Scanning invoices is a fundamental part of managing your business’s accounts payable tasks. This process can be taxing and tedious, consuming valuable time and resources when done manually.

According to recent studies, businesses spend an average of 30-40% of their accounting time on invoice processing alone.

This comprehensive guide will walk you through everything you need to know about invoice scanning, automated invoice scanning, and how to implement an invoice scanning system that transforms your accounts payable workflow.

By the end, you’ll understand how to reduce processing costs by up to 80% while improving accuracy and efficiency.

What is Invoice Scanning?

Invoice scanning is the process of capturing and extracting essential information from invoices for use in invoice processing and payment workflows.

This critical first step in accounts payable automation converts physical or digital documents into structured data.

Traditionally, invoice scanning was done manually, with accounting personnel visually reviewing documents and manually entering data into spreadsheets or ERP systems.

This approach is time-consuming and error-prone, with research showing error rates between 18-40% for manual data entry.

Modern invoice scanning software uses advanced technologies like Optical Character Recognition (OCR) to automate this process. OCR technology identifies and extracts key invoice data such as:

- Invoice numbers and dates

- Vendor information

- Line items and descriptions

- Tax amounts

- Payment terms

- Total amounts due

With an automated invoice scanning solution, businesses can process invoices in seconds rather than minutes or hours, dramatically reducing the labor involved in accounts payable workflows.

What Are the Benefits of Invoice Scanning?

After knowing what is invoice scanning and how your business or accounting practice can use it, here are some of its benefits of invoice scanning:

- Cost Reduction: Nearly 45% of finance executives cite lowering invoice processing costs as their top AP-related concern. By automating invoice scanning, you can reduce invoice data entry tasks by over 80%, bringing the cost of processing a paper-based documents down from $15 to $3 or less.

- Cost Savings: Automation reduces labor costs, as the average monthly salary for a data entry personnel is $3,375, while OCR software typically costs between $30 and $100 a month. This significant saving highlights the financial advantage of adopting automated solutions.

- Increased Accuracy: OCR invoice processing achieves an accuracy of 99.9%, whereas research indicates that manual data entry errors range between 18% to 40%, highlighting the efficiency of automation.

- Faster Processing: Automated invoice processing can reduce the payment cycle by up to 50%, enabling companies to take advantage of early payment discounts and avoid late payment penalties, significantly improving cash flow management.

- Improved Scalability: Businesses using automated invoice processing can handle up to 120% more invoices without increasing headcount based on our customer feedback, allowing for efficient growth and scalability without additional resource constraints.

- Enhanced Data Management: Scanned invoices are stored digitally, making invoices easy to organize, search, and retrieve. This improves your data management and ensures that invoice data is readily available for audits or financial reporting.

- Improved Tax Compliance: Digital storage of invoices helps in maintaining compliance with financial regulations and standards. It ensures that all invoice records are accurately recorded and easily accessible for auditing purposes.

- Improved Vendor Relationship: Automated invoice processing speeds up vendor payments, resulting in better vendor relationships. Timely payments enhance trust and reliability, potentially leading to favorable terms and long-term partnerships with suppliers for your business.

- Environmental Sustainability: Implementing an invoice scanning system significantly reduces paper usage and storage needs. The average office worker uses 10,000 sheets of paper annually, and paper accounts for 25% of landfill waste. Digital invoice processing helps organizations meet sustainability goals while reducing storage costs.

In general, invoice digitalization is excellent technique for businesses to process invoices faster and at much lower cost.

How to Automate Invoice Scanning

After knowing the benefits of invoice scanning, I believe that you might want to apply it to your business.

Here are the steps to help you get started:

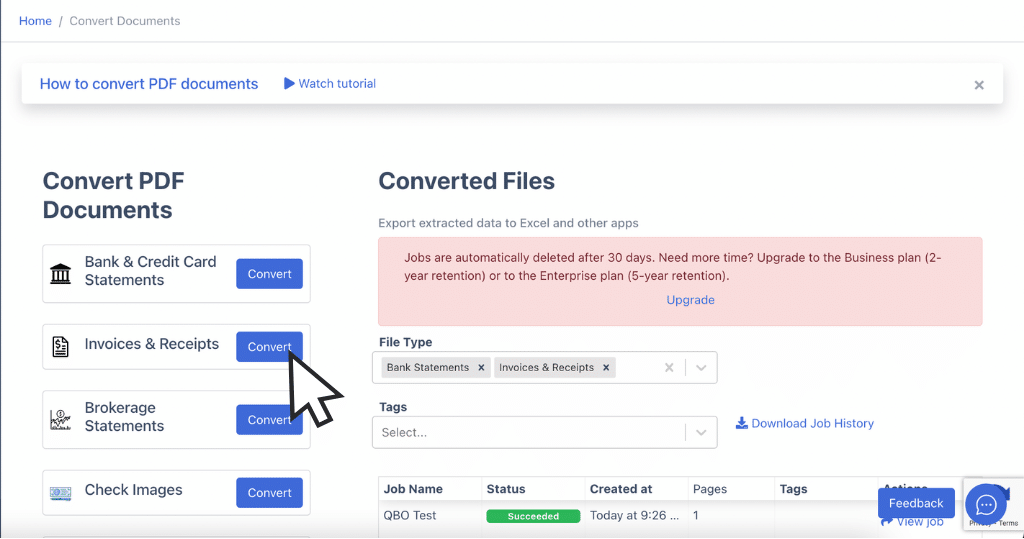

Step 1: Select Invoice Scanning Software

Choosing the most affordable and cost-efficient invoice-scanning software for your business is important.

DocuClipper is an excellent option, offering cost-effective features for only $39 a month. It covers not just invoices but also receipts, credit card and bank statements, and checks.

This software provides versatility and can easily convert hundreds of PDF invoices into formats like XLS, CSV, or QBO, based on your preference.

By picking DocuClipper, you ensure a flexible and efficient solution for all your invoice scanning needs.

Step 2: Establish Your Invoice Scanning Workflow

Before implementation, map out your ideal workflow. Consider:

- Document Collection: How invoices will be received (email, mail, vendor portals)

- Scanning Method: Hardware requirements for physical documents

- Verification Process: How exceptions will be handled

- Approval Routing: Who needs to review invoices before payment

- Storage Protocols: Retention policies and access permissions

Creating a clear workflow ensures smooth implementation and helps identify potential bottlenecks before they occur.

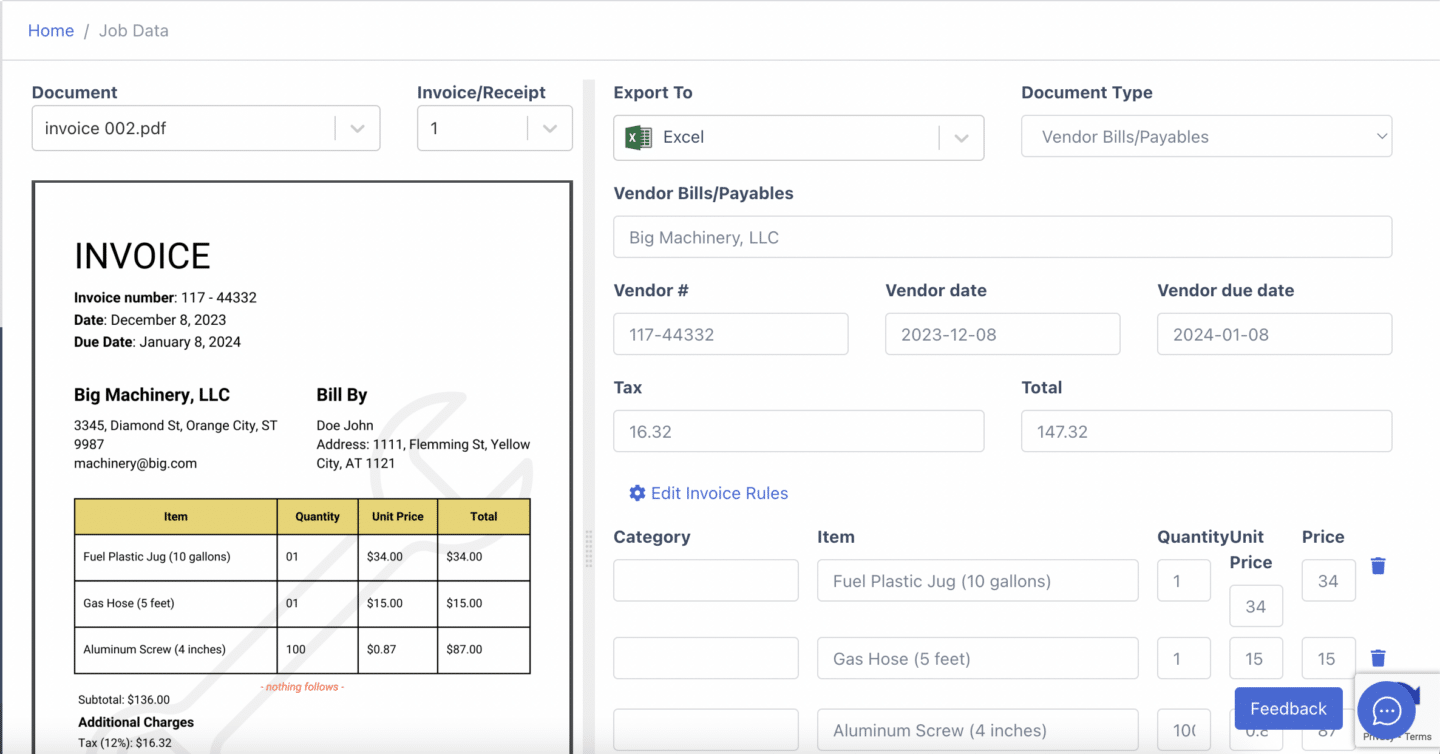

Step 3: Extract and Validate Invoice Data

With OCR software like DocuClipper, you can begin extracting invoice data from PDFs and scanned documents. The system will automatically capture essential information including:

- Invoice numbers and dates

- Vendor details

- Line items and descriptions

- Tax amounts

- Payment terms

- Total amounts due

- and more..

For optimal results, organize extracted data in XLS or CSV format compatible with your ERP or accounting software.

Most modern invoice software includes invoice validation features that flag potential errors or inconsistencies for human review before finalizing the data.

According to our analysis, implementing validation rules can catch up to 95% of potential errors before they enter your financial systems, significantly reducing reconciliation work and payment issues.

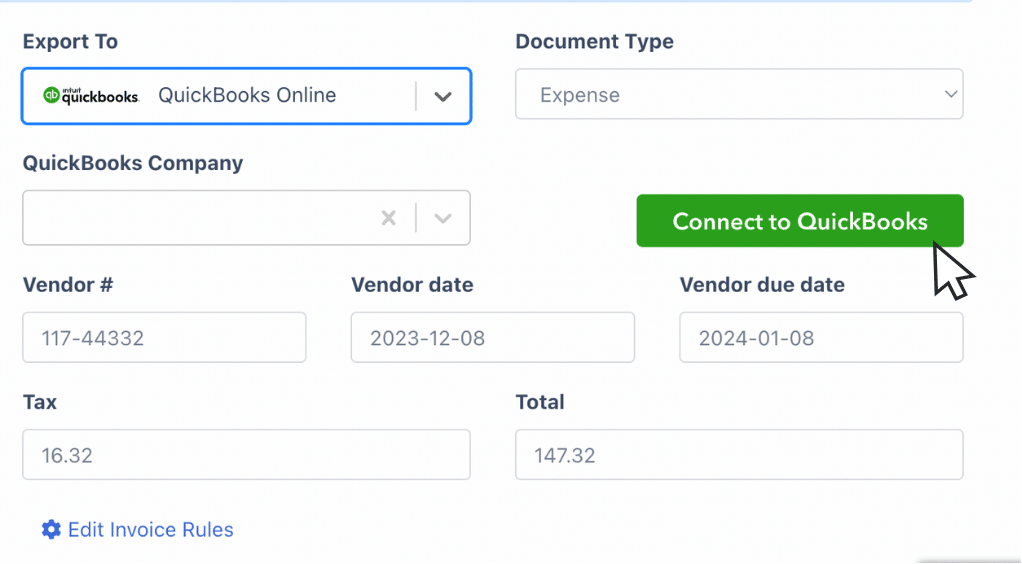

Step 4: Import Invoice Data Into Your ERP/Accounting Software

Importing your invoice data directly into your accounting software is straightforward with built-in import features.

From the QuickBooks interface, you can import invoices directly, streamlining the entire process and ensuring your financial data is accurately and efficiently integrated into your accounting system.

For example, you can import invoices into QuickBooks by uploading a CSV file. Alternatively, you can use an interface or API for seamless integration.

DocuClipper simplifies this process further by allowing you to connect your DocuClipper account to QuickBooks. You don’t need to convert your invoice spreadsheet to CSV, and you can import it directly.

Furthermore, you can apply invoice rules to automatically categorize your expenses and assign invoices to the right customer or vendor.

Implementing Invoice Scanning Best Practices

To maximize the effectiveness of your invoice scanning system, follow these best practices:

Standardize Invoice Requirements

Work with vendors to standardize invoice formats where possible. Consistent layouts improve OCR accuracy and reduce exceptions. Provide vendors with templates or guidelines that include:

- Required fields and their placement

- Preferred file formats for digital invoices

- Company-specific information requirements

Create Invoice Templates

For recurring vendors, create recognition templates that “teach” your invoice scanning software where to find relevant information on specific invoice formats. Most advanced OCR systems can store these templates to improve accuracy with each processing cycle.

Establish Quality Control Procedures

While automated invoice scanning is highly accurate, implement verification procedures for:

- Invoices above certain dollar thresholds

- First-time vendors

- Invoices with detected exceptions

- Random audits to ensure system accuracy

Train Your Team

Ensure your accounting staff understands how to:

- Use the invoice scanning software effectively

- Handle exceptions and corrections

- Leverage advanced features for maximum efficiency

- Troubleshoot common issues

Proper training can reduce implementation challenges and accelerate ROI achievement.

Conclusion

Invoice scanning is integral to accounts payable processes, and automating it offers many benefits for your business.

Automation can significantly reduce costs, enhance efficiency, and improve organization. By using OCR invoice scanners, you open the door to automation, avoiding the drawbacks of manual processes.

This technology streamlines your workflow, reduces errors, and saves valuable time, allowing you to focus on more strategic tasks. Employing automated invoice scanning is a smart move to optimize your accounts payable operations and drive business success.

FAQs about Invoice Scanning Software

Here are some frequently asked questions about invoice scanning software:

What is OCR invoice scanning?

OCR (Optical Character Recognition) invoice scanning is a technology that converts different types of documents, such as scanned paper documents, PDF files, or images captured by a digital camera, into editable and searchable data. This process extracts key information from invoices, such as invoice numbers, dates, amounts, and line items, automating data entry and streamlining invoice processing.

What is scanning in accounts payable?

Scanning in accounts payable involves converting paper invoices and receipts into digital formats using scanning technology. This process captures key information such as invoice numbers, dates, amounts, and line items. Digitalizing these documents streamlines the accounts payable process, reduces manual data entry, improves accuracy, and enhances the organization and accessibility of financial records.

What is the purpose of invoice processing?

The purpose of invoice processing is to manage and record all incoming invoices efficiently. This process ensures that invoices are accurately entered into the accounting system, approved, and paid on time. Effective invoice processing helps maintain accurate financial records, control expenses, prevent payment errors, and improve cash flow management, ultimately contributing to better financial health for the business.

What are the advantages of OCR in invoice scanning?

OCR in invoice scanning offers numerous advantages. It automates data extraction, reducing manual entry time and minimizing human errors for precise data capture. This leads to cost savings by lowering labor costs. It speeds up the invoice processing cycle, enabling faster payments and better cash flow management. It improves organization by converting paper invoices into digital formats, enhancing document management and accessibility. Additionally, OCR is scalable, handling large volumes of invoices effortlessly and supporting business growth.

What is the purpose of scanning receipts?

The purpose of scanning receipts is to convert paper receipts into digital formats for easier management and storage. This process captures essential details such as date, amount, and vendor information. Scanning receipts helps improve organization, ensures accurate record-keeping, facilitates expense tracking, simplifies tax preparation, and reduces the risk of lost or damaged receipts, ultimately streamlining financial management.

How does invoice scanning software handle different invoice formats?

Modern invoice scanning software uses advanced algorithms to handle various invoice formats through:

- Template-Based Recognition: Creating specific templates for recurring vendors

- Machine Learning: Identifying patterns across different invoice layouts

- Adaptive Processing: Adjusting extraction based on document structure

- Key-Value Pair Detection: Finding relationships between labels and data

- Context-Aware Extraction: Understanding data meaning based on location and format

The best systems can process structured, semi-structured, and unstructured invoices with high accuracy, regardless of the original format or layout.

What is the ROI of implementing an automated invoice scanning system?

The return on investment for automated invoice scanning is typically realized within 3-6 months. Key ROI factors include:

- Direct Cost Savings: 60-80% reduction in processing costs

- Early Payment Discounts: Capturing typical 2% discounts on eligible invoices

- Labor Reallocation: Shifting AP staff from data entry to analysis

- Error Reduction: Minimizing costs associated with payment mistakes

- Audit Efficiency: Reducing time spent on financial audits by up to 75%

- Scalability Benefits: Processing increased invoice volumes without additional headcount

Most businesses see full ROI within 6 months, with ongoing annual savings of $5-15 per invoice processed through automation.

How does invoice scanning improve compliance and audit readiness?

Invoice scanning systems enhance compliance and audit preparation by:

- Creating complete digital audit trails of all invoice transactions

- Ensuring consistent application of approval policies

- Providing instant access to historical invoice data

- Maintaining tamper-proof digital records for required retention periods

- Enabling easy search and retrieval of specific transactions

- Supporting detailed reporting for regulatory requirements

- Ensuring separation of duties through role-based access controls

These capabilities significantly reduce audit preparation time and minimize compliance risks associated with accounts payable processes.

What security features should I look for in invoice scanning software?

When selecting invoice scanning software, prioritize these security features:

- Data Encryption: Both in transit and at rest

- Access Controls: Role-based permissions for different user types

- Audit Logging: Detailed records of all system activities

- Compliance Certifications: SOC 2, GDPR, or industry-specific standards

- Secure Authentication: Multi-factor authentication options

- Data Backup: Automated backup and disaster recovery capabilities

- Vendor Security Practices: Third-party security audits and penetration testing

Proper security ensures that your financial data remains protected throughout the invoice scanning and processing workflow.

How can small businesses benefit from invoice scanning automation?

Small businesses can realize significant benefits from automated invoice scanning:

- Competitive Advantage: Achieving enterprise-level efficiency with limited resources

- Growth Support: Managing increased invoice volumes without adding staff

- Cash Flow Improvement: Better visibility into payment timing and obligations

- Reduced Overhead: Minimizing the need for physical storage space

- Remote Work Support: Enabling accounts payable functions from anywhere

- Improved Accuracy: Reducing costly errors that impact smaller cash reserves

- Affordable Solutions: Cloud-based options with low monthly fees instead of large capital investments

With solutions like DocuClipper available at just $39/month, even the smallest businesses can now afford professional invoice scanning systems that were previously accessible only to larger enterprises.