Validating documents is a common process for tracking accounts payable. You need to find a reliable method where you can easily validate invoices, receipts, bank statements, salary stubs, and statements.

However, the usual way of validation is to check it manually. While it is very basic, it is prone to a lot of errors. But there is a more efficient way around this.

In this article, we are going to talk about invoice validation and how to apply it to your accounting tasks and make it more efficient.

What is Invoice Validation?

Invoice validation is the process of verifying an invoice’s accuracy, compliance, and authenticity before it is approved for payment.

When you validate an invoice, you ensure it’s accurate, the details on a supplier invoice to ensure that the price, quantity, and description of goods or services match the terms of the purchase order or contract, it’s compliant, and authentic before giving it the green light for payment. This proactive approach helps you identify errors and fraud in your payment process.

What is Invoice Validation Accuracy?

Invoice validation accuracy refers to the precision of the information within invoices, whether it’s the names, amounts, dates, summaries, or other information regarding the transaction ensuring that all invoice details are accurate and align with the agreed-upon terms between a buyer and seller before payment is made; essentially, it’s a measure of how well the invoice verification process catches and corrects discrepancies.

This measure is crucial for maintaining good relations with your vendors, compliance, and effective cash flow in your business.

In other words, it is a check that ensures only the right invoices get paid every time.

Why is Invoice Validation Important?

The importance of validating invoices has clear monetary benefits, here are some:

- Increased financial accuracy: Validating your invoices with your supporting documents makes the accounting and auditing processes much smoother. This boosts your team’s efficiency and cuts unnecessary costs for your business. It helps you save time and money while keeping everything running seamlessly.

- Enhanced customer trust: Invoice errors can trouble your relationships with clients. Around 35% of businesses face collection challenges due to poor communication, often due to inaccurate invoices. By ensuring your invoices are precise, you can build trust and reliability, showing your customers that they can depend on you.

- Improved vendor relationship: Did you know 13% of invoices are disputed because of errors? Accurate invoice validation significantly reduces disputes, helping you maintain a smoother, more collaborative relationship with your partners

- Enhanced operational efficiency: More than 30% of small and medium-sized U.S. businesses experience late payments due to invoice inaccuracies, which take roughly 15 days annually to process. This can heavily impact operational efficiency, especially in your accounts payable (AP) department. Invoice validation eliminates these delays and helps streamline your processes.

- Reduction in dispute rate: Research estimates that 15% to 20% of invoice disputes are often due to inaccuracies. These disputes waste your time and resources that could be better spent elsewhere. By prioritizing invoice validation, you can reduce these disputes and free up valuable time for your team to focus on more critical tasks.

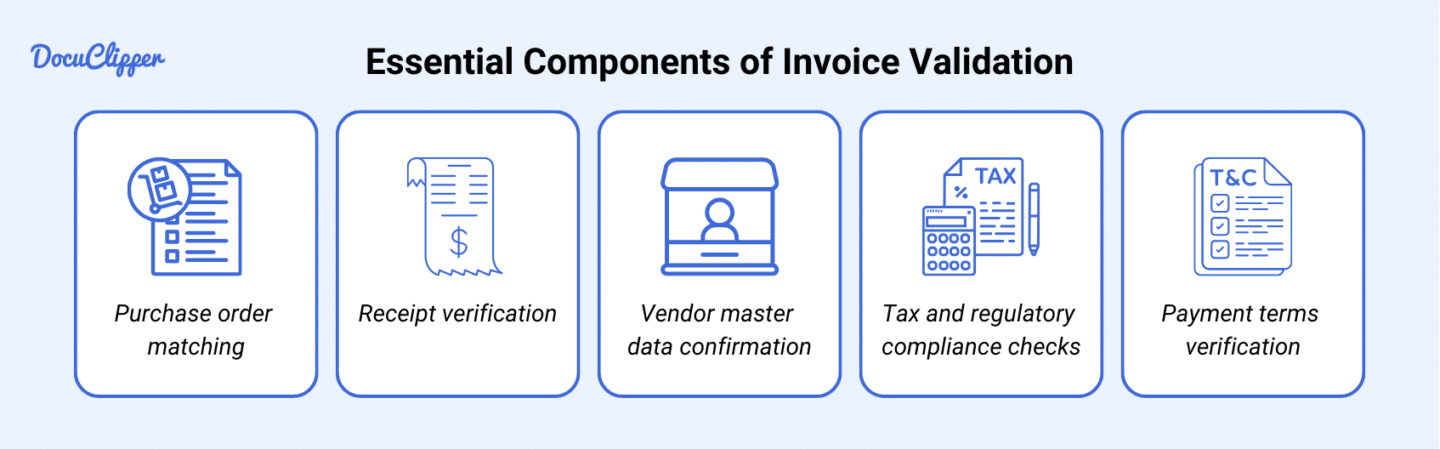

Essential Components of Invoice Validation

When validating invoices, you need to take a look at these significant steps and be sure that all of these are present before the process starts so you can begin the validation process.

- Purchase order matching: You need to have a purchase order as this is congruent with an invoice. Two-way matching or three-way matching are your best options to improve the invoice validation process and the accuracy of the invoices.

- Receipt verification: A receipt is released when the invoice is paid and the information within should relate to the purchase.

- Vendor master data confirmation: This data is cross-checked against the invoice to ensure accuracy and prevent fraud.

- Tax and regulatory compliance checks: Each state and region has tax charges and regulations, so these are always present when you are validating invoices.

- Payment terms verification: Suppliers often have terms so this should be verified whether it is agreed by both parties and it is reasonable in a business POV

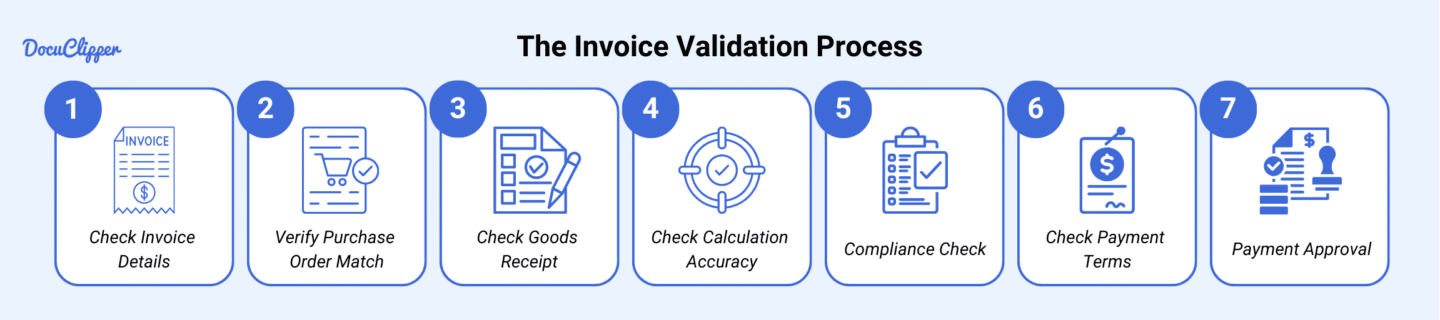

The Invoice Validation Process

So, you have received your invoice and how do you validate it?

In this section, I walk you through a step-by-step process on how to validate your invoices:

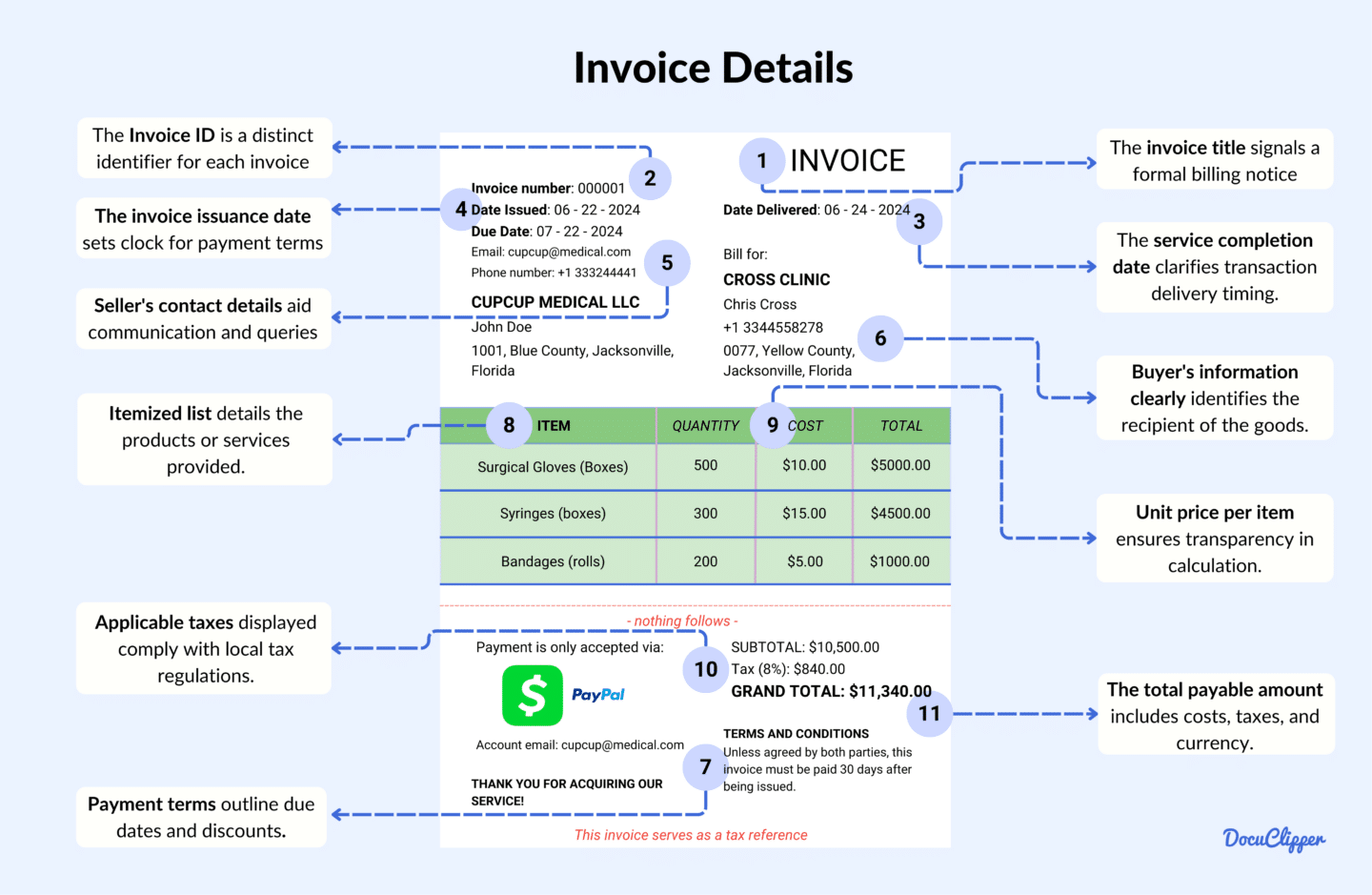

Step 1: Check Invoice Details

First, you have to ensure whether it is a legitimate invoice. Check for legitimate information like names, dates, and invoice numbers.

After knowing the basics of the invoice, review whether tax charges are already included and identify the payment terms to determine its urgency.

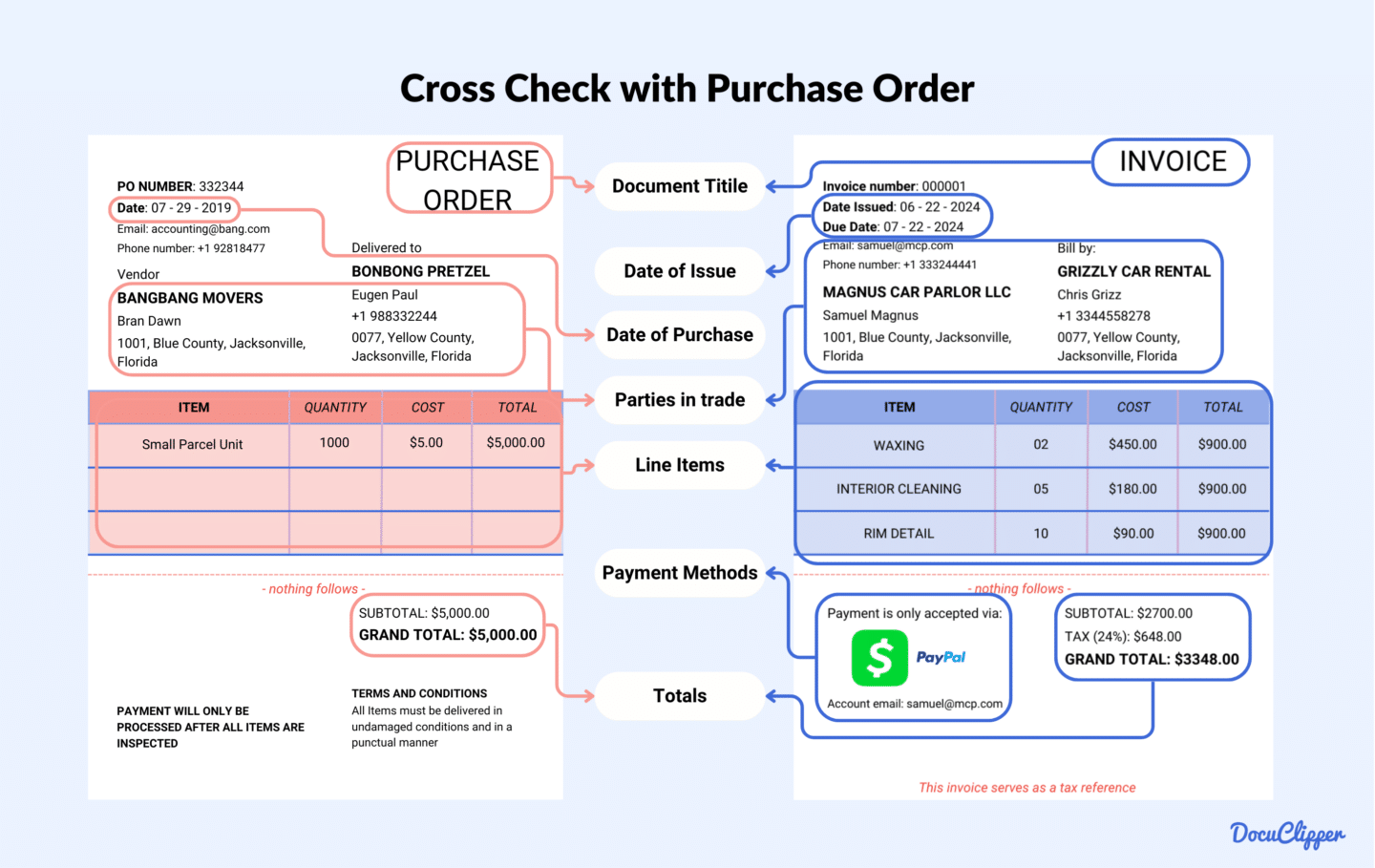

Step 2: Verify Purchase Order Match

Invoices always reflect with the Purchase Order. POs often contain all the requested items or services along with the tentative summary of the totals.

Check if the invoice and purchase correlate with one another. You could be basing the invoice on another Purchase order. Once you can confirm that they are related, check the line items if they match.

Also, check whether the original agreement you have with your supplier or service provider is reflected within the PO and invoice.

Step 3: Check Goods Receipt

Once the supplies have been delivered, you will receive a goods receipt. The goods receipt contains the items, quantities, and tentative amounts of the delivery. This document should align with both the invoice and the purchase order.

The term being used to name the invoice matching process of these documents is 3-way matching. If you identify discrepancies between the documents, review the purchase order or goods receipt details and contact the supplier for clarification if needed.

Step 4: Check Calculation Accuracy

If your supplier uses automated invoice processing, calculation errors are less common. But if they did this manually, you should check the calculation. Check that the totals add up to everything and that the taxes are properly detected according to legal obligations.

Step 5: Compliance Check

Governments often impose specific requirements for invoice formats and mandatory disclosures. Observe whether your supplier has charged you including taxes. If they complied with government mandates, then there should be no issue.

International transactions are a different case but it is certainly a gray area. Be prepared to meet any additional requirements to ensure adherence to all applicable regulations.

Step 6: Check Payment Terms

Payment terms are always disclosed within the invoice. Often suppliers have a due date set for the payment going through. Missing this deadline can result in penalties, which are often specified in the invoice.

Listed are also payment methods and additional charges when not paid in cash like wireless transactions or through credit card.

Step 7: Payment Approval, System Data Entry, and Payment Schedule

After verifying that the invoice matches supporting documents, complies with legal requirements, and adheres to agreed payment terms, the final step is to submit it for payment approval.

Once approved, it should be inputted into the ERP software being used and then wait for the payment schedule committed by the accounting team.

Why is Completeness Important in Invoice Validation?

Invoices have many checklists that need to be covered and being complete just validates the invoice to be authentic, accurate, and fair for your transaction with your partner.

You can effectively minimize errors, prevent overpayments, and reduce the risk of fraudulent activities when the invoice is complete before processing payments.

Common Invoice Validation Challenges

Validating invoices comes with many challenges that can affect your efficiency in invoice processing. Here are the main roadblocks:

- Duplicate Invoices: There are cases when suppliers may accidentally send the same invoice multiple times. Identifying and eliminating duplicates early in the process saves time and prevents overpayment.

- Data Discrepancies: A mismatch between the purchase order, invoice, and goods receipt can lead to disputes. If fraud or errors are suspected, these discrepancies may trigger investigations that takes a lot of time.

- Missing Information: Missing essential invoices like amounts, dates, names, or addresses disrupt the validation process. You’ll be forced to contact again and wait for the reply of your supplier with a revised invoice.

- Compliance Issues: Strict government regulations often require invoices to follow specific formats, especially during tax season. Non-compliant invoices can create complications during audits and may result in penalties.

- Processing Delays: Manual invoice data entry slows down the invoice validation process and is prone to errors. These delays can compound over time, requiring additional effort to correct mistakes and keep workflows on track.

Best Practices for Effective Invoice Validation

After talking about the blockers of invoice validation efficiency, here are some of the ways around it.

- Standardized validation procedures: Establish a consistent process for handling all invoices. Treat each invoice with the same level of urgency and everything should be done inspected in the smallest detail.

- Implementation of automation tools: Manual invoice validation is already known to be slow, using automated software removes these invoice validation delays.

- Staff training and expertise: The more AP personnel get proficient and used to the invoice format, compliance, and validating methods, they get more efficient the invoice validation process.

- Quality control measures: Maintain strict quality control standards. Avoid processing incomplete, fraudulent, or questionable invoices. Return or inquire about such documents promptly, as dealing with them later can become time-consuming and complex.

Benefits of an Efficient Invoice Validation

So since we already know how to improve your invoice validation process, here are the major benefits:

- Cost savings and error reduction: According to a study, 0.53% of invoices received contain mistakes, and these mistakes can easily be detected with an efficient invoice validation process.

- Fraud prevention: In the UK, 44.8% of fraudulent payments involve invoice transactions, having a proper invoice validation program gets you away from this.

- Improved vendor relationships: Studies show that 35% of businesses struggle with collections due to poor communication and this could be caused by invoice accuracy.

- Better cash flow management: Having an invoice validation process that is smooth will allow you to have more visibility for your cash flow and manage invoices.

- Audit readiness: Invoice validation checks all invoices whether it is compliant with government regulations.

Best Technologies for Invoice Validation

Now you know what are the benefits of having proper invoice validation methods, here are the best technologies to automate invoice validation with:

OCR and Data Capture Solutions

OCR invoice software is great for capturing data from static PDF invoices. This will eliminate the manual data extraction of your invoice validation. Reducing the cost being paid to manual data entry personnel. These tools convert PDF invoices to formats that are easy to validate such as CSV and XLS.

AP Automation Software

Accounts payable automation software is a widely adopted solution that streamlines invoice validation. Many tools come equipped with built-in validation features that can seamlessly integrate into your invoice processing workflow.

The majority of these AP tools are only limited to processing e-invoices or CSV formats of invoices, making this a significant roadblock for processing.

Integration with ERP systems

ERP software has some built-in invoice fraud detection and matching programs. These features allow you to easily validate your invoice whether it is fraudulent or matching with corresponding data that you have already uploaded in your ERP software.

AI and Machine Learning Capabilities

AI is a recent document processing tool that can detect, extract, and match invoices.

However, accuracy can vary depending on the complexity of the invoices, and processing speeds may sometimes be inconsistent. While promising, these tools should be closely evaluated with a trained AP personnel.

What is Authorization in Invoice Validation?

Authorization in invoice validation is the process of confirming that an invoice has been approved by the required personnel before committing to the payment.

This process secures compliance with internal policies, reduces the risk of errors or fraud, and verifies that the goods or services were properly received to what is agreed between the buyer and seller. .

Capture Your Invoice Data with DocuClipper

DocuClipper is an OCR invoice capture tool that converts PDF invoices to editable formats such as XLS, CSV, and QBO. It can process hundreds of invoices in just under a minute at near-perfect OCR accuracy.

This tool goes beyond invoice scanning software, it can convert PDF bank statements, receipts, checks, tax forms, and brokerage statements. This makes your invoice process for invoice validation faster, cost-effective, and more accurate than manual means.

FAQs about Invoice Validation

Here are some frequently asked questions about invoice validation:

How do I make an invoice valid?

To make an invoice valid, ensure it includes essential details such as the supplier’s name, address, invoice number, date, itemized charges, taxes, payment terms, and total amount. Verify its accuracy, compliance with legal and tax requirements, and approval by authorized personnel before processing it for payment.

What does it mean when an invoice is validated?

When an invoice is validated, it means the document has been reviewed for accuracy, compliance, and authenticity. Validation confirms that all details, such as amounts, dates, and taxes, are correct and align with purchase orders or contracts. This ensures the invoice is legitimate and ready for payment processing.

Which four tasks are performed by invoice validation?

Invoice validation involves four key tasks:

- Checking Invoice Accuracy: Verifying details like amounts, dates, and tax calculations.

- Matching Documents: Ensuring the invoice aligns with purchase orders and goods receipts (3-way matching).

- Compliance Verification: Confirming adherence to tax and regulatory requirements.

- Approval Authorization: Securing approval from designated personnel before payment processing.

How are invoices approved?

Invoices are approved by reviewing their accuracy, compliance, and alignment with purchase orders or contracts. Once verified, they are sent to authorized personnel for final approval. After approval, the invoice is recorded in the accounting or ERP system, ensuring it is ready for payment processing on the scheduled date.

How to identify a valid invoice?

A valid invoice includes key details such as the supplier’s name, address, invoice number, date, itemized charges, applicable taxes, total amount, and payment terms. It should align with any related purchase orders or contracts and comply with legal and tax requirements to be considered legitimate for payment.

What is billing validation?

Billing validation is the process of reviewing and verifying the accuracy, completeness, and compliance of a bill or invoice before it is approved for payment. This includes checking details like amounts, dates, taxes, and alignment with purchase orders or contracts to ensure legitimacy and prevent errors or fraud.

What does an invoice need to be valid?

For an invoice to be valid, it must include the supplier’s name, address, invoice number, date, itemized charges, applicable taxes, total amount, and payment terms. It should also align with purchase orders or agreements, comply with legal and tax requirements, and be authorized by the appropriate personnel.