Mindee is a popular choice for document processing, but it may not meet every business’s needs. You might encounter limitations like high costs, accuracy issues, or a lack of flexibility in handling complex documents. These drawbacks can slow down automation and require additional manual work.

If you’re looking for a Mindee alternative, several AI-driven solutions provide better data extraction, seamless integrations, and cost-effective pricing. Whether you need faster processing, improved accuracy, or industry-specific customization, the right tool can streamline your workflow.

This guide covers the best Mindee alternatives that enhance document automation without its limitations.

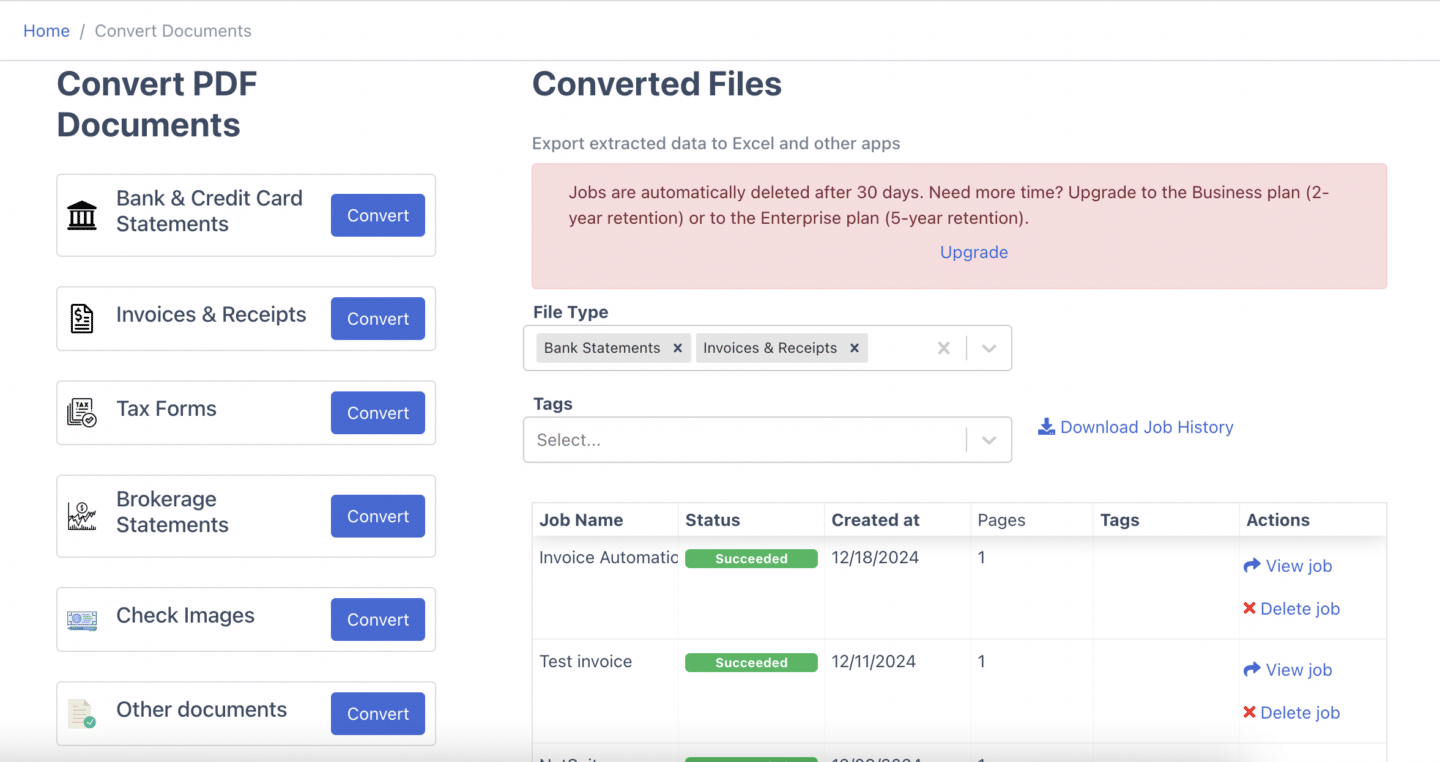

1. DocuClipper

DocuClipper is a powerful invoice data extraction solution that converts invoices, receipts, and financial statements into Excel, CSV, and QBO formats. Automating data capture and organization minimizes manual data entry and reduces errors.

Equipped with advanced OCR technology and specialized financial document processing algorithms, DocuClipper delivers high accuracy and fast processing speeds. Whether you’re managing a few invoices daily or processing bulk financial statements, it optimizes extraction, enhances efficiency, and ensures data accuracy in your workflow.

Pros

- Easy-to-Use Interface: DocuClipper’s web-based platform is designed for simplicity, allowing users to navigate and extract invoice data effortlessly.

- Cost-Effective Pricing: With a page-based pricing model, it provides an economical choice for small businesses compared to competitors that charge per line item.

- Highly Accurate OCR: Advanced OCR technology ensures precise extraction of invoice data, converting PDFs into Excel, CSV, or QBO with minimal errors.

- Fast Processing Speed: Capable of handling hundreds of invoices within minutes, it significantly reduces manual data entry efforts.

- Secure Cloud Storage: All financial data is encrypted and securely stored, ensuring compliance with data protection regulations.

Cons

- Lack of Mobile Application: DocuClipper does not offer a mobile app with camera scanning, meaning invoices must be converted to PDFs before processing.

- Restricted Direct Integrations: While it connects seamlessly with Sage, Xero, and QuickBooks, integrating with other accounting platforms requires API configuration.

Pricing

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details.

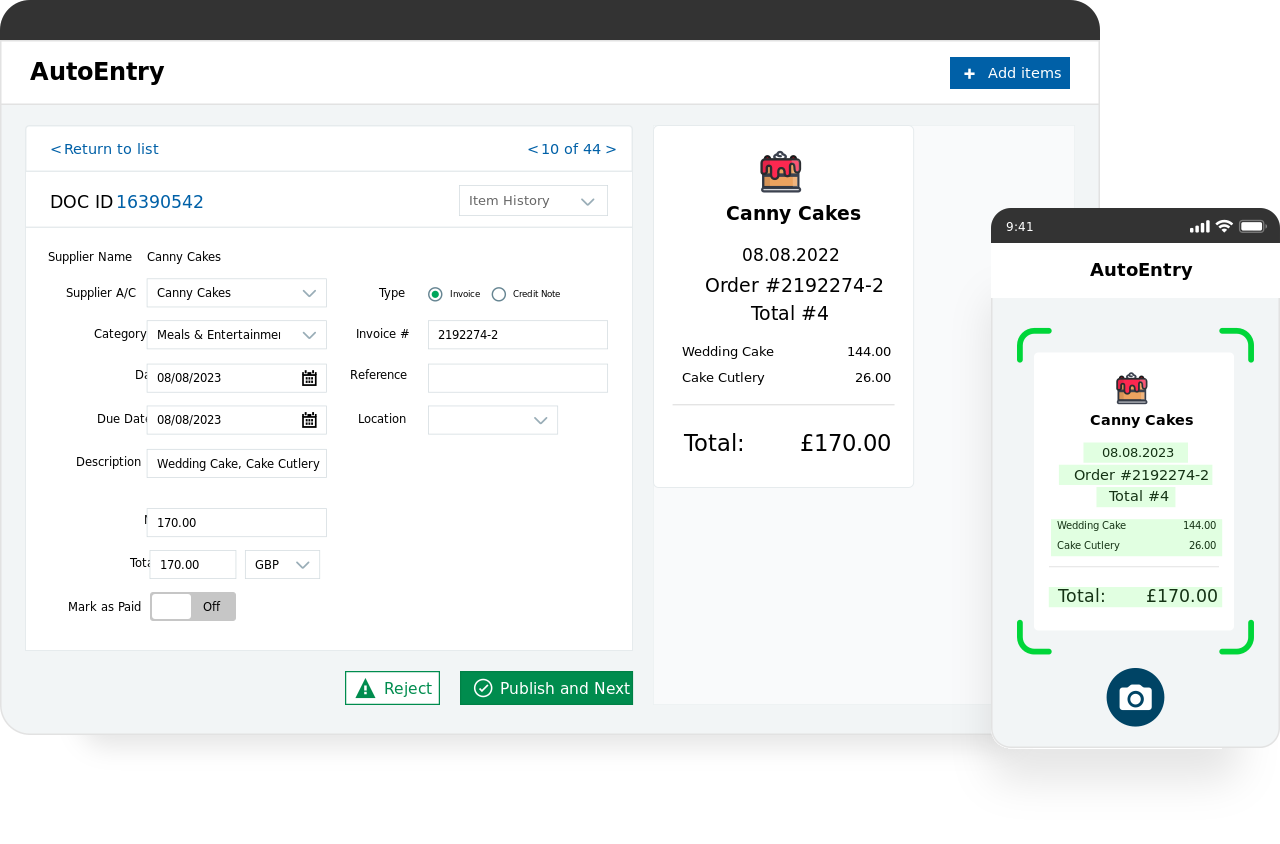

2. AutoEntry

AutoEntry is an automated invoice data extraction tool designed to streamline accounting processes. It enables users to scan, email, or upload invoices, receipts, and statements, which are then processed and sent directly to accounting platforms like Xero, Sage, and QuickBooks.

With mobile scanning, seamless integrations, and auto-publishing features, AutoEntry minimizes manual data entry errors and enhances efficiency. Its flexible pricing model operates on a pay-as-you-go basis, eliminating the need for long-term commitments..

Pros

- Detailed Line Item Extraction: AutoEntry accurately captures individual line items from invoices, making expense tracking more precise.

- Seamless Software Integration: It connects smoothly with Sage 50, Xero, QuickBooks, and other leading accounting platforms for efficient data transfer.

- Intuitive User Interface: The platform is easy to navigate, allowing quick access to documents and streamlined allocation of invoice details.

- Reliable Customer Support: Users appreciate the responsive support team, which actively assists with troubleshooting and issue resolution.

Cons

- No Lookup Table Uploads: The platform does not support uploading lookup tables, restricting customization options for data management.

- Invoice Rejection Handling: If an invoice is rejected, users must contact support since the “Move to Inbox” function does not resolve the issue.

- Limited PO Integration: The lack of purchase order integration with AccountsIQ may create workflow disruptions.

- Slow Processing Times: Some users experience delays when syncing invoices with Xero and other accounting systems.

- Software Stability Issues: Occasional system glitches may prevent invoices from uploading, requiring manual intervention.

- Customer Support Concerns: Users have reported difficulties with support responsiveness, continued charges after cancellation, and refund-related issues.

Pricing

AutoEntry offers flexible, usage-based pricing plans to accommodate various business needs. Each plan operates on a monthly subscription basis, with no contracts required, allowing you to cancel anytime without hidden fees. All features are included as standard across all plans.

Available Plans:

- Bronze: 50 credits at £13 per month (£0.26 per credit).

- Silver: 100 credits at £23 per month (£0.23 per credit).

- Gold: 200 credits at £43 per month (£0.22 per credit).

- Platinum: 500 credits at £99 per month (£0.20 per credit).

- Diamond: 1500 credits at £275 per month (£0.18 per credit).

- Sapphire: 2500 credits at £430 per month (£0.17 per credit).

New users receive a free trial that includes 25 credits to explore the platform’s features.

Understanding Credits:

Credits are the currency used within AutoEntry for processing documents:

- 1 credit: Processes a single invoice, bill, or receipt.

- 2 credits: Processes an invoice or receipt with line items.

- 3 credits: Processes a single page of bank statements.

This structure allows you to choose a plan that best fits your document processing volume and only pay for what you use.

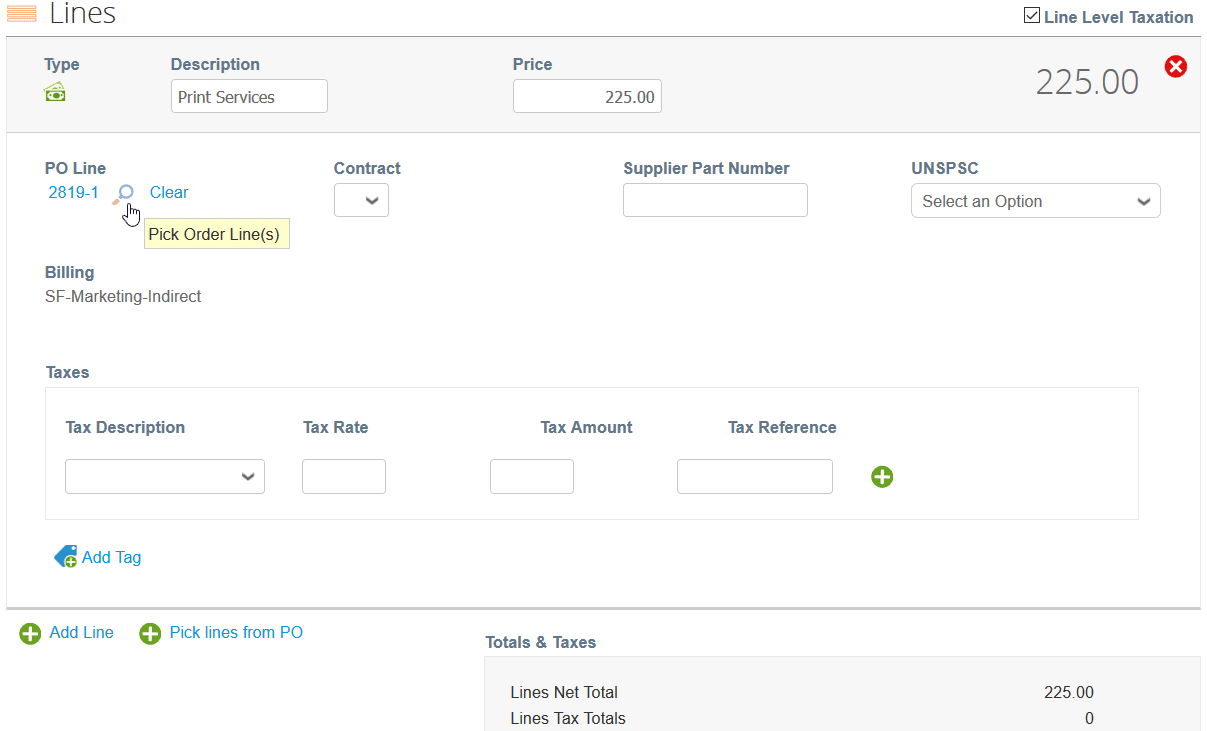

3. Coupa

Coupa is an all-in-one spend management solution that helps businesses streamline financial operations. It offers a centralized platform for managing expenses, improving financial visibility, and driving business growth. Organizations can begin with their most essential spending areas and scale as needed, ensuring adaptability and efficiency.

With built-in request and approval workflows, Coupa simplifies procurement by providing an intuitive, guided buying experience. This makes it easy for employees to find and purchase necessary items while maintaining compliance with company policies and approval structures.

Pros

- Intuitive Interface: Coupa offers a user-friendly design that simplifies spend management, making it accessible even for first-time users.

- Effortless Setup: The platform is easy to implement and integrates seamlessly with other business applications, ensuring smooth workflow operations.

Cons

- Complicated Supplier Onboarding: Registering a supplier account can be cumbersome, often requiring client assistance to complete the setup.

- Frequent Session Timeouts: Users are logged out automatically every 10 minutes, disrupting workflow and requiring frequent re-entry of information.

- Address Formatting Issues: The system lacks address validation, leading to potential accounting errors that require manual corrections.

- Repetitive Registration Requirements: Suppliers must re-register separately for each client, a process that can take up to two hours.

- Overwhelming User Interface: A cluttered login page filled with excessive notifications and alerts can make navigation difficult.

- Limited Catalog and cXML Invoicing Support: Users have trouble accessing detailed supplier catalogs due to insufficient publicly available information.

Pricing

- Registered (Free): Enables businesses to connect with Coupa customers, manage orders, send e-invoices, access catalogs, process payments, and participate in sourcing events.

- Verified ($549/year): Includes all Registered features plus a verified badge, priority search ranking, and increased visibility within Coupa’s buyer network.

- Premium Support ($499+/year): Provides at least six hours of 24/5 Zoom support, personalized one-on-one meetings, and tailored assistance based on business needs.

- Advanced ($4,800/year): Offers enhanced invoice management with customizable views, automated weekly reports, and Coupa-generated payment reminders.

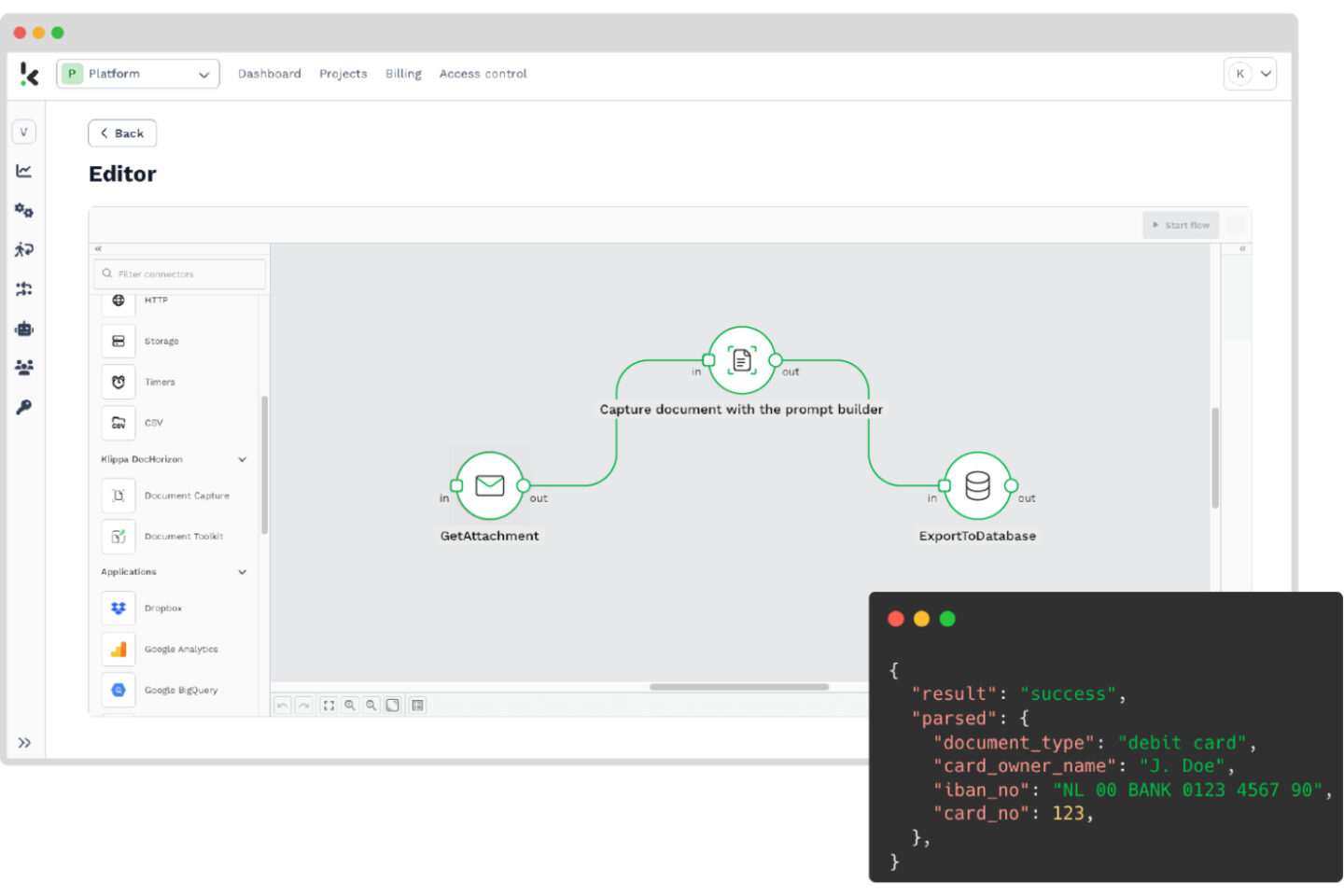

4. Klippa DocHorizon

Klippa DocHorizon is an invoice data extraction platform that automates document workflows using OCR, data extraction, classification, and format conversion. By reducing manual data entry, it enhances efficiency and accuracy in invoice processing.

With mobile scanning and document verification capabilities, Klippa DocHorizon streamlines invoice management for various industries. It provides a reliable solution for businesses aiming to automate financial document handling and improve workflow productivity.

Pros

- Intuitive Interface: Klippa DocHorizon offers a user-friendly design, making navigation simple for both new users and implementation teams.

- Advanced OCR Technology: The platform uses cutting-edge OCR for precise invoice data extraction, ensuring accuracy and reliability.

- Reliable Customer Support: A responsive support team assists with setup, troubleshooting, and workflow optimization.

- Continuous Improvements: Regular updates introduce new functionalities, enhancing document processing efficiency and platform performance.

Cons

- Limited Customization: The platform has restricted flexibility, which may pose challenges for users with specific workflow requirements.

- Workflow Limitations: Although functional, it may not integrate seamlessly with every business process, potentially requiring additional adjustments.

- Feature Overload: The extensive range of features can be overwhelming, making it difficult for some users to determine the best configuration for their needs.

- Restricted Customization: The platform offers limited flexibility, which may not fully accommodate specific workflow needs.

- Integration Challenges: While functional, it may not integrate seamlessly with all business processes, requiring additional modifications.

- Overwhelming Feature Set: The wide range of functionalities can be difficult to navigate, making it challenging for users to configure the best setup for their needs.

Pricing

Klippa DocHorizon follows a credit-based pricing structure. New users receive €25 in free trial credits, allowing them to test the platform. After the trial, additional credits must be purchased based on document usage, ensuring flexible and scalable pricing.

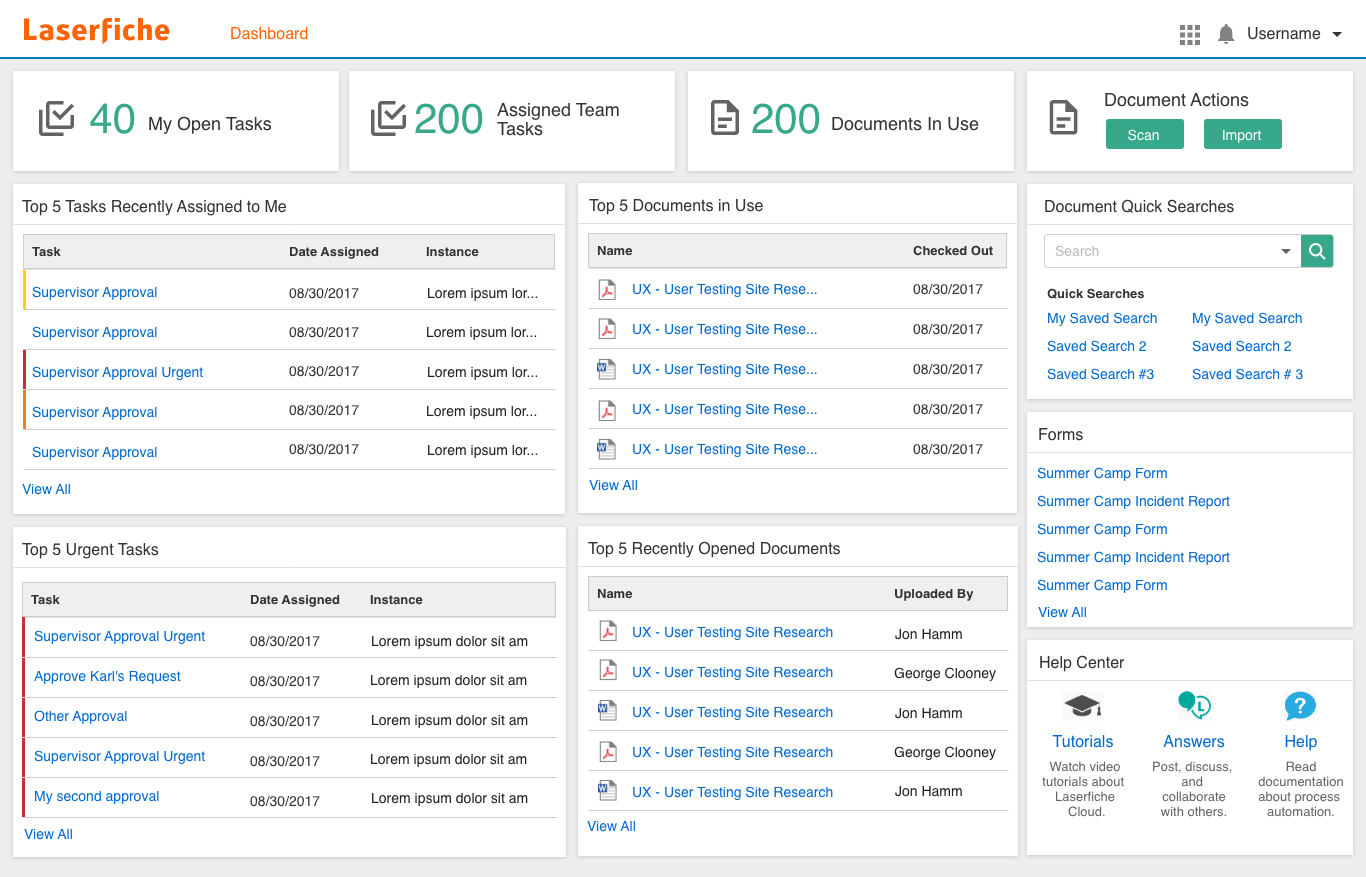

5. Laserfiche

Laserfiche revolutionized document management by introducing paperless office solutions through enterprise content management. Using a cloud-first strategy, it leverages AI and machine learning to help businesses streamline workflows and transition to fully digital processes.

Pros

- Centralized Document Management: Laserfiche provides a single platform for managing documents, eliminating the need to juggle multiple cloud storage services or network drives.

- Powerful Automation Tools: The platform streamlines workflows by automating file storage, records management, and form processing, reducing manual work and increasing productivity.

Cons

- Challenging Setup and Customization: The initial setup can be complex and may require technical expertise, though community support and training resources help mitigate difficulties.

- Workflow Interruptions: System upgrades can occasionally disrupt workflows, requiring adjustments, while new users may struggle with a steep learning curve despite available training materials.

- Limited Process Integration: The platform does not always integrate smoothly with different business processes, which can hinder workflow automation.

- Inconsistent Customer Support: Some users report delays in email responses and insufficient follow-up, making it difficult to resolve issues efficiently.

- Feature Discrepancies Between Cloud and On-Premise Versions: Businesses migrating to the cloud may experience differences in functionality, potentially complicating workflow continuity.

Pricing

Contact sales representatives for more information.

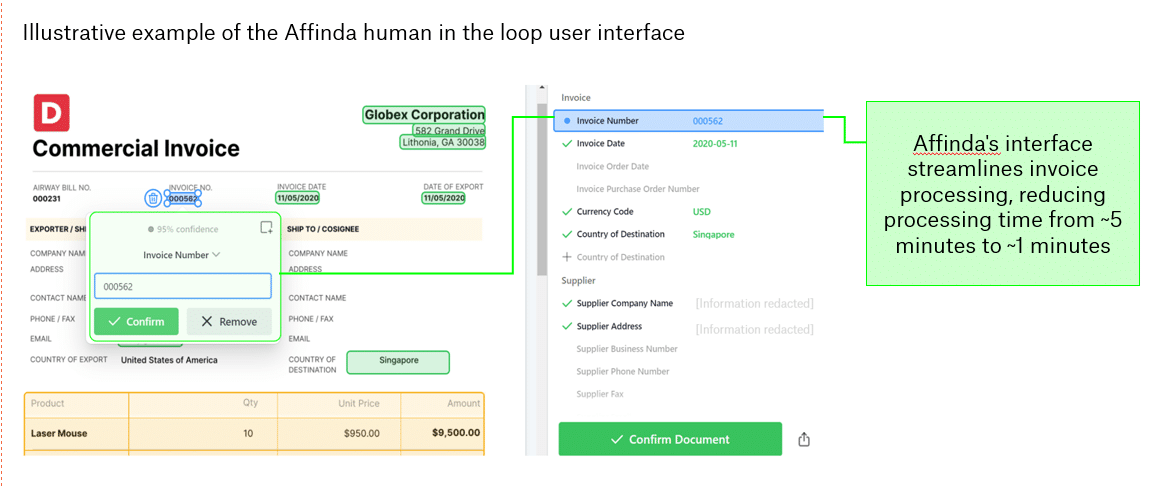

6. Affinda

Affinda provides AI-driven document automation solutions that combine human adaptability with machine accuracy to simplify document processing. Its intelligent tools cover Recruitment AI, Accounts Payable AI, Compliance AI, and customizable models designed for specific business needs.

By automating repetitive tasks, Affinda speeds up document workflows, enhances data extraction precision, and organizes information efficiently. It is widely utilized by job boards, HR teams, recruitment agencies, accounts payable departments, ERP platforms, IT consultants, and software firms to boost efficiency and productivity.

Pros

- Seamless API Integration: Affinda’s API is easy to implement, enabling businesses to quickly automate document processing.

- Wide Document Compatibility: Supports a variety of document types, including passports, insurance forms, and travel documents.

- Rapid Deployment: Minimal setup time allows companies to quickly integrate and start using automation.

- Custom AI Models: Can develop tailored AI models with just a few sample documents, enhancing accuracy for specific business needs.

Cons

- Restricted Payment Methods for API Credits: API credits cannot currently be purchased using a credit card, though future updates may address this limitation.

- Reduced JD Parsing Efficiency: Version 3 requires job descriptions to be converted into text documents, whereas Version 2 offered more effective direct text parsing.

- Job Title Recognition Issues: Certain job titles, such as “.Net Developer,” are not always extracted accurately, leading to occasional errors in data retrieval.

Pricing

Contact sales rep for pricing.

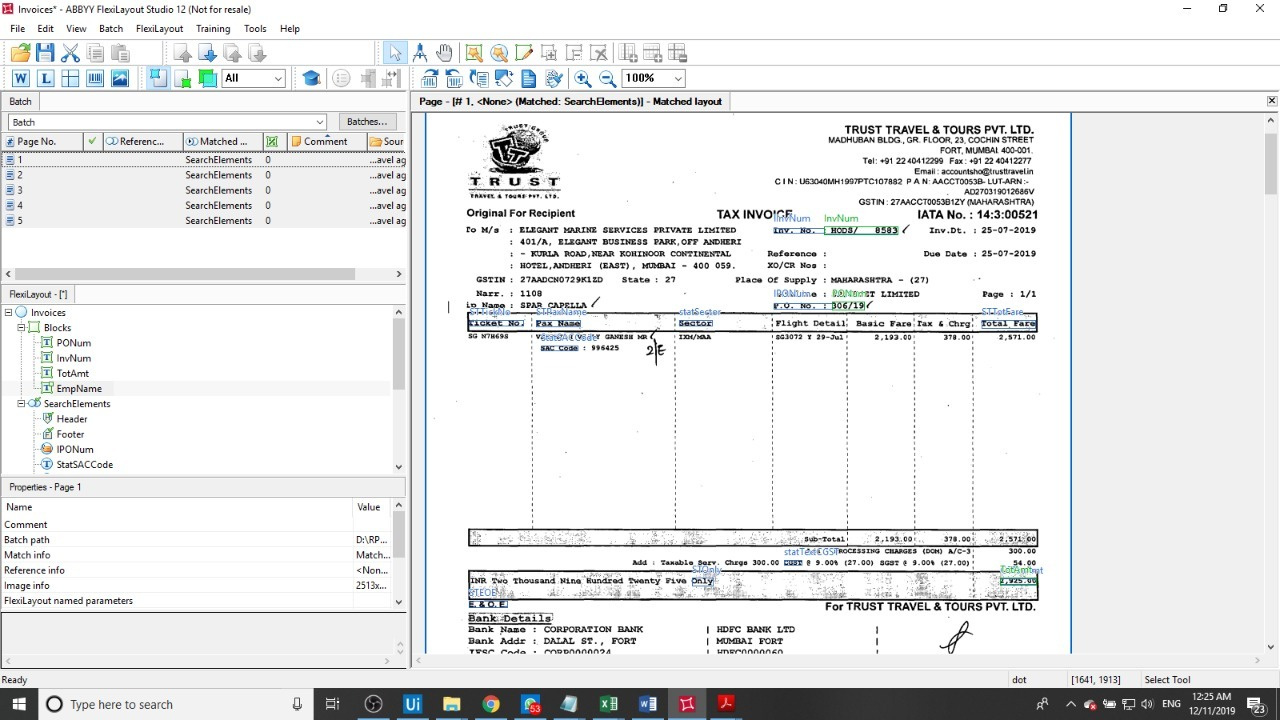

7. ABBY Flexicapture

ABBYY FlexiCapture is an AI-powered invoice data extraction solution that streamlines the processing of invoices, receipts, and financial documents. Utilizing advanced OCR technology and machine learning, it accurately captures and extracts critical data, reducing manual input and improving operational efficiency.

Designed for scalability, FlexiCapture integrates smoothly with financial systems, optimizing workflow automation. Its intelligent validation features enhance data accuracy, making it a reliable choice for businesses looking to automate invoice processing while ensuring precise financial data management.

Pros

- Streamlined Invoice Processing: ABBYY FlexiCapture automates data extraction from invoices, enhancing accounts payable workflows and significantly reducing manual input.

- Superior OCR Precision: Utilizing advanced OCR technology, the platform ensures highly accurate data recognition and extraction, improving invoice processing reliability.

Cons

- Inconsistent Data Extraction: The platform has difficulty processing complex invoice layouts, often necessitating manual corrections.

- Expensive Pricing Model: The cost may be too high for small businesses, limiting accessibility.

- Rigid Workflow Integration: Lacks flexibility, making it challenging to adapt to various business processes.

- Frequent Misclassification: Some invoices are incorrectly categorized, requiring additional manual adjustments.

- Storage Constraints: Managing extracted data on local servers can be cumbersome, especially for companies handling large volumes of documents.

Pricing

Contact their sales representatives for a quote.

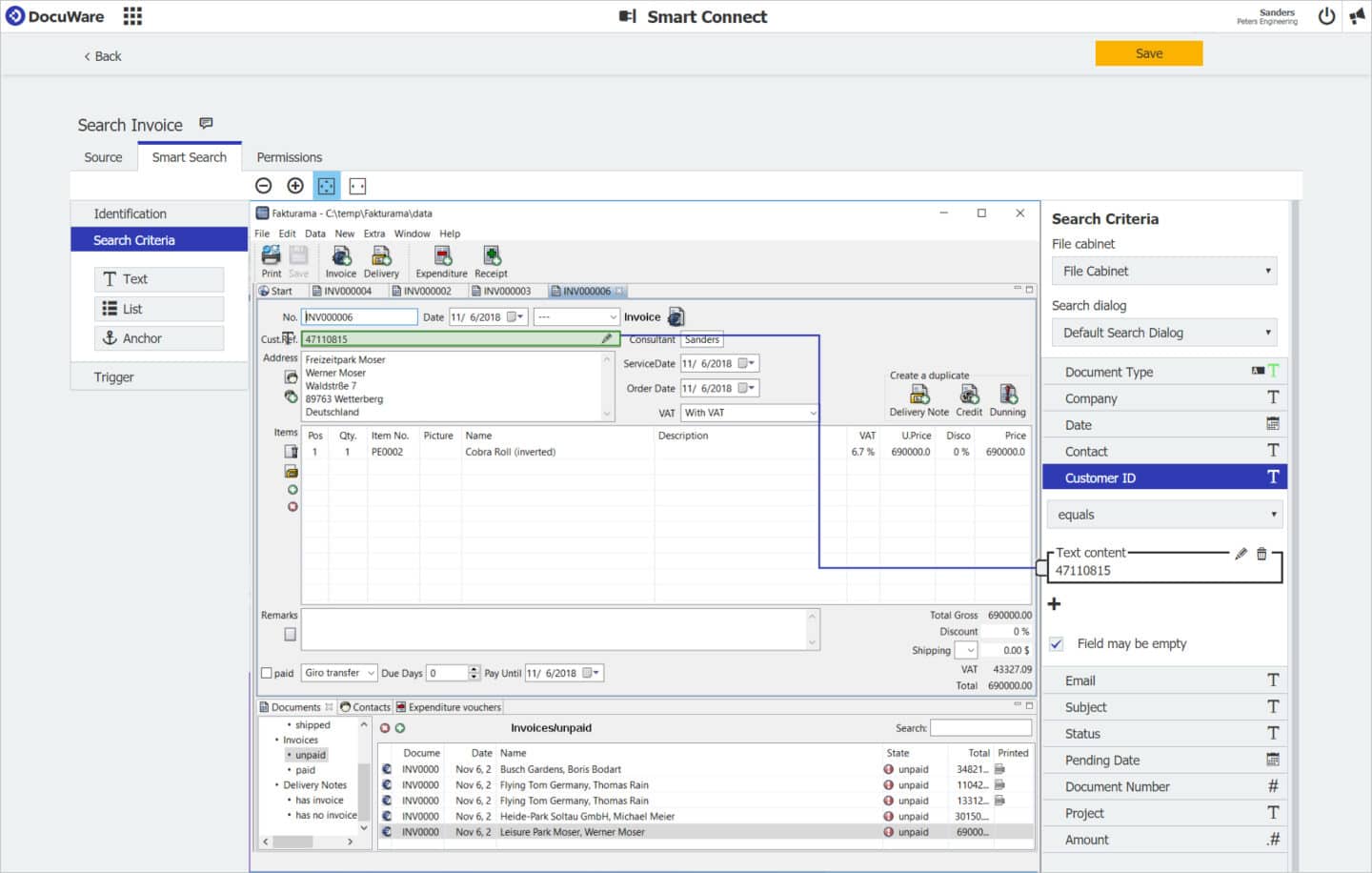

8. DocuWare

DocuWare is an all-in-one platform for capturing, processing, and managing business documents. Its automated invoice processing feature allows you to upload invoices in various formats, including paper, email, and XML. The system enables customizable approval workflows and organizes invoices based on your preferences, providing clear visibility into their status. With seamless integration into over 500 accounting and ERP systems, DocuWare is a flexible and scalable solution for businesses looking to streamline document management.

Pros

- Smooth Digital Transformation: Converts traditional paper workflows into fully digital processes, improving efficiency and accessibility.

- Effective Forms Management: Digitizes and organizes forms, creating a structured digital record for easy retrieval.

- Robust Database Integration: Connects seamlessly with internal and external databases, ensuring smooth data synchronization.

- Strong ERP Compatibility: Integrates well with ERP systems, streamlining workflow automation and financial data processing.

Cons

- Complex Initial Setup: Implementing and customizing DocuWare may require technical expertise, making the onboarding process time-consuming.

- Steep Learning Curve: New users may need training to fully utilize all features, which could slow adoption.

- Occasional Performance Delays: Large-scale document processing can sometimes lead to slow system response times.

- Cost Considerations: Pricing may be on the higher side for small businesses compared to alternative solutions.

- Limited Customization in Some Areas: While it integrates with many ERP systems, certain workflows may require additional adjustments to fit specific business needs.

Pricing

Contact Docuware to know their pricing and get a quote.

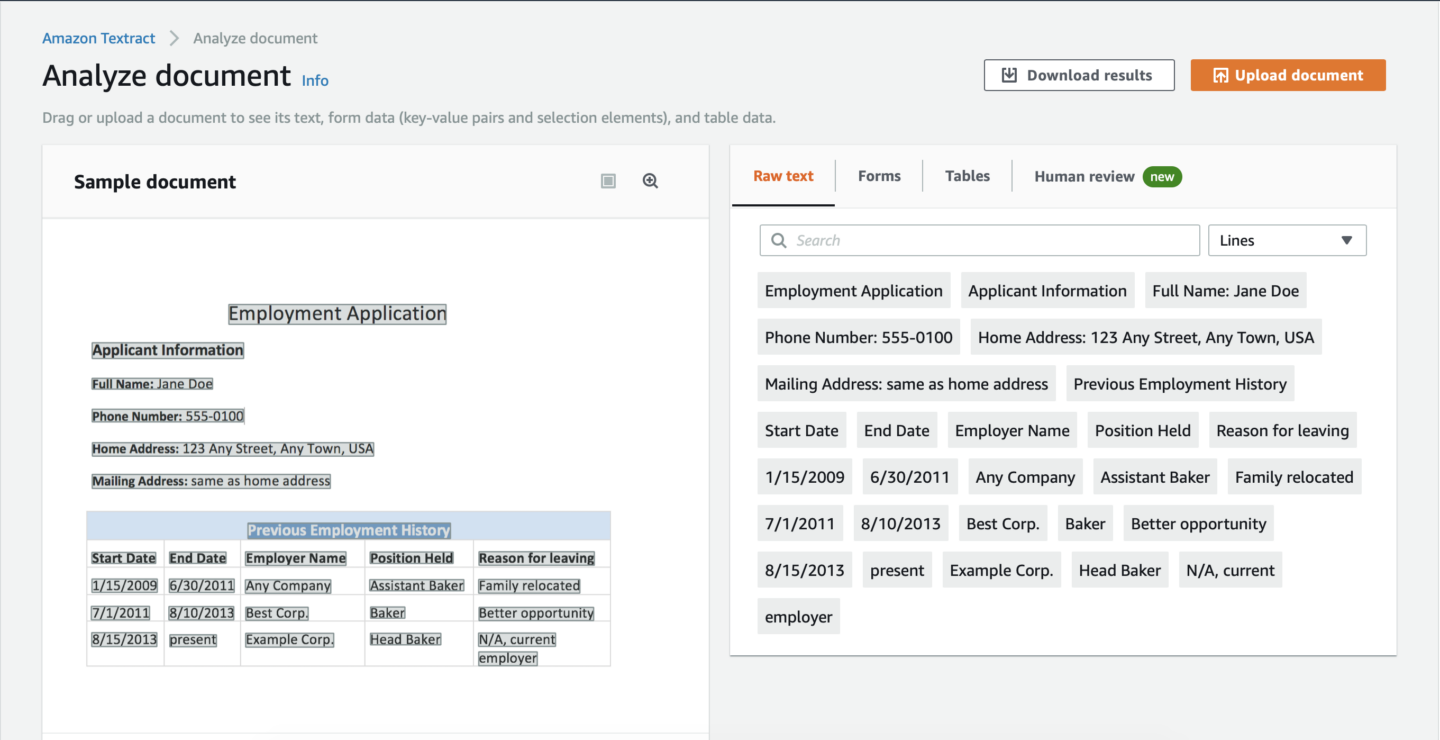

9. Amazon Textract

Amazon Textract is a cloud-based OCR solution designed to extract text and data from scanned documents automatically. Unlike traditional OCR, it identifies and captures text, handwriting, tables, and form fields, converting them into structured formats for seamless processing and integration. Engineered for efficient data extraction, it preserves context and document structure, enhancing analysis and usability.

Pros

- Easy to Implement: Amazon Textract streamlines document processing by eliminating manual data entry and complex OCR configurations, making integration hassle-free.

- High-Speed Processing: Efficiently handles large document volumes, making it suitable for businesses with extensive data processing needs.

- Advanced OCR Capabilities: Leverages machine learning to accurately extract text from printed documents, handwriting, tables, and forms.

- Seamless AWS Integration: Works effortlessly with other AWS services, ensuring scalability and smooth workflow automation.

Cons

- High Cost for Large-Scale Processing: The pricing model can become expensive for businesses handling large volumes of multi-page PDFs.

- Requires AWS Knowledge: Effective use of Textract depends on familiarity with AWS infrastructure, which may pose a challenge for teams without prior experience.

- Variable Handwriting Accuracy: While it supports handwriting recognition, extraction accuracy depends on writing styles, often necessitating manual corrections.

- Limited Customization: The platform does not offer the ability to train models for specific document types, reducing flexibility in data extraction.

Pricing

Contact sales representatives for a quote.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about MIndee alternatives:

What factors should I consider when choosing a Mindee alternative?

When selecting a Mindee alternative, consider factors such as OCR accuracy, processing speed, integration capabilities, and pricing structure. Look for a solution that supports your required document types, offers seamless integration with your existing accounting or ERP systems, and provides scalability. Additionally, evaluate customer support, customization options, and overall ease of use for better efficiency.

Are these alternatives suitable for small businesses?

Yes, many Mindee alternatives cater to small businesses by offering affordable pricing plans, easy-to-use interfaces, and seamless integrations with accounting and ERP systems. Some platforms provide pay-as-you-go models or low-cost subscriptions, making them accessible for businesses with lower document processing volumes. Choosing a solution with strong automation features can further reduce manual work and improve efficiency.

Do these tools support multiple languages?

Yes, many Mindee alternatives support multiple languages, enabling businesses to process documents in various regional formats. Advanced OCR technology allows these tools to recognize and extract text from invoices, receipts, and other financial documents in different languages. However, the level of language support varies by platform, so it’s important to verify compatibility with your specific requirements.

Can these platforms integrate with existing enterprise systems?

Yes, most Mindee alternatives offer integration with existing enterprise systems, including ERP and accounting software like QuickBooks, Xero, and SAP. Many platforms provide API access, allowing seamless data exchange between systems. However, the ease of integration varies, so it’s important to check compatibility and available connectors before selecting a solution.

Is training required to use these document processing tools?

Most document processing tools are designed to be user-friendly, but some level of training may be necessary, especially for advanced features like automation rules, API integration, and custom data extraction models. Many providers offer tutorials, onboarding support, and customer assistance to help users quickly adapt and maximize the tool’s capabilities.