If you’re using Ocrolus for invoice data extraction but find it lacking, whether due to pricing, features, or integration limitations, you’re not alone. Many businesses need a solution that offers faster processing, better accuracy, or more flexible pricing.

Finding the right Ocrolus alternative can save you time and money while improving how you handle invoice data.

Whether you need cost-effective automation, seamless integration with accounting software, or enterprise-level document processing, this list of the 10 best Ocrolus alternatives will help you choose the right tool for your business.

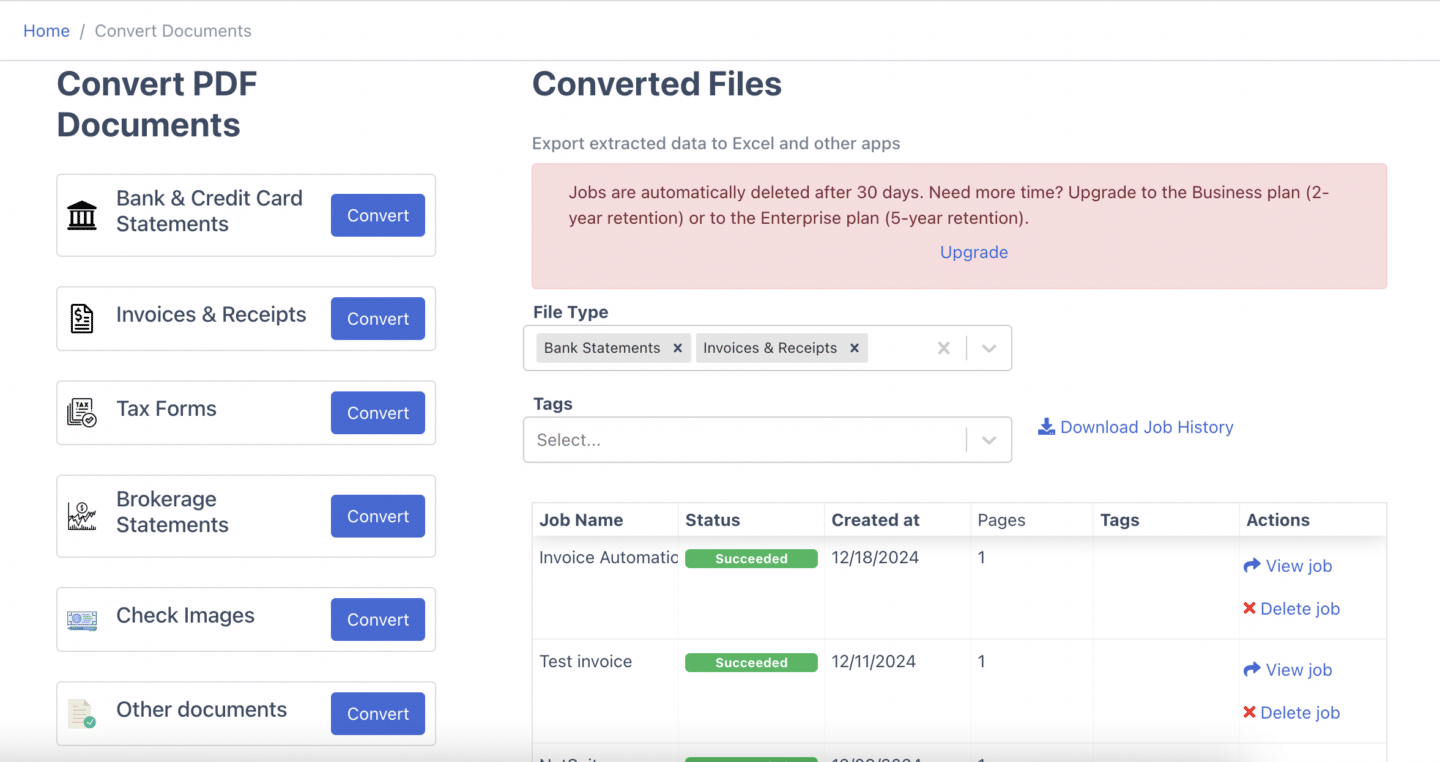

1. DocuClipper

DocuClipper is an advanced invoice data extraction tool that helps you convert invoices, receipts, and financial statements into Excel, CSV, and QBO formats. By automatically capturing and organizing invoice data, it eliminates the need for manual entry and reduces errors.

With cutting-edge OCR technology and algorithms designed for financial documents, DocuClipper ensures high accuracy and rapid processing.

If you’re looking to streamline invoice management, improve data accuracy, and save time, DocuClipper is a must-have. Whether you’re handling daily invoices or large batches of statements, it automates extraction, making your workflow more efficient.

Pros

- User-Friendly Interface: DocuClipper’s web-based platform is intuitive and easy to navigate, allowing you to extract invoice data with minimal effort.

- Cost-Effective Pricing: Designed for small businesses, its page-based pricing is more affordable compared to competitors that charge per line item.

- High Accuracy: Using advanced OCR technology, DocuClipper ensures precise invoice data extraction, converting PDFs into Excel, CSV, or QBO formats without errors.

- Fast Processing: Capable of handling hundreds of invoices in under a minute, it significantly reduces the time spent on manual data entry.

- Secure Storage: Your financial data remains protected with encryption and secure cloud storage, ensuring complete confidentiality and compliance.

Cons

- No Mobile App: DocuClipper lacks a mobile application with camera-based scanning, meaning you need to convert invoices into PDFs before processing.

- Limited Direct Integrations: While it integrates seamlessly with Sage, Xero, and QuickBooks, other accounting platforms require API-based connections.

Pricing

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details.

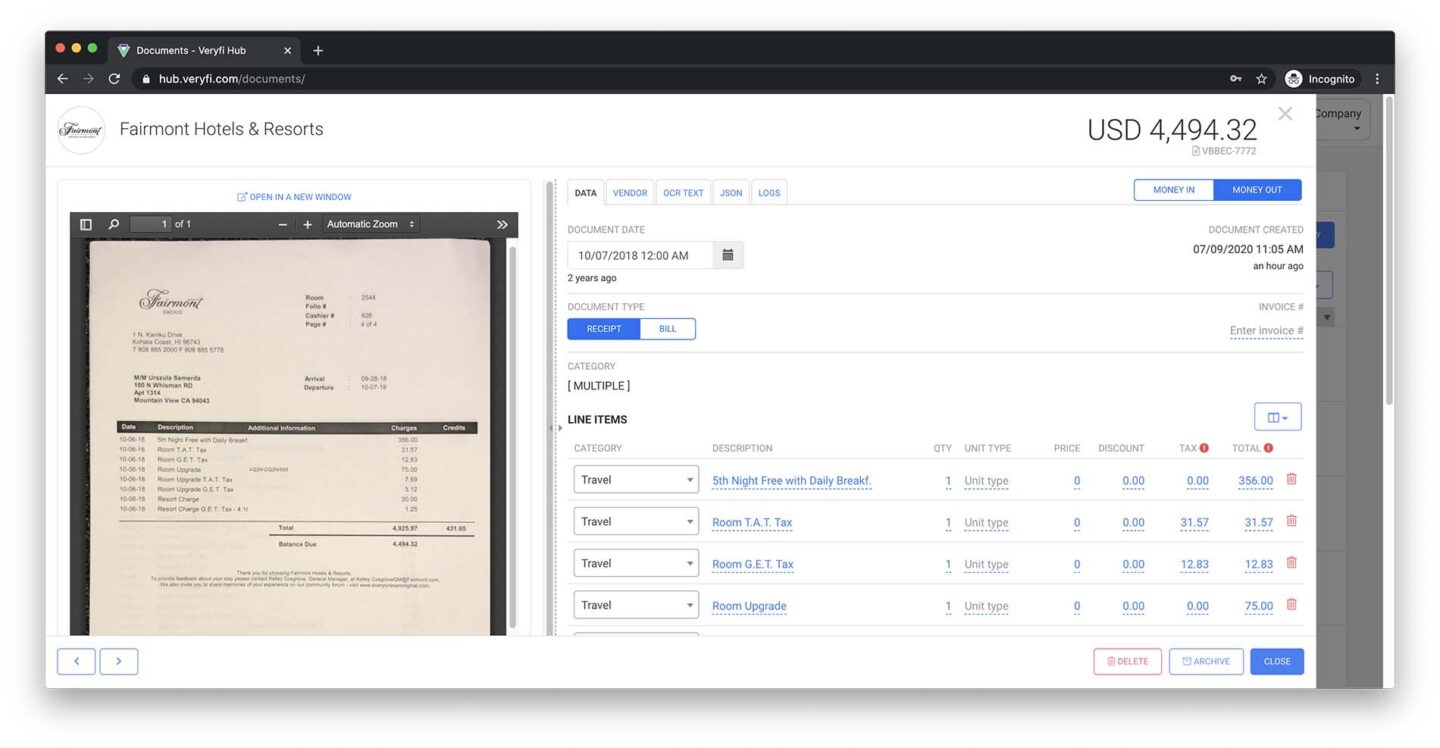

2. Veryfi

Veryfi is an AI-powered invoice data extraction tool that helps you capture, extract, and convert unstructured invoice data into structured formats. Its advanced OCR technology and mobile capture capabilities eliminate manual data entry, reducing errors and improving efficiency.

With real-time processing and automation, Veryfi enables you to extract key invoice details instantly, making it a valuable solution for businesses looking to streamline financial workflows. Trusted by enterprises worldwide, it offers secure and accurate data extraction for faster decision-making.

Pros

- Fast and Accurate Data Extraction: Veryfi quickly scans and extracts invoice data with high precision, reducing the time spent on manual data entry.

- Automated Categorization: You can set up rules to automatically classify transactions based on extracted invoice details, streamlining expense tracking.

- Web and Mobile Accessibility: The mobile app allows for on-the-go invoice scanning, while the web interface provides a robust platform for managing bulk transactions.

- Bank Integration: Veryfi connects with your bank, making it easier to match extracted invoice data with transactions and export reports.

Cons

- Inconsistent Support: Customer support has declined over time, making it difficult to resolve issues effectively.

- Occasional Downtime: Some users experience service interruptions, which can be problematic for real-time invoice processing.

- High Pricing: Compared to other invoice data extraction tools, Veryfi is more expensive, which may not be ideal for budget-conscious businesses.

- Accuracy Variability: While generally reliable, OCR extraction occasionally produces incorrect results, with no built-in feedback loop for improvements.

- Minor Bugs and Interface Issues: The app and web platform have minor glitches and display inconsistencies that need further refinement.

Pricing

Veryfi offers a tiered pricing structure to accommodate various business needs:

- Free Plan: Process up to 100 documents per month at no cost. This plan includes basic features suitable for development purposes, focusing on receipts and invoices.

- Pay As You Go: Starting at a $500 monthly minimum, this plan is designed for businesses with higher processing needs. It offers standard features with limited storage and email support, charging $0.16 per invoice and $0.08 per receipt beyond the minimum.

- Custom Plan: Tailored for enterprises processing over 10,000 documents monthly, this plan provides access to all document types, advanced features, unlimited storage, and additional support options. Pricing is customized based on specific requirements.

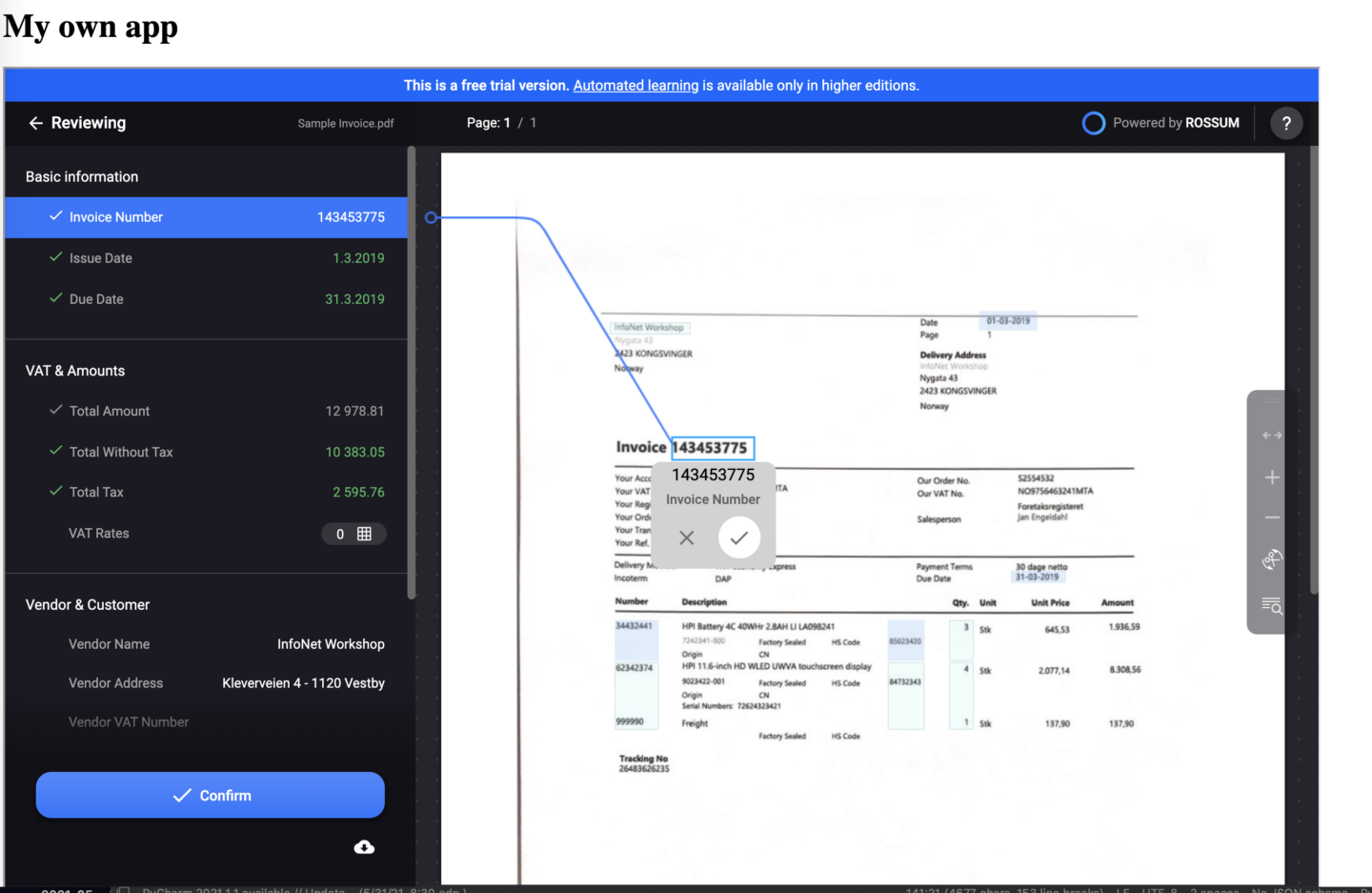

3. Rossum

Rossum is an intelligent document processing (IDP) solution designed to automate invoice data extraction and reduce manual effort. Its AI-powered platform speeds up processing by at least 90%, making it a reliable tool for businesses handling high volumes of invoices.

With a structured workflow, Rossum captures invoice data from multiple sources, understands the content using machine learning, and resolves exceptions through two-way communication. Its deep integrations ensure that extracted data seamlessly flows into your financial systems, minimizing errors and improving efficiency.

Pros

- User-Friendly Interface: Rossum’s intuitive design makes invoice data extraction simple, even for users with minimal technical experience.

- Seamless Integration: Its open APIs and extensions allow easy integration with corporate accounting and ERP systems.

- AI-Powered Learning: The platform continuously improves extraction accuracy by learning from past invoices.

- Dedicated Support: A knowledgeable account manager assists with implementation and troubleshooting, ensuring a smooth setup.

Cons

- Limited Field Extraction: While effective for invoices and purchase orders, Rossum struggles with extracting data from other document types.

- Slow Support Response: Beyond the assigned account manager, technical support can be slow, with long wait times for issue resolution.

- Lack of US-Based Support Hours: Businesses in the US may find it difficult to get timely assistance due to timezone differences.

- Limited Reporting Features: Currently, reporting options are minimal, making it challenging to generate detailed invoice analytics.

- Time-Intensive AI Training: The machine learning model requires significant training, demanding additional time and effort for optimization.

Pricing

- Starter Plan: Priced at $18,000 annually, this plan is ideal for scaling businesses seeking to automate data capture. It includes unlimited user seats, multiple document ingestion methods (email, API, manual upload), access to Rossum Aurora Document AI for precise data extraction, an ergonomic validation interface for exception handling, a 12-month document archive with search capabilities, and API access.

- Business Plan: Tailored for companies aiming to automate comprehensive document workflows, this plan encompasses all features in the Starter Plan, plus custom business logic for specific data extraction and workflow creation, master data matching, duplicate detection and handling across channels, an integrated intelligent mailbox for enhanced partner communication, customizable functions and webhooks, detailed document workflow reporting, and integration capabilities with various tech stacks, including SAP, Coupa, Workday, and Oracle.

- Enterprise Plan: Designed for established businesses with intricate requirements, this plan includes all features from the Business Plan, along with Single Sign-On (SSO) options for secure access, a sandbox environment for testing deployments, extended master data matching, choice of cloud location, options for signature onboarding and success plans, and custom branding opportunities.

- Ultimate Plan: Geared towards global enterprises managing high transaction volumes, this comprehensive plan offers all features from the Enterprise Plan, in addition to support for multi-document transactions and other advanced functionalities.

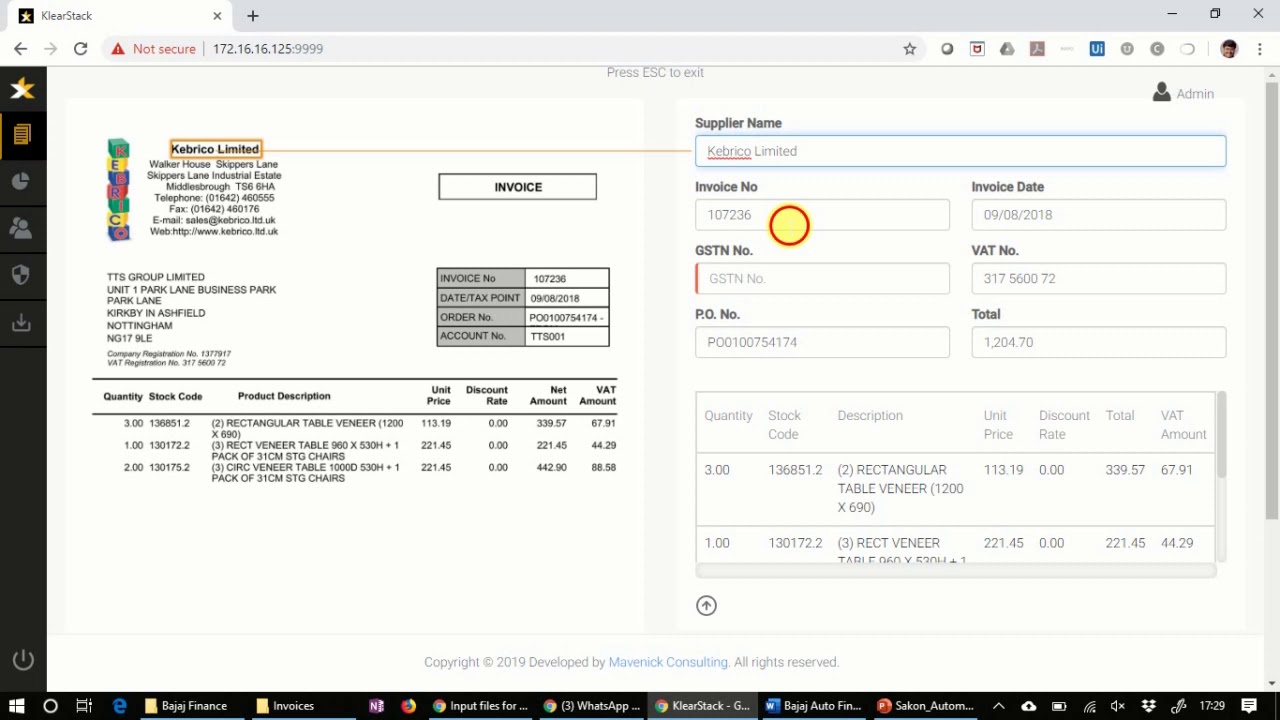

4. KlearStack

KlearStack is an AI-driven invoice data extraction platform that automates the processing of invoices, receipts, and other financial documents. Using machine learning, computer vision, and natural language processing (NLP), it converts unstructured invoice data into structured formats, reducing manual data entry and improving efficiency.

With automated workflows, KlearStack simplifies invoice handling, purchase order management, and financial document processing. It helps businesses across industries, including banking, healthcare, and compliance, streamline operations while cutting costs and minimizing errors.

Pros

- Fast and Accurate Processing: KlearStack efficiently extracts invoice data with high accuracy, minimizing manual corrections.

- Seamless Integration: The platform easily integrates with existing financial workflows, ensuring a smooth transition from manual to automated processes.

- OCR-Powered Efficiency: Its advanced OCR technology reduces the time spent on invoice data entry, streamlining transaction preparation.

Cons

- Limited Customization Options: While KlearStack is highly accurate, some users wish for more flexibility in data extraction settings.

- Occasional UI Limitations: Though user-friendly, the interface could benefit from more advanced customization features for power users.

- No Dedicated Mobile App: Users looking for on-the-go invoice scanning may find the lack of a mobile application limiting.

- Requires Initial Training: While intuitive, some users note that new team members may need time to fully leverage all advanced features.

- Pricing Transparency: Detailed pricing information is not readily available, requiring direct contact for quotes.

Pricing

KlearStack follows a Pay-As-You-Go pricing model, meaning you only pay based on:

- Number of documents processed

- Page count per document

- Data fields extracted

This flexible structure ensures cost efficiency without hidden fees. For exact pricing, you’ll need to contact KlearStack for a custom quote.

For more details, visit their official pricing page.

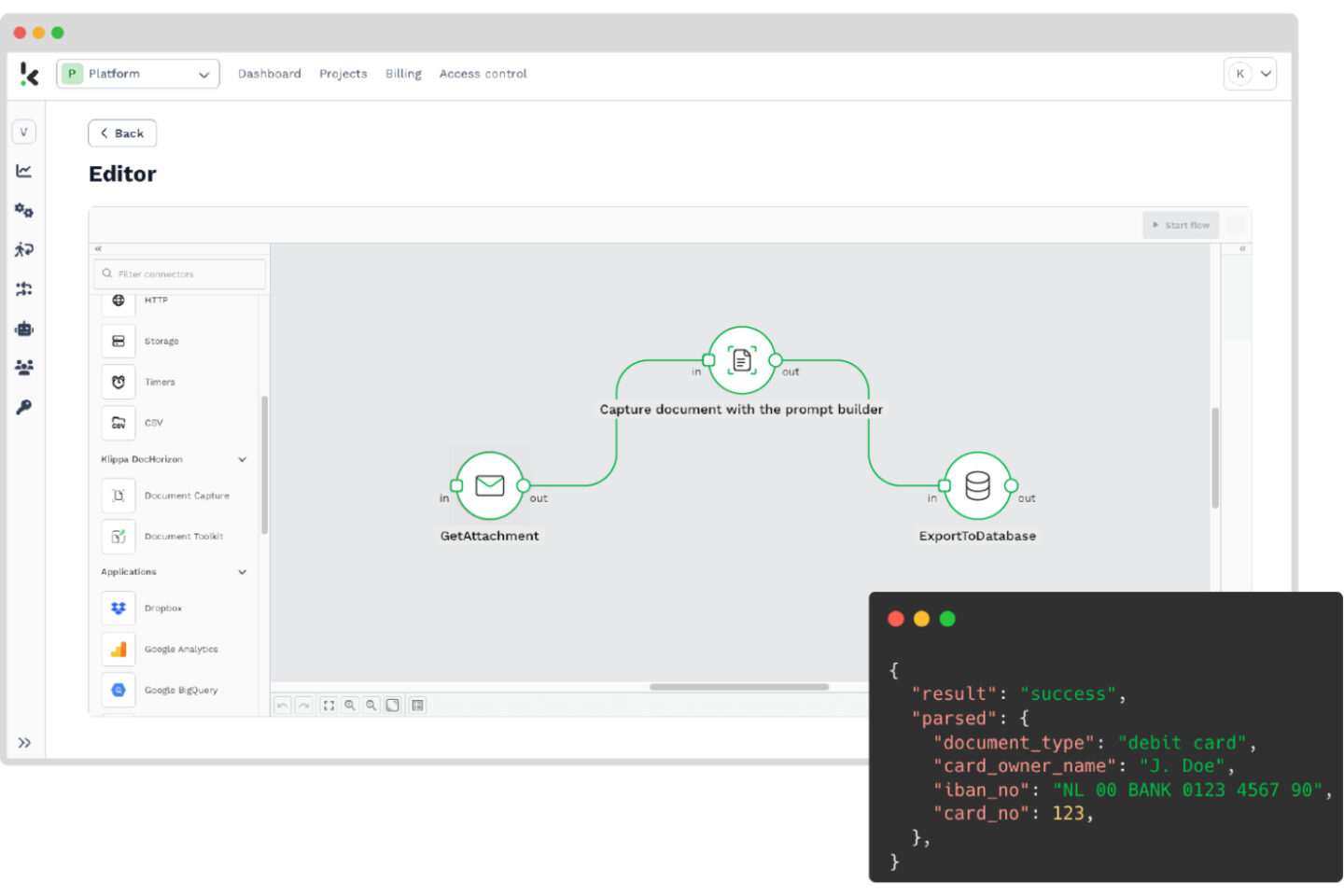

5. Klippa DocHorizon

Klippa DocHorizon is an invoice data extraction tool that automates document workflows with OCR, data extraction, classification, and conversion. It helps businesses process invoices efficiently by reducing manual data entry and improving accuracy.

With features like mobile scanning and document verification, Klippa DocHorizon simplifies invoice handling across various industries, making it a valuable solution for automating financial document management.

Pros

- Easy to Use: The platform is intuitive, making it simple for both new users and implementers to navigate.

- High-Quality OCR: Klippa’s OCR technology delivers accurate invoice data extraction with well-documented features.

- Reliable Customer Support: The support team is responsive and helpful, assisting with implementation and troubleshooting.

- Continuous Improvement: The platform consistently enhances its features, ensuring better document processing over time.

Cons

- Limited Customization: The software lacks flexibility for users with specific workflow requirements.

- Workflow Constraints: While functional, it may not fully align with all business processes.

- Overwhelming Options: The selection process can be complex due to the variety of available features.

- Minimal Negative Feedback: Most users are satisfied, making it hard to pinpoint major drawbacks.

Pricing

Klippa DocHorizon offers a credit-based pricing model. You receive €25 in free trial credits, and after that, you purchase additional credits as needed. Billing is calculated based on document usage.

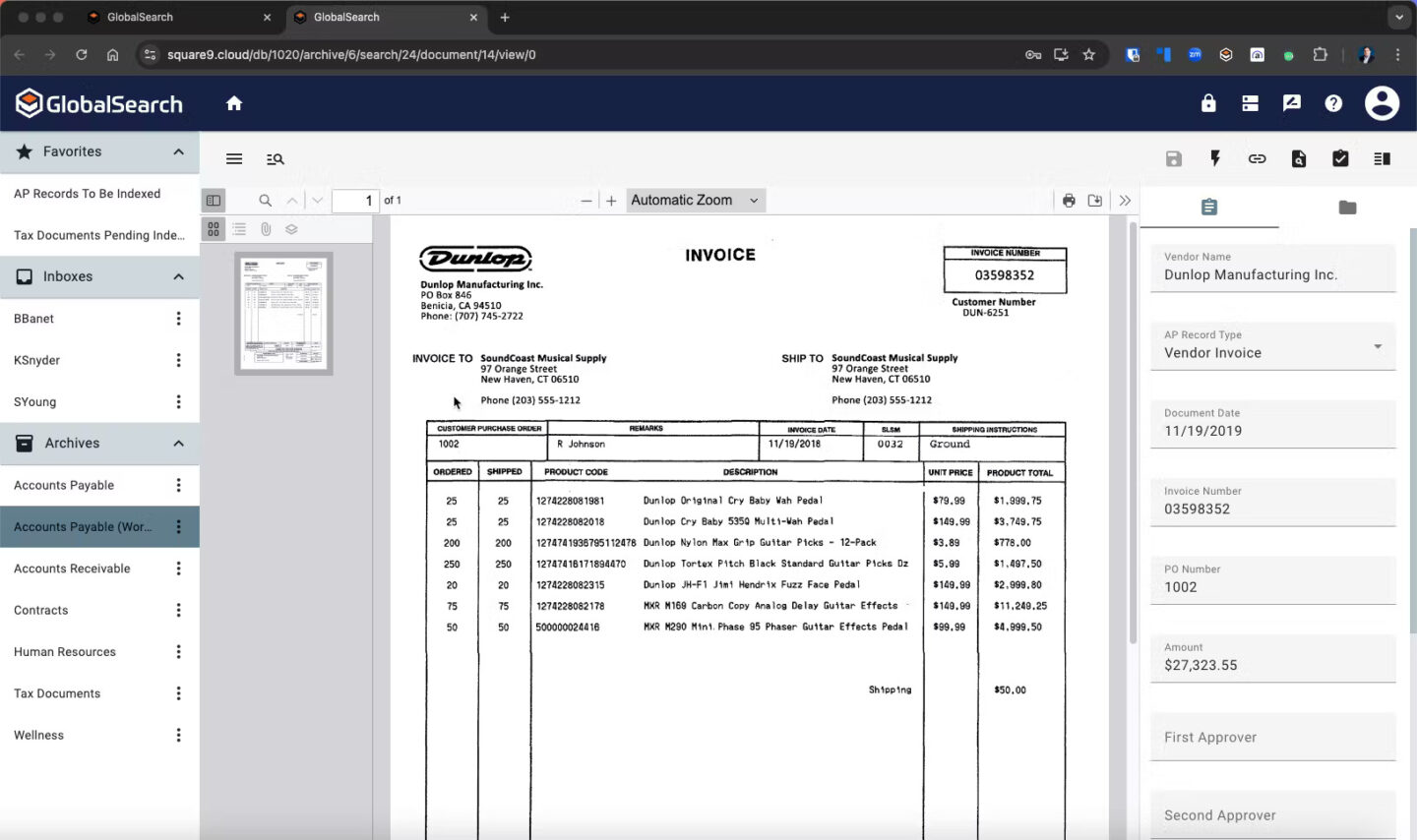

6. Square 9

Square 9 is an AI-powered document management platform designed to automate invoice data extraction and streamline financial workflows. It eliminates the inefficiencies of paper-based processes by converting scanned invoices and PDFs into structured, searchable data.

With intelligent automation and digital workflows, Square 9 helps businesses enhance productivity, reduce manual data entry, and improve invoice processing accuracy.

Pros

- Centralized Document Management: Easily search, access, and export invoices and other financial documents from a single location.

- Strong Security Controls: User access can be customized to protect sensitive financial data.

- Paperless Efficiency: Eliminates the need for physical document storage, making it easier to manage records digitally.

- Reliable Customer Support: Users report responsive and helpful support for setup and ongoing assistance.

- Streamlined AP Workflows: Helps businesses maintain accurate and organized invoice records for financial compliance.

Cons

- Document Download Issues: Downloaded files may open as “Enabled” files, requiring an extra step to access them.

- Difficult Scanner Integration: Setting up new scanners can be complex, though customer support is available to assist.

- High Implementation Costs: The platform offers long-term benefits, but the initial setup and implementation can be expensive.

- Occasional Software Bugs: Users report login issues and disappearing features that sometimes require an application reset.

- Complex Data Retrieval: Extracting data from large databases can be challenging, and the reporting tools could be more user-friendly.

Pricing

Square 9 offers three pricing plans:

- Process Automation Essentials – $50/user/month (min. 5 users) for AP, AR, HR, and contract management.

- Digital Transformation Essentials – $68/user/month with OCR extraction, table data extraction, and multi-company support.

- Enterprise Essentials – $75/user/month with integrations for Sage, Dynamics, SAP, and Microsoft 365.

7. ECIT Digital

ECIT Digital is an invoice data extraction platform that automates document processing with 99.8% accuracy. Using smart technology, it eliminates manual data entry by capturing invoice details from emails, APIs, and paper documents, making them ready for export into your financial systems.

Designed to reduce operational costs and speed up data handling, ECIT Digital helps businesses process invoices more efficiently while ensuring a strong return on investment.

Pros

- High Data Capture Accuracy: Delivers one of the most precise invoice data extraction performances available.

- Seamless Integration: Supports both API and file-based workflows, making it easy to connect with financial systems.

- Cost-Effective: Designed with efficiency in mind, offering high-quality results at a competitive price.

- Reliable Automation: Reduces manual data entry efforts while ensuring accuracy and consistency.

Cons

- Inconsistent AI Accuracy: Without manual intervention, extracted data may sometimes be inaccurate, requiring additional quality checks.

- Challenges with Uncommon Formats: Struggles with handwritten or uniquely formatted invoices, needing manual adjustments.

- Rule-Based Adjustments Needed: To improve accuracy, users may need to set up custom rules and validation checks.

Pricing

Contact their representatives to have a quote.

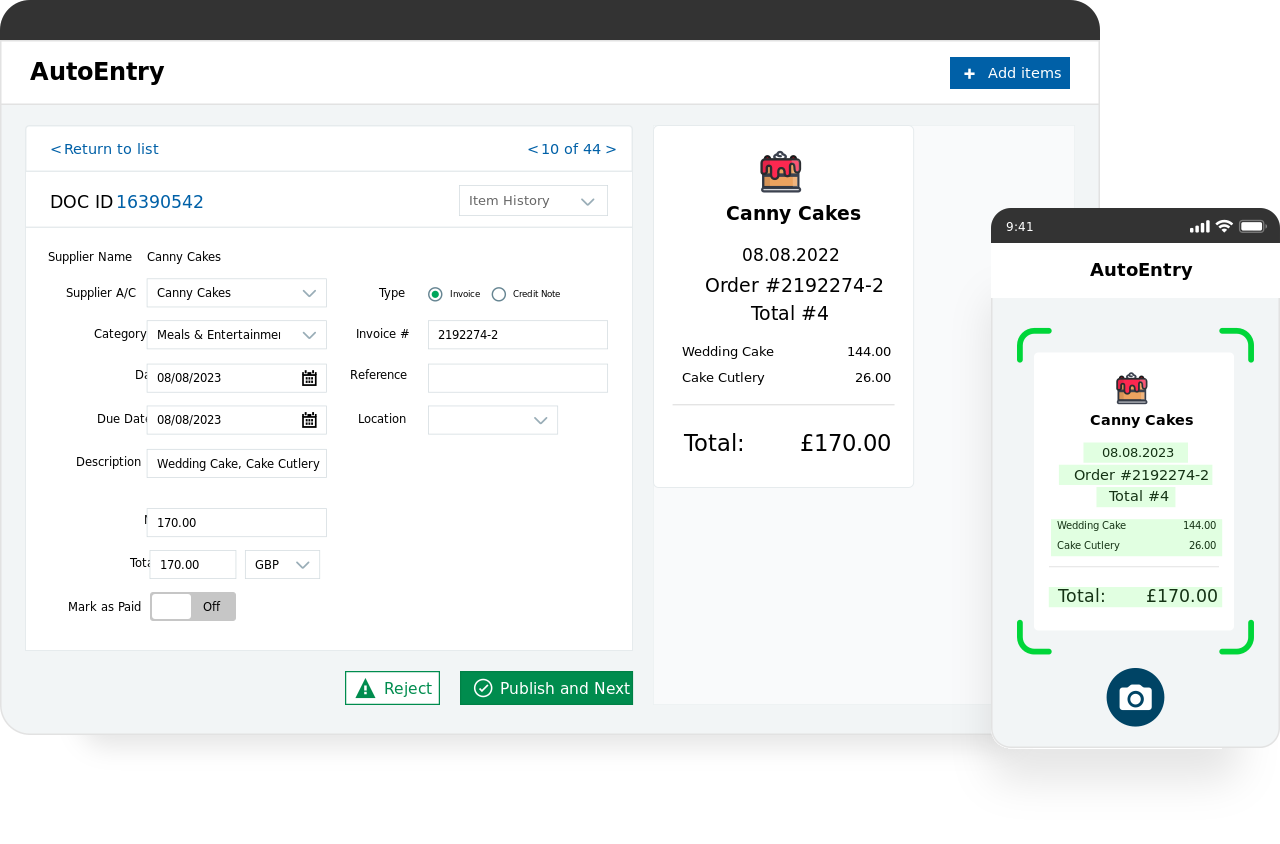

8. AutoEntry

AutoEntry is an invoice data extraction tool designed to automate data entry for accounting. It allows you to scan, email, or upload invoices, receipts, and statements, which are then extracted and published directly to major accounting software like Xero, Sage, and QuickBooks.

With mobile scanning, seamless integrations, and auto-publishing features, AutoEntry helps businesses save time and reduce manual data entry errors. Its flexible pricing model means no long-term contracts, allowing you to pay only for what you use.

Pros

- Line Item Extraction: AutoEntry can accurately extract detailed invoice data, including line items, making it easier to track expenses.

- Seamless Integration: Works well with Sage 50, as well as other major accounting software like Xero and QuickBooks, ensuring smooth data transfer.

- User-Friendly Interface: The platform is easy to use, allowing for quick document retrieval and efficient allocation of multiple invoice lines.

- Responsive Customer Support: Users report that the support team is diligent in resolving issues and providing assistance when needed.

Cons

- No Lookup Table Uploads: Users cannot upload lookup tables, which limits data customization.

- Invoice Rejection Issues: If an invoice is rejected, support is required to resolve it since the ‘Move to Inbox’ function does not work.

- Limited PO Integration: Does not integrate purchase orders with AccountsIQ, which may disrupt workflow.

- Slow Invoice Processing: Some users report delays when integrating with Xero and other accounting platforms.

- Software Stability Issues: Occasional glitches prevent invoices from uploading, requiring manual intervention.

- Customer Support Concerns: Some users experience poor support, ongoing charges after cancellation, and refund difficulties.

Pricing

AutoEntry offers flexible, usage-based pricing plans to accommodate various business needs. Each plan operates on a monthly subscription basis, with no contracts required, allowing you to cancel anytime without hidden fees. All features are included as standard across all plans.

Available Plans:

- Bronze: 50 credits at £13 per month (£0.26 per credit).

- Silver: 100 credits at £23 per month (£0.23 per credit).

- Gold: 200 credits at £43 per month (£0.22 per credit).

- Platinum: 500 credits at £99 per month (£0.20 per credit).

- Diamond: 1500 credits at £275 per month (£0.18 per credit).

- Sapphire: 2500 credits at £430 per month (£0.17 per credit).

New users receive a free trial that includes 25 credits to explore the platform’s features.

Understanding Credits:

Credits are the currency used within AutoEntry for processing documents:

- 1 credit: Processes a single invoice, bill, or receipt.

- 2 credits: Processes an invoice or receipt with line items.

- 3 credits: Processes a single page of bank statements.

This structure allows you to choose a plan that best fits your document processing volume and only pay for what you use.

9. Docsumo

Docsumo is an Intelligent Document Processing (IDP) platform tailored for small and medium-sized business (SMB) lenders, insurers, commercial real estate (CRE) lenders, and investors. Initially focused on automating invoice processing, Docsumo has expanded into a comprehensive data extraction solution for financial services across the USA.

Pros

- Comprehensive Backend Technology: Docsumo’s robust backend supports diverse use cases, allowing businesses to expand their document processing capabilities.

- Exceptional Customer Support: The team provides thorough assistance during integration and process refinement, ensuring a smooth user experience.

- User-Friendly Interface: Designed for ease of use, Docsumo’s platform simplifies document processing tasks, making it accessible to users with varying technical expertise.

- Flexible API Integration: Docsumo offers adaptable API integration, enabling seamless incorporation into existing workflows and systems.

- Reliability: Users report a stable, bug-free experience, enhancing operational efficiency.

Cons

- Requires Technical Knowledge: Some customization options may be challenging for non-technical users.

- Longer Implementation Time: Setting up models can take time, especially for businesses processing a variety of document formats.

- Limited Keyboard Navigation: Users prefer better keyboard shortcuts for reviewing extracted data.

- Retraining for Minor Changes: Small adjustments require retraining the AI model, which can slow down workflow improvements.

Pricing

Docsumo offers multiple pricing plans based on document volume and user needs:

- Free Plan – 100 pages/month for individual users at no cost.

- Starter Plan – 1,000 pages/month for $299, supporting up to 3 users.

- Growth Plan – 3,000 pages/month for $799, supporting up to 5 users.

- Business Plan – 10,000 pages/month for $2,499, supporting up to 10 users.

- Enterprise Plan – Custom pricing with flexible document volumes and unlimited users.

All plans include a 14-day free trial. For exact pricing, visit Docsumo’s website.

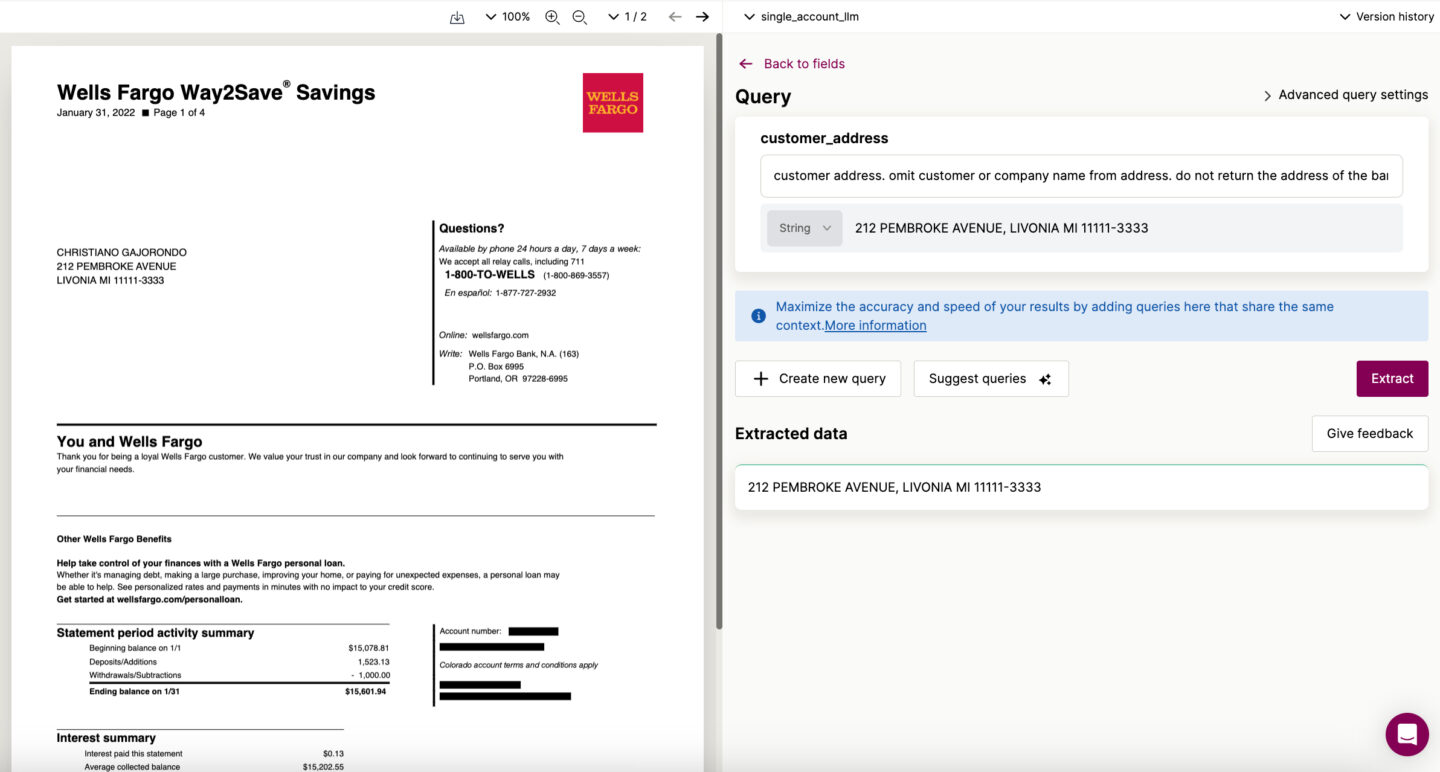

10. Sensible

Sensible is an API-first document processing platform that streamlines data extraction for developers and product teams. With advanced parsing techniques, comprehensive APIs, and a focus on seamless integration, Sensible enables developers to focus on building great products and features.

Pros

- Intuitive Parser Setup: The platform provides an easy-to-use UI with autocomplete, a responsive preview, and document markup for defining document parsers.

- Reliable API Integration: Sensible’s API is stable and integrates seamlessly into existing systems, making it developer-friendly.

- Comprehensive Documentation: Well-structured guides and documentation make implementation smooth, reducing the learning curve.

- Advanced Parsing Techniques: Uses LLM-based processing and visual layout-based rules for more accurate invoice data extraction.

Cons

- Intuitive User Interface: The platform offers an easy-to-use UI for setting up document parsers with autocomplete, responsive previews, and document markup.

- Reliable API Integration: Sensible’s API is stable and integrates seamlessly into existing systems.

- Comprehensive Documentation: Well-structured and easy-to-follow guides make implementation straightforward.

Pricing

Sensible offers three pricing plans based on document volume:

- Growth – $499/month for 750 documents, with $0.50 per additional document. Includes onboarding and integration support.

- Scale – $1,499/month for 3,200 documents, with $0.50 per additional document. Also includes onboarding and integration services.

- Enterprise – Custom pricing for 10,000+ documents, with volume-based pricing, HIPAA compliance, custom SLAs, and dedicated support.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about Ocrolus alternatives:

What factors should I consider when choosing an invoice processing tool?

When choosing an invoice processing tool, consider accuracy, ensuring it uses OCR and AI for precise data extraction. Look for seamless integration with accounting software like QuickBooks and Xero. Prioritize automation features, scalability, and security compliance such as SOC-2 and HIPAA. Finally, evaluate pricing models to find a cost-effective solution that fits your business needs.

Are these alternatives suitable for small businesses?

Yes, these alternatives are suitable for small businesses. Many offer affordable pricing, easy setup, and automation features that help reduce manual data entry. Tools like DocuClipper and AutoEntry provide cost-effective plans with seamless integration into accounting software, making them ideal for small teams looking to streamline invoice processing without a high learning curve or expensive setup.

Which tool provides the highest accuracy in invoice data extraction?

DocuClipper, Rossum, and Veryfi are among the tools known for high accuracy in invoice data extraction. They use advanced OCR and AI models to capture invoice details with minimal errors. Accuracy may vary based on document quality and formatting, so choosing a tool with machine learning capabilities and customizable extraction settings can further improve precision.

Can these platforms integrate with QuickBooks and Xero?

Yes, many of these platforms integrate with QuickBooks and Xero. Tools like DocuClipper, AutoEntry, and Veryfi offer direct integrations, allowing seamless invoice data transfer. Others, like Rossum and Sensible, provide API options for connecting with accounting software. It’s important to check the integration capabilities of each platform to ensure compatibility with your workflow.

Do these solutions support multi-currency invoices?

Yes, many of these solutions support multi-currency invoices. Platforms like DocuClipper, Rossum, and Veryfi can extract invoice data in various currencies and convert them based on accounting system settings. Some tools also offer automatic currency detection and exchange rate syncing, making them suitable for businesses handling international transactions. Check each platform’s features for specific currency support.

Are these invoice automation tools secure and compliant?

Yes, most invoice automation tools prioritize security and compliance. Many solutions, including DocuClipper, Rossum, and Sensible, offer data encryption, SOC-2, and HIPAA compliance to protect sensitive financial information. Some platforms also provide user access controls and audit logs for added security. It’s important to review each tool’s security features to ensure they meet your compliance requirements.