Invoice fraud is a serious problem for many accounts payable teams. An estimate has been made for middle-sized businesses that they lose an average of $280,000 per year.

Luckily, in this article, we’ll talk about a sensible and practical way to avoid this. The solution is called invoice matching.

We’ll discuss what is invoice matching, what are the ways to do it, and how to implement it for your business and avoid serious cases of fraud.

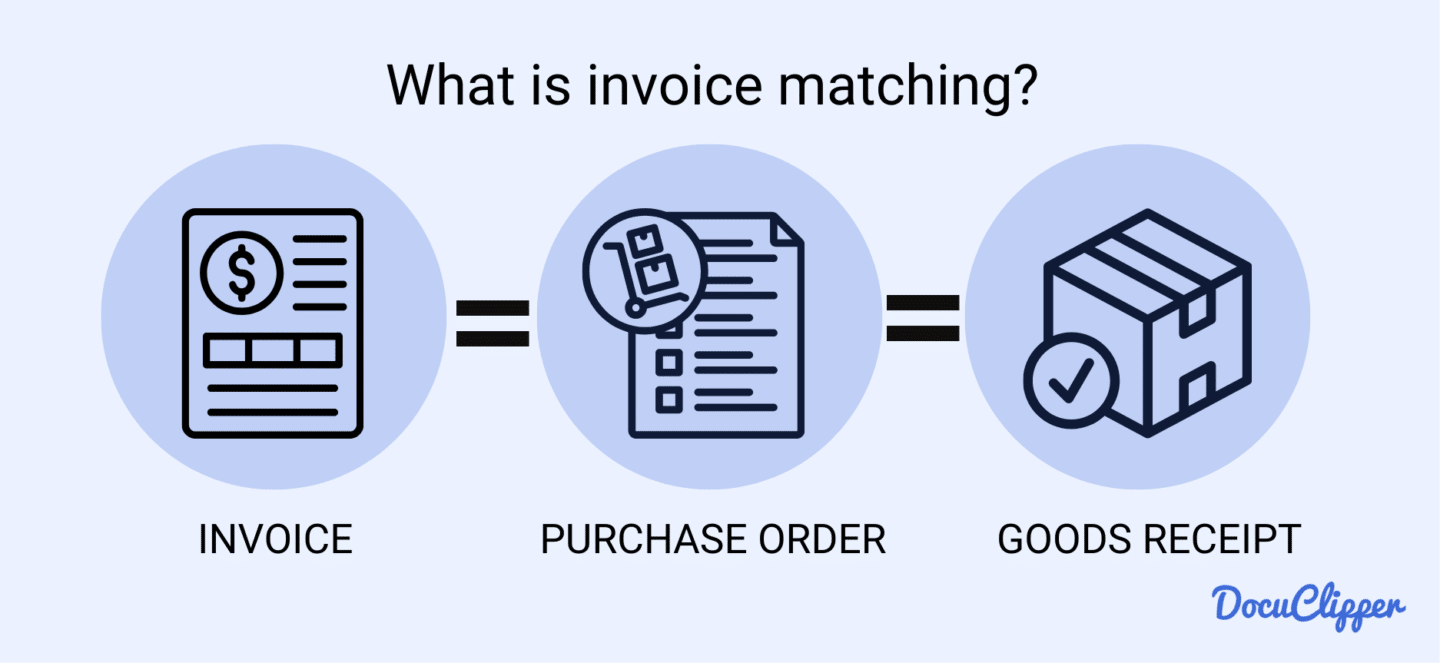

What is Invoice Matching?

Invoice matching is the process of matching an invoice with supporting documents such as purchase orders, contracts, and goods receipt notes to verify accuracy before payment.

This ensures that you only pay for goods or services that were received as ordered.

By automating this process, you can prevent errors, speed up vendor payments, and reduce the risk of overpayments or fraudulent activity.

In short, invoice matching safeguards your accounts payable process, ensuring accurate financial transactions and more efficient payment workflows.

What is Invoice Matching Deviation?

Invoice matching deviation occurs when an invoice’s details don’t match the supporting documents, such as purchase orders, goods receipt notes, or contracts.

The two main types of deviations are quantity and price discrepancies—where the number of items or the price invoiced differs from what was agreed upon.

When a deviation is identified, it prompts an investigation to determine if the difference is acceptable or if the vendor needs to correct the invoice.

Automating this process can simplify identifying and resolving these discrepancies, ensuring that only accurate and approved invoices move forward for payment.

Why is Invoice Matching Important?

Invoice matching has been an integral part of the AP process for businesses. Here are the major reasons why accounting personnel actively do it:

- Pricing and Cost Analysis: With invoice matching, you can better track cost allocation for each line item. This leads to more informed decisions in supplier selection and clearer visibility into pricing trends during invoice management tasks.

- Supplier Relationships: Accurate invoice matching ensures timely payments, helping you maintain strong relationships with suppliers. It reduces disputes and builds trust through consistency in payments.

- Cash Flow: Effective invoice matching supports better cash flow forecasting by ensuring accurate payment schedules. This keeps your financial planning on track and avoids unexpected shortfalls.

- Early Payment Discounts: By promptly matching invoices, you can meet payment terms and qualify for early payment discounts, reducing costs and boosting your savings.

- Accuracy and Security: Invoice matching reduces the risk of errors and potential fraud by ensuring that payments align with actual goods or services received. This protects your financial integrity and minimizes costly mistakes.

- Error Detection and Fraud Prevention: Invoice matching helps identify discrepancies like quantity or price differences, enabling you to address potential errors or fraudulent activities before payments are made, ensuring proper financial control.

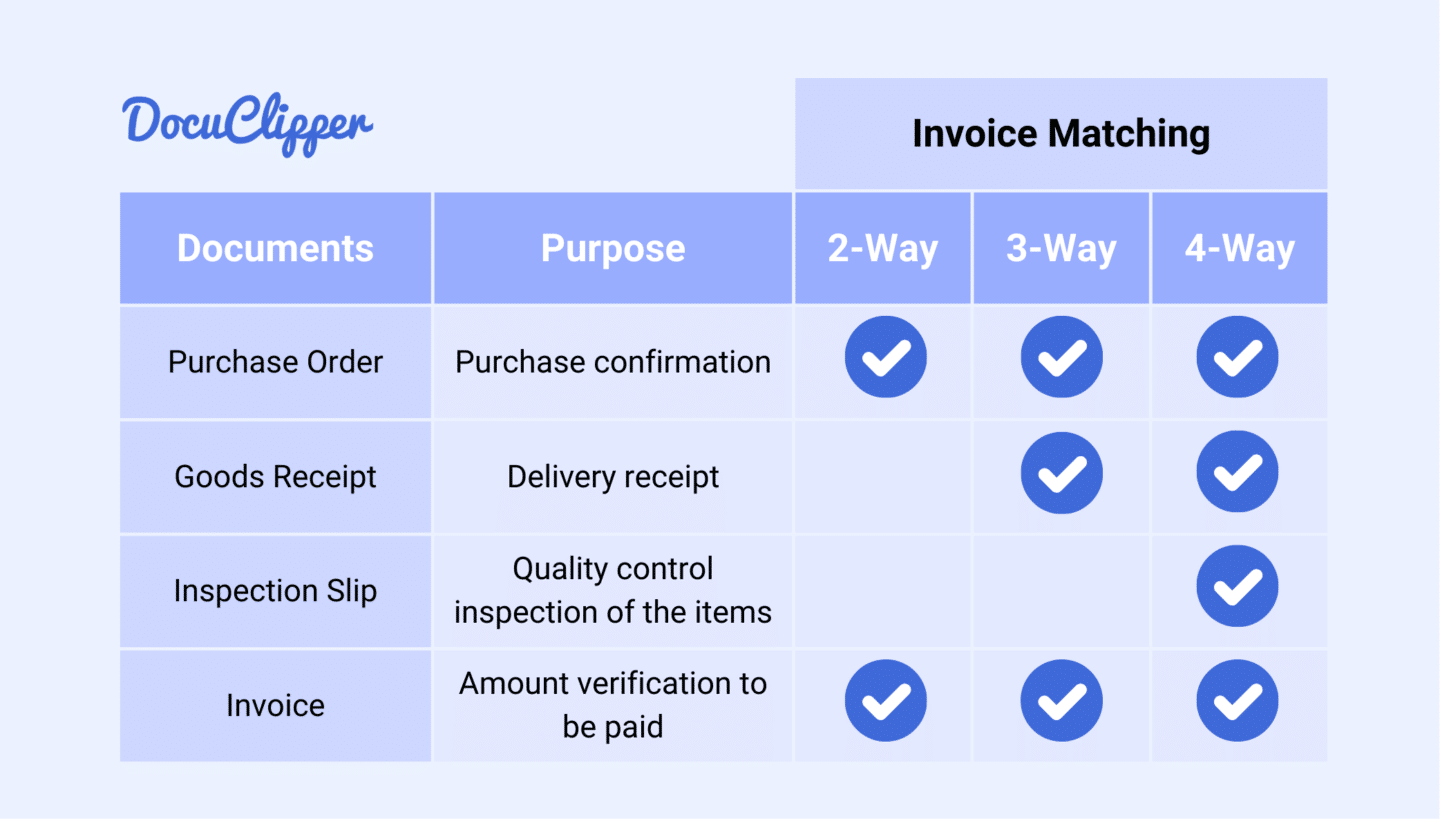

3 Main Types of Invoice Matching

There are many types of invoice matching and each with its strengths and weaknesses:

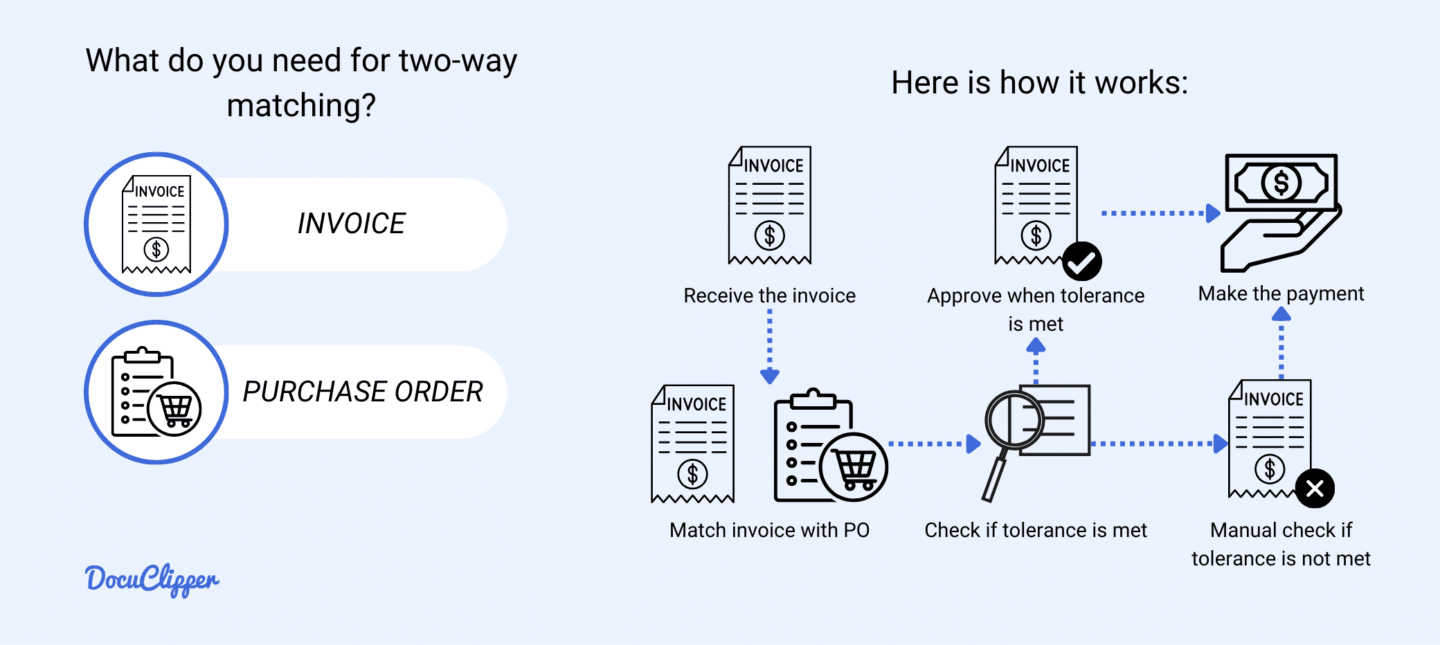

2-Way Matching

2-way matching is a basic form of invoice verification where the invoice is compared directly to the purchase order (PO).

It is mainly used for straightforward purchases with minimal complexity, where you only need to ensure that the quantities, prices, and terms on the invoice match what was agreed upon in the PO. The simplicity of this method makes it quick and efficient, reducing the time and effort required to review the documents.

However, because it doesn’t verify whether the goods or services were received or meet quality standards, there is a higher risk of paying for undelivered or defective items.

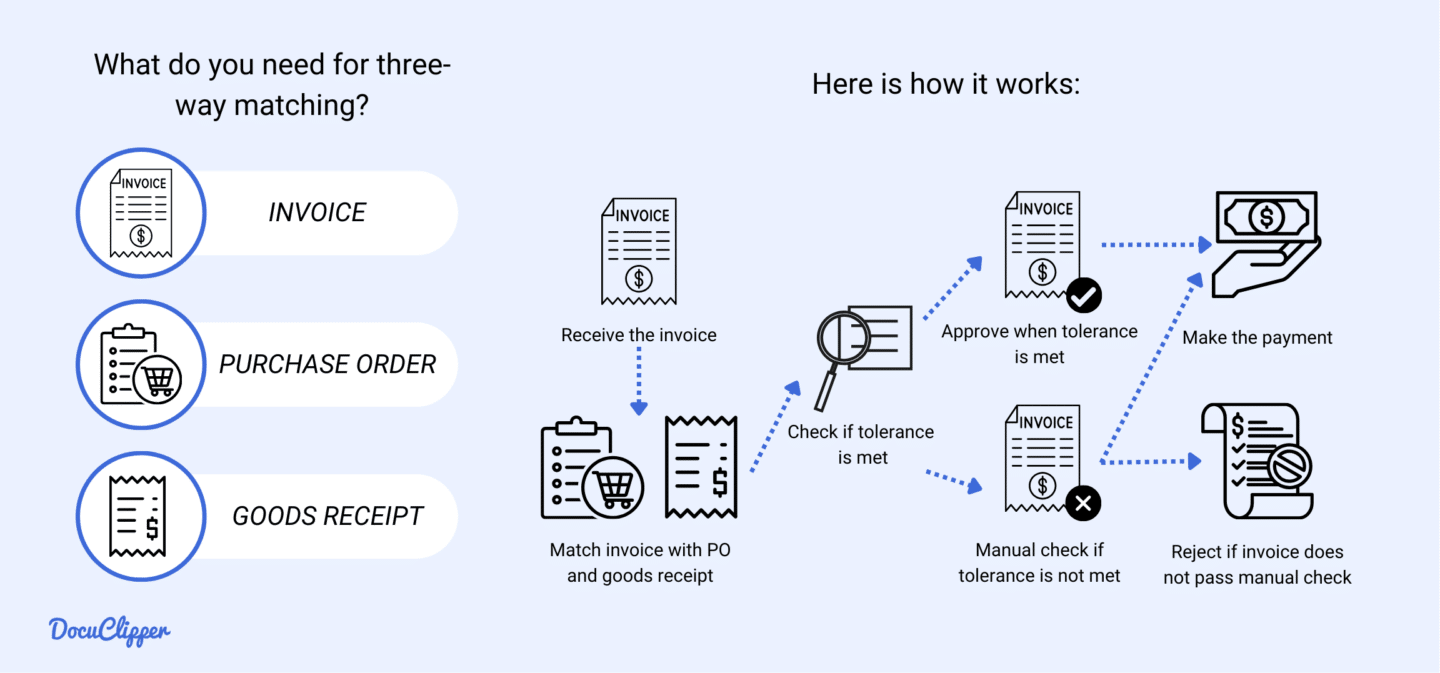

3-Way Matching

3-way matching is a more thorough process where the invoice is matched against both the purchase order and the goods receipt. It is mainly used when you want to ensure that the items billed for were not only ordered but also received as expected.

This method provides increased accuracy by verifying that goods or services have actually been delivered before payment is made. Additionally, it helps prevent overpayment or payment for undelivered items, reducing the risk of fraud.

However, 3-way matching can be more time-consuming due to the extra step and requires more detailed record-keeping and coordination between departments, which can slow down the payment process.

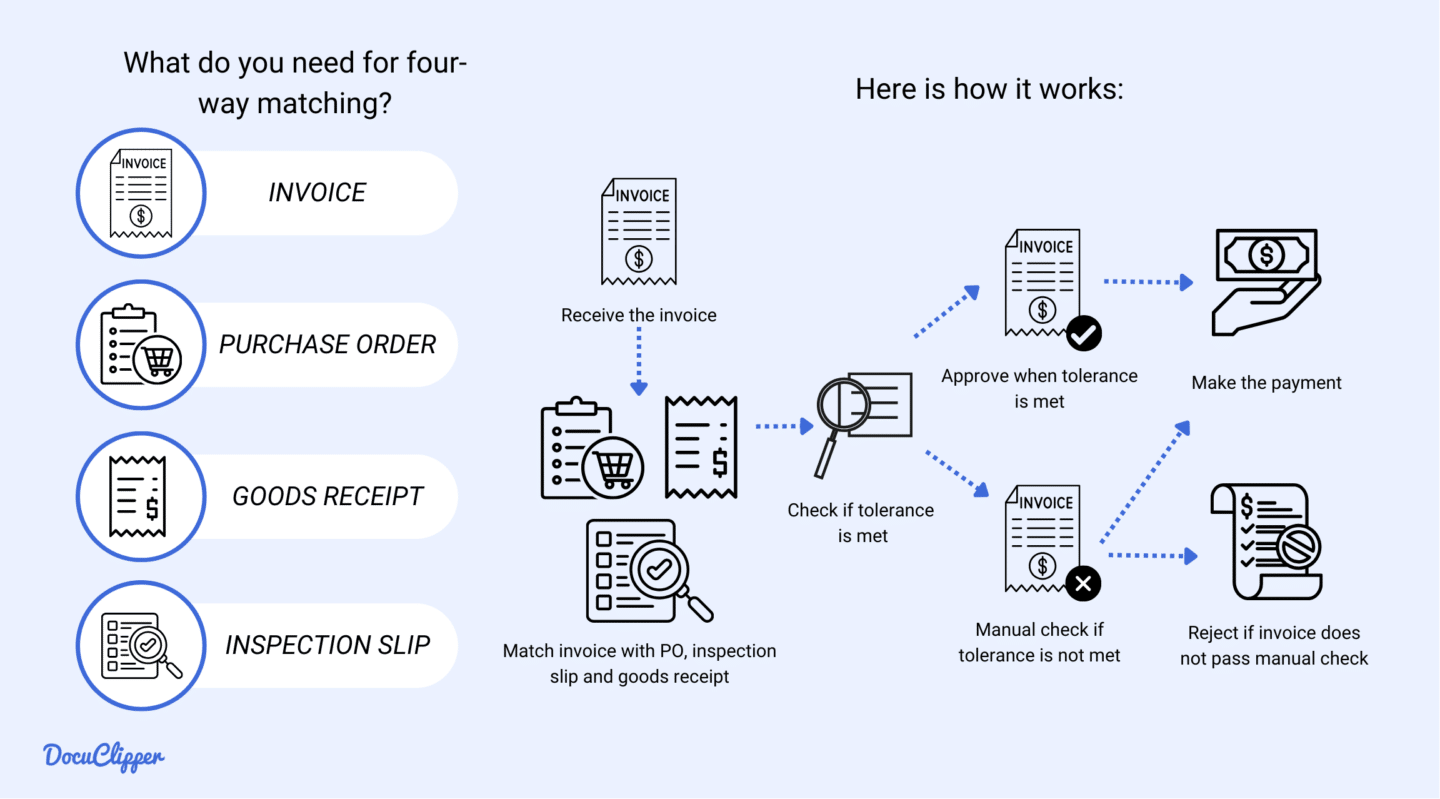

4-Way Matching

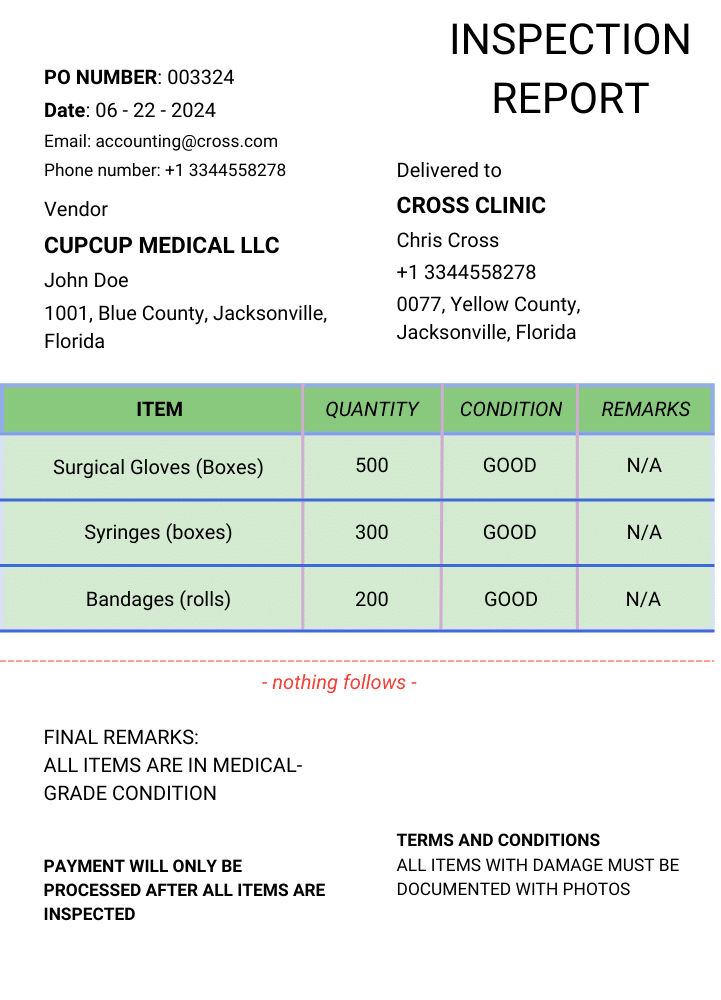

4-way matching extends the verification process by adding an inspection or quality check report to the 3-way matching process. It is primarily used when you want to ensure that the goods received not only match the order but also meet specific quality standards before approving payment.

This method provides maximum accuracy, ensuring your business pays only for items that meet both the agreed-upon specifications and quality requirements. It also offers strong quality assurance by preventing payment for defective or substandard goods.

However, 4-way matching is the most time-consuming and resource-intensive method, as it requires thorough coordination between procurement, receiving, quality control, and finance departments.

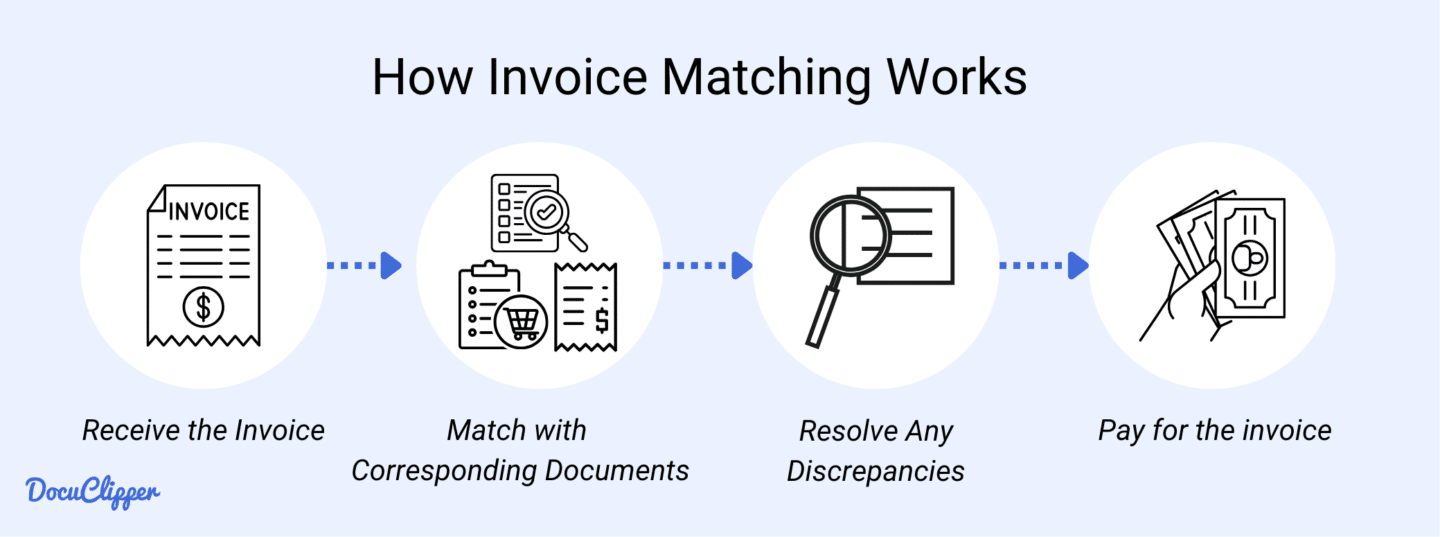

How Does Invoice Matching Work?

Invoice matching involves several key steps that ensure invoice accuracy before payments are made. Here’s a generalized process applicable across various types of matching:

- Receive the Invoice: The process begins when you receive the vendor’s invoice, which outlines the items or services provided, including quantities, prices, and any additional charges.

- Match with the Purchase Order (PO): The invoice is compared to the original purchase order to verify that the quantities, prices, and terms align with what was agreed upon during the purchase. This is a standard step for all types of invoice matching.

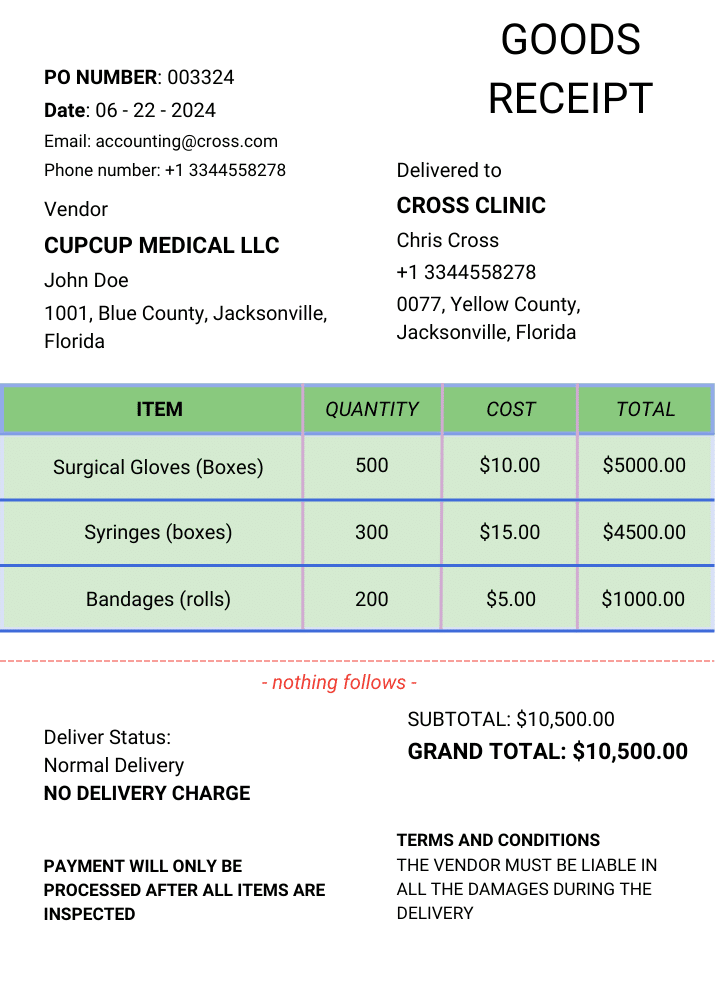

- Match with the Goods Receipt (GRN): In 3-way and 4-way matching, the next step is verifying the goods receipt or delivery note against both the purchase order and the invoice. This confirms that the correct items or services were received in the expected condition.

- Match with the Quality Inspection Report: Exclusive to 4-way matching, you’ll also check the invoice and goods receipt against an inspection or quality check report to ensure that the received goods meet the required standards. This additional step safeguards against paying for defective or substandard items.

- Discrepancy Identification: If any discrepancies are found during the matching process (e.g., quantity or price deviations), they are flagged for further investigation.

- Resolution and Payment: Any issues are resolved by coordinating with the vendor or internal departments. Once verified, the invoice is approved for payment.

- Record Keeping: Finally, the processed invoice is archived for accurate financial records and future audits.

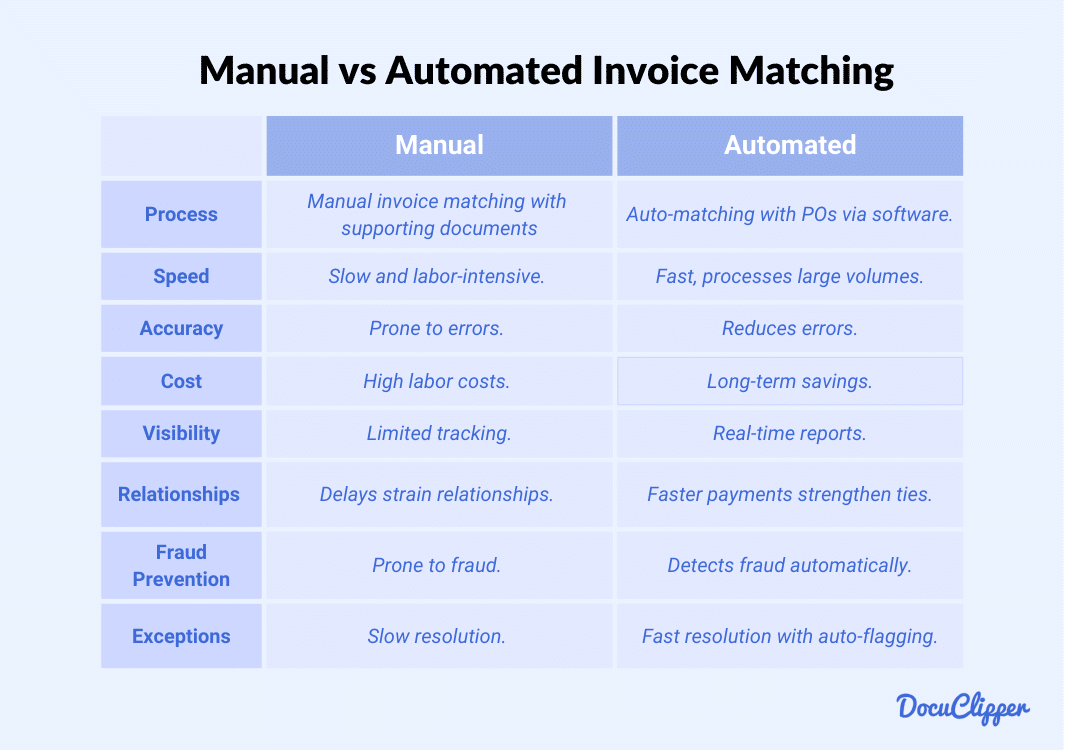

Manual vs Automated Invoice Matching

Invoice matching can be easily automated with the appropriate tools and systems that you have at your disposal. When you are planning to implement one, here are some notable differences:

Process Overview

- Automated Invoice Matching: AP automation software automatically compares invoices (paper, PDF or e-invoices) against purchase orders, and in the case of 3-way matching, against receiving reports. The software follows pre-set rules and tolerances, flagging discrepancies for follow-up. This significantly reduces manual work and speeds up payment approvals.

- Manual Invoice Matching: In manual matching, individuals compare invoices with purchase orders and, when applicable, receive reports. Manual invoice processing means can lead to delays and requires careful attention to detail to resolve discrepancies before approving payments.

Efficiency and Speed

- Automated Invoice Matching: Automation increases efficiency by processing large volumes of invoices quickly. Pre-configured rules allow the system to detect discrepancies automatically, reducing the time spent on matching and manual review.

- Manual Invoice Matching: Manual matching is slower and labor-intensive, as each invoice must be checked individually. This can cause bottlenecks, especially with large invoice volumes.

Accuracy and Error Reduction

- Automated Invoice Matching: Automation reduces human error by applying systematic matching rules and identifying discrepancies immediately. This minimizes the risk of mistakes being overlooked.

- Manual Invoice Matching: Human error is more likely in manual matching, particularly with data entry or when processing large volumes of paperwork, leading to potential mistakes.

Cost Implications

- Automated Invoice Matching: While there’s an initial cost for automation software, long-term savings from reduced labor, increased efficiency, and fewer errors make it cost-effective for high invoice volumes.

- Manual Invoice Matching: Manual matching incurs higher costs due to labor-intensive processes. Errors, delayed payments, and supplier disputes can further increase overall expenses.

Visibility and Reporting

- Automated Invoice Matching: Automation provides real-time insights into invoice statuses and exceptions through dashboards, aiding in decision-making and financial planning.

- Manual Invoice Matching: Manual processes offer limited visibility. Tracking and reporting rely on manual data entry, which can lead to outdated or incomplete information, making analysis difficult.

Supplier Relationship

- Automated Invoice Matching: Faster and more accurate payments through automation lead to stronger supplier relationships and fewer disputes over discrepancies.

- Manual Invoice Matching: Delays and errors in manual matching can strain supplier relationships, leading to tension and trust issues due to late payments or frequent disputes.

Fraud Prevention and Compliance

- Automated Invoice Matching: Automated systems help detect fraud by flagging unusual transactions. They also ensure adherence to internal controls and regulatory requirements, reducing compliance risks.

- Manual Invoice Matching: Manual processes are more prone to fraud, as they rely on human oversight, which can miss irregularities. Compliance is harder to enforce without systematic checks.

Exception Handling

- Automated Invoice Matching: Exceptions are flagged automatically, allowing the AP team to focus on specific issues rather than handling every invoice manually, speeding up resolution.

- Manual Invoice Matching: Manual exception handling is slower and often requires back-and-forth communication between departments and vendors, delaying the approval and payment process.

Important Invoice Matching Terms to Know

Here are some important invoice-matching terms you should know:

- Purchase Order (PO): A document authorizing a purchase from a supplier, detailing the items, quantities, and price.

- Goods Receipt Note (GRN): A document confirming the receipt of goods, used in 3-way matching with the purchase order and invoice.

- Invoice: A bill issued by a supplier detailing the goods or services provided and the payment terms.

- Deviation: A discrepancy between the invoice and purchase order or goods receipt that needs to be resolved before payment.

- Tolerance Levels: Predefined limits that allow for minor discrepancies between documents without requiring further review.

- Duplicate Invoice Check: A control to identify and prevent duplicate invoices from being processed or paid.

- Payment Terms: Agreed-upon conditions regarding the timing and method of payment between buyer and supplier.

- Touchless Invoice Processing: Automated invoice processing without manual intervention, improving efficiency and accuracy.

- Invoice on Hold: An invoice that is temporarily halted from payment due to an unresolved issue or discrepancy.

- Debit Memo: A document issued by a buyer to adjust an overcharge or reduce the amount owed on an invoice.

- Credit Memo: A document issued by a supplier to adjust a previously issued invoice, typically for returns or errors.

- Invoice Reconciliation: The process of ensuring that the purchase order, goods receipt, and invoice are all in agreement.

- Accounts Payable (AP): The department responsible for managing outgoing payments and overseeing the invoice matching process.

- Procure-to-Pay (P2P): The entire business process from procurement of goods or services to issuing payment to suppliers.

- Electronic Data Interchange (EDI): A system for electronically exchanging business documents between buyers and suppliers.

- Supplier Portal: An online platform where suppliers can submit invoices and track payment status.

- ERP (Enterprise Resource Planning) System: Software that manages and integrates core business processes, including procurement and invoice matching.

Conclusion

Invoice matching is crucial for ensuring accurate payments, minimizing errors, and maintaining strong supplier relationships.

By comparing invoices with supporting documents like purchase orders and goods receipts, businesses can prevent overpayments and fraud while improving financial accuracy.

Whether manual or automated, invoice matching strengthens your accounts payable process, ensuring timely payments and better cash flow management. Implementing a reliable matching process ultimately leads to more efficient financial operations and supports overall business success.

How DocuClipper Can Help with Invoice Matching?

DocuClipper simplifies invoice matching by using OCR for invoice data extraction capabilities. It allows you to easily extract data from PDF invoices and match it with supporting documents such as purchase orders and goods receipts.

With the ability to convert PDF invoices into formats like XLS, CSV, and QBO, DocuClipper enhances the accuracy of your financial records. Its high accuracy rate ensures minimal errors, and it can process hundreds of documents simultaneously.

Additionally, DocuClipper functions as a bank statement converter, seamlessly integrating with accounting systems like Sage, Xero, and QuickBooks.

FAQs about Invoice Matching

Here are some frequently asked questions about invoice matching:

What is the 3-way invoice matching process?

3-way invoice matching involves comparing the invoice, purchase order (PO), and goods receipt note (GRN) to verify that the goods or services were ordered, delivered, and accurately billed before payment is approved.

What is the difference between 2-way and 3-way matching?

2-way matching compares the invoice with the purchase order to verify accuracy. 3-way matching adds an additional verification step by checking the goods receipt to confirm that the goods were received as ordered.

What is the difference between 3-way matching and 4-way matching?

3-way matching compares the invoice, purchase order, and goods receipt. 4-way matching includes an additional step—a quality inspection report—to ensure that the received goods meet the required quality standards before payment is authorized.