice Validation Software (Optional): Although optional, you can use invoice validation software. These software vary but the principle is to match it with existing documents such as goods receipts and purchase orders. Many tools already do this via 2-way matching or 3-way matching.

- Maintain Records. After all these steps, you can then keep all accurate invoices for record keeping. You should also keep inaccurate records for further investigation in case there is some fraud or tampering.

It might seem like a tedious process, but many of these checks take only a few minutes of your team’s time and can save you a lot of money and time in the long run and even reduce the cost of processing invoices.

Best Ways to Improve Invoice Accuracy

After knowing how to validate the invoices, now is the time you can start working on your invoice accuracy:

Use Invoicing Software or Template

An invoice software is a tool where your invoices will be automatically made to a certain template and all you have to do is input the “correct” information and it should reflect in a structured format.

This could also be automated if a purchase is made online and all the purchases will be automatically collected and tallied.

This eliminates much of the human error that can lead to mistakes. However, using invoicing software doesn’t guarantee for perfect accuracy. You still need to configure prompts and conditions correctly to ensure the invoice software extracts and processes the right information.

Create an Itemized Table in Invoices

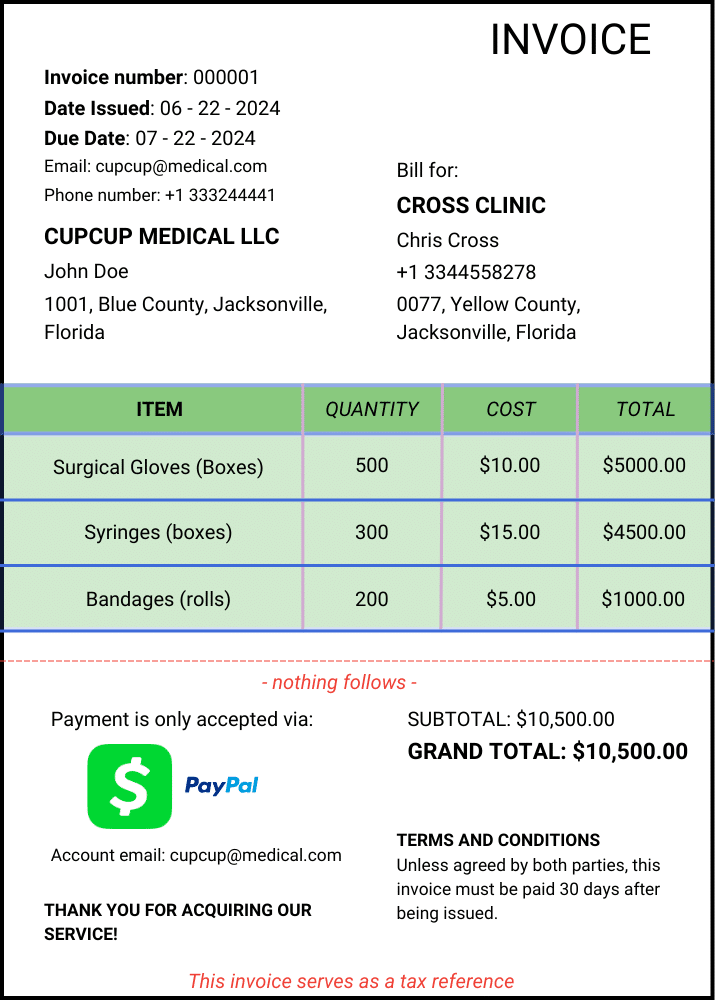

Most invoices should be formatted in a tabular format and creating an invoice like this makes it difficult to calculate and process:: <similar to the image>

Provide a similar example:

You need to make it easy for the buyer to process each line item and make everything aligned. You should segregate the quantity and cost for each line item because this will help them single out and not lose track of each item.

Here is a better example for your clients or customers to track things easily. Once your clients understand it better, it’s less likely that they will contact you for extra information and accuse you of giving an inaccurate invoice.

Create Invoice Management Processes

The generic invoice management process usually comes with receiving the invoice, extracting the information, validation and verification, payment approvals, and record keeping.

This has been the norm, but you can modify this depending on the relationship you have with your seller, industry requirements, or your overall experience with dealing with AP. You can add extra steps or measures or change your primary methods.

For example, during invoice data extraction, you can use an OCR invoice software to extract information and not do it manually.

This will help you save time and proceed with your verification process, saving you a lot of time and directly heading into looking out for inaccuracies.

You can also look back at the records that you have of cases of fraudulent or tampered patterns and add it as another layer to look out for.

Automate Your Invoice Creation & Processing

As a seller, adopting automated invoice generators can streamline your workflow. These tools can be linked to your landing page or sales system, making the buyer information automatically pulled into the invoice.

This gets rid of manual input, reduces errors, and speeds up the process.

Automation can also improve invoice processing. For instance, implementing an automated invoice matching system allows you to instantly compare invoices with purchase orders and receipts.

Using OCR invoice processing technology can further enhance accuracy by automatically extracting and verifying invoice details, reducing manual errors, and ensuring compliance with financial records.

This helps you quickly identify where the inaccuracies are and resolve any discrepancies, saving time and improving accuracy.

Common Errors on Invoices

So here is an extra look at what errors you can usually see on your invoices:

- Wrong customer billing information

- Invalid or missing invoice number

- Incorrect billing or payment information.

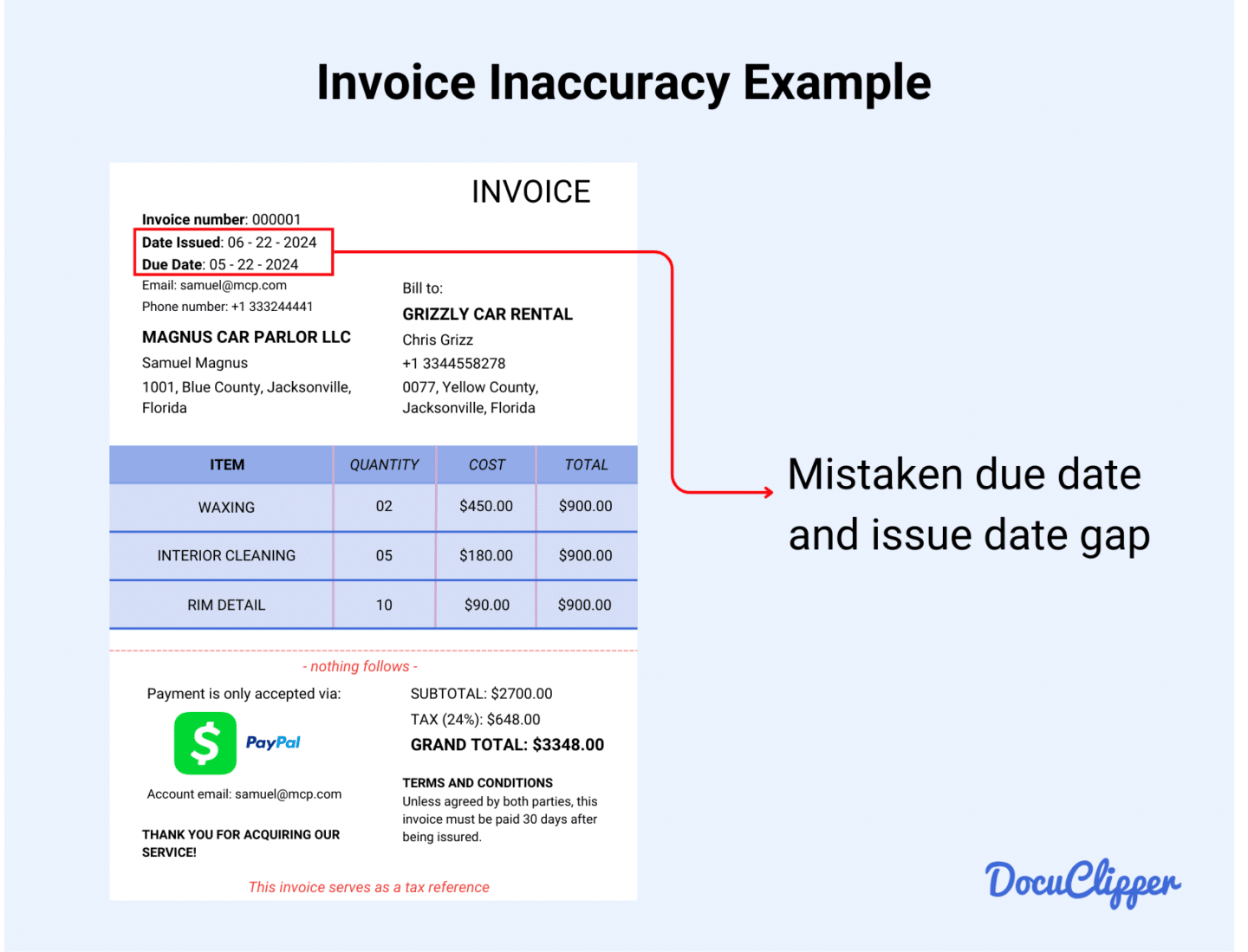

- Due dates and purchase dates

- Vague payment terms

- Delayed invoices (being sent to you past the set due date)

- Irregular invoice patterns that don’t match orders

- Incorrect contact information and address

- Wrong tax charges and rates

- Unclear conditions and terms of penalties for late payments

- Hidden fees added without disclosure

- Missing late fees that should have been included

- Unable to provide alternative payment options

- Unusual invoice formats or not tabular line item organization.

- Not branded or personalized invoices

There are more specified errors that you can find in an invoice, these are just the more prevalent ones.

FAQs about Invoice Accuracy

Here are some frequently asked questions about invoice accuracy:

How do you ensure the accuracy of invoices?

To ensure invoice accuracy, validate all details like customer information, amounts, and dates against purchase orders and receipts. Use automation tools like invoicing software or OCR to reduce manual invoice processing errors. Cross-check tax calculations and payment terms, and have invoices reviewed and approved before sending to clients.

How do I know if an invoice is correct?

To know if an invoice is correct, cross-check its details against purchase orders, receipts, and contracts. Verify amounts, line items, tax calculations, and payment terms. Ensure customer and vendor information is accurate, and confirm approvals. Using validation tools can further help detect discrepancies.

How do you ensure accuracy and attention to detail when processing invoices and payments?

To ensure accuracy and attention to detail when processing invoices and payments, validate all invoice details against purchase orders and receipts. Use automated tools like OCR or invoice processing software to minimize errors. Review tax calculations, payment terms, and approvals carefully before finalizing payments. Maintain organized records for accountability.

Why is billing accuracy important?

Billing accuracy is important because it ensures smooth financial operations, avoids disputes, and builds trust with clients and vendors. Accurate billing minimizes errors, saves time, prevents legal or compliance issues, and strengthens relationships by demonstrating professionalism and reliability. It also reduces costs associated with correcting mistakes or handling disputes.