Over 95% of invoices are received in digital format either as PDF or e-invoices, making invoice digitalization so much easier or almost obsolete.

However, despite most of the invoices being in some digital form, there is still a lot more you need to do, to process your invoices.

In this article, I am going to walk you through how you can digitalize paper invoices, as well as how to further process your invoices so you can import clean financial data into your ERP or accounting software.

What is Invoice Digitization?

Invoice digitization is the process of turning physical or scanned invoices into a digital format that you can easily process, manage, and integrate with software systems.

It starts by scanning paper invoices into PDF format and extracting important details like the invoice number, date, supplier information, line items, taxes, total amounts, and other details.

This digital transformation ensures your invoices are organized and ready for seamless use in accounting or ERP systems.

Think of it as a way to replace manual data entry and filing cabinets with efficient, software-driven workflows and instead of dealing with stacks of paper or cumbersome PDFs, digitization allows you to automate tasks, reduce errors, and save time.

Whether you’re scanning a paper invoice or capturing data directly from a PDF, the goal is the same, to make your invoice processing faster, smarter, and more accurate.

E-Invoice vs Digital Invoice

An e-invoice is an electronically generated invoice that follows a specific format for easy processing. A digital invoice is any invoice created or shared digitally.

All e-invoices are digital, but not all digital invoices are e-invoices. Both help your businesses streamline billing, but e-invoices are more structured.

- E-Invoice: An e-invoice is a standardized digital document designed for your business to interchange data electronically.

For example: In the USA when you submit an e-invoice through an invoice processing platform used by federal government agencies. This platform ensures that invoices are in a structured format which streamlines compliances.

It is often created and processed within specialized systems, following predefined formats and compliance requirements.

- Digital Invoice: A digital invoice is any other invoice that exists in an electronic format, such as a PDF, Word document, or image file. It is a general term that refers to invoices that are not on paper but are shared and stored digitally.

For example: A digital invoice could be a simple PDF invoice you email to a client or one created using invoicing software like QuickBooks

Key Differences:

| BASIS | Digital Invoice | E-Invoice |

| Format | Unstructured or Semi-structured (PDF or image) | Fully structured (XML or JSON) |

| Creation | Manually or Semi-automatically | Fully automated |

| Delivery | Email or sharing file | Shared via secured networks |

| Processing | Manual input or OCR technology | Fully automated |

| Compliances | Not always compliant | Designed for regulatory compliance |

| Usecase | General business communication | Tax reporting, EDI |

Benefits of Digitizing Invoices for AP

Managing invoices doesn’t have to be time-consuming or full of errors. With invoice digitization, you can move from manual paperwork to efficient digital processes. It saves you time, reduces mistakes, and streamlines your workflows.

Whether you run a small business or a large organization, this shift helps you stay organized and efficient.

- Reduced Processing Time: It can take 2-12 minutes to process a single paper invoice depending on the experience, complexity, and length of the invoice. However digitizing invoices using OCR software can reduce this to mere seconds, regardless of the invoice length, complexity, or even an employee experience.

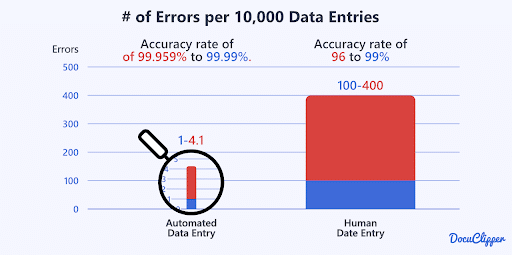

- Improved Data Accuracy: Invoice digitization uses tools like OCR to reduce errors from manual entry by automatically reading and checking details.

Manual data entry errors are so common that they range between 1% to 4%. This means almost 40 data entry errors in 1,000 entries while OCR accuracy ranges somewhere between 99% to 99.5%+ meaning only 5-10 errors per 1,000 entries.

- Direct Cost Reduction: Invoice digitization saves you money by cutting out costs for processing an invoice including paper, printing, storage, and postage. Automation reduces time spent on manual tasks, lowering labour costs.

Faster processing has helped businesses that adopted paperless invoicing reduce their invoicing costs by up to 80%.

- Indirect Cost Reduction: Indirect Cost Reduction is a significant benefit of invoice digitization, as it enhances your overall operational efficiency. By automating invoice processing, you reduce time spent on manual tasks, enabling staff to focus on more strategic activities.

- Improved Workflow: Digital invoicing is the first step towards improving your invoice processing workflow. It will automate your delivery and receipt of invoices into a standardized digital format.

As per recent studies it is shown excessive data entry work can cause your workforce with physical and psychological issues as well.

- Improved Compliance: Invoice digitization makes staying compliant much easier. Automated systems ensure your invoices meet tax regulations and are stored securely for audits. Due to invoice digitization, firms increased their reported sales, purchases, and tax liabilities by over 12%.

- Better Data Analysis: Due to invoice digitisation, analyzing data becomes simple. Automation organizes your invoices and receipts and provides real-time insights into spending, vendor performance, and cash flow.

This makes it easier to spot trends and make better decisions. Accurate data at your fingertips can help you save money and improve your business operations effortlessly.

- Reduced Environmental Impact: We all are well aware of the fact that the primary source of paper is trees. When you adopt invoice digitization you solve not just a business problem but also adopt a sustainable way of conducting operations.

Fully digitalizing regulatory procedures around trade could save between 32 and 86 kg of CO2

Challenges of Working with Paper or PDF Invoices

Handling paper or PDF invoices can be more challenging than you think. You’re stuck with piles of paperwork or endless email attachments, making tracking, storing, and organizing your invoices time-consuming and labour-intensive.

These issues not only slow you down but also disrupt your workflow.

- Manual Data Entry Challenges: Manual data entry is a major challenge for your business if you still deal with physical papers and PDFs. It’s time-consuming, prone to human errors, and often leads to delays in processing. More than 27.5% of accounting professionals claimed data was incorrectly entered in firms.

- Processing Inefficiencies: Due to the manual paperwork handling, you tend to slow down invoice approvals and increase workflow errors. However, automation of such tasks can be a true game changer for your business. With automated data entry companies have experienced an increase of 90% in data accuracy.

- Time and Resource Consumption: Manual data entry is the prime cause of slow turnaround time in your business. It requires a lot of effort from employees who enter all this information manually. Almost 40% of workers claim that most of their work involves manual data entry and repetitive tasks.

- Quality Control Issues: In traditional business practices, inconsistent data quality is a challenge due to working with paper or PDF invoices.

Issues like human error, varying data formats from different sources, and lack of standardized procedures often result in inaccuracies and inconsistent quality in the entered data.

- Compliance and Audit Challenges: Compliance is a challenging area to control when paper-based methods are used. It’s an area where the digital invoice has a major advantage.

You can check and get notifications about compliance due dates that are automatically integrated into your everyday workflow.

How to Digitize Invoices with OCR

Digitizing your invoices and accounts payable process with OCR technology can save you time and reduce errors. In the following steps, I will guide you through how to adopt OCR technology for seamless and efficient invoice management in your business.

Step 1: Scan Paper Invoice to PDF (Only for paper invoices)

The first step is to scan your paper invoices into PDF format.

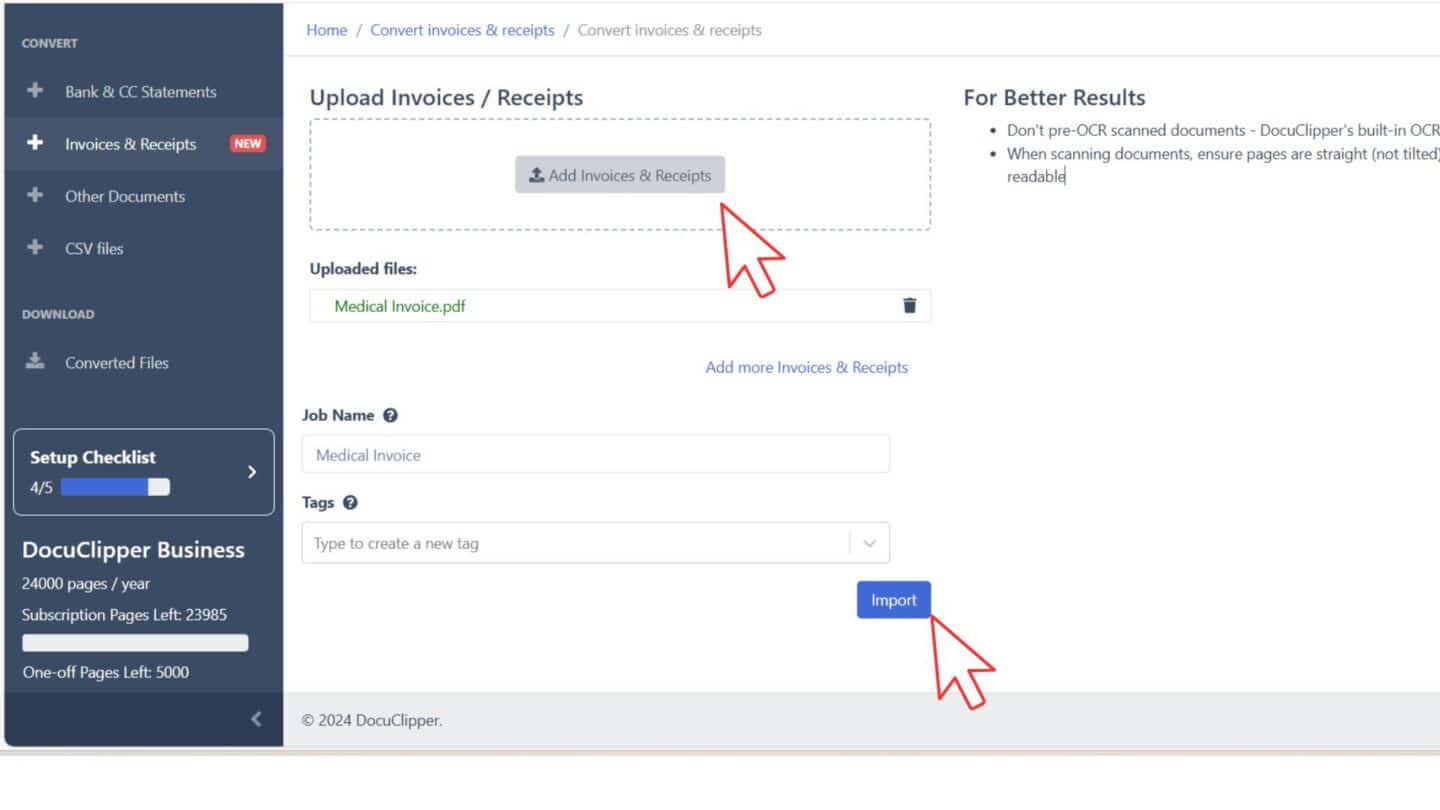

Step 2: Upload PDF Invoices to OCR for Data Extraction

First, upload your PDF invoice using the invoice data extraction software. Vendors often send PDF invoices making this process easier and faster.

Open the DocuClipper web application and select the PDF documents you want to convert. Click “Invoices and Receipts” then Click “Import”.

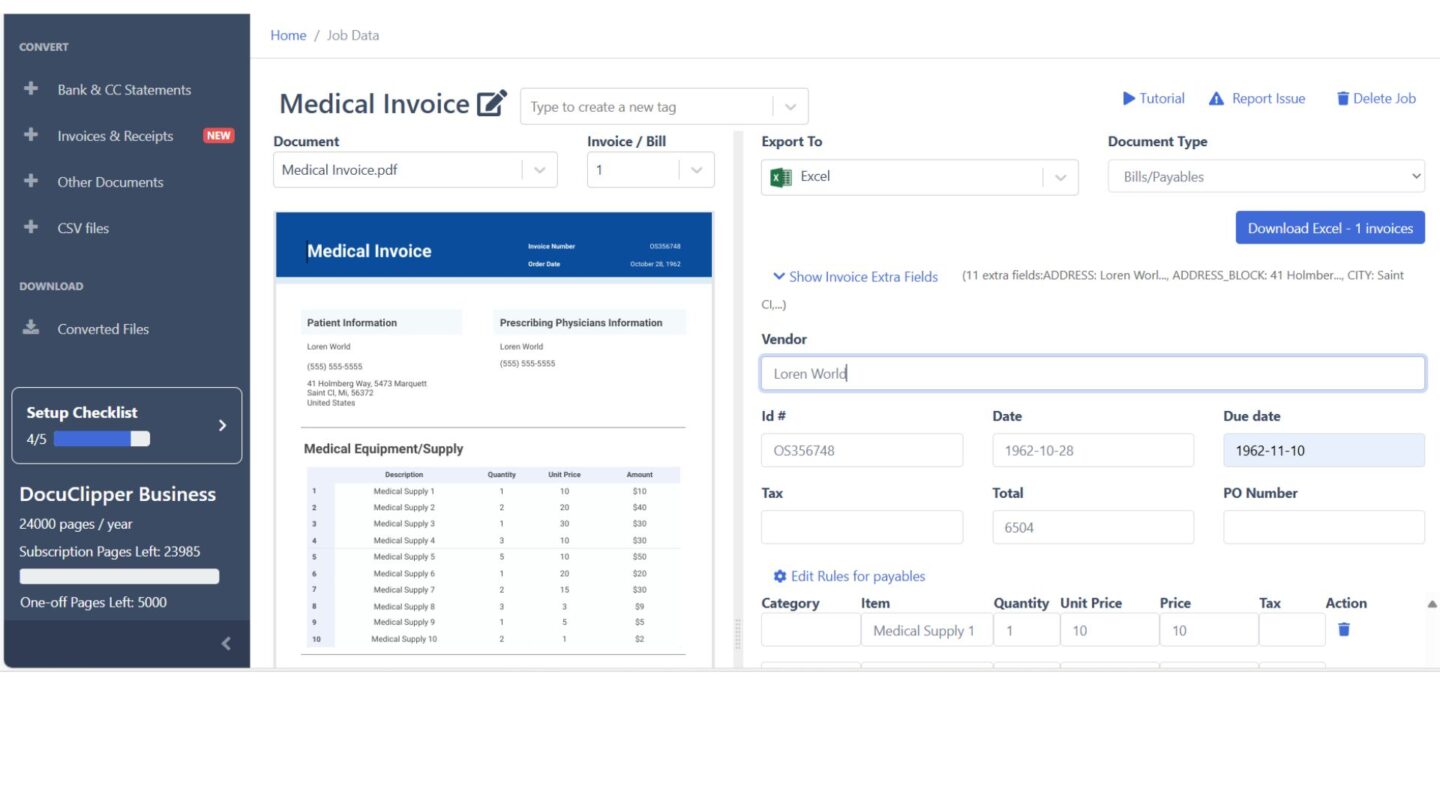

Step 3: Check Invoice Data Extraction

After clicking import, you’ll see a side-by-side comparison of the invoice and the extracted data from the PDF invoice.

This allows you to double-check if the extracted fields are correct, as OCR technology can have limitations.

Use the menu to switch between different invoices for thorough verification. This ensures accuracy before finalizing the OCR data extraction process.

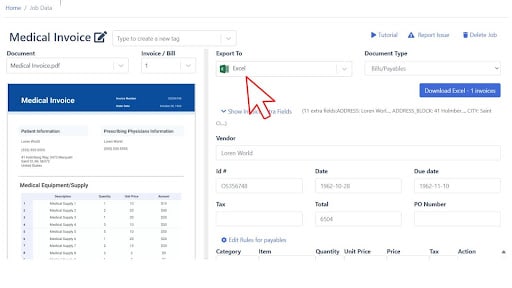

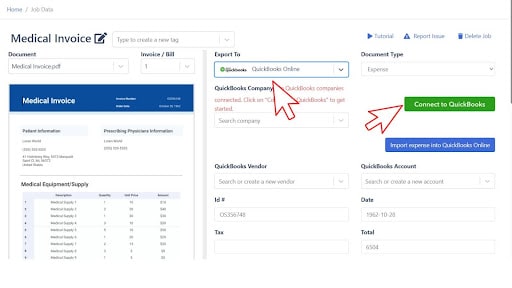

Step 4: Export or Import Invoices

Once you have compared the invoice with the extracted data, Select the type of file you want to export from the dropdown menu.

You will have the option to export it in your preferred format. As shown above, you can download the extracted data in Excel.

You can also export the extracted data into Quickbooks. You have to connect your Quickbooks account with Docuclipper. The integration and export are seamless and will happen in a few seconds.

Best Ways to Digitize Your Invoices and AP

There are multiple ways to digitize your accounts payable process, and the right approach depends on the nature of your business and the type of invoices you handle. You can also combine two or more software tools to create a solution that best fits your needs:

- Use Invoice Scanning Software: OCR invoice processing software extracts key details from your invoice like invoice numbers, dates, and amounts.

The extracted data can be directly integrated into your accounting systems, improving efficiency and record accuracy. It’s a simple yet powerful way to transition from your present manual processes to a more streamlined, digital workflow.

- Adopt Accounts Payable (AP) Automation Tools: Accounts Payable (AP) automation tools like Oracle streamline the entire AP process by automatically capturing and processing your invoice data entries. They will reduce your manual work, minimize errors, and speed up approvals with automated workflows.

By digitizing invoices, your business can save time, improve efficiency, and ensure more accurate financial management.

- Leverage Cloud-Based Solutions: Cloud-based invoice processing lets you save, analyze, and handle invoices automatically. That’s why cloud technology has become an important tool for Accounts Payable in the present accounting era.

The shift to remote work has made cloud invoicing even more popular. In the past, teams had to work on-site, and businesses have adapted their processes, but with finance teams now working from home or other locations

This makes it easier for you to access your invoices in real-time.

- Implement Electronic Invoicing (e-Invoicing): An e-invoice is an electronic invoice delivered in a specific standardized format. This ensures that both the sending and receiving parties can share and recognize the data seamlessly.

Since the invoice data is structured, it can be automatically imported into the buyer’s accounts payable system for easier processing. For example, your supplier might send an e-invoice directly into your company’s ERP system for instant approval and payment.

- Integrate with Enterprise Resource Planning (ERP) Systems: ERP software allows you to manage and record supplier invoices in a centralized system. You can scan, upload, or email invoices directly to the ERP, which will automatically capture and validate details like invoice number, date, amount, and supplier information.

Workflows and approvals can be set up to ensure timely processing and payments. Additionally, ERP systems help prevent duplicate or fraudulent invoices by cross-checking them against your purchase orders and receipts.

- Automate Three-Way Matching: 3-way matching is a process which verifies and cross-checks the details of your invoice with goods receipt notes and purchase orders. It ensures that the billed amount, ordered quantity, and received goods are matching which helps in reducing errors and fraud risks.

This process ensures the accounts payable process quicker approval of invoices, payment accuracy and better compliance in your business.

- Mobile Apps for Invoice Management: Mobile apps streamline invoice management by providing a user-friendly interface where you can generate invoices quickly. You can capture invoices using your mobile cameras, automatically capturing data with OCR technology.

By integrating with other accounting and financial tools, a mobile invoicing app allows you to keep track of their expenses and income seamlessly.

- Establish a Vendor Portal: A vendor portal is a powerful tool for digitizing your invoices by enabling vendors to directly upload their invoices in a digital format. Your vendor portal will streamline the invoice submission process, reducing the need for paper handling and email communication.

For example, using a portal like SAP Ariba, vendors can submit invoices and check payment updates in real-time. Vendors can track the status of their invoices, ensuring transparency and reducing follow-ups.

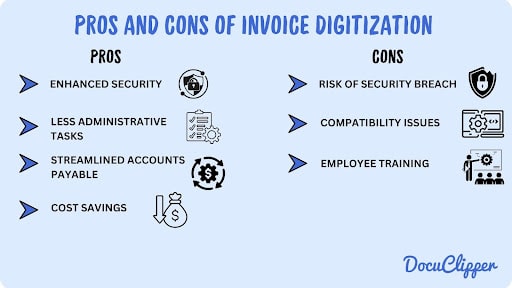

Pros and Cons of Invoice & AP Digitization

Digitizing your invoices and accounts payable can bring great benefits to your business, like faster processing and fewer errors. But it also has its challenges, such as security concerns and potential system compatibility issues. Let’s explore both the pros and cons of digitizing your accounts payable process:

Pros of Invoice Digitization

Digitizing invoices can transform your accounts payable process, improving efficiency, reducing errors, and enhancing your organization. Let’s explore how these benefits can help streamline your business operations and improve overall accounts payable process.

- Enhanced accuracy: Manual invoice processing can cause errors in your accounts payable. By digitizing with OCR, you ensure accurate billing, reduce disputes, and improve customer satisfaction.

- Less administrative tasks: Digitization saves you from time-consuming data entry and paperwork, reducing administrative tasks so you can focus on core business activities and delivering quality products or services.

- Streamlined Accounts Payable: Digital invoice processing integrates easily with your customers’ accounting systems, streamlining accounts payable. It matches invoices with purchase orders and payments, reducing manual effort and boosting efficiency for your customers.

- Cost savings: By digitizing your invoice processing, you save costs associated with paper, printing, mailing, and storage. You also reduce the need for manual labour, which ultimately minimizes labour costs. These cost savings all contribute to your increased margins in business.

Cons of Invoice Digitization

While invoice digitization offers many advantages, it also comes with potential challenges like system compatibility and security risks. Understanding these drawbacks is essential for you to make informed decision.

- Risk of security breaches: When shifting to digital document management, you should prioritize cybersecurity to protect against malware and human errors. Strong security practices safeguard your sensitive data and prevent financial or reputational damage.

- System compatibility issues: When digitizing documents, system compatibility issues can arise, causing inefficiencies or data loss. To prevent disruptions, ensure your new invoice software integrates seamlessly with your existing tools and systems.

- Employee training: Employee training is essential for successful digitization. Train your team to use digital tools effectively, ensuring smooth adoption and maximizing the benefits of digital invoicing for your business.

Accurately Digitize Your Invoices with DocuClipper in Seconds

Simplify your invoice processing with DocuClipper’s powerful OCR technology. You can effortlessly extract data from invoices and integrate it into your accounting system.

Whether you’re dealing with PDFs or scanned documents, DocuClipper makes the process quick and accurate.

Additionally, it’s secure and easy to use, so you can start digitizing your invoices today and experience the benefits.

FAQs about Invoice Digitization

Below we’ve answered some common questions about digital invoicing and related topics:

What is a digital invoice?

A digital invoice is simply an invoice created and stored electronically, often as a PDF. It replaces your paper invoices, making sharing and storing them much easier. You can use tools like OCR or accounting software to integrate it into your workflows and keep everything organized.

Can an invoice be digitally signed?

Yes, you can digitally sign an invoice to confirm its authenticity and ensure it hasn’t been tampered with. Digital signatures use encryption to verify the sender’s identity and protect the document. This adds security, supports legal compliance, and is widely recognized in digital invoicing systems worldwide.

What is the process of invoice scanning?

Invoice scanning lets you turn paper invoices into digital files using scanners or mobile apps. The scanned images are processed with OCR technology to pull out important details like amounts, dates, and vendor info. This data is then stored digitally, making it easy to access and integrate into your accounting system.

What is the invoice verification process?

Invoice verification is all about making sure your invoice is accurate and consistent. You compare the details on the invoice with purchase orders and receipts to check quantities, prices, and terms. If there are any mismatches, they’re flagged for review, helping you avoid errors and ensuring correct payments and fraud prevention.

Are invoices physical or digital?

Invoices can be either physical or digital. Physical invoices are paper documents that you handle manually, mail, or deliver. Digital invoices, however, are electronic files, usually in PDF or other formats, that you send and store online, making them easier to manage and more efficient.