If Klippa isn’t meeting your expectations, you may be searching for an invoice data extraction tool that offers better accuracy, automation, or integration.

Whether you’re looking for a more cost-effective solution, enhanced customization, or improved support, there are plenty of alternatives available.

From AI-powered OCR tools to seamless ERP integrations, the right choice depends on your business needs. This list highlights the best Klippa alternatives, helping you find a solution that streamlines your invoice processing and boosts efficiency.

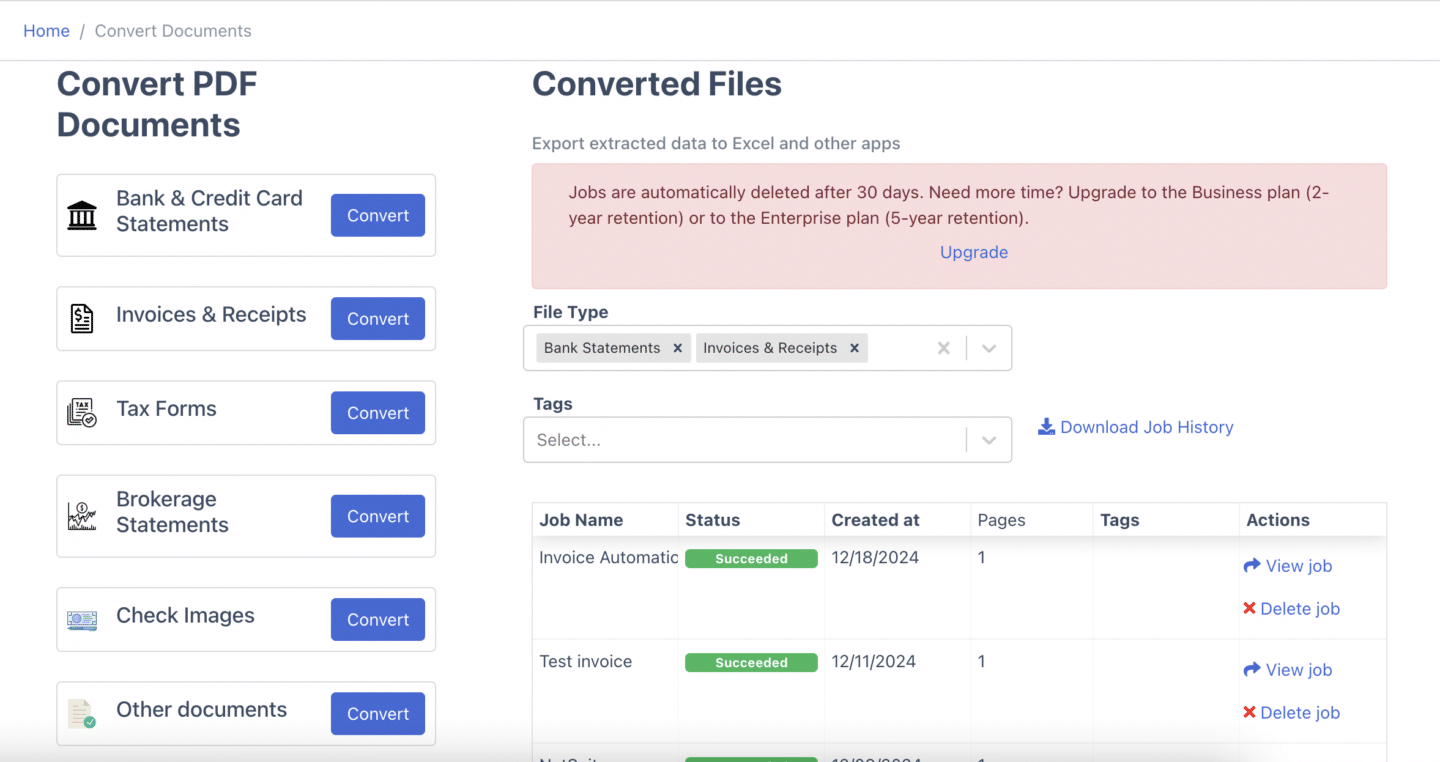

1. DocuClipper

DocuClipper is a powerful invoice data extraction solution that converts invoices, receipts, and financial statements into Excel, CSV, and QBO formats. By automating data capture and organization, it eliminates manual entry and minimizes errors.

Equipped with advanced OCR technology and specialized financial document algorithms, DocuClipper delivers high accuracy and fast processing.

If you need a tool to simplify invoice management, enhance data accuracy, and save time, DocuClipper is an excellent choice. Whether you’re managing daily invoices or bulk statements, it automates extraction, making your workflow smoother and more efficient.

Pros

- Easy to Use: DocuClipper’s web-based interface is simple and user-friendly, allowing you to extract invoice data effortlessly.

- Affordable Pricing: Ideal for small businesses, its page-based pricing structure is more budget-friendly compared to competitors that charge per line item.

- High Precision: Leveraging advanced OCR technology, DocuClipper accurately extracts invoice data, seamlessly converting PDFs into Excel, CSV, or QBO without errors.

- Rapid Processing: With the ability to process hundreds of invoices in under a minute, it dramatically cuts down on manual data entry time.

- Secure Data Storage: Your financial information is encrypted and stored in a secure cloud environment, ensuring confidentiality and compliance.

Cons

- No Mobile Application: DocuClipper does not offer a mobile app with built-in camera scanning, so invoices must be converted to PDFs before processing.

- Limited Native Integrations: While it connects directly with Sage, Xero, and QuickBooks, integrating with other accounting platforms requires API setup.

Pricing

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details.

2. Nanonets

Nanonets is an AI-powered invoice data extraction tool designed to automate the processing of invoices and financial documents.

Using advanced OCR and deep learning models, Nanonets captures key invoice details and converts unstructured data into structured formats. It helps businesses eliminate manual data entry in accounts payable, invoice reconciliation, and financial workflows.

With seamless API integration, Nanonets connects with existing accounting and ERP systems, reducing manual effort by up to 90%. It offers high accuracy, scalability, and automation, making it a valuable solution for businesses looking to streamline invoice processing while cutting costs and improving efficiency.

Pros

- Advanced and Scalable Technology: Nanonets offers highly accurate OCR-powered invoice extraction that is easy to use and scales efficiently for businesses of all sizes.

- Supportive Team: The customer support team ensures you maximize the platform’s capabilities, assisting with setup and best practices.

- Customization Options: When challenges arise, the Nanonets team works closely with users to refine processes and implement customizations for better results.

- Superior OCR Accuracy: After evaluating multiple solutions, users found Nanonets to outperform competitors in accuracy, speed, integration ease, and scalability.

Cons

- Slow Initial Support Response: While customer support has improved, earlier response times were reported as slow.

- High Cost for Low Volume Users: Nanonets can be expensive for businesses with a low volume of invoices, making it harder to justify the cost of additional models.

- Limited File Processing Control: Users handling large batches of invoices lack a streamlined way to track and reprocess specific pages, requiring manual uploads for corrections.

- Complex Setup: Initial configuration for invoice processing and workflow automation may require time and technical expertise.

- Pricing Transparency Issues: The pricing model may not be as clear or cost-effective compared to other invoice data extraction tools, particularly for smaller businesses.

- Manual Verification Still Needed: Despite automation, some extracted invoice data may require manual review, reducing potential efficiency gains.

Pricing

Nanonets offers flexible pricing plans to accommodate various business needs:

- Starter Plan: Ideal for individuals or small teams, this pay-as-you-go plan charges $0.30 per page processed, with no monthly subscription fee.

- Pro Plan: Designed for growing teams, it includes 10,000 pages per month for $999, with additional pages at $0.10 each. This plan offers advanced features like team collaboration, custom data capture AI, and integration with platforms such as Microsoft Dynamics, Salesforce, and SAP.

- Enterprise Plan: Tailored for large organizations with high-volume processing needs, this plan provides customized solutions, including dedicated account management, custom data retention policies, and personalized onboarding. Pricing is available upon request.

- All new users receive $200 in credits upon signing up, allowing them to explore the platform’s capabilities before committing to a paid plan.

3. ABBYY FlexiCapture

ABBYY FlexiCapture is an AI-powered invoice data extraction solution that automates the processing of invoices, receipts, and financial documents. Using machine learning and advanced OCR, it captures and extracts key data, reducing manual data entry and improving efficiency.

Designed for scalability, FlexiCapture integrates with financial systems to streamline workflows. It ensures high accuracy through intelligent validation, making it a reliable choice for businesses looking to automate invoice processing and enhance data accuracy.

Pros

- Efficient Invoice Processing: ABBYY FlexiCapture automates invoice data extraction, streamlining accounts payable workflows and reducing manual effort.

- Advanced OCR Accuracy: The tool offers intelligent data recognition and extraction, ensuring precise and reliable invoice processing.

Cons

- Inconsistent Accuracy – ABBYY FlexiCapture struggles with complex invoice formats, often requiring manual corrections to fix extraction errors.

- High Cost – The pricing may be too expensive for small businesses, limiting accessibility.

- Limited Flexibility – The platform lacks adaptability, making it challenging to use in varied workflows.

- Occasional Misclassification – Some invoices are incorrectly categorized, requiring additional manual intervention.

- Storage Limitations – Managing extracted data on local servers can be cumbersome, especially for businesses handling large volumes of paper documents.

Pricing

Contact their sales representatives for a quote.

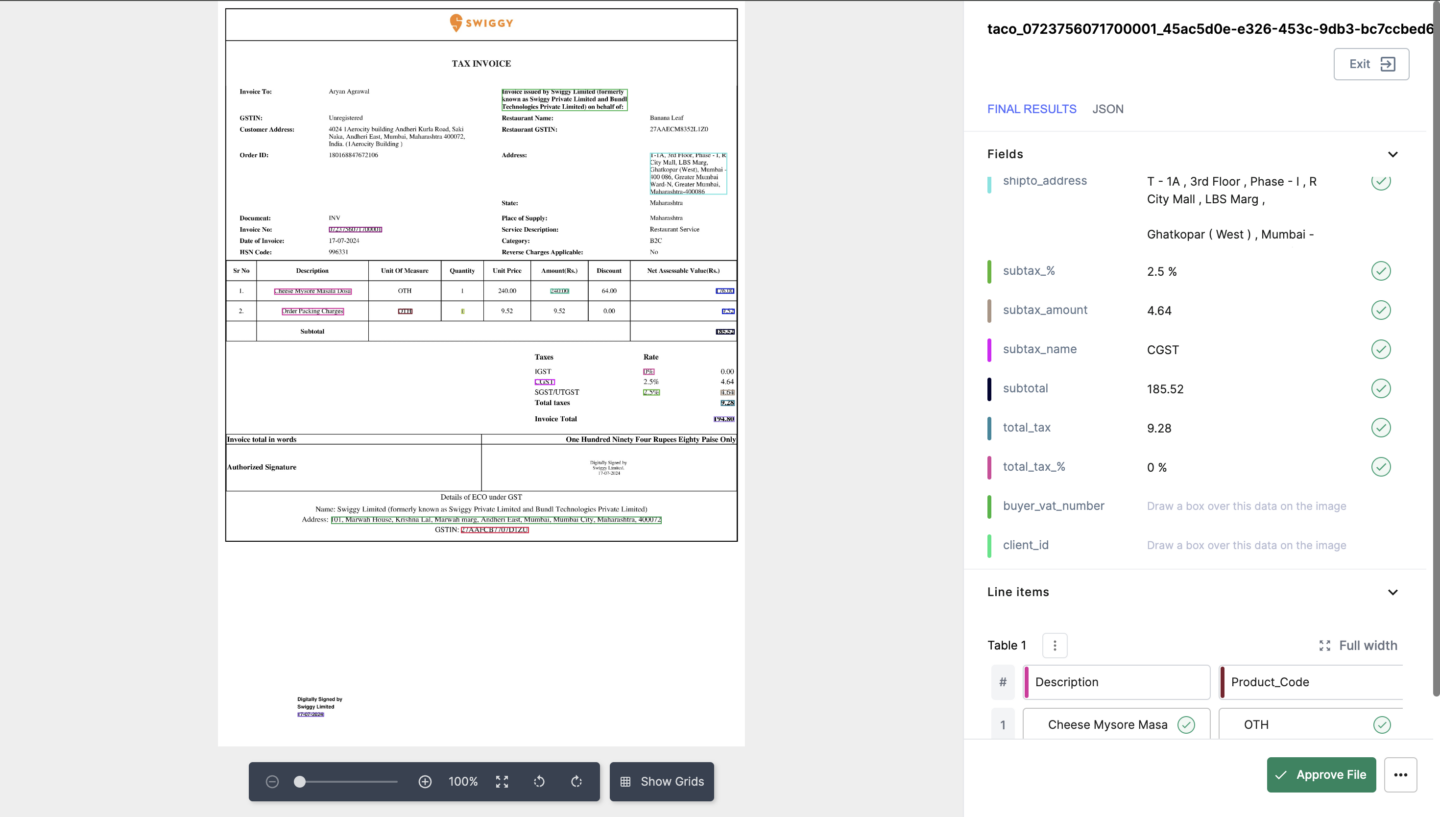

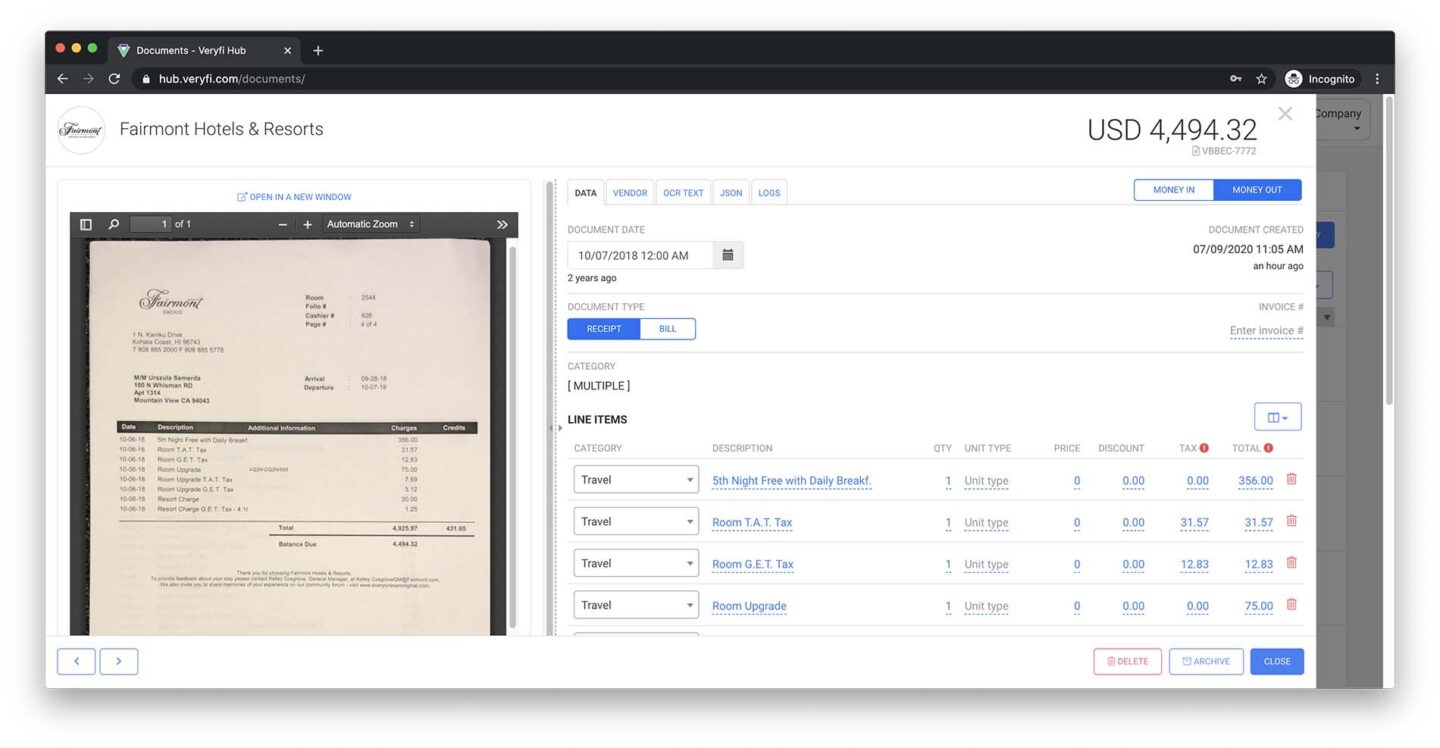

4. Veryfi

Veryfi is an AI-driven invoice data extraction solution designed to convert unstructured invoice data into structured formats with high accuracy. Utilizing advanced OCR technology and mobile scanning features, it automates data capture, eliminating manual entry and minimizing errors.

With real-time processing and automation, Veryfi allows you to extract critical invoice details instantly, making it an essential tool for optimizing financial workflows. Trusted by businesses globally, it ensures secure and precise data extraction, enabling faster and more efficient decision-making.

Pros

- Fast and Accurate Data Extraction: Veryfi processes invoices quickly and with high precision, minimizing manual data entry and improving efficiency.

- Automated Categorization: The platform allows you to create rules for automatically classifying transactions based on extracted invoice data, simplifying expense management.

- Web and Mobile Accessibility: With both a mobile app for scanning invoices on the go and a web platform for bulk processing, Veryfi offers flexibility in managing financial documents.

- Bank Integration: Veryfi syncs with your bank, enabling seamless transaction matching and easy report generation for better financial oversight.

Cons

- Inconsistent Support: Users report a decline in customer service quality, making it challenging to resolve issues efficiently.

- Occasional Downtime: Service interruptions can occur, causing disruptions for businesses relying on real-time invoice processing.

- High Pricing: Veryfi is more expensive than some competitors, which may not be suitable for businesses with tighter budgets.

- Accuracy Variability: While generally precise, OCR extraction occasionally produces errors, with no built-in feedback system for improvements.

- Minor Bugs and Interface Issues: Some users experience glitches and display inconsistencies in both the web and mobile platforms, requiring further refinement.

Pricing

Veryfi offers a tiered pricing structure to accommodate various business needs:

- Free Plan: Process up to 100 documents per month at no cost, offering basic features for receipts and invoices, ideal for development use.

- Pay As You Go: Starts at a $500 monthly minimum, with $0.16 per invoice and $0.08 per receipt beyond the limit. Includes standard features, limited storage, and email support.

- Custom Plan: Designed for enterprises processing over 10,000 documents monthly, providing full access to all document types, advanced features, unlimited storage, and additional support. Pricing is customized based on business needs.

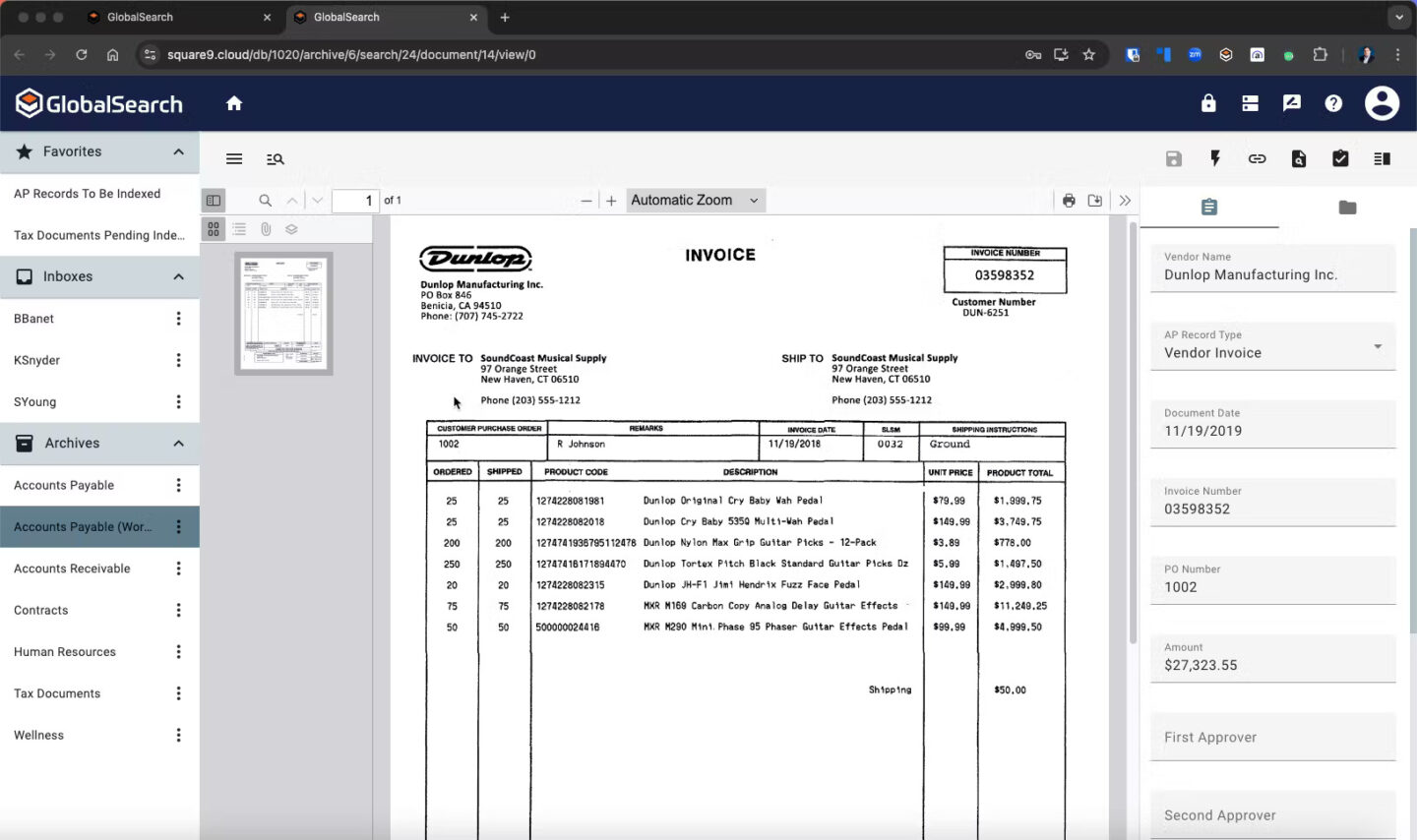

5. Square 9

Square 9 is an AI-driven document management solution that automates invoice data extraction and optimizes financial workflows. It replaces time-consuming paper-based processes by transforming scanned invoices and PDFs into structured, searchable data.

With advanced automation and digital workflows, Square 9 boosts efficiency, minimizes manual data entry, and enhances the accuracy of invoice processing for businesses.

Pros

- Centralized Document Management: Access, search, and export invoices and financial documents from one secure location.

- Robust Security Features: Customize user access controls to protect sensitive financial data.

- Digital Efficiency: Reduces reliance on physical document storage, simplifying financial record management.

- Responsive Customer Support: Users highlight the helpful and efficient support team for setup and issue resolution.

- Optimized AP Workflows: Ensures accurate and organized invoice records, improving financial compliance and efficiency.

Cons

- Document Download Issues: Downloaded files may open as “Enabled” files, requiring an additional step to access them.

- Challenging Scanner Integration: Setting up new scanners can be complicated, though support is available for assistance.

- High Implementation Costs: While beneficial long-term, the initial setup and deployment can be expensive.

- Software Bugs: Users report occasional login issues and disappearing features that sometimes require an application reset.

- Complex Data Retrieval: Extracting data from large databases can be difficult, and reporting tools could be more intuitive.

Pricing

Square 9 offers three pricing plans:

- Process Automation Essentials – $50/user/month (min. 5 users) for AP, AR, HR, and contract management.

- Digital Transformation Essentials – $68/user/month with OCR extraction, table data extraction, and multi-company support.

- Enterprise Essentials – $75/user/month with integrations for Sage, Dynamics, SAP, and Microsoft 365.

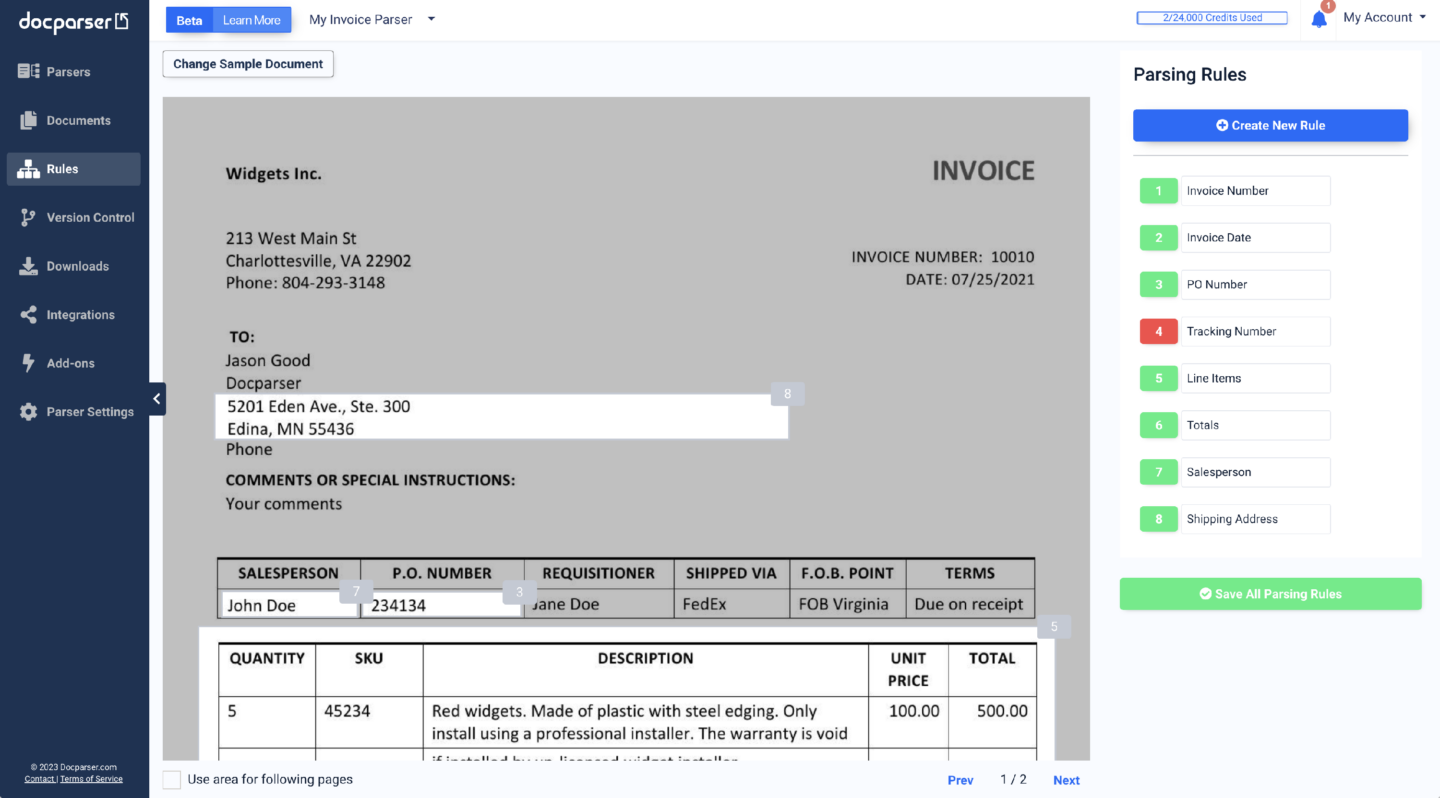

6. Docparser

Docparser is an automated data extraction tool designed to streamline invoice processing and eliminate manual data entry. Its intuitive interface and advanced OCR capabilities allow businesses to efficiently extract key details from invoices, receipts, and financial documents.

Supporting multiple file formats, including PDF, DOCX, CSV, and XLS, Docparser accurately extracts structured data for seamless integration into accounting systems. Whether handling invoices, bank statements, or shipping documents, it simplifies data processing, improving efficiency and accuracy.

Pros

- Ease of Use: Docparser features an intuitive interface, making it simple to extract invoice data with high accuracy. Users can customize parsing rules to fit their specific needs.

- Seamless Automation: The platform automates invoice processing by integrating with tools like Zapier, enabling automatic document uploads and eliminating manual data entry errors.

Cons

- Complex Document Setup: Configuring parsing rules for complex invoices can be time-consuming, sometimes requiring manual adjustments to formatting issues.

- Bulk Upload Challenges: Uploading large volumes of documents initially posed issues, though workarounds have been implemented to address this.

- Learning Curve: While the platform offers powerful customization, non-technical users may find the onboarding process overwhelming without prior experience.

- User Guidance: A more structured tutorial or guided setup could help users navigate parsing options more efficiently.

- Workflow Complexity: The process of setting up parsing rules involves multiple steps, requiring users to switch between screens, which can be improved for better usability.

Pricing

- Starter: $39/month – 100 credits per month. Ideal for individuals who need basic document extraction. Supports PDF, Word, and image files, with export options to Excel, CSV, JSON, and XML. Includes Google Sheets integration and access to various third-party tools.

- Professional: $74/month – 250 credits per month. Designed for professionals seeking advanced automation. Includes all Starter features, plus multifactor authentication, team management, free parsing setup, and version control.

- Business: $159/month – 1000 credits per month. Best for businesses automating large-scale document processing. Adds multi-layout parsing, priority support, and priority parsing access.

- Enterprise: Custom pricing. Offers unlimited parsing, extended document retention, white labeling, and additional enterprise-level features. Contact sales for details.

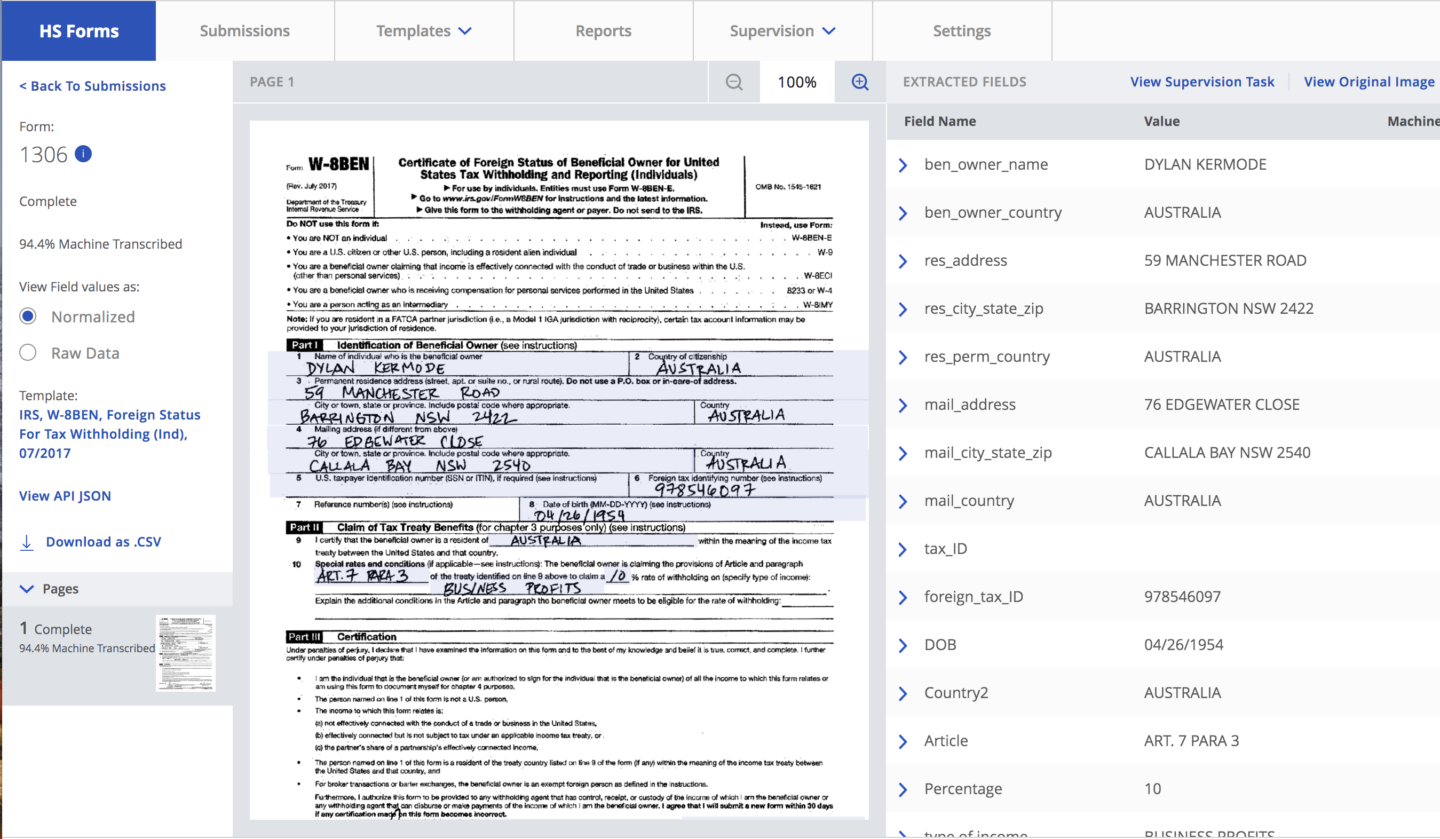

7. Hyperscience

Hyperscience automates invoice data extraction using AI and machine learning, minimizing manual entry and errors. It integrates seamlessly with enterprise systems, processing structured and unstructured documents with 99.5% accuracy. By streamlining financial workflows, it enhances efficiency and speeds up invoice processing.

Pros

- High Accuracy: Delivers excellent results for both handwritten and digitally scanned invoices, reducing manual corrections.

- Easy Integration: Simple to adopt and integrates seamlessly with various applications.

- Task Restriction Feature: Supports multiple lines of business on the same platform while maintaining audit compliance.

- Strong Support: Users report exceptional customer support, making implementation and troubleshooting smooth.

Cons

- Older Version Limitations: Some characters may not be processed accurately, but updates are expected to improve this.

- Performance Lag: Large data volumes can cause slow processing in certain cases.

- Integration Challenges: May require additional setup if an organization’s infrastructure is not well-structured.

- Security Concerns: Handling sensitive invoice data may require additional privacy measures.

- Semi-Structured Documents: Automation struggles with non-standard invoice formats, needing further improvements.

Pricing

Contact the sales representative for a quote

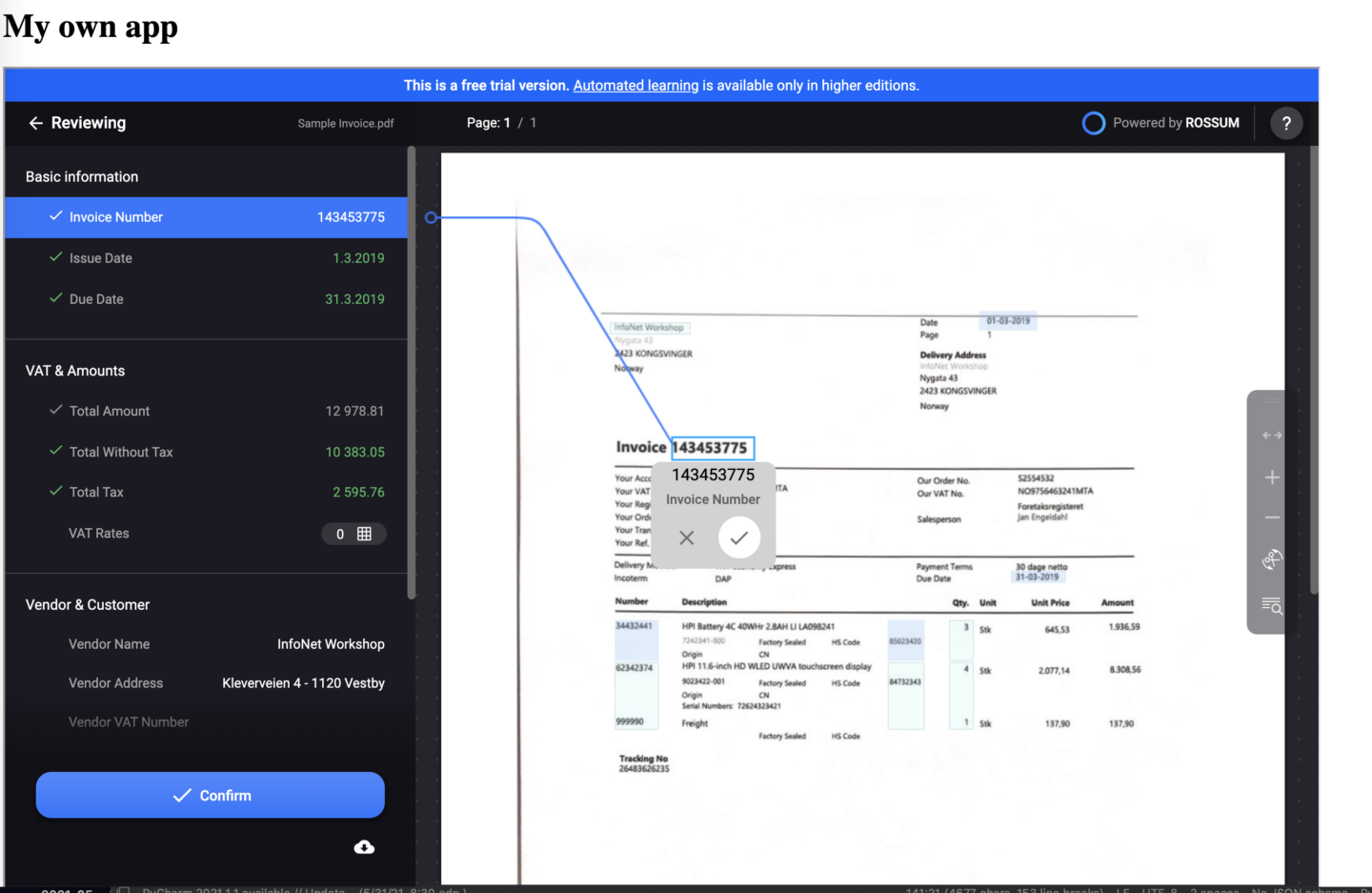

8. Rossum

Rossum is an AI-driven document processing platform that automates invoice data extraction, reducing manual workload and improving efficiency. Its intelligent system processes invoices 90% faster by capturing data from multiple sources, analyzing content with machine learning, and handling exceptions through interactive validation.

With deep integrations, Rossum ensures seamless data transfer into your financial systems, minimizing errors and optimizing workflow automation.

Pros

- User-Friendly Interface: Rossum’s intuitive design simplifies invoice data extraction, making it accessible even for non-technical users.

- Seamless Integration: Open APIs and extensions enable easy connectivity with accounting and ERP systems.

- AI-Powered Learning: The platform enhances extraction accuracy over time by learning from previous invoices.

- Dedicated Support: A dedicated account manager helps with implementation and troubleshooting for a smoother experience.

Cons

- Limited Field Extraction: Works well for invoices and purchase orders but struggles with other document types.

- Slow Support Response: Technical support beyond the account manager can be slow, with long resolution times.

- Lack of US-Based Support Hours: Businesses in the US may face delays in getting assistance due to timezone differences.

- Limited Reporting Features: Lacks robust reporting options, making it difficult to generate detailed invoice analytics.

- Time-Intensive AI Training: Requires extensive training to improve accuracy, which can be time-consuming.

Pricing

- Starter Plan: $18,000/year – Includes unlimited users, multiple document ingestion options (email, API, manual upload), Rossum Aurora Document AI, validation interface, 12-month archive, and API access.

- Business Plan: Adds custom data extraction logic, master data matching, duplicate detection, intelligent mailbox, webhooks, reporting, and integrations with SAP, Coupa, Workday, and Oracle.

- Enterprise Plan: Includes SSO, sandbox testing, extended master data matching, cloud location options, signature onboarding, and custom branding.

- Ultimate Plan: Designed for high-volume enterprises with all Enterprise features plus multi-document transaction support and advanced capabilities.

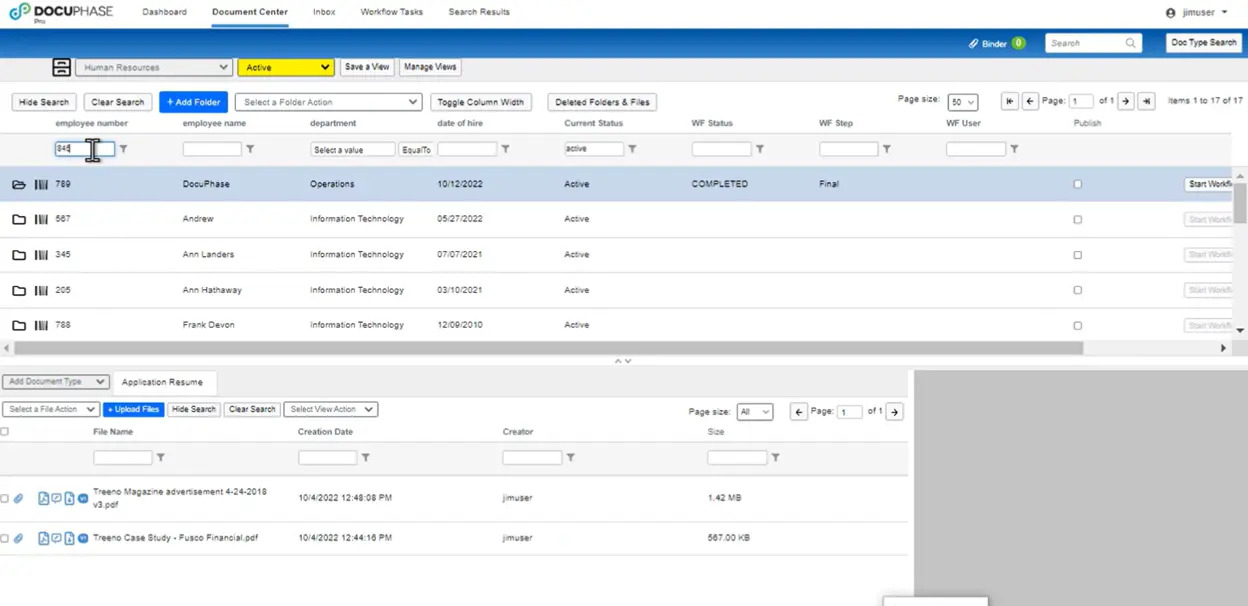

9. DocuPhase

DocuPhase provides financial automation solutions designed to streamline back-office operations. It offers accounts payable automation, payment processing, document management, and workflow automation to help businesses improve efficiency and scalability.

With over 25 years of experience, DocuPhase supports mid-sized organizations in automating financial workflows, reducing manual tasks, and enabling long-term growth. Its solutions help CFOs and finance teams optimize processes and enhance operational efficiency.

Pros

- Search and Retrieve Documents: DocuPhase allows users to quickly find invoices, contracts, and records using keywords, metadata, or content, reducing manual sorting time.

- Centralized Access: All financial reports, HR documents, and client contracts are stored in one platform, making document management more efficient, especially for businesses handling large volumes of paperwork.

- Improved Efficiency: With digital storage, documents can be accessed instantly from any device, streamlining workflows and improving collaboration across teams.

Cons

- Complex Setup: The workflow tools were initially designed for self-service, which made implementation challenging for users with diverse responsibilities.

- Learning Curve: Navigating the system’s backend required additional effort, making it less intuitive for users unfamiliar with automation tools.

- Support Dependency: While the support team is responsive and offers customized solutions, users may need assistance to optimize the platform fully.

Pricing

Contact the sales rep for pricing details.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about looking for Klippa Alternatives:

What Factors Should I Consider When Choosing a Document Processing Tool?

When choosing a document processing tool, prioritize accuracy, automation, and seamless integration with existing systems. Ensure it supports OCR and AI-driven extraction for minimal manual work. Security, compliance, and scalability are key factors. Consider pricing, user-friendliness, and customer support to find a solution that aligns with your business needs.

Are These Alternatives Suitable for Small Businesses?

Yes, many of these alternatives cater to small businesses with affordable pricing, easy setup, and automation features that reduce manual data entry. Solutions like DocuClipper, AutoEntry, and Nanonets offer scalable options, allowing small businesses to streamline invoice processing without requiring extensive technical expertise or large budgets.

Do These Tools Support Multiple Languages?

Yes, many of these tools support multiple languages for invoice data extraction. Platforms like ABBYY FlexiCapture, Rossum, and Nanonets offer multilingual OCR capabilities, enabling businesses to process invoices in different languages. However, language support varies by tool, so it’s best to check with the provider to ensure compatibility with your specific needs.

Can These Platforms Integrate with Existing Enterprise Systems?

Yes, most of these platforms offer seamless integration with enterprise systems through APIs, webhooks, and direct connections. Solutions like Rossum, Veryfi, and Nanonets support integrations with ERP, accounting, and document management systems, including QuickBooks, Xero, SAP, and Oracle. Be sure to check each provider’s integration capabilities to ensure compatibility with your existing workflow.

Is Training Required to Use These Document Processing Tools?

Most document processing tools are designed to be user-friendly, but some level of training may be required, especially for advanced features like custom data extraction and workflow automation. Platforms like Rossum and Nanonets use AI-driven learning, reducing manual setup, while others may require initial configuration to optimize accuracy and efficiency for specific use cases.