Invoice processing is always an integral part of dealing with financial tasks for a business or accounting practice.

However, invoices can be a pain as they come in batches, and extracting data from PDF invoices individually has its bad sides.

In this blog, we’ll talk about processing invoices and how to make it easier for your business to process them.

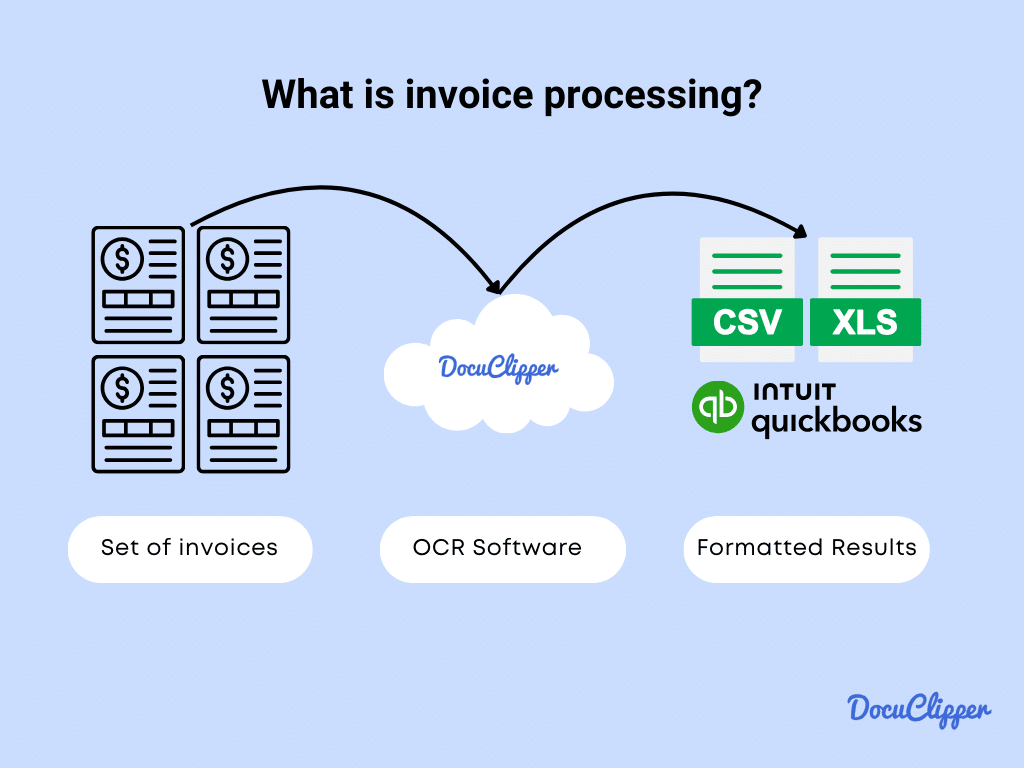

What is Invoice Processing?

Invoice processing is the administrative task that involves handling and managing incoming invoices from receipt to payment.

This process typically starts when an invoice is received, either in paper format or as an e-invoice (electronic invoice).

The key steps include validating the invoice details, ensuring they match purchase orders and delivery receipts, and confirming that the goods or services billed for have been received and meet the required standards.

This method is called 3-way matching.

Once verified, the data of the invoice is extracted into an accounting system. Depending on the company’s internal controls, the invoice may go through several approval stages to ensure that the expenditure is authorized.

Finally, the invoice is scheduled for payment according to the payment terms agreed upon with the supplier.

Efficient invoice data extraction and processing is crucial for maintaining good vendor relationships and managing cash flow effectively.

It also helps prevent errors and fraud, making it a critical component of financial management in businesses.

Overall, effective invoice processing often overlaps with pre-accounting tasks, ensuring the organized collection and preparation of financial documents.

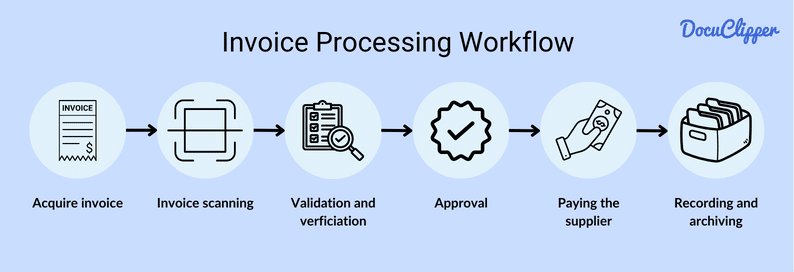

How to Process Invoices: Invoice Processing Workflow

Processing invoices is a fundamental part of invoicing procedures when running a business. It helps in dealing with accounts payables and making a smoother financial situation.

Here is the typical workflow of invoice processing:

- Invoice Receipt: Invoices arrive in various formats, such as paper or PDF. The initial step involves collecting these documents promptly to ensure a smooth workflow.

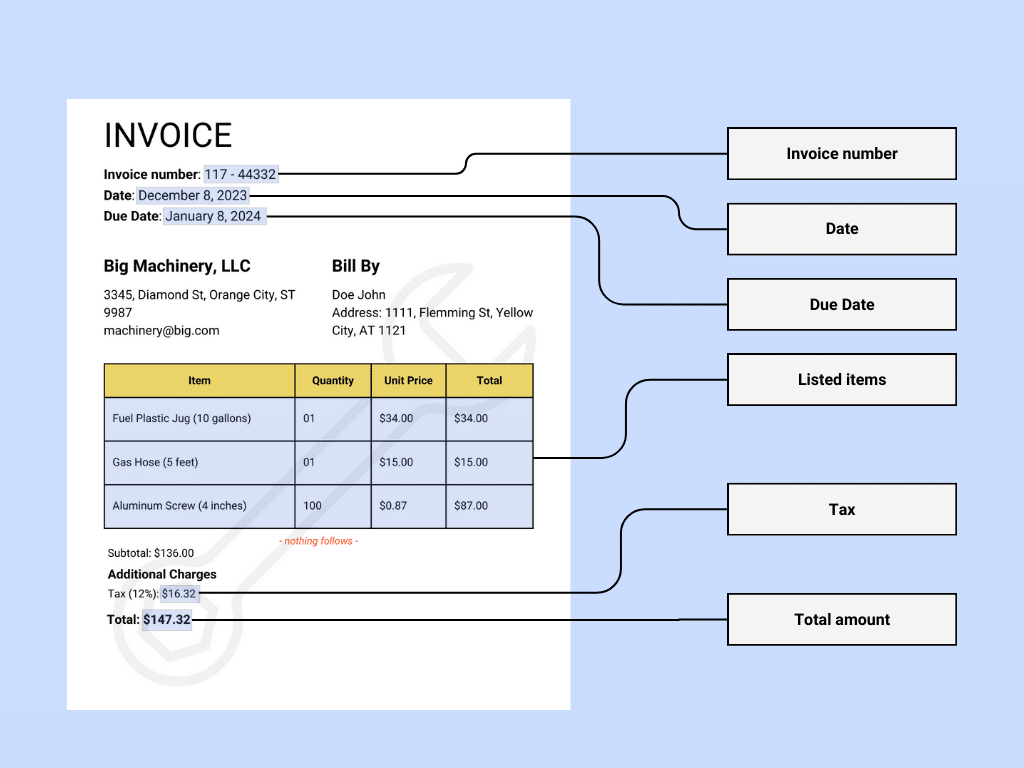

- Invoice Scanning: The accounts payable department takes charge here, either manually entering data from invoices or using invoice scanning software to digitalize the invoice to extract details. This step is crucial for converting PDF invoices to Excel for better manageable form for further processing.

- Invoice Reconciliation: Here, each invoice is checked against the original purchase order (PO) and other documents. This step confirms that the billed products or services were indeed ordered and delivered as agreed. (Learn more how to read an invoice)

- Invoice Approval: Before proceeding with payment, invoices must receive approval. This process often involves multiple checks to ensure invoice accuracy and adherence to company spending policies. (Read more about invoice approval workflow)

- Paying the Supplier: Once approved, the invoice moves to the payment stage where the supplier is paid according to the terms agreed upon. Timely payments help maintain healthy supplier relationships.

- Recording and Archiving: Finally, every invoice and its corresponding payment record are archived. This post-accounting step supports financial tracking, future audits, and compliance with regulatory requirements.

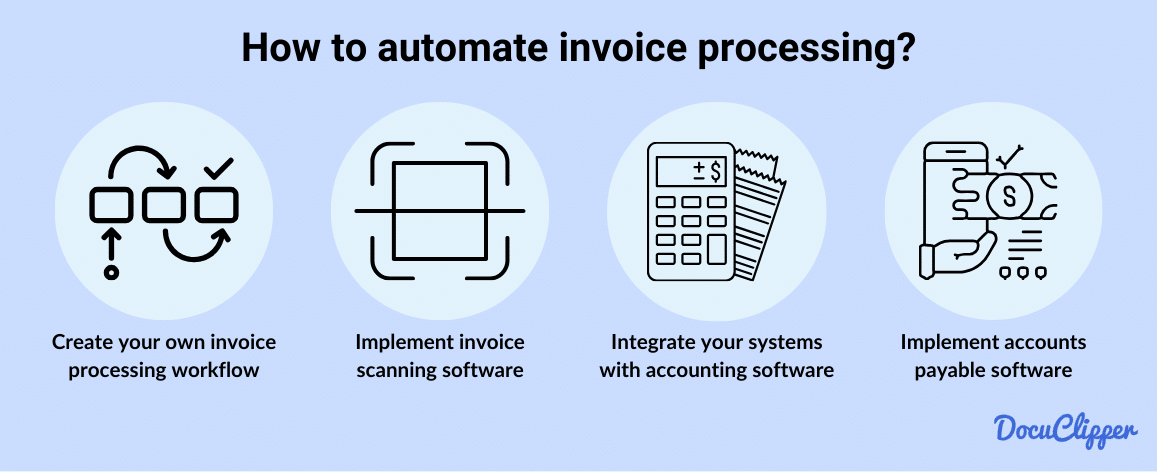

How to Automate Invoice Processing

Automating invoices strays away from the troublesome manual invoice process that it typically takes.

You have to take certain steps in how to set up your automation workflow and it’s easier than it sounds.

OCR invoice processing, AI invoice processing and ERP invoice processing have become standard approaches for many businesses looking to streamline their automation workflow, as they eliminate manual data entry.

This means you have to have software tools that’ll help you not to type everything by hand and place it on your system.

Create Your Own Invoice Processing Workflow

Processing a workflow for a process differs from one company to another. Make one that suits your work style and how your team works. You can use our example above as your basis for your workflow.

After making one, look for areas where you can implement invoice scanning software that you can use.

Implement Invoice Scanning Software

Every invoice scanning software is different from one another. But the good thing is that despite invoices having different formats, most of them come in PDFs or on paper that are organized.

Invoice converters can easily extract data from these invoices as information is already organized in a manner. Choose one that easily fits your budget and that is easy to use with responsive customer service.

Take for example DocuClipper. DocuClipper is an OCR software that specializes in converting PDF invoices into spreadsheets, it can process 100s of invoices in one go and all of the data will be compiled under one spreadsheet despite all the invoices having different formats from one another making it one of the best invoice parser.

Implement Accounts Payable Software

When selecting invoice software, choose one that pairs well with accounts payable software. This makes your financial tasks easier by syncing invoicing and payments, reducing errors as well as automatically performing invoice reconciliation.

Typically AP software should perform 2-way matching or 3-way matching, but ERP software can also perform 4-way matching for more detailed verification.

Opt for accounts payable software with a simple dashboard to easily see your cash flow and make payments directly from the platform, keeping all your invoices organized and processed in one spot.

Integrate Your Systems with Accounting Software

After getting an invoice scanning software, start it linking with accounting software to have a touch of invoice automation processes. This makes it easier for the data of your invoice to get compiled and ready to be analyzed.

There may be compatibility issues so choose the accounting software and invoice OCR that works the best together.

One great successful example of invoice automation software scanning integration is DocuClipper.

DocuClipper has API systems that can easily integrated invoice OCR with some accounting software that can function as invoice management tools.

Benefits of Automated Invoice Processing

Automated invoice processing is significantly better than processing it manually, here are some of the known benefits:

- Increased Productivity and Efficiency: Automation speeds up the entire invoice process, allowing staff to focus on more strategic tasks rather than routine invoice data entry.

- Cost Savings: By reducing the need for manual input, companies can lower operational costs significantly.

- Reduced Errors: Automated systems minimize human errors, ensuring more accurate invoicing.

- Time Savings: Automation shortens the cycle time of processing invoices from receipt to payment.

- Improved Vendor Relationships: Faster processing leads to timely payments, enhancing relationships with suppliers.

- Better Financial Visibility: Automation provides real-time insights into payable status, helping businesses manage their finances better.

- Improved Scalability: Automated systems easily adapt to increased invoice volumes without the need for extra staff.

- Eco-Friendly: Digital processing reduces the use of paper, supporting sustainability efforts.

Invoice Processing Best Practices

Here are some of the best practices according to successful businesses when they are processing invoices.

- Centralize Invoice Receipt: Streamline operations by consolidating all invoices to a single point of entry. This simplifies tracking and reduces the risk of lost invoices.

- Use Specialized Invoice Capture Software: Implementing specialized invoice data extraction software automates the extraction and conversion of data from invoices, enhancing efficiency and accuracy.

- Integrate Invoice Processing with Accounting Systems: Connecting your invoice processing system with accounting software ensures data consistency and facilitates real-time financial reporting.

- Establish a Standardized Approval Workflow: A consistent approval process eliminates confusion, speeds up the workflow, and maintains accountability.

- Use Three-Way Matching: Verify invoices against purchase orders and delivery receipts to prevent overpayments and fraud. This control is vital for financial integrity.

- Ensure You Keep Accurate Records: Maintain detailed records for audits and financial analysis. Good record-keeping supports compliance and decision-making.

- Plan for Scalability: Choose solutions that can grow with your business. Scalable processes adapt to increased volumes without sacrificing performance.

Challenges in Invoice Processing

Here are the challenges in processing invoices that you might encounter:

- Missing Invoices: Lost invoices disrupt the payment cycle, leading to delayed vendor payments and strained relationships.

- Poor Financial Visibility: Ineffective invoice management obscures spending patterns and cash flow, complicating financial planning.

- Confusing Invoices: Inconsistencies and unclear charges in invoices can delay approvals as staff spend time clarifying details.

- Miscommunication Between Business and Vendors: Misunderstandings over invoice details can lead to disputes and delayed payments, affecting business operations.

- Missing Data: Incomplete invoices require additional time to retrieve missing information, slowing down the payment process.

- Delayed Payments: Inefficient processing often results in late payments, which may incur penalties and damage vendor relationships.

- Data Entry Errors: Manual data entry is prone to errors, leading to incorrect payments and the need for time-consuming corrections.

Conclusion

Effective invoice processing is vital for maintaining a healthy financial workflow in any business. By implementing modern tools and adhering to best practices, companies can enhance their efficiency, reduce errors, and build stronger relationships with their suppliers.

With the right systems in place, businesses can achieve more streamlined operations and better financial transparency.

How DocuClipper Can Help?

DocuClipper simplifies the invoice processing task by automating data extraction from various invoice formats and integrating seamlessly with existing accounts payable and accounting software.

Our tool is designed to handle high volumes of invoices efficiently with an accuracy of 97%, reducing the time spent on manual entries, capable of processing 100s invoices in a few seconds, and allowing teams to focus on more critical financial strategies.

FAQs about Invoice Processing

Here are some frequently asked questions about processing invoices:

How many invoices can be processed in a day?

The number of invoices that can be processed in a day depends on the system used. Manual processes might handle dozens to a hundred, while automated systems like DocuClipper can process hundreds to thousands of invoices depending on the complexity and the setup.

What are the tasks of invoice processing?

Invoice processing involves several tasks including invoice receipt, scanning or OCR data capture, validation against purchase orders, invoice approval, payment processing, and recording and archiving the transactions.

What is the process of invoicing and billing?

The process typically starts with the issuance of an invoice, which details the transaction between buyer and seller. The invoice is then sent to the buyer who must verify and approve it before processing the payment. Finally, the payment is made and both parties record the transaction.

What is the method used for invoice processing?

Invoice processing can be either manual or automated. Manual processing involves physical handling and data entry, while automated processing uses software to extract, verify, and process invoices.

How many types of invoice processing are there?

There are primarily two types of invoice processing: manual and automated. However, within these, various technologies and methods can be applied, such as OCR for document data extraction in automated systems.

How do I collect an invoice payment?

To collect an invoice payment, ensure the invoice is accurate and sent promptly. Offer clear payment instructions and terms, and consider using electronic payment systems for faster processing. Following up with reminders and maintaining open communication with the customer can also help ensure timely payments.