Invoices contain essential details about a sale or transaction from a seller to a buyer, indicating products, services, amounts, and prices.

While processing a single invoice is straightforward, managing tens or hundreds each month can be overwhelming for a business.

Traditionally, this involves manually copying and pasting information—a tedious, repetitive, and time-consuming task. Fortunately, businesses are now automating manual invoice processing and gaining better quality data, saving time, and improving team productivity.

In this article, we’ll explore how you can get a head start in automating your invoice processing to save time, reduce errors, and improve efficiency.

What is Manual Invoice Processing?

Manual invoice processing means handling invoices without automation. It involves receiving invoices by mail, email, fax, or e-invoice systems, entering details into your accounting system, verifying against purchase orders, routing for approval, entering payment details, and storing copies for future reference.

This process is time-consuming, prone to errors, and costly due to the labor involved and tracking invoices can be challenging, leading to inefficiencies.

Automation offers a solution, using OCR for data extraction and digital workflows for approvals, making the process more efficient, accurate, and cost-effective.

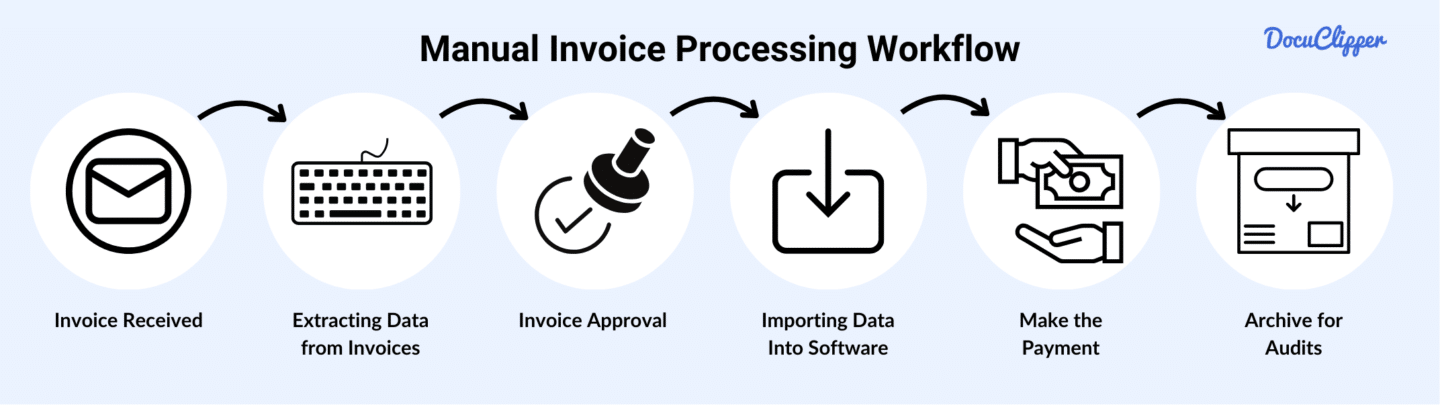

Manual Invoice Processing Steps

By looking at these steps, we will be able to find any potential ways to improve this process by automating it with cheaper and faster technology.

Additionally, it will help you standardize your invoice processing workflow, resulting in more predictable and better results for your team.

Here is what a typical manual invoice processing workflow looks like.

Step 1: Receive Invoice from Vendor

First, an AP team receives the invoice from a vendor. Suppliers can either send a PDF or paper invoice, depending on what is more convenient for the business but in most cases invoices are received via email in PDF version.

Step 2: Invoice Reconciliation

Invoice reconciliation is an important part of a workflow, whether manual or automated.

With invoice reconciliation businesses can ensure that the amounts billed by suppliers match the goods or services received, thus preventing overpayments, underpayments, and fraud.

This process is essential for compliance with internal policies and external regulations, such as tax laws, and it contributes to better financial control and cash flow management.

If you’re doing manual invoice verification, we recommend to read our article on how to read an invoice.

Step 3: Enter the Data Into Accounting/ERP Software

Once the invoice is verified, data is then imported into an accounting software or ERP system to maintain accurate financial records, monitor expenses, ensure tax compliance, and audit trail.

When an AP personnel does it manually, invoice data is typed by hand from a PDF or paper invoice to each field in an accounting system or ERP software, which is another opportunity for data entry errors as well as putting pressure on employees when employees need to process more invoices than usually.

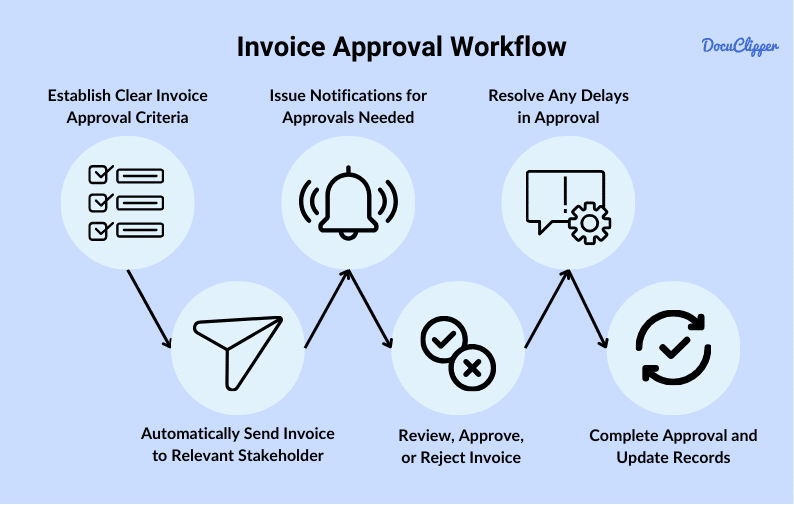

Step 4: Send Invoice for Approval

Once it has already been inputted into an accounting software or ERP system, a department head or a manager usually takes a look at the compiled invoices.

For instance, if the invoice approval workflow involves multiple layers of approval, each requiring detailed scrutiny, it can significantly delay the process.

Additionally, if different departments or individuals need to review and sign off on specific parts of the invoice, coordinating these approvals can further slow down the process.

The use of manual systems for tracking and approving invoices can exacerbate these delays, as each approver needs to manually verify details and ensure compliance with company policies.

This invoice approval scrutiny is necessary to avoid any financial losses and prevent paying for fraudulent invoices that might have slipped through during the initial manual verification.

Automating this step can significantly speed up the process and reduce the risk of errors, ensuring a more efficient and accurate invoice approval workflow.

Step 5: Make the Payment

Once the invoice has been approved, the AP department can proceed with the payment process.

Approved invoices are scheduled for payment according to the terms agreed upon with the supplier.

This includes deciding on the payment method (e.g., bank transfer, check, credit card). The payment is executed on the scheduled date.

This step often involves the accounts payable department and may require final authorization.

Proper documentation of the payment ensures that financial records are accurate and up-to-date.

Step 6: Archive the Invoice

The invoices then get individually stored and archived for tax purposes. The IRS might ask for extra information and these invoices are handy for businesses.

Businesses usually put it through a stack of cabinets and folders but for extra security, some put it in hard drives.

How to Automate Invoice Processing

Paperless invoice processing can significantly improve the quality of your financial data, business productivity, and greatly decrease the cost of processing your invoices.

After dealing with manual data entry processes, you might realize how difficult and tedious these tasks are.

Automating invoice processing can significantly improve the quality of your financial data, and business productivity, and greatly increase the cost of processing your invoices.

It can also help you to improve customer or vendor relationships and increase your revenue.

That’s why invoice automation is being implemented by more and more small and large businesses.

AI invoice processing has become a game-changer for businesses looking to streamline their accounts payable operations.

Here are some steps to transition from manual to automated invoice processing:

- Centralize Your Invoice Receiving: First, centralize the way you receive invoices. For automation purposes, ensure all invoices are in PDF format so your software can process them more easily. It will also help you to minimize the chance of missing any invoices.

- Utilize Invoice Data Extraction Software: Implement OCR invoice processing software to automate data extraction. to automate invoice data extraction. DocuClipper invoice OCR, for example, offers a 97% accuracy rate and can handle any invoice format. It can convert hundreds of invoices into formats like XLS, CSV, and QBO within seconds. Utilizing such software minimizes errors and speeds up the invoice data entry process.

- Import and Extract Data into Your Accounting/ERP Software: Once you have extracted the data, import it into your accounting or ERP software. DocuClipper allows you to automatically import invoices into your QuickBooks account and get CSV file to easily import the data into any ERP or accounting software.

- Create Invoice Approval Workflow: Establish an automated invoice approval workflow before making payments. This will ensure that your payments are processed correctly and no mistakes in payments are made. Plus you gain greater control over your business finances.

- Create Invoice Archive System: Ensure you store your invoices safely and securely for tax and audit purposes. This will help you to maximize your tax savings as well as avoid any troubles with the IRS.

Manual vs. Automated Invoice Processing

Automating invoice processing has profound benefits some of which we already mentioned.

Here are some comparisons between manual and automated invoice processing methods:

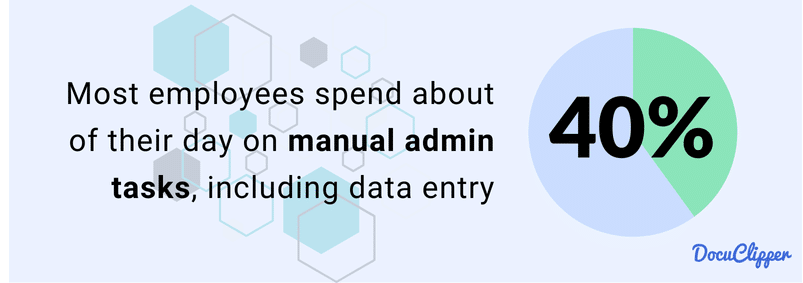

Speed and Efficiency

It’s known that most employees spend about 40% of their day on manual admin tasks, including invoice data entry. This is a significant amount of time wasted. In contrast, invoice automation software is incredibly efficient helping you to save over 80% of the time on manual invoice processing.

Using OCR invoice data extraction software, it takes only about 20 seconds to process data from hundreds of invoices. This dramatic improvement saves time and increases the overall productivity of your team.

Cost

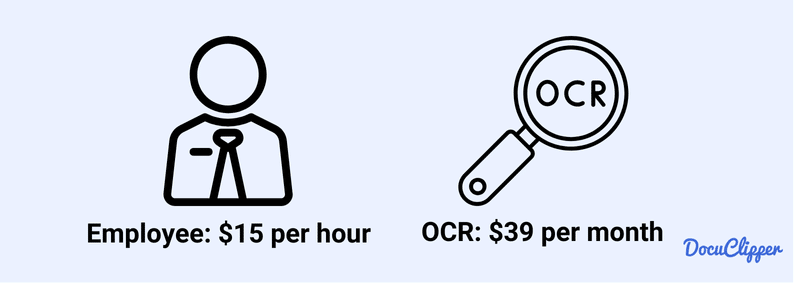

Manual data entry clerks are paid an average of $15 per hour. With 40% of their 8-hour workday spent on these tasks, a business can lose $48 a day per employee.

In contrast, an OCR subscription can cost around $30-$100 a month and can extract as many invoice data, line items, and other data from invoices as needed. This cost-effective solution significantly reduces labor expenses and increases overall efficiency.

Error Rate

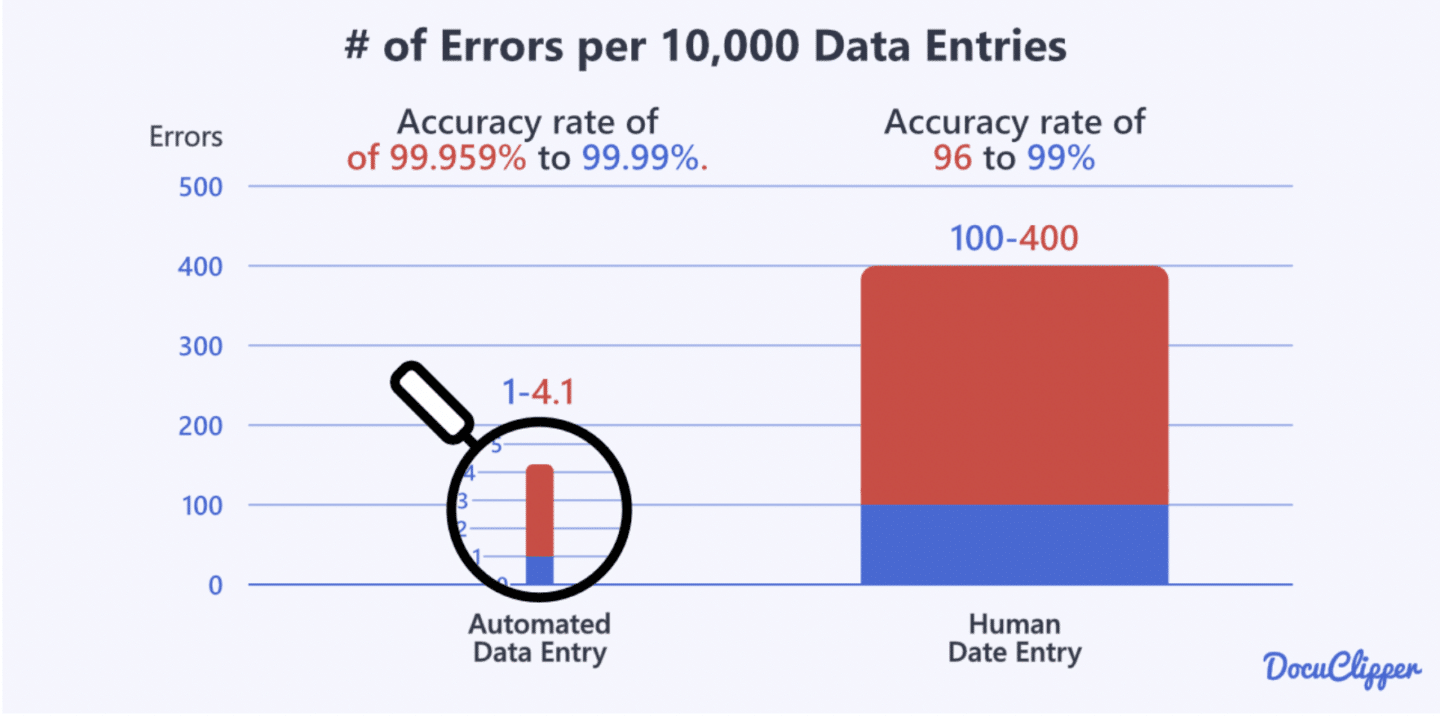

According to the Journal of Accountancy, manual data entry has an error rate of 1% to 5%, leading to various difficulties in accounting tasks.

In contrast, OCR invoice converters like DocuClipper boast a 97% accuracy rate, among the highest in leading software.

This high accuracy level is crucial for converting invoices with different formats, significantly reducing errors and ensuring more reliable financial data. By using OCR software technology, you can enhance the accuracy and reliability of your invoice processing.

Scalability

Manual invoice processing personnel have varying productivity levels, taking about 2 to 5 minutes to process one financial document. This time adds up quickly when handling large volumes of invoices.

In contrast, automated systems can process invoices in just a few seconds, regardless of the number. This scalability allows you to handle increasing volumes of invoices efficiently without needing additional staff, making your business more adaptable and capable of growth.

Employee Satisfaction

Employees often feel stressed with mundane, repetitive tasks, which don’t offer growth opportunities and can lead to careless mistakes and additional stress in fixing them.

By using automated systems, you eliminate these stressors, creating a more growth-focused work environment. Automation allows employees to focus on more meaningful, skill-enhancing tasks rather than constant clean-up, leading to higher job satisfaction and productivity.

Conclusion

Manual invoice processing covers the fundamental aspects of handling invoices from an accounts payable perspective. However, it has serious drawbacks, including high costs, inefficiency, low employee satisfaction, limited scalability, and slow speed.

Automation eliminates these issues, making invoice processing more efficient, accurate, and cost-effective. By automating your invoice processing, you can improve overall productivity, reduce errors, and create a more positive work environment for your employees.

FAQS about Manual Invoice Processing

Here are some frequently asked questions about manual invoice processing:

What are the steps of invoice processing?

The steps of invoice processing include receiving the invoice from the vendor, verifying the invoice against purchase orders and receipts, entering the data into accounting or ERP software, sending the invoice for approval, making the payment, and archiving the invoice for auditing purposes. Each step ensures invoice accuracy and accountability in managing financial transactions.

What is the difference between e invoice and manual invoice?

An e-invoice is a digital version of an invoice processed electronically, often through automated systems. It enables faster, more accurate data entry and easy integration with accounting software. In contrast, a manual invoice is a paper that requires manual data entry, which is time-consuming, error-prone, and less efficient.

What are the advantages of manual invoice processing?

Manual invoice processing offers greater control over each step, allowing for personalized handling and tailored adjustments. It provides flexibility in processing unique or irregular invoices and can be managed without sophisticated technology. Additionally, it may be more accessible for small businesses with minimal invoice volumes or those without the resources to invest in automated systems.