OCR invoice processing is revolutionizing how businesses handle financial documents.

This technology automatically extracts data from invoices by converting scanned images or PDFs into structured, machine-readable text.

With OCR invoice processing, companies can significantly reduce manual data entry, minimize errors, and accelerate their accounts payable workflows.

Key Takeaways

- Invoice OCR automates data extraction. Instead of manually inputting invoice details, OCR technology captures and converts text from scanned or digital invoices into structured, machine-readable data.

- Reduces costs and processing time. Automating invoice processing with OCR can lower costs by up to 80% and decrease processing time from minutes to seconds, significantly improving efficiency.

- Improves accuracy over manual entry. Modern OCR technology achieves 98-99% accuracy, minimizing errors in invoice processing and reducing payment disputes.

- Seamlessly integrates with accounting systems. Invoice OCR allows direct data transfer to ERP, accounting, and payment platforms, eliminating the need for manual data entry.

What is Invoice OCR?

Invoice OCR is a technology that automatically extracts data from invoices by converting scanned invoice images or PDFs into structured, editable text.

It converts the text and numbers from scanned paper invoices or digital invoice images into machine-readable data that can be processed by accounting and financial systems.

What is OCR Invoice Processing?

OCR Invoice Processing is an automated system that converts physical or digital invoices into structured, machine-readable data.

The technology combines OCR with intelligent data processing to automatically capture, interpret, and validate invoice information.

Automated invoice processing software uses OCR alongside page layout analysis to identify key invoice elements—vendor details, dates, amounts, invoice numbers, and line items.

Benefits of Implementing OCR Invoice Processing

Here are the main benefits of using OCR for your invoice processing:

- Lower processing costs – Automating invoice processing helps you cut costs by 60-80%. Manually processing invoices can cost $15-$40 per invoice, while OCR reduces this to $2-$5. If you process thousands of invoices, this results in major savings.

- Faster invoice handling – OCR can process hundreds of invoices in minutes, cuts processing time by up to 80%. Instead of spending 15-20 minutes manually entering data for each invoice, you can have it extracted in seconds.

- Higher data accuracy – With modern OCR accuracy achieving 98-99%, you minimize errors compared to manual data entry, which typically has a 90% accuracy rate. This prevents payment delays, disputes, and reconciliation issues.

- Better cash flow – Faster invoice processing allows you to take advantage of early payment discounts and optimize when you pay vendors, also avoiding penalties from suppliers for late payments.

- Stronger compliance readiness – Automated bookkeeping systems create detailed digital audit trails, helping you meet compliance requirements while making audits faster and more efficient.

- Higher employee productivity – By eliminating manual data entry, your team can focus on higher-value tasks like vendor management, financial analysis, and decision-making with OCR invoice data entry.

- Improved vendor relationships – When you process invoices faster and with fewer errors, vendors receive payments on time, reducing disputes and improving business relationships.

- Seamless system integration – OCR invoice processing connects with your ERP, accounting software, and payment platforms, streamlining ERP invoice processing and reducing the need for manually transferring all the invoice data from the computer to the accounting system.

How Does OCR Invoice Processing Work?

Here are the steps in how OCR invoice processing works:

Step 1: Invoice Digitalization

The first step is converting invoices into a digital format, preferably PDF. Invoices can be received as paper documents, images, or electronic files (eInvoices).

Since Invoice OCR software works only with PDFs, you should scan paper invoices or capture images using a mobile device and save them as PDFs before processing.

Observe proper preprocessing technique so you can extract the most accurate information possible during the process.

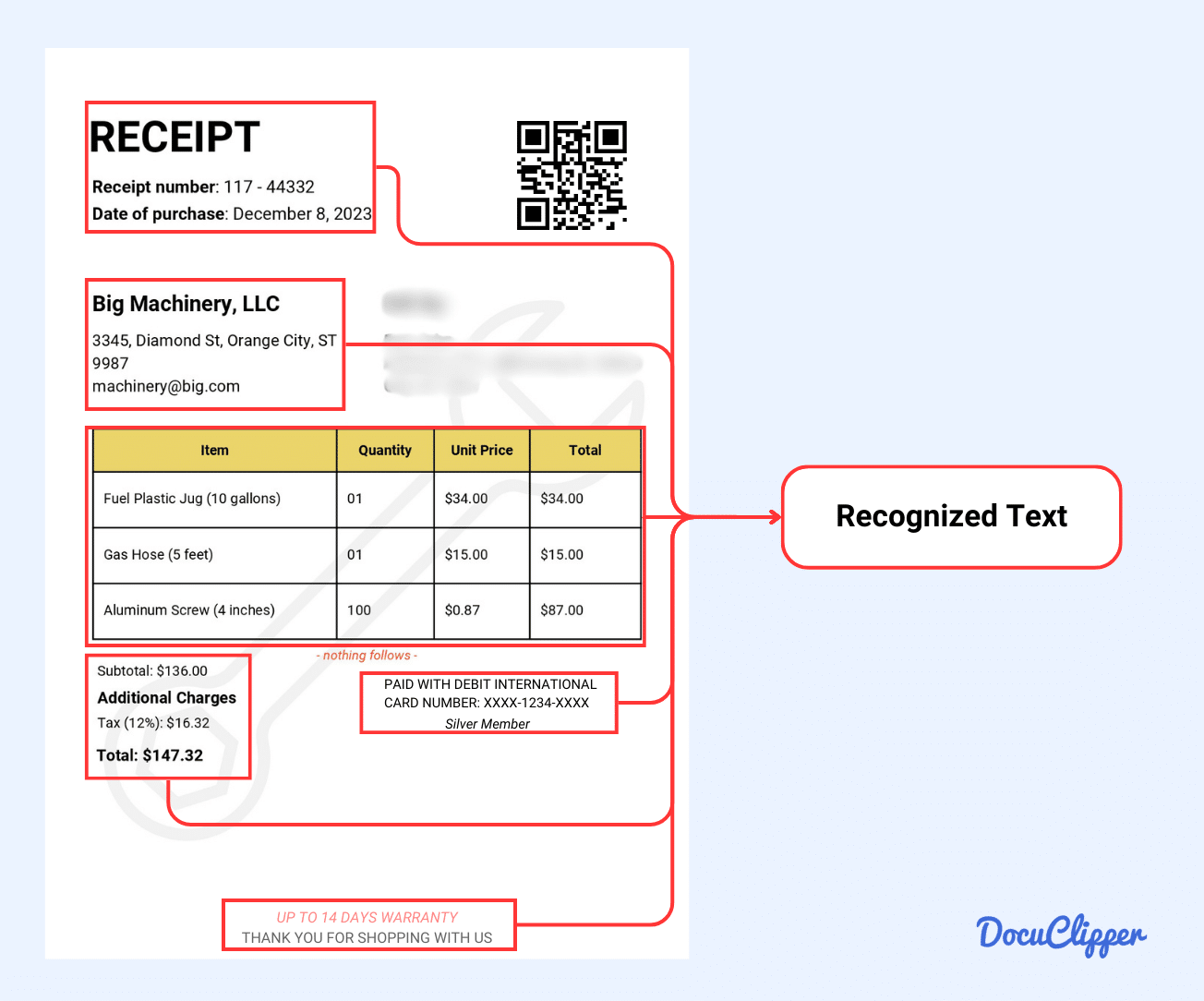

Step 2: Text Recognition and Extraction

Once the invoice is digitized, the OCR engine identifies and extracts text while ignoring logos, graphics, and other non-text elements.

The system first recognizes individual characters and numbers, then compares them against known fonts and styles using pattern matching. After identifying the text, it groups characters into meaningful words and phrases.

Then, layout analysis helps the system understand the document’s structure, ensuring the extracted data retains its original context.

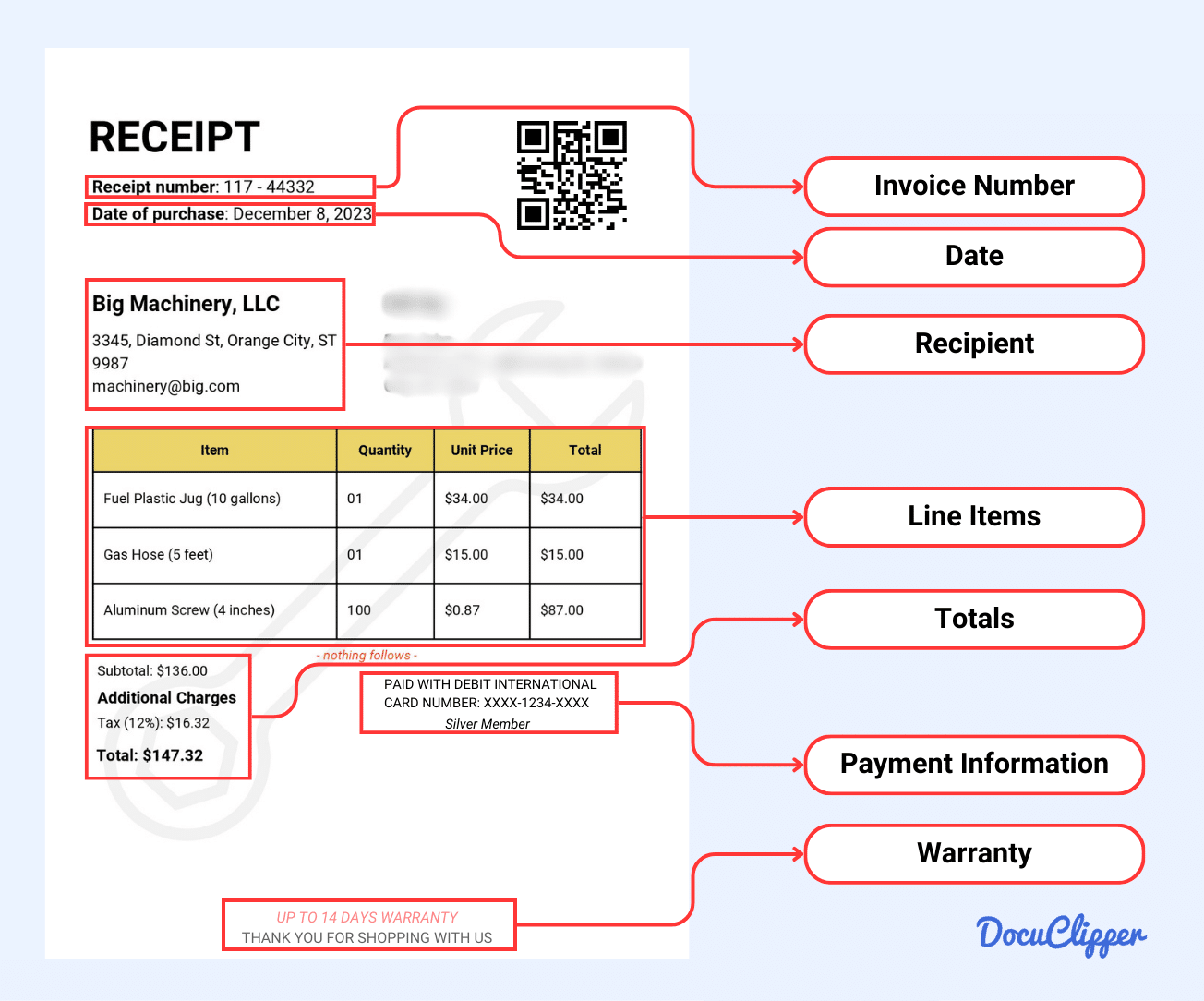

Step 3: Intelligent Field Mapping

After extracting the text, the OCR system analyzes and organizes the data based on predefined rules and coding. It determines which fields are necessary and verifies calculations to ensure accuracy.

Using AI and machine learning, the system automatically identifies key invoice details, including the invoice number, date, vendor information, line items, total amounts, tax calculations, payment terms, due dates, and purchase order references.

This structured data is then prepared for further processing and integration into financial systems.

Step 4: Structured Data Output

Once the document data is extracted, the system organizes it into a structured format so you can easily process it. It creates standardized data fields, ensuring consistency across invoices.

The extracted information is then converted into machine-readable formats like JSON or XML, allowing you to integrate it with your accounting software.

From there, the data is stored in a database for easy access, reporting, and audits. You also get a digital archive of all invoices, making it simple to retrieve records whenever needed.

Step 5: Exception Handling and Human Review

If the system detects potential errors or inconsistencies, it flags them for your review before finalizing the data.

This step ensures accuracy by identifying issues such as low-confidence recognition, calculation discrepancies, missing fields, or unusual invoice formats.

It also helps you catch duplicate submissions before they enter your accounting system. By reviewing and correcting flagged invoices, you maintain data integrity and prevent costly errors in financial processing.

Step 6: Integration and Workflow

Once the data is verified, it is sent to the appropriate business systems for further processing. You can integrate it with accounts payable software to manage payments, sync it with ERP systems for financial tracking, or connect it to payment processing platforms to automate transactions.

The data can also be stored in document management systems for record-keeping and compliance, while analytics and reporting tools help you gain insights into spending, vendor performance, and financial trends.

OCR Invoice Processing Methods

OCR technology processes invoices in different ways, each with its own strengths and limitations. The method you choose depends on the variety of invoices you handle and the level of flexibility required:

Template-Based OCR

This method relies on predefined templates to extract data from invoices with fixed layouts. It offers high accuracy for invoices that follow a consistent format but struggles with variations.

- Works best for businesses that receive invoices from the same vendors.

- Requires template setup and maintenance, which can be time-consuming.

- Not ideal for processing invoices with varying designs or layouts.

Intelligent/Free-Form OCR

This method utilizes AI and machine learning to extract data from invoices without relying on predefined templates. It adapts to different invoice layouts automatically, making it suitable for businesses that handle a variety of formats.

- Provides flexibility by processing invoices in any format.

- Learns and improves accuracy over time through machine learning.

- May have lower initial accuracy, requiring adjustments and validation.

- Can produce inconsistent results depending on invoice complexity.

Zonal OCR

This method extracts data from predefined regions of an invoice, making it a hybrid between template-based and intelligent OCR. It works best for invoices with semi-standardized layouts where key fields appear in consistent locations.

- Targets specific areas capture relevant invoice data.

- Offers a balance between accuracy and flexibility.

- Works well for businesses that receive invoices with minor variations in format.

- Commonly used for documents where field positions remain relatively stable, such as resumes and structured forms.

Cloud-Based OCR

This method processes invoices using cloud servers, allowing businesses to access OCR capabilities without needing on-premise hardware. It offers scalability and continuous improvements through automatic updates.

- Enables remote access, making it suitable for distributed teams.

- Reduces infrastructure costs since processing happens in the cloud.

- Continuously updates and improves accuracy over time.

- Supports a vast range of invoice templates due to its extensive database.

Hybrid OCR

This method combines multiple OCR techniques, adapting its approach based on the invoice type. It offers high accuracy but requires more processing power and configuration.

- Uses a mix of template-based, free-form, and zonal OCR for better flexibility.

- Delivers the highest accuracy by selecting the best extraction method for each invoice.

- Ideal for businesses handling invoices in multiple formats.

- May slow down processing due to the complexity of running multiple technologies simultaneously.

Mobile OCR

This method combines multiple OCR techniques, adapting its approach based on the invoice type. It offers high accuracy but requires more processing power and configuration.

- Uses a mix of template-based, free-form, and zonal OCR for better flexibility.

- Delivers the highest accuracy by selecting the best extraction method for each invoice.

- Ideal for businesses handling invoices in multiple formats.

- May slow down processing due to the complexity of running multiple technologies simultaneously.

OCR Invoice Processing vs. Manual Processing Comparison

Understanding the differences between manual and automated OCR invoice processing clearly demonstrates why businesses are increasingly adopting this technology.

The comparison below highlights key metrics that directly impact operational efficiency and bottom-line results.

| Aspect | Manual Invoice Processing | OCR Invoice Processing |

| Processing Time | 15-20 minutes per invoice | 30-90 seconds per invoice |

| Cost Per Invoice | $10-$40 | $0.5-$3 |

| Accuracy Rate | 90-95% with human errors | 98-99% with machine precision |

| Staff Required | 1 FTE per ~1,000 monthly invoices | 1 FTE per ~10,000 monthly invoices |

| Processing Capacity | Limited by working hours | 24/7 processing capability |

| Data Extraction | Manual typing of all fields | Automated extraction of all data points |

| Error Correction | Time-consuming manual review | Automated validation with exception flagging |

| Scalability | Requires hiring additional staff | Scales with minimal additional resources |

| Early Payment Discounts | Often missed due to slow processing | Frequently captured due to rapid processing |

| Audit Trail | Manual documentation | Automated digital audit trail with timestamps |

| Duplicate Detection | Relies on human memory/checking | Automated using invoice number validation |

| Integration with Systems | Manual re-entry into multiple systems | Seamless API connections to all platforms |

| Exception Handling | Manual investigation and resolution | Automated flagging with prioritized workflow |

| Vendor Communication | Manual emails and phone calls | Automated status updates and queries |

| Cash Flow Management | Reactive based on processed invoices | Proactive with real-time visibility |

| Compliance Tracking | Manual verification of requirements | Automated rules and validation checks |

| Storage Requirements | Physical filing space needed | Digital storage with minimal footprint |

| Document Retrieval | Minutes to hours to locate files | Seconds with searchable digital archives |

| Environmental Impact | High paper consumption | Paperless with reduced carbon footprint |

| Vendor Relationship | Often strained due to payment errors | Improved through consistent, accurate payments |

| Business Intelligence | Limited manual reporting | Comprehensive analytics and insights |

| Fraud Prevention | Difficult to detect patterns | Automated anomaly detection |

| Remote Work Support | Challenging without physical access | Fully supported with cloud access |

Recent industry research provides compelling evidence for the benefits of OCR invoice processing:

- According to a study by Ardent Partners, companies using automated invoice processing spend 81% less time processing invoices compared to those using manual methods.

- APQC research shows that top-performing organizations using OCR processing spend $2.07 per invoice, while bottom performers using manual methods spend $10.89 per invoice.

- A 2024 Institute of Finance and Management study found that OCR invoice processing reduced error rates from 3.6% to 0.3% among surveyed companies.

- Levvel Research reports that organizations implementing OCR invoice processing reduce their processing costs by an average of 78%.

- According to a Deloitte survey, 67% of companies using automated invoice processing reports capture early payment discounts compared to just 18% of those using manual methods.

Key Use Cases for OCR Invoice Processing

OCR invoice processing is widely used across industries to handle large volumes of invoices efficiently. Here’s where it provides the most value:

- Finance & Accounting – Helps you process vendor invoices, automate approval workflows, match purchase orders, manage expense reports, and handle multi-currency transactions.

- Healthcare – Speeds up medical billing, insurance claims, and supplier invoice processing. Also digitizes patient records, prescriptions, and Medicare/Medicaid documentation.

- Manufacturing – Tracks supplier invoices and material receipts, manages supply chain records, processes quality control documentation, and handles maintenance invoices.

- Retail – Automates vendor payments across multiple locations, processes store-level expenses, tracks inventory invoices and supports franchise payment systems.

- Government – Manages contractor and vendor payments, processes grant documentation, handles public records, ensures compliance, and automates budget tracking.

- Transportation & Logistics – Processes freight bills, customs documents, and driver expenses. Also manages equipment invoices and automates shipping manifest processing.

- Construction – Handles contractor and subcontractor payments, processes material receipts and equipment rentals, tracks project costs and manages change orders.

Conclusion

OCR invoice processing has become an essential tool for businesses looking to reduce costs, improve accuracy, and eliminate manual data entry.

Automating invoice data extraction, allows you to process large volumes of invoices faster, minimize errors, and integrate the extracted data into your financial systems.

As technology continues to evolve, OCR will play an even bigger role in optimizing invoice processing and financial operations.

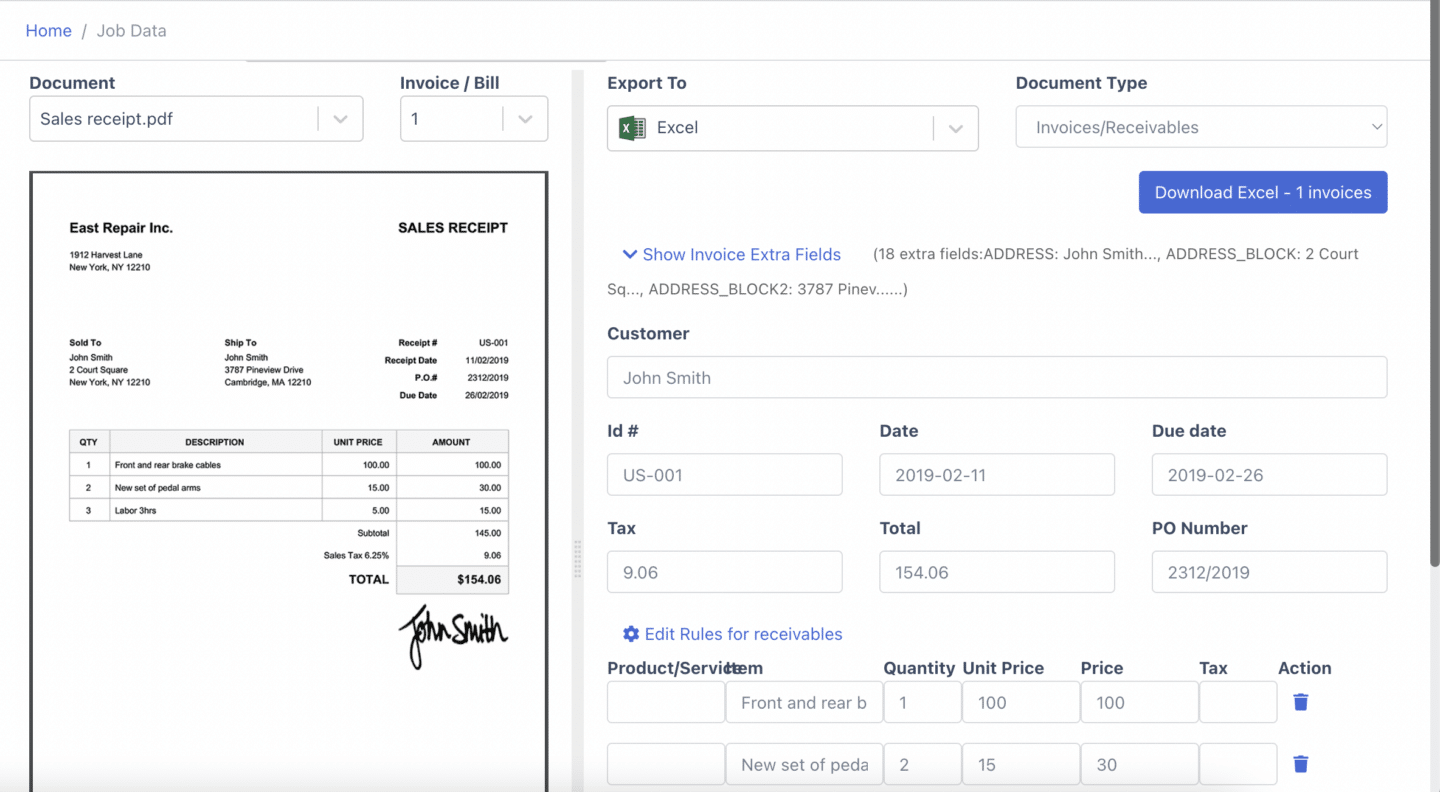

How DocuClipper Can Help with OCR Invoice Processing

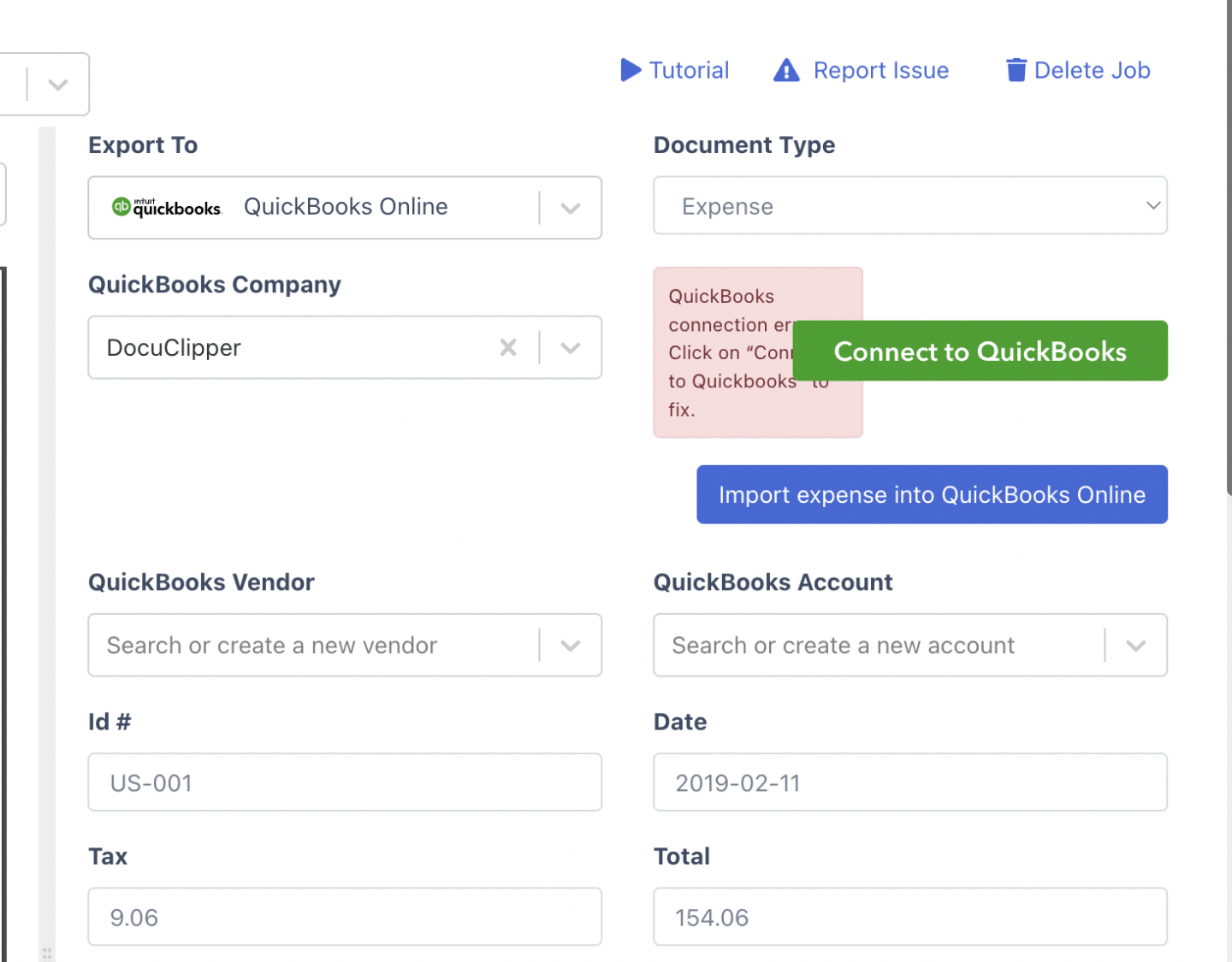

DocuClipper is an invoice OCR software that can be the best addition for your business when processing invoices. It effectively converts PDF invoices into XLS or CSV making it easier for you to process the invoice data.

If you are using accounting software, DocuClipper has an invoice OCR API feature that allows you to transfer all the information easily without having to manually transfer them.

This tool is not just only an invoice scanning software, it can also convert bank statements, receipts, credit card statements, and tax forms.

FAQs about OCR Invoice Processing

Here are some frequently asked questions about invoice processing:

What is OCR in invoice processing?

OCR (Optical Character Recognition) in invoice processing is a technology that extracts text from scanned or digital invoices and converts it into structured, editable data. This eliminates the need for manual data entry, allowing you to process invoices faster and with greater accuracy.

What does OCR stand for in billing?

OCR stands for Optical Character Recognition in billing. It is a technology that extracts text from scanned or digital invoices, receipts, and financial documents, converting them into machine-readable data for faster processing and automation.

What is OCR billing?

OCR billing refers to the use of Optical Character Recognition (OCR) technology to extract billing details from invoices, receipts, and financial documents. It converts scanned or digital text into structured data, allowing you to automate invoice processing, reduce manual entry, and improve accuracy in accounts payable and receivable systems.

What is the OCR process?

The OCR process involves scanning or uploading a document, recognizing the text within it, and converting that text into machine-readable data. It includes several steps: image preprocessing, text recognition, field extraction, data validation, and integration with accounting or ERP systems. This automation reduces manual data entry and improves processing efficiency.

What is OCR in procurement?

OCR in procurement refers to the use of Optical Character Recognition (OCR) technology to extract and process data from purchase orders, invoices, and other procurement documents. It helps automate data entry, improve accuracy, and integrate procurement records into accounting and ERP systems, reducing manual workload and processing time.