Invoice capture technology transforms how businesses handle financial documentation by automating the extraction of critical data. This automated invoice capture process eliminates manual data entry while significantly improving accuracy and efficiency.

For enterprises processing hundreds or thousands of invoices monthly, manual verification becomes nearly impossible for accounting teams.

Automated invoice capture solves this challenge by digitizing and extracting key data, making information instantly accessible and processable.

In this blog, we’ll talk about how invoice capture works how to check and extract invoice data from PDF and what are the benefits of having automated invoice capture processes.

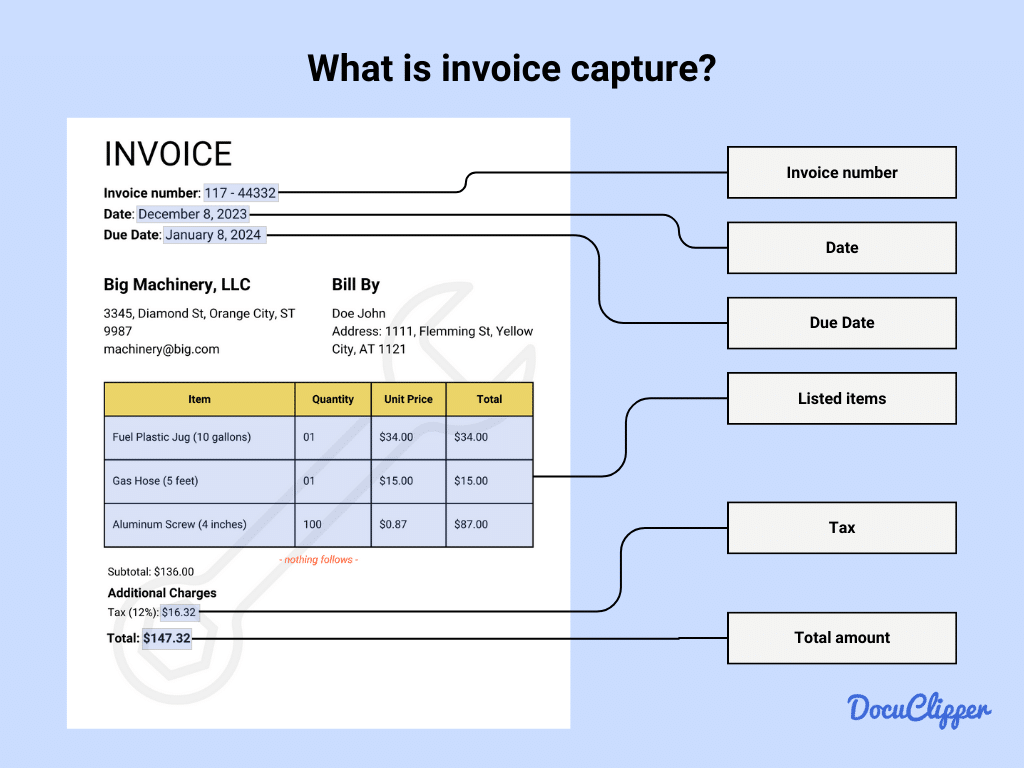

What is Invoice Capture?

Invoice capture is the process of extracting essential information from invoices using specialized automation technology.

This technology identifies and digitizes key data such as vendor information, invoice numbers, dates, amounts, line items, and payment terms from both digital and paper documents.

Modern invoice capture solutions use advanced technologies including Optical Character Recognition (OCR) and machine learning to accurately convert unstructured invoice data into structured, usable information for accounting systems.

These solutions typically achieve accuracy rates of up to 97% while processing documents in seconds rather than minutes.

For businesses handling multiple invoices daily, invoice capture technology eliminates the tedious manual data entry process that often leads to errors and delays. The technology works by:

- Automatically reading text from scanned or digital invoices

- Identifying important financial data points based on their location and context

- Converting this information into structured data formats

- Validating the extracted data against business rules

- Preparing the information for integration with accounting systems

Invoice capture serves as the foundation for efficient accounts payable automation, transforming what was previously a labor-intensive task into a streamlined digital workflow.

By eliminating manual data entry, organizations can significantly reduce processing costs while improving data accuracy and financial visibility.

As businesses increasingly move toward digital transformation, implementing effective invoice capture solutions has become essential for maintaining competitive operational efficiency in financial departments.

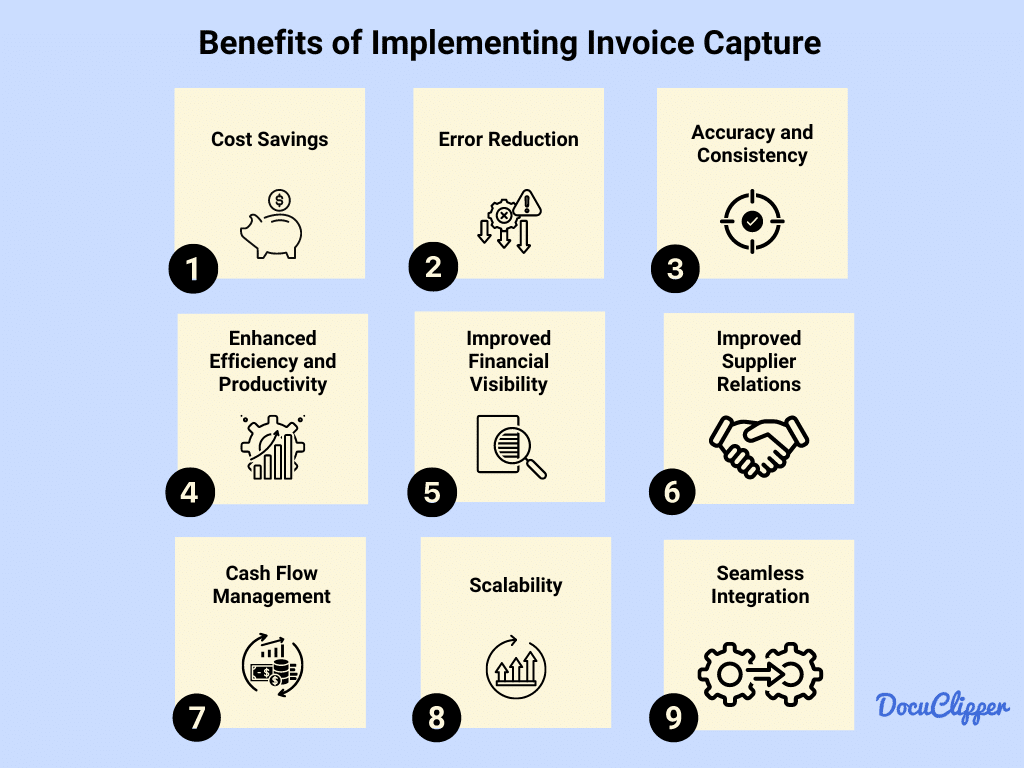

Benefits of Implementing Invoice Capture

There are many benefits in implementing invoice capture as many accounting firms are slowly adapting to automated data entry processes for assessing financial information.

1. Cost Savings: Automation significantly reduces costs per invoice from about $16 to as low as $3, according to the Institute of Finance & Management (IOFM).

2. Error Reduction: Automated systems like invoice data capture decrease data entry errors by up to 34%, improving overall financial accuracy.

3. Accuracy and Consistency: Optical Character Recognition (OCR) technology achieves 97% accuracy when processing invoices, ensuring uniform outputs across various formats.

4. Enhanced Efficiency: Streamlining accounts payable processes cut invoice processing times by up to 80%, allowing finance teams to focus on higher-value tasks.

5. Improved Financial Visibility: Digitalization of invoice data enables comprehensive real-time financial analysis and reporting within a unified system.

6. Better Supplier Relations: 25% of AP team members report that slow payment processing spoils client relations. Fast OCR data capture processes prevent this issue.

7. Enhanced Cash Flow Management: Financial tools within invoice processing software provide dynamic insights into cash flow patterns and opportunities.

8. Scalability: Modern systems can extract data from documents in seconds, allowing businesses to handle increasing invoice volumes without proportionally increasing staff.

9. Seamless Integration: API systems in software like DocuClipper facilitate direct connections to accounting platforms such as QuickBooks, Sage, and Xero, minimizing data transfer errors and eliminating duplicate entries.

By implementing automated invoice capture, businesses can transform their financial operations from a cost center to a strategic asset that drives organizational efficiency.

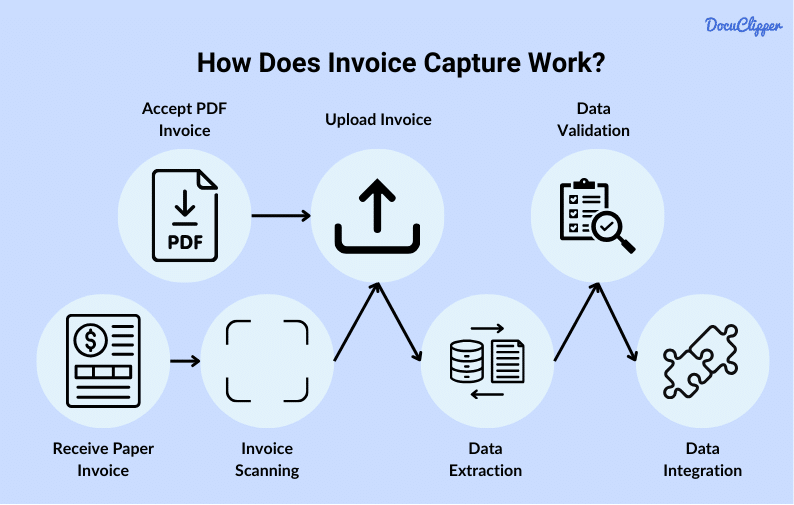

How the Invoice Capture Process Works

Invoice capture streamlines financial record-keeping by automating the entry and processing of invoice data. Here’s how it typically works:

- Centralize Invoice Receiving: Businesses receive invoices either as PDFs via email or as paper documents. Each format requires a different initial handling method.

- Uploading and Scanning: PDF invoices are directly uploaded to the invoice capture software. Paper invoices, however, must first be scanned to create a digital copy.

- Data Extraction: The invoice capture software then extracts information from the invoice. This includes the vendor’s name, address, invoice number, the total amount due, line items, dates, and possibly terms of payment.

- Data Validation: After extraction, the software performs invoice reconciliation. This step ensures that the extracted information matches what’s on the invoice, reducing the likelihood of errors. Common ways are 2-way matching, 3-way matching, or 4-way matching.

- Data Integration: Finally, the validated invoice data is transferred to an accounting system or a spreadsheet. This integration allows for streamlined financial management, where payment tracking and general bookkeeping are simplified.

The invoice capture process allows you to streamline your invoice processing and keep your invoices organized so you don’t miss any invoices and payments are made in due time.

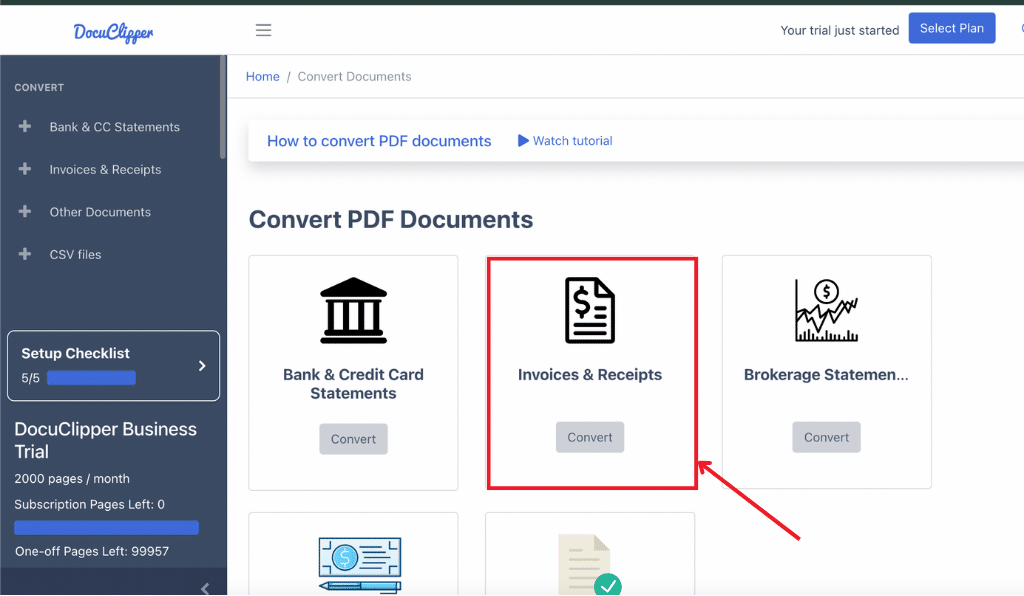

How to Implement Invoice Data Capture

Once you have decided that you need to capture invoice data with the right software in place, here are the steps to start it launching.

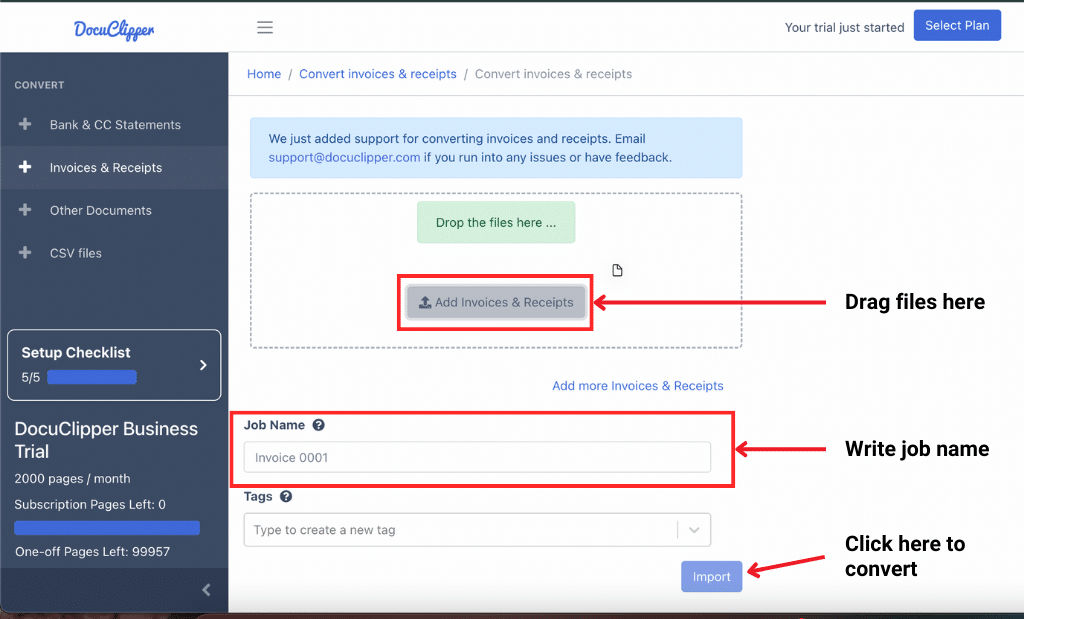

Step 1. Open Software: Launch DocuClipper and navigate to the “Invoices and Receipts” section.

Step 2. Upload Files: Drag or upload your invoice files into the software. Assign a name to this job for easy tracking.

Step 3. Initiate OCR: Use DocuClipper’s Optical Character Recognition (OCR) to read the invoice text on scanned invoices. This technology allows for the processing of multiple invoices simultaneously. Click on “import” to begin.

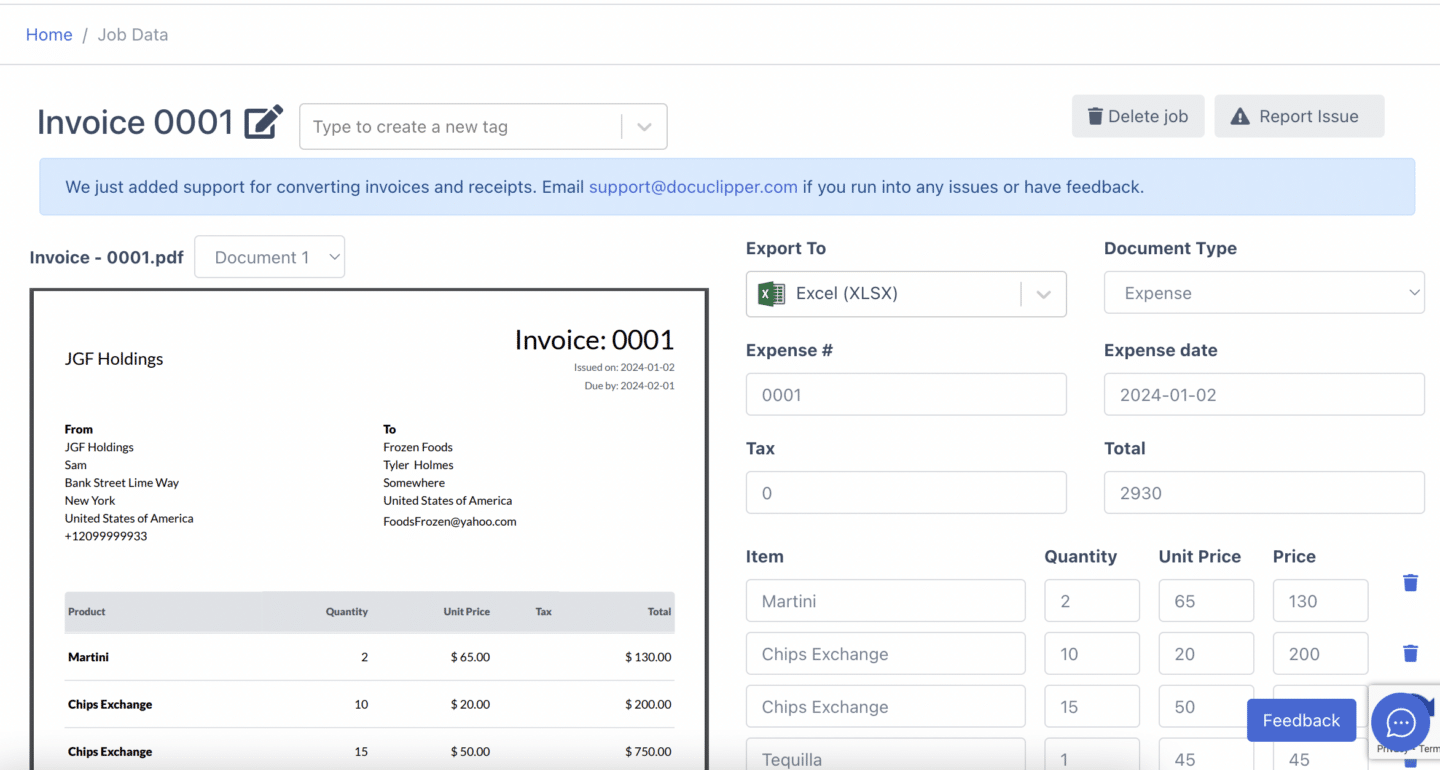

Step 4. Invoice Data Extraction: DocuClipper will automatically extract details such as item descriptions, subtotal, tax, total, and dates, from the invoices.

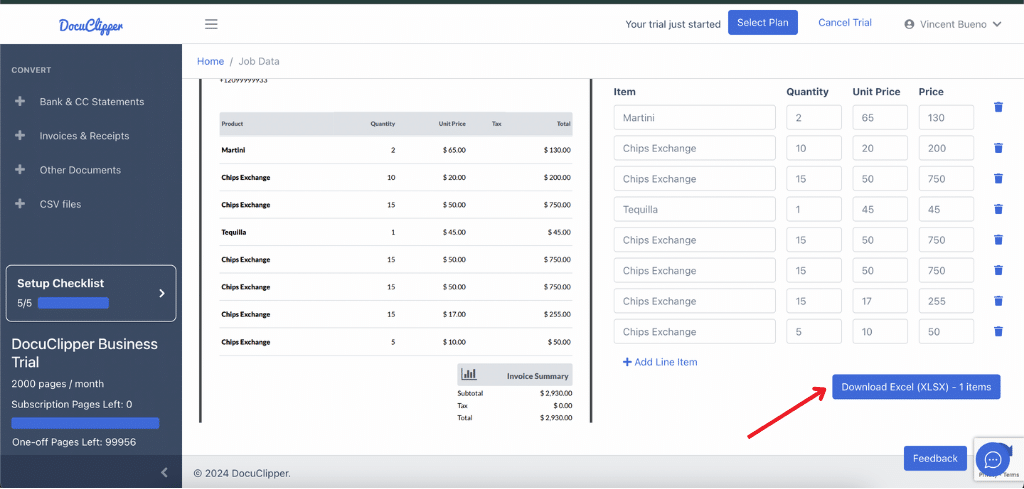

Step 5a. Preview and Export: Review a preview of the extracted data, including taxes, dates, and items. Decide the format for the output file—Excel, CSV, or QBO. Choose the desired format and click “Export” to complete the process.

Step 5b. Import Invoices Into QuickBooks: Furthermore you can import extracted invoices into QuickBooks by connecting your QB account to DocuClipper.

Best Practices for Improving Invoice Capture Accuracy

Here are 5 best practices for improving invoice capture accuracy:

- Upload Original PDFs: When the vendor, supplier, or shop provides a PDF invoice, use that one as it contains the best quality and original data

- Use High-Quality Scanners: Invest in high-quality scanners to ensure clear images, reducing the risk of OCR errors when converting paper invoices to digital formats.

- OCR Preprocessing: When using scanned data, preprocessing like cleaning, cropping, and tilting the invoice has a lower chance of affecting OCR accuracy.

- Select Specialized Invoice OCR Software: Unlike generic OCR software, Invoice OCR accounts payable OCR software such as DocuClipper uses specialized algorithms to extract data from invoices with the highest accuracy.

- Implement Double-Check Systems: Set up verification protocols where key invoice data is double-checked either by automated systems or manually by staff to catch and correct errors.

- Train Your Team: Regularly train employees on the latest invoice processing technologies and error-checking procedures to maintain high levels of invoice accuracy in data capture.

Overall, the Invoice OCR accuracy depends on several factors, practicing these steps can help you stay away and avoid any variables that might give rise to potential errors in your invoice capture process.

Invoice Capture vs. Manual Data Entry: ROI Comparison

When comparing invoice capture automation with traditional manual data entry, the return on investment becomes apparent across multiple dimensions.

Beyond the immediate cost savings, automated invoice capture delivers measurable improvements in efficiency, accuracy, and staff satisfaction.

Processing Time Comparison:

| Process | Manual Entry | Automated Invoice Capture | Improvement |

| Single Invoice Processing | 2-5 minutes | 30-60 seconds | 60-80% reduction |

| Monthly Invoice Volume (500) | 17-42 hours | ~1 hour (batch processing) | 95% reduction |

| Annual Time Commitment | 200-500 hours | 12-24 hours | 180-480 hours saved |

| Processing Cost | $10-$15 per invoice | $0.08-$0.20 per invoice | 98% cost reduction |

| Monthly Software Cost | N/A | $40-$100 | Process hundreds of invoices |

| Annual Cost (500 monthly) | $60,000-$90,000 | $480-$1,200 + subscription | $58,000+ annual savings |

| Error Rate | ~4% | <1% | 75% error reduction |

| ROI Timeline | N/A | Immediate | Quick payback period |

Error Rate Comparison:

Manual data entry typically results in a 4% error rate, while automated invoice processing reduces this to less than 1%. For a business processing 6,000 invoices annually, this translates to 240 errors with manual processing versus just 60 with automation—a 75% reduction in potential payment issues.

Additional ROI Factors:

- Early Payment Discounts: Faster processing enables capturing 1-2% discounts, saving $10,000-$20,000 annually on $1M in purchases

- Staff Reallocation: AP staff can focus on value-added activities like vendor relationship management and financial analysis

- Audit Preparedness: Digital records and consistent data formatting reduce audit preparation time by approximately 60%

- Scalability: Business growth no longer requires proportional increase in AP headcount

The transition to invoice capture technology typically achieves full ROI within 3-6 months for mid-sized businesses processing 300+ monthly invoices. Most organizations report payback periods shortening further as invoice volumes increase.

For businesses evaluating an invoice automation solution, calculating your specific ROI should include both the tangible cost savings and the less quantifiable benefits of improved data accuracy, enhanced vendor relationships, and strengthened financial controls.

Best Invoice Capture Software

Once you decide to go automated in processing invoices, here are some of the best invoice capture software available:

- DocuClipper: DocuClipper is a specialized web-based tool designed for scanning invoices into structured data formats such as Excel, CSV, and QBO with a remarkable accuracy rate of 97%.

- AutoEntry: AutoEntry is a specialized data automation tool tailored for streamlining accounting processes by automating the extraction and publication of data to major accounting software platforms. It can also scan invoices for accounting use.

- DextPrepare: Dext Prepare is a specialized platform designed to enhance the productivity and profitability of accountants and businesses. It offers robust tools that prepare, sort, and automatically publish invoices and receipts.

- Docsumo: Docsumo is a leading Intelligent Document Processing (IDP) solution for financial docs. Initially launched to automate invoice processing.

- Nanonets: Nanonets is an AI-driven invoice parser automation platform tailored for streamlining complex business processes. It uses AI to extract and convert valuable information from invoices and receipts into practical insights.

Conclusion

Invoice capture opens up accounting practices by automating data extraction from invoices, and streamlining financial management.

Paperless invoice processing ensures critical details are accurately and swiftly captured, supporting thorough financial analysis and reporting.

It ensures critical details are accurately and swiftly captured, supporting thorough financial analysis and reporting. Adopting automated invoice capture allows businesses to enhance efficiency, reduce costs, and improve accuracy across financial operations,

FAQs about Invoice Capture

Here are some frequently asked questions about invoice capture:

How do I capture information from an invoice?

To capture information from an invoice, utilize specialized software equipped with Optical Character Recognition (OCR) technology. This software scans both digital and paper invoices to extract key data automatically.

What is an invoice record?

An invoice record is a detailed document that captures all the transactional details between a seller and a buyer, such as dates, amounts, item descriptions, and other relevant service or product details.

How do I capture an invoice in Excel?

To capture an invoice in Excel, first, convert the invoice into a digital format using OCR software. Then, import the extracted data into Excel either manually or through automated data integration tools.

What is billing information for invoice?

Billing information refers to the details of the party responsible for making the payment. This typically includes the name, address, and financial details like credit terms and payment methods.

What is the invoice process?

The invoice process includes several steps: issuing the invoice, confirming its receipt, checking and validating its contents, approving it for payment, and processing the payment to close the transaction.

What is the invoice data?

Invoice data includes critical information such as vendor and customer details, invoiced amounts, dates of transaction, and descriptions of the items or services provided.

What is the main purpose of an invoice?

The primary purpose of an invoice is to formally request payment for goods or services provided, serving as a documented claim for payment under agreed-upon terms.

What is the difference between invoice and billing invoice?

Generally, both terms refer to the same document. However, ‘billing invoice’ is sometimes specifically used to refer to documents related to periodic or recurring billing.

What is invoice filling?

Invoice filling is the process of completing an invoice with necessary data, such as item descriptions, quantities, prices, and total costs, ensuring all information is accurate and comprehensive for billing purposes.