Running a business always involves processing invoices. However, not all invoices are valid, and some contain errors.

Fortunately, there is a solution for this. In this article, we’ll discuss invoice reconciliation and how to implement it in your invoice processing workflow.

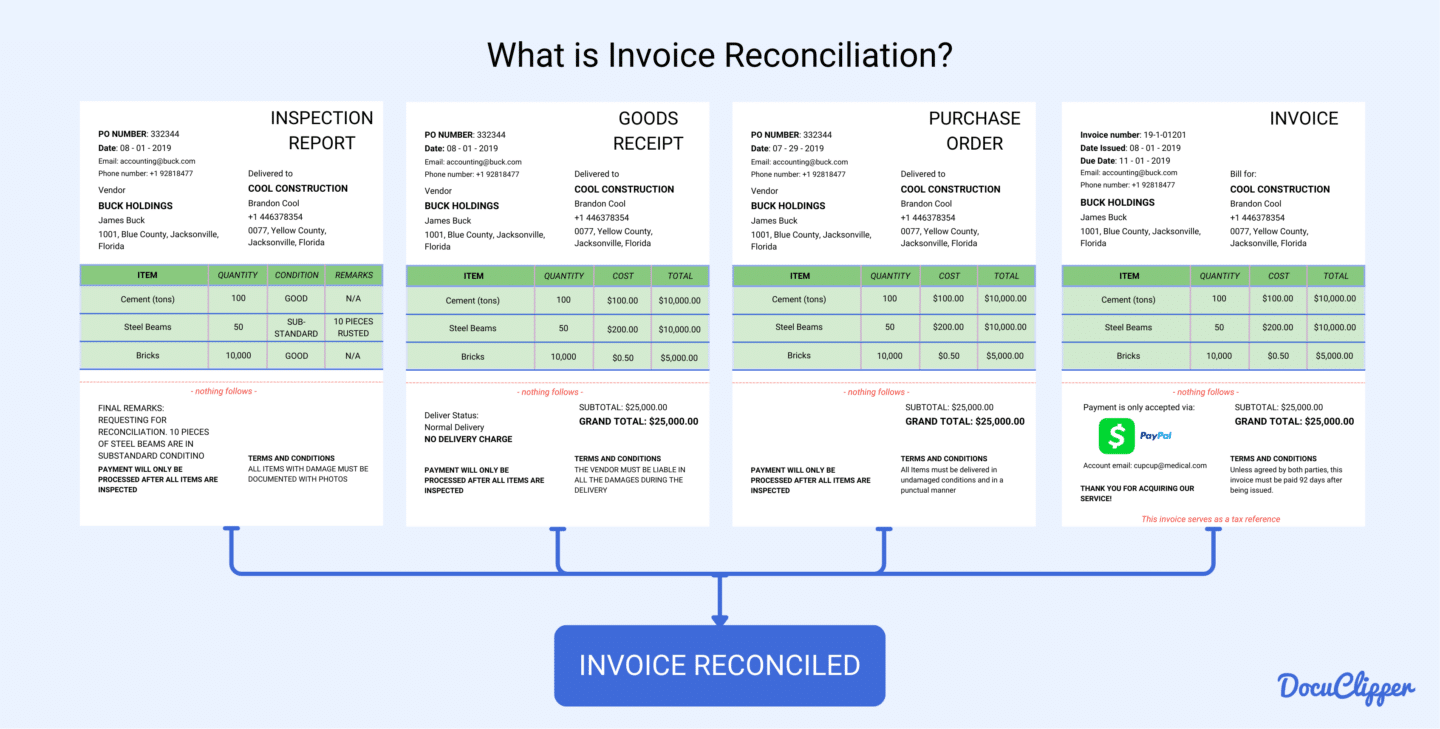

What is Invoice Reconciliation?

Invoice reconciliation is a process where you, as an accountant or accounts payable, ensure that each invoice matches corresponding purchase orders, reports, or other references like bank and credit card statements.

This verification process is crucial for maintaining accuracy in your financial records and preventing discrepancies between purchase and accounting departments

By carefully checking invoices against these references, you can confirm that the goods or services billed were indeed received, thereby ensuring the legitimacy and invoice accuracy of your financial transactions.

Why is Invoice Reconciliation Important?

Invoice reconciliation is crucial for your business because it ensures that the invoices you pay match the goods and services received. This process enhances transparency, allowing you to track the flow of funds accurately and maintain clear financial records.

Notably, 61% of late invoice payments result from mistakes, leading to unnecessary costs and delays. By reconciling invoices, you can identify and rectify these errors before they impact your cash flow.

Moreover, invoice reconciliation is a vital defense against fraud, which affects 51% of organizations globally. By comparing invoices with purchase orders and receipts, you can detect and prevent fraudulent activities, protecting your business from financial losses.

Regular reconciliation also helps you spot and correct discrepancies in your bookkeeping, ensuring that your accounting records are accurate and up-to-date. This approach not only maintains financial integrity but also aids in managing your business’s cash flow more effectively, supporting overall financial health and operational efficiency.

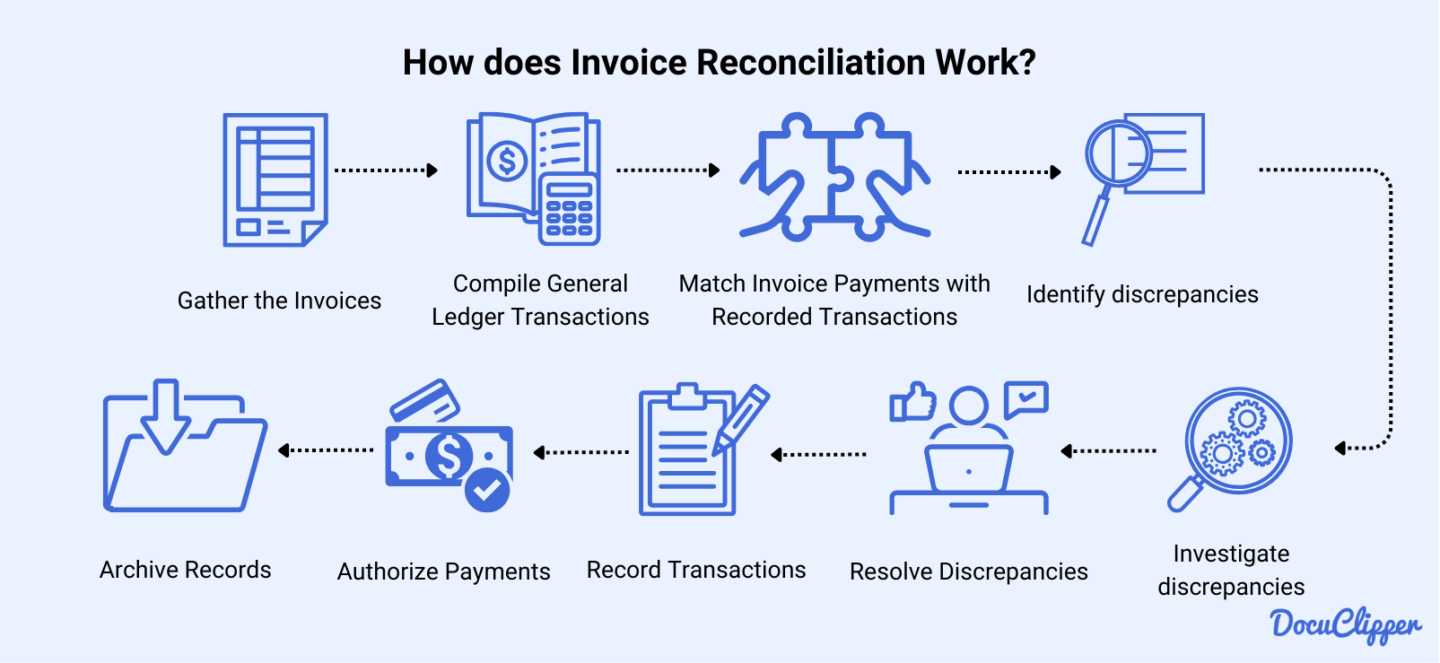

How does Invoice Reconciliation Work?

Invoice reconciliation is a structured process that ensures your financial records are accurate and consistent.

Here’s how you can effectively manage this process:

- Gather the Invoices: Start by collecting all invoices in a central location. It’s best to receive invoices in PDF format via email for easier tracking and organization. Centralizing your invoices simplifies processing and ensures that no invoice is overlooked.

- Prepare a General Ledger for Comparing Transactions: Next, collect all invoice transaction data and align it with your general ledger. This step involves ensuring that your invoices match the payments made to respective vendors. Make sure you have an accurate ledger for the time frame. Be sure to include both outgoing payments and incoming deposits, as errors can often occur in transaction categorization.

- Match Invoice Payments with Recorded Transactions: Once your data is compiled, match each invoice transaction with your general ledger. This step ensures that the goods or services billed were indeed received and correctly recorded.

- Identify Discrepancies: During the matching process, look for discrepancies such as fake invoice numbers, duplicated payments, inconsistent amounts, or questionable vendors and line items. Identifying these issues early prevents financial inaccuracies and potential fraud.

- Investigate Discrepancies: If you find any discrepancies, begin investigating to determine their cause. Here, you can use the Purchase Orders (POs) and inventory records. This might also involve verifying with the person who made the purchase.

- Resolve Discrepancies: After identifying the cause of the discrepancies, take corrective action. This could involve contacting the vendor for clarification or adjusting your records to reflect the correct information.

- Record Transactions: Once discrepancies are resolved, accurately record each transaction.

- Authorize Payments: After all transactions are reviewed and verified, the accounts payable head can authorize payments. This ensures that only accurate and verified invoices are paid.

- Archive Records: Finally, after payments are made, archive the invoices for record-keeping and future tax audits. Proper archiving ensures that you have a comprehensive audit trail and can easily retrieve documents when needed.

Types of Invoice Reconciliation

Invoice reconciliation has different variations, and each has different purposes. Here are its examples:

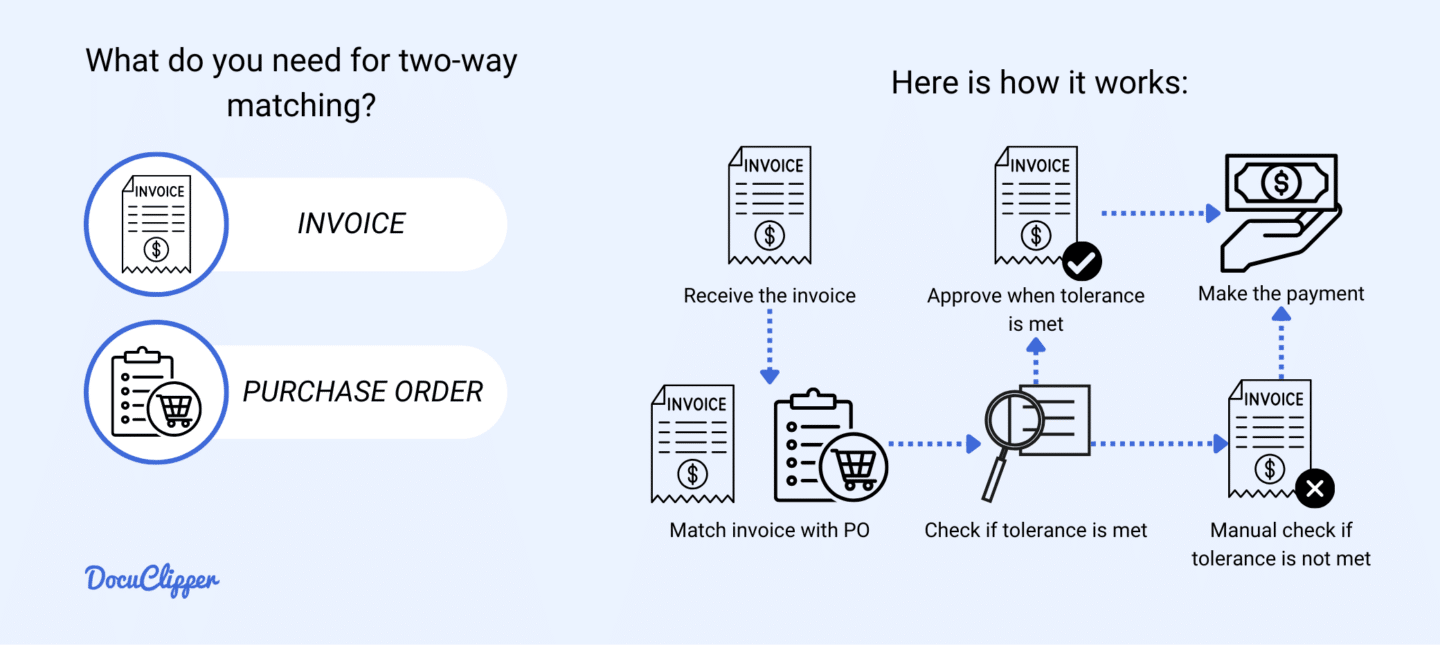

Two-Way Matching

In accounts payable, two-way matching ensures that the data on the purchase order matches the invoice details. This method is ideal for recurring purchases, as it helps you become familiar with the process, reducing the chance of errors.

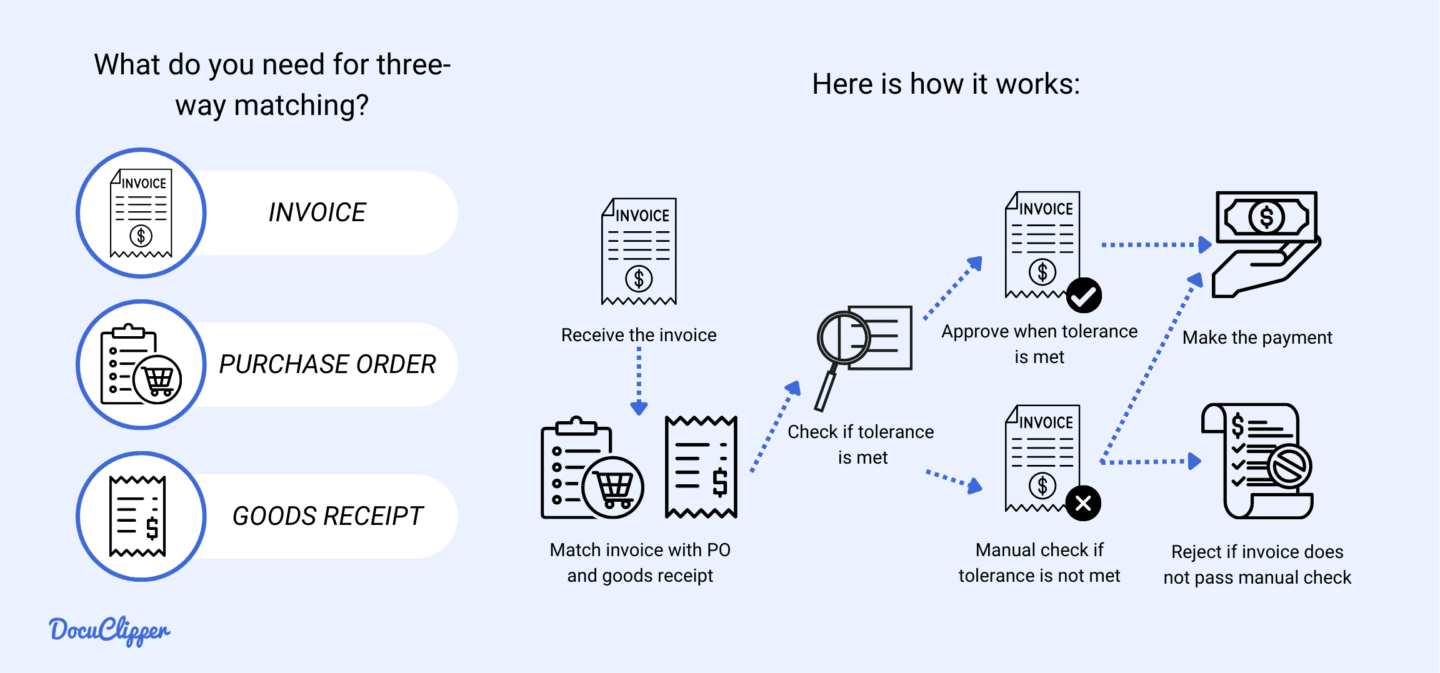

Three-Way Matching

In accounts payable, three-way matching ensures that the data on the purchase order, invoice, and goods receipt all align. This method is ideal for one-time purchases that differ from your usual orders, such as lifetime license subscriptions.

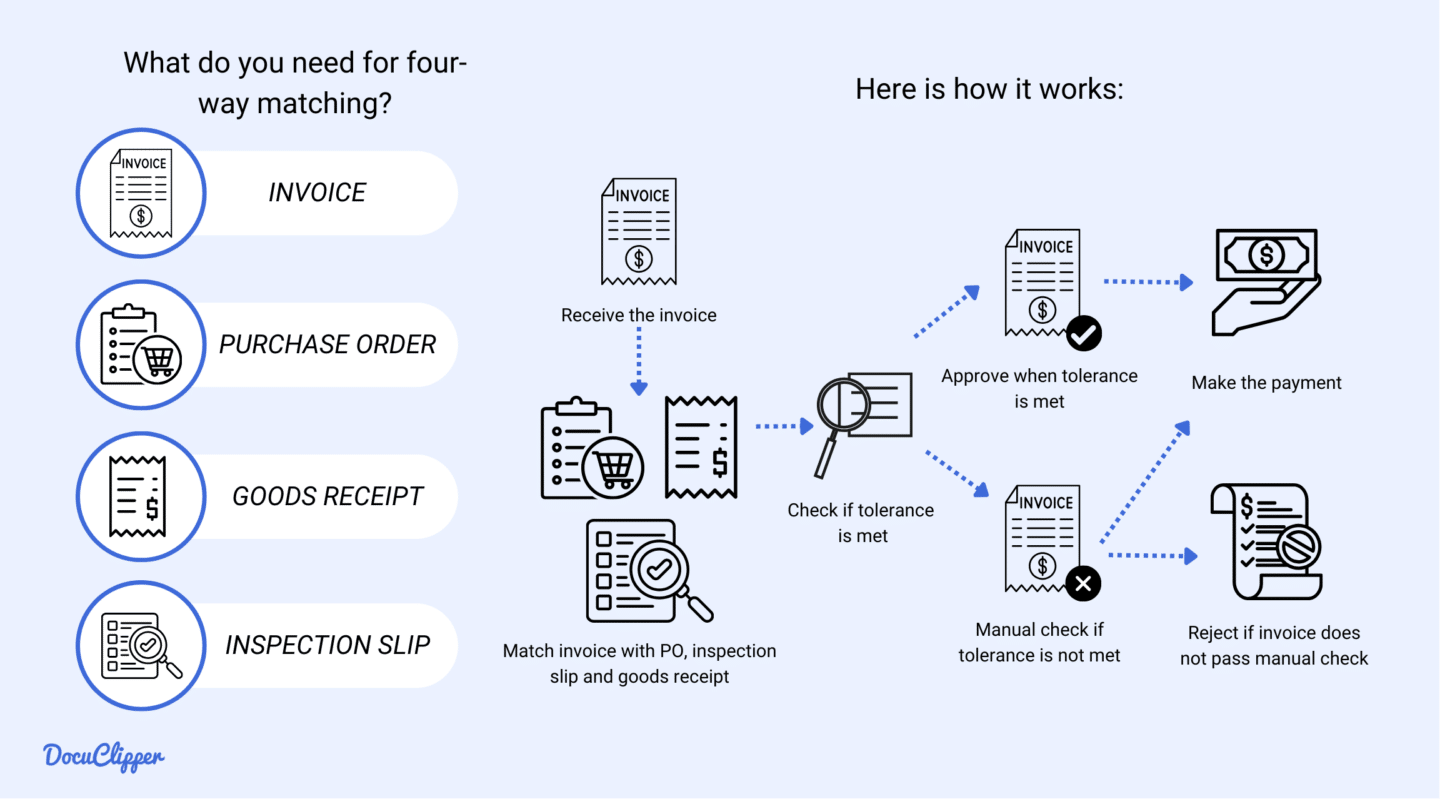

Four-Way Matching

Four-way matching involves verifying four documents before paying an invoice: the purchase order, receipt, inspection slip, and the invoice itself. This method is ideal for significant and unusual purchases, such as renovations or upgrades, where thorough verification is crucial.

Invoice Reconciliation Best Practices

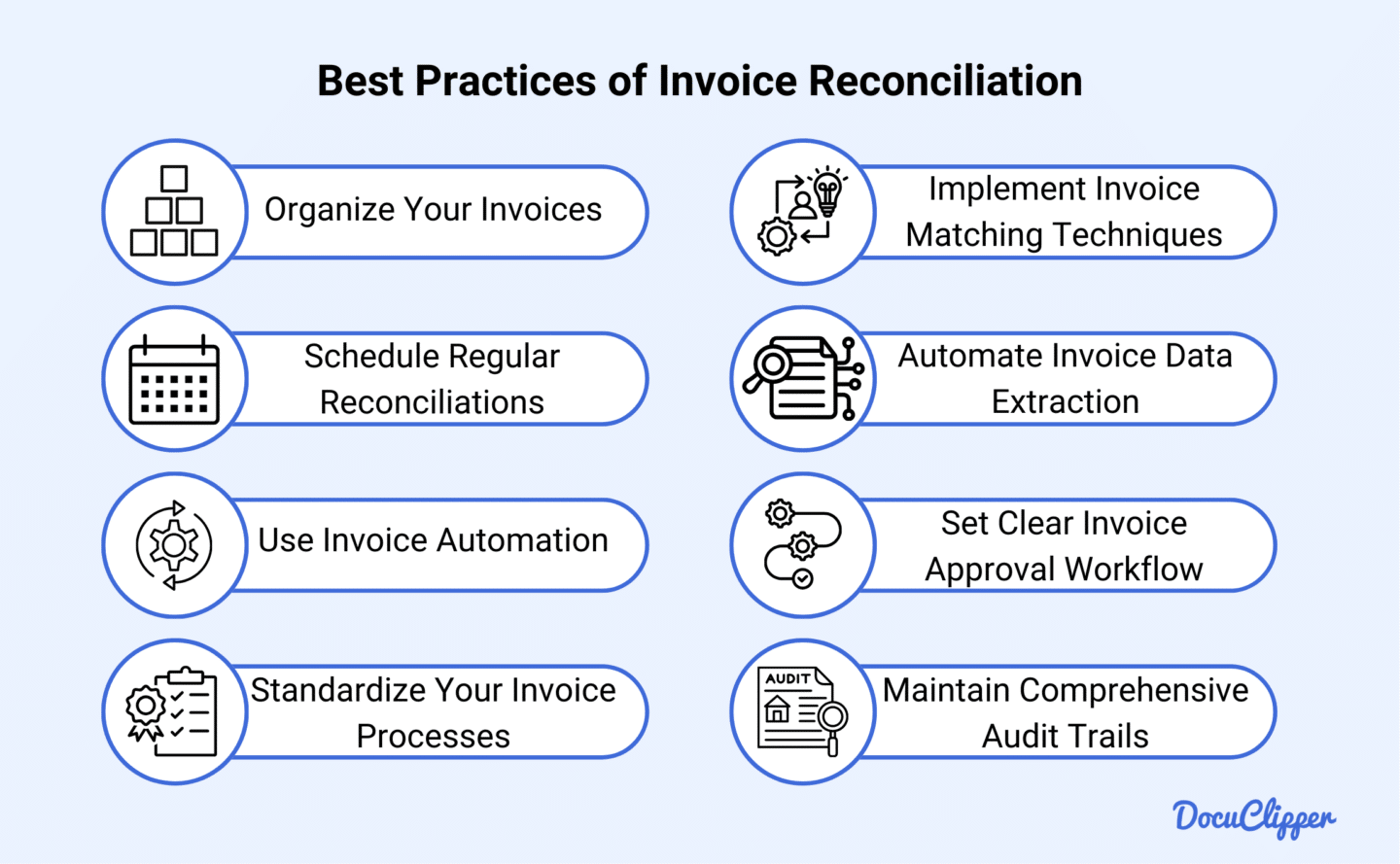

Once you have decided what type of invoice matching you will use for your business, here are some practices to make it more effective:

- Organize Your Invoices: Keep all invoices systematically organized in a central location, whether digitally or physically. This ensures easy access and streamlined processing during reconciliation.

- Schedule Regular Reconciliations: Conduct regular reconciliations to catch discrepancies early and maintain accurate financial records. Set a consistent schedule to ensure timely detection and resolution of issues.

- Use Invoice Automation: Implement invoice automation tools to handle repetitive tasks and reduce manual errors. Automation increases efficiency and allows your team to focus on more critical tasks.

- Standardize Your Invoice Reconciliation Processes: Develop standardized procedures for invoice reconciliation to ensure consistency and accuracy. Clear guidelines help streamline the process and minimize errors.

- Implement Invoice Matching Techniques: Use appropriate invoice matching techniques, such as two-way, three-way, or four-way matching, based on the transaction type. This ensures thorough verification and accuracy in your financial records.

- Automate Invoice Data Extraction: Utilize tools to automate the extraction of data from invoices, converting them into editable formats. This saves time and improves accuracy in data entry and reconciliation.

- Set Clear Invoice Approval Workflow: Establish a clear and transparent invoice approval workflow to ensure accountability and accuracy. Define roles and responsibilities to streamline the approval process.

- Maintain a Comprehensive Audit Trail: Keep detailed records of all reconciliations and approvals to maintain a comprehensive audit trail. This enhances transparency and facilitates easier audits and reviews.

Conclusion

Reconciling invoices is essential and correcting discrepancies before payment can save you significant money. Choose the appropriate level of reconciliation based on your specific situation. Using invoice data capture tools simplifies compiling transaction data, making the reconciliation process more efficient and accurate.

Extract Data from PDF Invoices with DocuClipper

Use DocuClipper to simplify your invoice reconciliation by extracting data from PDF invoices. DocuClipper is a financial document converter that transforms PDF invoices, receipts, and financial statements into editable formats like Excel, CSV, and QBO.

With its outstanding accuracy and speed, DocuClipper processes hundreds of invoices in just seconds, compiling all data into a single spreadsheet for easy management and analysis.

FAQs about Invoice Reconciliation

Here are some frequently asked questions about invoice reconciliation:

What does recon invoice mean?

Recon invoice refers to the process of verifying that an invoice matches purchase orders, receipts, and other financial documents. This ensures accuracy and legitimacy, confirming that goods or services billed were actually received.

What are the 3 types of reconciliation?

The three types of reconciliation are two-way matching (purchase order and invoice), three-way matching (purchase order, invoice, and receipt), and four-way matching (purchase order, receiving report, inspection slip, and invoice). Each provides different levels of verification.

What are the benefits of invoice reconciliation?

Invoice reconciliation ensures accurate financial records, prevents overpayments, and identifies discrepancies. It enhances transparency in financial transactions and helps maintain the integrity of your bookkeeping, ultimately saving your business money and reducing errors.

How do you reconcile supplier invoices?

To reconcile supplier invoices, gather all relevant documents, match invoices to purchase orders and receipts, identify discrepancies, investigate and resolve issues, and record transactions accurately. This process ensures that payments align with received goods or services.

How to do reconciliation?

To perform reconciliation, collect all financial documents, match transactions, identify and investigate discrepancies, resolve issues, and record accurate data. Regular reconciliation helps maintain financial accuracy and prevents errors in your accounting records.

What is the purpose of reconciliation?

The purpose of reconciliation is to ensure that financial records are accurate and consistent with actual transactions. It helps identify discrepancies, prevent fraud, and maintain the integrity of your accounting system, ultimately ensuring accurate financial reporting.