Key Takeaways:

- Paperless invoice processing replaces manual data entry with automation, improving accuracy and reducing processing time.

- Switching to digital invoicing lowers costs, speeds up payments, and enhances cash flow visibility.

- OCR and AP automation software help extract and manage invoice data efficiently, eliminating paper-based inefficiencies.

- Integrating with accounting or ERP systems streamlines invoice matching, approvals, and payments.

- While implementation requires training and system setup, the long-term benefits outweigh the challenges.

What is Paperless Invoice Processing?

Paperless invoice processing is the digital handling of invoices without relying on paper-based workflows. It involves using invoice automation software to capture, extract, approve, and store invoices electronically.

Instead of scanning physical invoices and manually entering data, businesses use OCR (Optical Character Recognition) technology to extract key details automatically. The entire accounts payable (AP) process, from invoice receipt to payment, happens digitally, reducing errors, speeding up approvals, and improving cash flow management.

With paperless AP, you eliminate printing, mailing, and storing physical invoices, cutting costs and increasing efficiency. It also enhances security by minimizing the risk of lost or fraudulent invoices.

Benefits of Paperless Invoice Processing

Here are the benefits of having paperless invoice processing for your AP team:

- Cost savings: Eliminates expenses related to paper, ink, printing, envelopes, postage, and storage. Businesses that switch to digital invoices save $1,210 per year on invoice-related costs.

- Faster payments: Reduces the waiting period for payments by eliminating mailing delays. With electronic payments, the processing time of businesses paying vendors by 51%.

- Security: Minimizes the risk of lost or fraudulent invoices by encrypting data and sending invoices directly to recipients.

- Time efficiency: Eliminates manual data entry, allowing AP teams to focus on higher-value tasks.

- Cash flow visibility: Integrates with accounting and ERP systems for real-time insights into pending payments and cash flow.

- Accuracy: Reduces processing mistakes and duplicate payments. OCR invoice data extraction has accuracy of at least 99%, preventing disputes and rework.

- Environmental impact: Lowers carbon footprint and reduces paper waste, contributing to sustainability efforts.

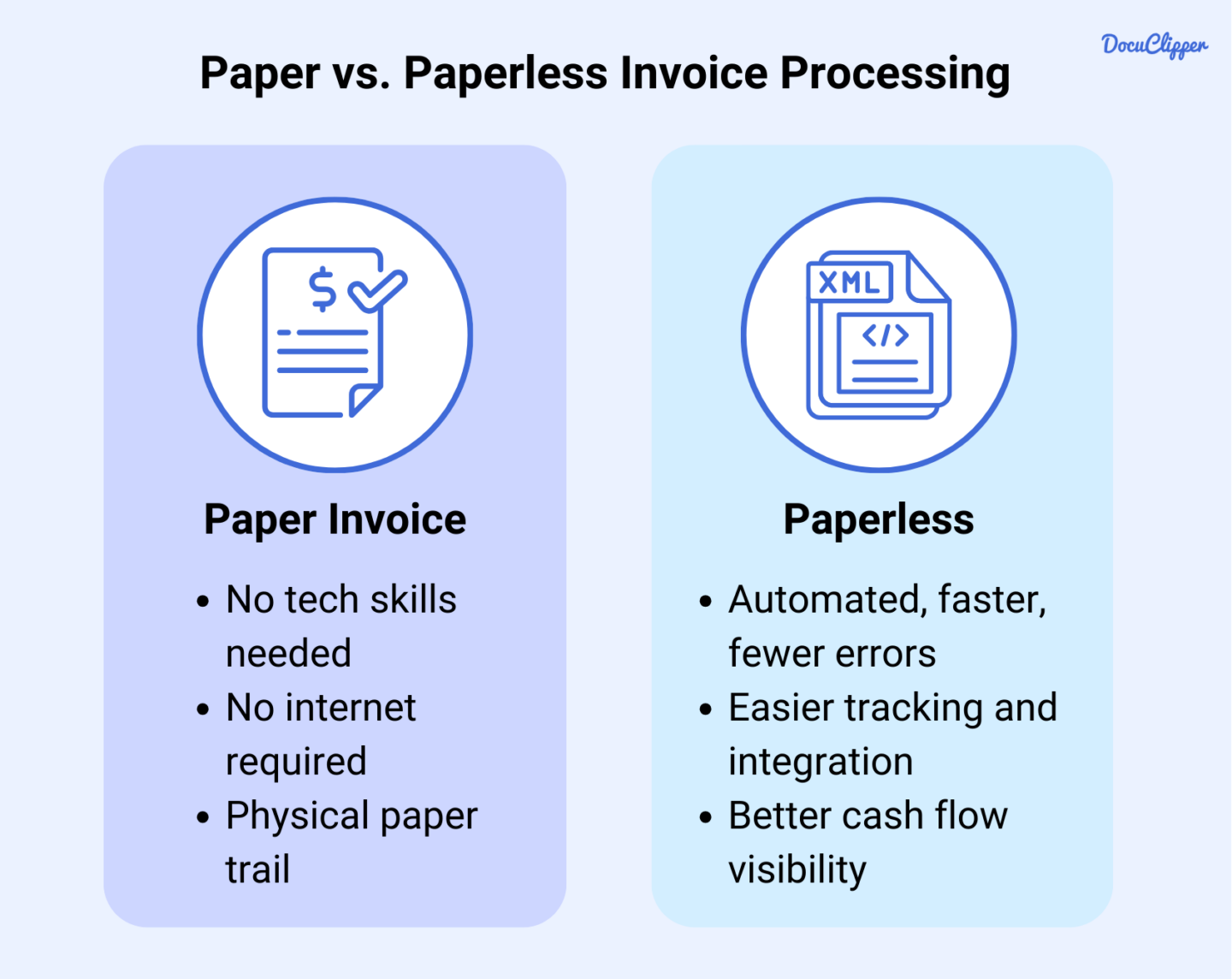

Paper vs Paperless Invoice Processing

Paper-based invoicing relies on physical records, making it familiar and accessible without requiring technical skills. It doesn’t depend on an internet connection and provides a tangible paper trail. However, it is slow, costly, and prone to errors.

Processing high invoice volumes manually leads to delays, misplaced documents, and disputes. Printing, postage, and storage expenses add up, and retrieving past invoices can be time-consuming.

Paperless invoicing automates the entire accounts payable process, reducing errors and speeding up payments. Digital invoices are easier to track, process, and integrate with accounting systems, improving cash flow visibility.

However, electronic invoicing requires an internet connection, security measures, and staff training. Some customers may resist switching to digital invoices, requiring businesses to offer alternative options or assist with onboarding.

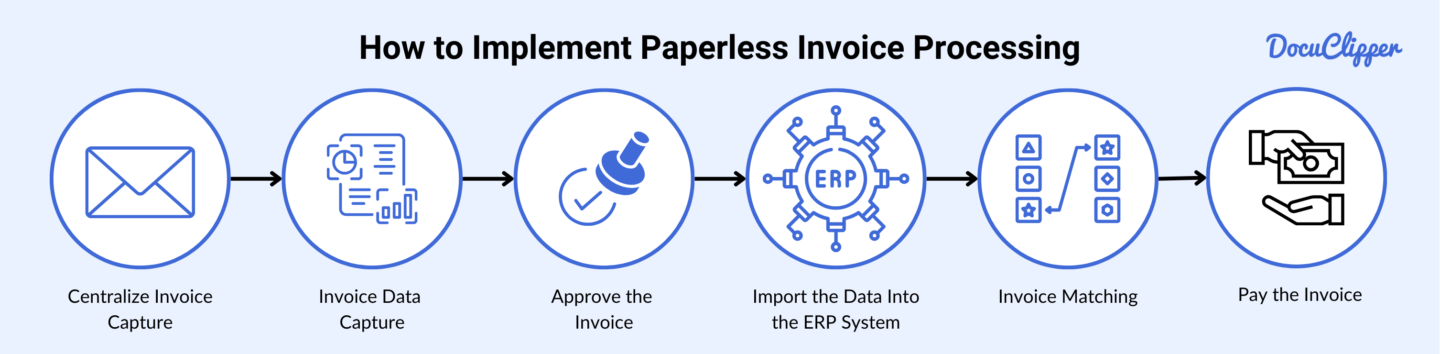

How to Implement Paperless Invoice Processing

Here are the steps when you decide to shift from paper invoice processing to paperless:

Step 1: Centralize Invoice Capture

The first step in paperless invoice processing is consolidating all invoices in one place. Instead of managing paper stacks or searching through scattered email attachments, you can use DocuClipper to streamline invoice collection with its email upload feature.

DocuClipper is an OCR invoice data extraction tool that converts PDF invoices into Excel, CSV, or QuickBooks-compatible formats. Suppliers can send invoices directly to your dedicated

DocuClipper email, ensuring all invoices are captured automatically. If you receive paper invoices, you’ll need to scan and upload them as PDFs before extraction. By centralizing invoice capture, you eliminate manual sorting and speed up processing.

Step 2: Invoice Data Capture

Once an invoice is received, DocuClipper automatically captures key details such as invoice numbers, dates, amounts, and line items. This eliminates manual data entry, ensuring invoices are securely stored and ready for processing.

At this stage, data is captured but not yet extracted, allowing your team to review invoices for legitimacy, duplicates, or fraud. While DocuClipper has built-in measures to detect errors, a manual review adds an extra layer of validation before moving forward.

Step 3: Approve the Invoice

After verifying the captured data and ensuring there are no discrepancies, the next step is approval. Once the invoice is reviewed and confirmed, you can convert it to your preferred format, whether Excel, CSV, or QuickBooks. This ensures that only accurate and validated invoices proceed to the next stage of processing.

Step 4: Import the Data Into the Accounting or ERP System

Once everything is set up, you can import your invoice data into your accounting system or ERP. If you use QuickBooks, you can connect your account for direct integration.

Otherwise, you can export the data in CSV format and upload it to your software. Most accounting platforms have specific import formats, so following their guidelines ensures a smooth transfer without errors.

Step 5: Invoice Matching

To ensure accuracy, match the invoice with the corresponding purchase order and goods receipt note. This step verifies that the billed amount aligns with what was ordered and received. Your ERP system provides the necessary records for comparison.

If discrepancies arise, you may need to establish a dispute resolution workflow with your supplier before proceeding with payment.

Step 6: Pay the Invoice

Once all are matched, then you can proceed by having an approval sequence, then you can succeed with paying the invoice

Challenges and Disadvantages of Paperless Invoice Processing

Switching to paperless invoicing makes your process more efficient, but it also comes with challenges. You need to adapt to new systems, manage potential risks, and handle technical limitations.

While there are drawbacks, the long-term benefits will likely outweigh the initial hurdles.

Challenges

- Initial implementation costs and system integration complexity

- Resistance to change from employees and suppliers

- Data security and compliance risks

- Potential system downtimes affecting processing

- Need for ongoing software updates and maintenance

- Compatibility issues with legacy systems

- Training requirements for staff to use new systems

Disadvantages

- Dependence on digital infrastructure and internet connectivity

- Risk of cyber threats and data breaches

- Limited accessibility in case of technical failures

- Potential for software errors or misclassification of invoices

- Subscription and licensing costs for software solutions

- Requires robust backup solutions to prevent data loss

Accurately Extract Data from Any Invoice with DocuClipper

DocuClipper simplifies invoice data extraction by using advanced OCR technology to capture key details from any invoice format.

Whether you receive invoices as PDFs, scanned documents, or email attachments, DocuClipper accurately extracts invoice numbers, dates, line items, taxes, totals, and more. This eliminates manual data entry, reducing errors and speeding up processing.

With batch processing, you can extract data from multiple invoices at once, saving time when handling high volumes. DocuClipper’s AI-powered recognition ensures that even complex invoices with different layouts are processed accurately.

Once extracted, the data can be exported to Excel, CSV, or integrated directly with QuickBooks, making it easy to manage invoices within your accounting system.

FAQs about Paperless Invoice Processing

Here are some frequently asked questions about paperless invoice processing:

How do I go paperless with an invoice?

To go paperless with invoices, use invoice scanning software or OCR tools like DocuClipper to digitize and extract invoice data. Store invoices in a cloud-based system, automate approvals, and integrate with accounting software. This eliminates manual entry, speeds up processing, and improves accuracy while reducing costs and paper waste.

Can invoice processing be automated?

Yes, invoice processing can be automated using OCR and accounts payable automation software. These tools capture invoice data, match it with purchase orders, route it for approval, and integrate it into accounting systems. Automation reduces manual entry, minimizes errors, speeds up approvals, and ensures timely payments, improving overall efficiency and cash flow management.

Can accounts payable be paperless?

Yes, accounts payable can be completely paperless by using AP automation software. Digital invoice ocr data capture, OCR data extraction, automated approvals, and electronic payments replace manual processes. This reduces costs, minimizes errors, speeds up processing, and improves cash flow visibility. Integrating AP automation with accounting systems ensures seamless invoice management without relying on physical documents.

What is electronic invoice processing?

Electronic invoice processing is the automation of receiving, capturing, approving, and storing invoices digitally. It eliminates manual data entry by using OCR to extract key details and integrates with accounting systems for seamless payment processing. This speeds up approvals, reduces errors, and improves financial visibility while eliminating the need for paper-based invoicing.

Is paperless billing a good idea?

Yes, paperless billing is a good idea as it reduces costs, improves efficiency, and enhances security. Digital invoices eliminate printing and mailing expenses, speed up payments, and minimize errors. It also provides better tracking and integration with accounting systems while reducing environmental impact. With automation, businesses can streamline billing and improve cash flow management.

What is touchless invoice processing?

Touchless invoice processing is a fully automated invoicing system that requires no manual intervention. It uses OCR and AI to capture invoice data, validate details, match invoices with purchase orders, and route them for approval. Once verified, invoices are automatically processed and integrated into accounting software, reducing errors, speeding up payments, and improving efficiency.

What is one strategy to improve invoice processing?

One strategy to improve invoice processing is to automate data capture using OCR and AP automation software. This eliminates manual entry, reduces errors, and speeds up approvals. By integrating invoices with an accounting system, you can streamline workflows, improve accuracy, and ensure faster payments, ultimately enhancing efficiency and cash flow management.