Processing invoices is an essential business process that the accounting team deals with every day.

But, there are some inefficiencies when people process them manually.

Luckily, we have a solution here ready and in this blog, we’ll talk about how invoice OCR tools can help you process invoices efficiently.

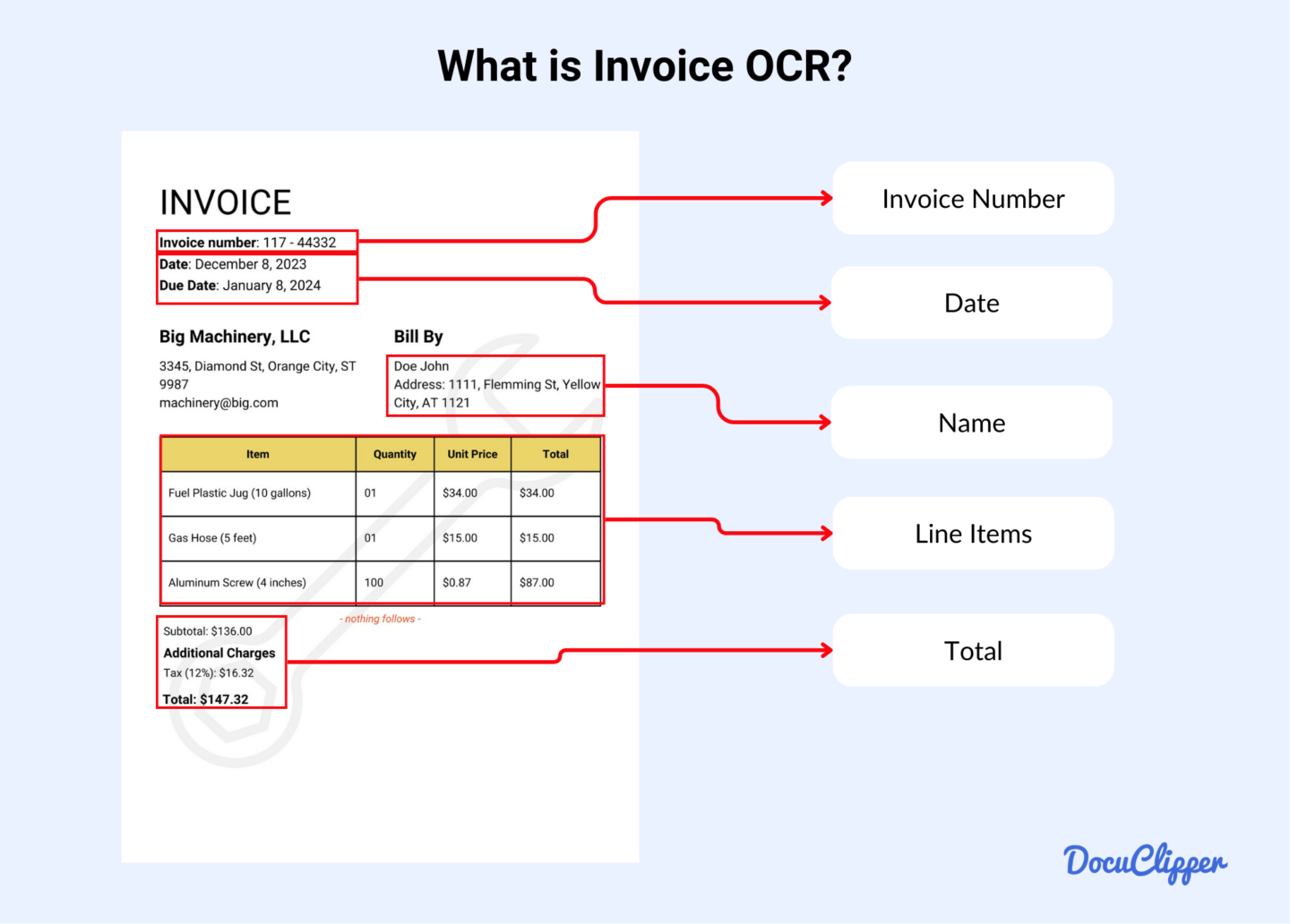

What is Invoice OCR?

Invoice OCR (Optical Character Recognition) is the process of extracting text from invoice documents, whether paper or PDF and converting it into a structured format such as Excel or CSV.

Using OCR allows you to digitalized these PDF invoices in editable formats effectively without relying on manual invoice processing.

It is important as it can help you manage accounts payable, build trust with suppliers, pay vendors on time, and improve your operational efficiency.

With invoice OCR AKA invoice parser, you can easily organize, analyze, and integrate invoice data into your accounting systems, making your workflow more efficient and error-free.

How Does Invoice OCR Work?

OCR invoice processing is a powerful and useful technology for businesses that efficiently detects and extracts text from invoices.

Extracting PDF invoices into machine-readable text involves several precise steps:

Here’s a step-by-step run-through:

- Upload Image/Document: When you upload a PDF invoice, the process begins. This document is the source from which the OCR system extracts data.

- OCR Preprocessing: After uploading the invoice, a preprocessing procedure enhances image quality, cleans up noise, and optimizes the document for invoice data extraction. This can include adjusting brightness and contrast, removing background noise, and properly aligning text to mitigate OCR limitations.

- Text Recognition: The software detects the visual patterns of the invoice and compares them to a database of known characters and symbols. This matching process allows the system to identify and differentiate individual characters within the invoice. Advanced algorithms are used to recognize various fonts and styles, ensuring high accuracy in text detection.

- Postprocessing: Lastly, the OCR system corrects any errors, conducts contextual analysis, and assembles recognized characters into coherent words and sentences. This postprocessing step ensures that the extracted data is not only accurate but also contextually sensible, providing you with clean and readable output.

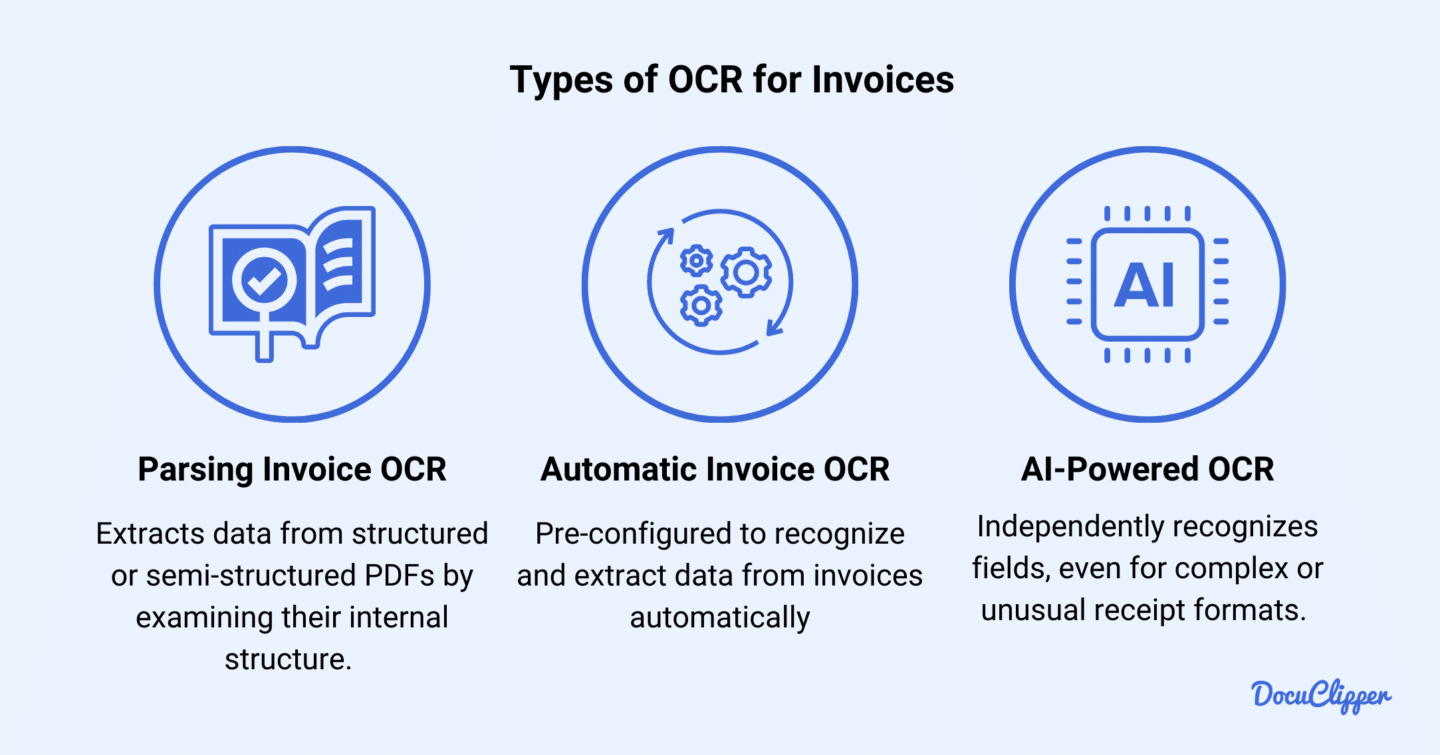

Types of OCR for Invoices

OCR technology varies across providers, offering unique methods for processing documents. Evaluate options like parsing OCR, automatic OCR, and AI-powered OCR. Each has pros and cons, so understanding their capabilities helps you select the best fit for your needs.

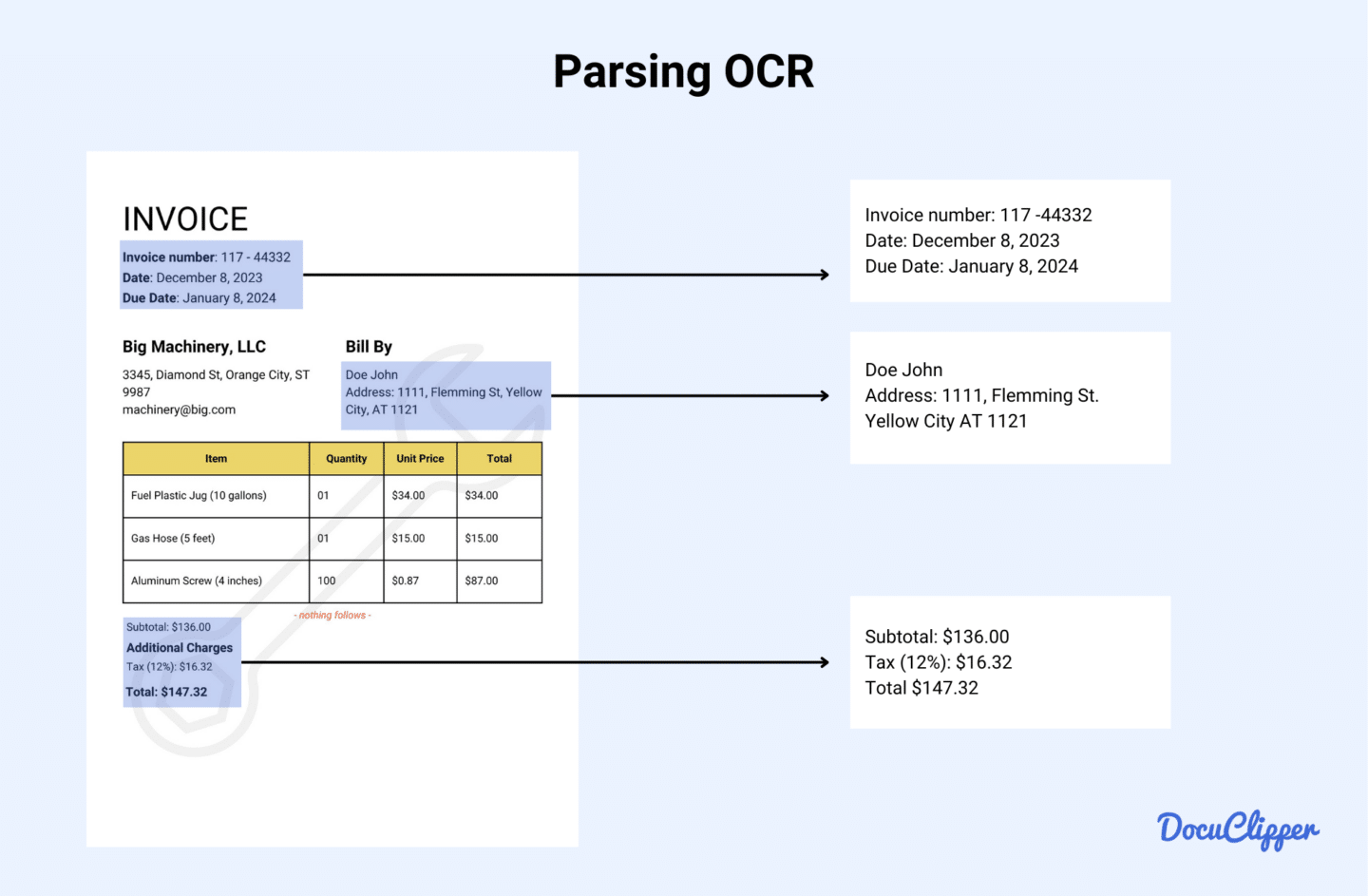

Parsing Invoice OCR

Parsing invoice OCR extracts data from structured or semi-structured PDFs by examining their internal structure.

To use parsing OCR effectively, you need to create specific templates for each type of invoice. These templates guide the software on where to find and interpret the data.

Each unique invoice format requires its template, making the initial setup time-consuming but ensuring high accuracy once configured.

By using these templates, parsing OCR can precisely extract and process the necessary information from your invoices, providing reliable and accurate data extraction tailored to your specific invoice formats.

Pros

- Cost-Effective: Parsing OCR is affordable since it’s relatively simple for developers to create.

- High Accuracy: With specialized parsing templates, the software processes localized areas, ensuring precise data extraction.

Cons

- Time-Consuming Setup: Setting up and configuring templates can consume a significant amount of time.

- Scalability Issues: As your business grows and you might face a variety of invoices, you’ll need more templates, making it difficult to scale.

- Unique Templates Required: Each type of invoice requires a distinct template, and if not well-integrated, it complicates the process further.

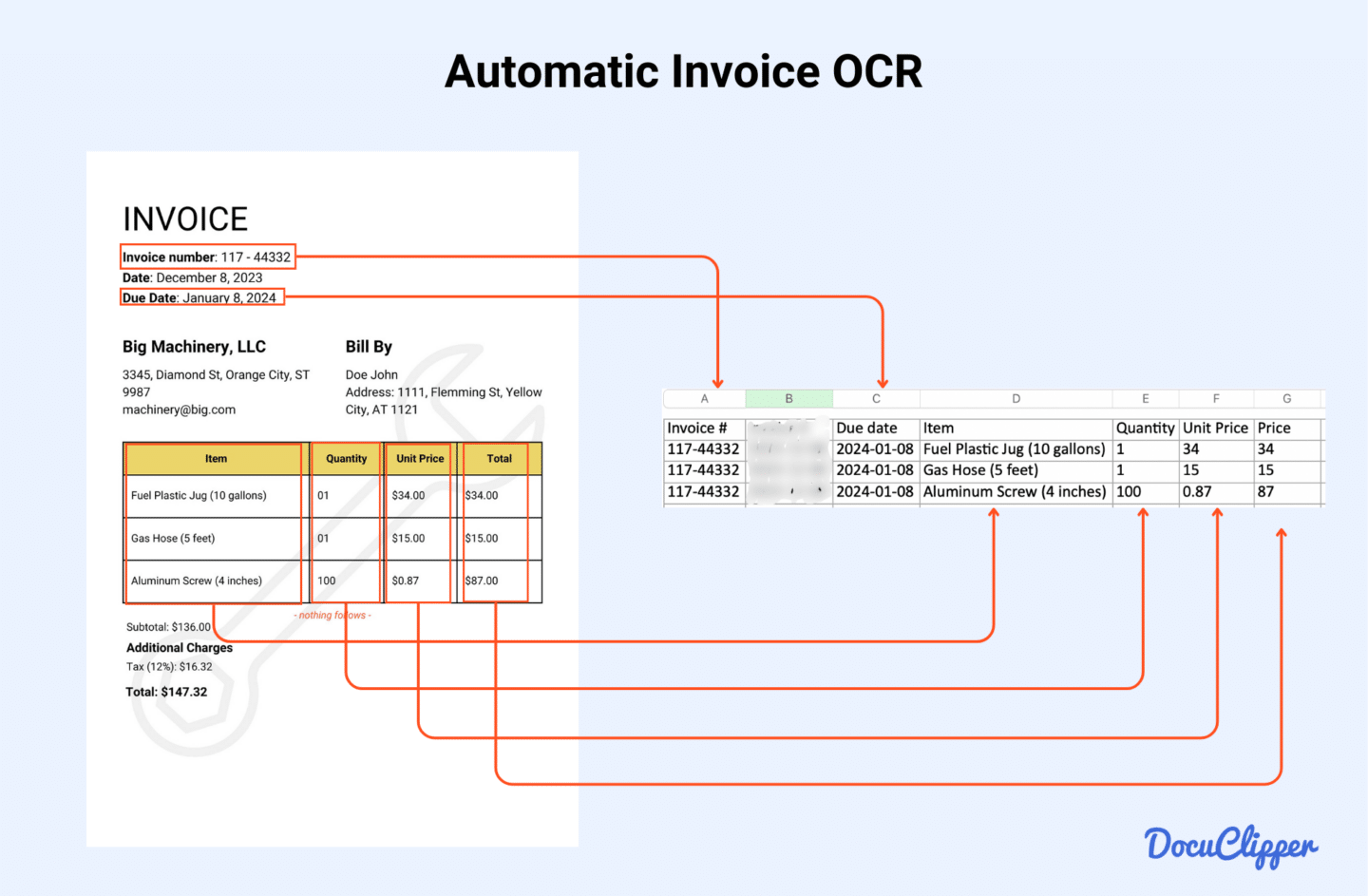

Automatic Invoice OCR

Automatic invoice OCR simplifies the data extraction process by eliminating the need for manual setup. The software is pre-configured to recognize and extract data from invoices automatically.

There is no need to create prior templates for an invoice, you just have to upload a PDF file. This makes it a highly efficient and user-friendly option for businesses looking to streamline their receipt processing without investing significant time in configuring templates.

Pros

- Automatic OCR is very cost-effective, with some subscriptions under $100 per month.

- High Accuracy: Top OCR models can achieve up to 99.6% accuracy.

- Scalability: It processes large volumes of receipts without needing manual templates for each document type.

- Receipt Automation: This OCR type automates significant parts of the process, reducing manual intervention.

Cons

- Field Errors: There may be occasional errors in field recognition.

- Challenges with Unusual Receipts: It might struggle with non-standard receipt formats due to predefined templates.

- Less Control over Data Capture: Automatic modes limit user control over data extraction, though many OCR tools also offer parsing capabilities for more precise data selection.

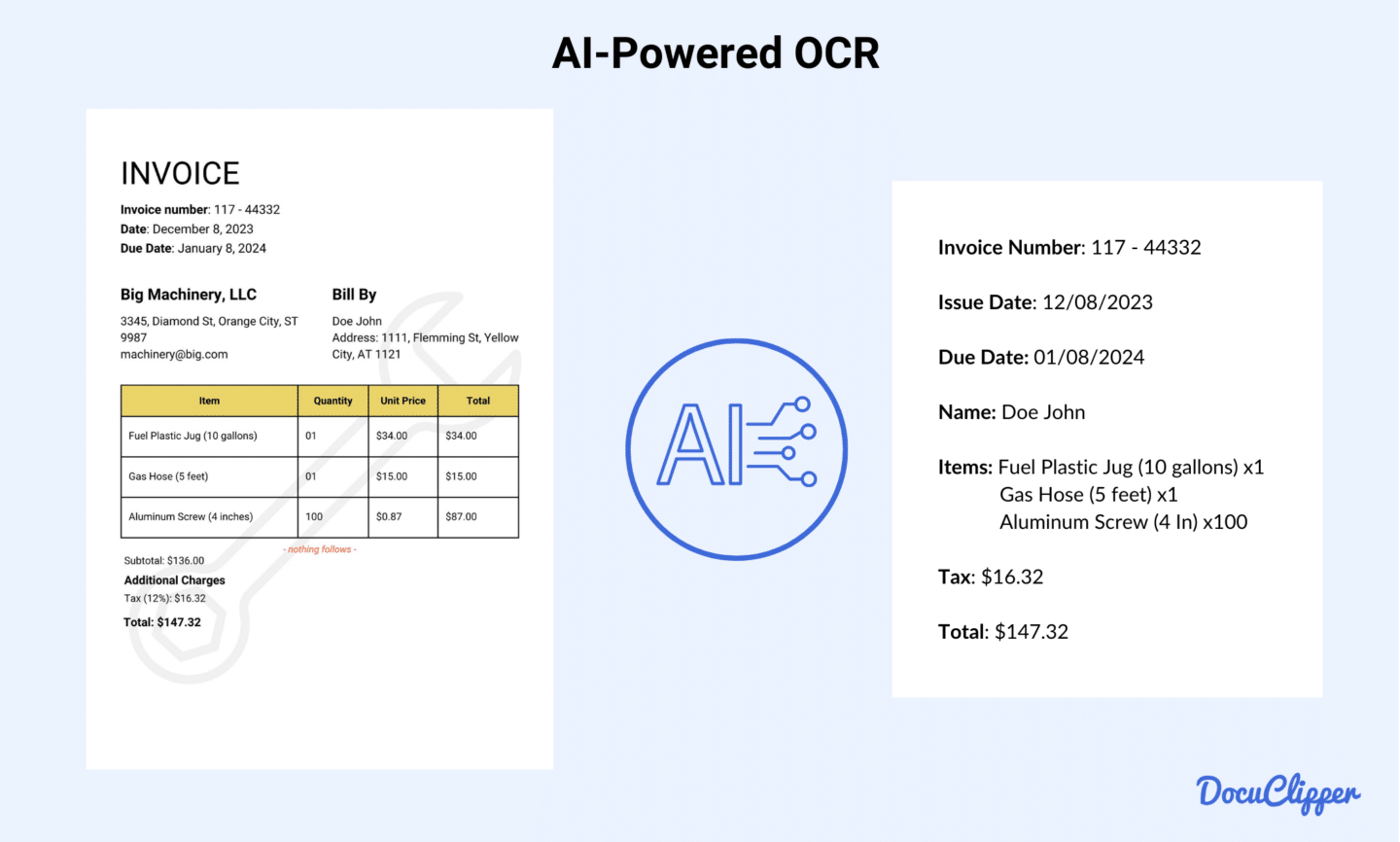

AI-Powered OCR

AI-powered OCR is the latest advancement in receipt processing technology. Unlike traditional parsing and automatic OCR, AI-powered OCR independently recognizes fields, even for complex or unusual receipt formats.

This technology learns from your inputs, improving over time and handling a wider variety of receipts. By teaching the software-specific fields, you can boost its accuracy and efficiency in extracting relevant data. This adaptability makes AI-powered OCR a powerful tool for managing diverse and intricate receipt formats, ensuring precise and reliable data extraction.

Pros

- High Accuracy and Reliability: AI-powered OCR is incredibly precise, greatly minimizing errors.

- Versatile Template Recognition: It can identify a variety of templates, making it suitable for businesses with different receipt formats.

- Industry-Specific Adaptability: Ideal for specialized industries with various receipt styles and layouts.

Cons

- Higher Cost: As an advanced technology, AI-powered OCR tends to be more costly and may charge higher per page than other OCR types.

- Time-Consuming Processing: Analyzing each line item and receipt can take more time due to the AI’s detailed processing.

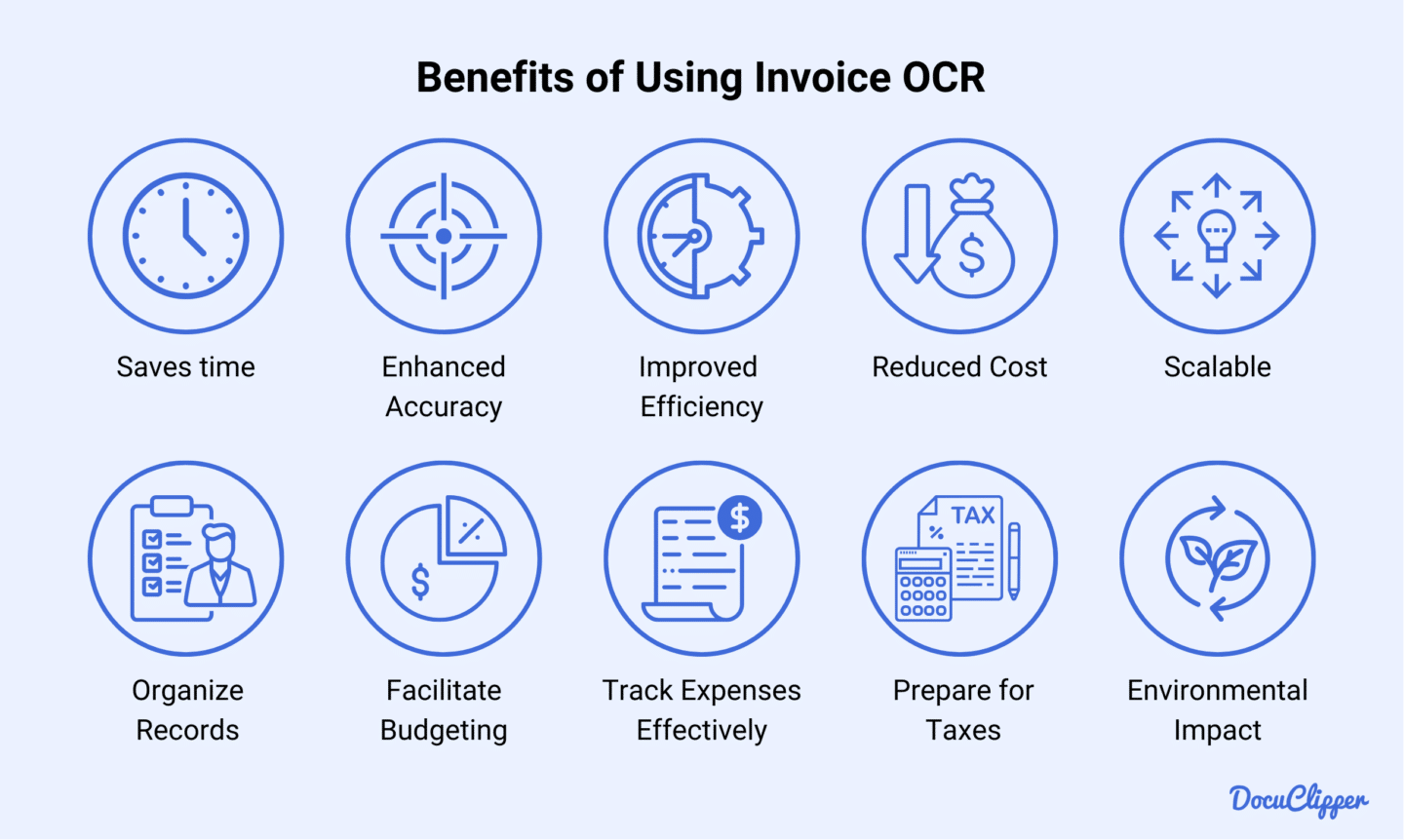

Benefits of Using Invoice OCR

Integrating invoice OCR tools into your business operations can greatly enhance both efficiency and accuracy. Modern accounts payable OCR software offers numerous benefits for organizations handling regular invoice processing:

- Save Time: OCR removes the need for manual data entry, quickly extracting information so you can focus on more important tasks.

- Efficiency: It speeds up the processing of large volumes of receipts efficiently.

- Cost Reduction: Reduces operational costs by minimizing the need for manual labor.

- Scalability: Scales easily with business growth, handling more receipts without additional resources.

- Organize Records: Extracts necessary data, improving record organization and accessibility.

- Facilitate Budgeting: Detailed OCR-extracted information aids in making informed budget adjustments.

- Track Expenses Effectively: Provides enhanced visibility into spending for better monitoring and control.

- Accurate Data: More accurate than manual data entry, reducing the chance of errors.

- Prepare for Taxes: Compiles all spending data in one place, simplifying tax filing and ensuring compliance.

- Environmental Impact: Digitizes receipts, reducing paper use and promoting eco-friendly practices.

Key Features to Look for in Invoice OCR Solutions

Once you’re convinced of the benefits, you can choose the best invoice OCR software for your business. Here’s what to look for in invoice OCR technology:

High Accuracy

Accuracy is essential since extracting inaccurate data is futile. When choosing your invoice OCR software, prioritize those with excellent accuracy reviews. Aim for solutions with accuracy rates above 96% to ensure dependable data extraction.

This high level of accuracy will help maintain the integrity of your financial records and make your accounting processes more efficient

Reliable data extraction is crucial for effective financial management, so investing in a high-accuracy OCR tool will save you time and prevent errors in your records. Prioritizing accuracy will streamline your workflow and ensure that your financial data is consistently precise and reliable.

Processing Speed

Speed is critical for efficient data extraction. Choose OCR software that can process hundreds of documents in under 30 seconds. If it can’t achieve this with high accuracy, it’s not worth considering.

Your software should outperform a data entry clerk, who usually takes 3 to 5 minutes per document. Fast and accurate processing not only saves time but also boosts productivity, allowing you to focus on more important tasks.

Prioritizing speed in your OCR software will enhance overall efficiency and ensure your data extraction process is both quick and reliable.

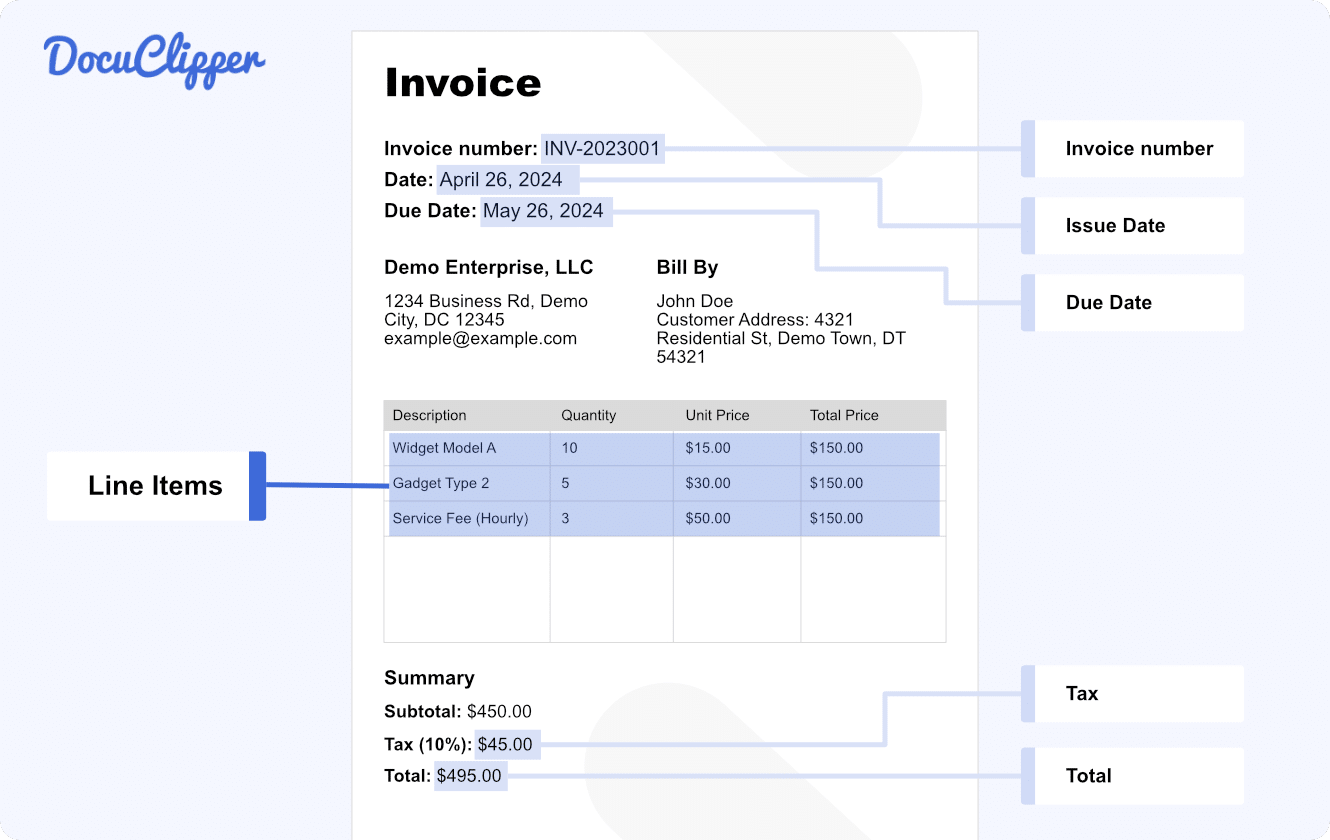

Line Item Extraction

Invoice OCR focuses on capturing data from line items, where most information is stored. Make sure the software accurately extracts all line items without missing any details. This precision is vital for maintaining comprehensive and reliable financial records, enabling you to track and manage expenses effectively.

Accurate line item extraction ensures you have all the necessary details for financial analysis, budgeting, and compliance. By prioritizing this feature, you can ensure your financial records are complete and reliable, making your expense tracking more efficient and accurate.

Integration with Accounting Software

Make sure your invoice OCR solution integrates seamlessly with your accounting software. Many converters output to TXT or XLS, requiring manual copy-pasting and increasing error risk.

Choose software that integrates directly with your accounting system, allowing immediate access to data. This streamlines your workflow and minimizes the chance of errors during data transfer.

Security and Compliance

When entrusting financial data to software, prioritize security. Look for OCR tools with top-notch security measures like AES 256-bit SSL encryption, SOC 2 compliance, HIPAA, and etc.

Also, check if reputable companies like Intuit and Amazon endorse the tool’s security compliance. This ensures your data is protected and gives you confidence in the software’s reliability.

Top 5 Use Cases for Invoice OCR

Here are some of the tasks where you utilize the most of a receipt OCR software for your accounting and business tasks.

Accounts Payable

Invoices are central to accounts payable. Using invoice OCR tools eliminates the need for manual data entry, allowing your accounts payable team to process invoices much faster. This efficiency helps you meet vendor deadlines and ensures timely payments.

By automating invoice processing, you can significantly reduce the workload on your team and improve overall accuracy. Invoice OCR tools streamline the entire process, making it easier to manage and ensuring that all invoices are handled promptly and efficiently.

Expense Management

When managing a business or handling accounting, reviewing invoices and spending is essential. Invoice OCR allows you to compile all financial data into a single view, enhancing visibility into your expenses.

This comprehensive overview simplifies tracking and managing finances, giving you clear insights into your spending.

By using invoice OCR, you can easily monitor and analyze your expenses, ensuring better financial management and informed decision-making. This tool provides a streamlined approach to understanding your financial data, making it easier to keep track of where your money is going.

Audit Preparation

Invoices and receipts are routinely checked by the IRS, though they typically review only the summary of your spending.

Using invoices OCR compiles all this information into a single spreadsheet, allowing auditors to see everything in one view. It also helps them examine each line item in detail, potentially identifying tax write-offs.

This comprehensive approach simplifies audits, ensuring that all your financial data is accurately recorded and easily accessible, making the audit process smoother and more efficient.

Financial Analysis

Using invoice OCR for processing makes financial analysis easier for your accounts payable team. This tool streamlines data extraction and organization, providing clear and accurate financial insights.

By automating invoice data entry, your team can quickly access and analyze financial information, enhancing decision-making and overall efficiency in managing your business finances.

Best Invoice OCR Tools

Once you have seen the necessary criteria for getting an invoice OCR tool, here are someopf the best invoice scanner software available:

- DocuClipper: DocuClipper is a web-based tool that converts invoices into structured data formats like Excel, CSV, and QBO with 97% accuracy. It excels in streamlining the invoice scanning process and supports batch processing, enhancing file conversion efficiency. DocuClipper also offers API functionality for seamless integration with leading accounting platforms such as QuickBooks, Xero, Sage, and other ERP software.

- AutoEntry: AutoEntry is designed to streamline accounting processes by automating data extraction and publication directly into major accounting software platforms. It efficiently scans invoices, making it a valuable tool for accounting purposes.

- Dext Prepare: Dext Prepare enhances productivity and profitability by offering advanced data management and analytics. It automates the extraction of financial data from receipts and invoices, categorizing and organizing it for easy access and analysis.

- Nanonets: Nanonets is an AI-driven platform that streamlines complex business processes across finance, accounting, supply chain, operations, sales, HR, and more. It uses advanced machine learning to automate data extraction and processing, reducing manual data entry time and improving overall efficiency.

Final Advice

Choosing the best receipt OCR for your accounting practice requires time and careful consideration. Think about how you will use the tool to maximize its potential. Evaluate each option for accuracy, speed, extraction capabilities, security, and integration with your existing systems.

One highly versatile OCR tool to consider is DocuClipper. It excels in converting PDF invoices, receipts, bank, and credit card statements into XLS, CSV, and QBO formats.

DocuClipper can process hundreds of documents in seconds, efficiently organizing and formatting all data into a single spreadsheet. Additionally, it integrates seamlessly with major accounting platforms like QuickBooks, Xero, and Sage.

By choosing DocuClipper, you can ensure a smooth, accurate, and efficient receipt processing experience, significantly enhancing your accounting workflow.

Its ability to quickly and accurately handle large volumes of documents makes it a valuable asset for any accounting practice, streamlining processes and improving overall productivity. Take the time to assess your needs and select the best OCR tool to support your accounting operations.