Automation makes business tasks like handling receipts, invoices, payroll, and transactions faster and more accurate.

It helps businesses work more efficiently, improve invoice accuracy, and give them more time to grow and invest their resources in other aspects of their business.

In this blog, we’ll look at invoice automation, which helps manage billing and payments. We’ll explain what it is, why it’s beneficial, and how to start using it in your business.

What is Invoice Automation?

Invoice automation is a mix of software and processes that allows you to streamline and automate the entire process of handling invoices.

It starts with capturing invoice data using OCR technology, extracting key information such as vendor details, invoice date, amounts, and due dates.

You then validate invoice data against purchase orders and contracts to ensure accuracy.

Then route invoices through your specific approval workflow, which can involve multiple approvers. Approved invoices are automatically posted to your ERP or accounting system for payment processing.

You can automate payments, schedule them, and manage various payment methods. Additionally, you gain access to detailed reports and analytics on your invoice processing metrics.

By implementing invoice automation, you reduce manual invoice processing, work and errors, save costs, speed up processing times, enhance accuracy, ensure compliance, and gain real-time visibility into invoice statuses and payment workflows. This boosts efficiency and control over your finances.

Why is Invoice Automation Important?

Invoice automation helps businesses handle accounts payable faster and with fewer mistakes, which makes the whole process smoother and more efficient.

This technology speeds up how quickly invoices are processed and reduces the chance of errors while saving valuable time.

With invoice automation software you can process hundreds of invoices in just a few seconds.

Additionally, it saves money by doing jobs that people used to do. With fewer people needed to process invoices, businesses can use their resources better and cut down on staffing costs or allocate their resources where are more needed.

This makes financial operations not just faster, but also cheaper, more efficient, and profitable.

For example, getting a data entry clerk to transfer the information from an invoice costs a lot on an hourly basis.

A data entry clerk can cost $18.93 every hour and it can take around 10-15 minutes to manually extract data from one invoice into ERP or accounting software while OCR software that specializes in invoices can cost around $40.00 for the whole month and can process 100s of invoices in seconds and you can easily import the data into any ERP or accounting software.

Automation is crucial for accounts payable and invoice automation is one of the essential ones your company should implement into your invoice workflow.

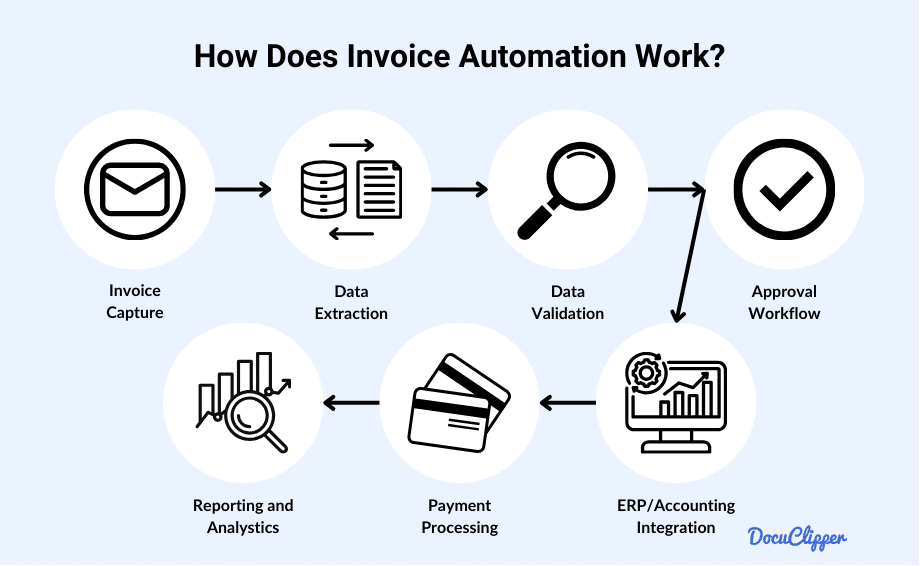

How Does Invoice Automation Work?

Invoice automation works through a series of streamlined and automated steps designed to handle invoices efficiently from receipt to payment, automating both of yours pre-accounting and post-accounting processes.

Of course, at first, you might not be able to streamline and automate the entire invoice process, but you can automate first the most time-consuming, error-prone, and/or expensive tasks.

Here’s how the full automation typically works:

- Invoice Capture: Invoices are received through various channels such as email, paper, or e-invoice formats. OCR (Optical Character Recognition) technology is used to digitize and capture invoice data, facilitating paperless invoice processing.

- Data Extraction: With invoice parser Key data such as vendor information, invoice number, date, line items, amounts, and due dates are automatically extracted from the captured invoices.

- Invoice Reconciliation: The extracted data is validated against predefined rules and cross-checked with purchase orders, contracts, and receipts to ensure accuracy and compliance.

- Invoice Approval Workflow: The system routes the invoice through an automated approval process based on your organization’s specific workflow, which may involve multiple levels of approval.

- ERP/Accounting Integration: Once approved, ERP invoice processing begins and the data is automatically posted to your Enterprise Resource Planning or accounting system, ready for payment processing.

- Payment Processing: Payments can be scheduled and managed automatically, ensuring timely payments through various methods like ACH, wire transfer, or checks.

- Reporting and Analytics: The system provides detailed reports and analytics on invoice processing metrics, offering insights into processing times, volumes, and payment statuses.

As I said, at first you might not be able to automate the entire process.

Furthermore, you might need several tools to automate it, such as invoice scanning solutions such as DocuClipper for extracting data from invoices and accounting software for invoice approval and payment processing.

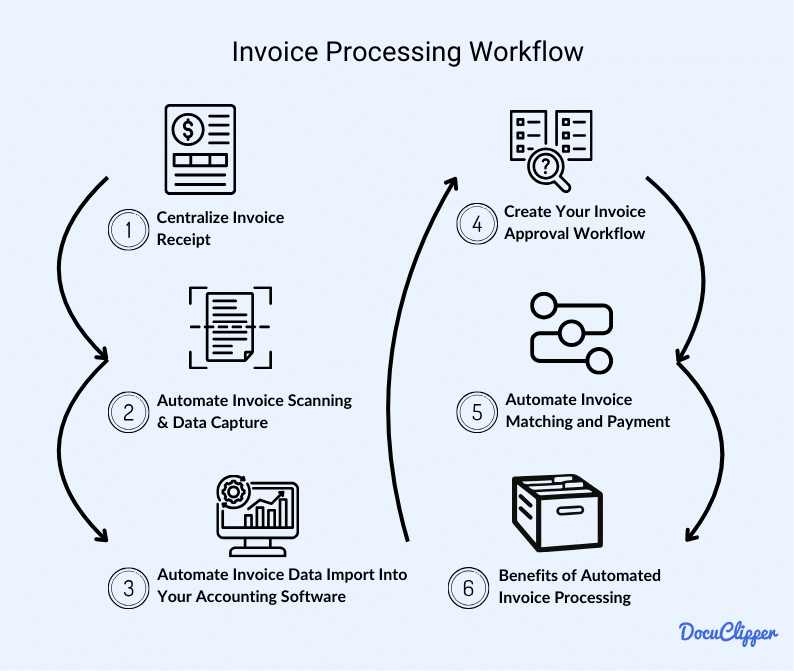

How to Automate Invoice Processing for Your Business?

Automation is quite a broad term when you put it into practice for your business. You have the option to automate your entire invoice workflow or just a portion of it, depending on the availability of resources that you have.

Once you decide or talk through your team about automating your process, here are some steps to start automating your invoice processing for your business.

Step 1: Centralize Invoice Receiving

First, centralize all invoices and receipts by collecting them in a single system or location, such as a dedicated accounts payable software or a centralized digital repository. This ensures that every invoice and receipt is accounted for and easily accessible.

Centralizing documents in one place prevents any invoices from being overlooked or missed, This approach not only keeps your invoices organized but also streamlines the processing and tracking of payments.

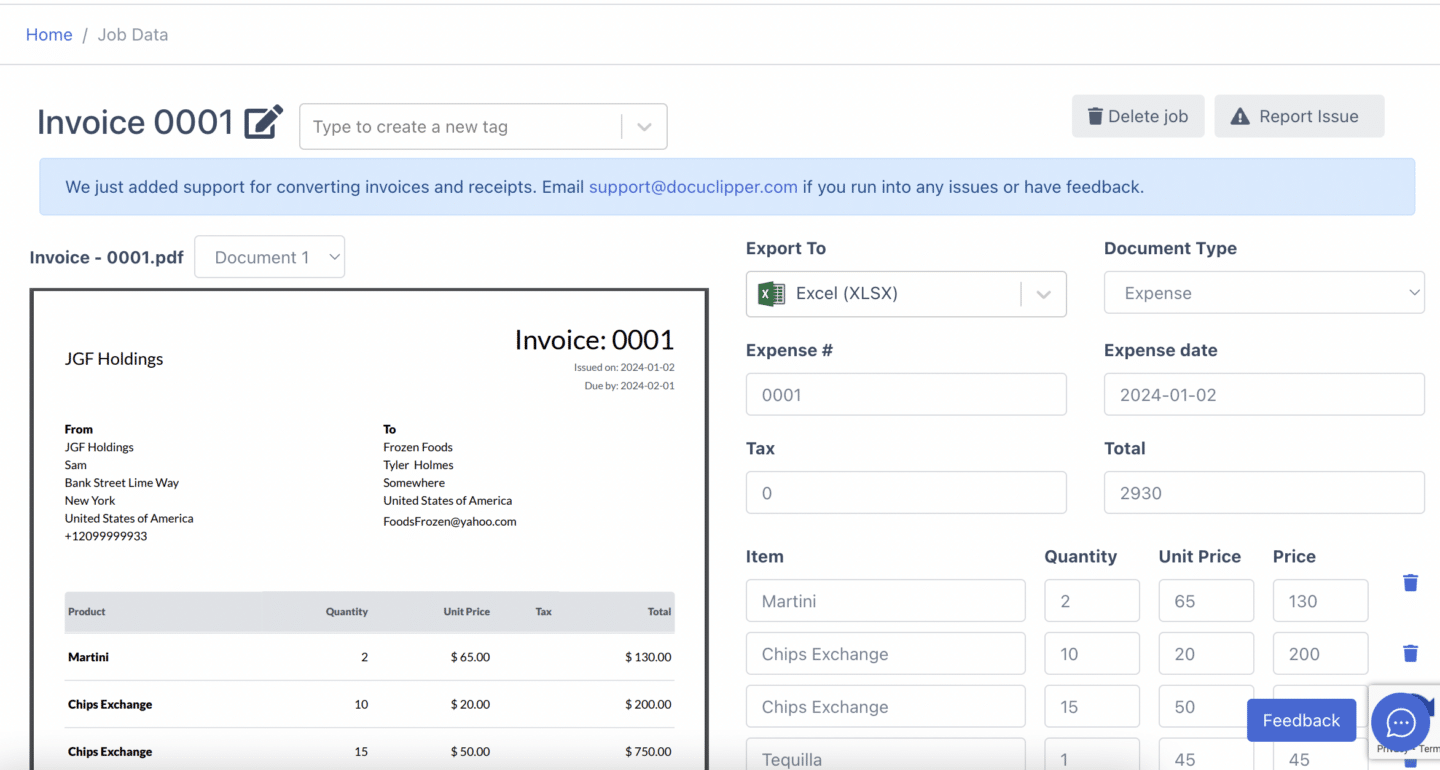

Step 2: Automate Invoice Scanning & Data Capture

Once you’ve gathered all your invoices and receipts in one place it’s time to convert your invoices into Excel, CSV, or import them into your accounting or ERP software.

You can use a tool like DocuClipper to scan and collect data from invoices automatically.

DocuClipper invoice scanning capabilities are great because it can handle lots of invoices from various vendors and providers and quickly pick out the important details, no matter their format as long as they are in PDFs.

Even though this tool does most of the document data extraction work, it’s a good idea to check over the information it collects now and then to make sure everything is correct.

This step makes managing your invoices a lot easier and helps to avoid mistakes helping you to digitalize your invoices.

Step 3: Automate Invoice Data Import Into Your ERP/Accounting Software

Once you’ve collected invoices using tools like DocuClipper invoice OCR, the next step is to automate their import into your ERP (Enterprise Resource Planning) or accounting software.

With DocuClipper you can easily import invoices into QuickBooks while also setting rules to categorize expenses and assign invoices to customers or vendors.

This integration should be automatic to eliminate manual data entry, thus reducing errors and saving time.

By ensuring that all invoice information flows seamlessly into your financial systems, you streamline the entire accounting process. This automation not only improves accuracy but also enhances financial reporting and analysis capabilities.

For example, DocuClipper can automatically import your invoice and receipt data into QuickBooks with one click.

Or you can just export the data into CSV and upload your data into any accounting or ERP software.

However, if you want to really automate your invoice processing, then using invoice OCR API such as from DocuClipper will allow you to automatically send invoices for data capture and import them into your accounting or ERP system.

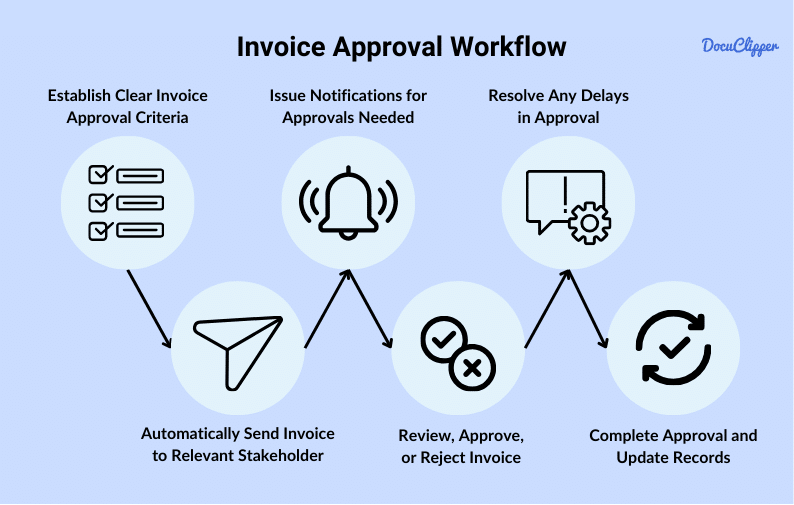

Step 4: Create Your Invoice Approval Workflow

Set up an automated invoice approval workflow in your system. Define clear rules and criteria for invoice reviews and approvals to ensure consistency such as sending the invoice to the right stakeholder based on selected criteria.

This automated process helps in managing cash flow better by speeding up the approval process, reducing bottlenecks, maintaining financial control, and improving your supplier relationships.

Implement features like notifications for pending approvals to keep the process moving without delays. Streamlining this process helps maintain financial integrity and operational efficiency.

Step 5: Automate Invoice Matching and Payment

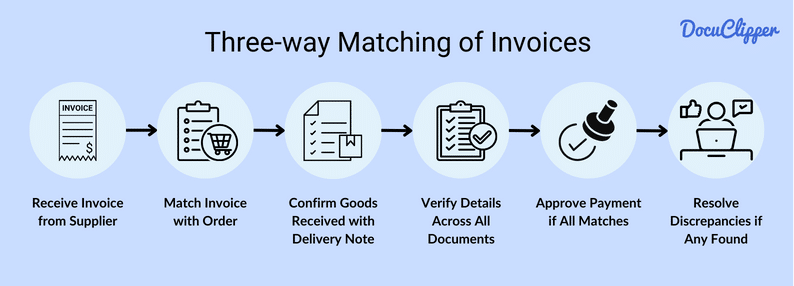

Implement three-way matching to automate your invoice matching and payment processes. This system ensures that every invoice matches the corresponding purchase order and goods receipt before payment is approved.

Specifically, three-way matching involves verifying that the product types, quantities, and prices on the invoice align with both the initial purchase order and the receiving report confirming delivery.

Automating this verification process minimizes financial risks, such as fraud, overpayment, and duplicate payments. It also accelerates the payment cycle, guaranteeing timely payments to suppliers in accordance with agreed terms.

This level of accuracy and efficiency not only strengthens supplier relationships but also enhances overall financial reliability.

Learn more about invoice matching:

Step 6: Archive Your Invoices

Develop a secure and efficient system for archiving invoices. Digital archiving of all processed invoices is essential for compliance, auditing, and financial analysis.

Examples of effective archiving practices include using cloud storage solutions that offer robust security features and automatic backup, employing document management systems that classify and index invoices for easy access, or using dedicated financial software with built-in archiving and search functions.

Ensure that your system supports easy searching and retrieving of invoice data as needed.

Benefits of Automated Invoice Processing

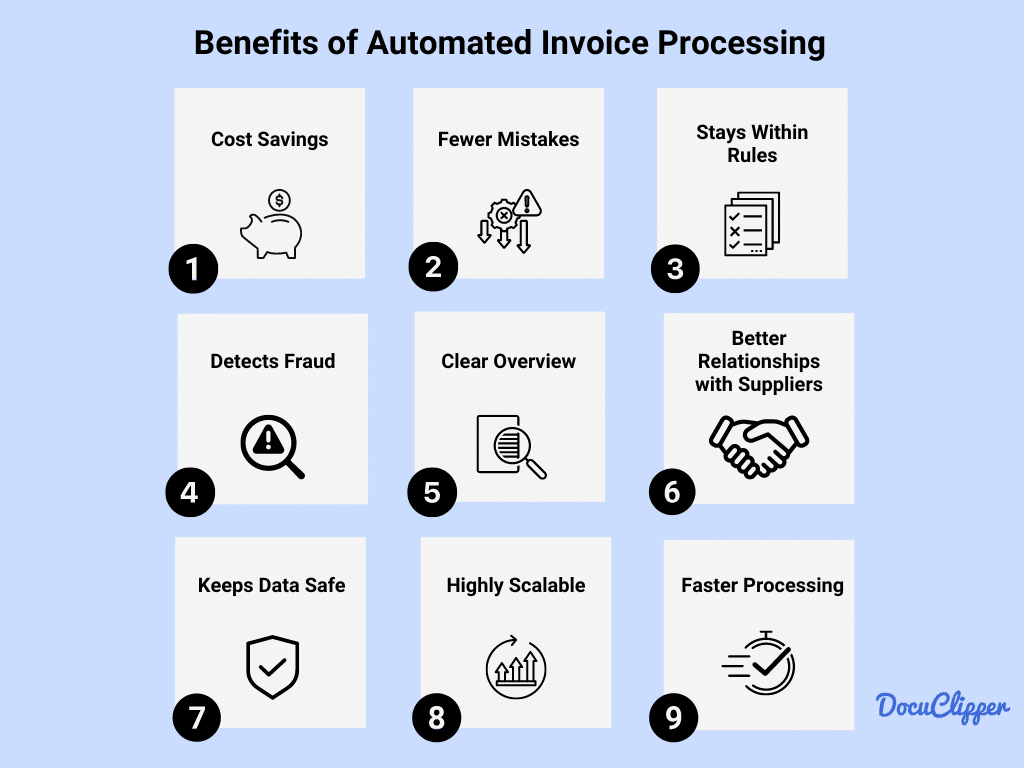

Automated invoice processing has many benefits that help businesses run more smoothly and efficiently:

- Faster Processing: Automation speeds up the entire process of handling invoices. OCR quickly captures and processes data, allowing businesses to approve and pay invoices much faster.

- Cost Savings: It reduces the need for people to manually enter invoice data, lowering the cost of processing invoices. This saves money and allows employees to focus on more important tasks. Many businesses combine invoice automation with online accounting and bookkeeping services to further streamline their financial operations and reduce overhead costs.

- Fewer Mistakes: Automated systems are very accurate, reducing errors from manual data entry. This means fewer issues and adjustments later on. AI invoice processing systems are highly accurate, reducing errors from manual data entry

- Stays Within Rules: Automation ensures that all the transactions are done correctly according to the rules, which is great for when businesses need to show their accounts to auditors or comply with regulations.

- Better Relationships with Suppliers: Because invoices get processed faster, payments to suppliers are quicker. This can lead to better relationships and possibly better terms from suppliers.

- Clear Overview: Automation gives businesses a clear view of their billing and payments at any time, helping them manage their money better.

- Highly Scalable: As a business grows and handles more invoices, automated systems can manage the increase without needing more staff.

- Detects Fraud: The system can spot unusual patterns that might suggest fraud, helping to prevent it.

- Keeps Data Safe: Automated systems often have strong security measures to protect sensitive information from being stolen or seen by the wrong people.

Conclusion

Invoice automation is a transformative solution that significantly enhances the efficiency and accuracy of financial processes for modern businesses.

By implementing this technology, companies can expedite the handling of invoices—from invoice capture to payment—ensuring that financial operations are not only faster but also more cost-effective and secure.

Automating the mundane tasks associated with invoice processing allows businesses to allocate more resources to strategic growth initiatives, fostering a more dynamic and resilient operation.

How DocuClipper Can Help with Automating Invoices?

DocuClipper is a smart financial document processing tool that tackles bank statements, invoices, checks, brokerage statements, and receipts. It has an accuracy rating of 97% in invoice data extraction that can easily be extracted into Excel, CSV, and QBO.

It can also process hundreds of invoices in a few seconds and possess high-security measures for data protection. This software is highly versatile and easy to use once you enter business automation.

FAQs about Invoice Automation

Here are some frequently asked questions about invoice automation and how to do it.

What is the best software to capture data from Invoices?

DocuClipper is highly recommended for its accuracy and efficiency in data extraction from invoices. It seamlessly integrates with systems like Excel, CSV, and QBO, making it a versatile choice for various business needs.

How does invoice automation impact financial reporting and compliance?

Invoice automation improves financial reporting by providing accurate and timely data, which helps in making informed business decisions. It enhances compliance by ensuring that all transactions adhere to regulatory standards and are easily traceable, which is crucial during audits.

Can invoice automation work with multiple currencies and tax systems?

Yes, advanced invoice automation systems are designed to handle multiple currencies and accommodate different tax systems. This flexibility is essential for businesses operating in a global market, allowing them to manage international transactions efficiently.

What are the typical costs involved with setting up invoice automation?

The costs can vary depending on the complexity of the system and the scale of implementation. Initial expenses may include the cost of software acquisition, integration into existing systems, and training staff. However, these costs are often offset by the savings achieved through reduced manual labor and increased efficiency.