Managing financial data efficiently is crucial. Traditional methods of handling bank statements can be time-consuming and prone to errors. However, with bank statement OCR technology, this can be automated.

In this post, we’ll explore how Bank Statement OCR technology, is revolutionizing the way businesses handle bank statements.

From explaining what OCR is, to its benefits, use cases, and how to use OCR Bank Statement DocuClipper technology to convert bank statements to Excel or CSV in seconds.

What is OCR?

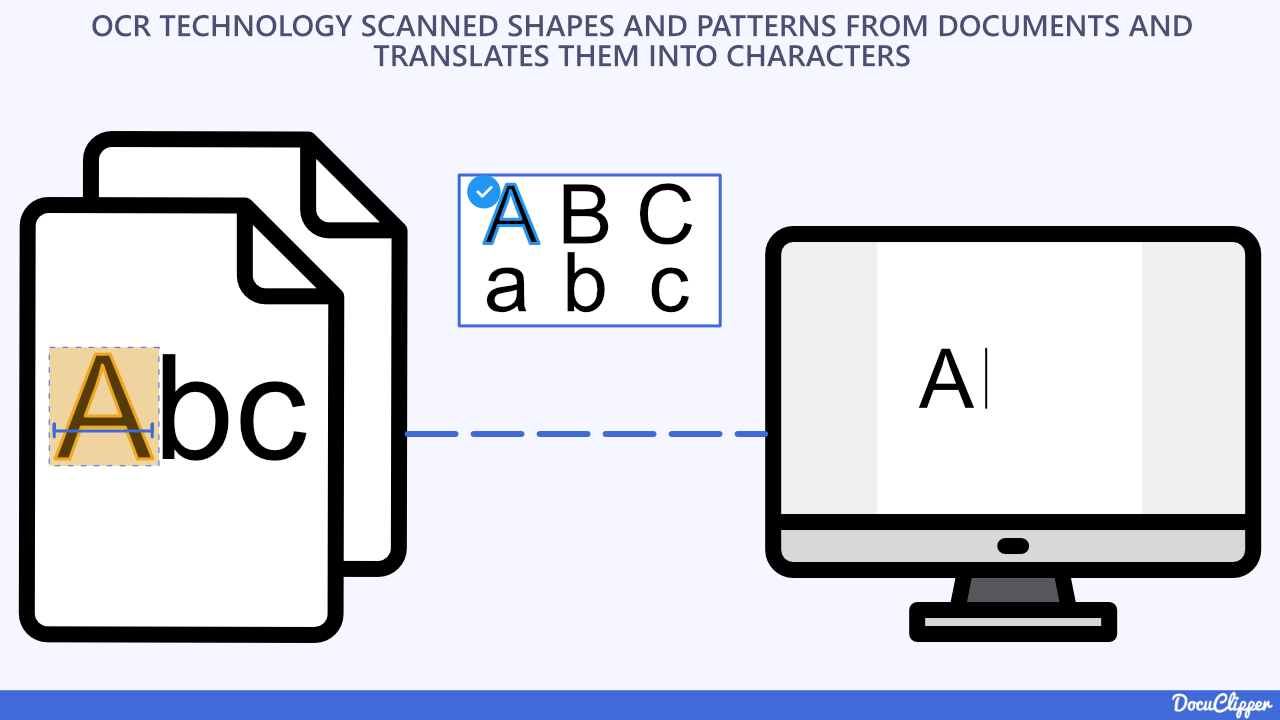

Optical Character Recognition, commonly known as OCR, is a transformative technology that converts different types of documents, such as scanned paper documents, PDF files, or images captured by a digital camera, into editable and searchable data often in Excel or CSV format.

OCR technology works by analyzing the shapes and patterns of the letters and words in the scanned document or image. It then translates these patterns into characters using a set of pre-defined rules or learning algorithms.

The result is a digital document that you can edit, format, and search using a computer.

The power of OCR lies in its ability to extract data trapped in physical documents, making it accessible and usable in digital formats. This technology has wide-ranging applications and is particularly beneficial in sectors like banking, accounting, financial services, or even law services where handling and processing large volumes of data is a daily necessity.

What is OCR Bank Statement?

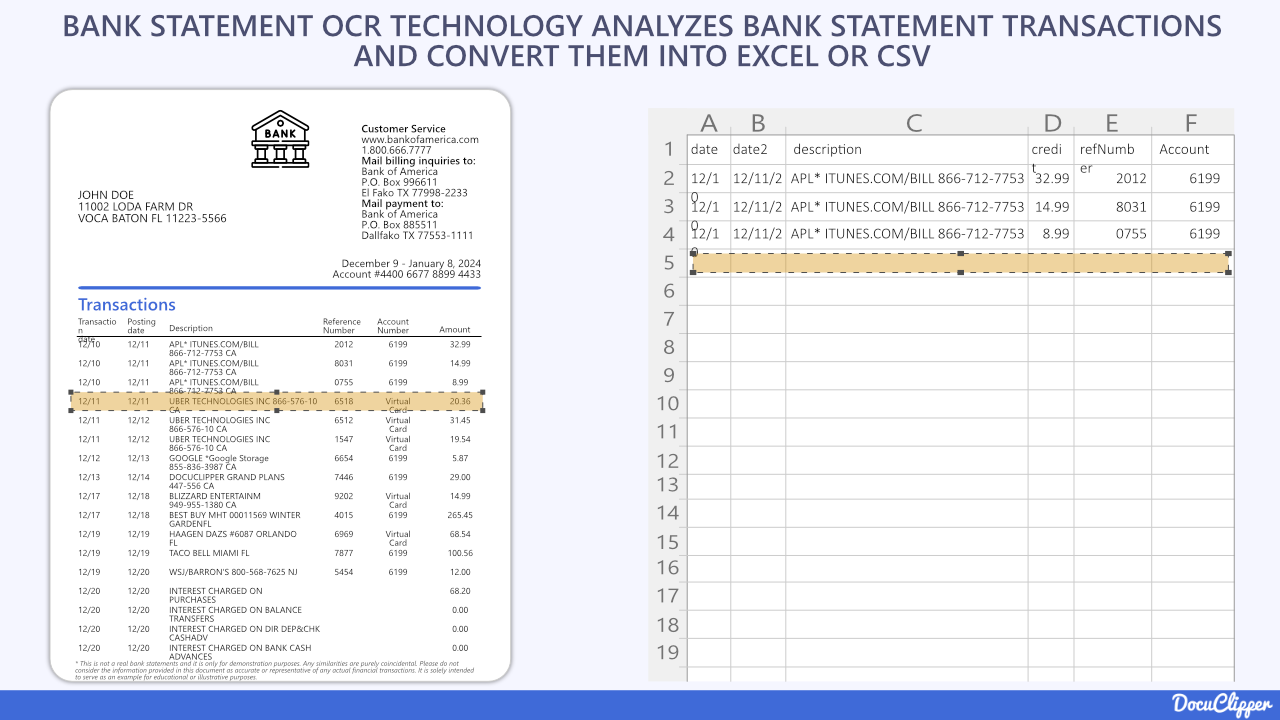

An OCR Bank Statement is a digital version of a paper bank statement created using Optical Character Recognition (OCR) technology. It involves the conversion of the text in scanned bank statement images into editable and searchable data. This process is often referred to as bank statement conversion.

A bank statement is a summary of financial transactions that have occurred over a specific period on a bank account held by a person or business with a financial institution.

Traditionally, these statements have been paper-based, making them difficult to manage, especially when dealing with large volumes of data.

OCR technology has revolutionized this process, making it easier to handle and process these statements in bulk, while minimizing the time of processing and improving data accuracy and it’s used to automate bookkeeping.

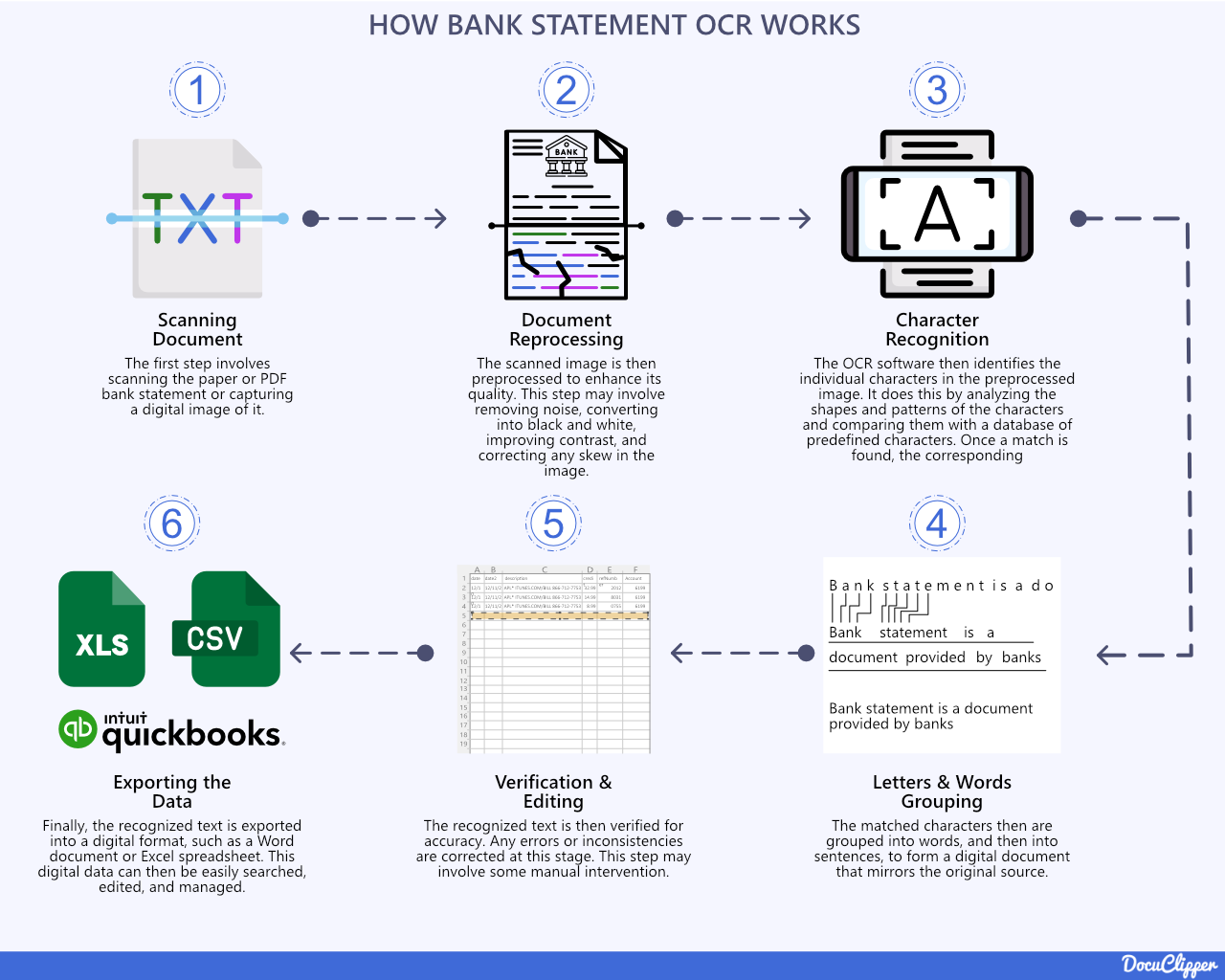

How Does OCR Bank Statement Work?

At the surface of the technology, the processes seem relatively easy, but several steps make this technology work. Here you can see the process of how OCR bank statement works:

- Scanning or Capturing the Document: The first step involves scanning the paper or PDF bank statement or capturing a digital image of it.

- Document Preprocessing: The scanned image is then preprocessed with OCR to enhance its quality. This step may involve removing noise, converting it into black and white, improving contrast, and correcting any skew in the image.

- Character Recognition: The OCR bank statement software then identifies the individual characters in the preprocessed image. It does this by analyzing the shapes and patterns of the characters and comparing them with a database of predefined characters. Once a match is found, the corresponding digital character is applied.

- Letters & Words Grouping: After that characters are grouped into words, and then into sentences, to form a digital document that mirrors the original source.

- Verification and Editing: The recognized text is then verified for accuracy. Any errors or inconsistencies are corrected at this stage. This step may involve some manual intervention.

- Exporting the Data: Finally, the recognized text is exported into a digital format, such as a Word document or Excel spreadsheet. This digital data can then be easily searched, edited, and managed.

The result is a digital, editable version of the bank statement that can be easily managed and processed. This bank statement converter process significantly reduces the time and effort required to handle bank statements, making it a valuable tool for individuals, businesses, and financial institutions.

Two Types of OCR Technology for Bank Statements

When it comes to OCR technology for bank statements, there are two main types: Template OCR and Automatic Conversion OCR. Each has its own advantages and disadvantages, and the choice between the two often depends on the specific needs and circumstances of the user.

Template OCR

Template OCR involves manually creating templates for your bank statements and defining what each text within the bank statement means. This method essentially teaches the software to recognize any bank statements that are exactly the same.

Benefits of Template OCR:

- OCR Accuracy: Since you’re manually defining the areas of interest in the bank statement, the OCR process can be highly accurate, provided the statements follow the same format.

- Customization: Template OCR allows for a high degree of customization. You can define exactly what data you want to extract from the bank statements.

Disadvantages of Template OCR:

- Time-Consuming: Creating templates for each type of bank statement can be a time-consuming process, especially if you’re dealing with statements from different banks or in different formats.

- Lack of Flexibility: Template OCR can struggle with bank statements that deviate from the defined template. Any changes in the format of the bank statement can lead to errors in the OCR process.

Automatic Conversion OCR

Automatic Conversion OCR, on the other hand, involves training the OCR software to automatically recognize your bank statements and convert the data without the need for any manual input.

Benefits of Automatic Conversion OCR:

- Efficiency: This method can process a large volume of bank statements quickly, as it doesn’t require the creation of individual templates.

- Adaptability: Automatic Conversion OCR can handle bank statements from different banks or in different formats. It’s designed to adapt to variations in the layout and format of the statements.

- Accuracy: In most cases, the accuracy of automatic conversion is just as same. For example, DocuClipper has 99% accuracy for any bank statement conversion regardless of which bank it came from.

Disadvantages of Automatic Conversion OCR:

- Not Supported Format: If your bank statement format is not supported, then you may struggle to convert the bank statements. However, in this case, you can email the bank statement to customer support and they can within a few hours train the software to support your bank statement format.

Advantages of OCR Bank Statement Technology

The use of OCR technology for bank statements offers several significant advantages. Here are some of the key benefits:

- Speed and Efficiency: OCR technology rapidly processes bank statements, significantly improving data processing efficiency and saving valuable time.

- Accuracy: By automating data extraction, OCR reduces human error, ensuring reliable and accurate data for bank statement analysis.

- Cost-effectiveness: OCR data entry reduces operational costs by minimizing the time and labor required for data entry, and prevents costs associated with errors in financial records.

- Enhanced Security and Fraud Detection: OCR aids in monitoring financial transactions and identifying suspicious activity, contributing to enhanced security and fraud detection.

Use Cases of Bank Statement OCR for Industries

OCR technology for bank statements has a wide range of applications across various industries.

And it’s one of the best ways to automate data entry to avoid manual data entry.

Here are some of the key use cases:

OCR Bank Statement for Accounting/Bookkeeping

In the field of accounting and bookkeeping, bank statement OCR for accountants and bookkeepers can significantly streamline the process of data entry and reconciliation, ensuring that no fake bank statement goes unnoticed and all financial data is accurate and reliable.

Instead of manually entering data from bank statements, accountants, lenders, and others can use OCR to automatically extract and import this data into accounting software.

This not only saves time but also reduces the risk of errors that can occur with manual data entry.

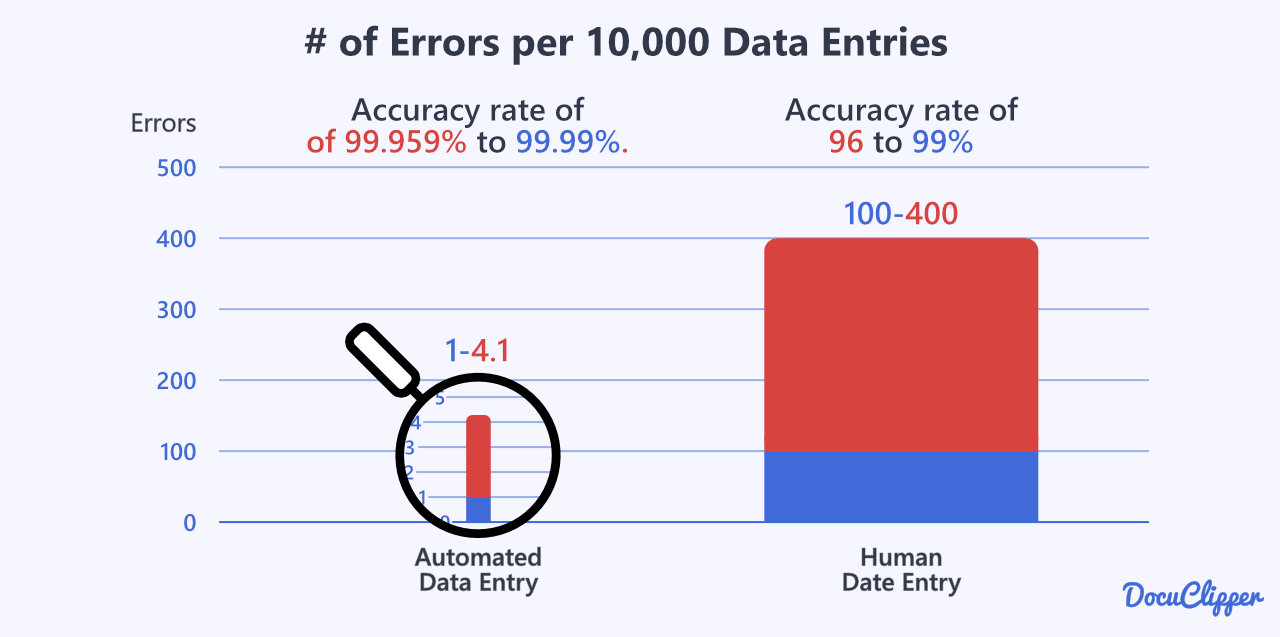

In fact, Humans make 100x more data entry errors compared to automated data entry systems. (data entry statistics)

This is especially useful if you are dealing with a lot of scanned or PDF bank statements whether they are from your clients or your own business.

OCR Bank Statement for Financial Investigators

Financial investigators often need to analyze large volumes of bank statements as part of their investigations.

Bank Statement OCR for Financial Investigators can make this process much more efficient by converting these statements into a digital format that can be easily searched and analyzed.

This can help investigators quickly identify suspicious bank transactions or patterns of activity.

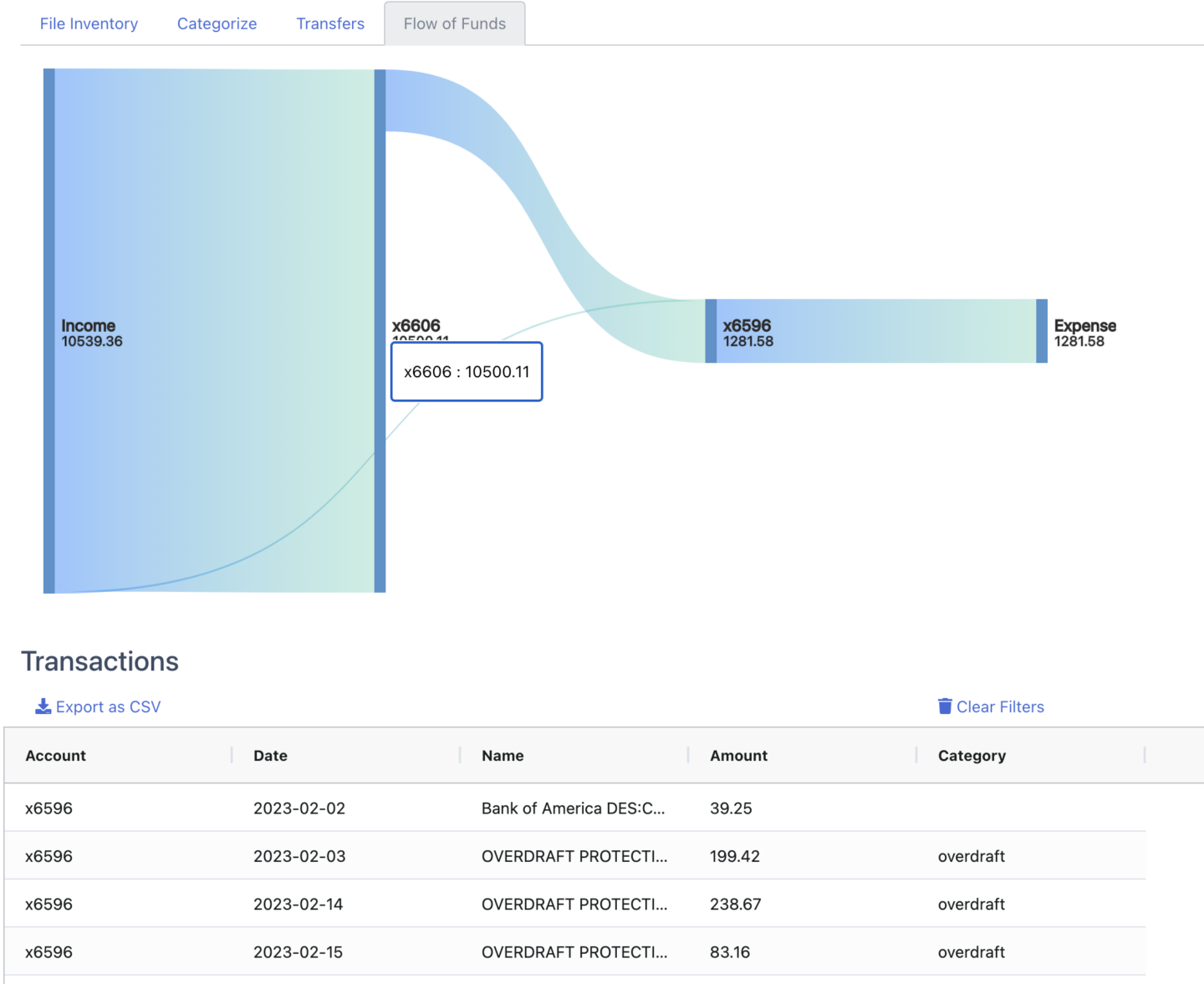

Additionally, specialized Bank Statement Converter like DocuClipper provides excellent financial investigation features such as:

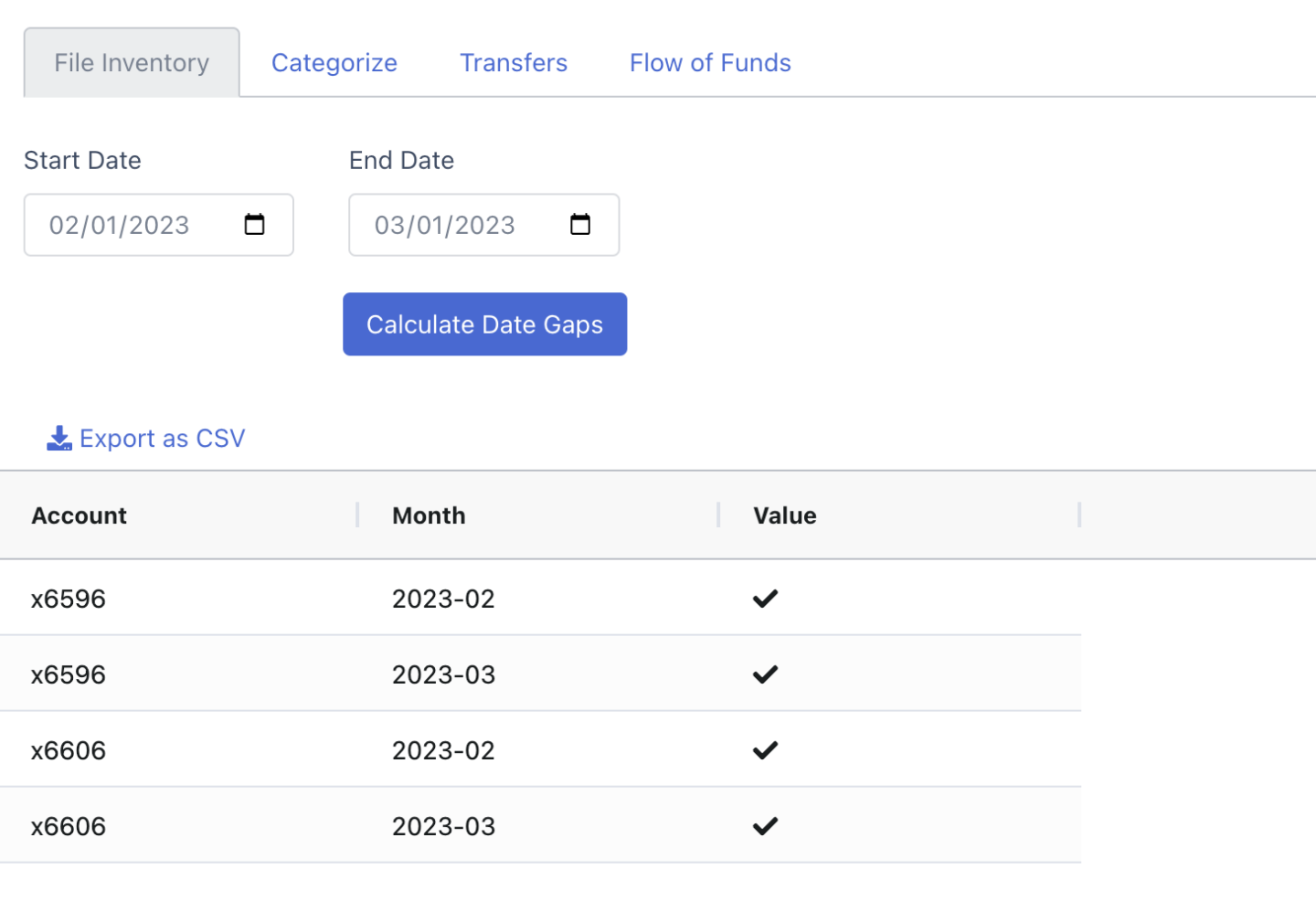

- File Inventory: The file Inventory feature ensures all necessary statements are present for your analysis, providing a comprehensive overview of your available data.

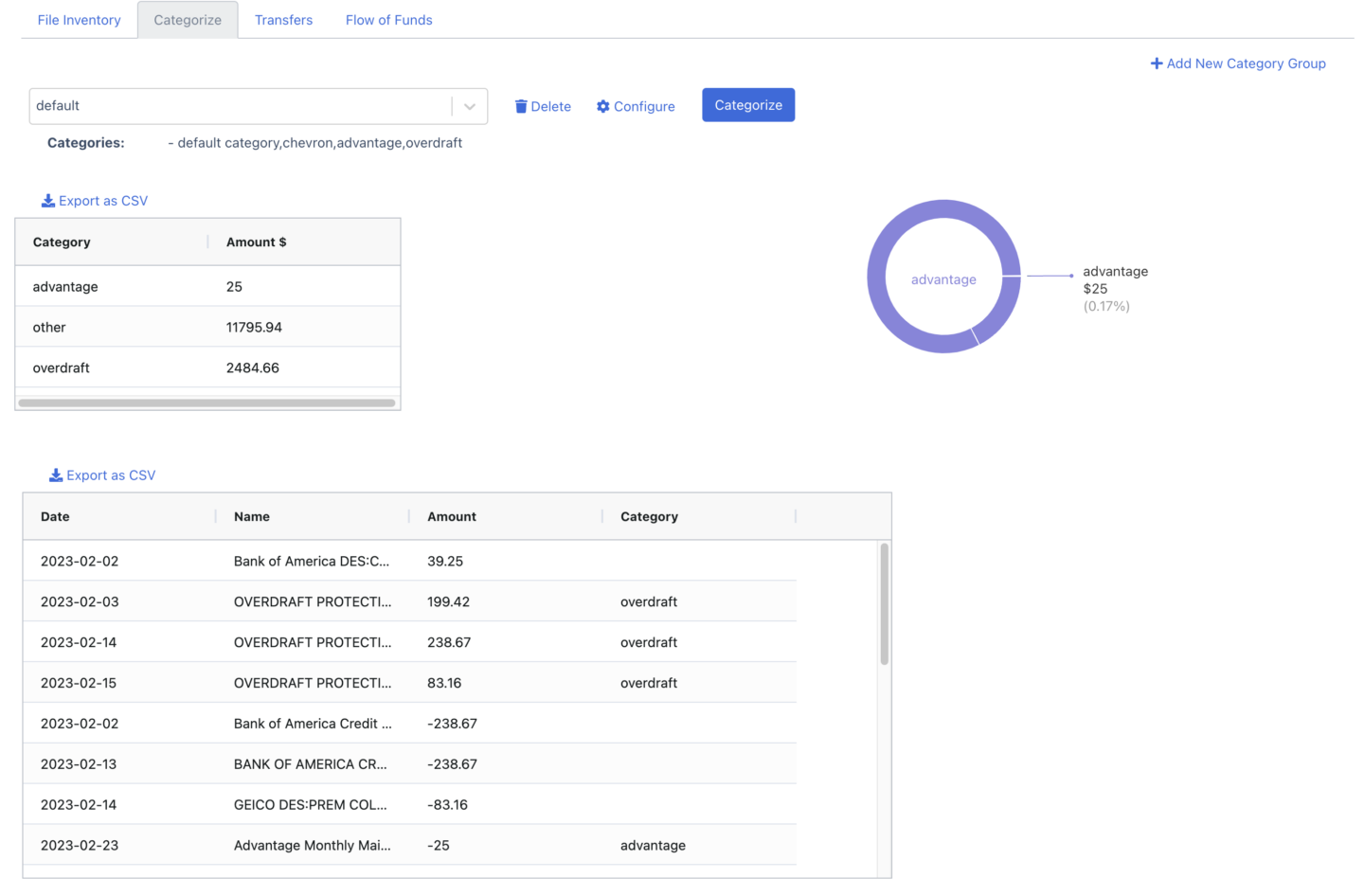

- Transaction Categorization: Allows you to automatically categorize transactions using keywords, simplifying data analysis and interpretation.

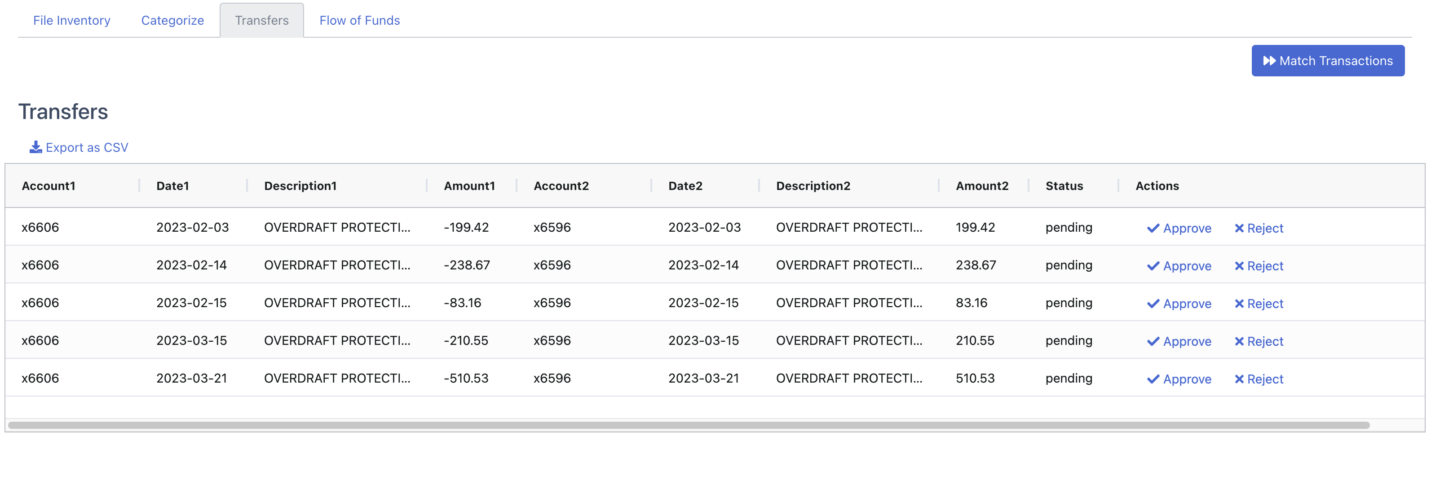

- Transfer Detection: Automatically identifies transfers between accounts, providing a clear and concise view of financial behaviors.

- Flow of Funds: Visuals that clearly illustrate the flow of money across accounts.

To learn more about this, check out DocuClipper’s financial investigation features.

OCR Bank Statement for Business Owners

For business owners, keeping track of bank transactions is crucial for managing cash flow and making informed business decisions.

Bank Statement OCR for Business Owners can automate the process of extracting data from bank statements, making it easier for business owners to monitor their income and expenses and keep their financial records up to date as well as easily import the bank transaction data into accounting software.

OCR Bank Statement for Family Law

In OCR for family law cases, bank statements can provide important evidence regarding a person’s financial situation.

Lawyers can use Bank Statement OCR for Family Law to quickly convert these statements into a digital format, making searching for specific transactions or analyzing financial patterns easier.

This can be particularly useful in cases involving divorce or child support, where a detailed understanding of a person’s financial situation is required.

OCR Bank Statement for Lenders

In the loan processing industry, lenders often need to review an applicant’s bank statements to assess their creditworthiness.

Bank Statement OCR for Lenders can automate this process, allowing lenders to quickly extract and analyze the necessary financial data.

This can speed up the loan approval process and help lenders make more accurate lending decisions.

How To Extract Data from Bank Statements Using DocuClipper?

Using DocuClipper to extract bank data from bank statements can literally take seconds. Additionally, the software is so easy to use that you won’t even need to use tutorials such as this.

But, let me show you how to convert bank statements to Excel or CSV.

Here is also a video if you don’t want to read this 150-word tutorial:

Step #1: Import Your Bank Statements

Log into DocuClipper and select “Bank & Credit Card Statements”. Drag and drop your bank statements into the platform. DocuClipper can process multiple statements at once, even scanned ones, thanks to its Optical Character Recognition technology.

Step #2: Automatic Data Extraction

Once you click on convert, DocuClipper automatically generates a bank extract by pulling all transactions and other data like balances, dates, and account numbers from the bank statement.

Step #3: Bank Statement Reconciliation

DocuClipper reconciles the bank statements by comparing transaction totals to the summary information on the statement. You can see the reconciliation status on the summary table.

Step #4: Bank Statement Conversion

To convert the bank statement to Excel or CSV, click on “Download data” and select your preferred output format. The spreadsheet will then be downloaded to your computer.

For more information, DocuClipper can also convert CSV to QBO. Read more on how to convert CSV to QBO.

Step #5: Import Bank Statement into Accounting Software

With DocuClipper, you can customize the output format to include the columns you need. This makes it easy to import the data into your accounting software, whether it’s QuickBooks Online, Desktop, Xero, or Sage.

Learn more:

- How to Import bank statements into Sage in 7 Easy Steps

- How to Import Bank Statements into QuickBooks Online: Easy Step-by-Step Guide

- How to Import Bank Statements into Xero in 5 Easy Steps

- How to Convert a Brokerage Statement

Conclusion

In conclusion, OCR technology, such as DocuClipper, is transforming the way businesses manage their bank statements. By converting bank statements to Excel or CSV formats, it offers speed, accuracy, cost-effectiveness, and enhanced security.

As every business has accounting needs, the ability to efficiently manage bank statements is crucial. With the increasing digitization of business operations, using OCR for bank statements is becoming not just a convenience, but a necessity.

Try DocuClipper OCR Technology for Bank Statements

Experience the power and efficiency of OCR technology for your bank statements with DocuClipper. Don’t just take our word for it, see the benefits for yourself.

Sign up today for a 14-day free trial and revolutionize the way you manage your financial data. No strings attached and no credit card is required.

Start your journey towards efficient and accurate bank statement management with DocuClipper today!

Related Articles:

- How to Convert Credit Card Statements to Excel or CSV

- Best Bank Statement Converter Software

- How to Read a Bank Statement

- How to Convert CSV to QBO

- What is OCR Data Visualization? Why Is It Important & Examples

- Outsourced Bookkeeping: Benefits, Costs, and How To Outsource Bookkeeping

- How To Automatically Categorize Bank Transactions in Excel: Template Included

- How to Read a Brokerage Statement

- How Long to Keep a Brokerage Statement