As your business grows you may experience a rise in a number of invoices your accounts payable department receives.

What used to be an easy job to process invoices manually is now becoming troublesome with data entry errors, losing invoices, late payments to vendors, or having problems when filing taxes.

All this can be overcome with proper invoice management practices.

In this blog, we’ll talk about what invoice management is and why it’s important for your accounting practice and business.

What is Invoice Management?

Invoice management is a critical internal business function tied to procurement, responsible for handling and processing invoice documents from vendors and suppliers.

As a crucial aspect of your business operations, it involves gathering, processing, and storing information from invoices through erp invoice processing and other organized methods.

This process ensures that all invoices are accurately recorded, verified, and approved for payment.

Effective invoice management helps in maintaining accurate financial records, improving cash flow management, reducing errors and fraud, and fostering better relationships with vendors by ensuring timely and accurate payments.

Invoice Management & Accounts Payable

Accounts Payable (AP) is the department within your business responsible for managing the money you owe to vendors and suppliers. It involves tracking invoices, ensuring they are accurate, and processing payments on time.

AP also plays a key role in managing cash flow, ensuring that your company has the funds available to meet its obligations.

Invoice management and accounts payable are closely linked, as effective invoice management is essential for the smooth operation of your AP department.

While invoice management is primarily a pre-accounting function, it directly impacts your post-accounting activities such as financial reporting and analysis.

When you efficiently manage invoices, you ensure that all vendor invoices are processed accurately and promptly. This reduces the risk of errors and delays, helping your AP team to process payments on time.

By streamlining invoice management, you also provide AP with accurate data, enabling better financial tracking and reporting.

Together, these functions ensure that your business can meet its financial obligations and maintain strong vendor relationships.

Why is Invoice Management Important?

As I mentioned, effective invoice management is vital for the smooth operation of any business.

It ensures that financial transactions are processed accurately and efficiently, helping to maintain positive relationships with vendors and suppliers.

Additionally, good invoice management practices can provide valuable insights into the financial health of the business and aid in strategic planning.

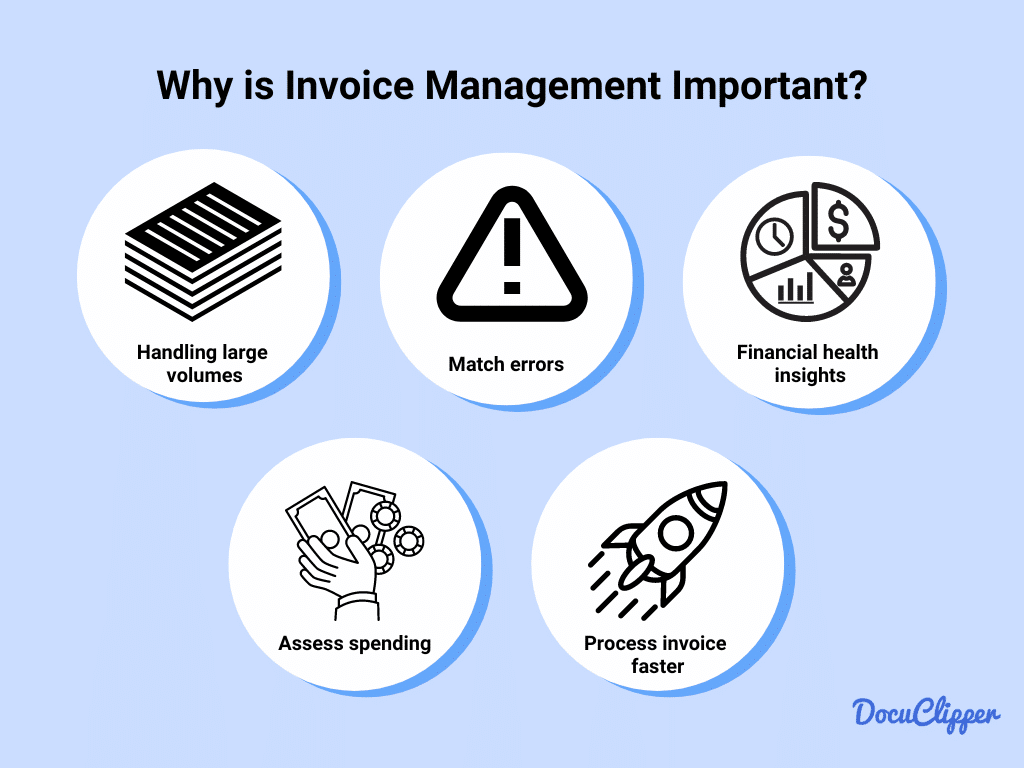

Below are some notable reasons why invoice management is crucial:

- Handling large volumes: A typical business can handle 500 invoices a month and it can be daunting and very expensive. Organizing all invoices collected from vendors and suppliers ensures they are easily accessible and manageable. With half of these invoices not being received electronically, organizing them properly is crucial for efficient handling and processing.

- Match errors: Effective invoice management allows you to quickly solve any discrepancies in invoice reconciliation. This capability is essential for resolving disputes, ensuring accuracy in payments, and maintaining good relationships with your vendors and suppliers.

- Financial health insights: By managing invoices effectively, you gain insights into your business’s financial health, allowing you to see and predict your profits. This foresight is crucial for strategic planning and making informed business decisions.

- Assess spending: Invoice management helps you assess your spending and choose better vendors and suppliers. By analyzing invoice data, you can identify cost-saving opportunities and make more informed purchasing decisions, leading to better vendor relationships and improved profitability.

- Processes invoices faster: Processing invoices typically takes about five days each month. Proper invoice management makes this process faster and easier, allowing your accounts payable team to work more efficiently and focus on more strategic tasks.

- Reduce Cost of Processing Invoices: Invoice management reduces invoice processing costs by automating workflows, minimizing errors, speeding up approvals, and lowering manual labor expenses.

What is the Invoice Management Process?

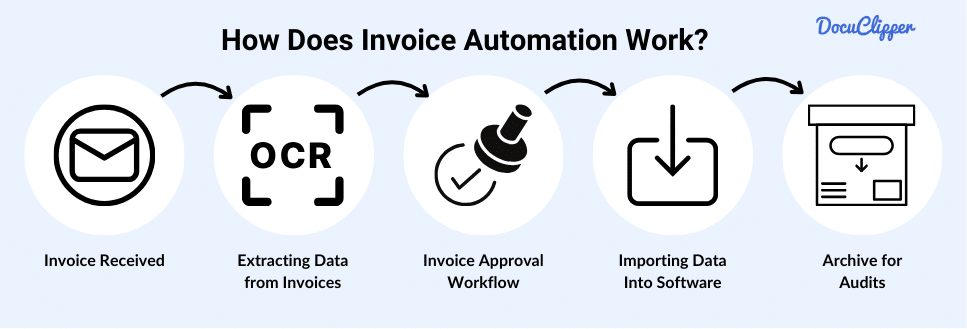

A proper invoice management process helps you organize invoices in proper manner and streamline the entire process from receiving to paying and archiving your invoices.

The invoice management process involves several steps from receiving the invoice to archiving it for safekeeping. Here’s how the process looks:

Invoice Received

Receive the invoice from your vendor or supplier, which can arrive either as an e-invoice, electronically through email, or as a paper document.

By diligently managing this step, you can maintain accurate records and begin the process of verification and approval, setting the stage for smooth financial operations.

Extracting Data from Invoices

Extracting key details from invoices is still crucial. Important information is gathered in the invoice data extraction process such as invoice numbers, line items data, amounts, quantities, vendors, buyers, currency, payment schemes, and payment structures.

And the more invoices you need to process, the more important it is to use AI invoice processing and automated invoice OCR solutions such as invoice scanning software to convert PDF invoices to Excel, and CSV so you can easily import it anywhere you need it.

Extracting these details into a spreadsheet makes processing easier and more organized. You can compile data from multiple invoices into one file for comprehensive analysis and tracking, and it can be easily uploaded into any accounting or ERP software.

This step ensures all relevant information is accurately captured, facilitating better financial management and reporting. Using tools like OCR software can automate this process, reducing manual errors and saving time.

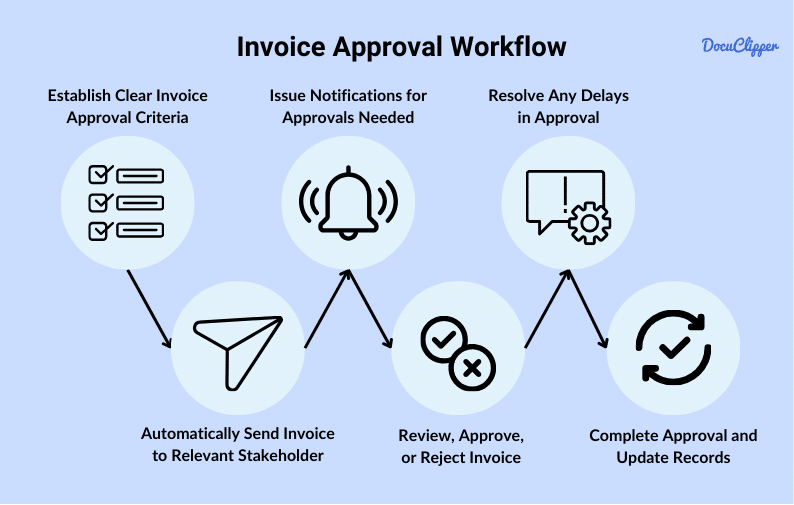

Invoice Approval Workflow

In this step, we discuss the invoice approval workflow.

This is where you verify whether the invoice accurately reflects the amount, quantity, and quality of the goods and services provided. Start by defining clear rules and criteria for invoice reviews and approvals to ensure consistency. This includes routing the invoice to the appropriate stakeholder based on specific criteria.

Approval typically involves multiple people and steps. Initially, the invoice is reviewed by the person responsible for purchasing the particular product or service. This individual verifies the invoice for accuracy and truthfulness, checking for any discrepancies such as missing or questionable information.

Next, the invoice goes through a verification process to confirm its legitimacy. If any discrepancies are found, they need to be resolved before proceeding. After the initial check, the invoice is sent to the appropriate personnel for approval. This may include department heads, finance managers, or other designated approvers.

By involving multiple stakeholders in the approval workflow, you ensure that the invoice is thoroughly vetted before payment is made. This reduces the risk of errors and fraud, ensuring that your company only pays for legitimate expenses.

Importing Data Into ERP or Accounting Software

ERP systems and accounting software are both used by businesses and accounting firms alike. This step involves consolidating all extracted invoice information into one platform for processing.

This allows for seamless handling of payments, analysis, audits, and projections. Many invoice extraction tools can automatically import data into accounting software. If automation isn’t available, APIs can facilitate the transfer.

Otherwise, manual entry is an option, though it is prone to mistakes and inefficiency. Ensuring accurate data import is crucial for maintaining accurate financial records and optimizing your financial processes.

Archive for Audits

After extracting and importing invoice data into QuickBooks or any other your accounting software, store the invoices for tax purposes and potential audits. Keep physical copies as major references and back them up in a secure cloud system and on a hard drive.

Proper archiving ensures that all invoices are easily accessible for compliance checks and investigations, safeguarding your business against discrepancies and ensuring smooth audit processes.

How to Automate Invoice Management: Best Tips

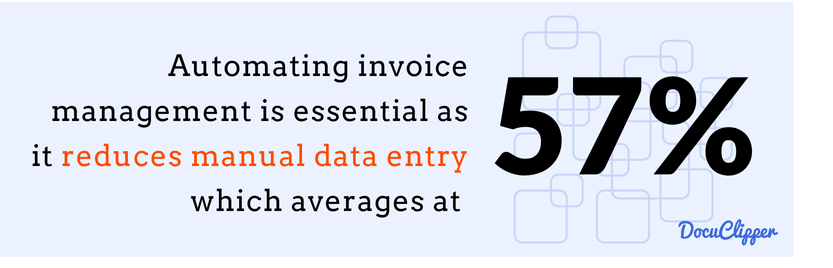

Manual invoice processing is tedious, time-consuming, and prone to data entry errors. Implementing paperless invoice processing is essential as it reduces manual invoice data entry, which averages 57%.

Transitioning from a manual system to invoice automation software enhances efficiency and accuracy. This transition holds more benefits, here are some tips:

Look for the Best Invoice Scanning Software

Find an invoice scanning tool that fits your budget and usage needs.

Ensure it is feature-rich and includes OCR software to read PDF invoices and extract data efficiently.

The right tool will streamline your invoice management process, reducing manual entry and increasing accuracy, effectively saving you time and enhancing your business operations.

Link up your ERP or Accounting Software with Your Invoice Management Tool

Once you’ve determined where to use the software, link your ERP or accounting software with your invoice management tool. This integration simplifies tracking all invoices, ensuring seamless data flow and accurate financial records. By connecting these systems, you enhance efficiency and streamline your overall invoice management process.

Set up a Payment System for your Invoices

Establish a payment system to streamline tracking your invoices and managing expenses. This system will help you stay organized, ensure timely payments, and maintain accurate financial records. By setting up an efficient payment process, you can easily monitor your cash flow and improve your overall financial management.

Benefits of Automated Invoice Management

There are many benefits when automating your invoice management systems.

- Improved Cash Flow: Automating invoice management allows you to see your cash flow better. By tracking invoices and payments in real-time, you gain a clearer picture of your financial status, making it easier to manage future expenses and investments.

- Enhanced Vendor Relationships: Automating invoice management makes your invoice processing faster, improving relationships with vendors. A slower process threatens these relationships, but timely payments build trust and reliability with your vendors.

- Reduced Errors and Disputes: Payment delays are often caused by invoice errors that need correction and rebilling before payment. Incorrect invoices account for 61% of late payments. Automation minimizes these errors, leading to fewer disputes and more efficient payment cycles.

- Better Financial Planning and Forecasting: Automated invoice management makes it easier to forecast and plan financially because the data is accessible and easy to process. This allows you to quickly generate reports and forecasts, aiding in strategic planning and budgeting.

Conclusion

Invoice management involves systematically handling invoices at every step, from receiving and data processing to invoice validation, archiving, and making payments.

This process is crucial for your business as it improves cash flow by ensuring timely payments, enhances vendor relationships by fostering trust, reduces errors through accurate data handling, and enables better financial forecasting with accessible and well-organized information.

Effective invoice management streamlines your financial operations and supports overall business efficiency.

Automate Invoice Data Capture & Import with DocuClipper

DocuClipper is a comprehensive financial document data extraction software with a 97% accuracy rate for invoices in various formats. It enhances your invoice data capture and management with its rapid extraction speed, processing hundreds of invoices in just seconds.

Being cloud-based, DocuClipper is easily accessible through any browser, providing convenience and efficiency. This powerful tool streamlines your invoice management process, saving time and reducing errors.

FAQs about Invoice Management

Here are some frequently asked questions about invoice management:

How do you manage invoices?

Managing invoices involves receiving, processing, approving, and paying invoices promptly. Using automated tools can streamline this process, reduce errors, and improve efficiency.

What is the invoice process?

The invoice process includes receiving invoices, verifying details, obtaining approvals, extracting data, importing into accounting software, and archiving for future reference.

What is the best way to keep track of invoices?

The best way to keep track of invoices is by using an automated invoice management system that provides real-time tracking, alerts, and comprehensive reporting.

What is invoice flow management?

Invoice flow management refers to the process of handling invoices from receipt to payment, ensuring that each step is completed accurately and efficiently.

What is the role of invoice management?

The role of invoice management is to ensure that all invoices are processed, approved, and paid accurately and on time, supporting effective financial operations and vendor relationships.

What is the purpose of invoice management?

The purpose of invoice management is to maintain accurate financial records, manage cash flow, and ensure timely payments to vendors and suppliers.

How do you organize invoices and payments?

Organizing invoices and payments involves using systematic methods for tracking, categorizing, and storing invoices to ensure timely and accurate processing.

How do you handle customer invoicing?

Handling customer invoicing involves creating, sending, and tracking invoices to ensure timely payments. Automation tools can help streamline this process and improve accuracy.